In our modern, consumer-driven society everyone is looking for a great bargain. One method of gaining significant savings on your purchases is by using Electric Car Tax Rebate Forms. Electric Car Tax Rebate Forms are an effective marketing tactic employed by retailers and manufacturers to give customers a part return on their purchases once they have made them. In this article, we'll dive into the world Electric Car Tax Rebate Forms, looking at the nature of them as well as how they work and how you can make the most of your savings through these efficient incentives.

Get Latest Electric Car Tax Rebate Form Below

Electric Car Tax Rebate Form

Electric Car Tax Rebate Form -

Web We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

A Electric Car Tax Rebate Form in its most basic definition, is a refund offered to a customer after having purchased a item or service. It's a very effective technique used by businesses to attract customers, increase sales and market specific products.

Types of Electric Car Tax Rebate Form

Delaware Electric Car Tax Rebate Printable Rebate Form

Delaware Electric Car Tax Rebate Printable Rebate Form

Web 9 d 233 c 2022 nbsp 0183 32 If your vehicle qualifies you ll receive a credit equal to 10 of the cost of each qualified plug in electric vehicle with a maximum credit of 2 500 per vehicle Keep in mind that you must be the original purchaser

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Cash Electric Car Tax Rebate Form

Cash Electric Car Tax Rebate Form are the most straightforward type of Electric Car Tax Rebate Form. Customers get a set amount of money back upon purchasing a product. These are often used for big-ticket items, like electronics and appliances.

Mail-In Electric Car Tax Rebate Form

Mail-in Electric Car Tax Rebate Form require customers to provide proof of purchase in order to receive their money back. They're more involved, however they can yield huge savings.

Instant Electric Car Tax Rebate Form

Instant Electric Car Tax Rebate Form are applied at point of sale, which reduces your purchase cost instantly. Customers do not have to wait until they can save in this manner.

How Electric Car Tax Rebate Form Work

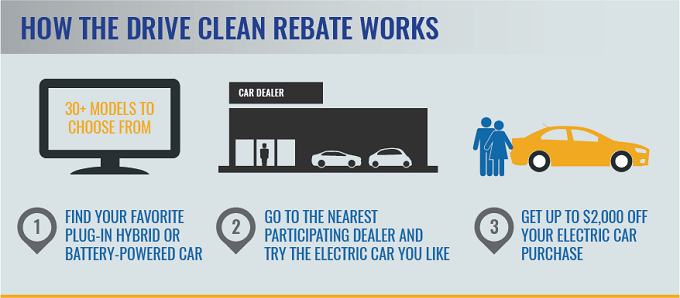

California Electric Car Tax Rebate ElectricCarTalk

California Electric Car Tax Rebate ElectricCarTalk

Web 17 janv 2023 nbsp 0183 32 You can file for the EV Tax credit by filling out IRS Form 8936 Please consult your local tax professional for details Is the EV tax credit refundable No the EV Tax Credit is non refundable Are there

The Electric Car Tax Rebate Form Process

The procedure usually involves a handful of simple steps:

-

Buy the product: At first, you purchase the item just like you normally would.

-

Fill in this Electric Car Tax Rebate Form template: You'll need to fill in some information like your address, name, along with the purchase details, in order to receive your Electric Car Tax Rebate Form.

-

Submit the Electric Car Tax Rebate Form: Depending on the type of Electric Car Tax Rebate Form there may be a requirement to submit a form by mail or submit it online.

-

Wait for the company's approval: They will evaluate your claim to make sure it is in line with the guidelines and conditions of the Electric Car Tax Rebate Form.

-

Receive your Electric Car Tax Rebate Form Once you've received your approval, you'll receive your refund in the form of a check, prepaid card, or another method specified by the offer.

Pros and Cons of Electric Car Tax Rebate Form

Advantages

-

Cost savings: Electric Car Tax Rebate Form can significantly lower the cost you pay for a product.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Improve Sales: Electric Car Tax Rebate Form can boost a company's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Electric Car Tax Rebate Form in particular, can be cumbersome and demanding.

-

Days of expiration Most Electric Car Tax Rebate Form come with specific deadlines for submission.

-

Risk of Not Being Paid Customers may lose their Electric Car Tax Rebate Form in the event that they do not adhere to the guidelines precisely.

Download Electric Car Tax Rebate Form

Download Electric Car Tax Rebate Form

FAQs

1. Are Electric Car Tax Rebate Form similar to discounts? No, the Electric Car Tax Rebate Form will be a partial refund after the purchase, whereas discounts cut prices at moment of sale.

2. Do I have to use multiple Electric Car Tax Rebate Form for the same product What is the best way to do it? It's contingent on terms for the Electric Car Tax Rebate Form incentives and the specific product's suitability. Some companies will allow it, but some will not.

3. How long does it take to get a Electric Car Tax Rebate Form? The amount of time varies, but it can be anywhere from a few weeks up to a couple of months for you to receive your Electric Car Tax Rebate Form.

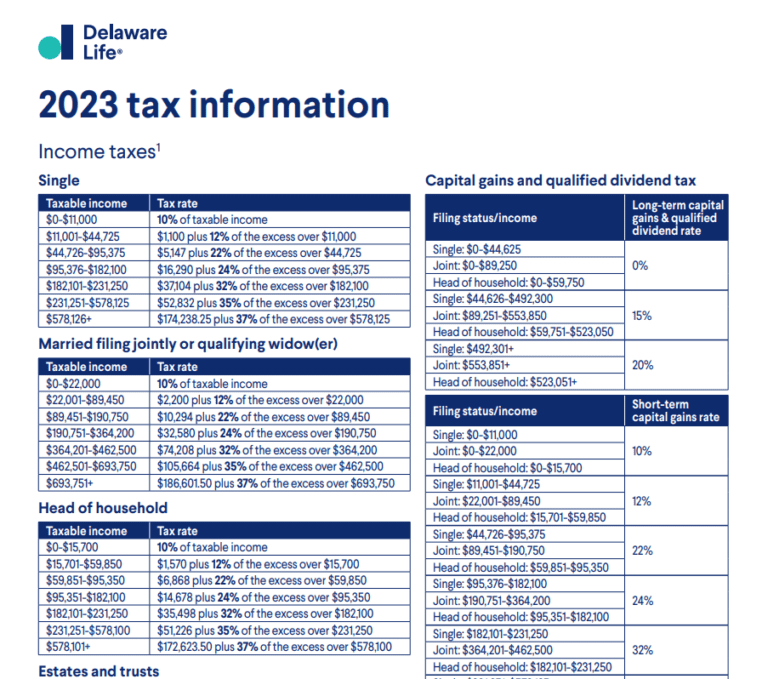

4. Do I need to pay tax in relation to Electric Car Tax Rebate Form amount? the majority of circumstances, Electric Car Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Electric Car Tax Rebate Form offers from lesser-known brands It is essential to investigate and ensure that the brand giving the Electric Car Tax Rebate Form is reputable prior making a purchase.

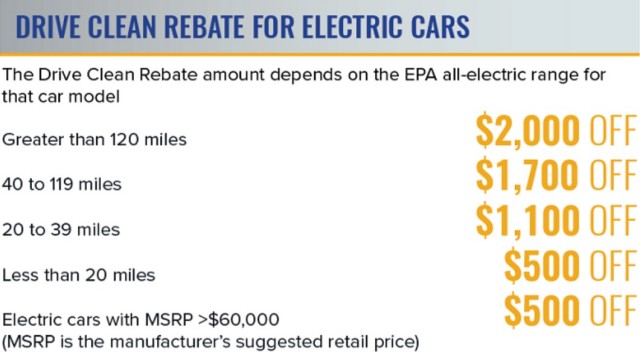

California Electric Car Rebate 2022 Printable Rebate Form

Electric Car Tax Rebate California ElectricCarTalk

Check more sample of Electric Car Tax Rebate Form below

Is There A Tax Cut For A Used Electric Car OsVehicle

Printable Old Style Rebate Form Printable Forms Free Online

Tax Rebates For Electric Car 2023 Carrebate

Electric Car Rebates Washington State 2023 Carrebate

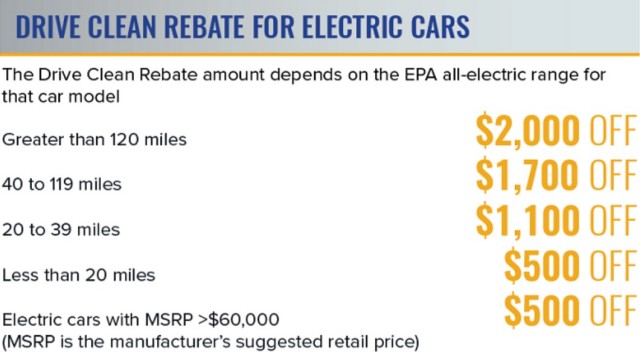

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

Tax Rebates For Electric Car 2023 Carrebate

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Web Complete Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles and file it

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

Web Complete Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles and file it

Electric Car Rebates Washington State 2023 Carrebate

Printable Old Style Rebate Form Printable Forms Free Online

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

Tax Rebates For Electric Car 2023 Carrebate

Tax Rebate On Electric Cars 2022 2023 Carrebate

California Electric Car Tax Rebate ElectricCarTalk

California Electric Car Tax Rebate ElectricCarTalk

The Florida Hybrid Car Rebate Save Money And Help The Environment