In today's world of consumerism, everyone loves a good bargain. One way to make substantial savings from your purchases is via New Zealand Tax Form Rebates. The use of New Zealand Tax Form Rebates is a method that retailers and manufacturers use to provide customers with a portion of a refund on their purchases after they have bought them. In this article, we will dive into the world New Zealand Tax Form Rebates and explore the nature of them and how they operate, and how you can maximize the savings you can make by using these cost-effective incentives.

Get Latest New Zealand Tax Form Rebate Below

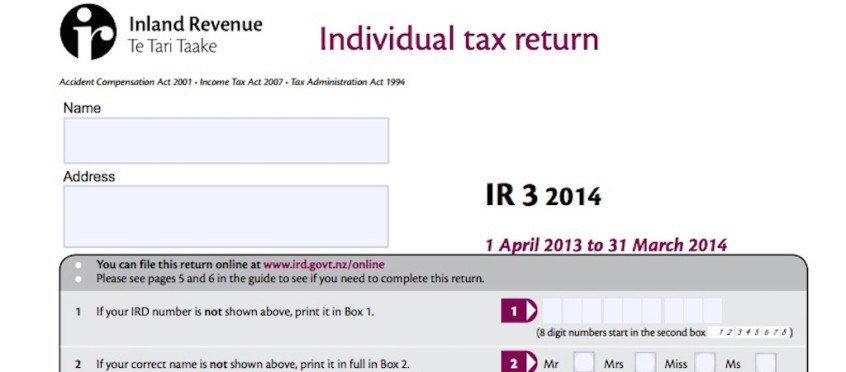

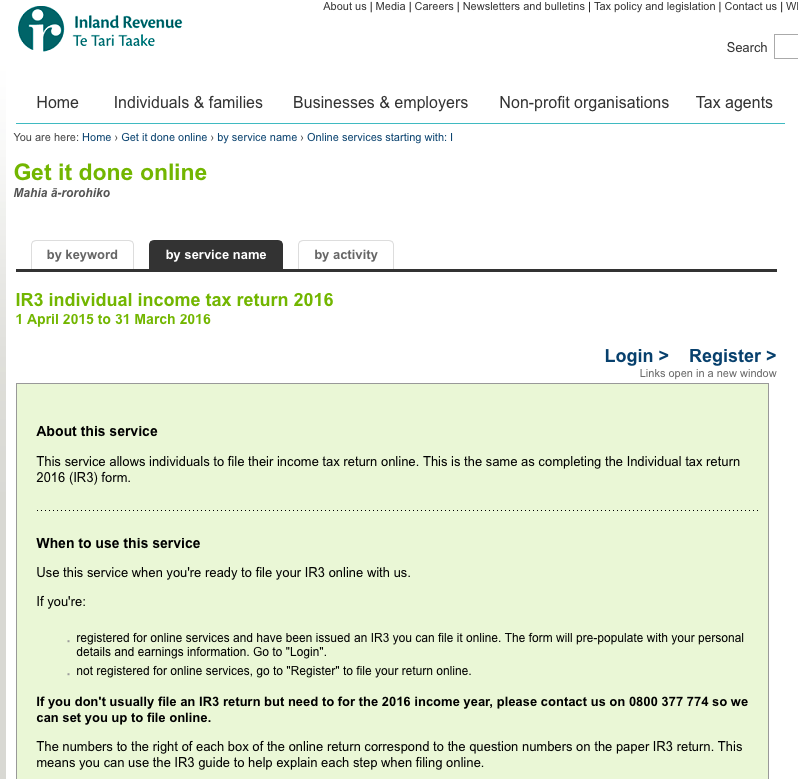

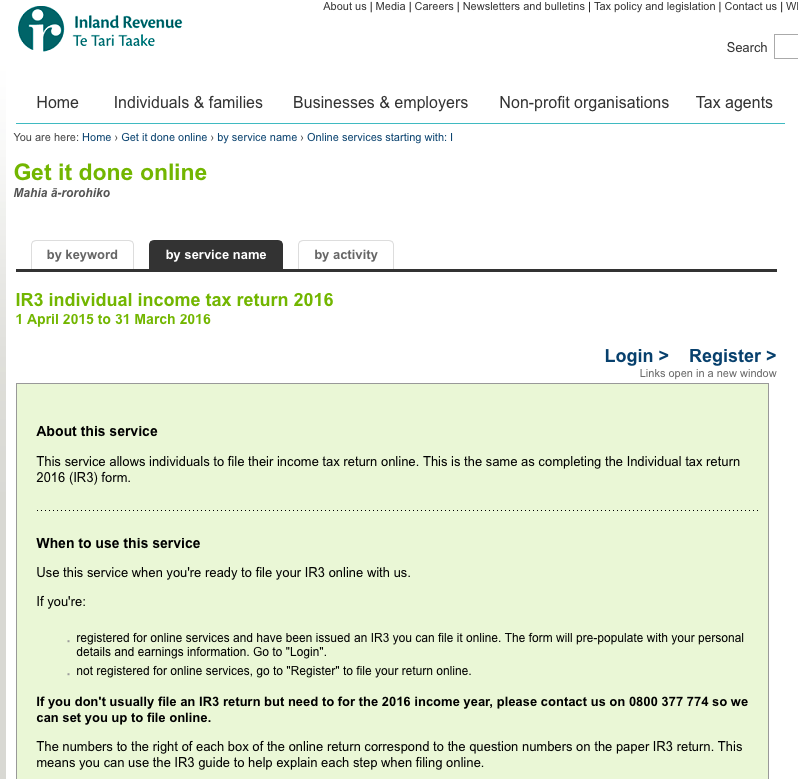

New Zealand Tax Form Rebate

New Zealand Tax Form Rebate -

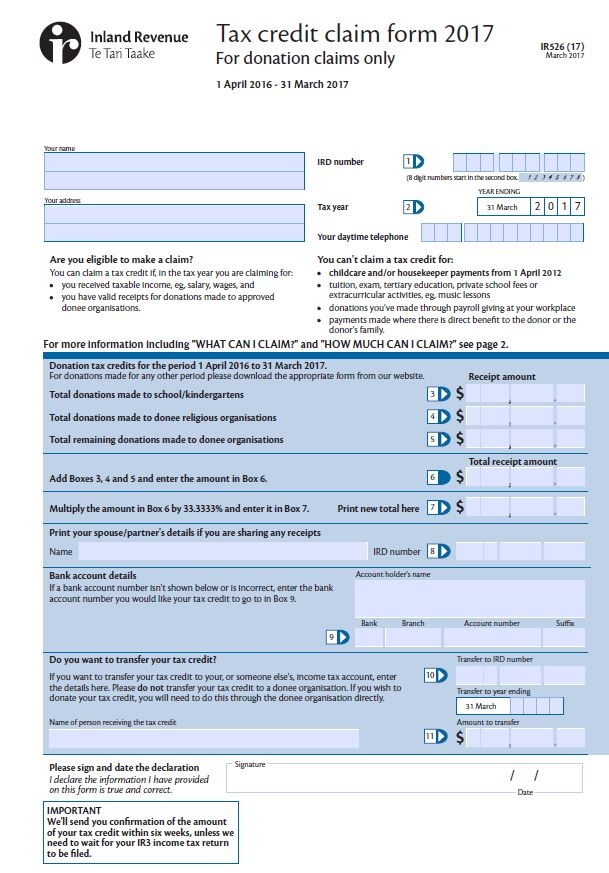

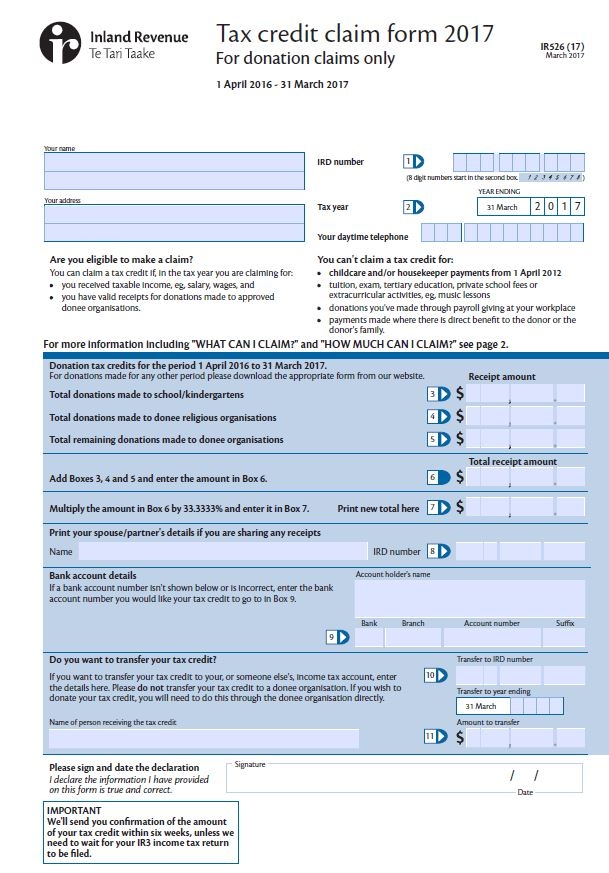

Web Many of our donors choose to donate their tax rebate to ChildFund transforming every 100 into 133 You can even choose to apply your rebate to one of our matching

Web Individual tax credits There are some tax credits you can claim as an individual This means that you do not have to pay as much income tax If you ve already paid the tax

A New Zealand Tax Form Rebate as it is understood in its simplest form, is a payment to a consumer after they've purchased a good or service. It's a highly effective tool utilized by businesses to attract customers, boost sales, and to promote certain products.

Types of New Zealand Tax Form Rebate

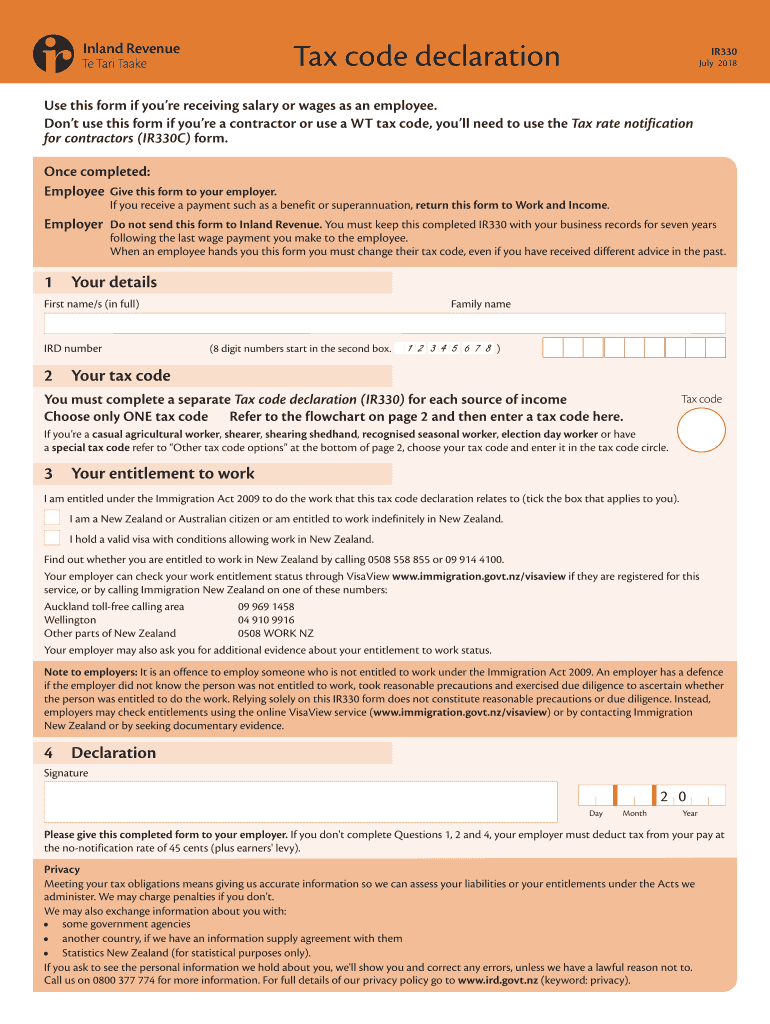

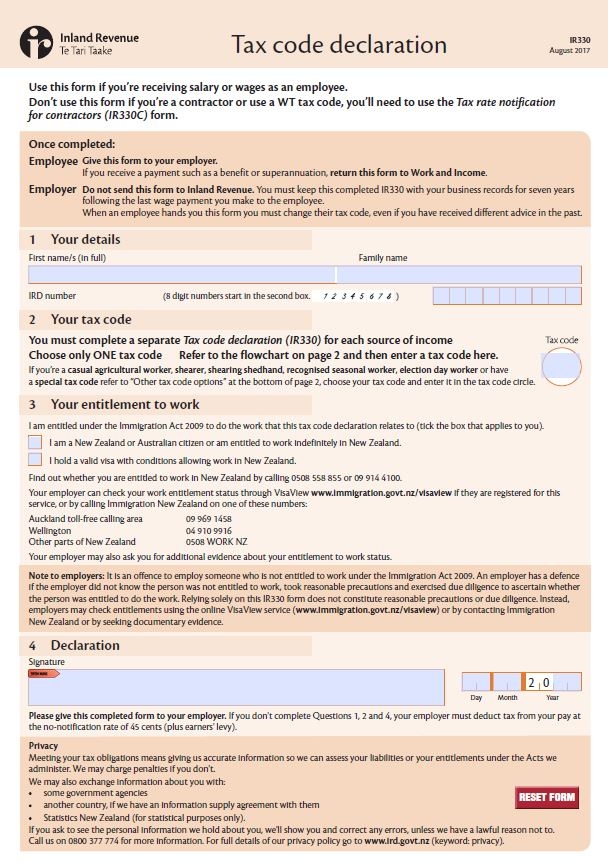

2018 2021 Form NZ IR330 Fill Online Printable Fillable Blank PdfFiller

2018 2021 Form NZ IR330 Fill Online Printable Fillable Blank PdfFiller

Web Getting a tax refund Most people automatically get a tax refund if they re owed one Changing your tax code If you start or stop work remember that you may need to

Web You are then eligible to claim the rebate Application for approval as a New Zealand participant for a wine equalisation tax rebate Before you complete your application for

Cash New Zealand Tax Form Rebate

Cash New Zealand Tax Form Rebate are the simplest type of New Zealand Tax Form Rebate. Customers are offered a certain amount back in cash after buying a product. These are usually used for high-ticket items like electronics or appliances.

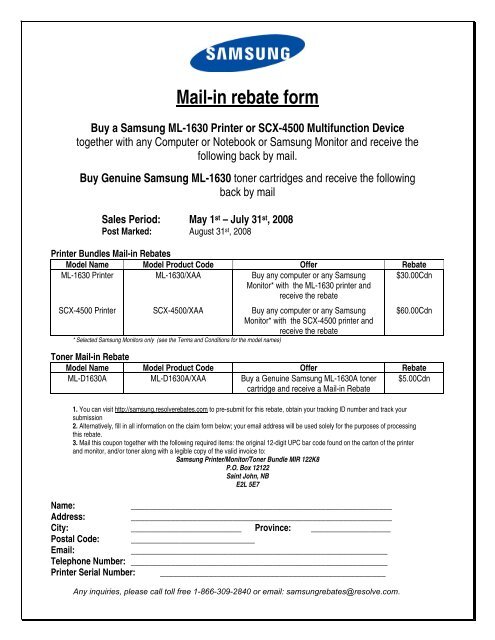

Mail-In New Zealand Tax Form Rebate

Mail-in New Zealand Tax Form Rebate require customers to provide the proof of purchase in order to receive their reimbursement. They're a little more complicated but could provide huge savings.

Instant New Zealand Tax Form Rebate

Instant New Zealand Tax Form Rebate are applied at point of sale, which reduces the price of your purchase instantly. Customers do not have to wait for their savings by using this method.

How New Zealand Tax Form Rebate Work

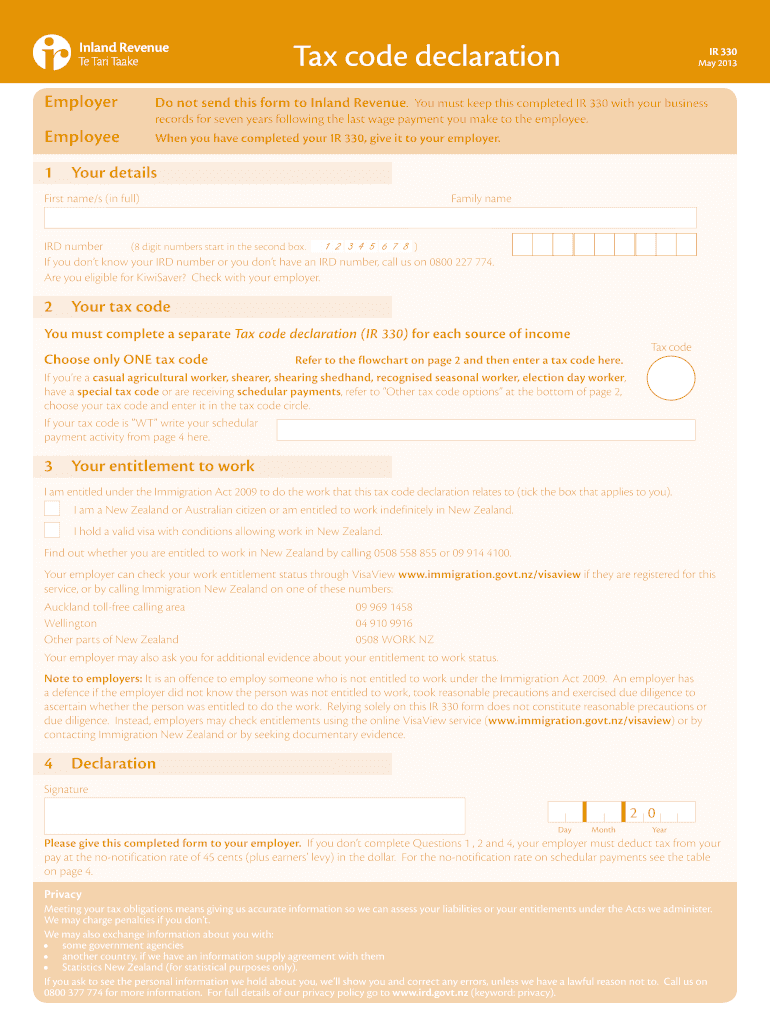

2013 Form NZ IR330Fill Online Printable Fillable Blank PdfFiller

2013 Form NZ IR330Fill Online Printable Fillable Blank PdfFiller

Web Visit www govt nz housing and property and download the forms required to apply for a rates rebate You may also need to supply other information to support your application

The New Zealand Tax Form Rebate Process

The process usually involves a few simple steps:

-

When you buy the product, you purchase the item the way you normally do.

-

Complete the New Zealand Tax Form Rebate request form. You'll need be able to provide a few details like your name, address, and purchase information, in order to get your New Zealand Tax Form Rebate.

-

Complete the New Zealand Tax Form Rebate It is dependent on the kind of New Zealand Tax Form Rebate there may be a requirement to submit a claim form to the bank or send it via the internet.

-

Wait until the company approves: The company will evaluate your claim to determine if it's in compliance with the refund's conditions and terms.

-

Get your New Zealand Tax Form Rebate Once it's approved, you'll receive a refund via check, prepaid card, or a different way specified in the offer.

Pros and Cons of New Zealand Tax Form Rebate

Advantages

-

Cost savings New Zealand Tax Form Rebate could significantly reduce the price you pay for an item.

-

Promotional Offers Incentivize customers to experiment with new products, or brands.

-

Accelerate Sales New Zealand Tax Form Rebate can enhance the sales of a business and increase its market share.

Disadvantages

-

Complexity Pay-in New Zealand Tax Form Rebate via mail, particularly difficult and take a long time to complete.

-

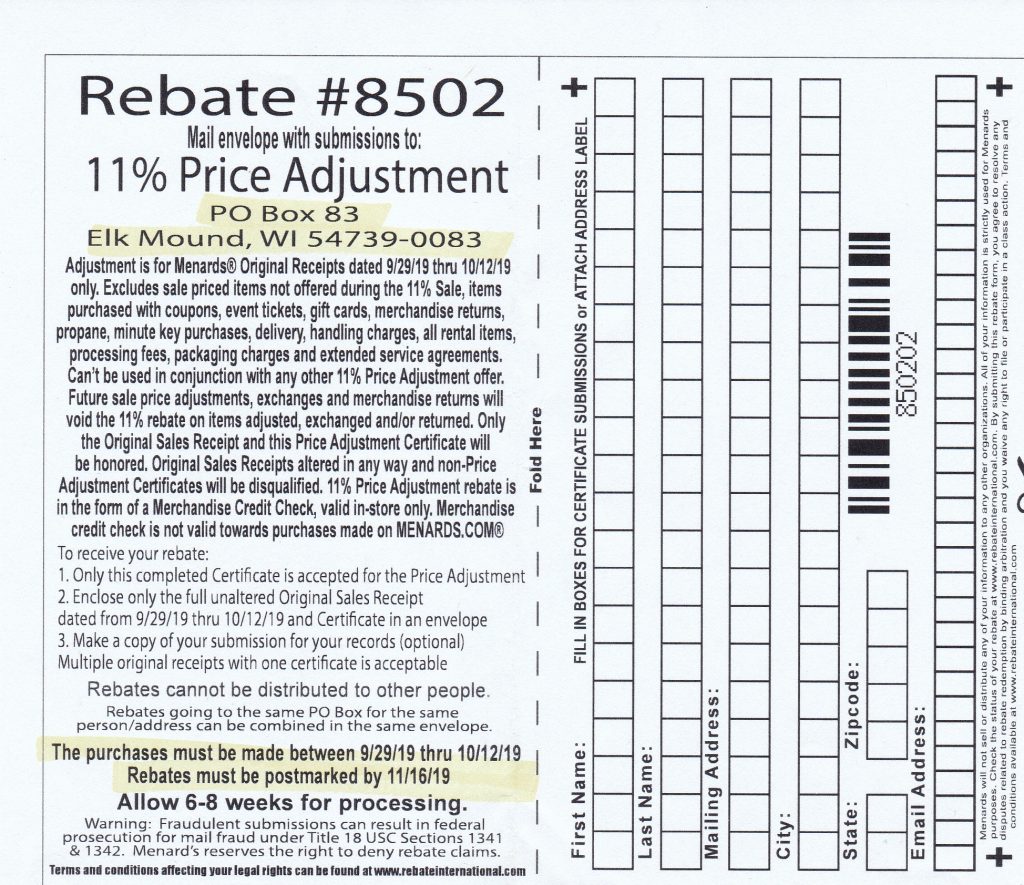

End Dates Many New Zealand Tax Form Rebate have deadlines for submission.

-

Risk of not receiving payment Customers may miss out on New Zealand Tax Form Rebate because they do not follow the rules exactly.

Download New Zealand Tax Form Rebate

Download New Zealand Tax Form Rebate

FAQs

1. Are New Zealand Tax Form Rebate similar to discounts? No, the New Zealand Tax Form Rebate will be partial reimbursement after purchase, and discounts are a reduction of your purchase cost at point of sale.

2. Can I use multiple New Zealand Tax Form Rebate on the same item? It depends on the terms of the New Zealand Tax Form Rebate offers and the product's suitability. Certain companies may allow it, but others won't.

3. How long will it take to get the New Zealand Tax Form Rebate? The amount of time varies, but it can be anywhere from a few weeks up to a couple of months for you to receive your New Zealand Tax Form Rebate.

4. Do I have to pay taxes of New Zealand Tax Form Rebate montants? the majority of situations, New Zealand Tax Form Rebate amounts are not considered to be taxable income.

5. Do I have confidence in New Zealand Tax Form Rebate deals from lesser-known brands It is essential to investigate and verify that the brand providing the New Zealand Tax Form Rebate is reputable prior making any purchase.

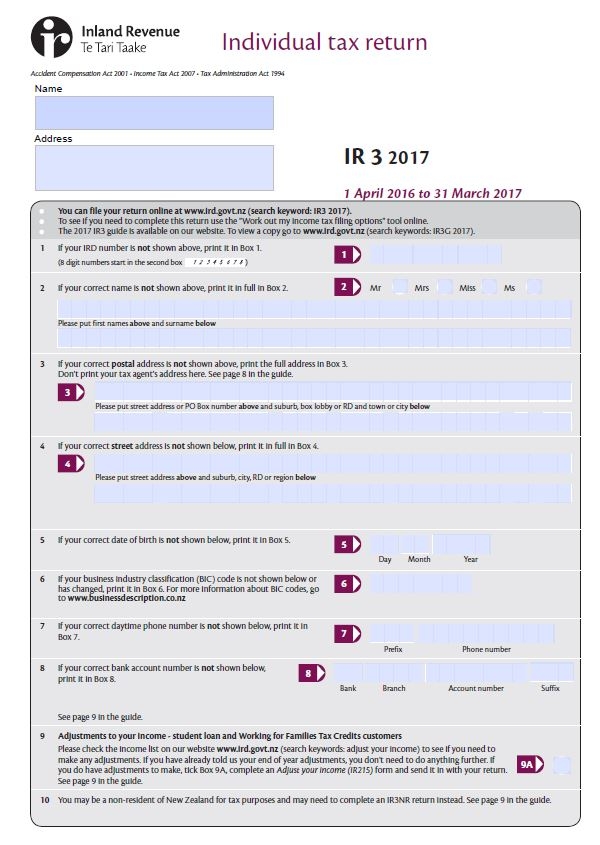

Doing Your Own Tax Return Nz Step By Step Guide How To File A Tax

Step By Step Guide How To File A Tax Return In New Zealand NZ Pocket

Check more sample of New Zealand Tax Form Rebate below

New Zealand Tax Information

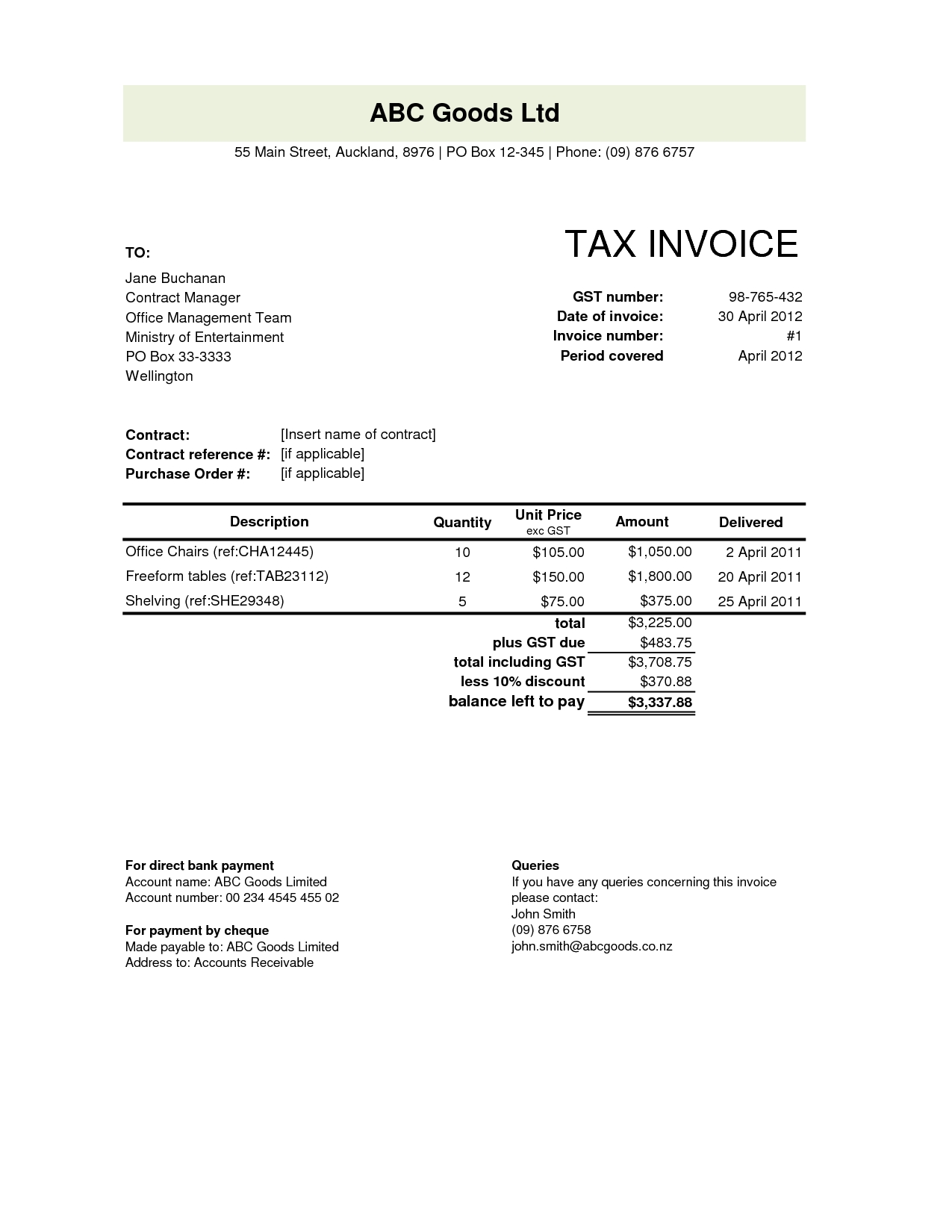

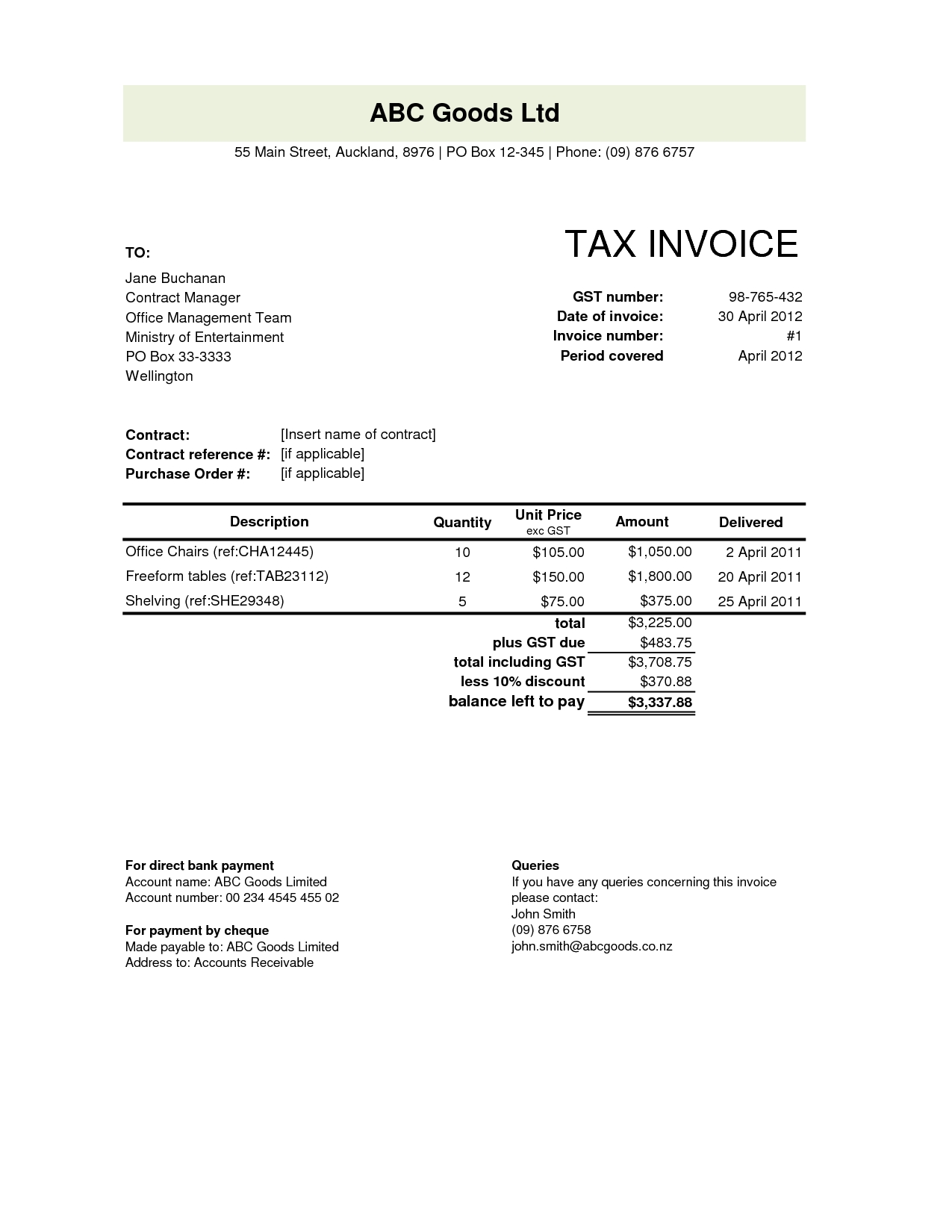

Gst Invoice Template Nz Printable Receipt Template

Mail in Rebate Form

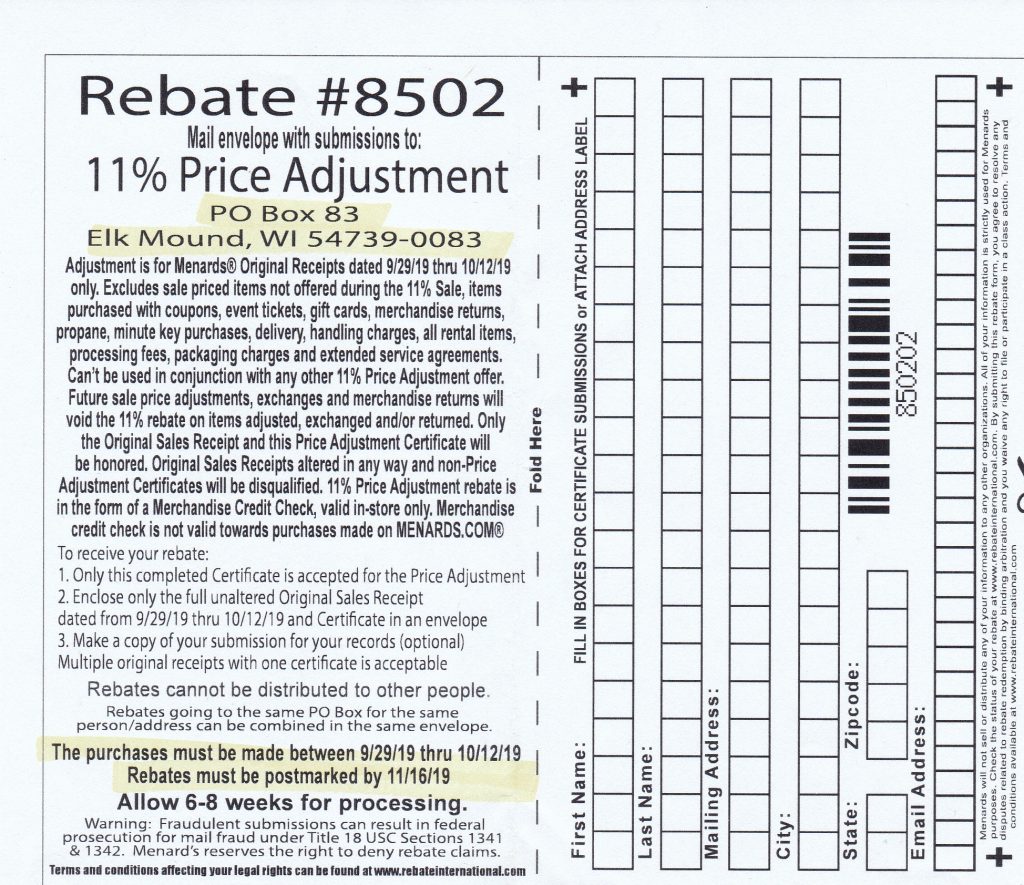

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Changes To GST Online Filing Laurenson Chartered Accountants

New Zealand Tax Invoice Template Regarding Invoice Template New Zealand

https://www.ird.govt.nz/income-tax/income-tax-for-individuals/...

Web Individual tax credits There are some tax credits you can claim as an individual This means that you do not have to pay as much income tax If you ve already paid the tax

https://www.ird.govt.nz/income-tax/income-tax-for-individuals/...

Web You can claim 33 33 cents for every dollar you donated to approved charities and organisations You can only claim on donations that added up to the same amount or

Web Individual tax credits There are some tax credits you can claim as an individual This means that you do not have to pay as much income tax If you ve already paid the tax

Web You can claim 33 33 cents for every dollar you donated to approved charities and organisations You can only claim on donations that added up to the same amount or

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Gst Invoice Template Nz Printable Receipt Template

Changes To GST Online Filing Laurenson Chartered Accountants

New Zealand Tax Invoice Template Regarding Invoice Template New Zealand

Forex Trading Tax New Zealand Is Trading Forex Easier Than Stocks

IRD New Zealand All About New Zealand Working Holiday

IRD New Zealand All About New Zealand Working Holiday

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form