In today's consumer-driven world everyone appreciates a great deal. One method to get significant savings when you shop is with 2023 Recovery Rebate Credit Form Turbotaxs. They are a form of marketing employed by retailers and manufacturers to provide customers with a partial refund for their purchases after they've made them. In this article, we will delve into the world of 2023 Recovery Rebate Credit Form Turbotaxs, examining the nature of them and how they function, and how you can make the most of your savings using these low-cost incentives.

Get Latest 2023 Recovery Rebate Credit Form Turbotax Below

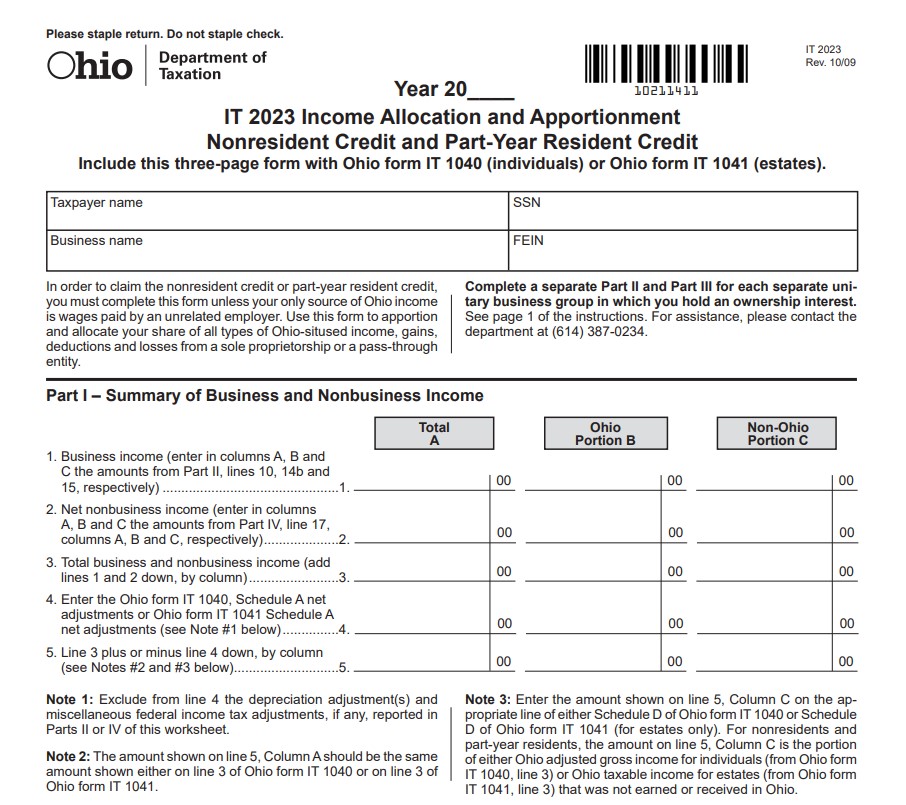

2023 Recovery Rebate Credit Form Turbotax

2023 Recovery Rebate Credit Form Turbotax -

If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility re

A 2023 Recovery Rebate Credit Form Turbotax, in its simplest format, is a refund that a client receives after they've bought a product or service. This is a potent tool for businesses to entice customers, increase sales, as well as promote particular products.

Types of 2023 Recovery Rebate Credit Form Turbotax

Recovery Rebate Credit On Turbotax Recovery Rebate

Recovery Rebate Credit On Turbotax Recovery Rebate

TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3

Resources Community Support TurboTax Taxes Tax reports Why was my refund adjusted after claiming the Recovery Rebate Credit TurboTax Help Intuit Why

Cash 2023 Recovery Rebate Credit Form Turbotax

Cash 2023 Recovery Rebate Credit Form Turbotax are the simplest type of 2023 Recovery Rebate Credit Form Turbotax. Customers receive a specific amount of money back upon purchasing a particular item. These are often used for the most expensive products like electronics or appliances.

Mail-In 2023 Recovery Rebate Credit Form Turbotax

Mail-in 2023 Recovery Rebate Credit Form Turbotax require customers to provide proof of purchase to receive their cash back. They're a bit more involved, but can result in huge savings.

Instant 2023 Recovery Rebate Credit Form Turbotax

Instant 2023 Recovery Rebate Credit Form Turbotax are applied at the point of sale. They reduce the purchase cost immediately. Customers don't have to wait long for savings when they purchase this type of 2023 Recovery Rebate Credit Form Turbotax.

How 2023 Recovery Rebate Credit Form Turbotax Work

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

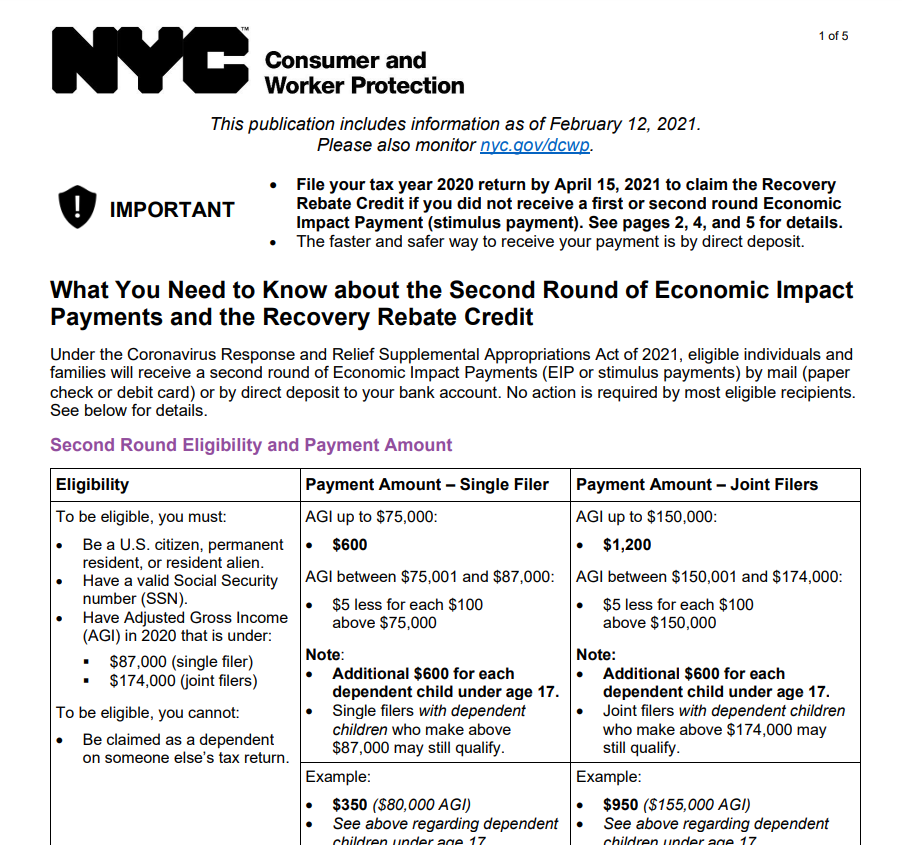

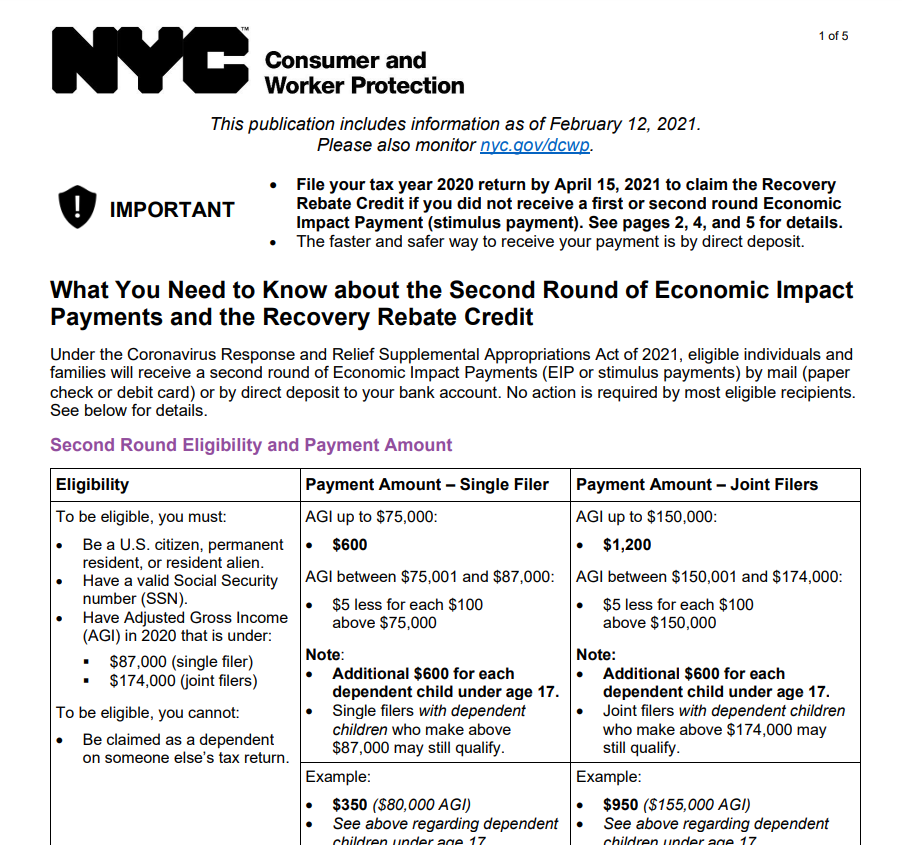

People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or

The 2023 Recovery Rebate Credit Form Turbotax Process

It usually consists of a few simple steps:

-

Purchase the item: First you purchase the product exactly as you would normally.

-

Complete the 2023 Recovery Rebate Credit Form Turbotax request form. You'll need to give some specific information like your name, address, and the purchase details, in order to submit your 2023 Recovery Rebate Credit Form Turbotax.

-

You must submit the 2023 Recovery Rebate Credit Form Turbotax It is dependent on the type of 2023 Recovery Rebate Credit Form Turbotax you might need to send in a form, or submit it online.

-

Wait for the company's approval: They will review your request to determine if it's in compliance with the refund's conditions and terms.

-

You will receive your 2023 Recovery Rebate Credit Form Turbotax After approval, you'll be able to receive your reimbursement, in the form of a check, prepaid card, or another method specified by the offer.

Pros and Cons of 2023 Recovery Rebate Credit Form Turbotax

Advantages

-

Cost savings The use of 2023 Recovery Rebate Credit Form Turbotax can greatly cut the price you pay for products.

-

Promotional Deals Incentivize customers in trying new products or brands.

-

Help to Increase Sales 2023 Recovery Rebate Credit Form Turbotax can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity The mail-in 2023 Recovery Rebate Credit Form Turbotax particularly they can be time-consuming and long-winded.

-

Days of expiration Some 2023 Recovery Rebate Credit Form Turbotax have strict time limits for submission.

-

Risque of Non-Payment Customers may not be able to receive their 2023 Recovery Rebate Credit Form Turbotax if they don't follow the regulations precisely.

Download 2023 Recovery Rebate Credit Form Turbotax

Download 2023 Recovery Rebate Credit Form Turbotax

FAQs

1. Are 2023 Recovery Rebate Credit Form Turbotax equivalent to discounts? No, they are a partial refund upon purchase, whereas discounts cut the purchase price at the point of sale.

2. Can I make use of multiple 2023 Recovery Rebate Credit Form Turbotax for the same product It is contingent on the terms in the 2023 Recovery Rebate Credit Form Turbotax promotions and on the products quality and eligibility. Certain companies may permit the use of multiple 2023 Recovery Rebate Credit Form Turbotax, whereas other won't.

3. How long does it take to receive an 2023 Recovery Rebate Credit Form Turbotax? The length of time differs, but it can take anywhere from a few weeks to a few months for you to receive your 2023 Recovery Rebate Credit Form Turbotax.

4. Do I need to pay taxes of 2023 Recovery Rebate Credit Form Turbotax amounts? In the majority of cases, 2023 Recovery Rebate Credit Form Turbotax amounts are not considered to be taxable income.

5. Can I trust 2023 Recovery Rebate Credit Form Turbotax offers from brands that aren't well-known It's crucial to research and verify that the brand which is providing the 2023 Recovery Rebate Credit Form Turbotax is trustworthy prior to making the purchase.

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate

Check more sample of 2023 Recovery Rebate Credit Form Turbotax below

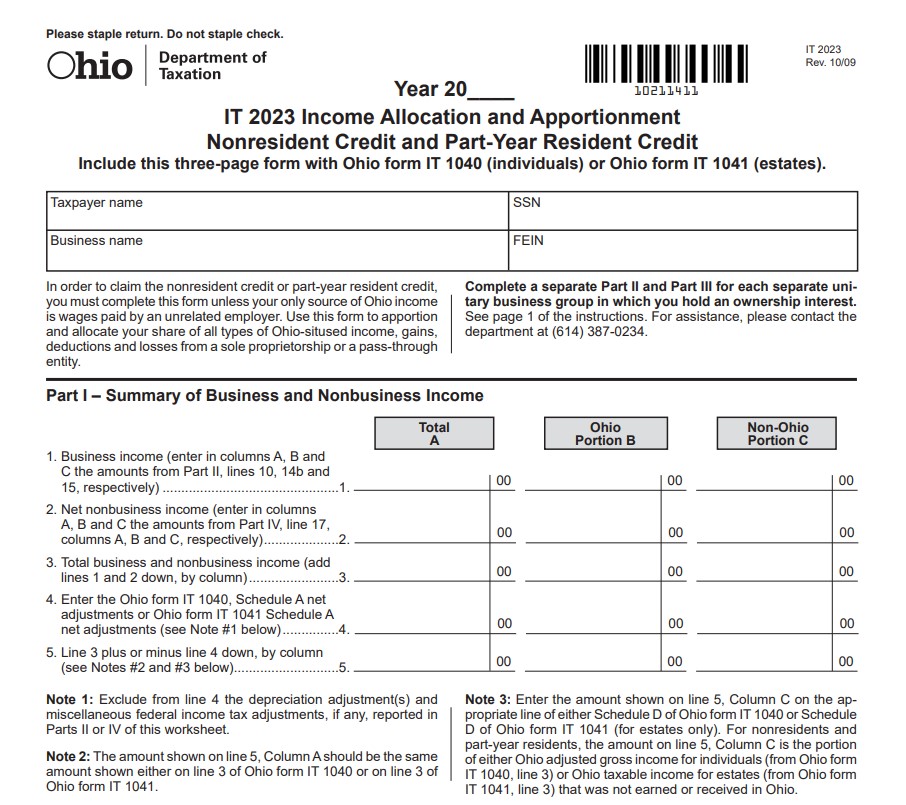

Recovery Rebate Credit Form 1040 Recovery Rebate

How Much Does Taxact Charge To E File QATAX Recovery Rebate

2023 Recovery Rebate Instructions Recovery Rebate

Rebate Recovery Credit 2022 Turbotax Recovery Rebate

Turbotax Return TurboTax Tax Return App Max Refund Guaranteed For

Aep Ohio Rebates 2023 Printable Rebate Form

https://www.youtube.com/watch?v=dIWs6a1ZGZY

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility re

https://turbotax.intuit.com/tax-tips/tax-relief/...

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility re

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial

Rebate Recovery Credit 2022 Turbotax Recovery Rebate

How Much Does Taxact Charge To E File QATAX Recovery Rebate

Turbotax Return TurboTax Tax Return App Max Refund Guaranteed For

Aep Ohio Rebates 2023 Printable Rebate Form

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

Free File 1040 Form 2021 Recovery Rebate