In this modern-day world of consumers everybody loves a good bargain. One way to gain substantial savings on your purchases is by using 1040 Form 2023 Recovery Rebate Credits. They are a form of marketing employed by retailers and manufacturers to offer customers a partial cash back on their purchases once they have bought them. In this article, we'll investigate the world of 1040 Form 2023 Recovery Rebate Credits. We'll look at what they are and how they operate, as well as ways to maximize your savings with these cost-effective incentives.

Get Latest 1040 Form 2023 Recovery Rebate Credit Below

1040 Form 2023 Recovery Rebate Credit

1040 Form 2023 Recovery Rebate Credit -

Verkko 8 maalisk 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the Economic Impact Payments To qualify for any of the three stimulus payments all of the following had to apply at the time You were a US citizen or US resident alien

Verkko 17 marrask 2023 nbsp 0183 32 The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

A 1040 Form 2023 Recovery Rebate Credit in its simplest description, is a refund that a client receives after they've bought a product or service. It's a highly effective tool that companies use to attract clients, increase sales and advertise specific products.

Types of 1040 Form 2023 Recovery Rebate Credit

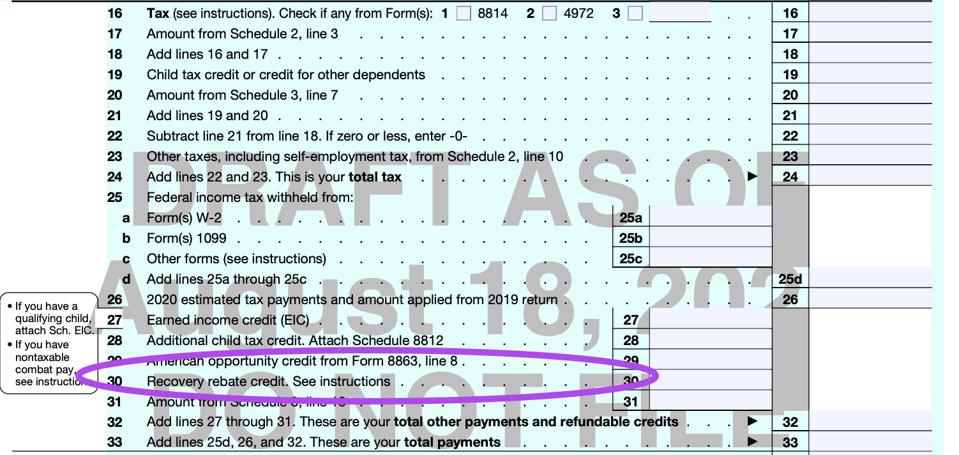

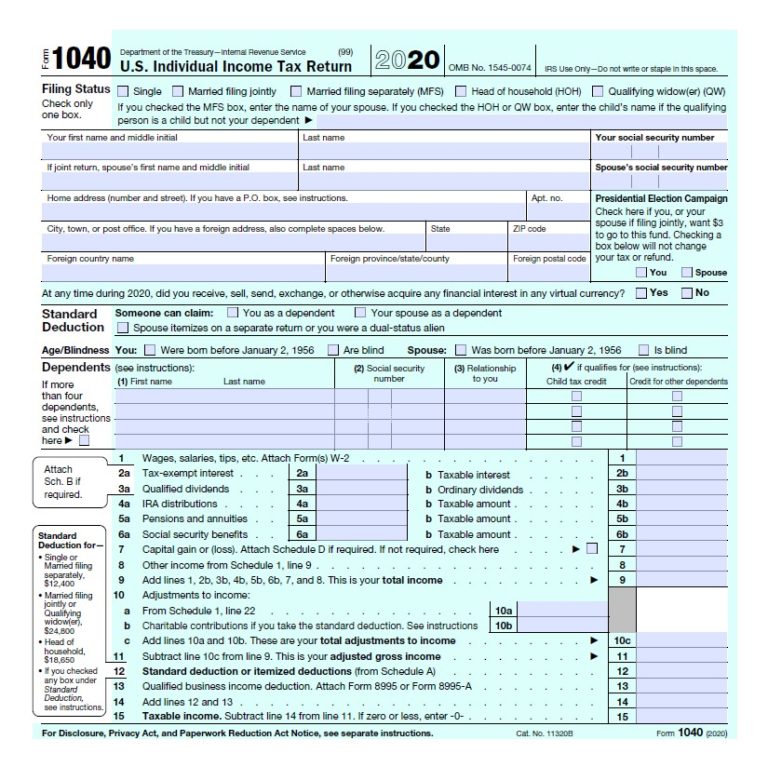

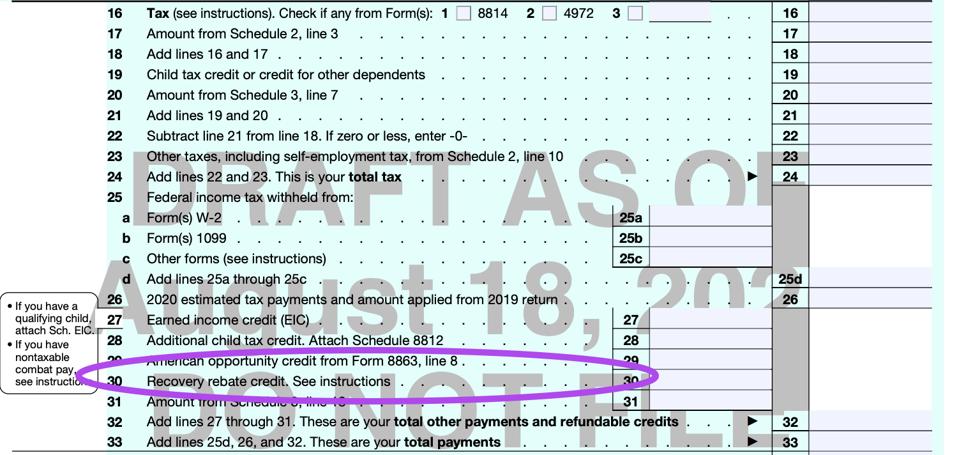

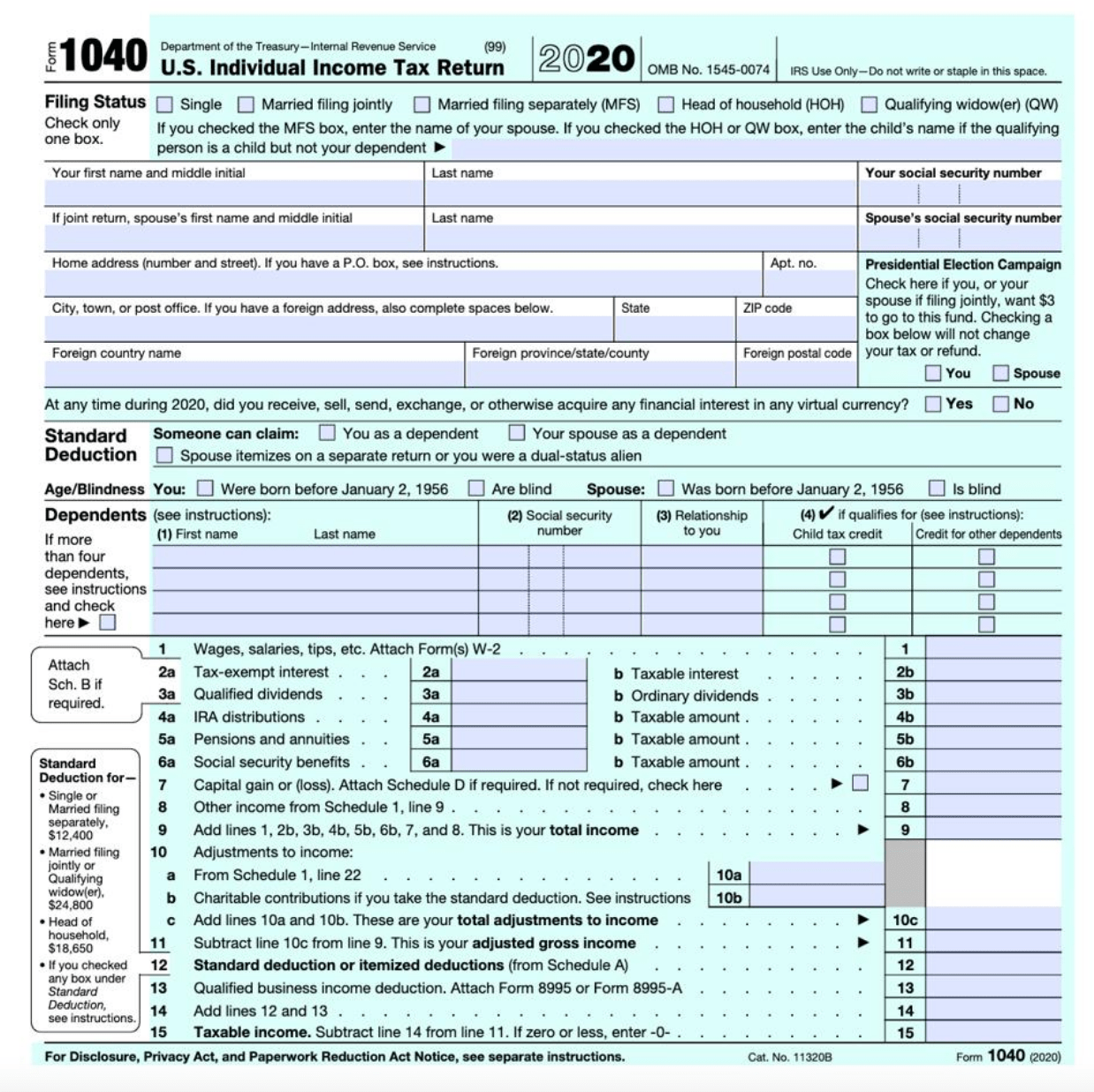

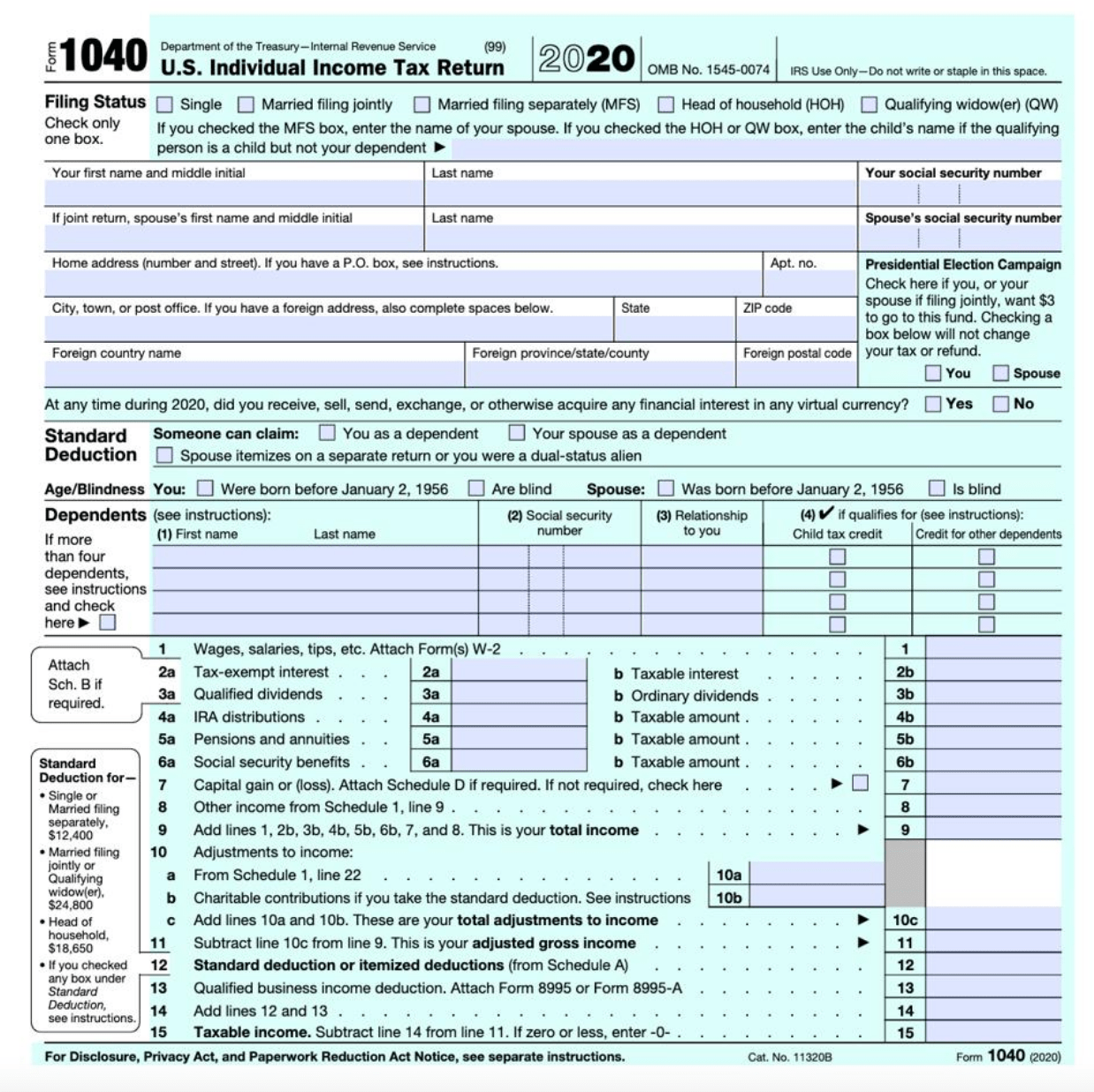

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Verkko Feb 3 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win

Verkko 8 helmik 2021 nbsp 0183 32 The Recovery Rebate Credit is similar except that it s based on the 2020 tax return Tax preparation software including IRS Free File will help you figure the amount See the Recovery Rebate Credit FAQs for more information

Cash 1040 Form 2023 Recovery Rebate Credit

Cash 1040 Form 2023 Recovery Rebate Credit are by far the easiest type of 1040 Form 2023 Recovery Rebate Credit. Customers receive a specific amount of money after buying a product. They are typically used to purchase large-ticket items such as electronics and appliances.

Mail-In 1040 Form 2023 Recovery Rebate Credit

Customers who want to receive mail-in 1040 Form 2023 Recovery Rebate Credit must submit documents of purchase to claim their reimbursement. They're more involved but offer huge savings.

Instant 1040 Form 2023 Recovery Rebate Credit

Instant 1040 Form 2023 Recovery Rebate Credit are credited at the point of sale, which reduces prices immediately. Customers don't need to wait long for savings with this type.

How 1040 Form 2023 Recovery Rebate Credit Work

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

Verkko 17 maalisk 2023 nbsp 0183 32 In the absence of Notice 2023 21 the lookback period in section 6511 b 2 would prohibit the taxpayer from claiming a credit or refund for any timely paid income taxes if the Form 1040 X were filed more than 3 years after the due date of the income tax return even though under section 6511 a taxpayers can file a Form 1040

The 1040 Form 2023 Recovery Rebate Credit Process

The process generally involves a number of easy steps:

-

Buy the product: At first, you buy the product the way you normally do.

-

Complete your 1040 Form 2023 Recovery Rebate Credit template: You'll have to give some specific information like your address, name, and purchase details to claim your 1040 Form 2023 Recovery Rebate Credit.

-

Submit the 1040 Form 2023 Recovery Rebate Credit: Depending on the nature of 1040 Form 2023 Recovery Rebate Credit, you may need to mail in a form or submit it online.

-

Wait until the company approves: The company will scrutinize your submission to verify that it is compliant with the 1040 Form 2023 Recovery Rebate Credit's terms and conditions.

-

You will receive your 1040 Form 2023 Recovery Rebate Credit After being approved, you'll receive the refund whether via check, credit card, or through another procedure specified by the deal.

Pros and Cons of 1040 Form 2023 Recovery Rebate Credit

Advantages

-

Cost savings 1040 Form 2023 Recovery Rebate Credit can substantially reduce the cost for the product.

-

Promotional Offers: They encourage customers to try new items or brands.

-

Boost Sales: 1040 Form 2023 Recovery Rebate Credit can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Reward mail-ins particularly difficult and demanding.

-

Extension Dates Some 1040 Form 2023 Recovery Rebate Credit have extremely strict deadlines to submit.

-

Risk of not receiving payment Some customers might miss out on 1040 Form 2023 Recovery Rebate Credit because they don't follow the regulations precisely.

Download 1040 Form 2023 Recovery Rebate Credit

Download 1040 Form 2023 Recovery Rebate Credit

FAQs

1. Are 1040 Form 2023 Recovery Rebate Credit the same as discounts? Not at all, 1040 Form 2023 Recovery Rebate Credit provide partial reimbursement after purchase, and discounts are a reduction of the purchase price at the point of sale.

2. Can I make use of multiple 1040 Form 2023 Recovery Rebate Credit on the same product It is contingent on the conditions on the 1040 Form 2023 Recovery Rebate Credit deals and product's potential eligibility. Certain businesses may allow this, whereas others will not.

3. What is the time frame to get a 1040 Form 2023 Recovery Rebate Credit What is the timeframe? differs, but could last from a few weeks until a few months to receive your 1040 Form 2023 Recovery Rebate Credit.

4. Do I need to pay taxes regarding 1040 Form 2023 Recovery Rebate Credit amounts? In most situations, 1040 Form 2023 Recovery Rebate Credit amounts are not considered taxable income.

5. Do I have confidence in 1040 Form 2023 Recovery Rebate Credit deals from lesser-known brands it is crucial to conduct research to ensure that the name which is providing the 1040 Form 2023 Recovery Rebate Credit is reputable before making a purchase.

Recovery Rebate Credit Form 1040 Recovery Rebate

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Check more sample of 1040 Form 2023 Recovery Rebate Credit below

Solved Amend 2020 Tax Forms For The Recovery Rebate Credit Recovery

2023 Recovery Rebate Credit Turbotax Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Rebate Credit Your Last Chance To Get A 1 400 Stimulus

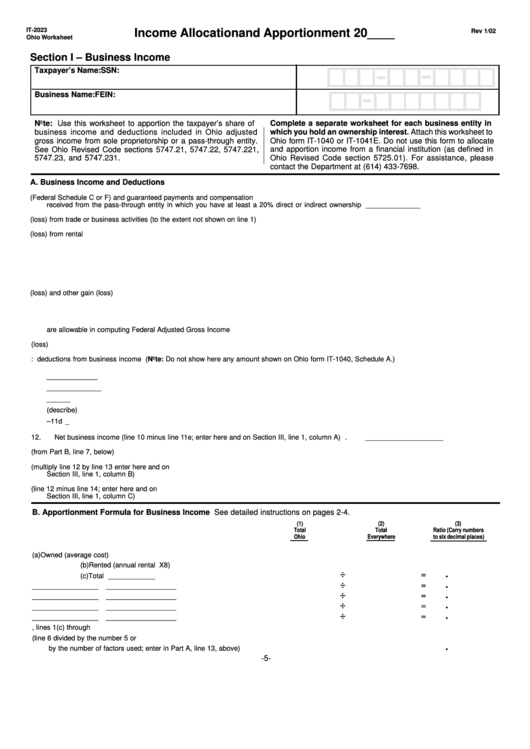

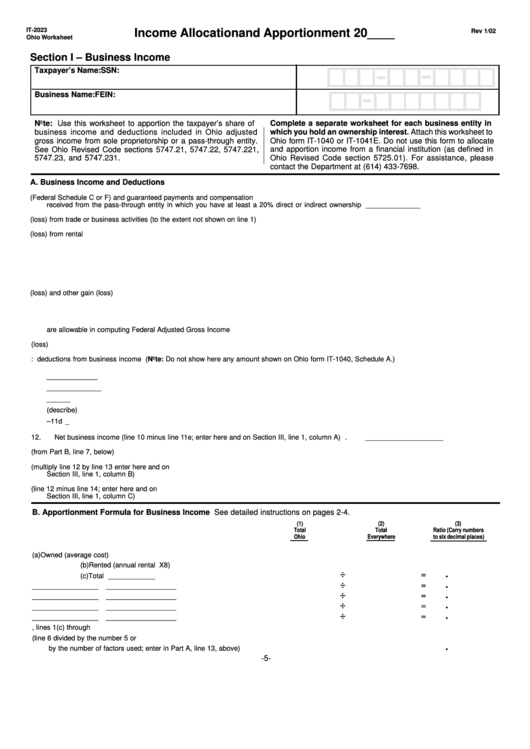

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non...

Verkko 17 marrask 2023 nbsp 0183 32 The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

https://www.irs.gov/about-irs/the-2023-tax-season-has-begun-irs-offers...

Verkko 17 helmik 2023 nbsp 0183 32 Review the changes under the Inflation Reduction Act of 2022 to qualify for a Clean Vehicle Credit Refunds may be smaller in 2023 Several factors contribute to this your AGI is on line 11 of the Form 1040 If you didn t keep a copy of your 2021 tax return you can log in to your Online Account to find your prior year AGI

Verkko 17 marrask 2023 nbsp 0183 32 The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively

Verkko 17 helmik 2023 nbsp 0183 32 Review the changes under the Inflation Reduction Act of 2022 to qualify for a Clean Vehicle Credit Refunds may be smaller in 2023 Several factors contribute to this your AGI is on line 11 of the Form 1040 If you didn t keep a copy of your 2021 tax return you can log in to your Online Account to find your prior year AGI

Recovery Rebate Credit Your Last Chance To Get A 1 400 Stimulus

2023 Recovery Rebate Credit Turbotax Recovery Rebate

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

2022 Form 1040 Schedule A Instructions

2022 Form 1040 Schedule A Instructions

What Is The Recovery Rebate Credit CD Tax Financial