In today's consumer-driven world everybody loves a good bargain. One method to get substantial savings in your purchase is through Tax Rebate Ireland Forms. Tax Rebate Ireland Forms can be a way of marketing employed by retailers and manufacturers to offer customers a return on their purchases once they've placed them. In this article, we will examine the subject of Tax Rebate Ireland Forms. We'll look at the nature of them about, how they work, and how you can make the most of your savings via these cost-effective incentives.

Get Latest Tax Rebate Ireland Form Below

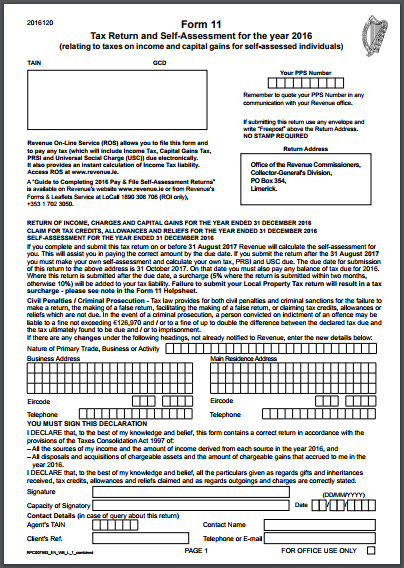

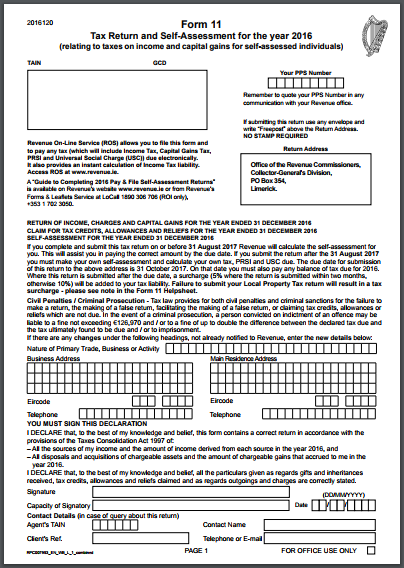

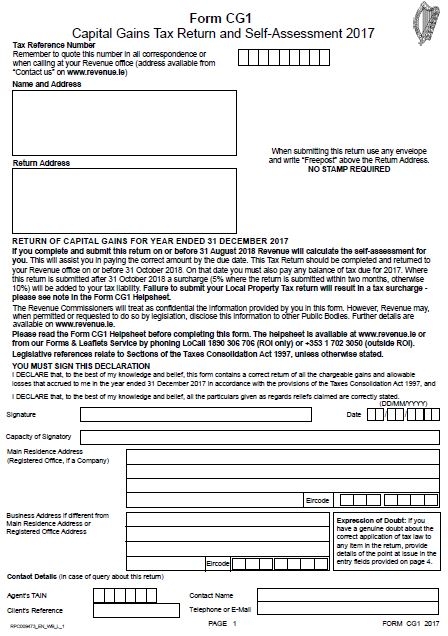

Tax Rebate Ireland Form

Tax Rebate Ireland Form - Tax Return Ireland Form, Tax Return Ireland Form 11, Tax Back Form Ireland, Tax Credit Form Ireland, Who Are Irish Tax Rebates, How Can I Claim My Tax Back In Ireland, How To Get A Tax Rebate Form

Web For 2022 and 2023 to calculate the amount of costs you can get tax relief on Add your electricity heating and internet costs and multiply the total costs by the number of days

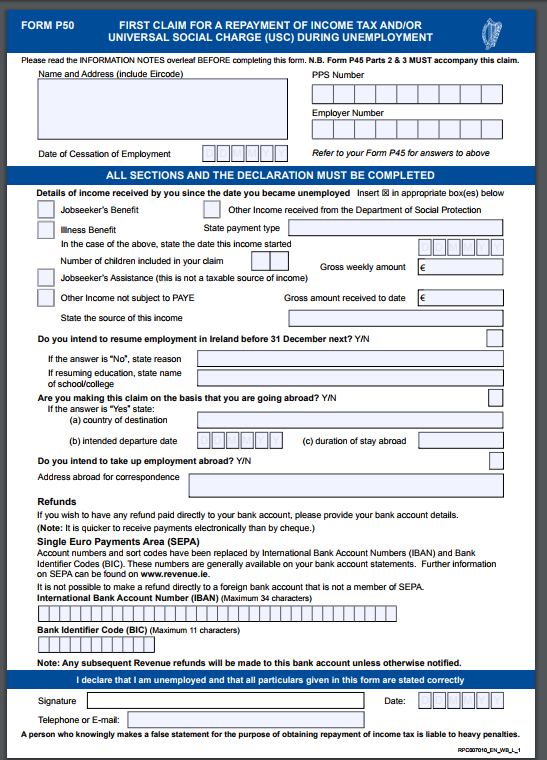

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

A Tax Rebate Ireland Form in its most basic definition, is a return to the customer after purchasing a certain product or service. This is a potent tool that businesses use to draw customers, boost sales, and even promote certain products.

Types of Tax Rebate Ireland Form

Ireland Tax Refund AmberTax

Ireland Tax Refund AmberTax

Web Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more Tax relief on medical expenses You can claim tax relief on

Web 11 janv 2022 nbsp 0183 32 1 Medical Expenses Medical expenses is the single most popular tax relief that goes unclaimed every year you can claim 20 back on most of your doctor or dentist fees except routine dentist e g

Cash Tax Rebate Ireland Form

Cash Tax Rebate Ireland Form are by far the easiest type of Tax Rebate Ireland Form. Customers are offered a certain amount of money back after purchasing a particular item. This is often for the most expensive products like electronics or appliances.

Mail-In Tax Rebate Ireland Form

Customers who want to receive mail-in Tax Rebate Ireland Form must provide proof of purchase to receive their cash back. They are a bit more complicated, but they can provide substantial savings.

Instant Tax Rebate Ireland Form

Instant Tax Rebate Ireland Form are applied at point of sale, which reduces prices immediately. Customers don't have to wait for their savings with this type.

How Tax Rebate Ireland Form Work

2018 2022 Form IE RF100A Fill Online Printable Fillable Blank

2018 2022 Form IE RF100A Fill Online Printable Fillable Blank

Web 12 juil 2022 nbsp 0183 32 Overview Revenue will prioritise the approval and processing of repayments and refunds to taxpayers primarily for Value Added Tax VAT repayments Where

The Tax Rebate Ireland Form Process

It usually consists of a few steps:

-

You purchase the item: First you purchase the product in the same way you would normally.

-

Complete this Tax Rebate Ireland Form paper: You'll have to provide some data including your name, address, as well as the details of your purchase in order to take advantage of your Tax Rebate Ireland Form.

-

In order to submit the Tax Rebate Ireland Form: Depending on the type of Tax Rebate Ireland Form, you may need to fill out a form and mail it in or send it via the internet.

-

Wait for the company's approval: They will review your request to verify that it is compliant with the Tax Rebate Ireland Form's terms and conditions.

-

Receive your Tax Rebate Ireland Form After you've been approved, the amount you receive will be whether by check, prepaid card, or other procedure specified by the deal.

Pros and Cons of Tax Rebate Ireland Form

Advantages

-

Cost savings A Tax Rebate Ireland Form can significantly decrease the price for the product.

-

Promotional Deals Incentivize customers to explore new products or brands.

-

increase sales Tax Rebate Ireland Form can enhance a company's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly could be cumbersome and time-consuming.

-

End Dates Most Tax Rebate Ireland Form come with rigid deadlines to submit.

-

A risk of not being paid Certain customers could lose their Tax Rebate Ireland Form in the event that they don't adhere to the rules precisely.

Download Tax Rebate Ireland Form

Download Tax Rebate Ireland Form

FAQs

1. Are Tax Rebate Ireland Form the same as discounts? No, Tax Rebate Ireland Form are only a partial reimbursement following the purchase, whereas discounts cut costs at point of sale.

2. Can I get multiple Tax Rebate Ireland Form for the same product What is the best way to do it? It's contingent on conditions on the Tax Rebate Ireland Form provides and the particular product's admissibility. Some companies will allow the use of multiple Tax Rebate Ireland Form, whereas other won't.

3. What is the time frame to receive a Tax Rebate Ireland Form What is the timeframe? can vary, but typically it will last from a few weeks until a few months for you to receive your Tax Rebate Ireland Form.

4. Do I need to pay taxes for Tax Rebate Ireland Form quantities? the majority of cases, Tax Rebate Ireland Form amounts are not considered to be taxable income.

5. Do I have confidence in Tax Rebate Ireland Form offers from brands that aren't well-known it is crucial to conduct research to ensure that the name offering the Tax Rebate Ireland Form has a good reputation prior to making a purchase.

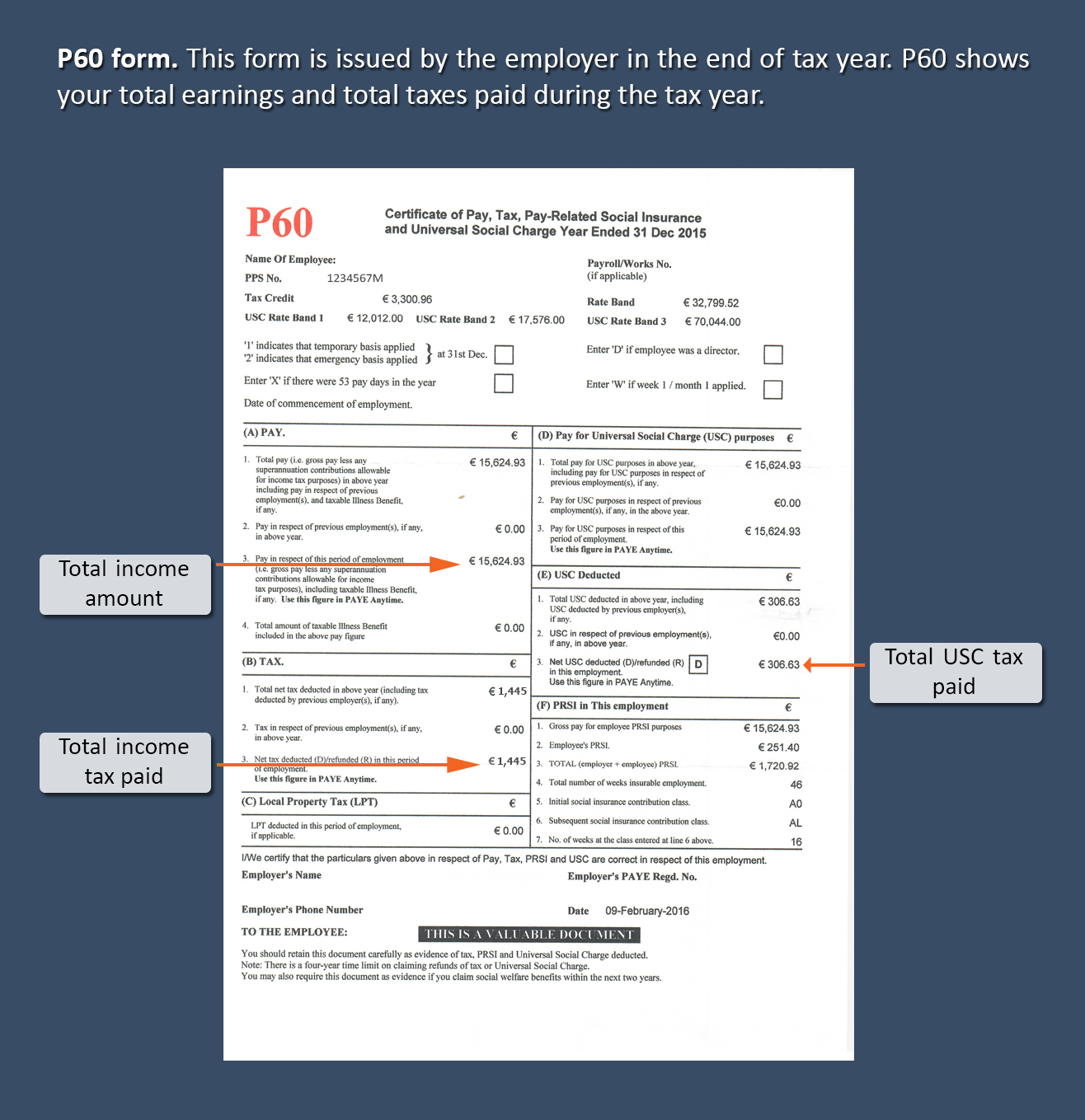

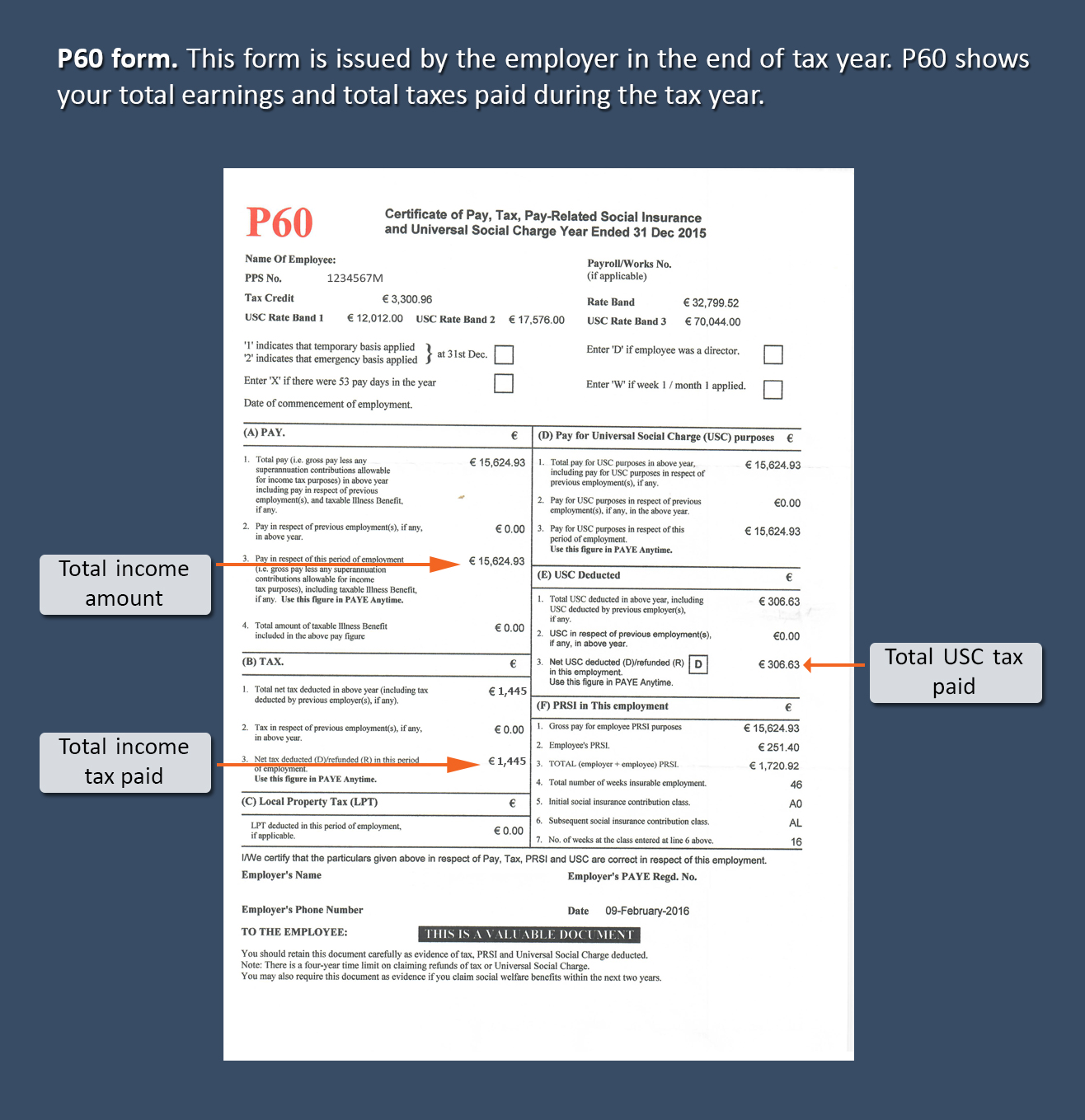

Your Bullsh t Free Guide To PAYE Taxes In Ireland

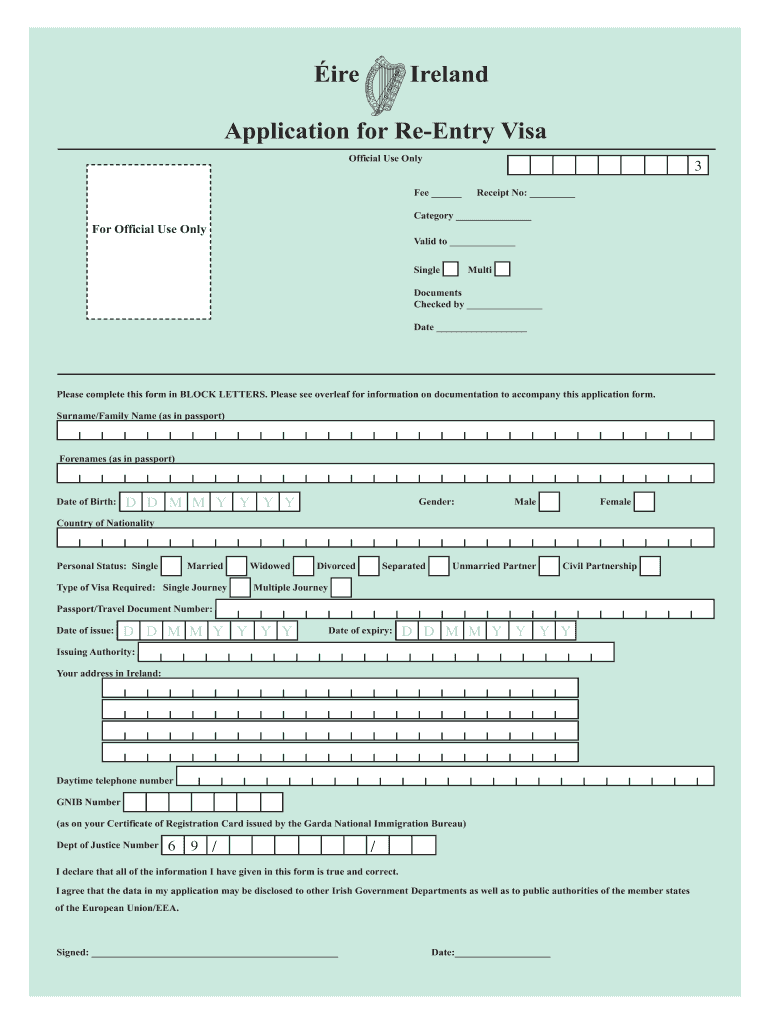

Ie Re Entry Visa Fill Online Printable Fillable Blank PdfFiller

Check more sample of Tax Rebate Ireland Form below

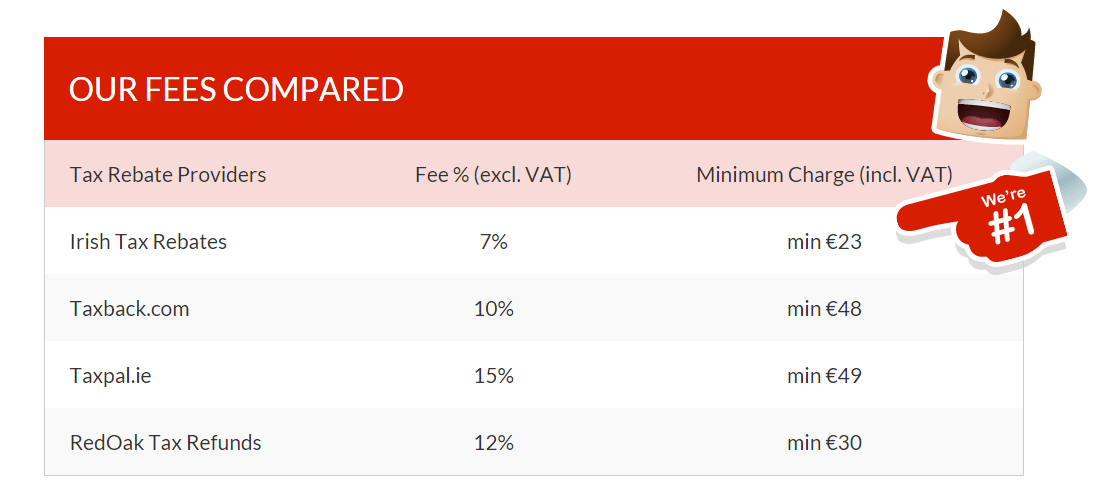

Consult Tax Experts To Claim Tax Back Irish Tax Rebates

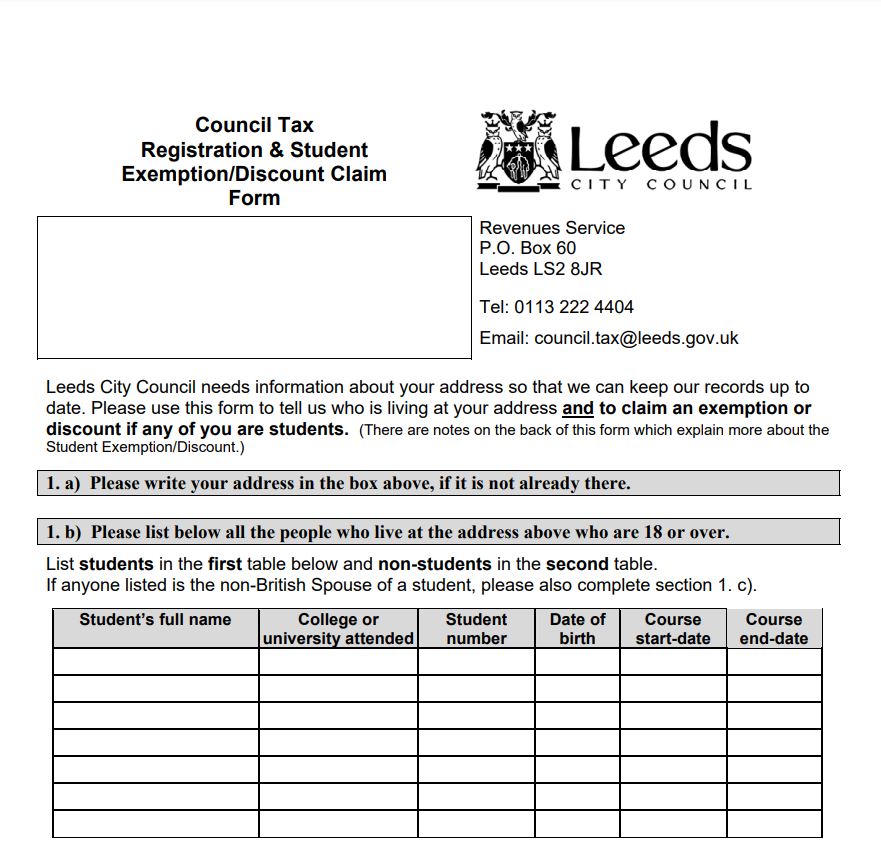

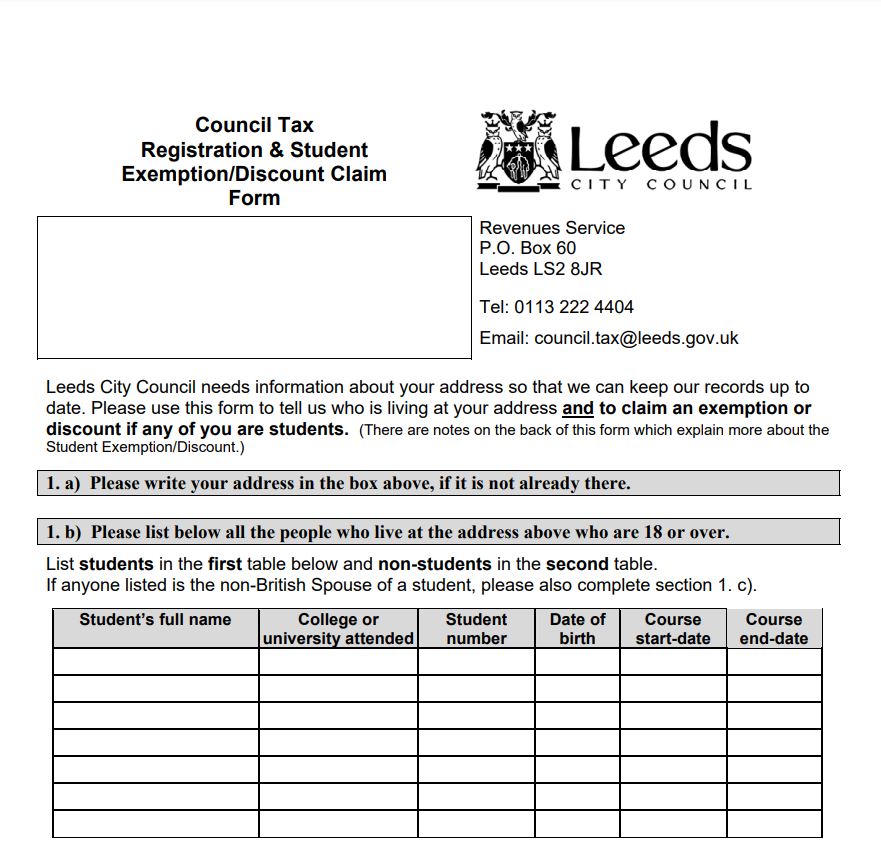

Leeds Council Printable Rebate Form

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

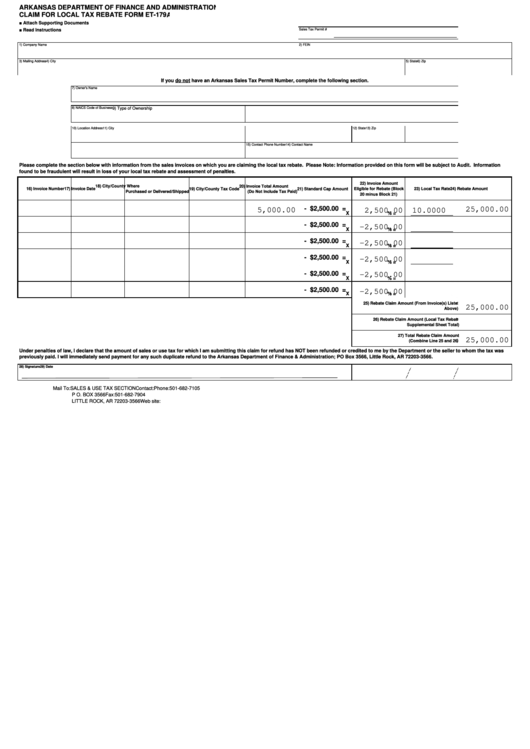

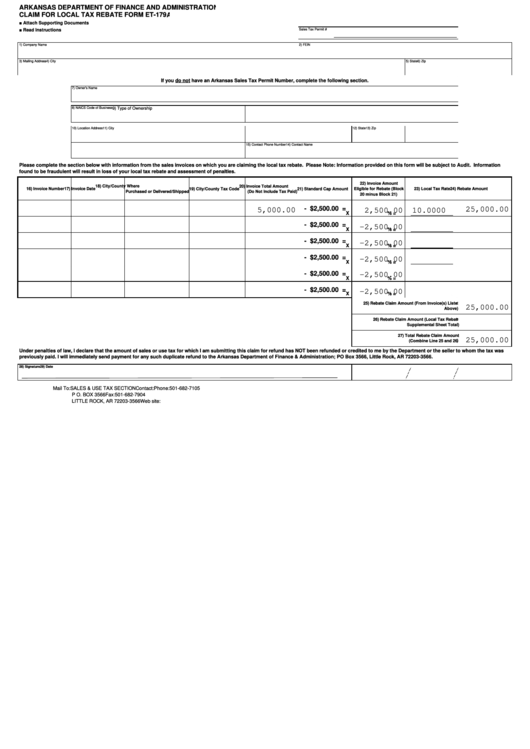

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

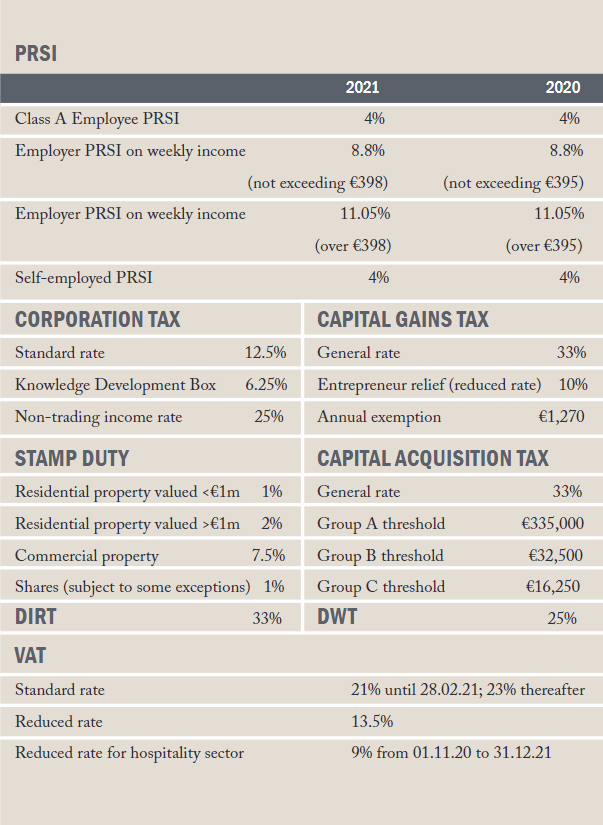

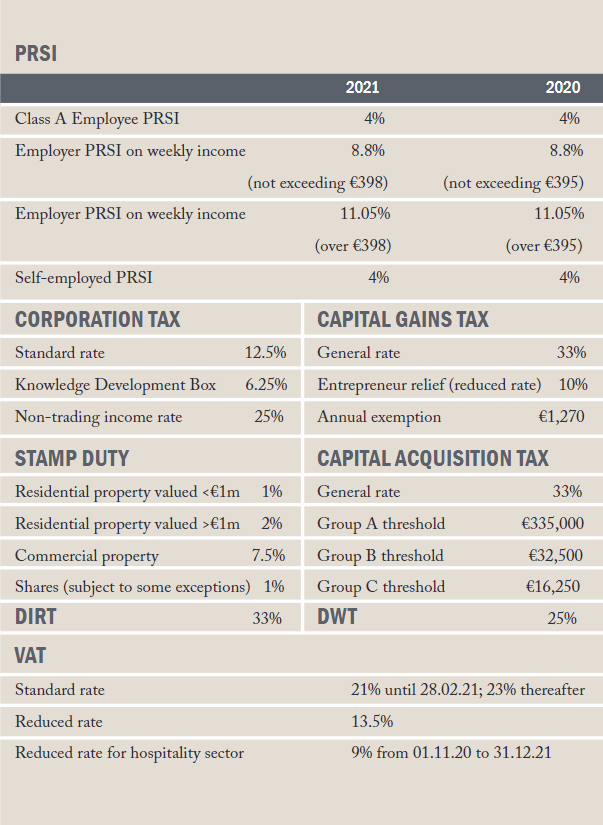

Budget 2021 IRISH TAX GUIDE FOR 2021 Rebates

https://www.revenue.ie/.../are-you-entitled-to-a-refund-of-tax.aspx

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

https://www.revenue.ie/.../documents/form12.pdf

Web allowances and reliefs as set out below For further information on the content of this form you should refer to the Guide to Completing 2022 Pay amp File Self Assessment Returns

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

Web allowances and reliefs as set out below For further information on the content of this form you should refer to the Guide to Completing 2022 Pay amp File Self Assessment Returns

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

Leeds Council Printable Rebate Form

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Budget 2021 IRISH TAX GUIDE FOR 2021 Rebates

Council Tax Rebate Form 2023 Printable Rebate Form

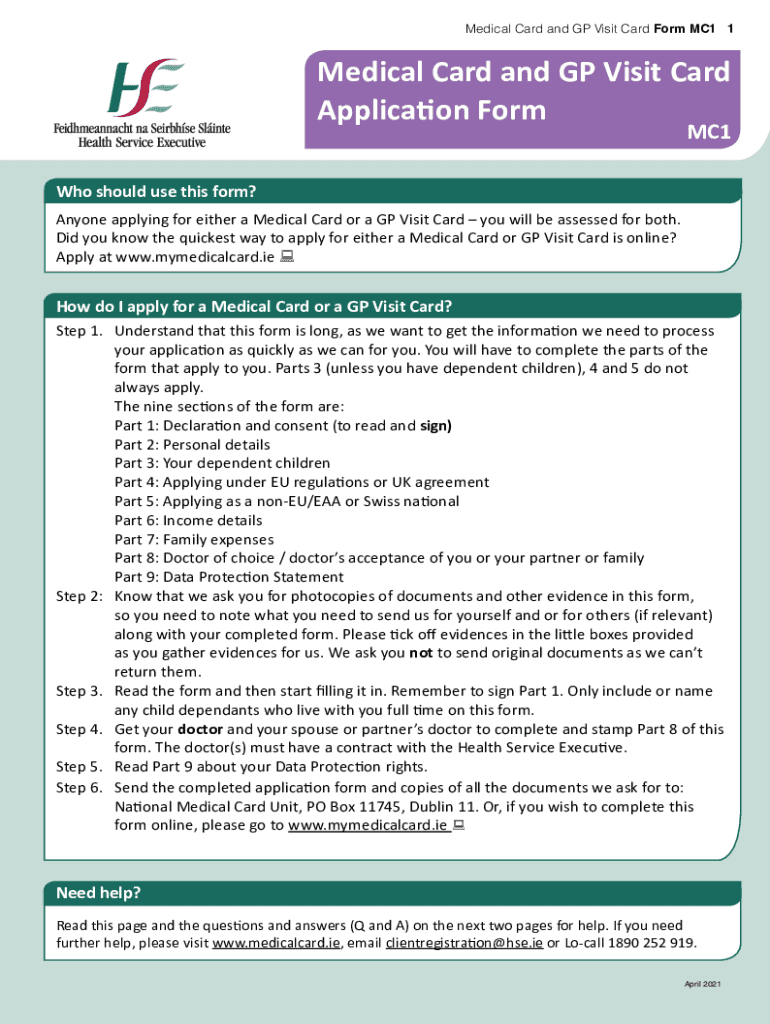

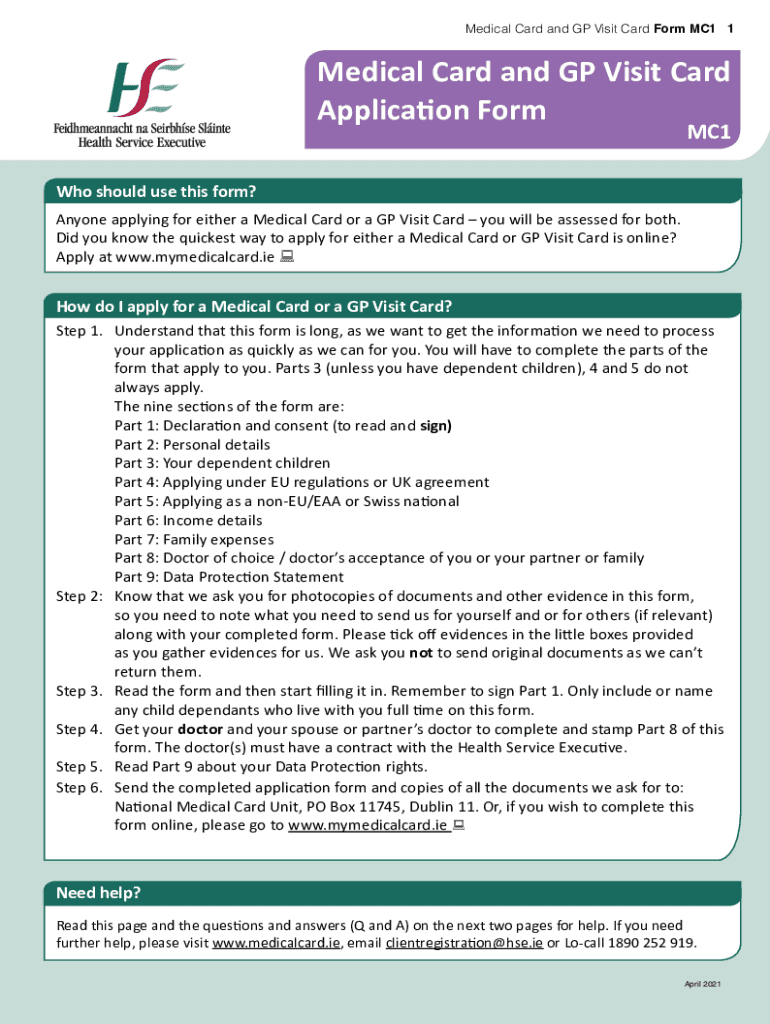

Ireland Form Application 2021 2022 Template In MS Word DOC PdfFiller

Ireland Form Application 2021 2022 Template In MS Word DOC PdfFiller

Centrelink Rent Certificate Form Su523 Download Vann Forrie