In this day and age of consuming everybody loves a good deal. One option to obtain substantial savings on your purchases can be achieved through Rebate U S 87as. They are a form of marketing employed by retailers and manufacturers to offer customers a payment on their purchases, after they have bought them. In this article, we will take a look at the world that is Rebate U S 87as. We will explore what they are, how they work, and how you can maximise the value of these incentives.

Get Latest Rebate U S 87a Below

Rebate U S 87a

Rebate U S 87a -

Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be

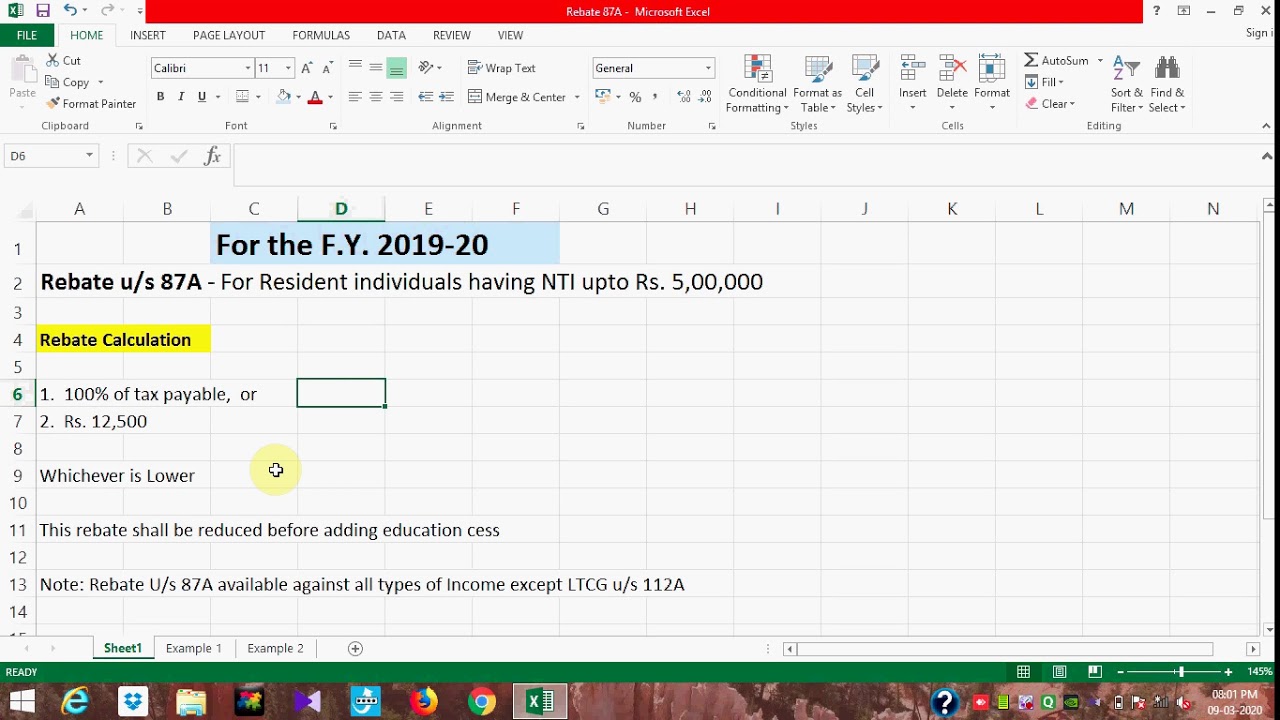

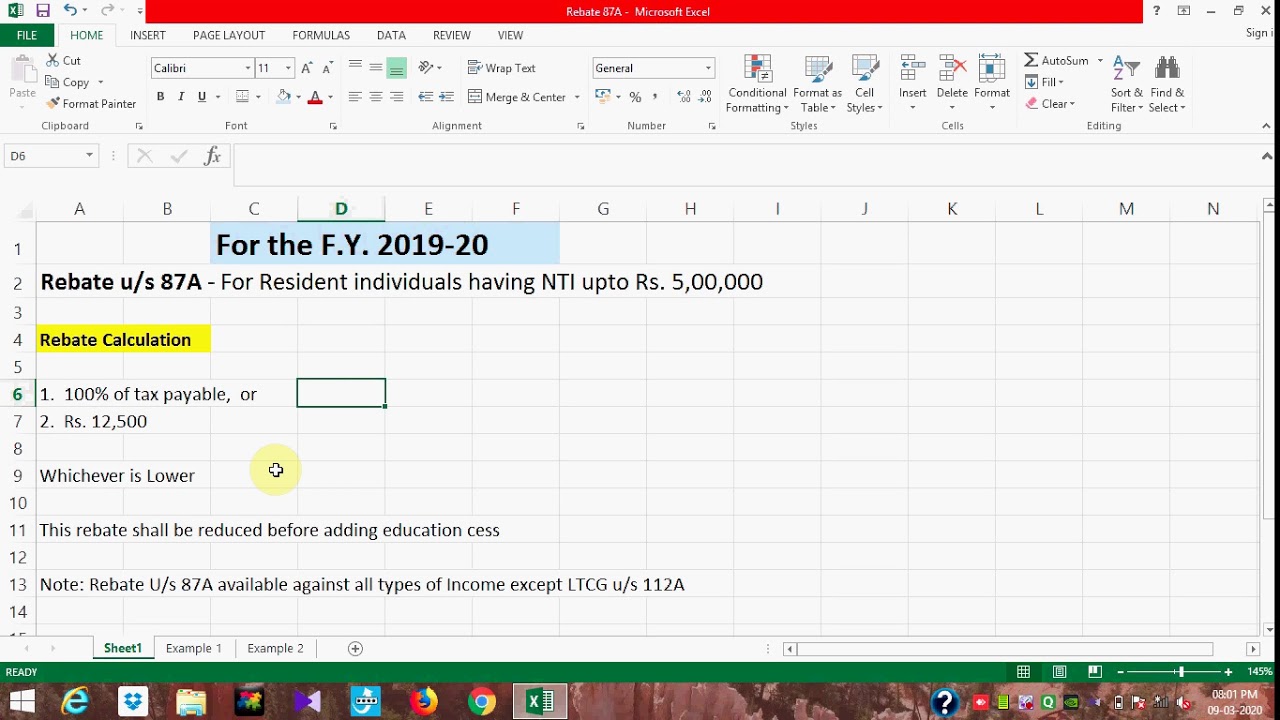

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

A Rebate U S 87a, in its simplest form, is a refund given to a client after they've bought a product or service. It's a powerful instrument that companies use to attract buyers, increase sales and also to advertise certain products.

Types of Rebate U S 87a

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you start

Web 2 f 233 vr 2023 nbsp 0183 32 Rebate under section 87A of Income Tax Act helps taxpayers to reduce their tax liability Resident individuals having a net taxable income less than or equal to INR

Cash Rebate U S 87a

Cash Rebate U S 87a are the most straightforward type of Rebate U S 87a. Customers get a set amount of money after buying a product. They are typically used to purchase more expensive items such electronics or appliances.

Mail-In Rebate U S 87a

Customers who want to receive mail-in Rebate U S 87a must submit proof of purchase to receive their cash back. They're a bit more involved, but offer huge savings.

Instant Rebate U S 87a

Instant Rebate U S 87a apply at the point of sale, which reduces the price of purchases immediately. Customers do not have to wait for their savings by using this method.

How Rebate U S 87a Work

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Web 12 avr 2022 nbsp 0183 32 The rebate u s 87A is claimed by filing the tax return The fact that your total income exceeds the minimum threshold of Rs 2 50 000 you are liable to file a tax

The Rebate U S 87a Process

The process usually involves a few simple steps

-

When you buy the product, you buy the product the way you normally do.

-

Complete your Rebate U S 87a forms: The Rebate U S 87a form will have to give some specific information including your name, address and the purchase details, in order to claim your Rebate U S 87a.

-

Submit the Rebate U S 87a depending on the nature of Rebate U S 87a you could be required to submit a form by mail or send it via the internet.

-

Wait for approval: The business will scrutinize your submission for compliance with rules and regulations of the Rebate U S 87a.

-

You will receive your Rebate U S 87a After you've been approved, you'll receive a refund using a check or prepaid card, or another procedure specified by the deal.

Pros and Cons of Rebate U S 87a

Advantages

-

Cost Savings Rebate U S 87a are a great way to reduce the price you pay for the item.

-

Promotional Offers They encourage customers to experiment with new products, or brands.

-

Increase Sales Rebate U S 87a can enhance sales for a company and also increase market share.

Disadvantages

-

Complexity: Mail-in Rebate U S 87a, particularly they can be time-consuming and time-consuming.

-

The Expiration Dates Some Rebate U S 87a have extremely strict deadlines to submit.

-

Risk of Non-Payment Certain customers could not receive their refunds if they do not adhere to the guidelines precisely.

Download Rebate U S 87a

FAQs

1. Are Rebate U S 87a equivalent to discounts? No, Rebate U S 87a are only a partial reimbursement following the purchase, whereas discounts decrease prices at time of sale.

2. Can I use multiple Rebate U S 87a for the same product? It depends on the conditions of the Rebate U S 87a offer and also the item's quality and eligibility. Certain businesses may allow the use of multiple Rebate U S 87a, whereas other won't.

3. How long will it take to receive an Rebate U S 87a? The amount of time is variable, however it can take several weeks to a couple of months to receive your Rebate U S 87a.

4. Do I have to pay taxes of Rebate U S 87a the amount? the majority of instances, Rebate U S 87a amounts are not considered taxable income.

5. Should I be able to trust Rebate U S 87a deals from lesser-known brands It is essential to investigate and ensure that the business which is providing the Rebate U S 87a is trustworthy prior to making any purchase.

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Check more sample of Rebate U S 87a below

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

Rebate U s 87A

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Rebate U s 87A YouTube

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

Rebate U s 87A YouTube

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Rebate Of Income Tax Under Section 87A YouTube