In today's world of consumerism everyone is looking for a great deal. One option to obtain substantial savings when you shop is with Plug In Rebate Tax Forms. Plug In Rebate Tax Forms are marketing strategies used by manufacturers and retailers to provide customers with a partial return on their purchases once they have completed them. In this article, we'll go deeper into the realm of Plug In Rebate Tax Forms, looking at what they are as well as how they work and how you can make the most of your savings by taking advantage of these cost-effective incentives.

Get Latest Plug In Rebate Tax Form Below

Plug In Rebate Tax Form

Plug In Rebate Tax Form - Ev Rebate Tax Form, How To Get Rebate On Tax, How To Get The Rebate Tax Credit, What Is Rebate Tax Credit

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

A Plug In Rebate Tax Form, in its simplest type, is a refund that a client receives following the purchase of a product or service. It's an effective method for businesses to entice buyers, increase sales or promote a specific product.

Types of Plug In Rebate Tax Form

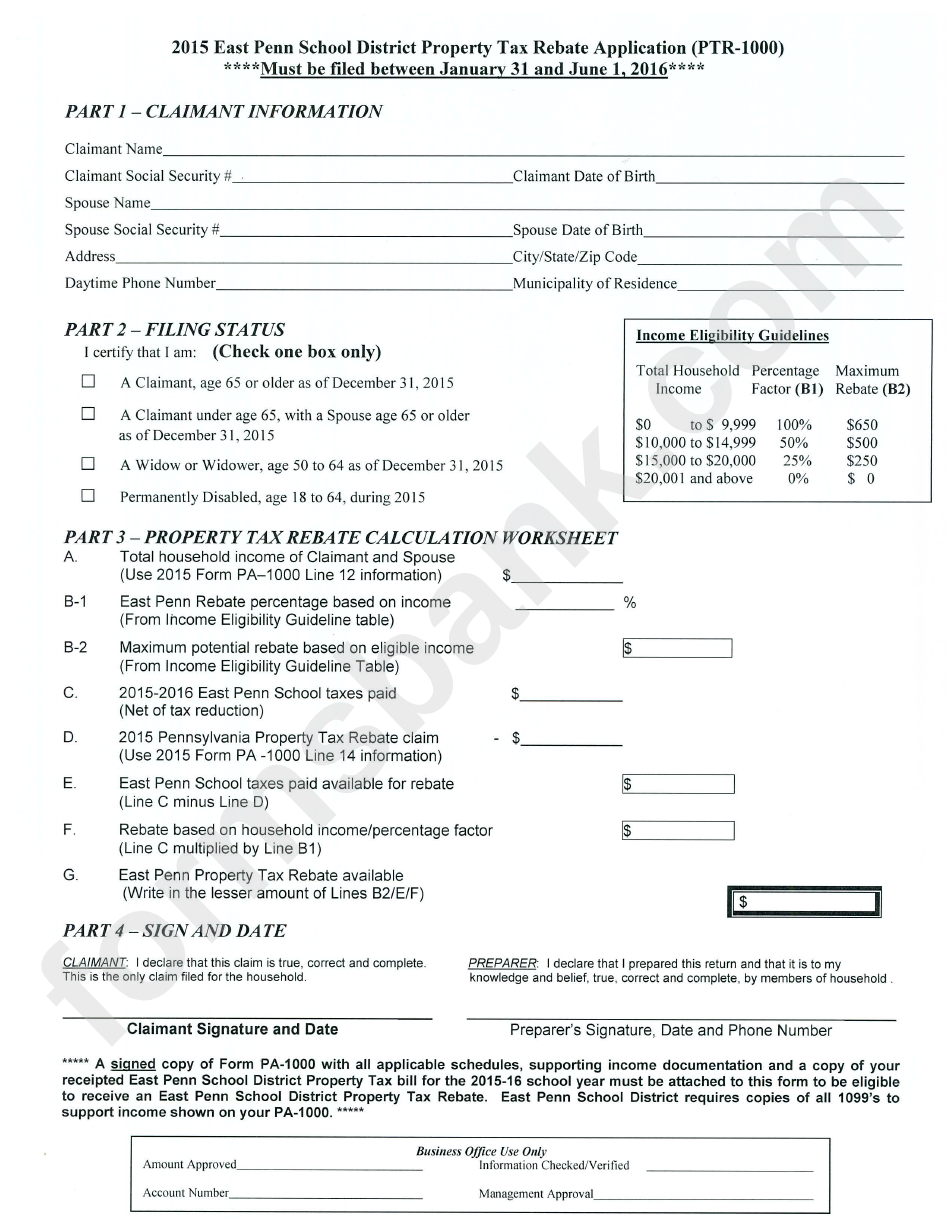

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Web Instructions for Form 8936 Department of the Treasury Internal Revenue Service Rev January 2023 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric

Cash Plug In Rebate Tax Form

Cash Plug In Rebate Tax Form can be the simplest type of Plug In Rebate Tax Form. Customers get a set amount of money back upon purchasing a item. These are typically applied to expensive items such as electronics or appliances.

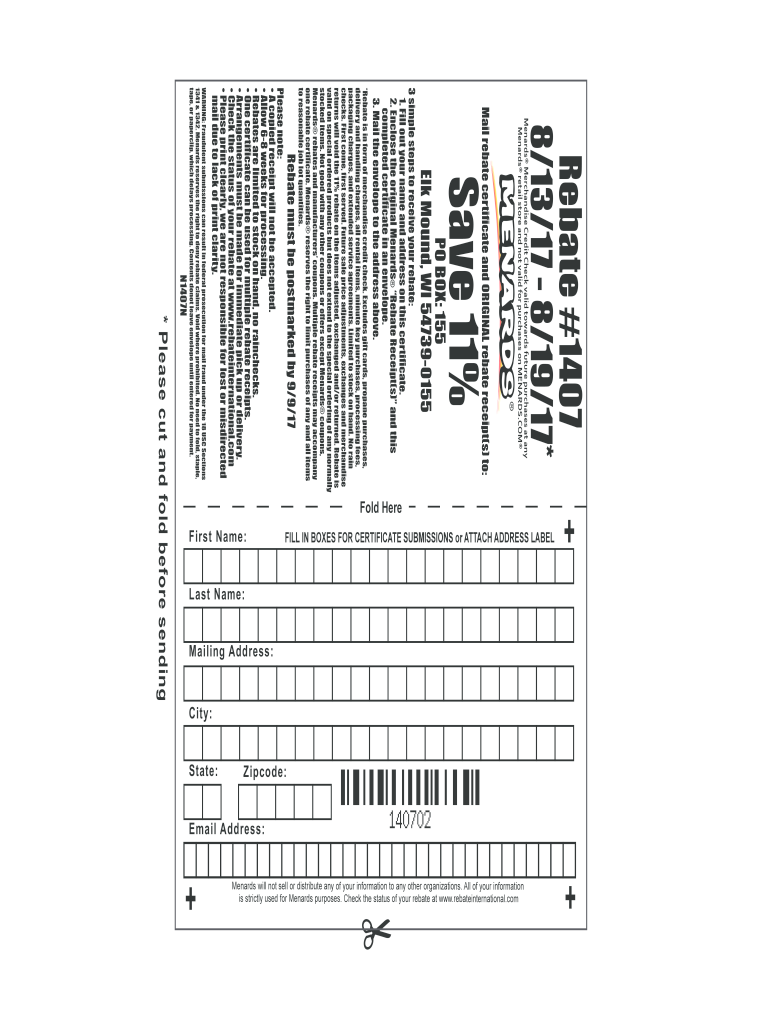

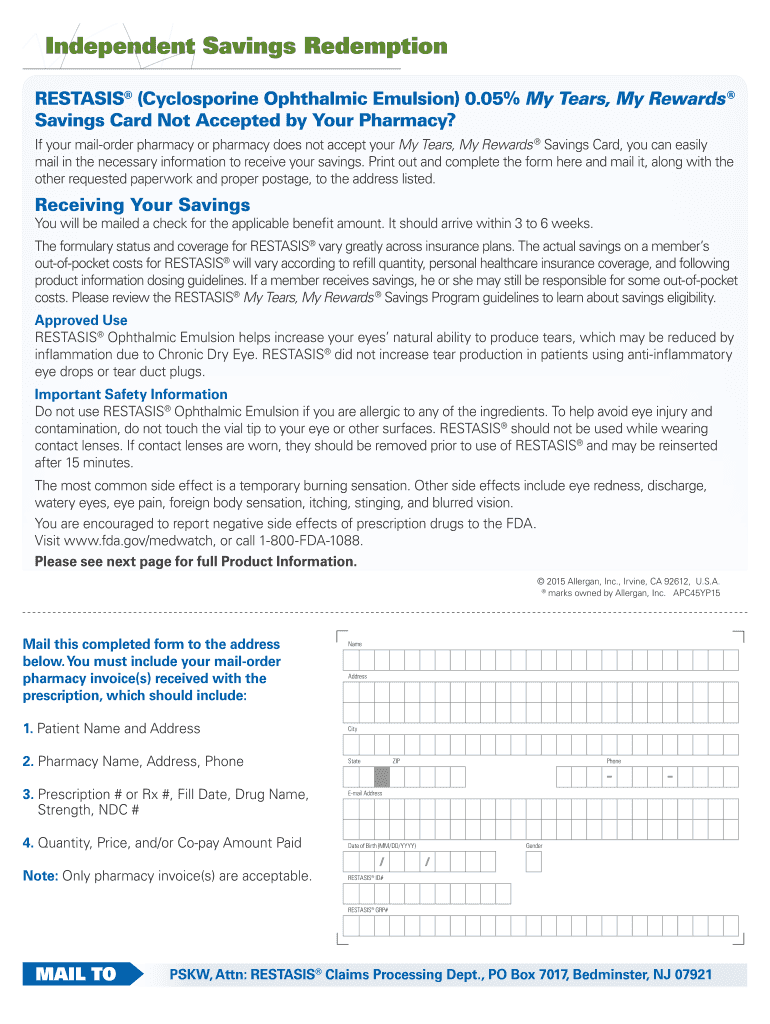

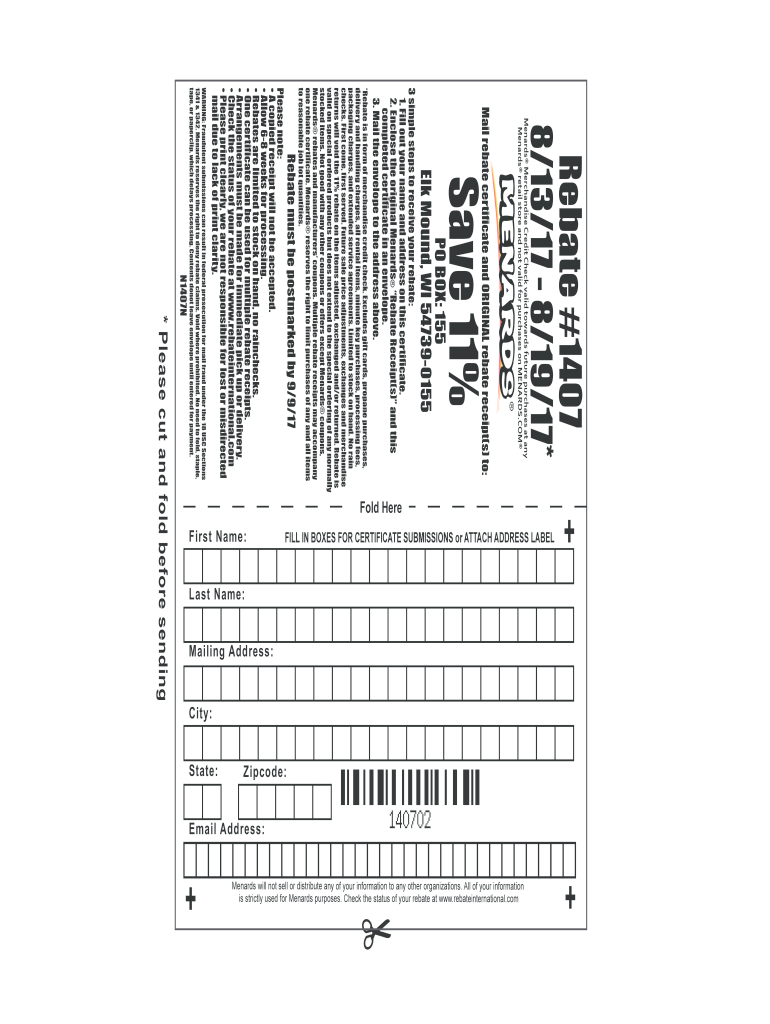

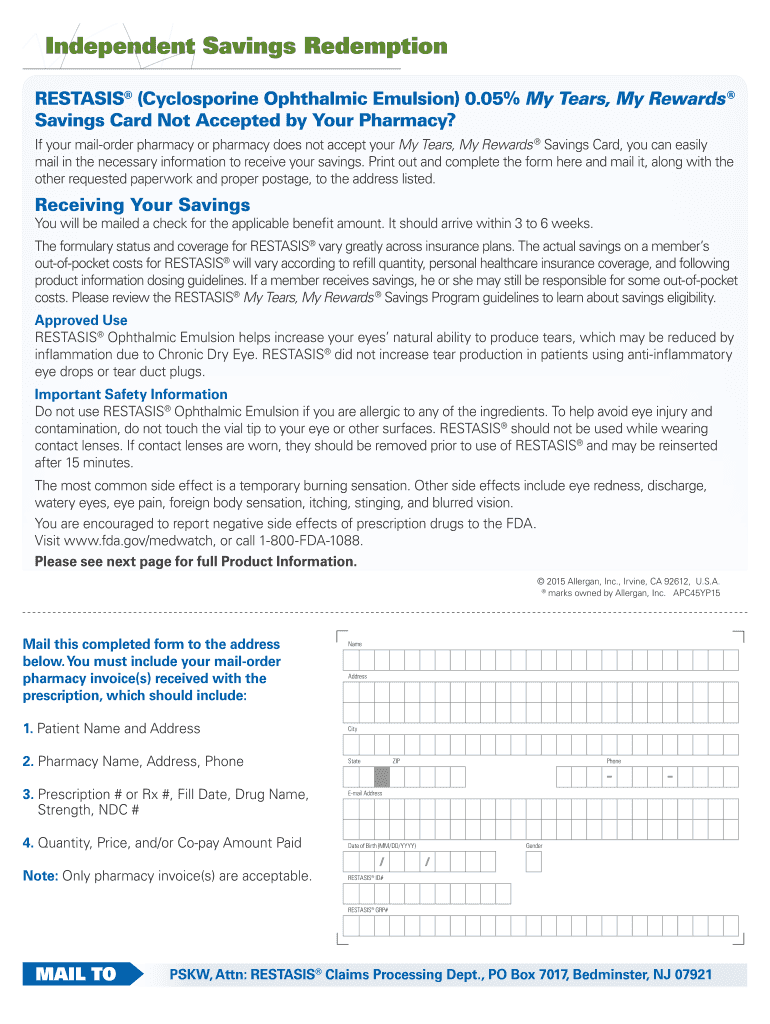

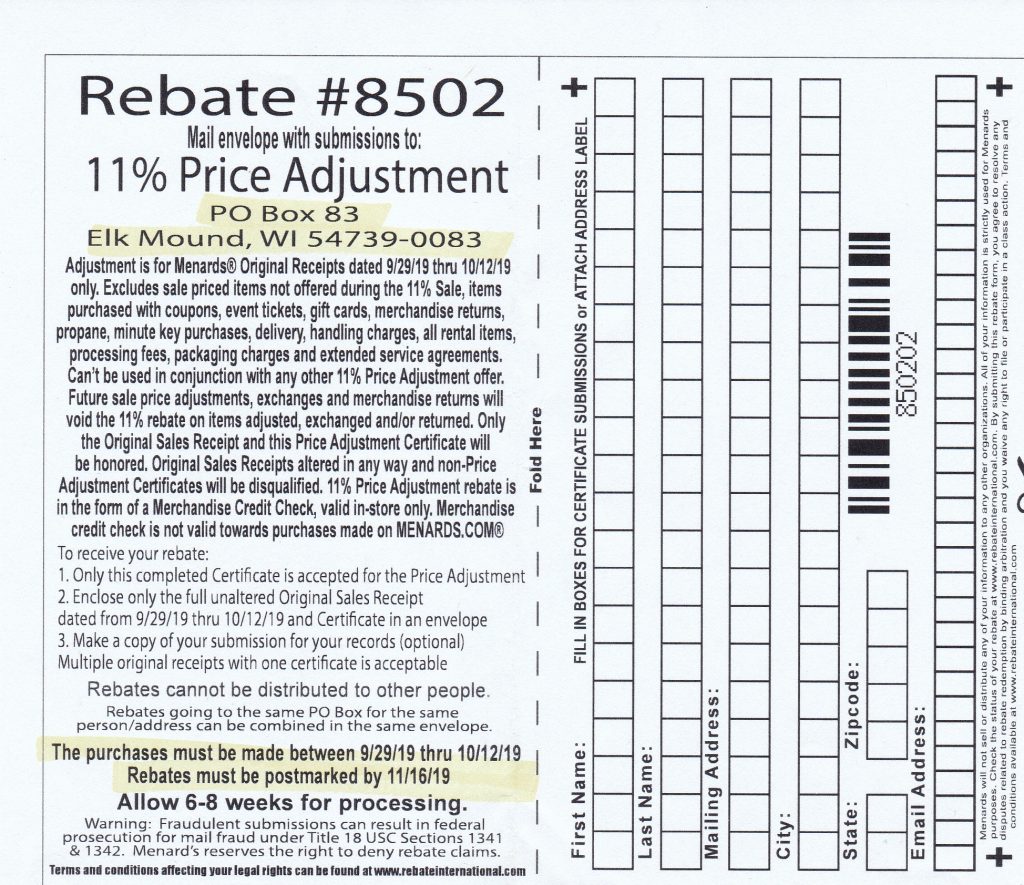

Mail-In Plug In Rebate Tax Form

Mail-in Plug In Rebate Tax Form need customers to submit the proof of purchase to be eligible for the refund. They're a bit more involved, but offer significant savings.

Instant Plug In Rebate Tax Form

Instant Plug In Rebate Tax Form are made at the point of sale and reduce the price of your purchase instantly. Customers do not have to wait until they can save through this kind of offer.

How Plug In Rebate Tax Form Work

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

The Plug In Rebate Tax Form Process

The procedure usually involves a handful of simple steps:

-

Buy the product: At first you purchase the product just as you would ordinarily.

-

Complete the Plug In Rebate Tax Form Form: To claim the Plug In Rebate Tax Form you'll need provide certain information like your name, address as well as the details of your purchase in order to claim your Plug In Rebate Tax Form.

-

Complete the Plug In Rebate Tax Form In accordance with the kind of Plug In Rebate Tax Form the recipient may be required to submit a claim form to the bank or send it via the internet.

-

Wait for approval: The business will examine your application to ensure it meets the refund's conditions and terms.

-

Enjoy your Plug In Rebate Tax Form After approval, you'll receive a refund whether via check, credit card, or a different option as per the terms of the offer.

Pros and Cons of Plug In Rebate Tax Form

Advantages

-

Cost Savings A Plug In Rebate Tax Form can significantly lower the cost you pay for the product.

-

Promotional Deals They encourage customers to explore new products or brands.

-

boost sales Plug In Rebate Tax Form can enhance a company's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly, can be cumbersome and tedious.

-

Day of Expiration Many Plug In Rebate Tax Form are subject to specific deadlines for submission.

-

The risk of non-payment Customers may not receive their Plug In Rebate Tax Form if they don't follow the regulations exactly.

Download Plug In Rebate Tax Form

Download Plug In Rebate Tax Form

FAQs

1. Are Plug In Rebate Tax Form the same as discounts? Not necessarily, as Plug In Rebate Tax Form are only a partial reimbursement following the purchase whereas discounts will reduce the purchase price at the time of sale.

2. Are there Plug In Rebate Tax Form that can be used on the same item It's contingent upon the conditions in the Plug In Rebate Tax Form incentives and the specific product's ability to qualify. Some companies will allow the use of multiple Plug In Rebate Tax Form, whereas other won't.

3. What is the time frame to get the Plug In Rebate Tax Form? The duration will differ, but can take anywhere from a couple of weeks to a few months to receive your Plug In Rebate Tax Form.

4. Do I need to pay tax upon Plug In Rebate Tax Form the amount? the majority of cases, Plug In Rebate Tax Form amounts are not considered to be taxable income.

5. Do I have confidence in Plug In Rebate Tax Form offers from brands that aren't well-known it is crucial to conduct research and ensure that the brand that is offering the Plug In Rebate Tax Form is reputable prior making a purchase.

How Do I Claim The Recovery Rebate Credit On My Ta

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Check more sample of Plug In Rebate Tax Form below

P G And E Ev Rebate Printable Rebate Form

Mo Crp Form 2018 Fill Out Sign Online DocHub

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Ouc Rebates Pdf Fill And Sign Printable Template Online US Legal Forms

What Is The Recovery Rebate Credit CD Tax Financial

Rebate Form Fill And Sign Printable Template Online US Legal Forms

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

https://turbotax.intuit.com/tax-tips/going-green/filing-tax-form-8936...

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying plug in EV or clean vehicle during the required timeframes either after December 31 2009 through December 31 2022 or January 1

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying plug in EV or clean vehicle during the required timeframes either after December 31 2009 through December 31 2022 or January 1

Ouc Rebates Pdf Fill And Sign Printable Template Online US Legal Forms

Mo Crp Form 2018 Fill Out Sign Online DocHub

What Is The Recovery Rebate Credit CD Tax Financial

Rebate Form Fill And Sign Printable Template Online US Legal Forms

Government Rebate Program Fill Out Sign Online DocHub

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19