In today's consumer-driven world everybody loves a good deal. One way to make significant savings in your purchase is through Tax Rebate Electric Car 2023 Forms. They are a form of marketing used by manufacturers and retailers to provide customers with a portion of a refund for their purchases after they have created them. In this post, we'll delve into the world of Tax Rebate Electric Car 2023 Forms and explore the nature of them, how they work, and how you can make the most of the savings you can make by using these cost-effective incentives.

Get Latest Tax Rebate Electric Car 2023 Form Below

Tax Rebate Electric Car 2023 Form

Tax Rebate Electric Car 2023 Form -

What to know about the 7 500 IRS EV tax credit for electric cars in 2023 NPR Your Money Buying an electric car You can get a 7 500 tax credit but it won t be easy Updated

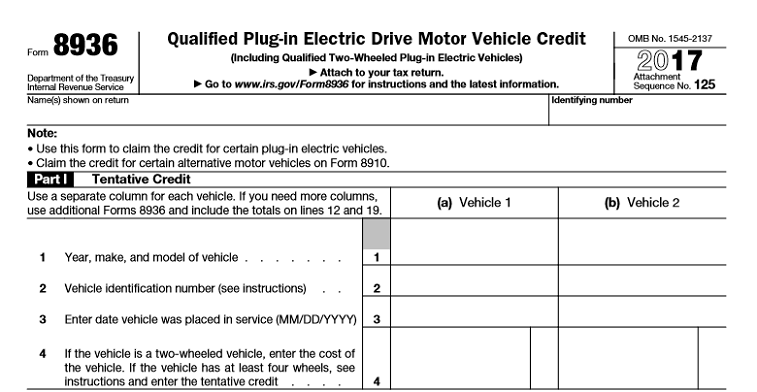

If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit At the time of sale a seller must give you information about your vehicle s qualifications Sellers must also register online and report the same information to the IRS

A Tax Rebate Electric Car 2023 Form at its most basic type, is a refund to a purchaser who has purchased a particular product or service. It's a highly effective tool that companies use to attract customers, increase sales and promote specific products.

Types of Tax Rebate Electric Car 2023 Form

Electric Vehicle Tax Credit Form 2021 Irs Federal Phelcky

Electric Vehicle Tax Credit Form 2021 Irs Federal Phelcky

Getty You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return

The IRS now allows you to claim the EV tax credit for previously owned electric vehicles for purchases up to 25 000 However the tax credit works differently for used cars You can claim a

Cash Tax Rebate Electric Car 2023 Form

Cash Tax Rebate Electric Car 2023 Form are the simplest type of Tax Rebate Electric Car 2023 Form. The customer receives a particular amount back in cash after purchasing a particular item. They are typically used to purchase products that are expensive, such as electronics or appliances.

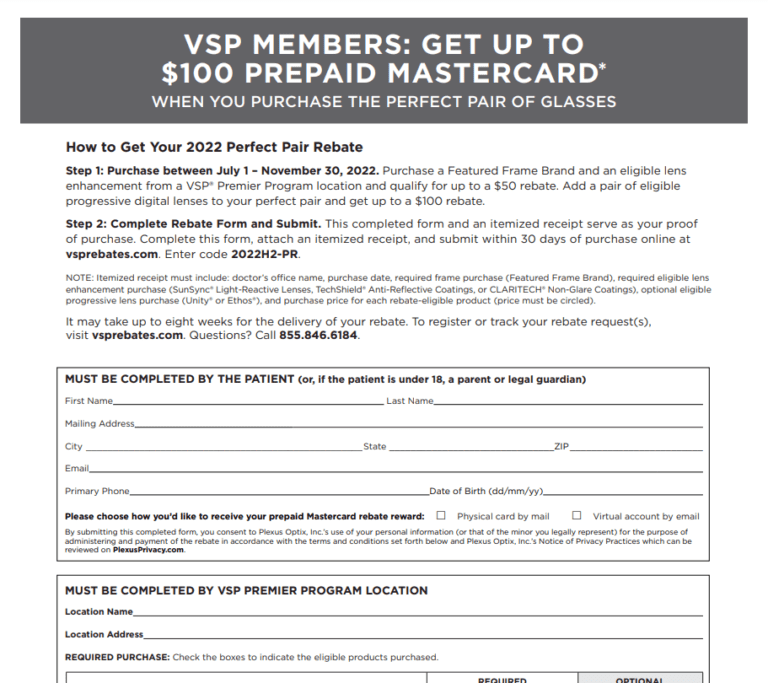

Mail-In Tax Rebate Electric Car 2023 Form

Mail-in Tax Rebate Electric Car 2023 Form require consumers to send in proof of purchase to receive their money back. They are a bit longer-lasting, however they offer significant savings.

Instant Tax Rebate Electric Car 2023 Form

Instant Tax Rebate Electric Car 2023 Form apply at the point of sale, reducing the price of your purchase instantly. Customers don't need to wait around for savings through this kind of offer.

How Tax Rebate Electric Car 2023 Form Work

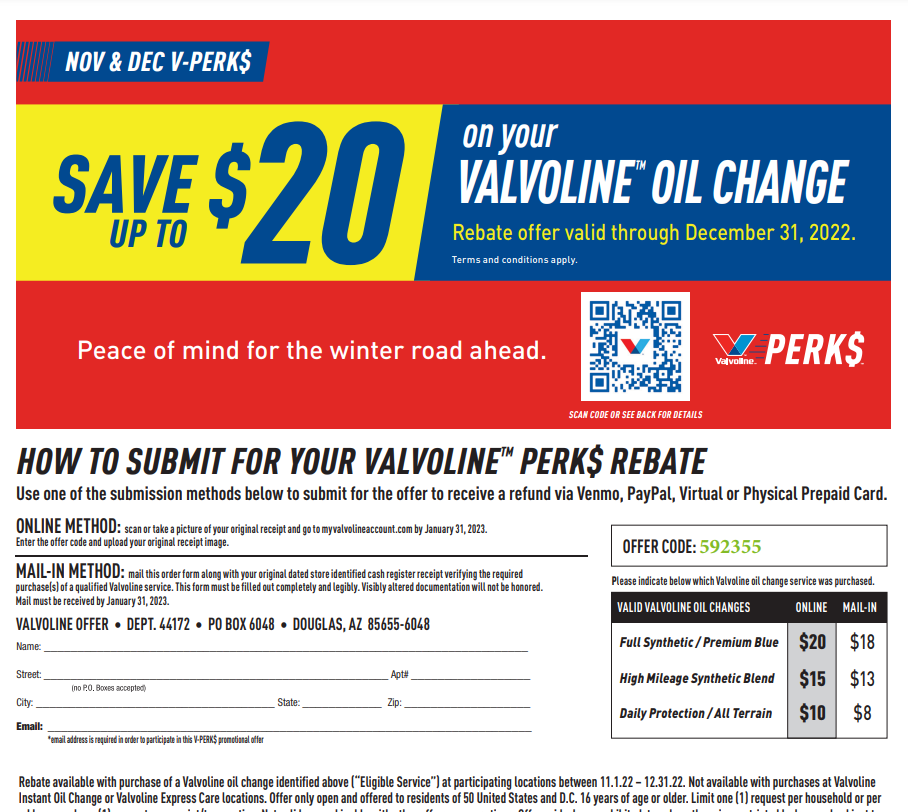

Valvoline Rebate Forms Printable Rebate Form

Valvoline Rebate Forms Printable Rebate Form

A family inspects the engine of a new Toyota Prius model during the Electrify Expo In D C in Washington D C on July 23 2023 Getting an electric vehicle tax credit of up to 7 500 will get a

The Tax Rebate Electric Car 2023 Form Process

The process typically comprises a few steps

-

Purchase the item: First make sure you purchase the product like you normally do.

-

Fill out the Tax Rebate Electric Car 2023 Form Form: To claim the Tax Rebate Electric Car 2023 Form you'll have to supply some details, such as your address, name, and the purchase details, in order in order to take advantage of your Tax Rebate Electric Car 2023 Form.

-

Make sure you submit the Tax Rebate Electric Car 2023 Form If you want to submit the Tax Rebate Electric Car 2023 Form, based on the kind of Tax Rebate Electric Car 2023 Form, you may need to send in a form, or make it available online.

-

Wait for approval: The business will review your request to verify that it is compliant with the terms and conditions of the Tax Rebate Electric Car 2023 Form.

-

Receive your Tax Rebate Electric Car 2023 Form: Once approved, the amount you receive will be via check, prepaid card, or other option as per the terms of the offer.

Pros and Cons of Tax Rebate Electric Car 2023 Form

Advantages

-

Cost savings Tax Rebate Electric Car 2023 Form can dramatically reduce the cost for an item.

-

Promotional Offers they encourage their customers to explore new products or brands.

-

Enhance Sales Tax Rebate Electric Car 2023 Form are a great way to boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Tax Rebate Electric Car 2023 Form that are mail-in, particularly difficult and time-consuming.

-

Extension Dates: Many Tax Rebate Electric Car 2023 Form have the strictest deadlines for submission.

-

Risk of Non-Payment Certain customers could lose their Tax Rebate Electric Car 2023 Form in the event that they don't adhere to the rules precisely.

Download Tax Rebate Electric Car 2023 Form

Download Tax Rebate Electric Car 2023 Form

FAQs

1. Are Tax Rebate Electric Car 2023 Form equivalent to discounts? No, Tax Rebate Electric Car 2023 Form offer some form of refund following the purchase, while discounts lower the price of the purchase at the time of sale.

2. Can I get multiple Tax Rebate Electric Car 2023 Form on the same product It's dependent on the terms applicable to Tax Rebate Electric Car 2023 Form promotions and on the products qualification. Certain companies might allow it, but some will not.

3. What is the time frame to receive the Tax Rebate Electric Car 2023 Form What is the timeframe? differs, but could be anywhere from a few weeks up to a couple of months to receive your Tax Rebate Electric Car 2023 Form.

4. Do I need to pay tax upon Tax Rebate Electric Car 2023 Form values? the majority of circumstances, Tax Rebate Electric Car 2023 Form amounts are not considered to be taxable income.

5. Should I be able to trust Tax Rebate Electric Car 2023 Form offers from brands that aren't well-known It's crucial to research and verify that the brand providing the Tax Rebate Electric Car 2023 Form is credible prior to making an purchase.

Washington State Tax Rebate Printable Rebate Form

Alcon Choice Rebate Code 2023 Printable Rebate Form

Check more sample of Tax Rebate Electric Car 2023 Form below

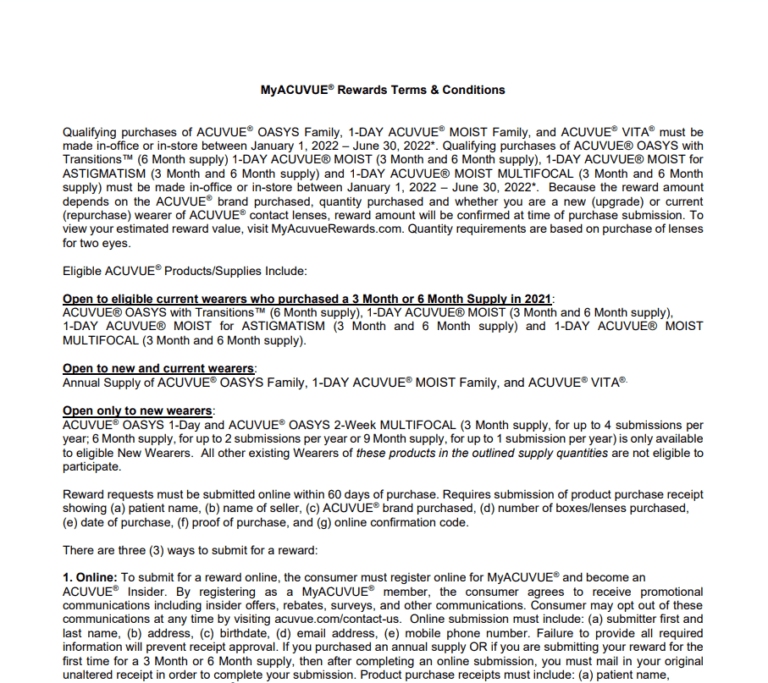

Acuvue Rebate 2023 Printable Rebate Form

Rent Rebate 2023 Pa Printable Rebate Form

Maine Renters Rebate 2023 Printable Rebate Form

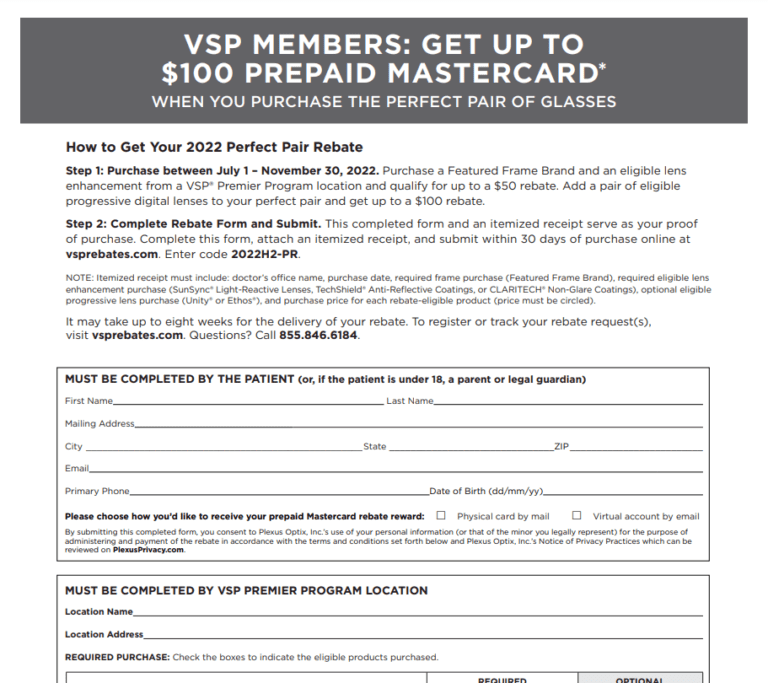

Vsp Rebate 2023 Printable Rebate Form

Ri Electric Car Rebate 2023 Carrebate

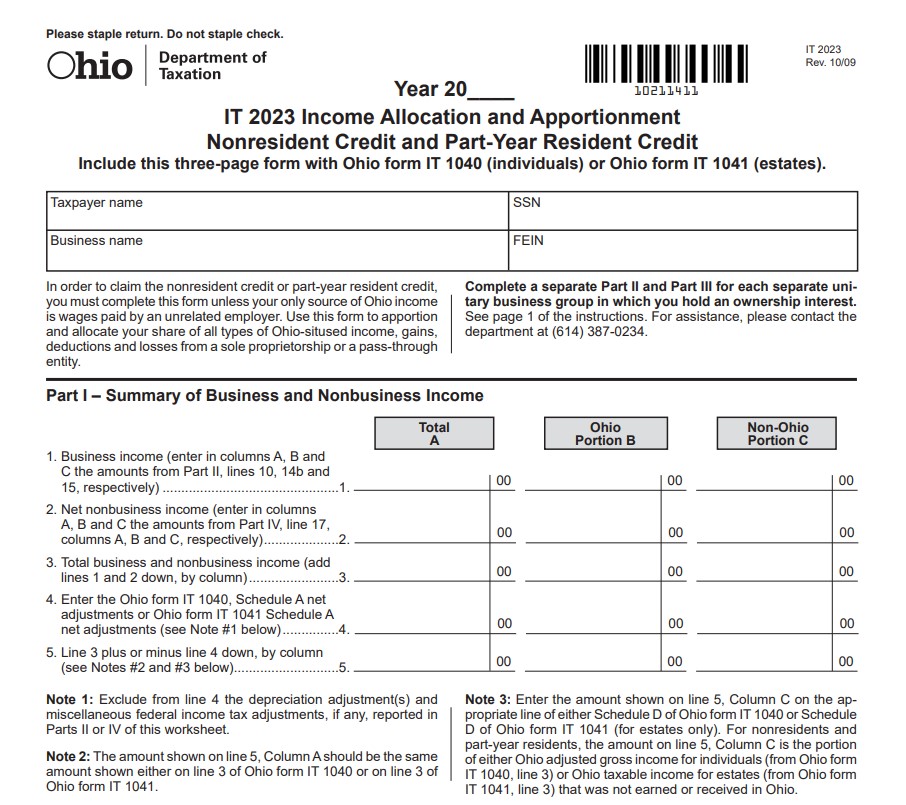

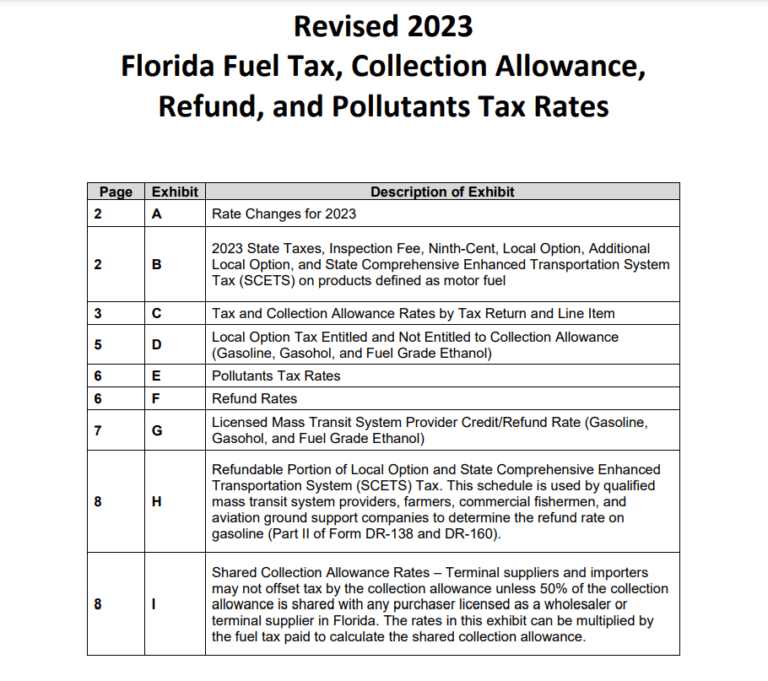

Child Tax Rebate 2023 Florida Printable Rebate Form

https://www.irs.gov/credits-deductions/credits-for...

If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit At the time of sale a seller must give you information about your vehicle s qualifications Sellers must also register online and report the same information to the IRS

https://www.irs.gov/clean-vehicle-tax-credits

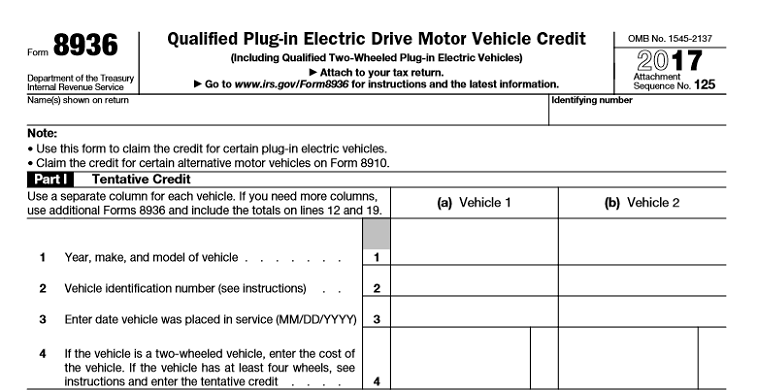

About Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Page Last Reviewed or Updated 01 Nov 2023 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type

If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit At the time of sale a seller must give you information about your vehicle s qualifications Sellers must also register online and report the same information to the IRS

About Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Page Last Reviewed or Updated 01 Nov 2023 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type

Vsp Rebate 2023 Printable Rebate Form

Rent Rebate 2023 Pa Printable Rebate Form

Ri Electric Car Rebate 2023 Carrebate

Child Tax Rebate 2023 Florida Printable Rebate Form

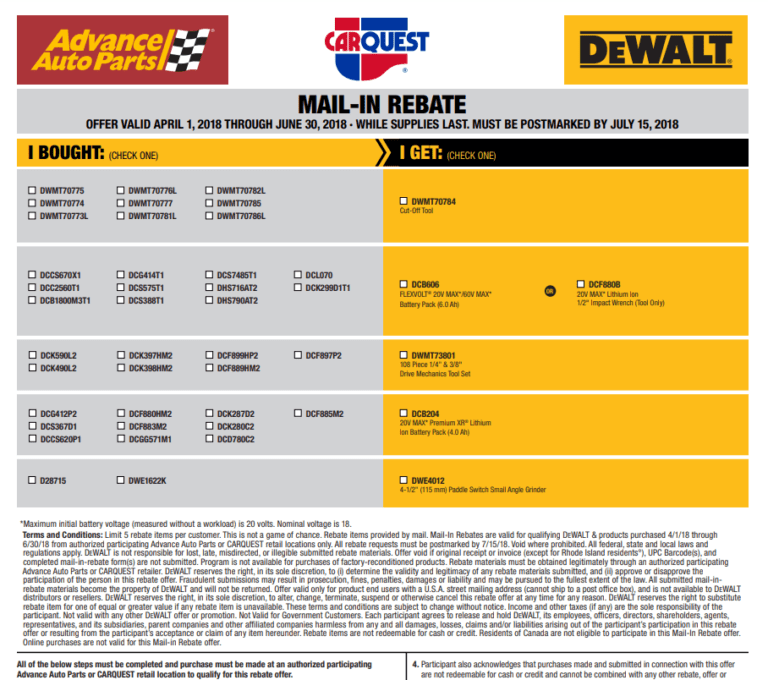

Advance Auto Parts Rebate Forms Printable Rebate Form

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Canadian Government Electric Car Rebate 2022 List 2022 Carrebate