In this modern-day world of consumers everyone is looking for a great bargain. One method of gaining significant savings on your purchases is through Irs Recovery Rebate Credit 2023 Forms. Irs Recovery Rebate Credit 2023 Forms can be a way of marketing employed by retailers and manufacturers to provide customers with a portion of a refund on purchases made after they have completed them. In this post, we'll look into the world of Irs Recovery Rebate Credit 2023 Forms, exploring what they are and how they function, and how to maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Irs Recovery Rebate Credit 2023 Form Below

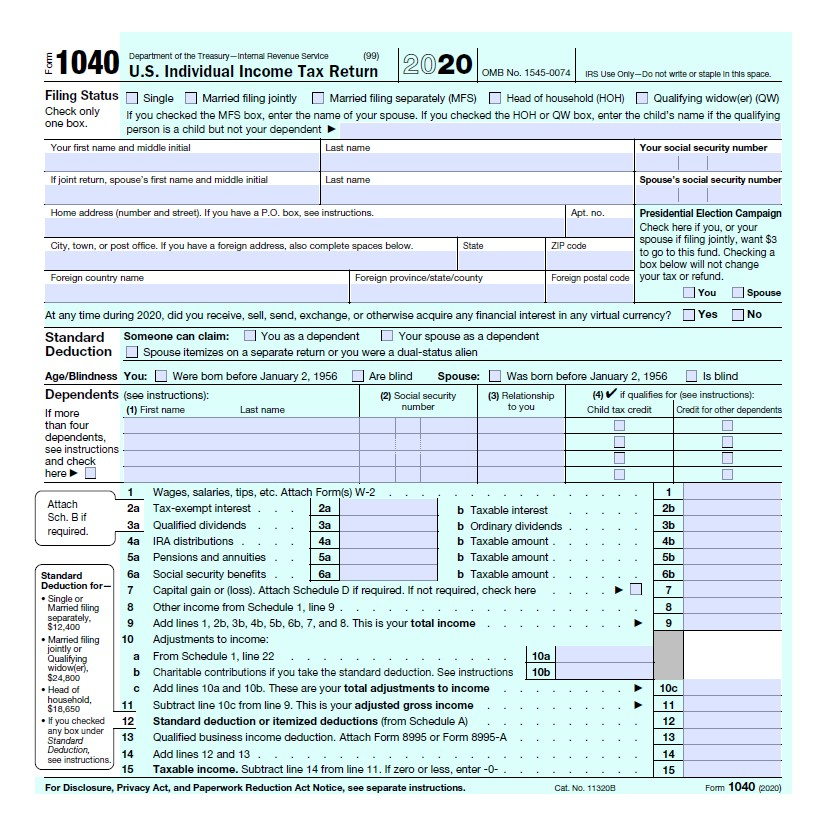

Irs Recovery Rebate Credit 2023 Form

Irs Recovery Rebate Credit 2023 Form -

Web 6 Okt 2023 nbsp 0183 32 You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers

Web 6 Okt 2023 nbsp 0183 32 Starting in January Inflation Reduction Act Provision Will Allow Consumers to Transfer Credit to Car Dealer Reducing Purchase Price of New and Previously Owned

A Irs Recovery Rebate Credit 2023 Form is, in its most basic description, is a cash refund provided to customers who has purchased a particular product or service. It's a highly effective tool used by businesses to attract buyers, increase sales as well as promote particular products.

Types of Irs Recovery Rebate Credit 2023 Form

Recovery Rebate Credit Irs Form Recovery Rebate

Recovery Rebate Credit Irs Form Recovery Rebate

Web 9 Okt 2023 nbsp 0183 32 The U S Department of the Treasury and IRS on Oct 6 2023 released proposed regulations on the transfer of clean vehicle credits under Internal Revenue

Web Coronavirus Recovery Rebate Credit and Economic Impact Payments Resources and Guidance Page Last Reviewed or Updated 01 May 2023 Get up to date information on

Cash Irs Recovery Rebate Credit 2023 Form

Cash Irs Recovery Rebate Credit 2023 Form are a simple kind of Irs Recovery Rebate Credit 2023 Form. Customers are offered a certain amount back in cash after purchasing a item. These are typically applied to big-ticket items, like electronics and appliances.

Mail-In Irs Recovery Rebate Credit 2023 Form

Mail-in Irs Recovery Rebate Credit 2023 Form demand that customers submit their proof of purchase before receiving their money back. They're more complicated but could provide huge savings.

Instant Irs Recovery Rebate Credit 2023 Form

Instant Irs Recovery Rebate Credit 2023 Form are applied right at the point of sale. They reduce the purchase price immediately. Customers do not have to wait long for savings by using this method.

How Irs Recovery Rebate Credit 2023 Form Work

Recovery Rebate Credit 2022 What Is It Rebate2022

Recovery Rebate Credit 2022 What Is It Rebate2022

Web 13 Apr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information

The Irs Recovery Rebate Credit 2023 Form Process

The procedure usually involves a few simple steps

-

You purchase the item: First purchase the product just like you normally would.

-

Fill out your Irs Recovery Rebate Credit 2023 Form application: In order to claim your Irs Recovery Rebate Credit 2023 Form, you'll have to fill in some information including your address, name, and purchase details, to get your Irs Recovery Rebate Credit 2023 Form.

-

Complete the Irs Recovery Rebate Credit 2023 Form It is dependent on the kind of Irs Recovery Rebate Credit 2023 Form you may have to fill out a form and mail it in or make it available online.

-

Wait for approval: The business will look over your submission to confirm that it complies with the guidelines and conditions of the Irs Recovery Rebate Credit 2023 Form.

-

Accept your Irs Recovery Rebate Credit 2023 Form When it's approved you'll be able to receive your reimbursement, either through check, prepaid card, or any other method that is specified in the offer.

Pros and Cons of Irs Recovery Rebate Credit 2023 Form

Advantages

-

Cost savings A Irs Recovery Rebate Credit 2023 Form can significantly reduce the price you pay for a product.

-

Promotional Offers they encourage their customers to explore new products or brands.

-

boost sales Irs Recovery Rebate Credit 2023 Form are a great way to boost a company's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Irs Recovery Rebate Credit 2023 Form in particular is a time-consuming process and lengthy.

-

Day of Expiration Many Irs Recovery Rebate Credit 2023 Form are subject to the strictest deadlines for submission.

-

A risk of not being paid Customers may not receive their Irs Recovery Rebate Credit 2023 Form if they don't comply with the rules exactly.

Download Irs Recovery Rebate Credit 2023 Form

Download Irs Recovery Rebate Credit 2023 Form

FAQs

1. Are Irs Recovery Rebate Credit 2023 Form the same as discounts? No, Irs Recovery Rebate Credit 2023 Form offer a partial refund after purchase, while discounts reduce costs at point of sale.

2. Can I make use of multiple Irs Recovery Rebate Credit 2023 Form on the same item What is the best way to do it? It's contingent on conditions for the Irs Recovery Rebate Credit 2023 Form offers and the product's potential eligibility. Certain companies may allow it, while others won't.

3. What is the time frame to receive an Irs Recovery Rebate Credit 2023 Form? The timing is variable, however it can take anywhere from a few weeks to a few months before you receive your Irs Recovery Rebate Credit 2023 Form.

4. Do I need to pay tax upon Irs Recovery Rebate Credit 2023 Form values? the majority of situations, Irs Recovery Rebate Credit 2023 Form amounts are not considered to be taxable income.

5. Should I be able to trust Irs Recovery Rebate Credit 2023 Form offers from lesser-known brands It is essential to investigate and ensure that the business giving the Irs Recovery Rebate Credit 2023 Form is reliable prior to making an acquisition.

How Do I Claim The Recovery Rebate Credit On My Ta

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Check more sample of Irs Recovery Rebate Credit 2023 Form below

IRS Updates Recovery Rebate Credit FAQ Flowers Rieger CPA Recovery Rebate

Irs Forms Recovery Rebate Credit 2020 IRSTAC Recovery Rebate

IRS Updates Recovery Rebate Credit And EIP Guidance Scott M Aber CPA PC

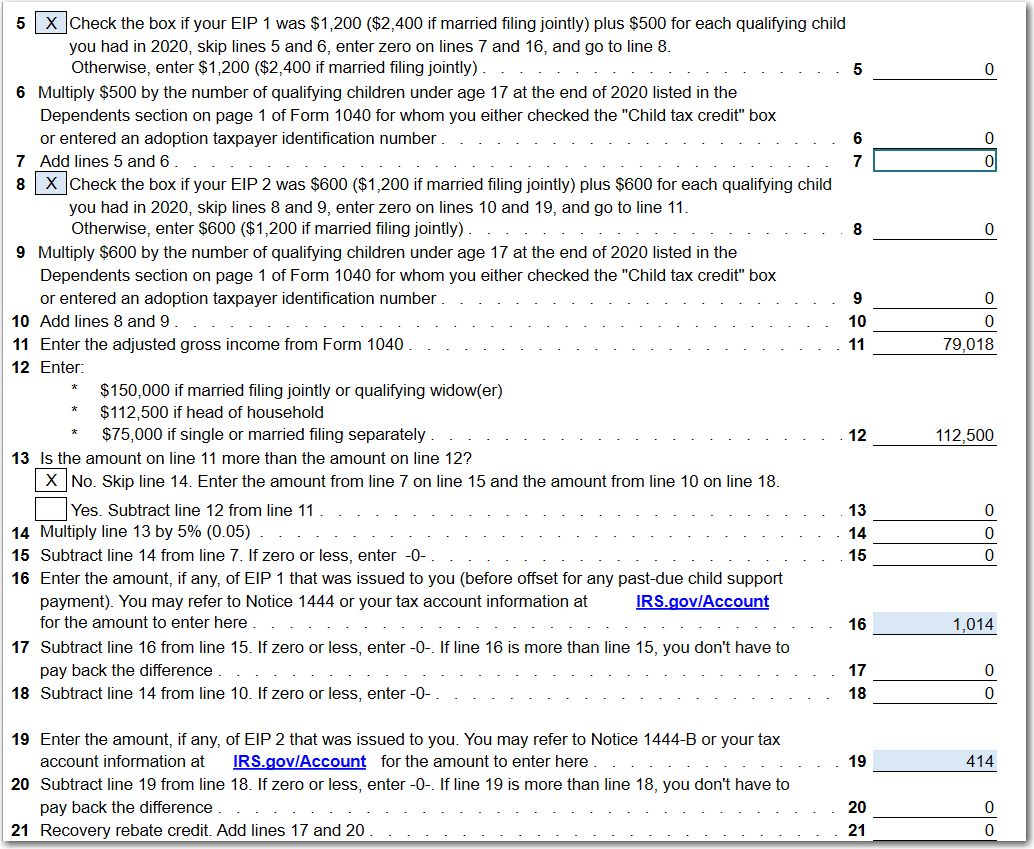

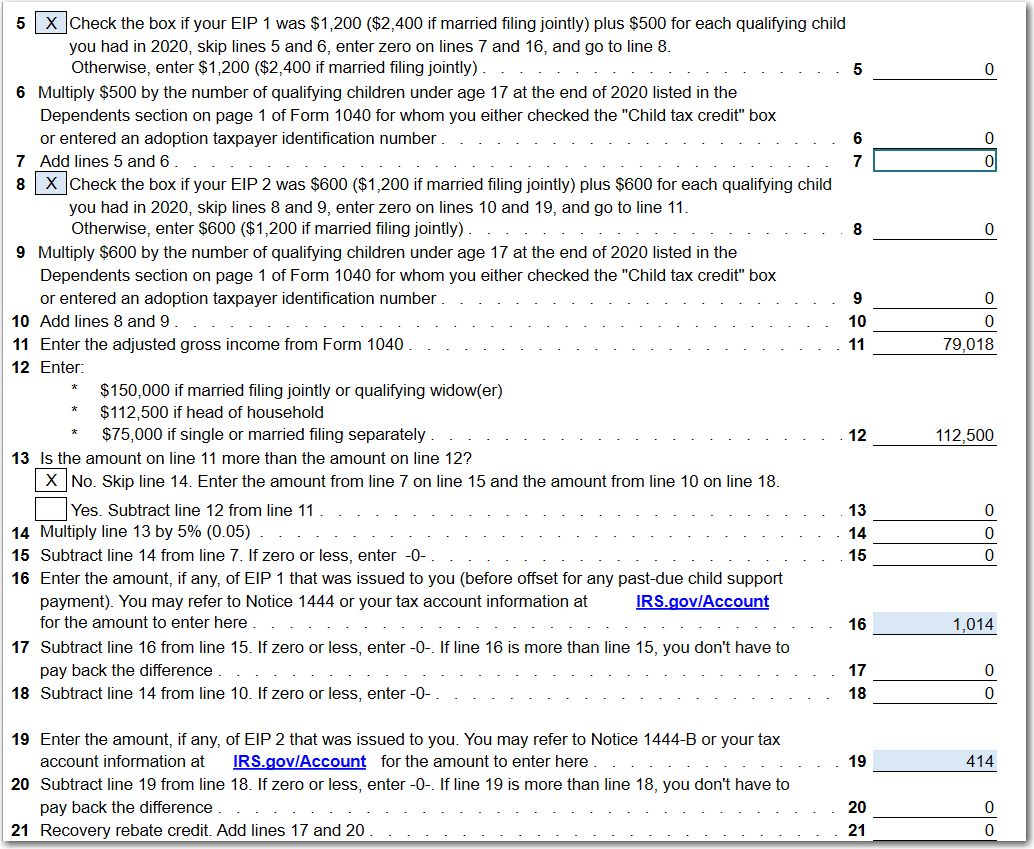

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Irs Form To Claim Recovery Rebate Credit Recovery Rebate

Irs Recovery Rebate Credit Recovery Rebate

https://home.treasury.gov/news/press-releases/jy1783

Web 6 Okt 2023 nbsp 0183 32 Starting in January Inflation Reduction Act Provision Will Allow Consumers to Transfer Credit to Car Dealer Reducing Purchase Price of New and Previously Owned

https://www.irs.gov/pub/irs-pdf/p5486a.pdf

Web To claim it you must file a tax return even if you otherwise are not required to file a tax return Your Recovery Rebate Credit will be included in your tax refund If you re

Web 6 Okt 2023 nbsp 0183 32 Starting in January Inflation Reduction Act Provision Will Allow Consumers to Transfer Credit to Car Dealer Reducing Purchase Price of New and Previously Owned

Web To claim it you must file a tax return even if you otherwise are not required to file a tax return Your Recovery Rebate Credit will be included in your tax refund If you re

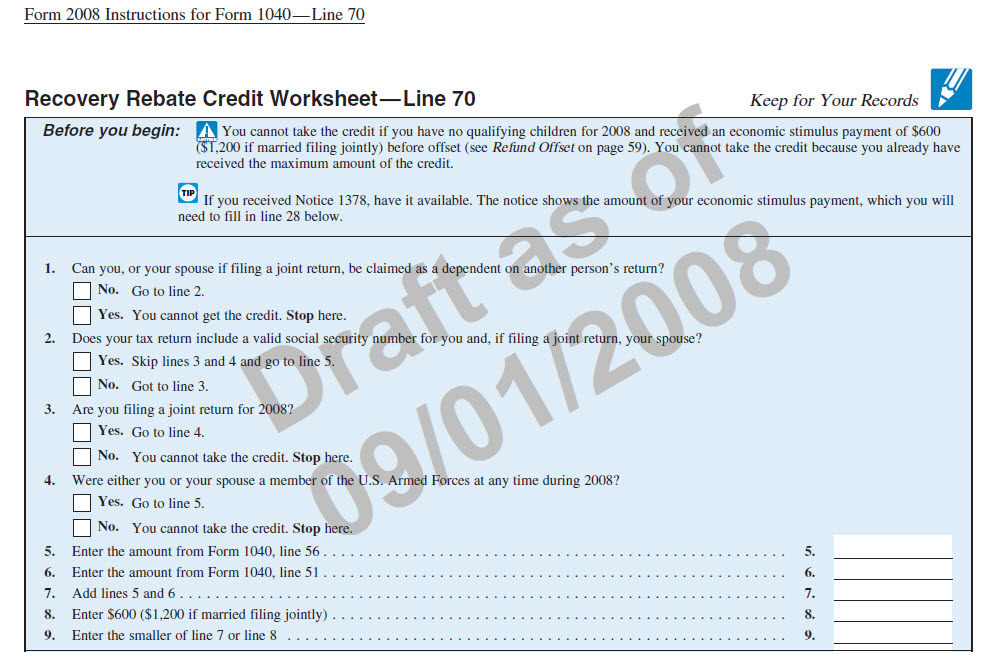

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Irs Forms Recovery Rebate Credit 2020 IRSTAC Recovery Rebate

Irs Form To Claim Recovery Rebate Credit Recovery Rebate

Irs Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter