In the modern world of consumerization everyone enjoys a good deal. One way to earn significant savings from your purchases is via Inland Revenue Tax Rebate Forms. Inland Revenue Tax Rebate Forms are a method of marketing employed by retailers and manufacturers for offering customers a percentage return on their purchases once they have completed them. In this post, we'll go deeper into the realm of Inland Revenue Tax Rebate Forms and explore what they are about, how they work, and how you can make the most of the value of these incentives.

Get Latest Inland Revenue Tax Rebate Form Below

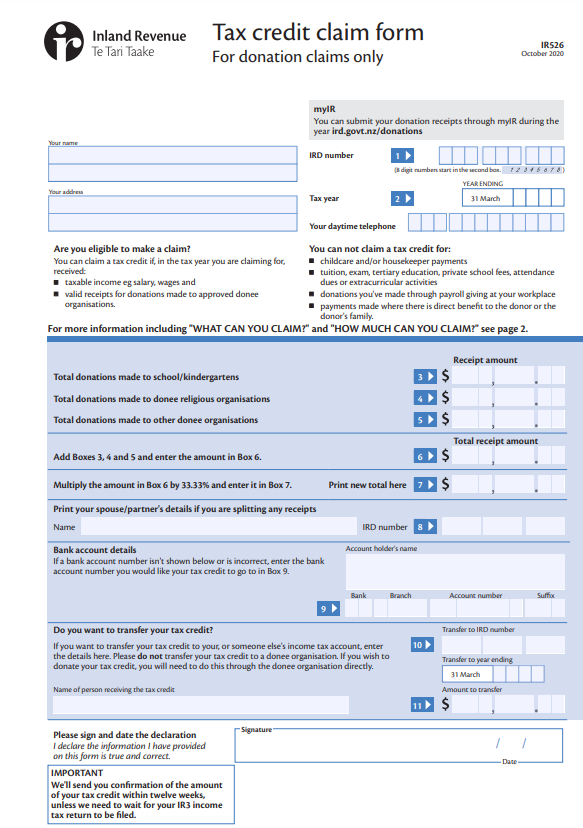

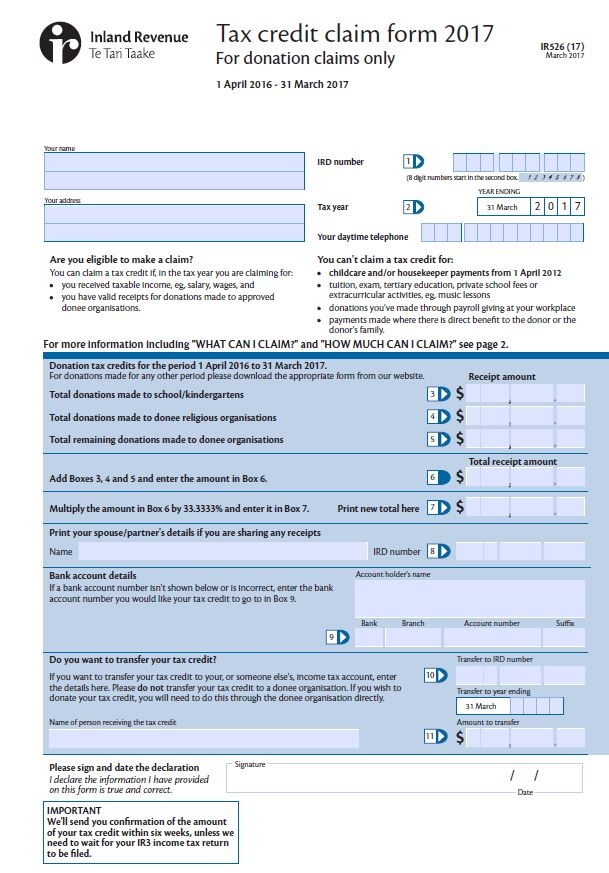

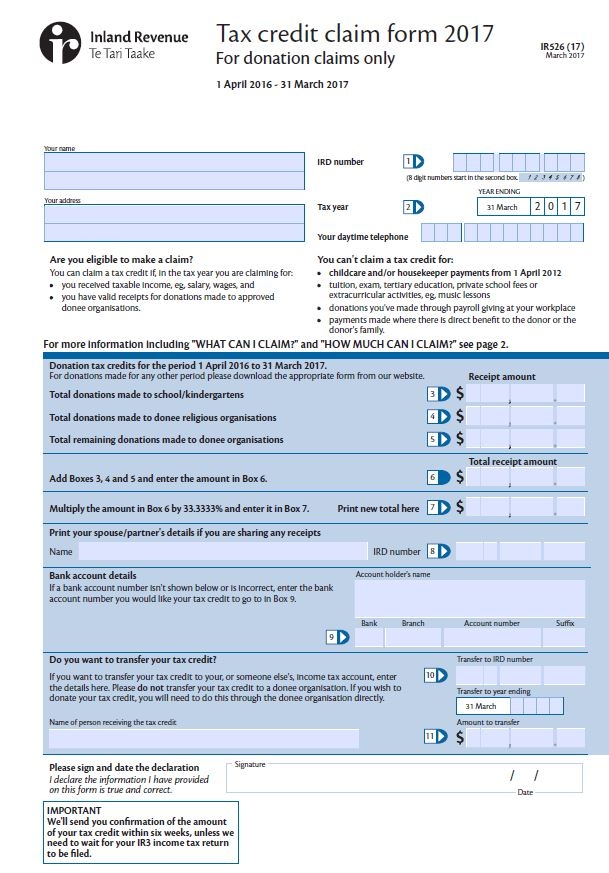

Inland Revenue Tax Rebate Form

Inland Revenue Tax Rebate Form -

Web 20 d 233 c 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

A Inland Revenue Tax Rebate Form in its simplest form, is a refund offered to a customer who has purchased a particular product or service. It's a powerful instrument employed by companies to draw clients, increase sales and promote specific products.

Types of Inland Revenue Tax Rebate Form

FORM 500 CTR Inland Revenue Division Fill Out Sign Online DocHub

FORM 500 CTR Inland Revenue Division Fill Out Sign Online DocHub

Web International EN International particuliers Services Services Filing and correcting an income tax return Filing a return You can file your return online It s easy reliable and

Web Contact HMRC Get contact details if you have a query about coronavirus COVID 19 Self Assessment tax credits Child Benefit Income Tax National Insurance tax for employers

Cash Inland Revenue Tax Rebate Form

Cash Inland Revenue Tax Rebate Form are by far the easiest type of Inland Revenue Tax Rebate Form. Customers are given a certain amount of money back after purchasing a item. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Inland Revenue Tax Rebate Form

Mail-in Inland Revenue Tax Rebate Form need customers to send in the proof of purchase in order to receive their money back. They're somewhat more involved but can offer substantial savings.

Instant Inland Revenue Tax Rebate Form

Instant Inland Revenue Tax Rebate Form are applied at place of purchase, reducing prices immediately. Customers don't have to wait for savings with this type.

How Inland Revenue Tax Rebate Form Work

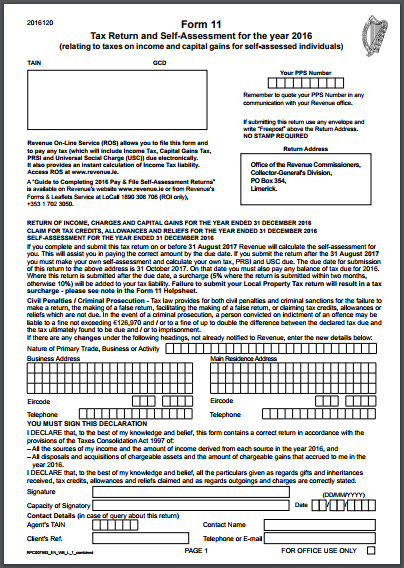

Your Bullsh t Free Guide To PAYE Taxes In Ireland

Your Bullsh t Free Guide To PAYE Taxes In Ireland

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity

The Inland Revenue Tax Rebate Form Process

The process generally involves a few simple steps

-

Buy the product: At first you buy the product in the same way you would normally.

-

Fill in the Inland Revenue Tax Rebate Form paper: You'll have to provide some information, such as your address, name, and purchase details, to be eligible for a Inland Revenue Tax Rebate Form.

-

Send in the Inland Revenue Tax Rebate Form: Depending on the kind of Inland Revenue Tax Rebate Form there may be a requirement to fill out a form and mail it in or upload it online.

-

Wait for approval: The company will look over your submission to determine if it's in compliance with the refund's conditions and terms.

-

Pay your Inland Revenue Tax Rebate Form When it's approved you'll receive your money back, either by check, prepaid card, or by another option specified by the offer.

Pros and Cons of Inland Revenue Tax Rebate Form

Advantages

-

Cost Savings Inland Revenue Tax Rebate Form can substantially decrease the price for products.

-

Promotional Deals These promotions encourage consumers to explore new products or brands.

-

Accelerate Sales A Inland Revenue Tax Rebate Form program can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in Inland Revenue Tax Rebate Form in particular, can be cumbersome and long-winded.

-

Deadlines for Expiration: Many Inland Revenue Tax Rebate Form have rigid deadlines to submit.

-

The risk of non-payment Certain customers could have their Inland Revenue Tax Rebate Form delayed if they don't adhere to the requirements exactly.

Download Inland Revenue Tax Rebate Form

Download Inland Revenue Tax Rebate Form

FAQs

1. Are Inland Revenue Tax Rebate Form equivalent to discounts? No, Inland Revenue Tax Rebate Form require a partial refund after the purchase, whereas discounts decrease costs at time of sale.

2. Do I have to use multiple Inland Revenue Tax Rebate Form for the same product It's contingent upon the conditions that apply to the Inland Revenue Tax Rebate Form offers and the product's qualification. Certain companies may permit the use of multiple Inland Revenue Tax Rebate Form, whereas other won't.

3. How long does it take to get an Inland Revenue Tax Rebate Form? The duration is variable, however it can take a couple of weeks or a few months to receive your Inland Revenue Tax Rebate Form.

4. Do I need to pay tax for Inland Revenue Tax Rebate Form montants? the majority of instances, Inland Revenue Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Inland Revenue Tax Rebate Form offers from brands that aren't well-known Do I need to conduct a thorough research and ensure that the brand which is providing the Inland Revenue Tax Rebate Form is reputable before making an purchase.

P55 Tax Rebate Form Business Printable Rebate Form

Rebate Form Download Printable PDF Templateroller

Check more sample of Inland Revenue Tax Rebate Form below

Donate Your Tax Return To UNICEF NZ

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Ptr Tax Rebate Libracha

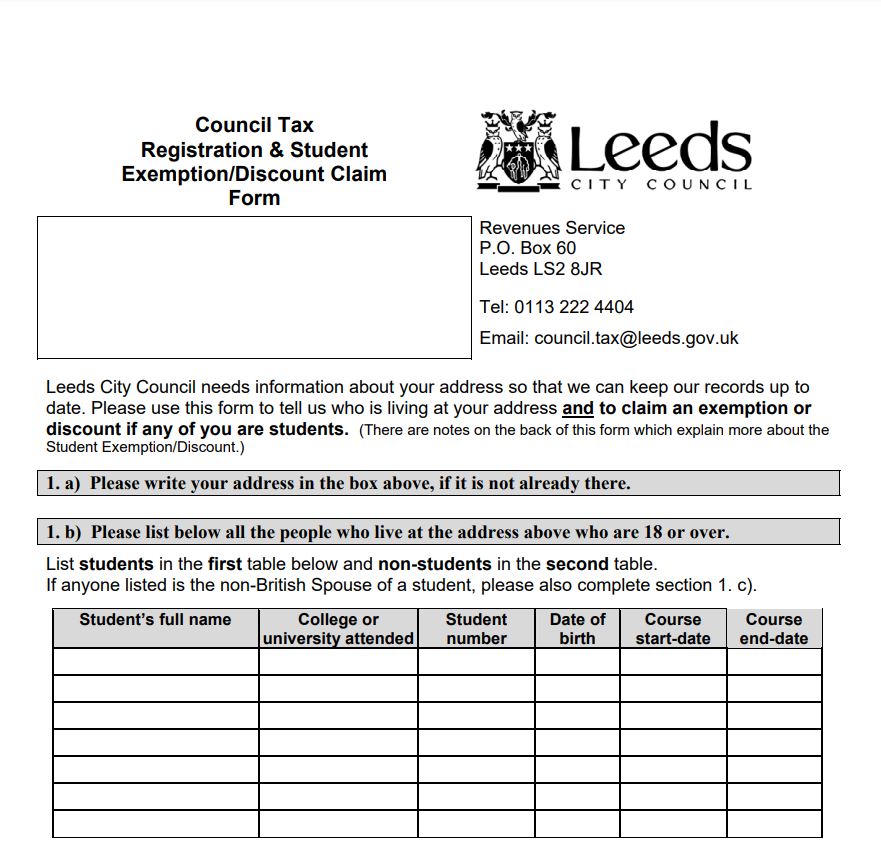

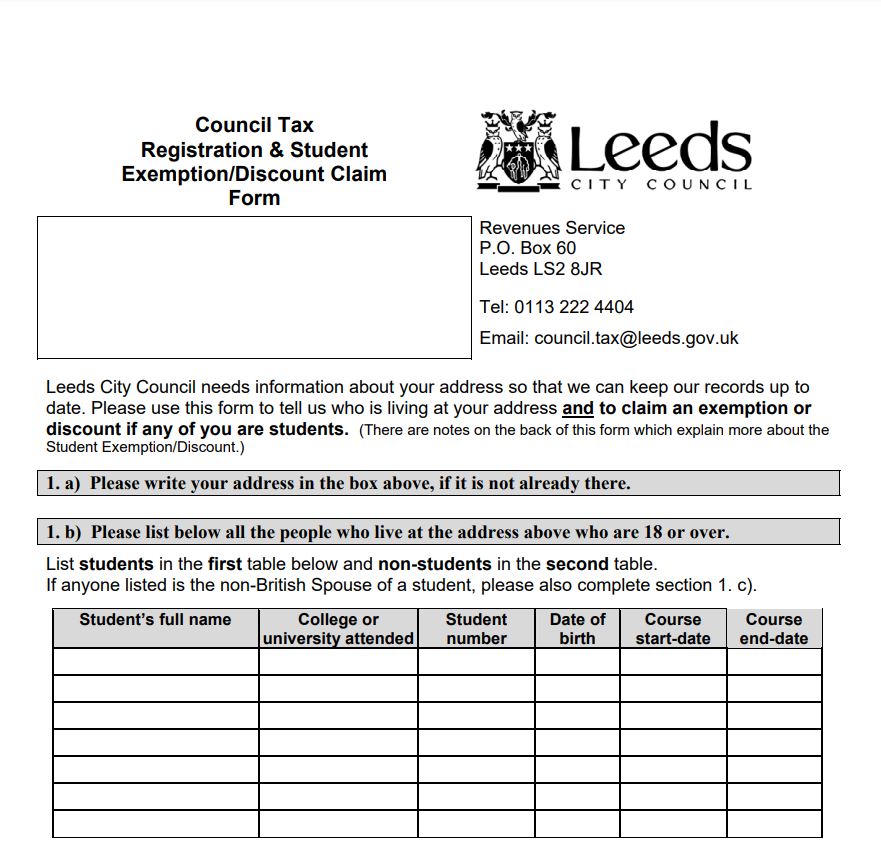

Leeds Council Tax Helpline Printable Rebate Form

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.gov.uk/government/collections/hmrc-forms

Web 1 janv 2014 nbsp 0183 32 HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 1 janv 2014 nbsp 0183 32 HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages

Leeds Council Tax Helpline Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Property Tax Rebate Application Printable Pdf Download

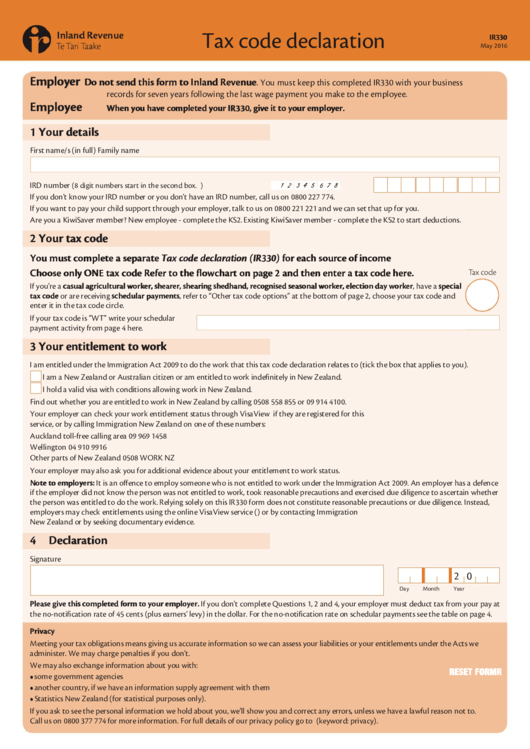

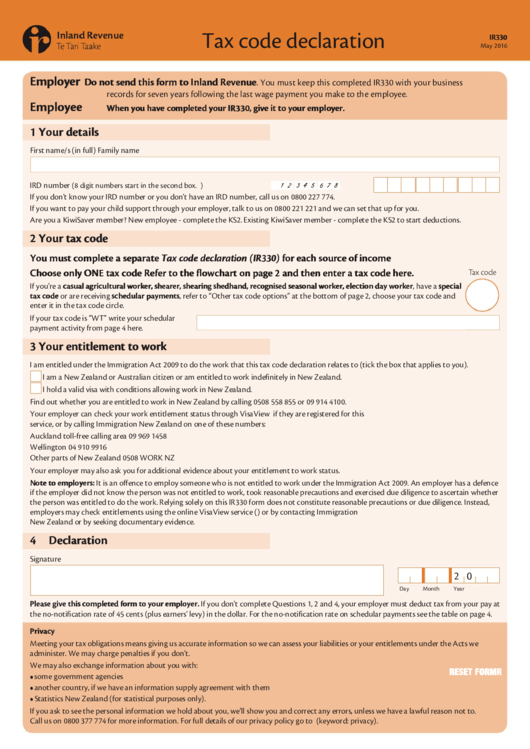

Fillable Inland Revenue Tax Code Declaration Printable Pdf Download

Fillable Inland Revenue Tax Code Declaration Printable Pdf Download

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms