Today, in a world that is driven by the consumer everyone appreciates a great deal. One method of gaining significant savings on your purchases can be achieved through Rebate Under 80cs. Rebate Under 80cs are marketing strategies that retailers and manufacturers use to offer customers a return on their purchases once they have made them. In this article, we will look into the world of Rebate Under 80cs, looking at what they are what they are, how they function, and ways to maximize the value of these incentives.

Get Latest Rebate Under 80c Below

Rebate Under 80c

Rebate Under 80c -

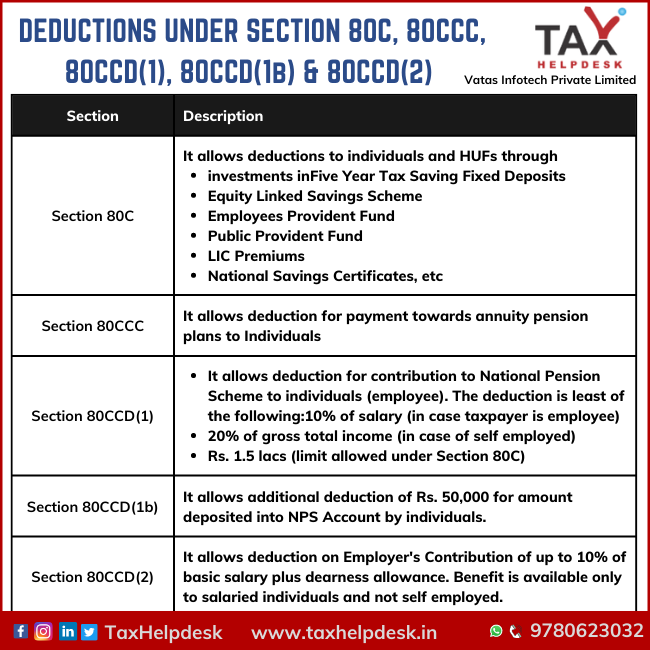

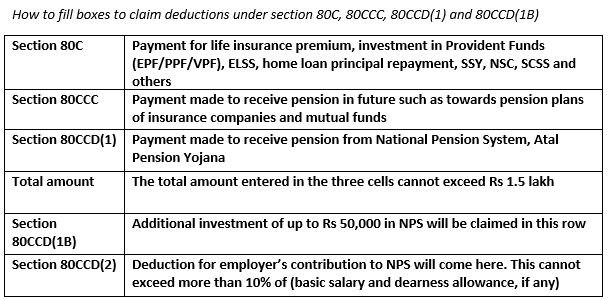

Section 80C is an income tax deduction that helps you reduce your taxable income and thus helps in reducing the tax outgo It covers specified investment and payment options that can reduce your taxable income by an amount of up to Rs 1 5 lakhs

Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions which have been enumerated below Who is eligible This deduction can be claimed only by a parent An adopted child s school fees is also eligible for deduction

A Rebate Under 80c, in its simplest form, is a refund given to a client following the purchase of a product or service. It is a powerful tool used by businesses to attract clients, increase sales and also to advertise certain products.

Types of Rebate Under 80c

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

A maximum deduction allowed is Rs 1 5 lakh under 80C Hence if you fall in the 30 tax bracket then you can save taxes upto Rs 46800 including cess 31 2 on Rs 1 5 lakh Accordingly if you belong in the 20 tax bracket then

Section 80C A taxpayer can claim various deductions on their total income through 80C Here is complete guide on how to save income tax under section 80C One time Offer Get ET Money Genius at 80 OFF at 249 49 for the first 3 months

Cash Rebate Under 80c

Cash Rebate Under 80c is the most basic type of Rebate Under 80c. Customers receive a specific amount back in cash after purchasing a item. These are often used for big-ticket items, like electronics and appliances.

Mail-In Rebate Under 80c

Mail-in Rebate Under 80c require consumers to submit evidence of purchase to get their money back. They are a bit longer-lasting, however they offer significant savings.

Instant Rebate Under 80c

Instant Rebate Under 80c apply at the point of sale. They reduce the cost of purchase immediately. Customers don't have to wait long for savings with this type.

How Rebate Under 80c Work

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

What are the investments eligible for deduction under 80C PPF NSC NPS Tax saver FDs Post Office Term Deposit ELSS ULIP Senior Citizens Savings Scheme Sukanya Samridhi Account Here is a complete guide to all the deductions allowed under Section 80C Frequently Asked Questions

The Rebate Under 80c Process

The process typically comprises a handful of simple steps:

-

When you buy the product, you purchase the item just as you would ordinarily.

-

Complete your Rebate Under 80c questionnaire: you'll need submit some information, such as your name, address, and purchase details, to take advantage of your Rebate Under 80c.

-

To submit the Rebate Under 80c depending on the type of Rebate Under 80c you may have to fill out a form and mail it in or upload it online.

-

Wait for the company's approval: They will review your request for compliance with rules and regulations of the Rebate Under 80c.

-

Accept your Rebate Under 80c After being approved, you'll be able to receive your reimbursement, either through check, prepaid card, or through another method as specified by the offer.

Pros and Cons of Rebate Under 80c

Advantages

-

Cost Savings A Rebate Under 80c can significantly lower the cost you pay for the item.

-

Promotional Deals These promotions encourage consumers to try out new products or brands.

-

Enhance Sales Rebate Under 80c can enhance sales for a company and also increase market share.

Disadvantages

-

Complexity: Mail-in Rebate Under 80c, in particular, can be cumbersome and costly.

-

Deadlines for Expiration: Many Rebate Under 80c have rigid deadlines to submit.

-

Risk of Non-Payment Certain customers could not get their Rebate Under 80c if they don't adhere to the requirements exactly.

Download Rebate Under 80c

FAQs

1. Are Rebate Under 80c the same as discounts? No, Rebate Under 80c involve some form of refund following the purchase, while discounts lower the price of the purchase at the point of sale.

2. Are there any Rebate Under 80c that I can use for the same product? It depends on the conditions in the Rebate Under 80c offered and product's quality and eligibility. Some companies will allow it, and some don't.

3. How long will it take to get the Rebate Under 80c? The amount of time differs, but it can take several weeks to a few months to get your Rebate Under 80c.

4. Do I need to pay tax with respect to Rebate Under 80c the amount? most cases, Rebate Under 80c amounts are not considered to be taxable income.

5. Do I have confidence in Rebate Under 80c offers from lesser-known brands It's important to do your research and confirm that the company offering the Rebate Under 80c is reputable prior making any purchase.

Income Tax Deductions Available For The Financial Year 2017 18

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

Check more sample of Rebate Under 80c below

A Quick Look At Deductions Under Section 80C To Section 80U

Section 80C Income Tax Deduction Under Section 80C Tax2win

Income Tax 80C TAMNEWS

Deduction Under Section 80C Its Allied Sections

Income Tax Saving Chart From 80C To 80U

A Quick Look At Deductions Under Section 80C To Section 80U

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions which have been enumerated below Who is eligible This deduction can be claimed only by a parent An adopted child s school fees is also eligible for deduction

https://taxguru.in/income-tax/section-80c-80ccc-80ccd-deduction.html

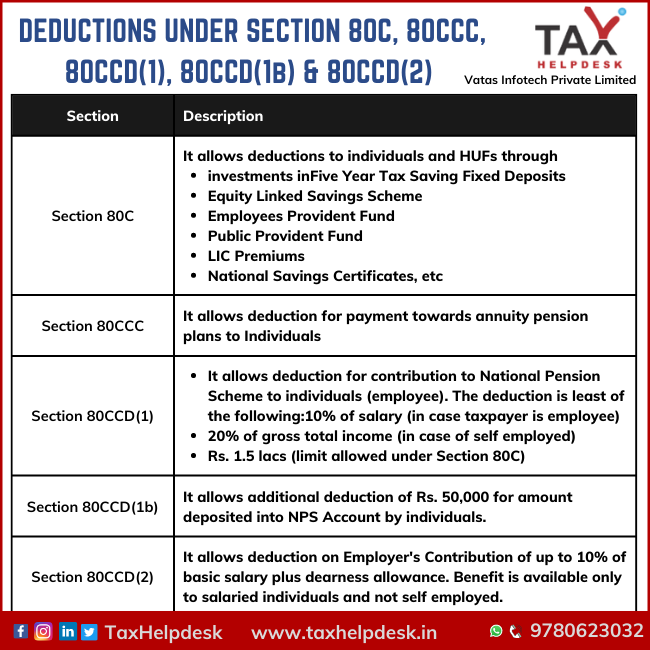

Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income of an Individual HUF certain payments are very important to claim deduction u s 80

Persons paying any sum fees towards the education of their children can claim tax deduction under Section 80C subject to the satisfaction of certain conditions which have been enumerated below Who is eligible This deduction can be claimed only by a parent An adopted child s school fees is also eligible for deduction

Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income of an Individual HUF certain payments are very important to claim deduction u s 80

Deduction Under Section 80C Its Allied Sections

Section 80C Income Tax Deduction Under Section 80C Tax2win

Income Tax Saving Chart From 80C To 80U

A Quick Look At Deductions Under Section 80C To Section 80U

Deduction Under 80C To 80U Revision YouTube

What Is The Best Way To Save 1 Lakh Under Section 80C Quora

What Is The Best Way To Save 1 Lakh Under Section 80C Quora

Investing Can Be Interesting Financial Awareness Deduction Under