In our modern, consumer-driven society people love a good bargain. One of the ways to enjoy significant savings on your purchases is by using Tax Rebate Form P50s. Tax Rebate Form P50s can be a way of marketing used by manufacturers and retailers to provide customers with a partial payment on their purchases, after they've done so. In this article, we'll take a look at the world that is Tax Rebate Form P50s, exploring the nature of them as well as how they work and the best way to increase your savings with these cost-effective incentives.

Get Latest Tax Rebate Form P50 Below

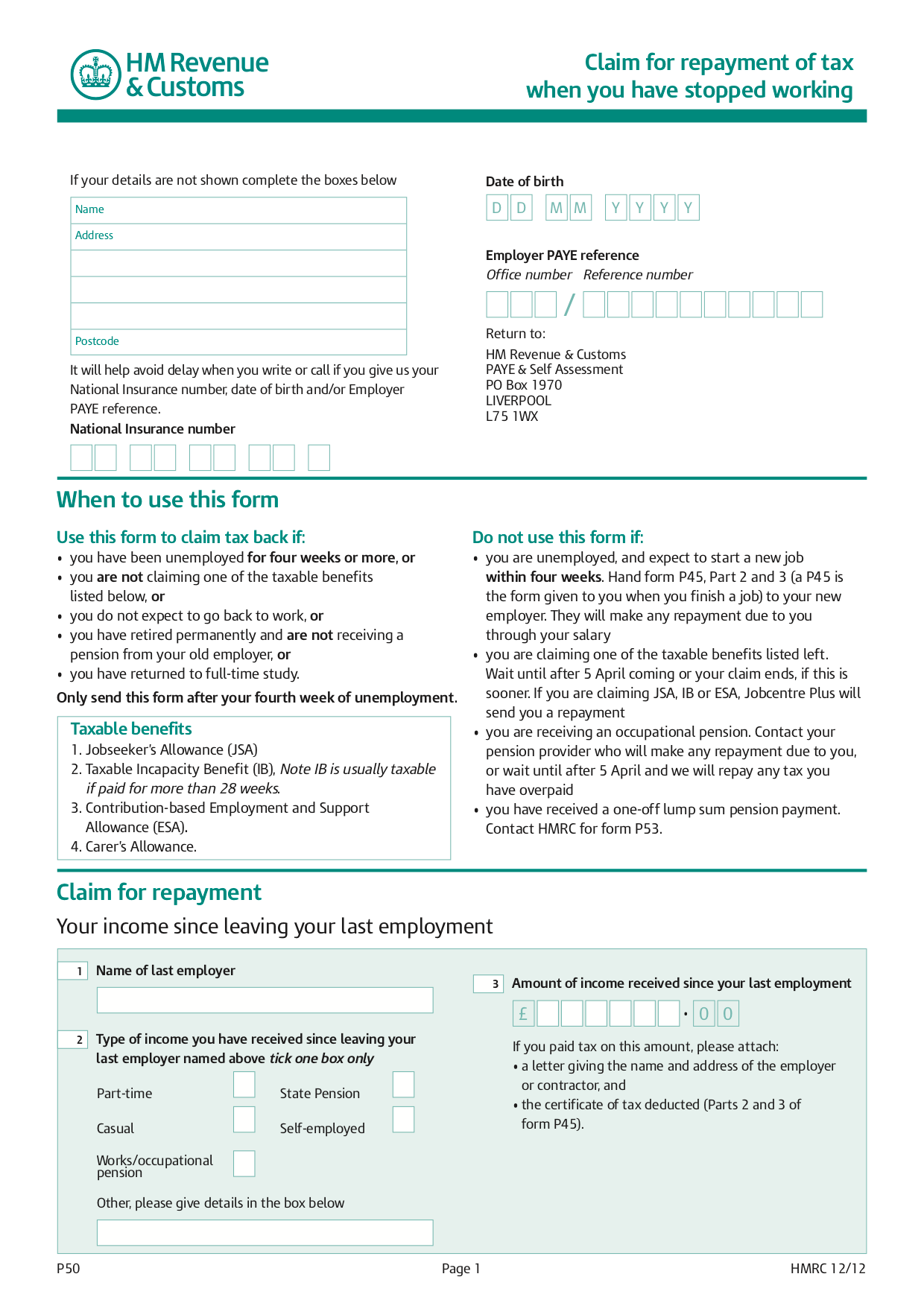

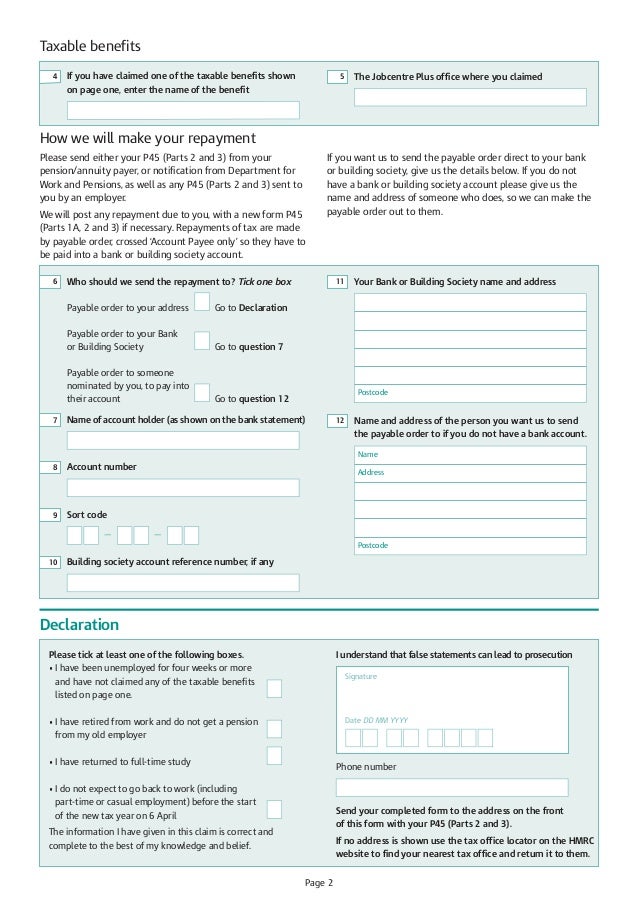

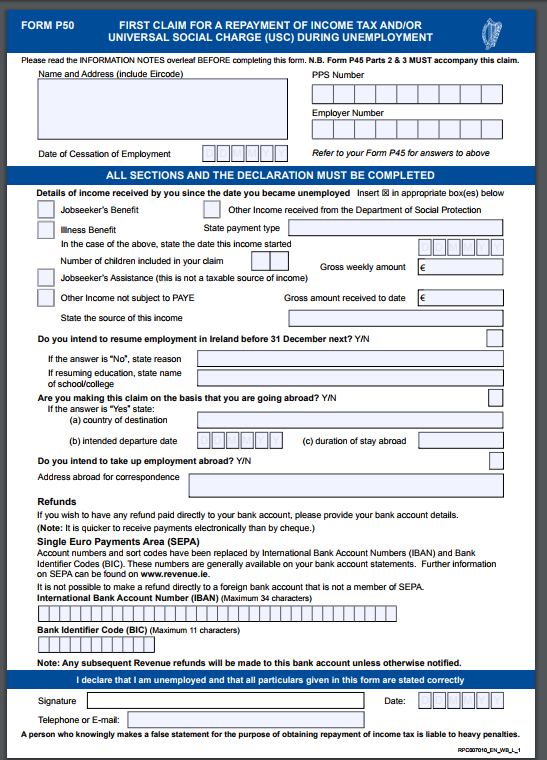

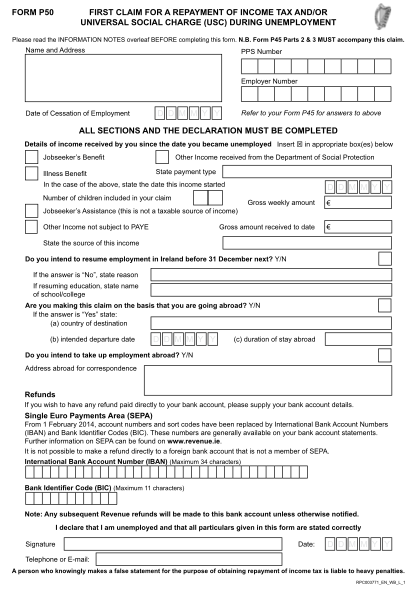

Tax Rebate Form P50

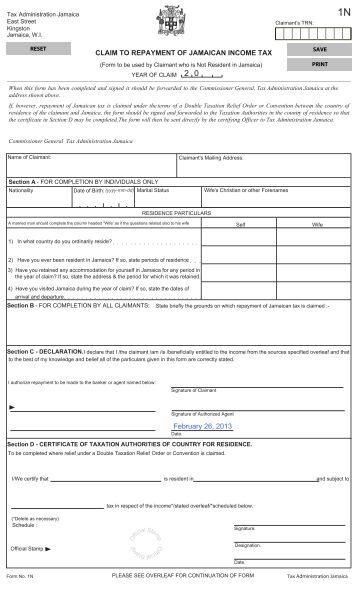

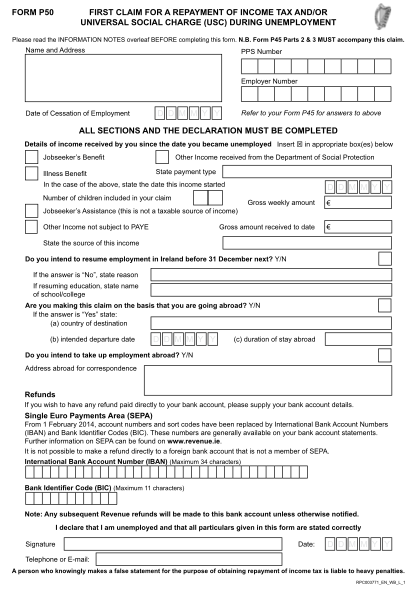

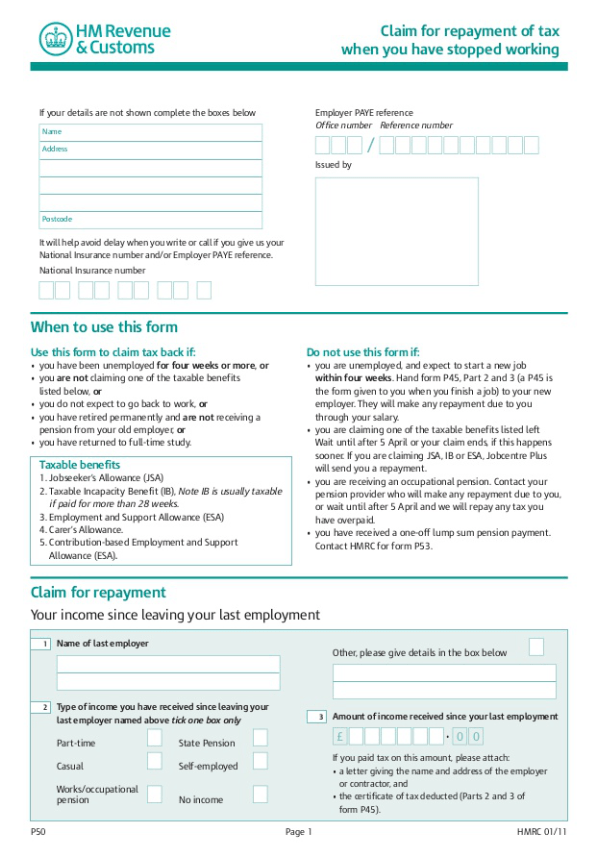

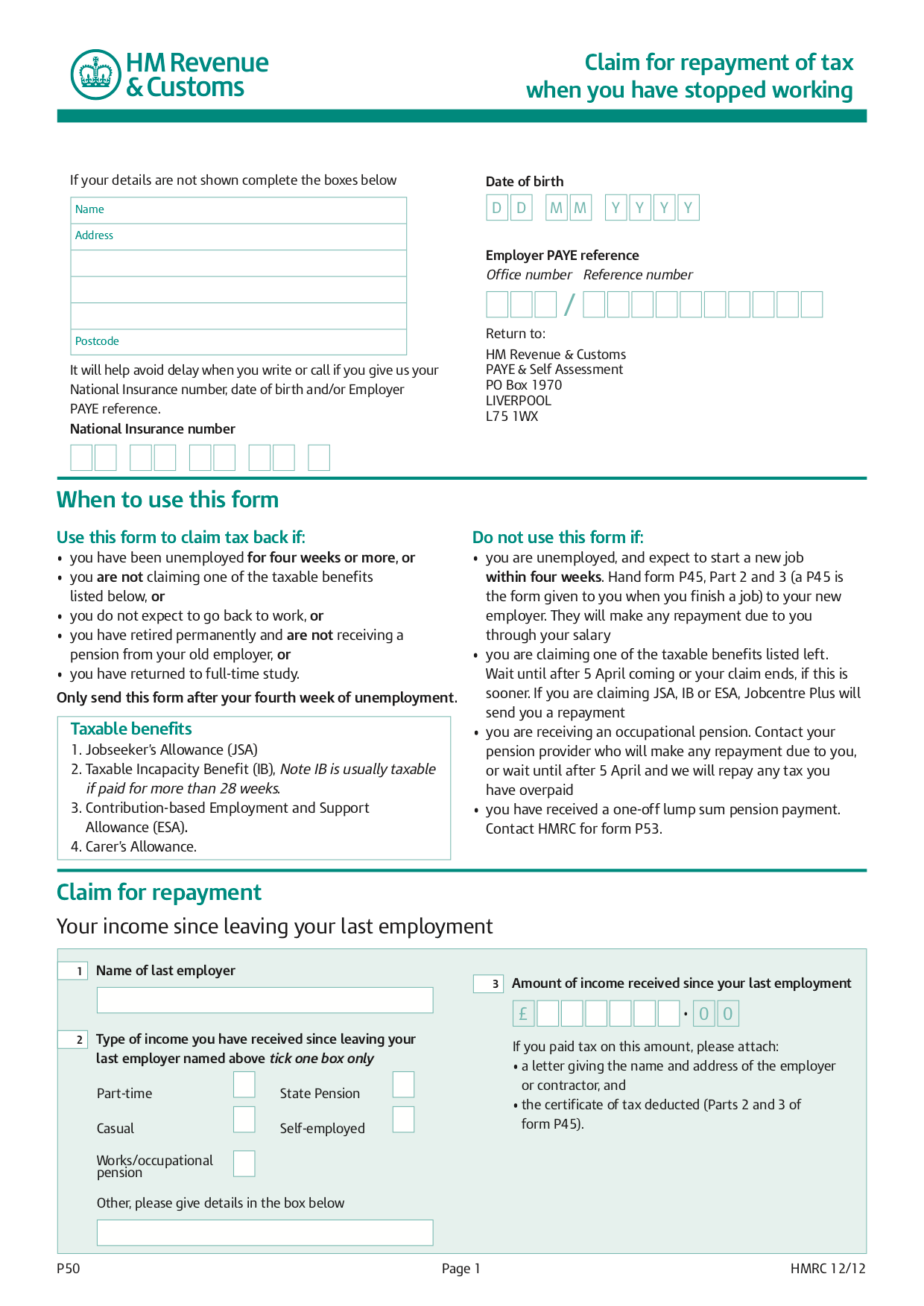

Tax Rebate Form P50 -

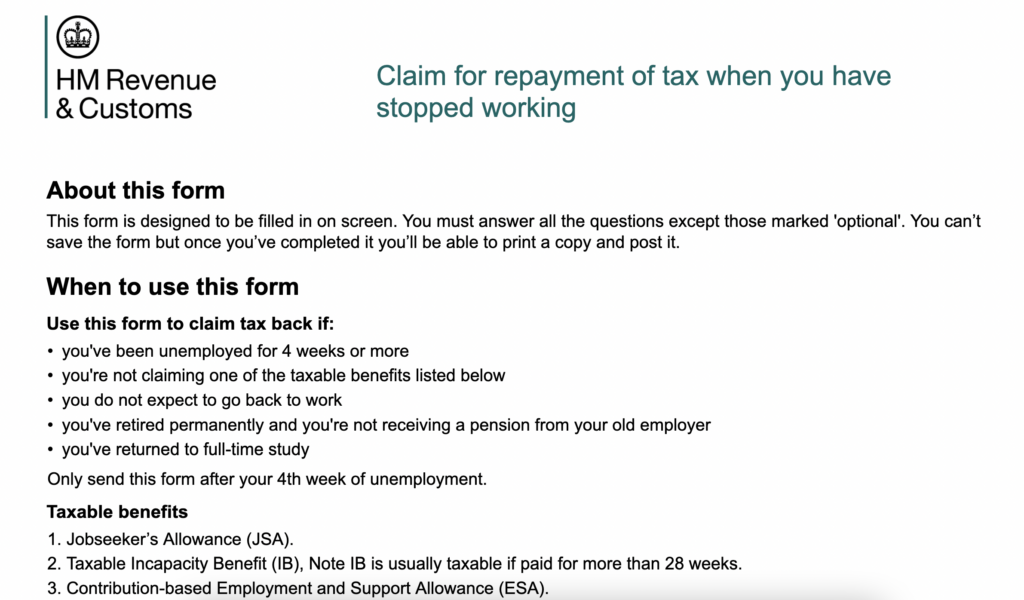

Web 9 d 233 c 2019 nbsp 0183 32 Form P50 Get Your Money Back Before the End of the Tax Year If you overpay your taxes and you don t get any taxable income for 4 weeks you can contact

Web 30 nov 2015 nbsp 0183 32 Details If you re reclaiming tax because you ve flexibly accessed your pension pot you can use the online service fill in the form on screen print and post to

A Tax Rebate Form P50 in its most basic definition, is a return to the customer following the purchase of a product or service. It is a powerful tool used by businesses to attract customers, increase sales and even promote certain products.

Types of Tax Rebate Form P50

How To Claim Personal Tax Back With P50 If You Overpaid HMRC

How To Claim Personal Tax Back With P50 If You Overpaid HMRC

Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Web You can claim a tax refund by filling in form P50 Download form P50 from the GOV UK website Contact HMRC before filling in the form and they ll tell you what other

Cash Tax Rebate Form P50

Cash Tax Rebate Form P50 are the simplest kind of Tax Rebate Form P50. The customer receives a particular amount of money when purchasing a product. This is often for big-ticket items, like electronics and appliances.

Mail-In Tax Rebate Form P50

Mail-in Tax Rebate Form P50 require that customers send in their proof of purchase before receiving their reimbursement. They are a bit more involved, but can result in significant savings.

Instant Tax Rebate Form P50

Instant Tax Rebate Form P50 will be applied at points of sale. This reduces the purchase cost immediately. Customers don't have to wait around for savings through this kind of offer.

How Tax Rebate Form P50 Work

P50 Tax Form Printable Printable Forms Free Online

P50 Tax Form Printable Printable Forms Free Online

Web 11 nov 2011 nbsp 0183 32 You can claim a rebate using form P50 if you are sure you will not be working again in the tax year Mock said Otherwise you should make your claim through your tax return

The Tax Rebate Form P50 Process

The process generally involves a few steps

-

Buy the product: Firstly then, you buy the item as you normally would.

-

Fill in the Tax Rebate Form P50 Form: To claim the Tax Rebate Form P50 you'll have to supply some details including your name, address, and purchase information, to apply for your Tax Rebate Form P50.

-

You must submit the Tax Rebate Form P50 It is dependent on the type of Tax Rebate Form P50 you could be required to mail a Tax Rebate Form P50 form in or send it via the internet.

-

Wait for approval: The company will evaluate your claim to make sure it is in line with the Tax Rebate Form P50's terms and conditions.

-

You will receive your Tax Rebate Form P50: Once approved, you'll receive your cash back either by check, prepaid card, or another option that's specified in the offer.

Pros and Cons of Tax Rebate Form P50

Advantages

-

Cost Savings Tax Rebate Form P50 can dramatically reduce the cost for the product.

-

Promotional Offers They encourage customers to try new products and brands.

-

Accelerate Sales Tax Rebate Form P50 are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in Tax Rebate Form P50 via mail, in particular is a time-consuming process and costly.

-

Days of expiration: Many Tax Rebate Form P50 have deadlines for submission.

-

Risque of Non-Payment: Some customers may lose their Tax Rebate Form P50 in the event that they don't observe the rules precisely.

Download Tax Rebate Form P50

FAQs

1. Are Tax Rebate Form P50 equivalent to discounts? Not at all, Tax Rebate Form P50 provide some form of refund following the purchase, whereas discounts cut the price of the purchase at the moment of sale.

2. Can I get multiple Tax Rebate Form P50 on the same item What is the best way to do it? It's contingent on conditions on the Tax Rebate Form P50 provides and the particular product's potential eligibility. Certain companies might allow it, while other companies won't.

3. How long does it take to get an Tax Rebate Form P50? The period is different, but it could be anywhere from a few weeks up to a few months to receive your Tax Rebate Form P50.

4. Do I have to pay taxes with respect to Tax Rebate Form P50 montants? the majority of situations, Tax Rebate Form P50 amounts are not considered taxable income.

5. Can I trust Tax Rebate Form P50 offers from lesser-known brands It is essential to investigate and confirm that the company that is offering the Tax Rebate Form P50 is reputable prior making an acquisition.

P50 Tax Refund Taxes

How To Claim A Tax Refund If You ve Stopped Work P50 Form

Check more sample of Tax Rebate Form P50 below

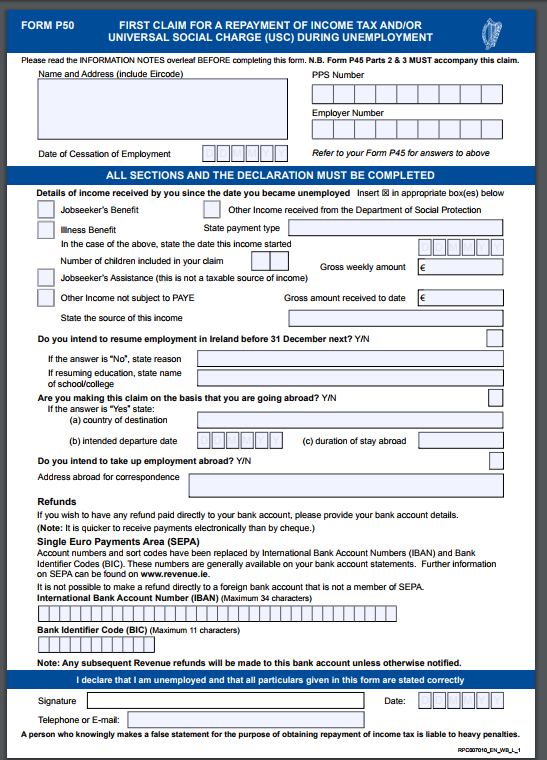

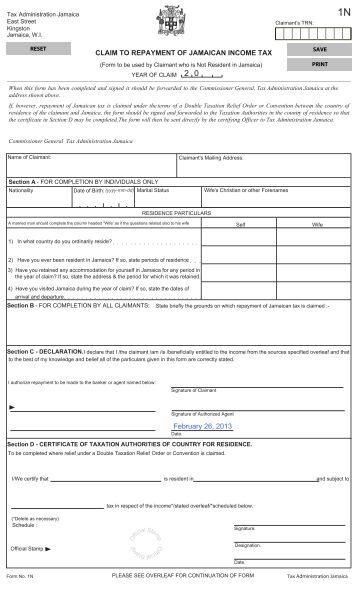

Fill Free Fillable Irish Tax Customs PDF Forms

Form P50 Income Tax pdf Tax Refund Taxes

P50 Tax Form Printable Printable Forms Free Online

Your Bullsh t Free Guide To PAYE Taxes In Ireland

Form P50 First Claim For Tax Repayment During Unemployment

119 P45 Forms Download Page 8 Free To Edit Download Print CocoDoc

https://www.gov.uk/government/publications/income-tax-claim-for...

Web 30 nov 2015 nbsp 0183 32 Details If you re reclaiming tax because you ve flexibly accessed your pension pot you can use the online service fill in the form on screen print and post to

https://www.gov.uk/.../guidance-for-filling-in-form-p50z

Web Income Tax Claim a tax refund if you ve stopped work and flexibly accessed your pension

Web 30 nov 2015 nbsp 0183 32 Details If you re reclaiming tax because you ve flexibly accessed your pension pot you can use the online service fill in the form on screen print and post to

Web Income Tax Claim a tax refund if you ve stopped work and flexibly accessed your pension

Your Bullsh t Free Guide To PAYE Taxes In Ireland

Form P50 Income Tax pdf Tax Refund Taxes

Form P50 First Claim For Tax Repayment During Unemployment

119 P45 Forms Download Page 8 Free To Edit Download Print CocoDoc

Government Rebate Program Fill Out Sign Online DocHub

PA Property Tax Rebate Forms Printable Rebate Form

PA Property Tax Rebate Forms Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf