In today's consumer-driven world, everyone loves a good deal. One method of gaining substantial savings on your purchases is through Illinois Property Tax Rebate Forms. Illinois Property Tax Rebate Forms are a marketing strategy used by manufacturers and retailers for offering customers a percentage discount on purchases they made after they've purchased them. In this article, we will explore the world of Illinois Property Tax Rebate Forms. We'll discuss what they are, how they work, and ways to maximize your savings through these efficient incentives.

Get Latest Illinois Property Tax Rebate Form Below

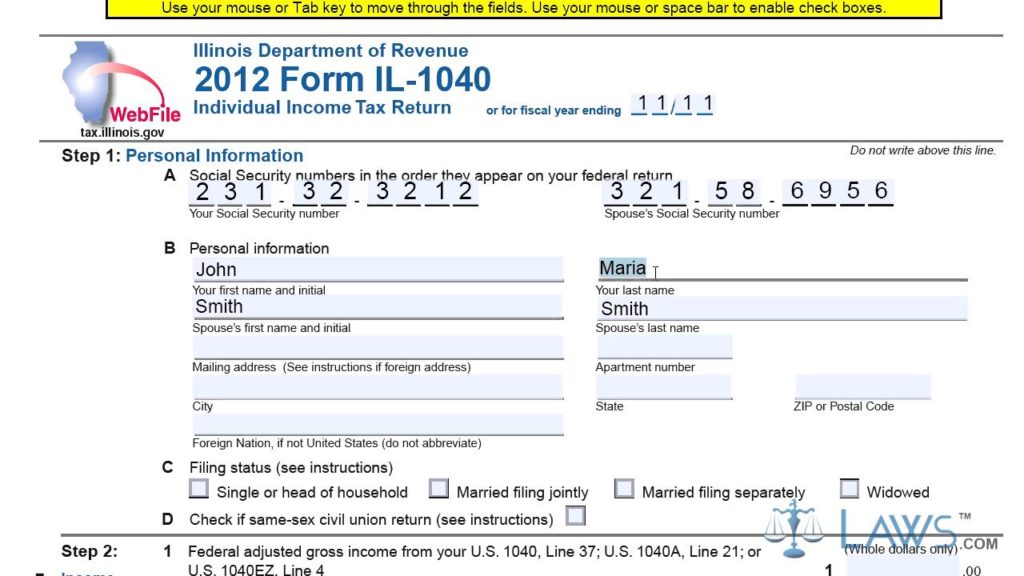

Illinois Property Tax Rebate Form

Illinois Property Tax Rebate Form -

Web If you are eligible to claim a property tax credit but did not do so on your Illinois income tax return for 2021 IL 1040 and Schedule ICR Illinois Credits you must complete and submit electronically or by mail Form IL 1040 PTR Property Tax Rebate to receive your property tax rebate

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income tax rebate You must file Form IL 1040 including Schedule IL E EIC Illinois Exemption and Earned Income Credit to report any eligible dependents on or before October 17 2022

A Illinois Property Tax Rebate Form as it is understood in its simplest form, is a return to the customer when they purchase a product or service. It's a powerful instrument for businesses to entice buyers, increase sales and even promote certain products.

Types of Illinois Property Tax Rebate Form

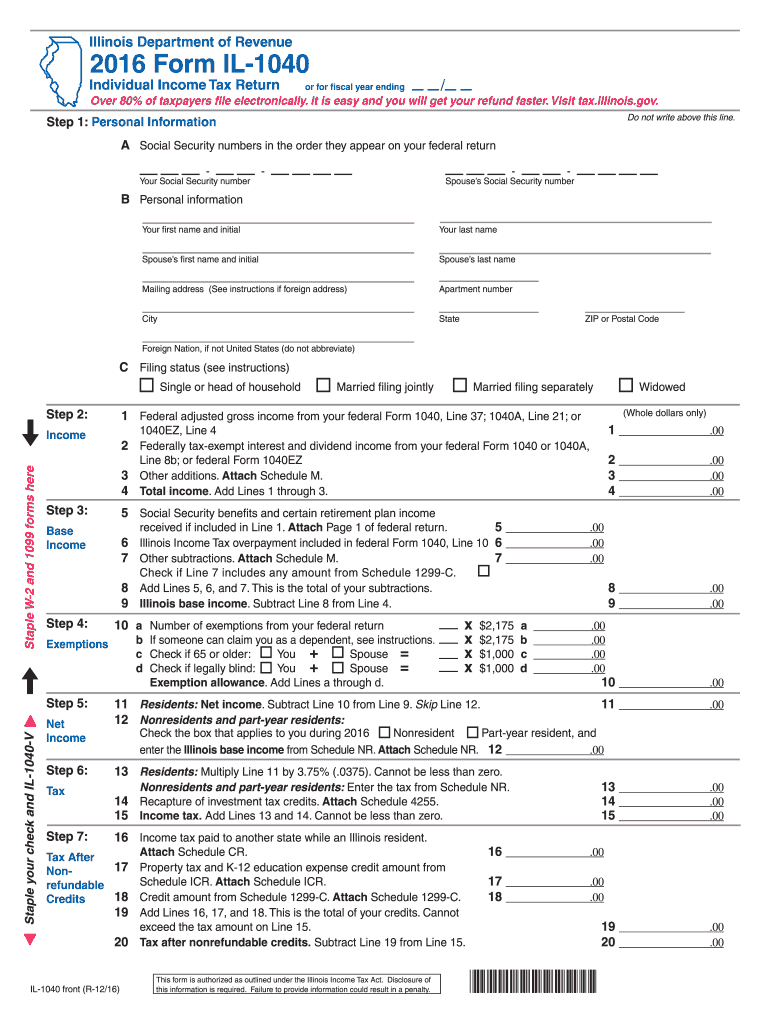

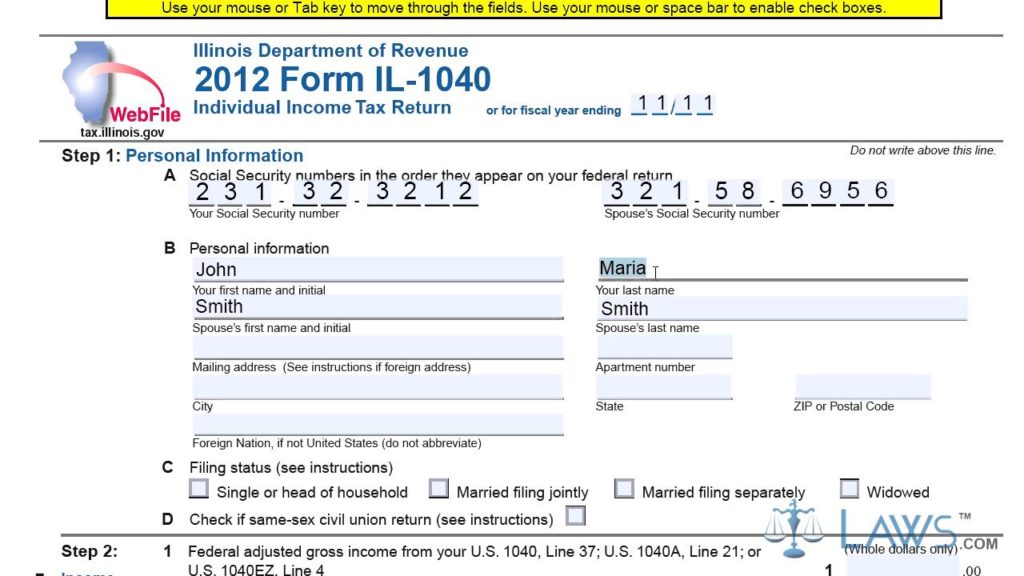

Il 1040 Fill Out Sign Online DocHub

Il 1040 Fill Out Sign Online DocHub

Web 5 juil 2022 nbsp 0183 32 The instructions include that 1 taxpayers must complete the form to request their property tax rebate only if they weren t required to file Form IL 1040 Illinois Individual Income Tax Return or didn t previously file Schedule ICR with Form IL 1040 2 taxpayers must submit Form IL 1040 PTR on or before Oct 17 3 the rebate isn t

Web 9 oct 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have

Cash Illinois Property Tax Rebate Form

Cash Illinois Property Tax Rebate Form is the most basic type of Illinois Property Tax Rebate Form. Customers receive a certain amount back in cash after purchasing a product. They are typically used to purchase large-ticket items such as electronics and appliances.

Mail-In Illinois Property Tax Rebate Form

Mail-in Illinois Property Tax Rebate Form are based on the requirement that customers present documents of purchase to claim their money back. They're a little more involved but can offer significant savings.

Instant Illinois Property Tax Rebate Form

Instant Illinois Property Tax Rebate Form are credited at the point of sale, and can reduce the purchase price immediately. Customers don't need to wait around for savings by using this method.

How Illinois Property Tax Rebate Form Work

Illinois Form Tax 2016 Fill Out Sign Online DocHub

Illinois Form Tax 2016 Fill Out Sign Online DocHub

Web 12 sept 2022 nbsp 0183 32 Form IL 1040 PTR the Property Tax Rebate Form is available on IDOR s website at tax illinois gov rebates Taxpayers eligible for both rebates will receive one payment Rebates will be sent automatically using the same method original refunds were transmitted if they were sent directly to the taxpayer by the State of Illinois

The Illinois Property Tax Rebate Form Process

It usually consists of a few simple steps

-

You purchase the item: First, you purchase the item like you normally do.

-

Fill out your Illinois Property Tax Rebate Form application: In order to claim your Illinois Property Tax Rebate Form, you'll need provide certain information like your name, address, as well as the details of your purchase to be eligible for a Illinois Property Tax Rebate Form.

-

In order to submit the Illinois Property Tax Rebate Form According to the nature of Illinois Property Tax Rebate Form there may be a requirement to fill out a form and mail it in or send it via the internet.

-

Wait for approval: The company will look over your submission to ensure it meets the Illinois Property Tax Rebate Form's terms and conditions.

-

Enjoy your Illinois Property Tax Rebate Form If it is approved, you'll receive your cash back via check, prepaid card or another option that's specified in the offer.

Pros and Cons of Illinois Property Tax Rebate Form

Advantages

-

Cost savings A Illinois Property Tax Rebate Form can significantly reduce the price you pay for products.

-

Promotional Deals The aim is to encourage customers to try new items or brands.

-

Accelerate Sales A Illinois Property Tax Rebate Form program can boost sales for a company and also increase market share.

Disadvantages

-

Complexity The mail-in Illinois Property Tax Rebate Form particularly may be lengthy and costly.

-

Time Limits for Illinois Property Tax Rebate Form: Many Illinois Property Tax Rebate Form have the strictest deadlines for submission.

-

Risque of Non-Payment: Some customers may not get their Illinois Property Tax Rebate Form if they don't follow the rules precisely.

Download Illinois Property Tax Rebate Form

Download Illinois Property Tax Rebate Form

FAQs

1. Are Illinois Property Tax Rebate Form the same as discounts? No, Illinois Property Tax Rebate Form are one-third of the amount refunded following purchase, whereas discounts cut costs at time of sale.

2. Do I have to use multiple Illinois Property Tax Rebate Form on the same item? It depends on the conditions and conditions of Illinois Property Tax Rebate Form incentives and the specific product's ability to qualify. Some companies will allow it, while other companies won't.

3. How long will it take to receive a Illinois Property Tax Rebate Form? The period is different, but it could take a couple of weeks or a few months for you to receive your Illinois Property Tax Rebate Form.

4. Do I have to pay taxes with respect to Illinois Property Tax Rebate Form quantities? most circumstances, Illinois Property Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Illinois Property Tax Rebate Form deals from lesser-known brands Consider doing some research and verify that the organization offering the Illinois Property Tax Rebate Form is reputable before making an acquisition.

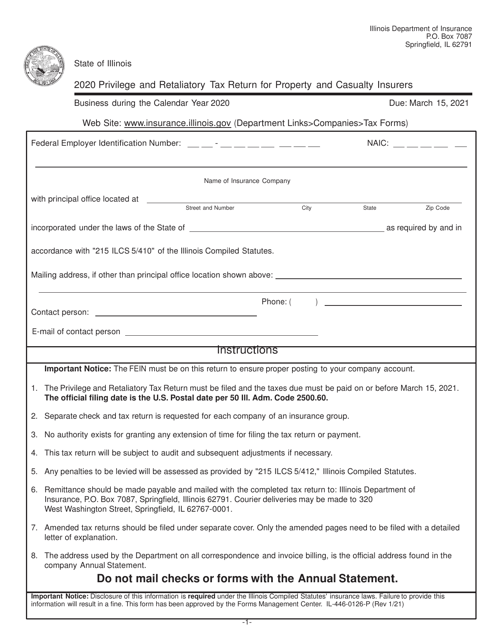

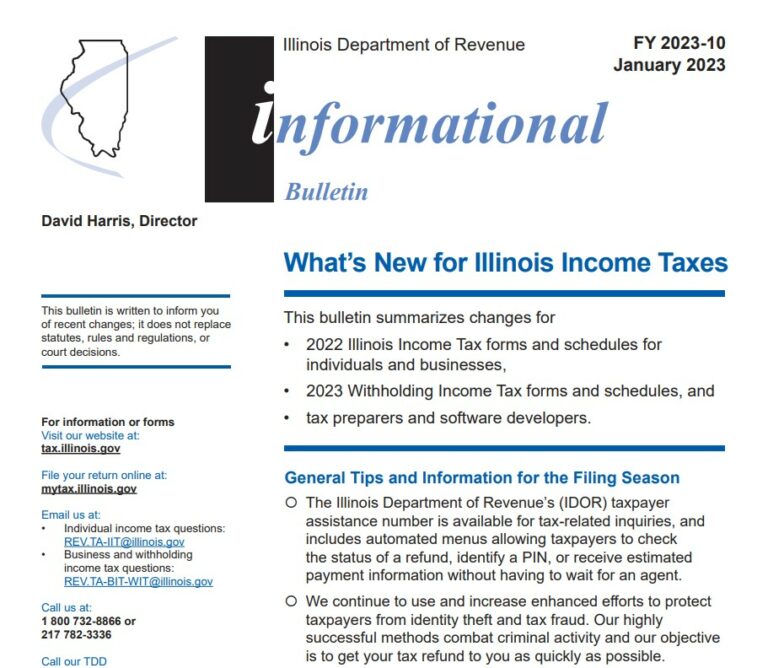

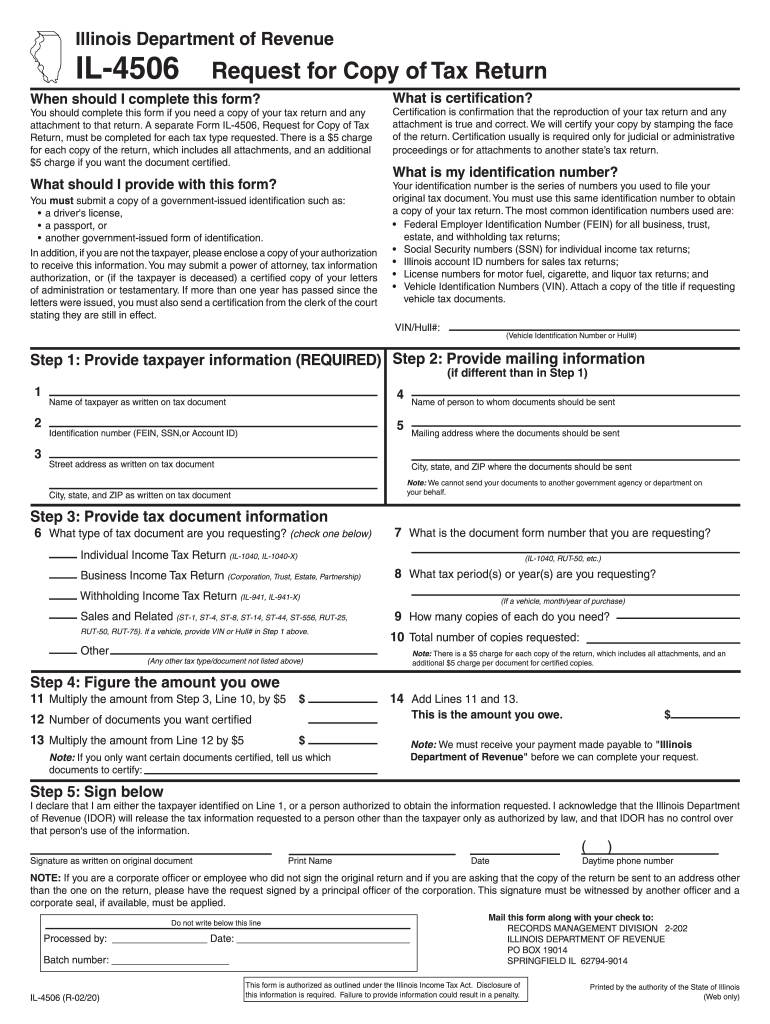

Form IL446 0126 P Download Printable PDF Or Fill Online Privilege And

Illinois Tax Exemption Form

Check more sample of Illinois Property Tax Rebate Form below

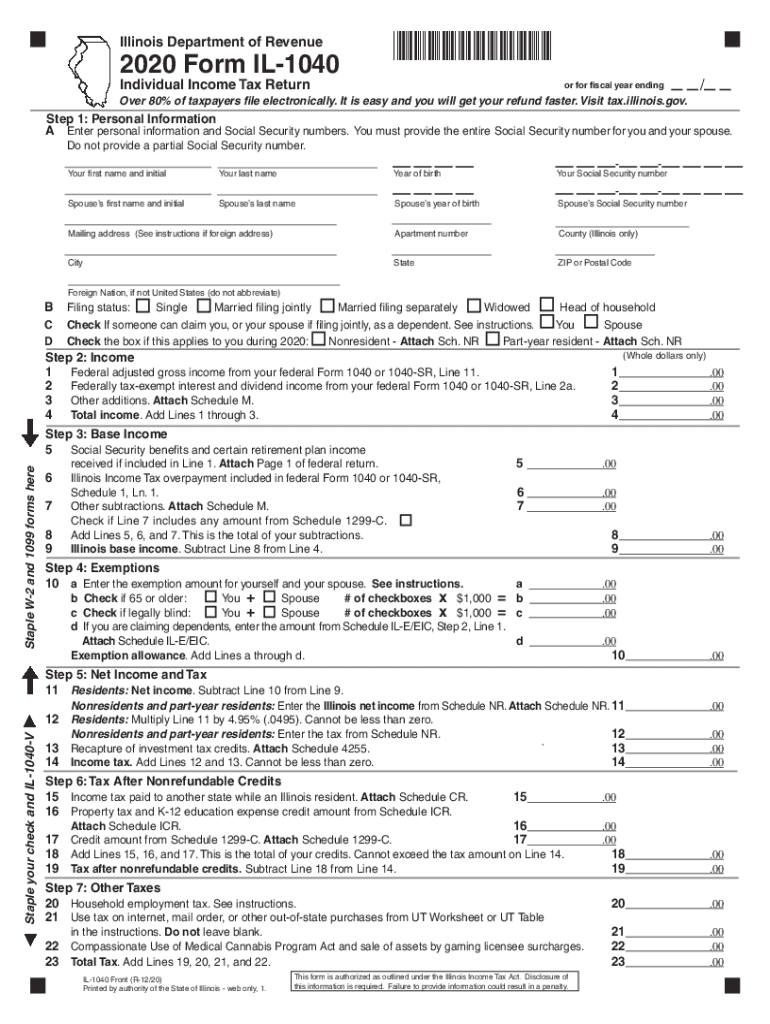

Illinois Tax Forms Fill Out Sign Online DocHub

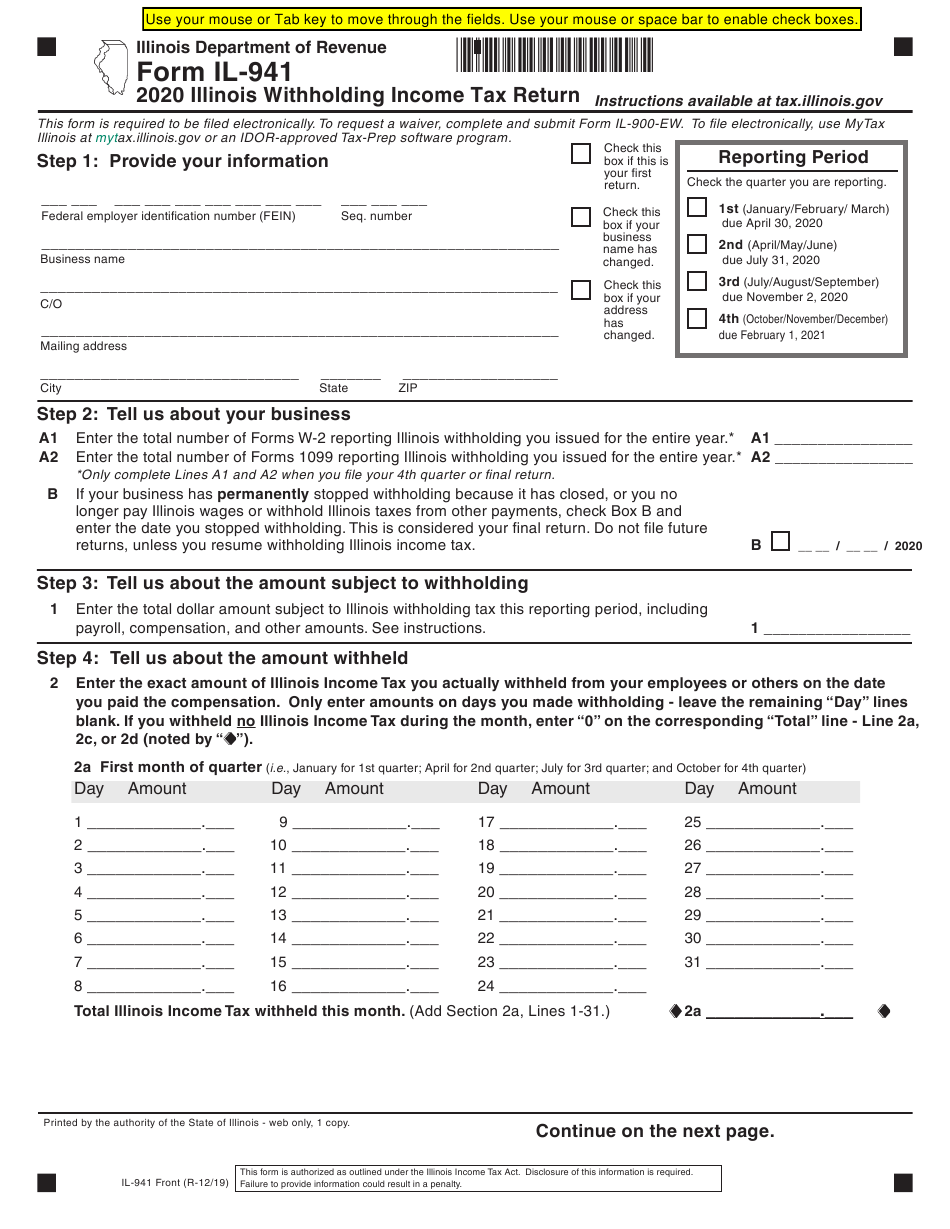

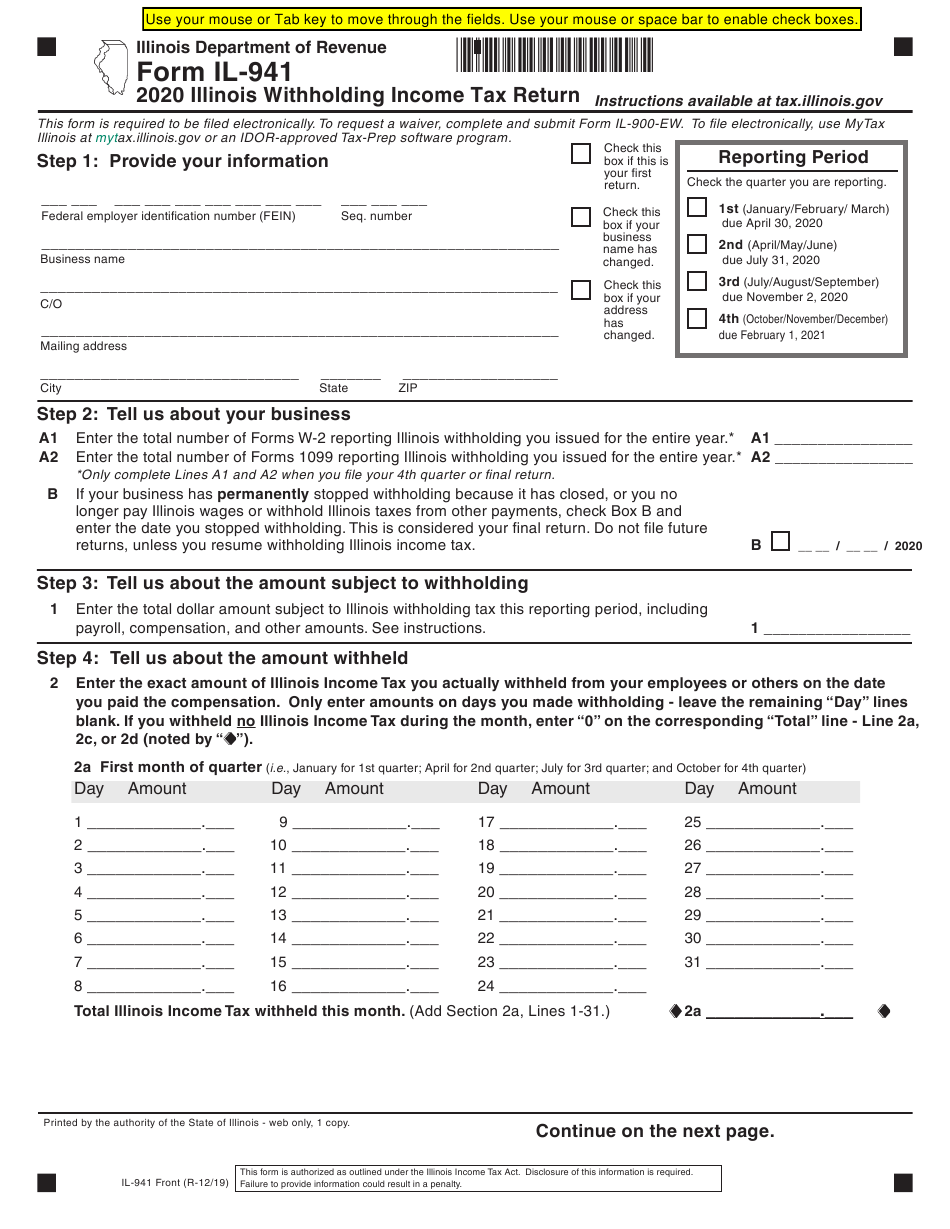

Illinois Unemployment 941x Fill Out Sign Online DocHub

Illinois Form 2848 Fill Out Sign Online DocHub

Il 941 Fillable Form Printable Forms Free Online

Monday Is Deadline To Submit Additional Paperwork For Illinois Tax

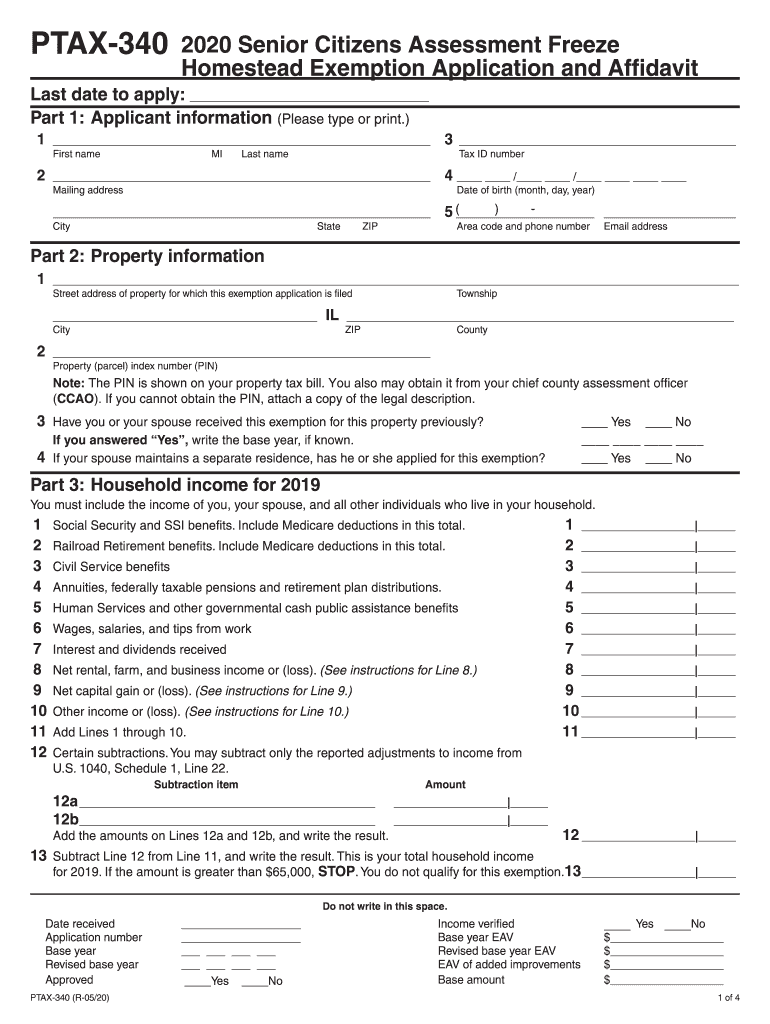

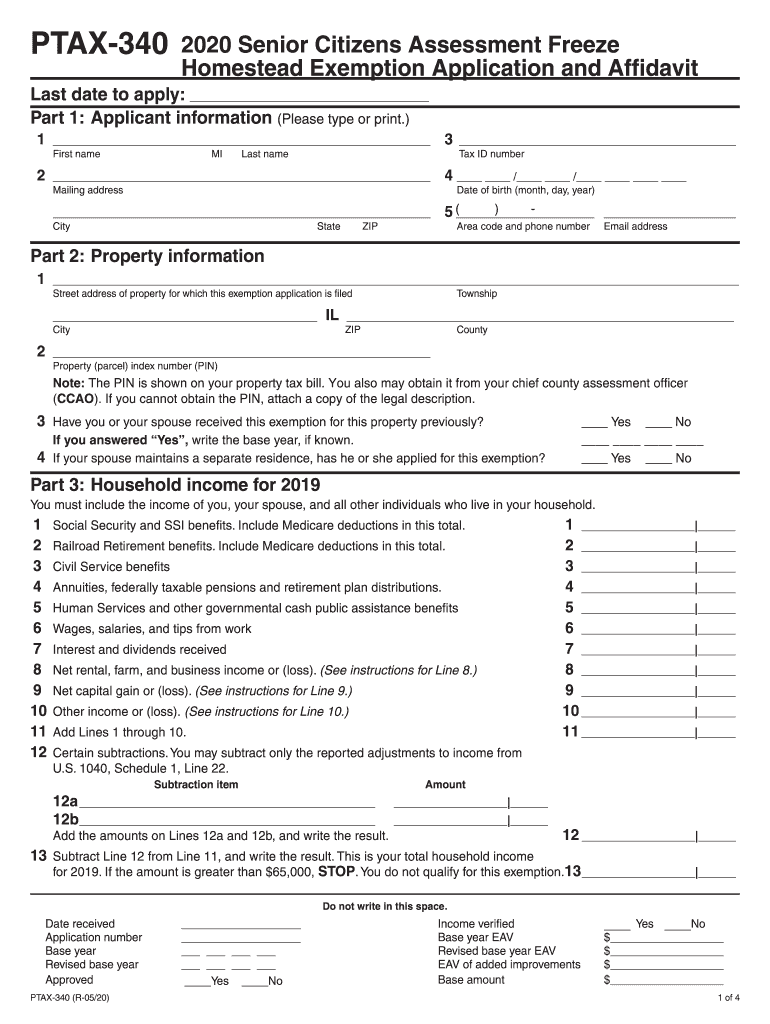

Ptax 340 Fill Out Sign Online DocHub

https://tax.illinois.gov/programs/rebates.html

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income tax rebate You must file Form IL 1040 including Schedule IL E EIC Illinois Exemption and Earned Income Credit to report any eligible dependents on or before October 17 2022

https://tax.illinois.gov/programs/rebates/rebates-filing-guide.html

Web Situation 2 If you want to request only your property tax rebate or you filed your 2021 IL 1040 but did not include Schedule ICR and want to request your property tax rebate you will need to complete and submit Form IL 1040 PTR Complete Steps 1 and 2 Note If you were not required to file a 2021 federal Form 1040 or 1040 SR enter zero on

Web Only the property tax rebate You must complete and submit Form IL 1040 PTR Property Tax Rebate Form on or before October 17 2022 Only the individual income tax rebate You must file Form IL 1040 including Schedule IL E EIC Illinois Exemption and Earned Income Credit to report any eligible dependents on or before October 17 2022

Web Situation 2 If you want to request only your property tax rebate or you filed your 2021 IL 1040 but did not include Schedule ICR and want to request your property tax rebate you will need to complete and submit Form IL 1040 PTR Complete Steps 1 and 2 Note If you were not required to file a 2021 federal Form 1040 or 1040 SR enter zero on

Il 941 Fillable Form Printable Forms Free Online

Illinois Unemployment 941x Fill Out Sign Online DocHub

Monday Is Deadline To Submit Additional Paperwork For Illinois Tax

Ptax 340 Fill Out Sign Online DocHub

Up To 700 For IL Residents How To Get Your Tax Rebate Check 100 7

Illinois Dept Of Revenue Forms Fill Out And Sign Printable PDF

Illinois Dept Of Revenue Forms Fill Out And Sign Printable PDF

The Latest Stimulus Checks Illinois 2022 Tax Rebates