In today's world of consumerism everyone enjoys a good deal. One method of gaining significant savings on your purchases is through Pa Tax Rebate Form 2023s. Pa Tax Rebate Form 2023s are a strategy for marketing that retailers and manufacturers use to offer consumers a partial reimbursement on their purchases following the time they've done so. In this article, we'll look into the world of Pa Tax Rebate Form 2023s, examining the nature of them and how they function, and ways to maximize your savings via these cost-effective incentives.

Get Latest Pa Tax Rebate Form 2023 Below

Pa Tax Rebate Form 2023

Pa Tax Rebate Form 2023 - Pa Tax Rebate Form 2023, Pa Tax Rebate Status

Harrisburg PA The deadline for older adults and Pennsylvanians with disabilities to apply for rebates on rent and property taxes paid in 2022 has been extended from June 30 to December 31 2023 Acting Secretary

The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults have received more than 7 6 billion in property tax and rent

A Pa Tax Rebate Form 2023 or Pa Tax Rebate Form 2023, in its most basic description, is a refund to a purchaser who has purchased a particular product or service. It's a highly effective tool that companies use to attract customers, boost sales, as well as promote particular products.

Types of Pa Tax Rebate Form 2023

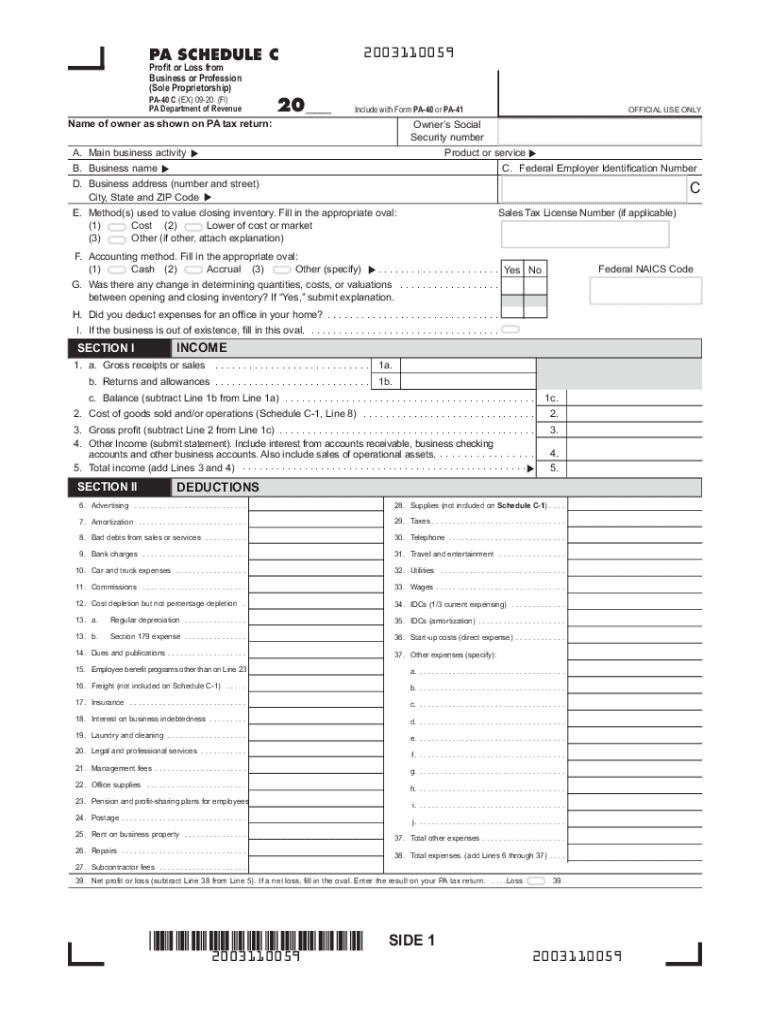

2020 2023 Form PA PA 40 C Fill Online Printable Fillable Blank

2020 2023 Form PA PA 40 C Fill Online Printable Fillable Blank

Rebates will be distributed beginning July 1 as required by law The best way to check the status of your rebate is by visiting Where s My PA Property Tax Rent Rebate As a reminder paper application forms are typically loaded into the Department of Revenue s processing system in late April

Reminder Deadline for Property Tax Rent Rebate Program is December 31 November 30 2023 Harrisburg PA Older adults and people with disabilities have until Sunday December 31 2023 to apply for rebates on property taxes and rent paid

Cash Pa Tax Rebate Form 2023

Cash Pa Tax Rebate Form 2023 are by far the easiest type of Pa Tax Rebate Form 2023. Customers receive a certain sum of money back when purchasing a item. They are typically used to purchase products that are expensive, such as electronics or appliances.

Mail-In Pa Tax Rebate Form 2023

Customers who want to receive mail-in Pa Tax Rebate Form 2023 must submit documents of purchase to claim their reimbursement. They are a bit more involved, however they can yield significant savings.

Instant Pa Tax Rebate Form 2023

Instant Pa Tax Rebate Form 2023 are made at the point of sale, which reduces the price instantly. Customers don't need to wait long for savings when they purchase this type of Pa Tax Rebate Form 2023.

How Pa Tax Rebate Form 2023 Work

2021 Pa Fill Out Sign Online DocHub

2021 Pa Fill Out Sign Online DocHub

Yes In July state lawmakers approved a one time increase to this year s rebates so recipients will get their usual amount plus 70 So if you normally get 650 this year you ll get that plus 455 or a total of 1 105 How do I get the bonus If you ve already filed your application for this year you don t have to do anything else

The Pa Tax Rebate Form 2023 Process

The process typically comprises a few simple steps:

-

Purchase the product: First then, you buy the item exactly as you would normally.

-

Fill out this Pa Tax Rebate Form 2023 forms: The Pa Tax Rebate Form 2023 form will have to provide some information including your address, name, and information about the purchase in order to be eligible for a Pa Tax Rebate Form 2023.

-

Submit the Pa Tax Rebate Form 2023 If you want to submit the Pa Tax Rebate Form 2023, based on the kind of Pa Tax Rebate Form 2023, you may need to submit a form by mail or upload it online.

-

Wait until the company approves: The company will scrutinize your submission to confirm that it complies with the requirements of the Pa Tax Rebate Form 2023.

-

Pay your Pa Tax Rebate Form 2023 After you've been approved, the amount you receive will be either by check, prepaid card or through a different procedure specified by the deal.

Pros and Cons of Pa Tax Rebate Form 2023

Advantages

-

Cost Savings Pa Tax Rebate Form 2023 can substantially reduce the cost for an item.

-

Promotional Offers They encourage customers to test new products or brands.

-

Improve Sales The benefits of a Pa Tax Rebate Form 2023 can improve the sales of a company as well as its market share.

Disadvantages

-

Complexity mail-in Pa Tax Rebate Form 2023 in particular is a time-consuming process and lengthy.

-

Extension Dates Many Pa Tax Rebate Form 2023 have strict time limits for submission.

-

Risk of Non-Payment Customers may have their Pa Tax Rebate Form 2023 delayed if they don't adhere to the requirements precisely.

Download Pa Tax Rebate Form 2023

Download Pa Tax Rebate Form 2023

FAQs

1. Are Pa Tax Rebate Form 2023 the same as discounts? No, Pa Tax Rebate Form 2023 offer an amount of money that is refunded after the purchase, whereas discounts decrease their price at time of sale.

2. Are there multiple Pa Tax Rebate Form 2023 I can get on the same item This is dependent on terms and conditions of Pa Tax Rebate Form 2023 is offered as well as the merchandise's suitability. Certain companies may allow this, whereas others will not.

3. What is the time frame to get a Pa Tax Rebate Form 2023 What is the timeframe? is different, but it could last from a few weeks until a few months for you to receive your Pa Tax Rebate Form 2023.

4. Do I need to pay taxes in relation to Pa Tax Rebate Form 2023 values? the majority of circumstances, Pa Tax Rebate Form 2023 amounts are not considered to be taxable income.

5. Should I be able to trust Pa Tax Rebate Form 2023 offers from brands that aren't well-known It is essential to investigate and verify that the organization offering the Pa Tax Rebate Form 2023 is reputable before making an purchase.

Psers Pa Gov Fill Out Sign Online DocHub

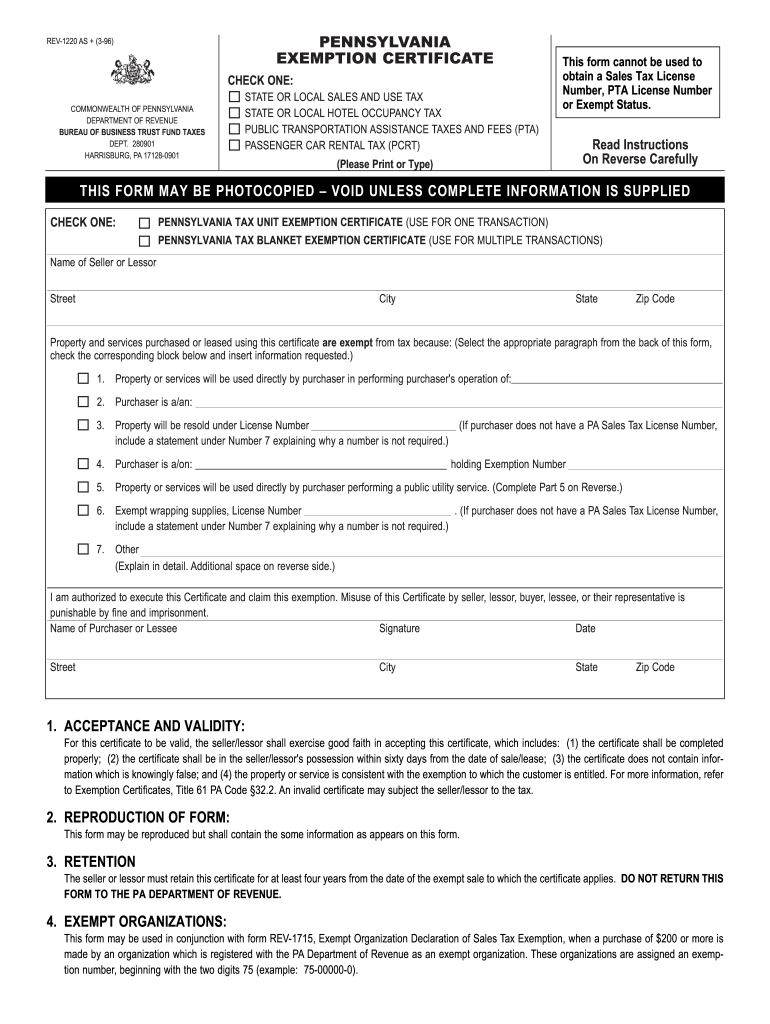

How To Get A Pa Tax Exempt Number 2012 Form Fill Out Sign Online

Check more sample of Pa Tax Rebate Form 2023 below

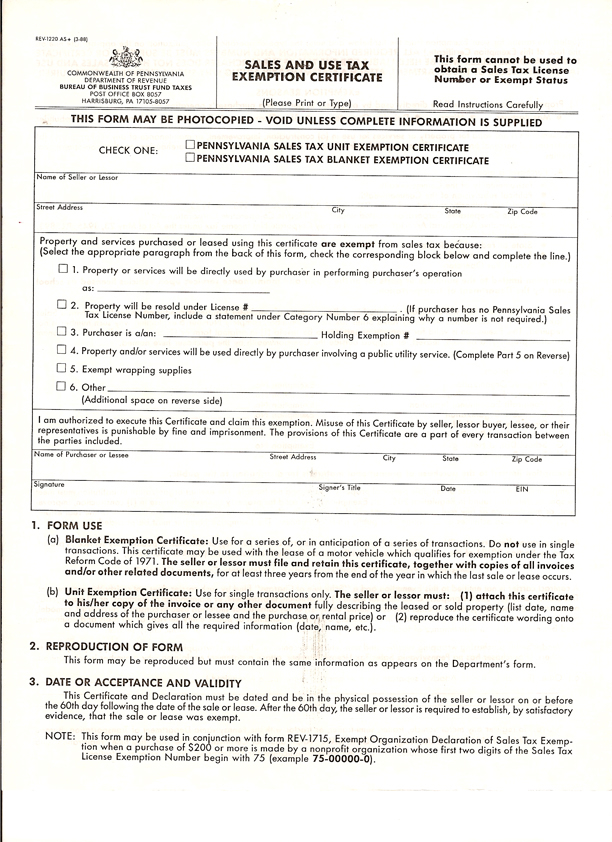

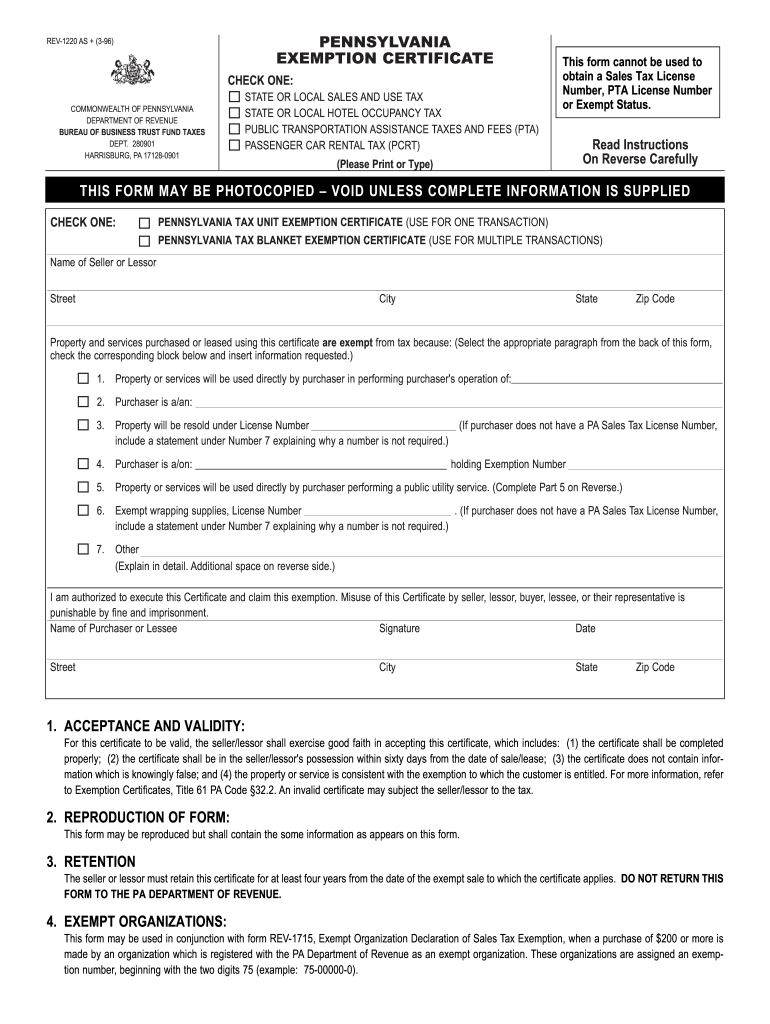

Pa Sales Tax Exemption Form 2023 ExemptForm

Property Tax Rebate Pennsylvania LatestRebate

Rev 1220 Fill Out Sign Online DocHub

Pa Tax Exempt Form 2023 ExemptForm

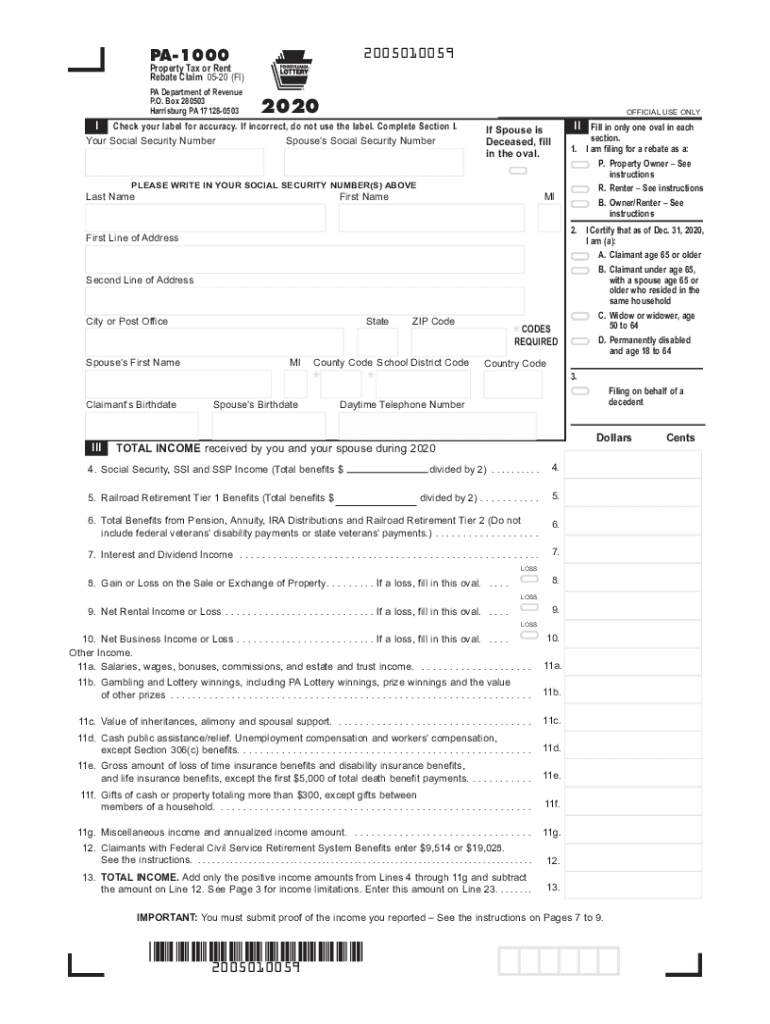

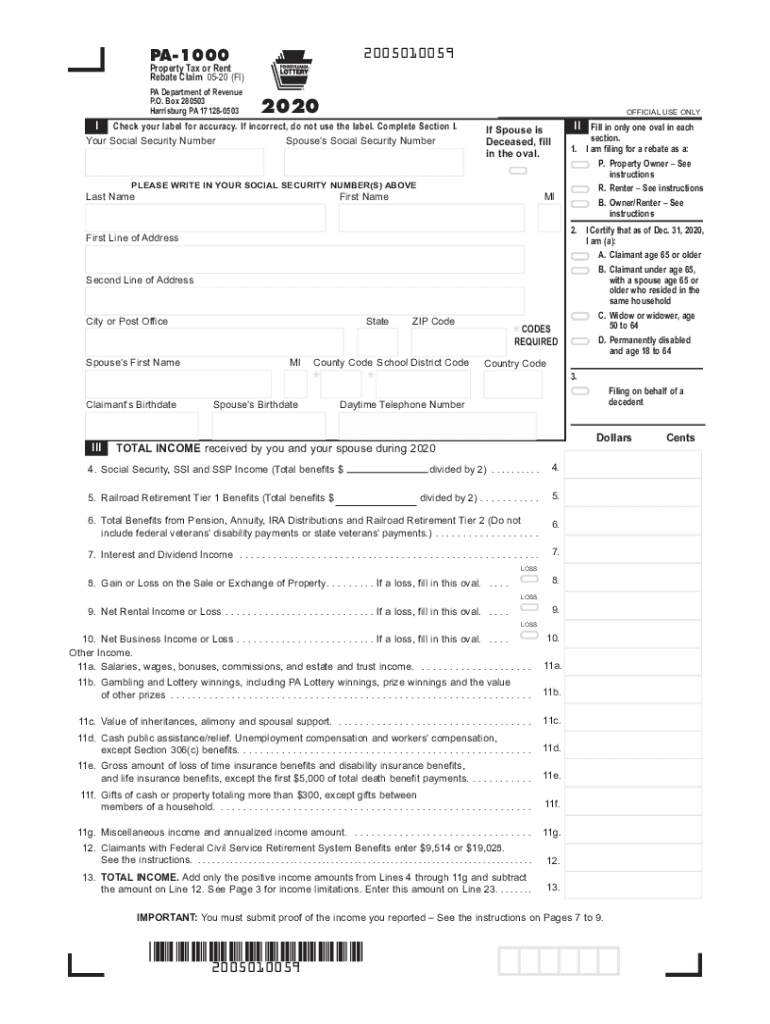

Pa 1000 2019 Fill Out Sign Online DocHub

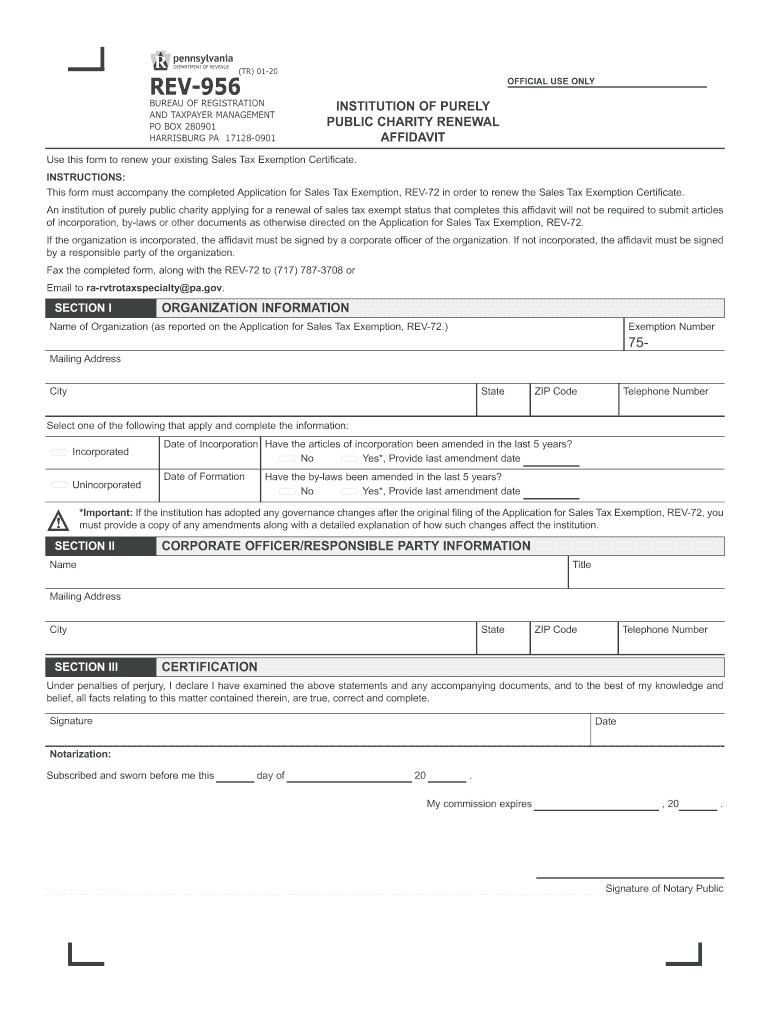

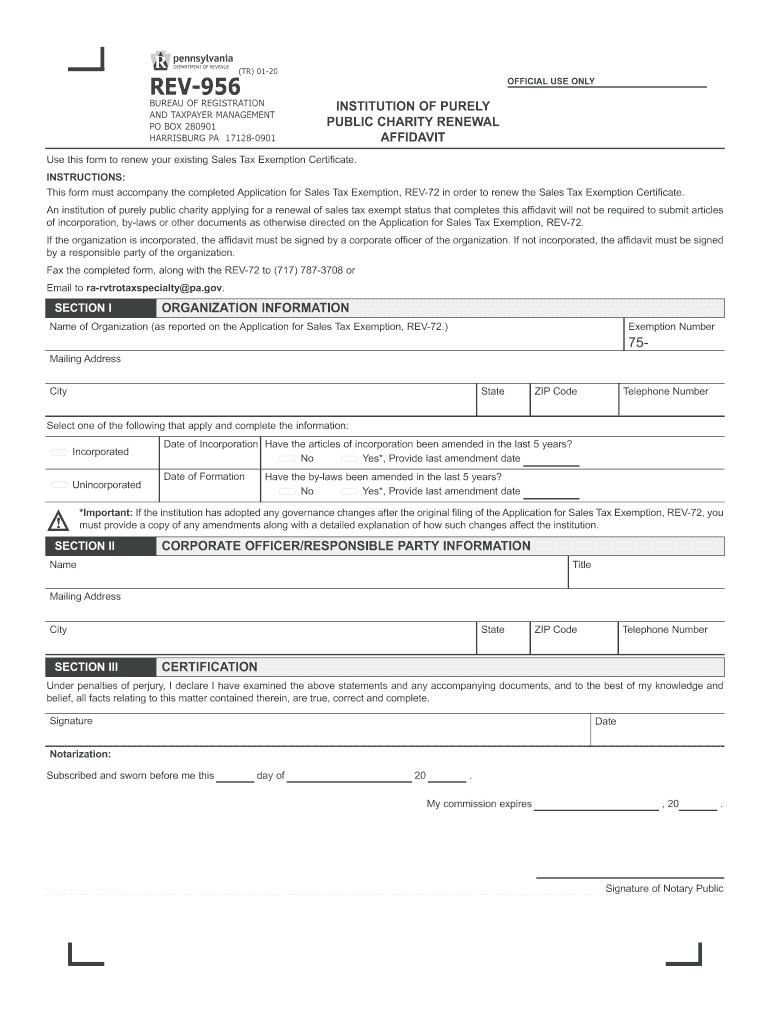

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

https://www.revenue.pa.gov...

The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults have received more than 7 6 billion in property tax and rent

https://www.revenue.pa.gov/IncentivesCredits...

Starting in mid January 2024 the Department of Revenue will open the filing period for eligible applicants to submit applications for rebates on property taxes and rent paid in 2023 Here are the changes that will take effect at that time First the maximum standard rebate is increasing from 650 to 1 000

The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults have received more than 7 6 billion in property tax and rent

Starting in mid January 2024 the Department of Revenue will open the filing period for eligible applicants to submit applications for rebates on property taxes and rent paid in 2023 Here are the changes that will take effect at that time First the maximum standard rebate is increasing from 650 to 1 000

Pa Tax Exempt Form 2023 ExemptForm

Property Tax Rebate Pennsylvania LatestRebate

Pa 1000 2019 Fill Out Sign Online DocHub

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

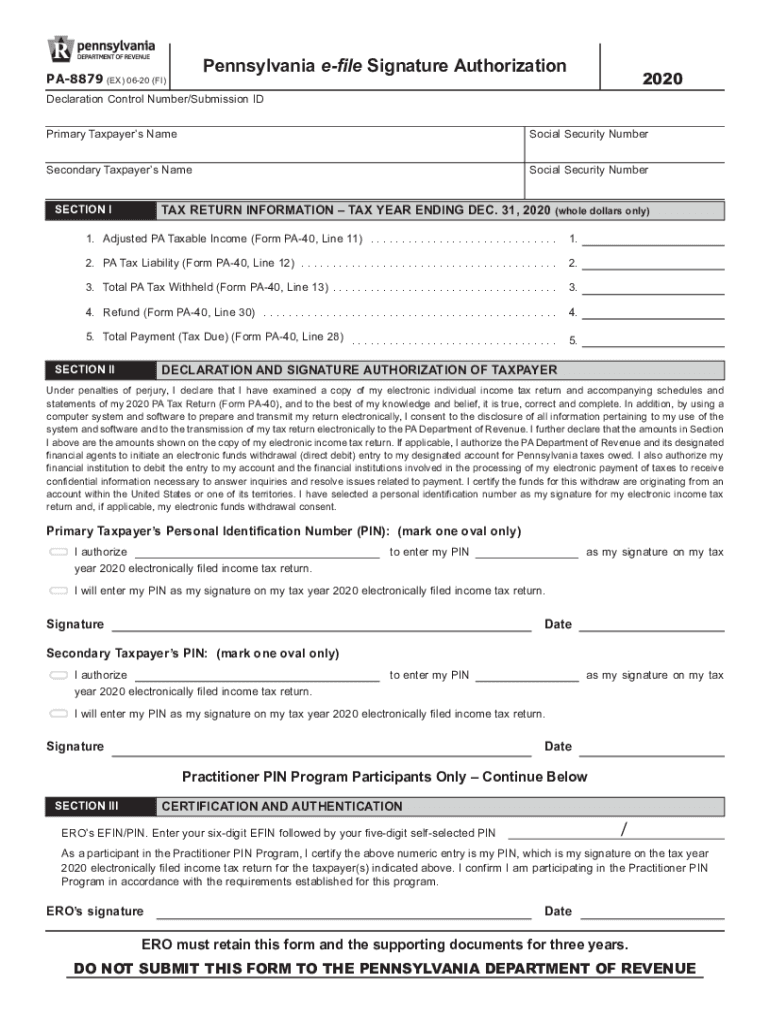

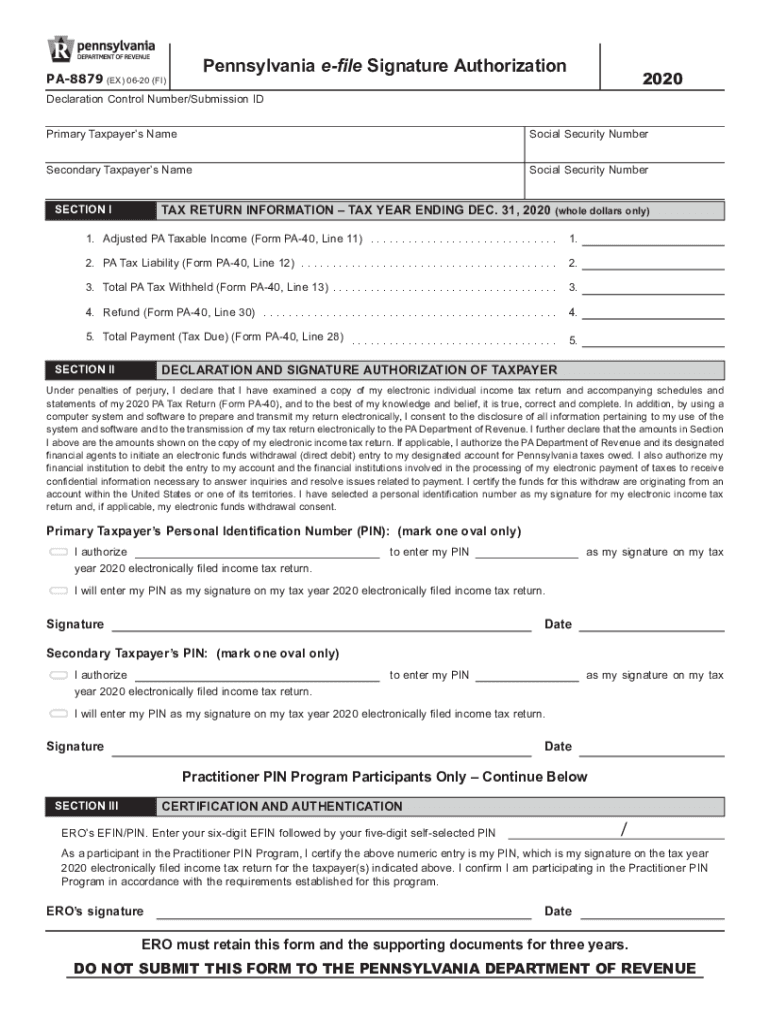

Pa Form 8879 Fill Out Sign Online DocHub

Pa Form 8879 Fill Out Sign Online DocHub

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications