In today's consumer-driven world everyone appreciates a great deal. One way to score significant savings on your purchases is by using R40 Tax Rebate Forms. R40 Tax Rebate Forms are a marketing strategy that retailers and manufacturers use to provide customers with a portion of a refund for their purchases after they have done so. In this article, we'll take a look at the world that is R40 Tax Rebate Forms, looking at the nature of them, how they work, and ways you can increase your savings by taking advantage of these cost-effective incentives.

Get Latest R40 Tax Rebate Form Below

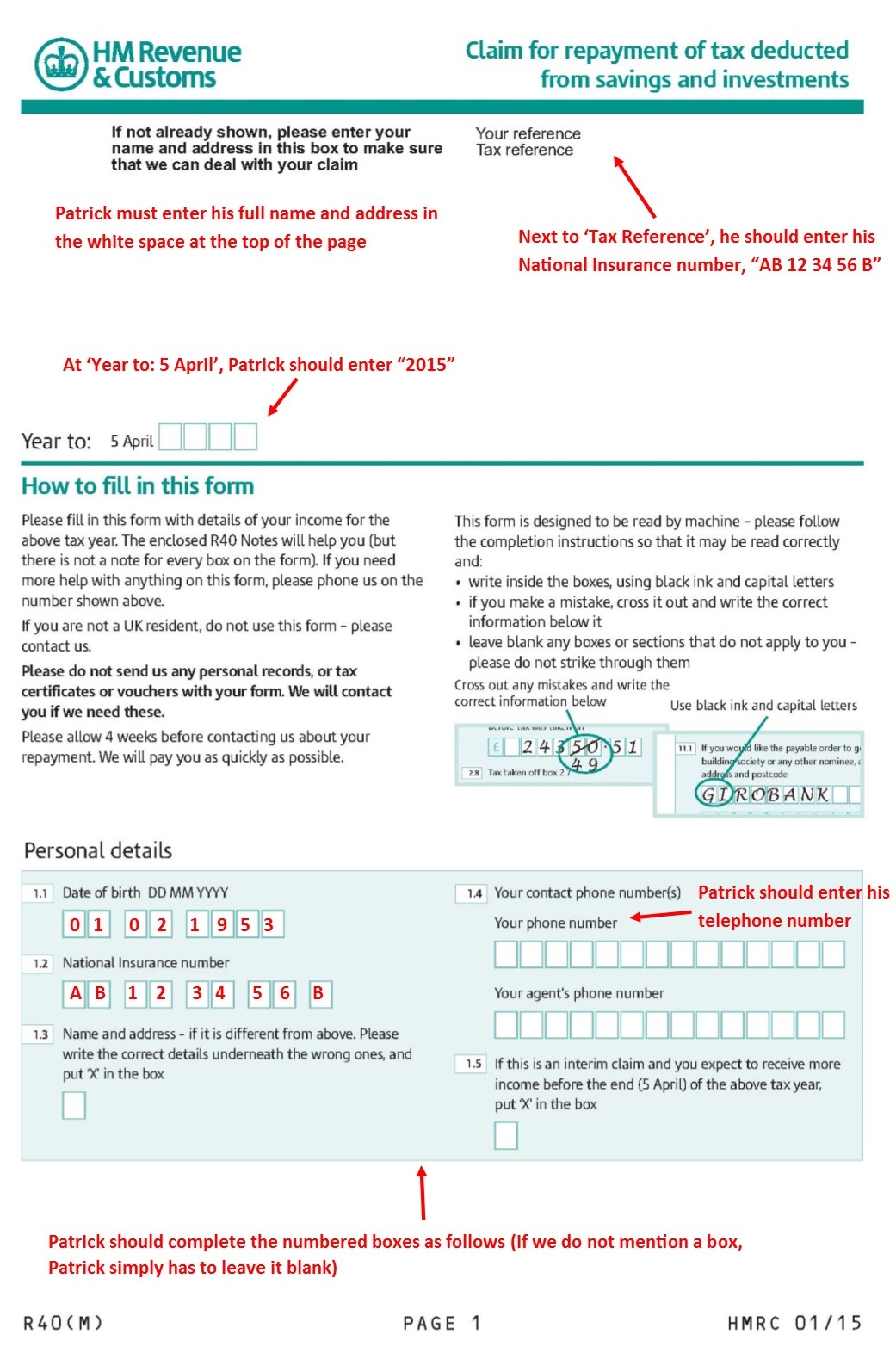

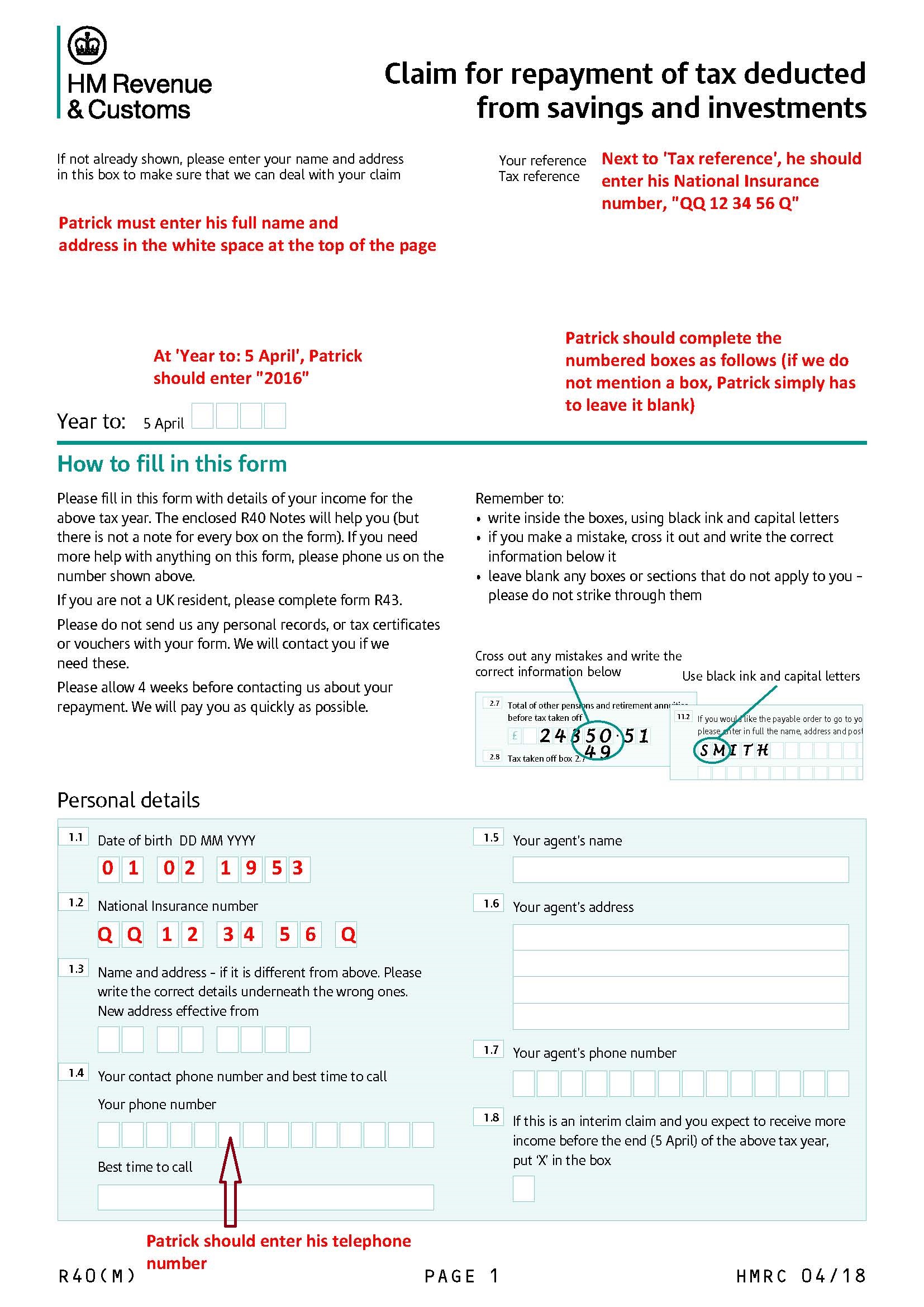

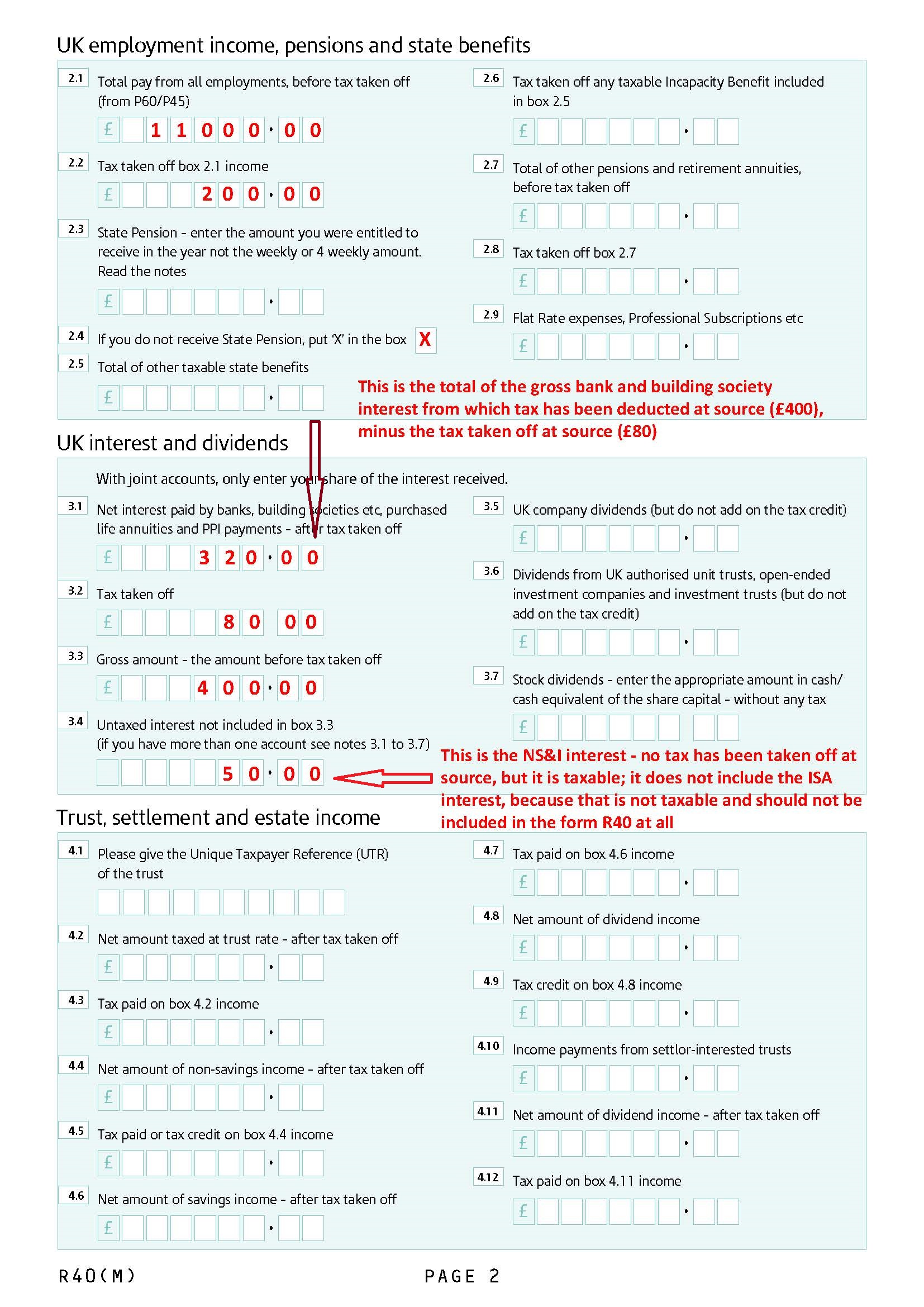

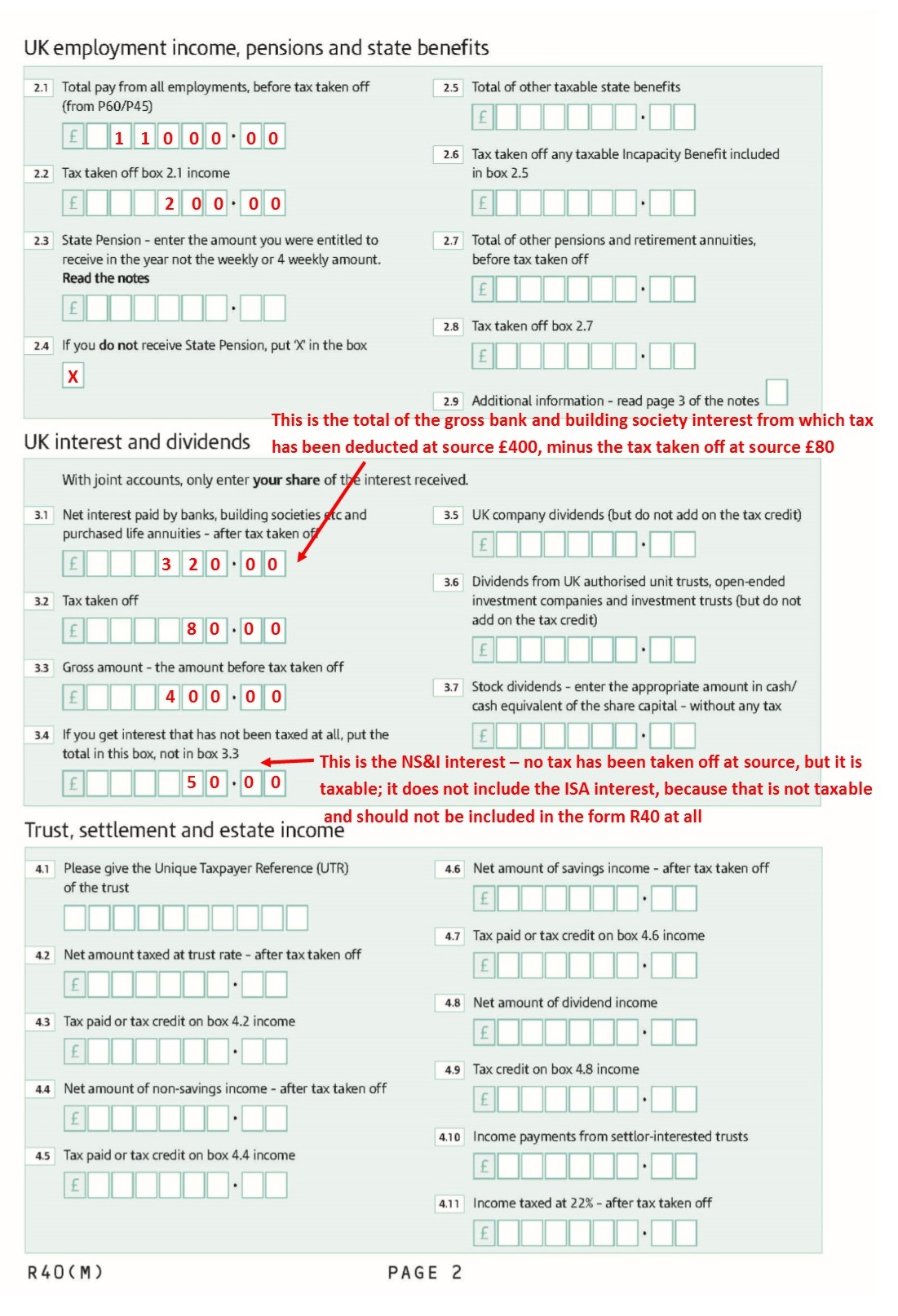

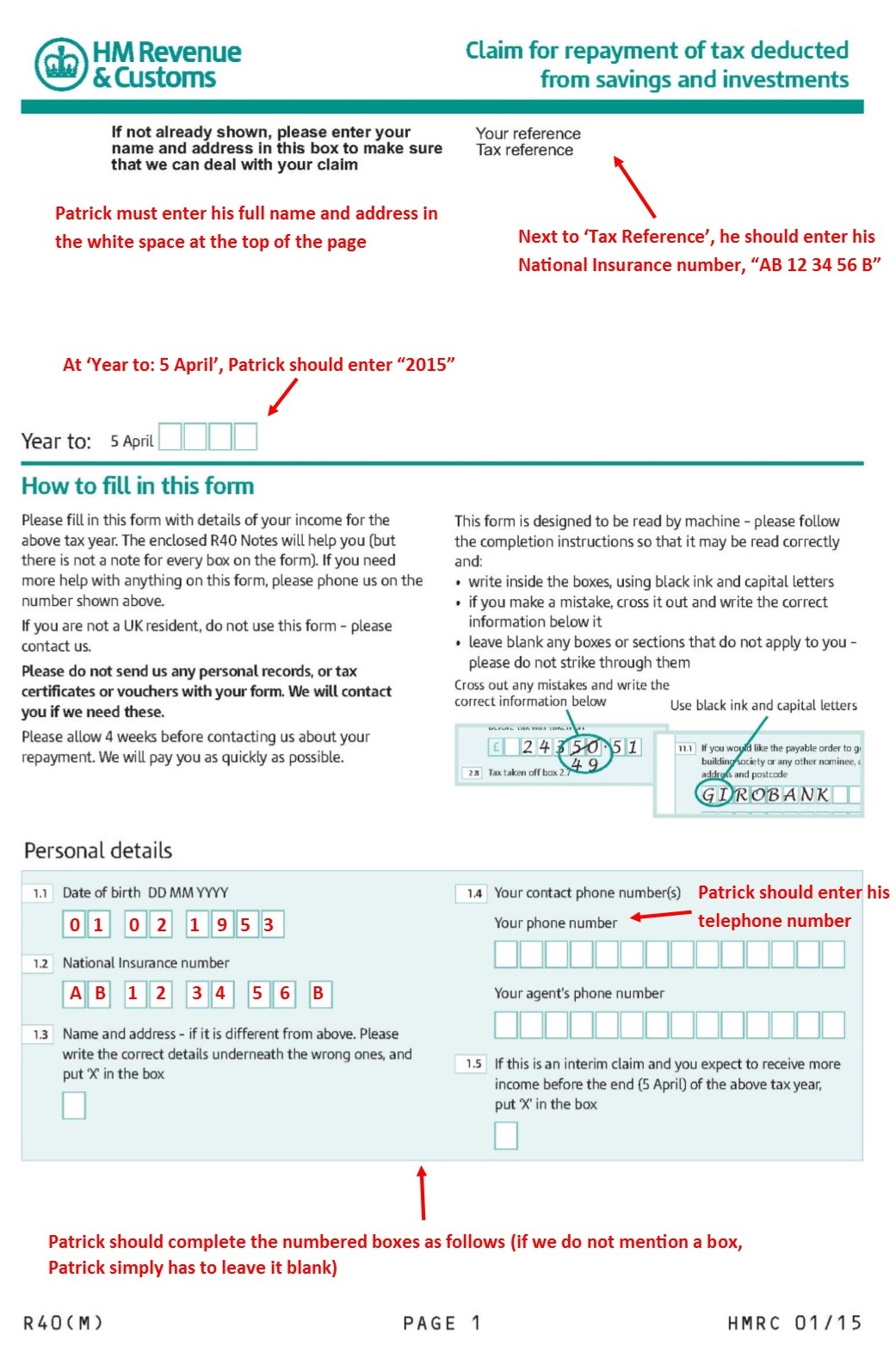

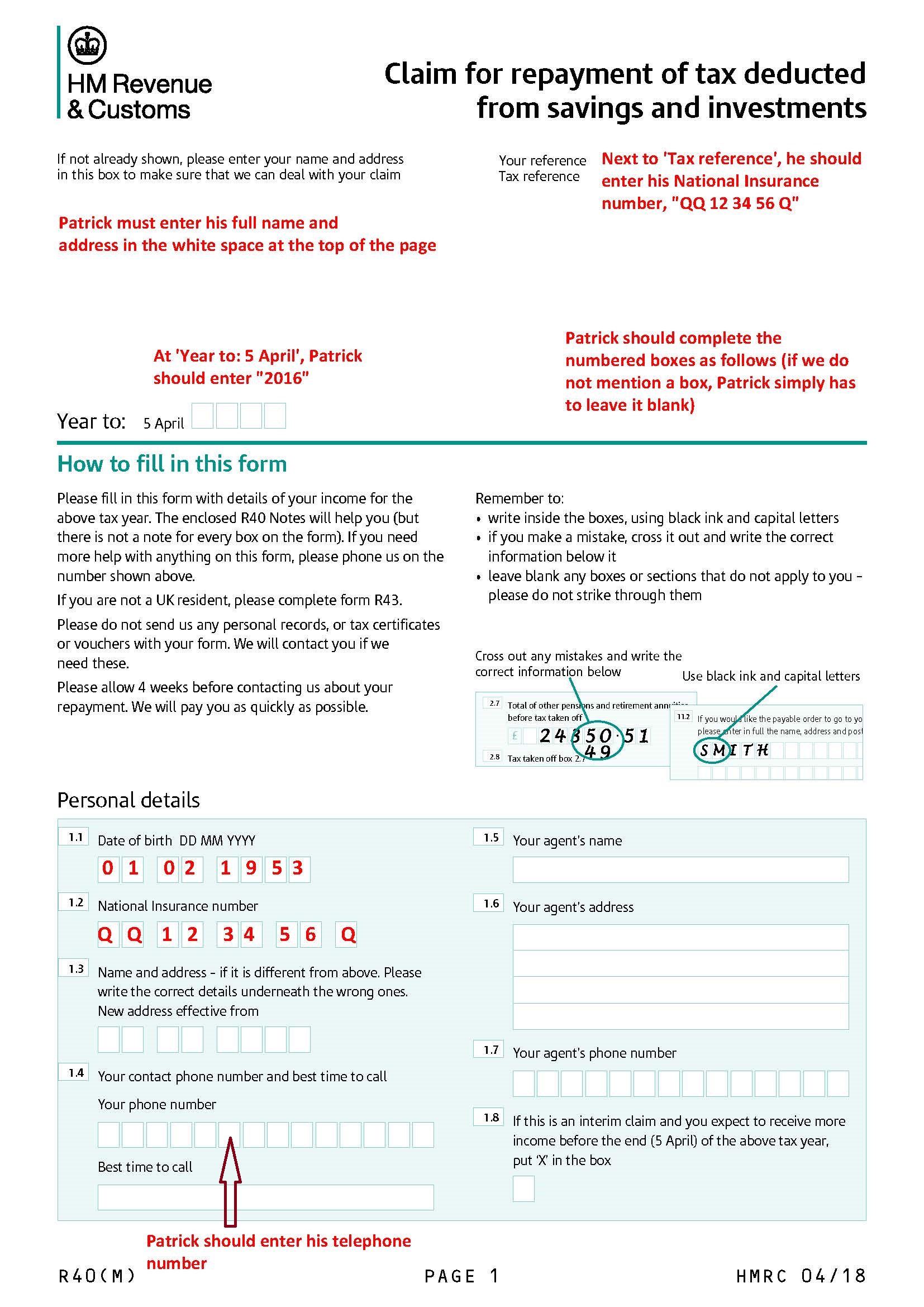

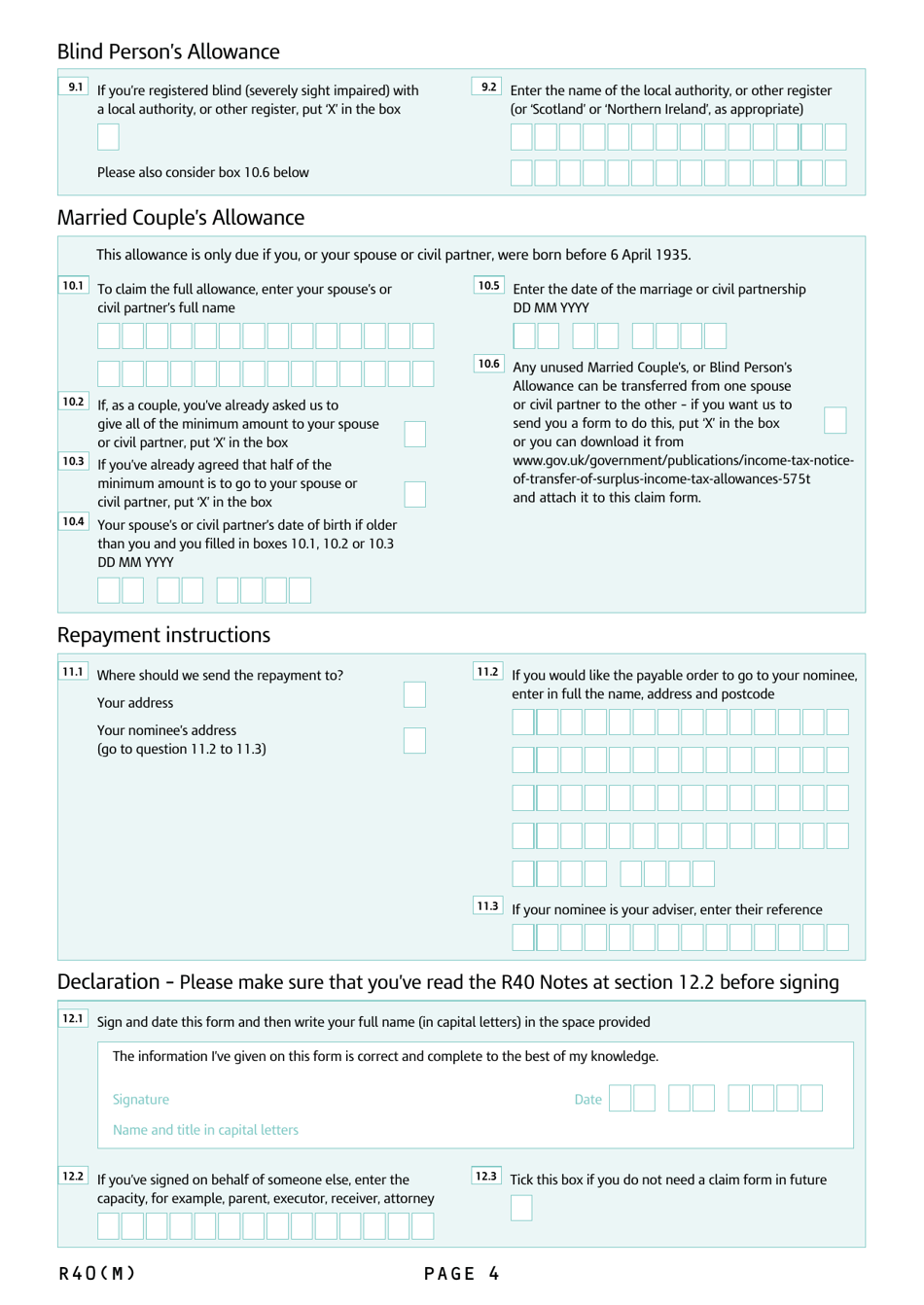

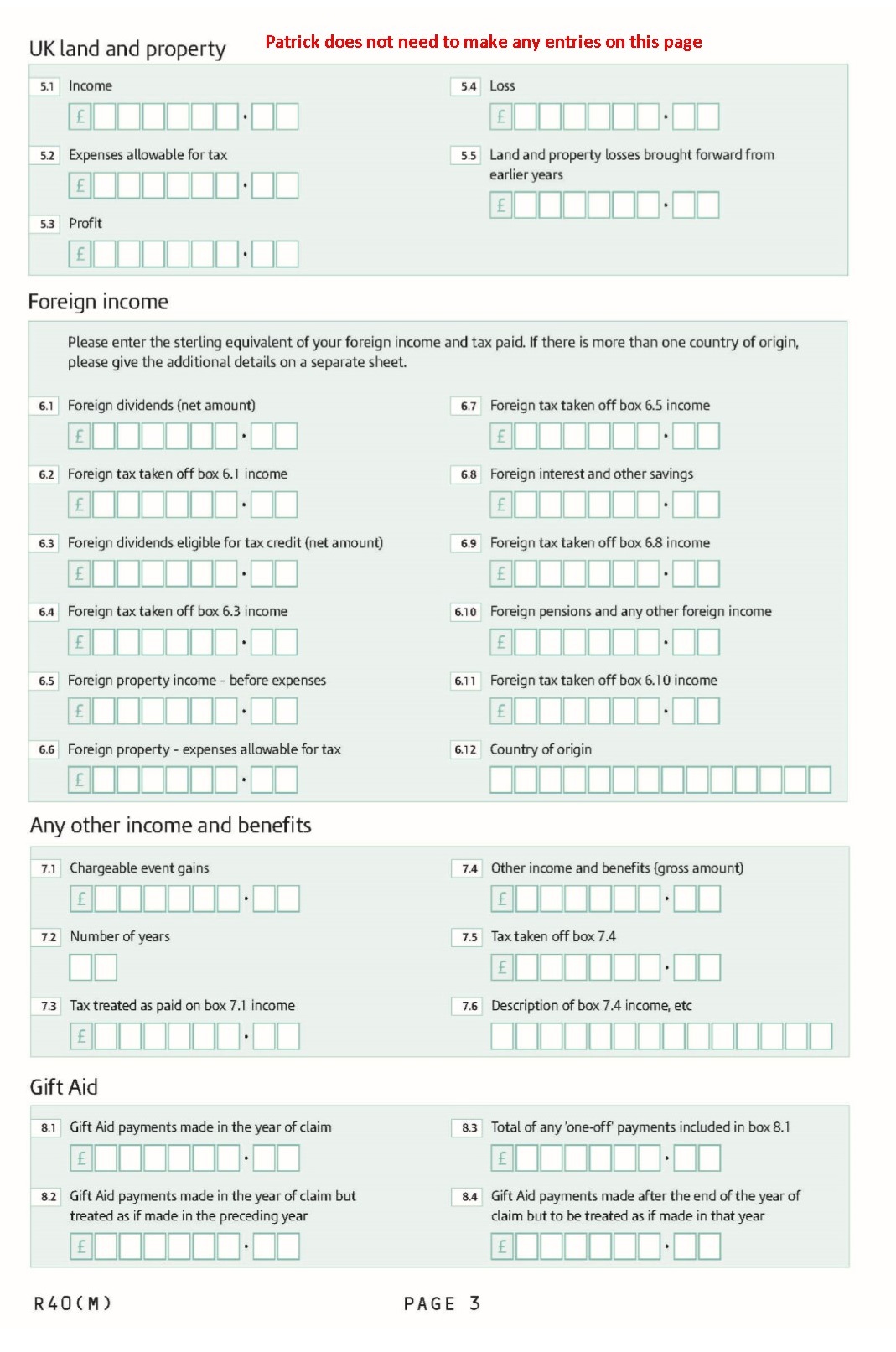

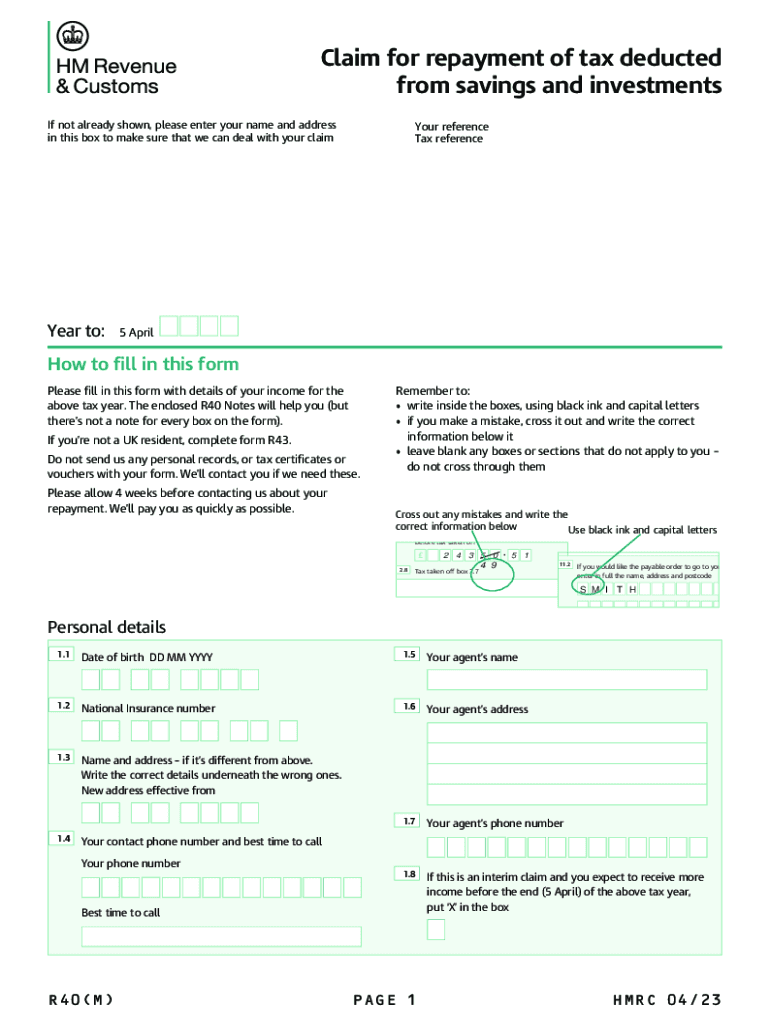

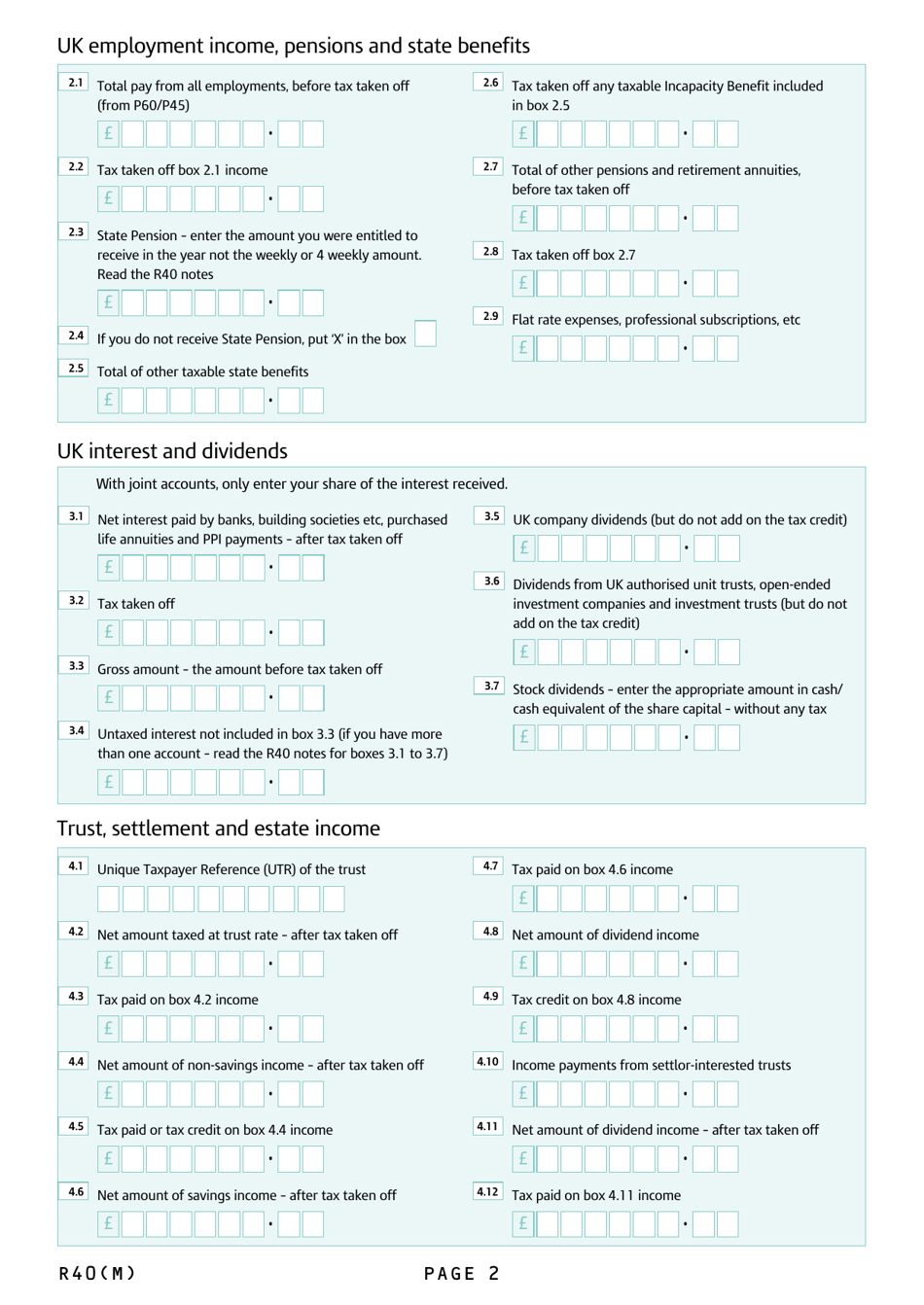

R40 Tax Rebate Form

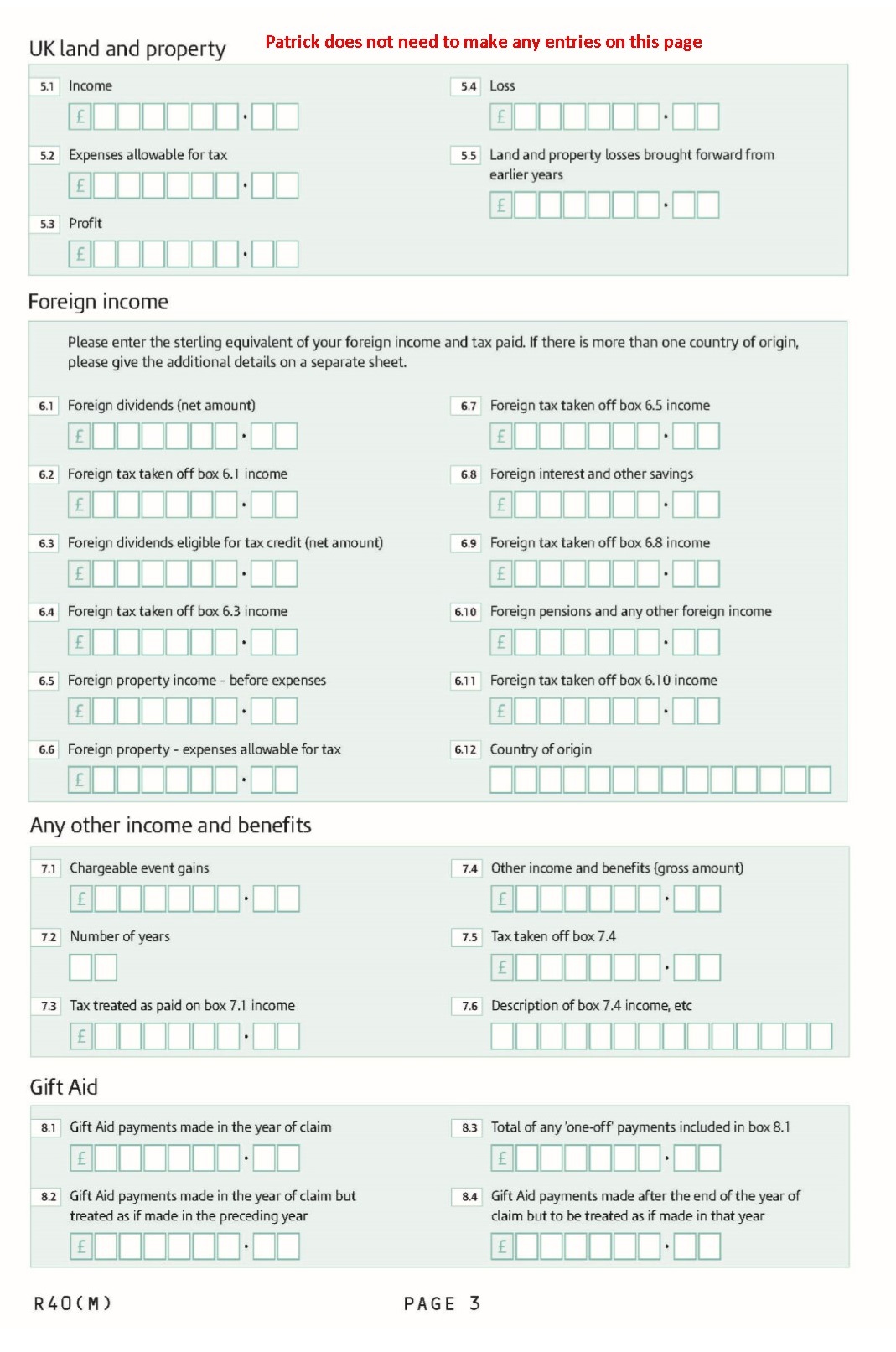

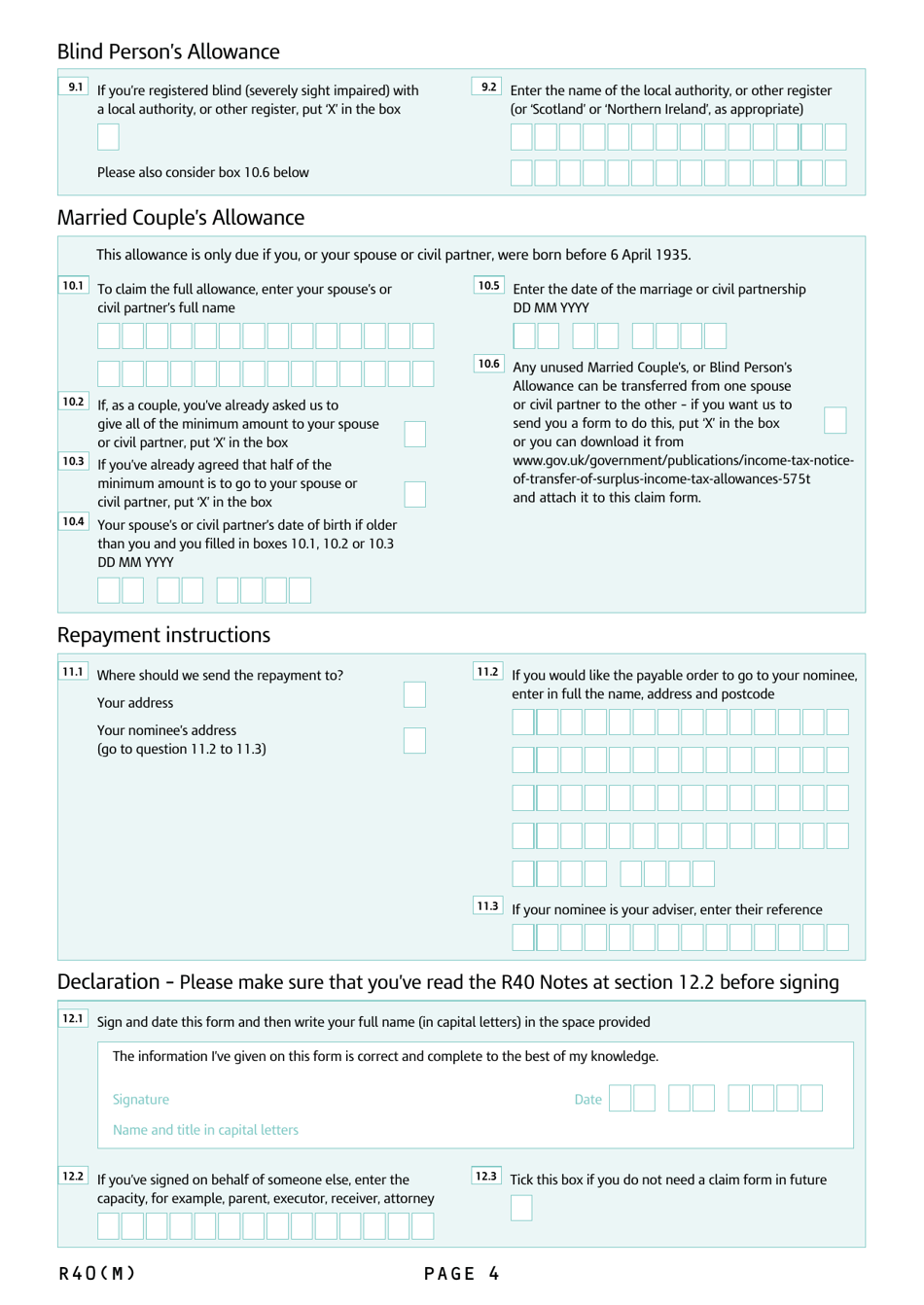

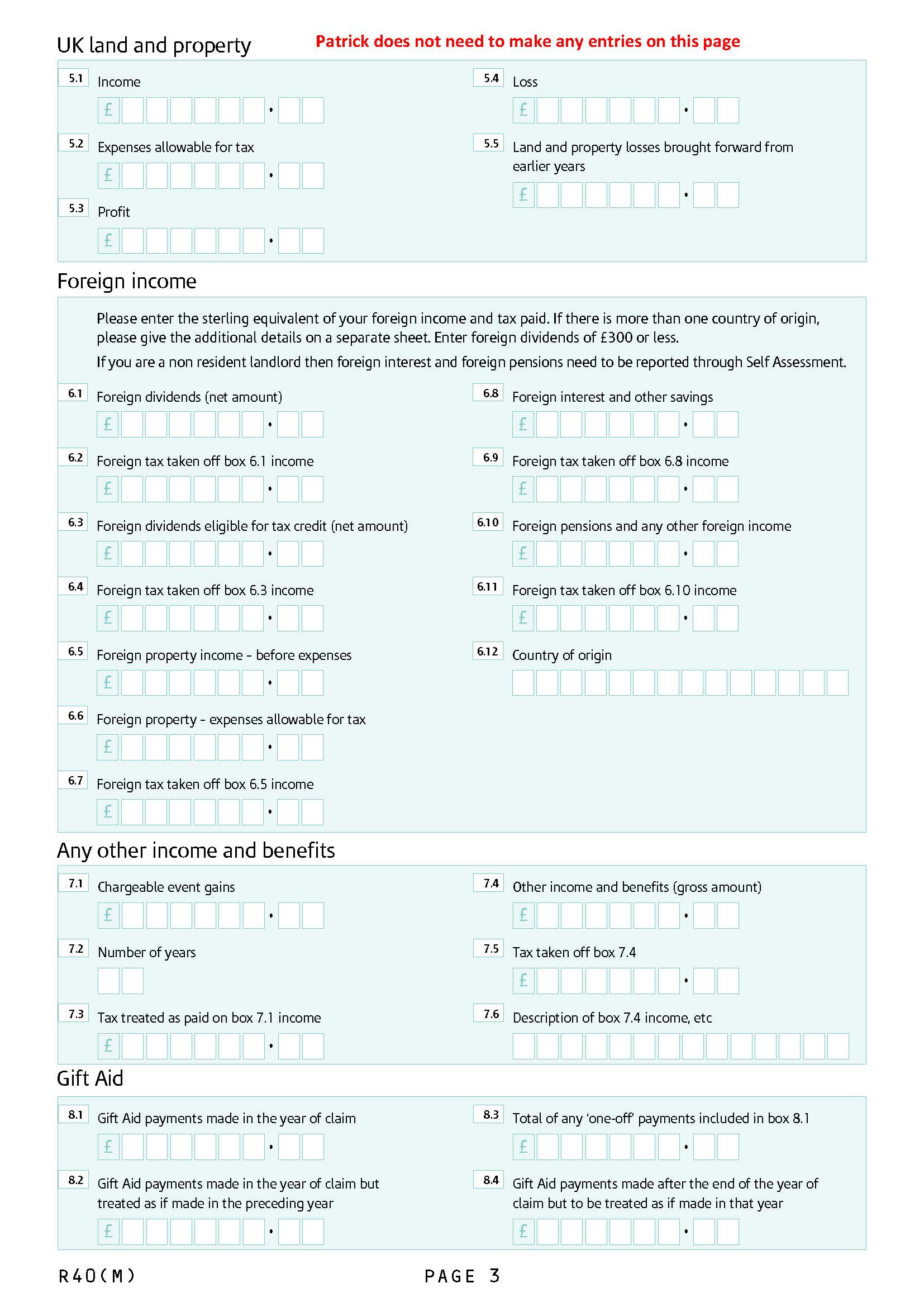

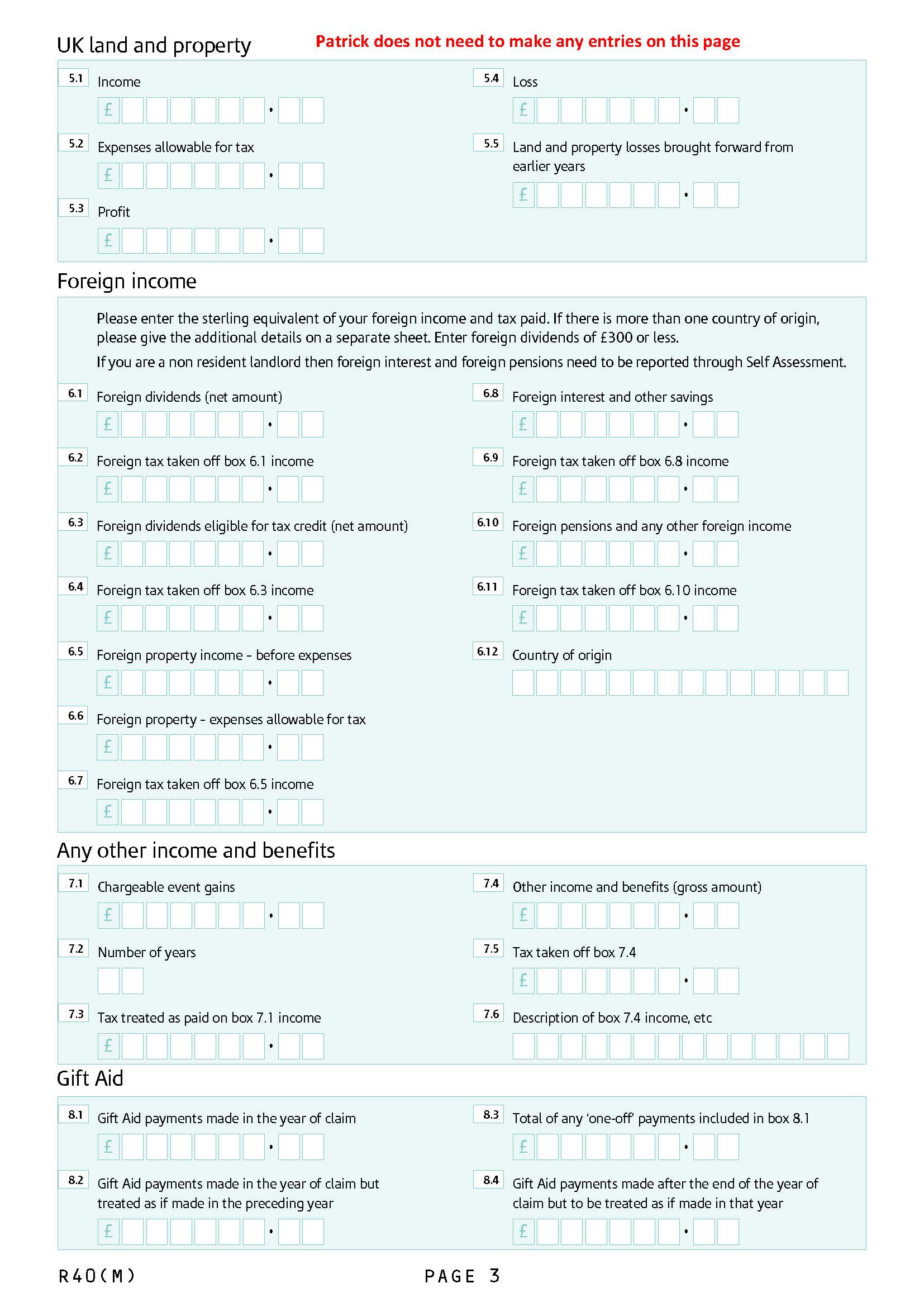

R40 Tax Rebate Form -

Web 19 nov 2014 nbsp 0183 32 Find Income Tax forms for tax refunds allowances and reliefs savings and investments and leaving the UK

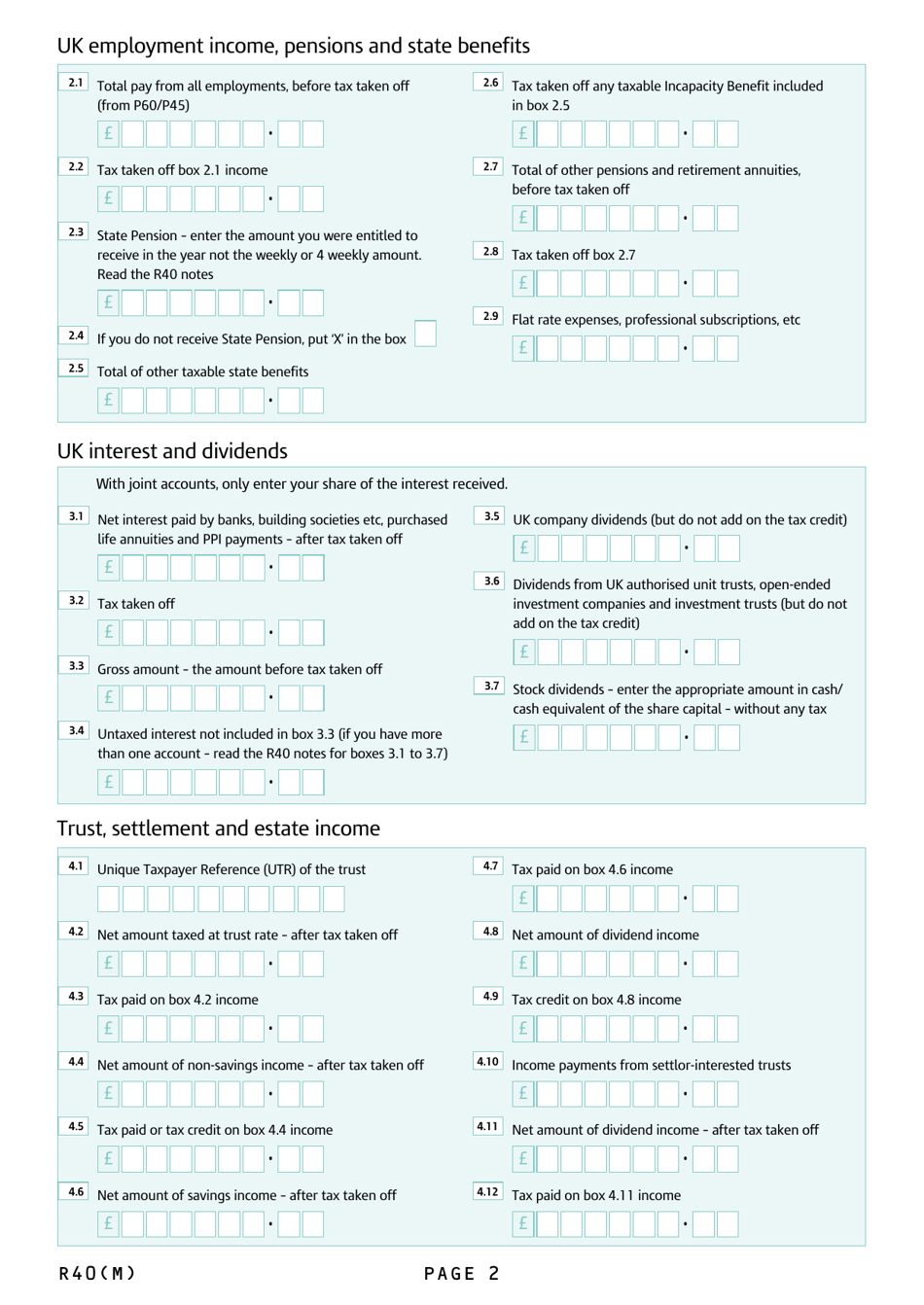

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

A R40 Tax Rebate Form as it is understood in its simplest type, is a cash refund provided to customers after they have purchased a product or service. It's an effective way used by companies to attract customers, increase sales, and even promote certain products.

Types of R40 Tax Rebate Form

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Web Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there is not a note for every box on the form If you need more

Web 3 f 233 vr 2023 nbsp 0183 32 The HMRC Tax Refund Form R40 PPI is a tool for individuals in the UK who believe that they have been taxed on their personal pension income at the incorrect rate By completing the form and submitting it to

Cash R40 Tax Rebate Form

Cash R40 Tax Rebate Form are the most basic kind of R40 Tax Rebate Form. Customers get a set amount of money back upon purchasing a product. These are usually used for large-ticket items such as electronics and appliances.

Mail-In R40 Tax Rebate Form

Mail-in R40 Tax Rebate Form require consumers to submit their proof of purchase before receiving their cash back. They're somewhat more involved, but offer substantial savings.

Instant R40 Tax Rebate Form

Instant R40 Tax Rebate Form are applied at place of purchase, reducing the price instantly. Customers don't need to wait around for savings by using this method.

How R40 Tax Rebate Form Work

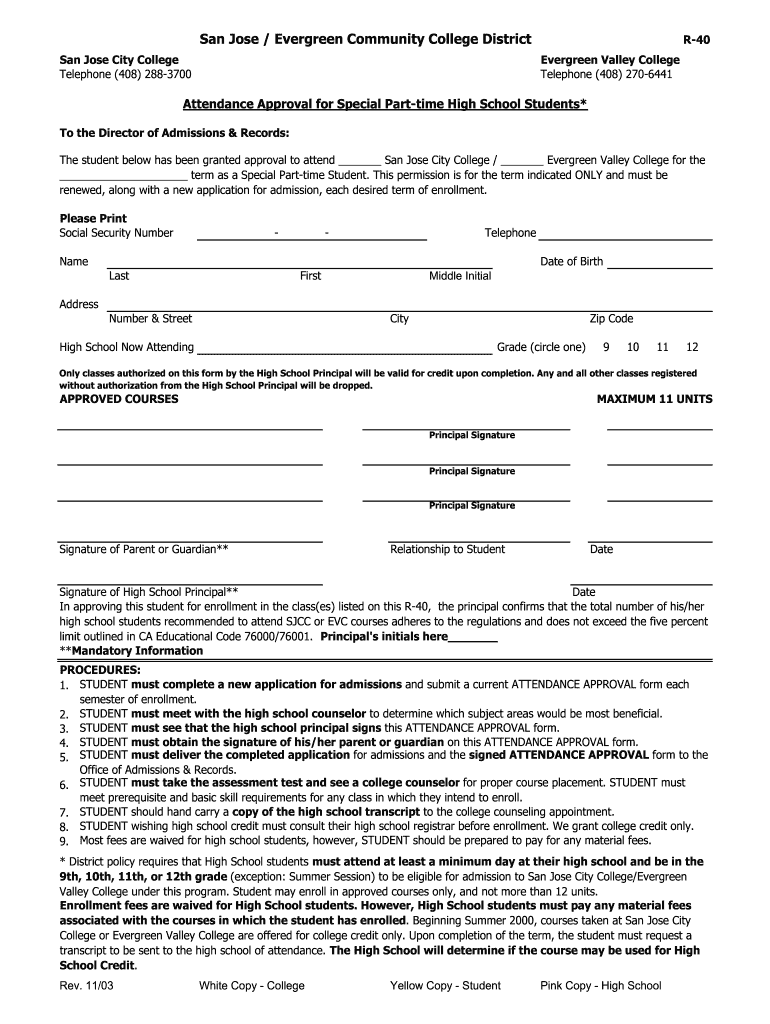

2015 Form UK R40 Fill Online Printable Fillable Blank PdfFiller

2015 Form UK R40 Fill Online Printable Fillable Blank PdfFiller

Web These notes will help you complete the form R40 You need to complete a separate claim for each tax year The tax year starts on 6 April and finishes on the following 5 April If

The R40 Tax Rebate Form Process

The procedure typically consists of a few steps:

-

You purchase the item: First, you buy the product as you normally would.

-

Complete your R40 Tax Rebate Form application: In order to claim your R40 Tax Rebate Form, you'll have to fill in some information like your address, name, along with the purchase details, to receive your R40 Tax Rebate Form.

-

Send in the R40 Tax Rebate Form In accordance with the nature of R40 Tax Rebate Form you might need to submit a form by mail or upload it online.

-

Wait for approval: The company will look over your submission to ensure it meets the R40 Tax Rebate Form's terms and conditions.

-

Get your R40 Tax Rebate Form After approval, you'll receive your cash back through a check, or a prepaid card, or other method that is specified in the offer.

Pros and Cons of R40 Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically decrease the price for the product.

-

Promotional Deals These promotions encourage consumers to try new products and brands.

-

increase sales Reward programs can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity R40 Tax Rebate Form that are mail-in, particularly may be lengthy and demanding.

-

Time Limits for R40 Tax Rebate Form Most R40 Tax Rebate Form come with rigid deadlines to submit.

-

The risk of non-payment Certain customers could not receive their refunds if they don't follow the regulations exactly.

Download R40 Tax Rebate Form

FAQs

1. Are R40 Tax Rebate Form equivalent to discounts? Not necessarily, as R40 Tax Rebate Form are partial reimbursement after purchase, and discounts are a reduction of your purchase cost at moment of sale.

2. Can I use multiple R40 Tax Rebate Form on the same item It is contingent on the conditions that apply to the R40 Tax Rebate Form offers and the product's eligibility. Certain companies may allow it, while other companies won't.

3. What is the time frame to receive the R40 Tax Rebate Form? The amount of time will vary, but it may be from several weeks to few months to receive your R40 Tax Rebate Form.

4. Do I have to pay taxes with respect to R40 Tax Rebate Form quantities? the majority of cases, R40 Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust R40 Tax Rebate Form offers from lesser-known brands it is crucial to conduct research and verify that the organization which is providing the R40 Tax Rebate Form is credible prior to making any purchase.

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Check more sample of R40 Tax Rebate Form below

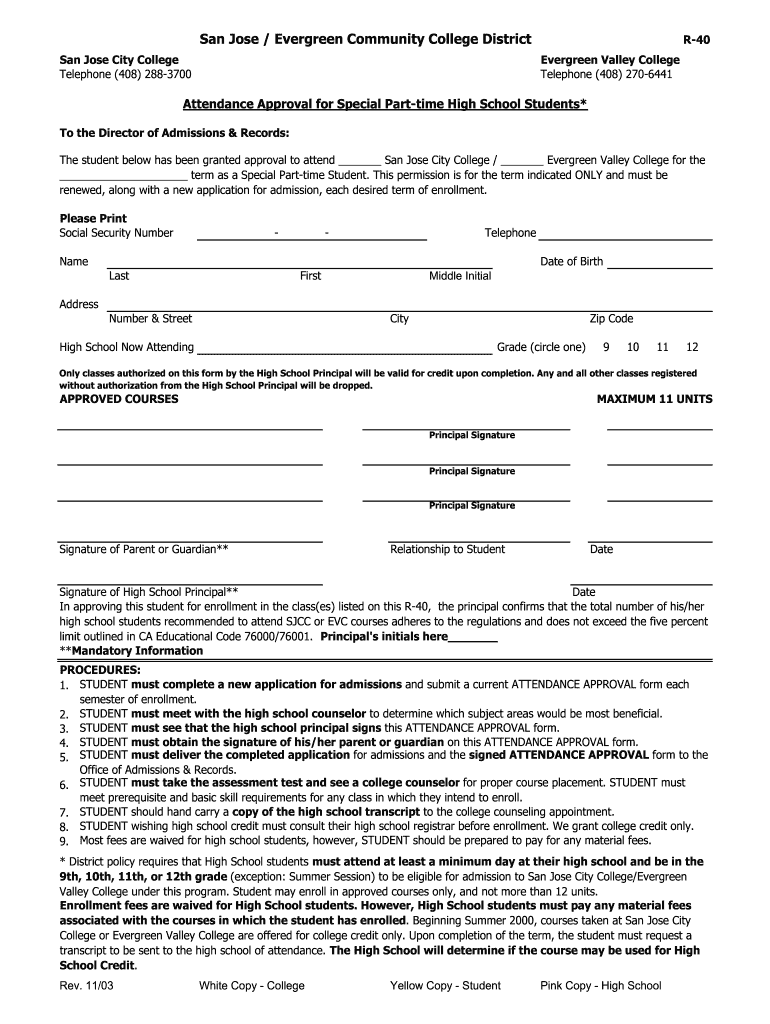

R40 M Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Form Fill Out Sign Online DocHub

https://assets.publishing.service.gov.uk/.../file/1172652/R40…

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

https://www.gov.uk/.../contact/repayments-where-to-send-claim-forms

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and a tax

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

Web Complete form R40 to claim a refund if you think you ve paid too much tax on interest from your savings in an earlier tax year Use form R43 to claim personal allowances and a tax

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Form Fill Out Sign Online DocHub

R40 Form Fill Out And Sign Printable PDF Template SignNow

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

What Is An R40 Form Goselfemployed co