In this modern-day world of consumers everyone appreciates a great deal. One of the ways to enjoy substantial savings on your purchases is through Pa Real Estate Tax Rebate Form Decedents. Pa Real Estate Tax Rebate Form Decedents are a marketing strategy that retailers and manufacturers use to offer customers a partial refund on their purchases after they've placed them. In this post, we'll dive into the world Pa Real Estate Tax Rebate Form Decedents. We'll discuss what they are about, how they work, and how to maximize your savings via these cost-effective incentives.

Get Latest Pa Real Estate Tax Rebate Form Decedent Below

Pa Real Estate Tax Rebate Form Decedent

Pa Real Estate Tax Rebate Form Decedent -

Web Please Print or Type Name of Decedent Date of Death Decedent s Social Security Number Name and Address of Person Filing for Refund Rebate NAME NUMBER

Web The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults

A Pa Real Estate Tax Rebate Form Decedent in its most basic form, is a partial return to the customer after they have purchased a product or service. It's a highly effective tool used by companies to attract customers, boost sales, and advertise specific products.

Types of Pa Real Estate Tax Rebate Form Decedent

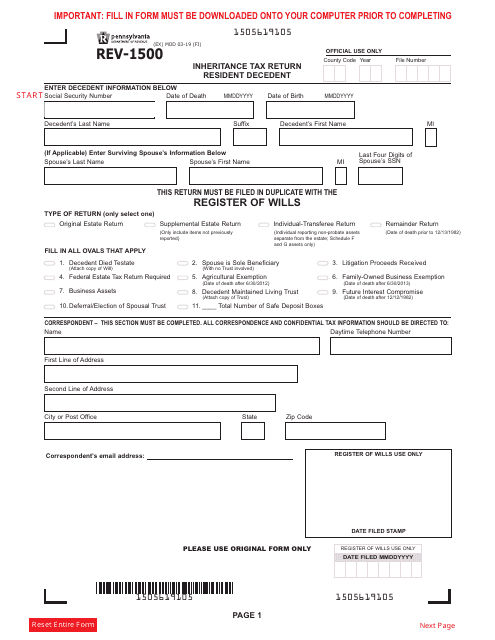

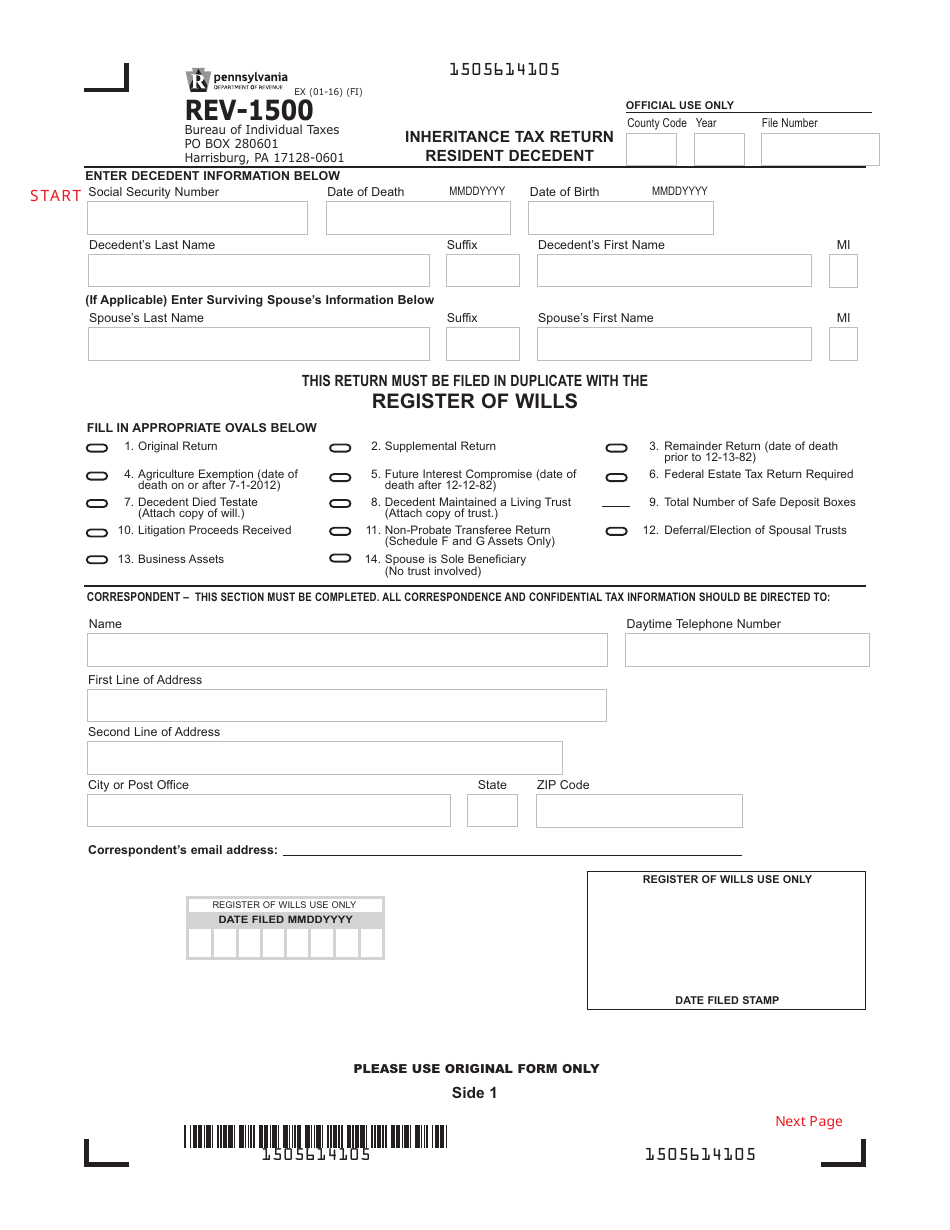

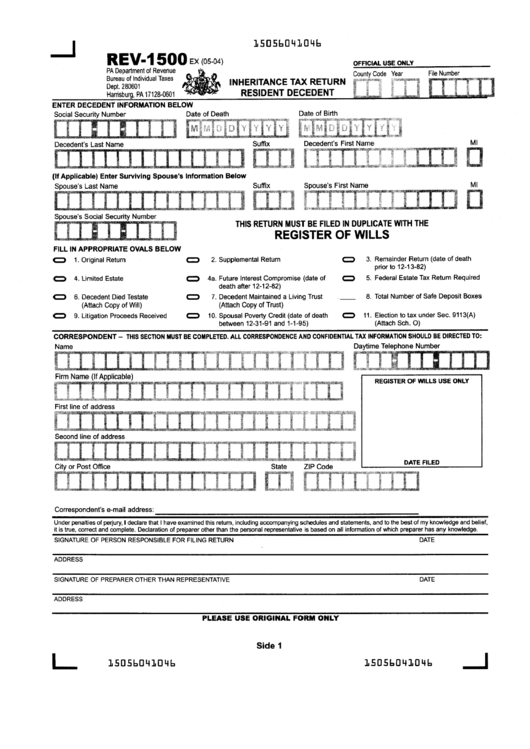

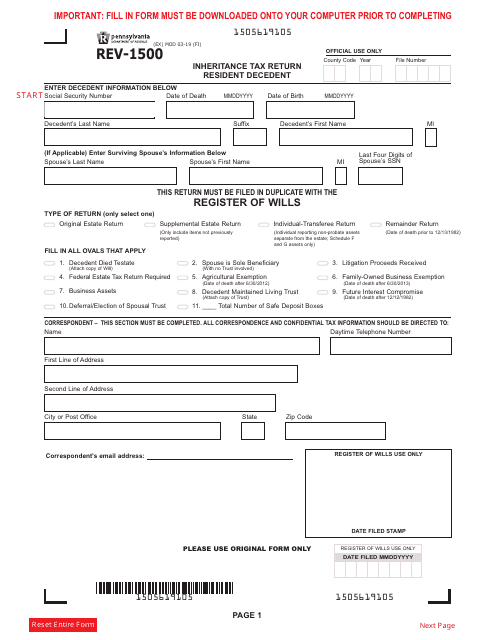

Form REV 1500 Download Fillable PDF Or Fill Online Inheritance Tax

Form REV 1500 Download Fillable PDF Or Fill Online Inheritance Tax

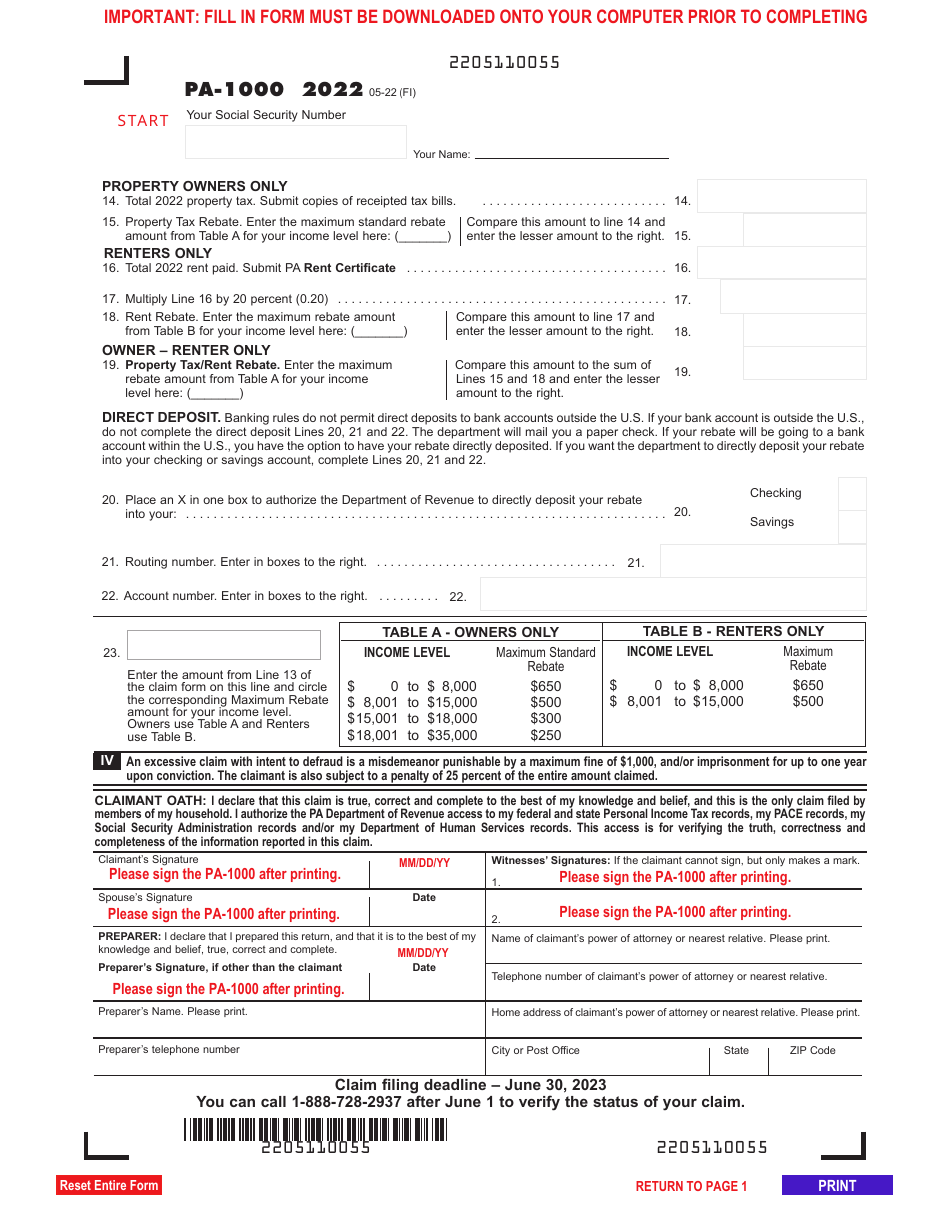

Web Property Tax Rent Rebate Enter the maximum Compare this amount to the sum of rebate amount from Table A for your income Lines 15 and 18 and enter the lesser level here

Web December 31 It is expected this will be the final filing deadline for rebate applications on property taxes or rent paid in 2023 How to File All eligible Pennsylvanians are

Cash Pa Real Estate Tax Rebate Form Decedent

Cash Pa Real Estate Tax Rebate Form Decedent are the simplest kind of Pa Real Estate Tax Rebate Form Decedent. Customers are given a certain amount of money back after buying a product. This is often for high-ticket items like electronics or appliances.

Mail-In Pa Real Estate Tax Rebate Form Decedent

Customers who want to receive mail-in Pa Real Estate Tax Rebate Form Decedent must send in the proof of purchase to be eligible for the money. They are a bit more complicated, but they can provide huge savings.

Instant Pa Real Estate Tax Rebate Form Decedent

Instant Pa Real Estate Tax Rebate Form Decedent are credited at the point of sale, which reduces the price of purchases immediately. Customers do not have to wait for their savings by using this method.

How Pa Real Estate Tax Rebate Form Decedent Work

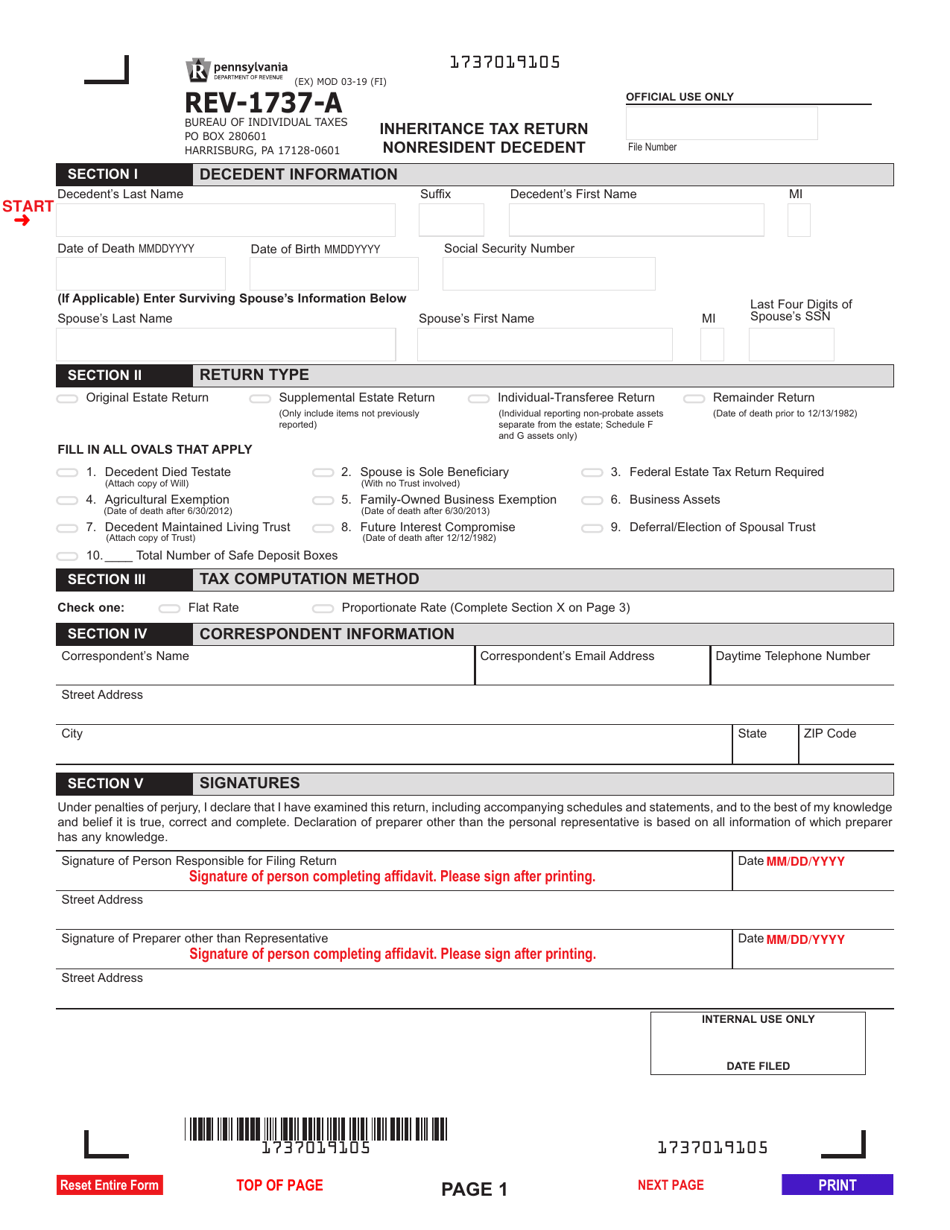

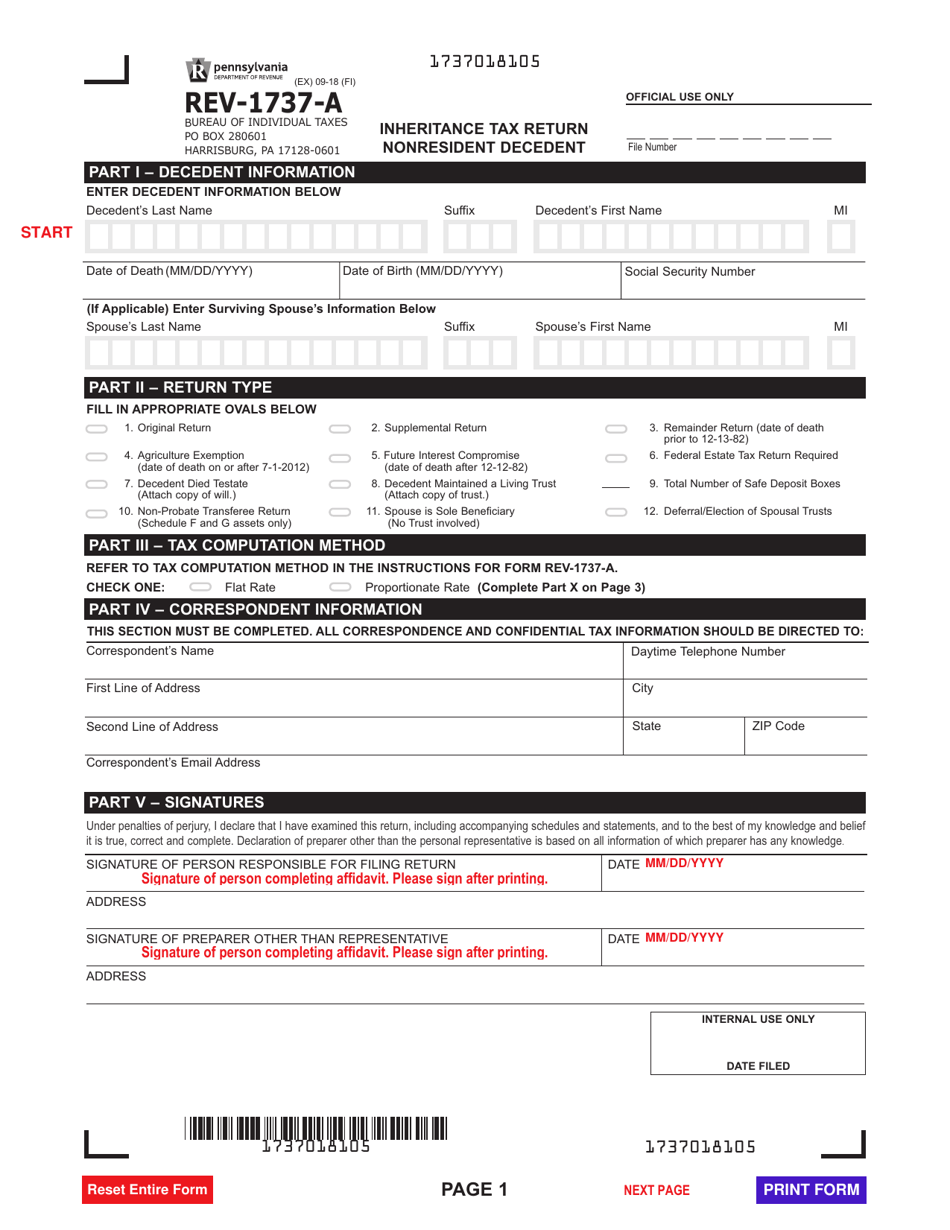

Form REV 1737 A Download Fillable PDF Or Fill Online Inheritance Tax

Form REV 1737 A Download Fillable PDF Or Fill Online Inheritance Tax

Web erty tax rebate To determine if a deceased claimant is eligible for a rebate a deceased claimant s claim form must also include an annualized income amount in the calcu

The Pa Real Estate Tax Rebate Form Decedent Process

The procedure usually involves a handful of simple steps:

-

Purchase the item: First, you purchase the item like you would normally.

-

Complete this Pa Real Estate Tax Rebate Form Decedent Form: To claim the Pa Real Estate Tax Rebate Form Decedent you'll need to fill in some information, such as your address, name, and purchase information, to be eligible for a Pa Real Estate Tax Rebate Form Decedent.

-

Send in the Pa Real Estate Tax Rebate Form Decedent The Pa Real Estate Tax Rebate Form Decedent must be submitted in accordance with the nature of Pa Real Estate Tax Rebate Form Decedent it is possible that you need to submit a claim form to the bank or make it available online.

-

Wait until the company approves: The company will look over your submission to make sure it is in line with the reimbursement's terms and condition.

-

Get your Pa Real Estate Tax Rebate Form Decedent If it is approved, you'll receive the refund either through check, prepaid card, or another procedure specified by the deal.

Pros and Cons of Pa Real Estate Tax Rebate Form Decedent

Advantages

-

Cost savings Pa Real Estate Tax Rebate Form Decedent can dramatically reduce the price you pay for the product.

-

Promotional Offers Customers are enticed to explore new products or brands.

-

Enhance Sales Pa Real Estate Tax Rebate Form Decedent can help boost an organization's sales and market share.

Disadvantages

-

Complexity The mail-in Pa Real Estate Tax Rebate Form Decedent in particular are often time-consuming and costly.

-

Day of Expiration: Many Pa Real Estate Tax Rebate Form Decedent have rigid deadlines to submit.

-

A risk of not being paid Some customers might lose their Pa Real Estate Tax Rebate Form Decedent in the event that they do not adhere to the guidelines precisely.

Download Pa Real Estate Tax Rebate Form Decedent

Download Pa Real Estate Tax Rebate Form Decedent

FAQs

1. Are Pa Real Estate Tax Rebate Form Decedent similar to discounts? Not necessarily, as Pa Real Estate Tax Rebate Form Decedent are only a partial reimbursement following the purchase, while discounts lower prices at moment of sale.

2. Can I use multiple Pa Real Estate Tax Rebate Form Decedent on the same item It's dependent on the conditions of Pa Real Estate Tax Rebate Form Decedent is offered as well as the merchandise's eligibility. Certain companies may allow the use of multiple Pa Real Estate Tax Rebate Form Decedent, whereas other won't.

3. How long does it take to get the Pa Real Estate Tax Rebate Form Decedent? The time frame differs, but could take anywhere from a few weeks to a few months to receive your Pa Real Estate Tax Rebate Form Decedent.

4. Do I have to pay taxes for Pa Real Estate Tax Rebate Form Decedent sums? most instances, Pa Real Estate Tax Rebate Form Decedent amounts are not considered to be taxable income.

5. Can I trust Pa Real Estate Tax Rebate Form Decedent deals from lesser-known brands Consider doing some research and ensure that the brand providing the Pa Real Estate Tax Rebate Form Decedent is legitimate prior to making a purchase.

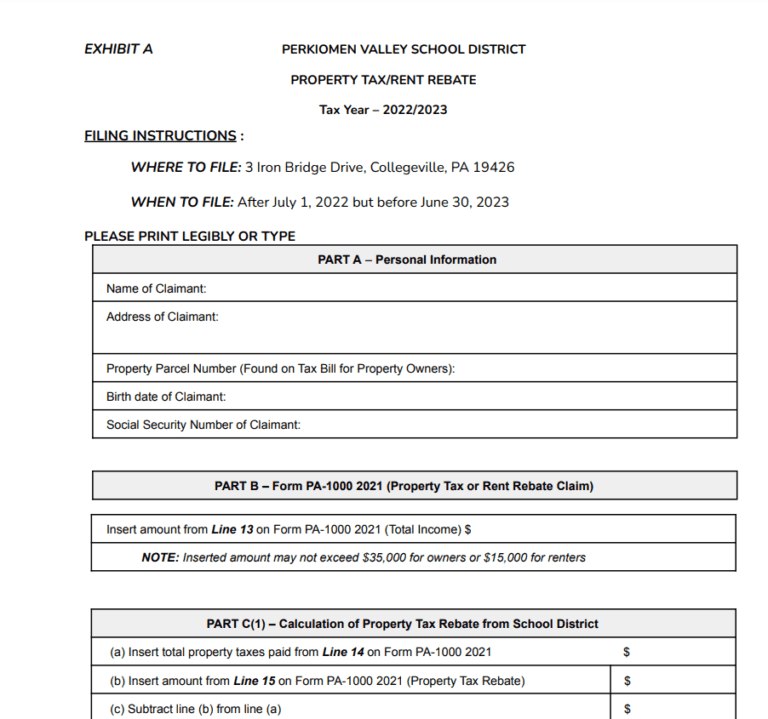

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Form REV 1500 Download Fillable PDF Or Fill Online Inheritance Tax

Check more sample of Pa Real Estate Tax Rebate Form Decedent below

Form REV 1737 A Download Fillable PDF Or Fill Online Inheritance Tax

Fillable Pennsylvania Inheritance Tax Return Nonresident Decedent

Form Rev 1500 Ex Inheritance Tax Return Resident Decedent Pa Dept

Instructions For Form Rev 1500 Pennsylvania Inheritance Tax Return

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults

https://revenue-pa.custhelp.com/app/answers/detail/a_id/4181

Web 19 juin 2023 nbsp 0183 32 The personal representative must submit a copy of the applicant s death certificate a DEX 41 a completed RA 1000 with Line 3 filled in and a receipted copy of

Web The Property Tax Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery Since the program s 1971 inception older and disabled adults

Web 19 juin 2023 nbsp 0183 32 The personal representative must submit a copy of the applicant s death certificate a DEX 41 a completed RA 1000 with Line 3 filled in and a receipted copy of

Instructions For Form Rev 1500 Pennsylvania Inheritance Tax Return

Fillable Pennsylvania Inheritance Tax Return Nonresident Decedent

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Fillable Pa 40 Fill Out Sign Online DocHub

Fillable Pa 40 Fill Out Sign Online DocHub

Form Pa 1000 Instructions For Completing Your Claim Form Property