In this day and age of consuming, everyone loves a good bargain. One of the ways to enjoy significant savings when you shop is with Substantial Renovation Hst Rebate Forms. Substantial Renovation Hst Rebate Forms are a method of marketing that retailers and manufacturers use to provide customers with a portion of a reimbursement on their purchases following the time they've bought them. In this article, we will dive into the world Substantial Renovation Hst Rebate Forms and explore what they are and how they function, and how to maximize the savings you can make by using these cost-effective incentives.

Get Latest Substantial Renovation Hst Rebate Form Below

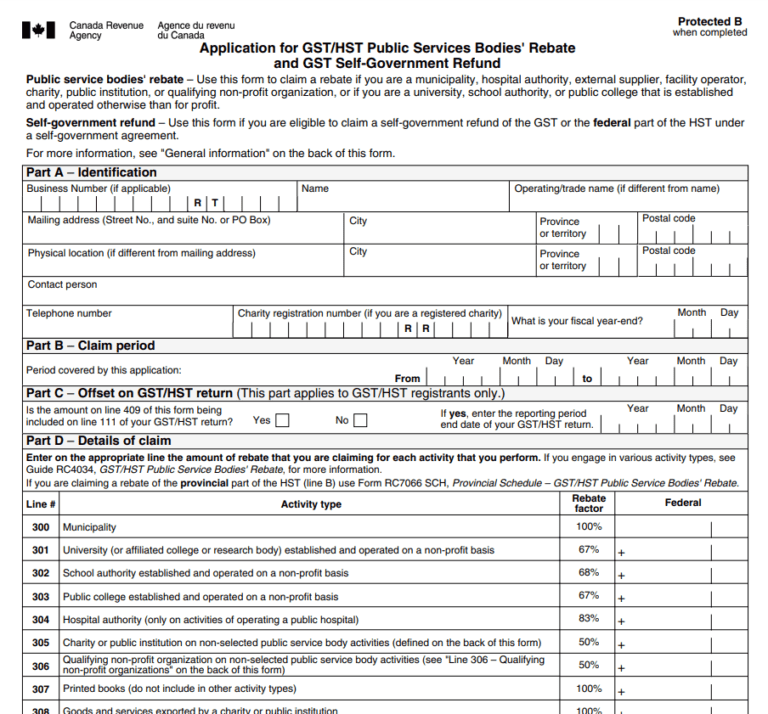

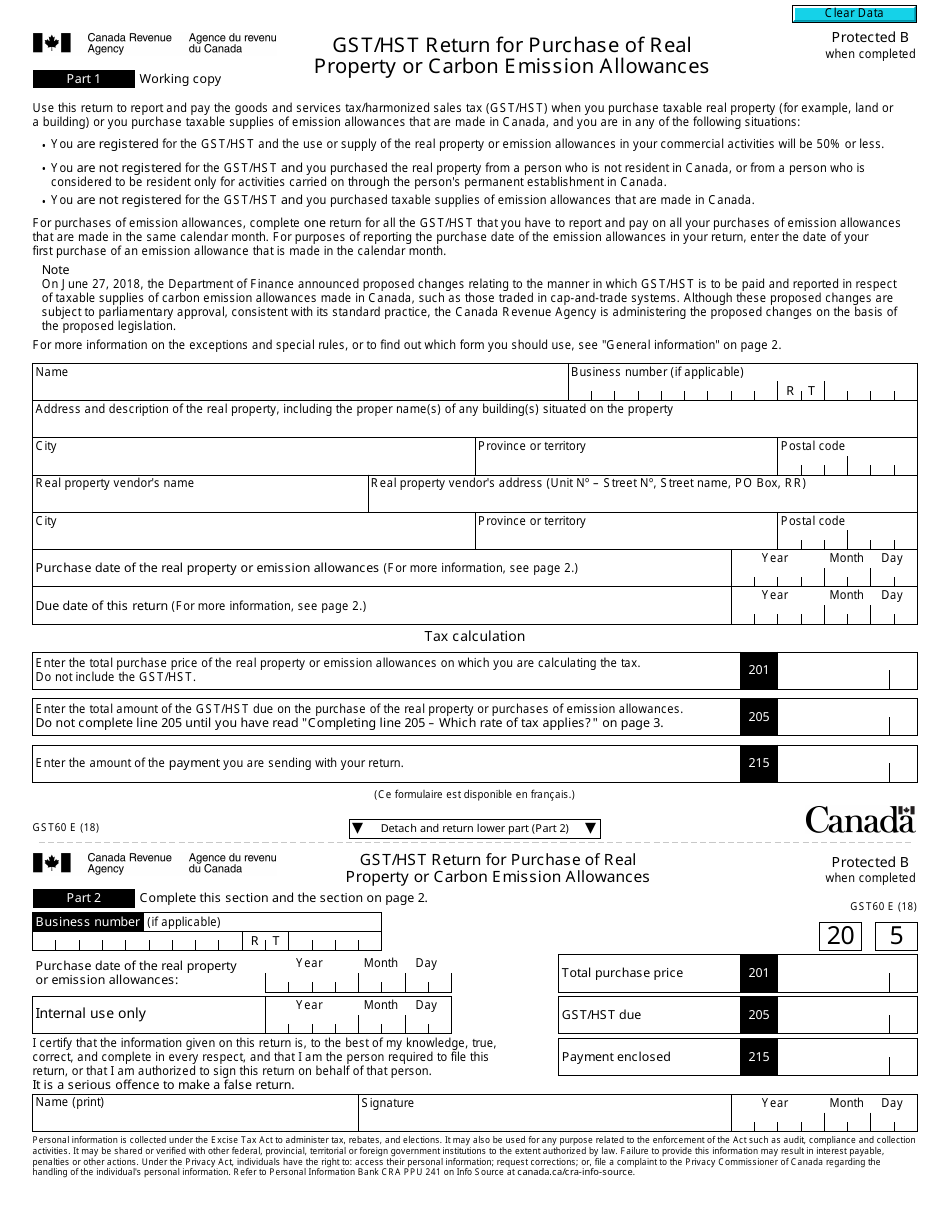

Substantial Renovation Hst Rebate Form

Substantial Renovation Hst Rebate Form - Substantial Renovation Hst Rebate Form, Who Qualifies For Hst Rebate, How Do You Qualify For Hst Rebate

Web 20 mai 2021 nbsp 0183 32 If you ve recently undergone substantial renovations built or hired someone to build an addition built or hired someone to build a new home or purchased a new

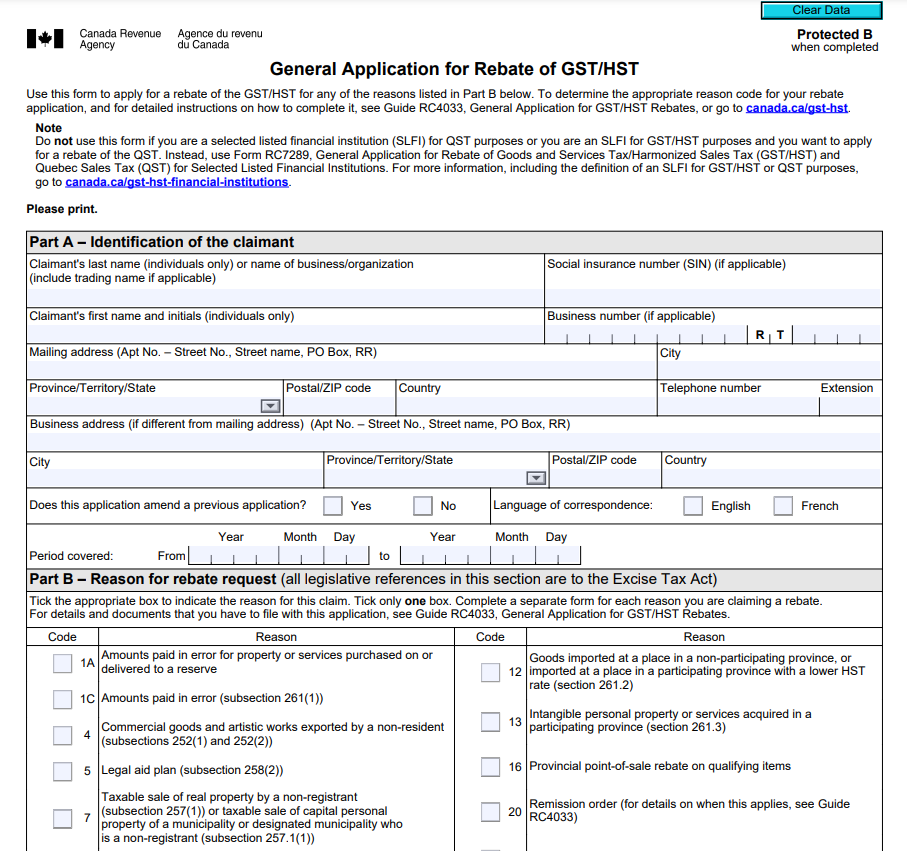

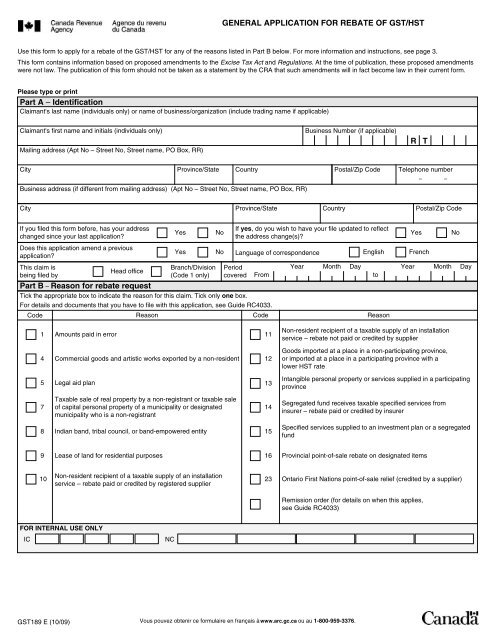

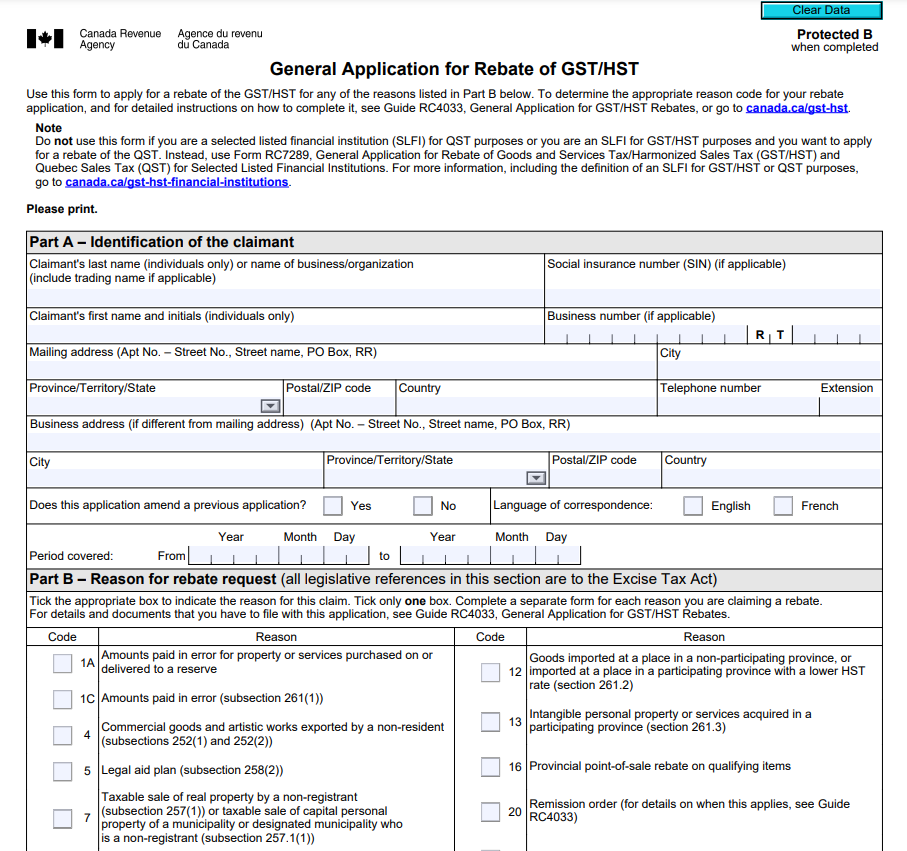

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

A Substantial Renovation Hst Rebate Form, in its simplest type, is a refund given to a client after having purchased a item or service. It's an effective way used by companies to attract customers, increase sales and also to advertise certain products.

Types of Substantial Renovation Hst Rebate Form

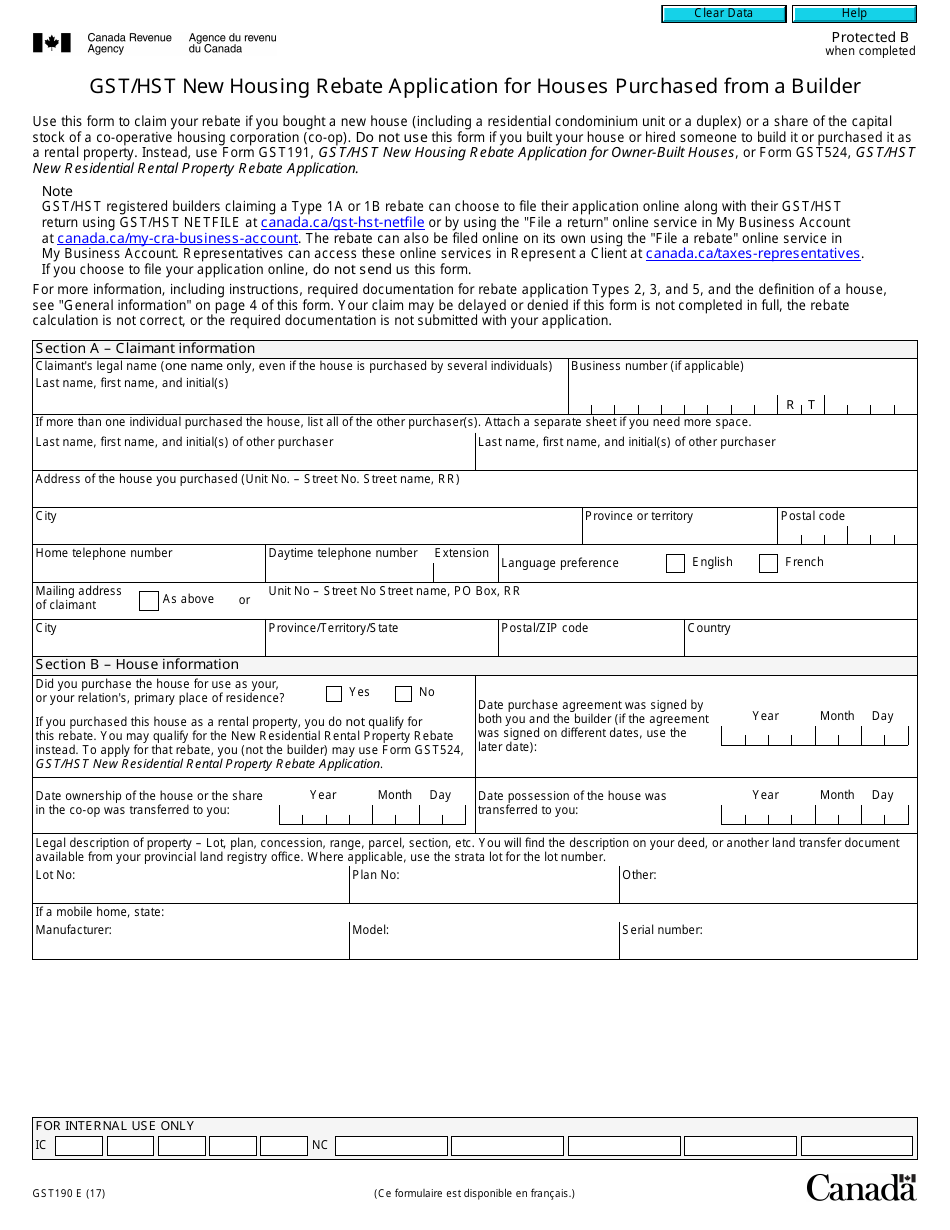

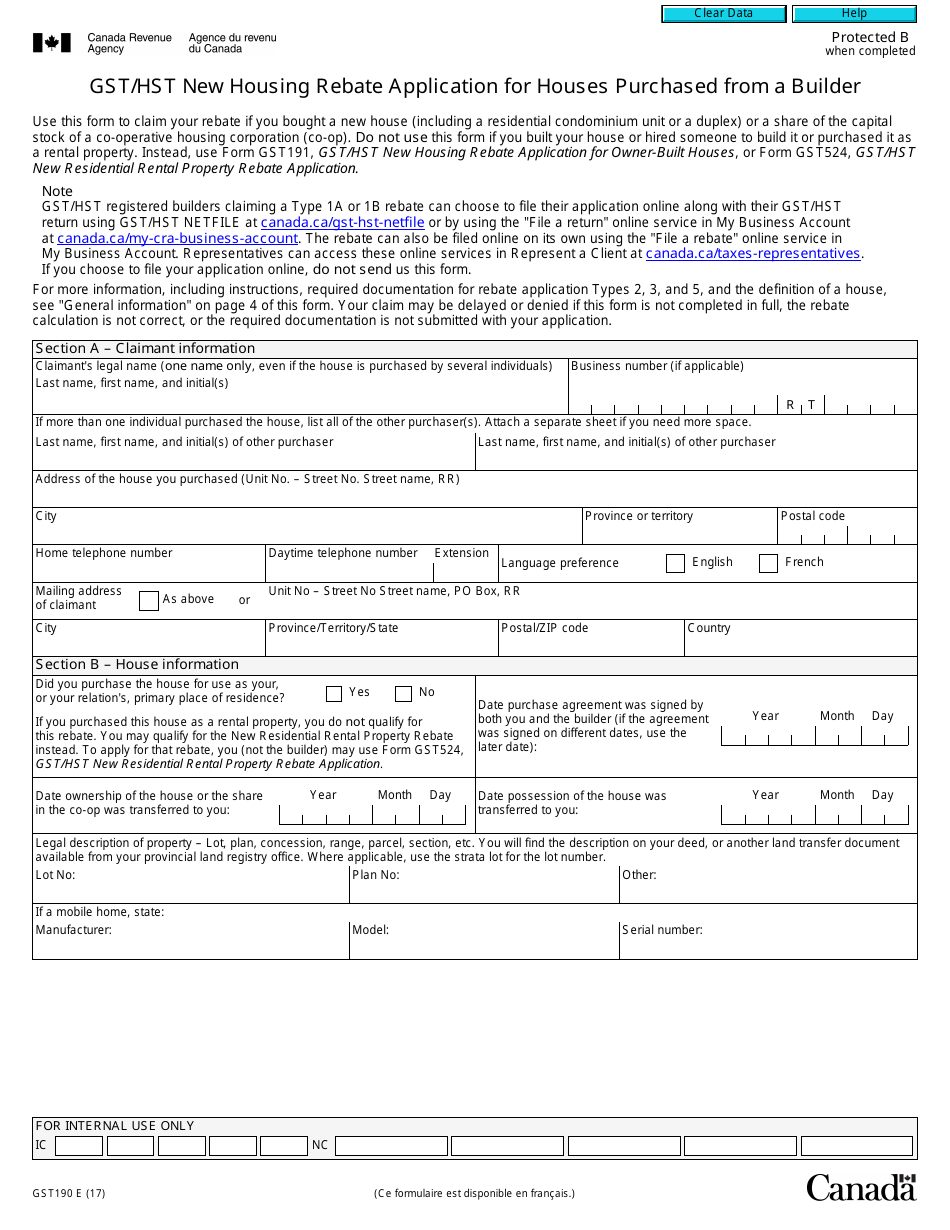

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

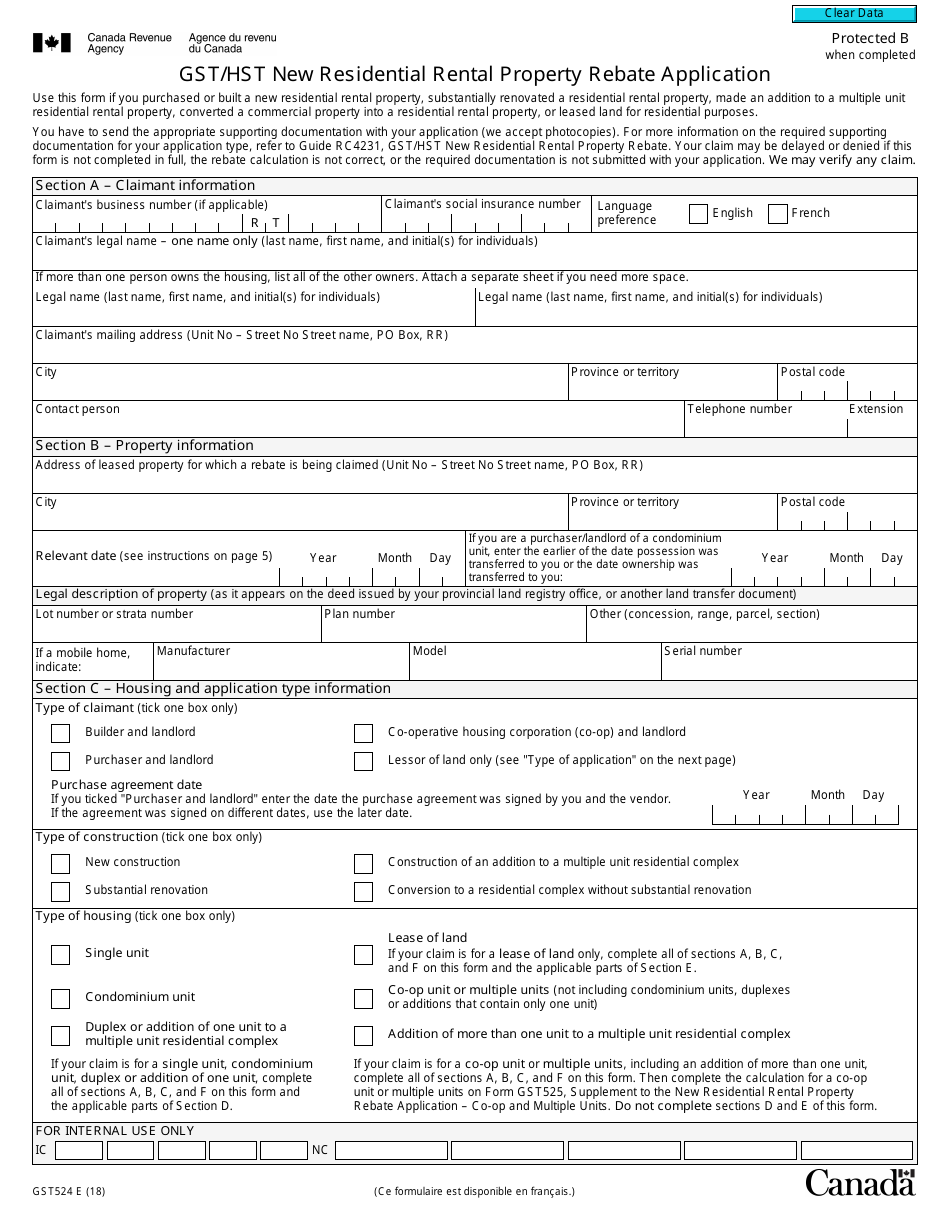

Web For a single unit residential complex residential condominium unit or lease of land use the following forms to apply for an NRRP rebate if you are eligible Fill out Form GST524

Web If you substantially renovate your home you may qualify for a rebate of a portion of the GST HST paid on labour and materials See the CRA RC4028 information on

Cash Substantial Renovation Hst Rebate Form

Cash Substantial Renovation Hst Rebate Form can be the simplest type of Substantial Renovation Hst Rebate Form. Clients receive a predetermined amount of money in return for buying a product. These are typically applied to big-ticket items, like electronics and appliances.

Mail-In Substantial Renovation Hst Rebate Form

Mail-in Substantial Renovation Hst Rebate Form require the customer to provide proof of purchase in order to receive their refund. They're more involved, but can result in significant savings.

Instant Substantial Renovation Hst Rebate Form

Instant Substantial Renovation Hst Rebate Form are applied right at the point of sale. They reduce your purchase cost instantly. Customers don't have to wait for savings when they purchase this type of Substantial Renovation Hst Rebate Form.

How Substantial Renovation Hst Rebate Form Work

Hst New Housing Rebate Ontario Forms Printable Rebate Form

Hst New Housing Rebate Ontario Forms Printable Rebate Form

Web Substantial Renovation In addition to rebates on newly built homes the HST New Housing Rebate also includes properties that are substantially renovated by 90 or more

The Substantial Renovation Hst Rebate Form Process

The process typically involves few simple steps

-

Purchase the item: First make sure you purchase the product just as you would ordinarily.

-

Fill in the Substantial Renovation Hst Rebate Form application: In order to claim your Substantial Renovation Hst Rebate Form, you'll need submit some information like your address, name, and the purchase details, in order in order to take advantage of your Substantial Renovation Hst Rebate Form.

-

Make sure you submit the Substantial Renovation Hst Rebate Form Based on the kind of Substantial Renovation Hst Rebate Form the recipient may be required to mail in a form or make it available online.

-

Wait for approval: The business will examine your application to ensure it meets the Substantial Renovation Hst Rebate Form's terms and conditions.

-

You will receive your Substantial Renovation Hst Rebate Form After being approved, you'll receive your cash back using a check or prepaid card or another option specified by the offer.

Pros and Cons of Substantial Renovation Hst Rebate Form

Advantages

-

Cost savings The use of Substantial Renovation Hst Rebate Form can greatly decrease the price for the item.

-

Promotional Deals they encourage their customers to try new items or brands.

-

Enhance Sales A Substantial Renovation Hst Rebate Form program can boost companies' sales and market share.

Disadvantages

-

Complexity Mail-in Substantial Renovation Hst Rebate Form particularly is a time-consuming process and long-winded.

-

Expiration Dates Some Substantial Renovation Hst Rebate Form have deadlines for submission.

-

Risk of not receiving payment Some customers might not be able to receive their Substantial Renovation Hst Rebate Form if they don't observe the rules exactly.

Download Substantial Renovation Hst Rebate Form

Download Substantial Renovation Hst Rebate Form

FAQs

1. Are Substantial Renovation Hst Rebate Form equivalent to discounts? No, Substantial Renovation Hst Rebate Form involve only a partial reimbursement following the purchase, and discounts are a reduction of the price of the purchase at the moment of sale.

2. Can I make use of multiple Substantial Renovation Hst Rebate Form on the same item? It depends on the conditions in the Substantial Renovation Hst Rebate Form incentives and the specific product's suitability. Certain companies allow it, but some will not.

3. How long does it take to receive the Substantial Renovation Hst Rebate Form? The length of time varies, but it can take anywhere from a couple of weeks to a couple of months for you to receive your Substantial Renovation Hst Rebate Form.

4. Do I need to pay tax regarding Substantial Renovation Hst Rebate Form the amount? most circumstances, Substantial Renovation Hst Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Substantial Renovation Hst Rebate Form offers from brands that aren't well-known? It's essential to research and confirm that the company offering the Substantial Renovation Hst Rebate Form is reputable before making the purchase.

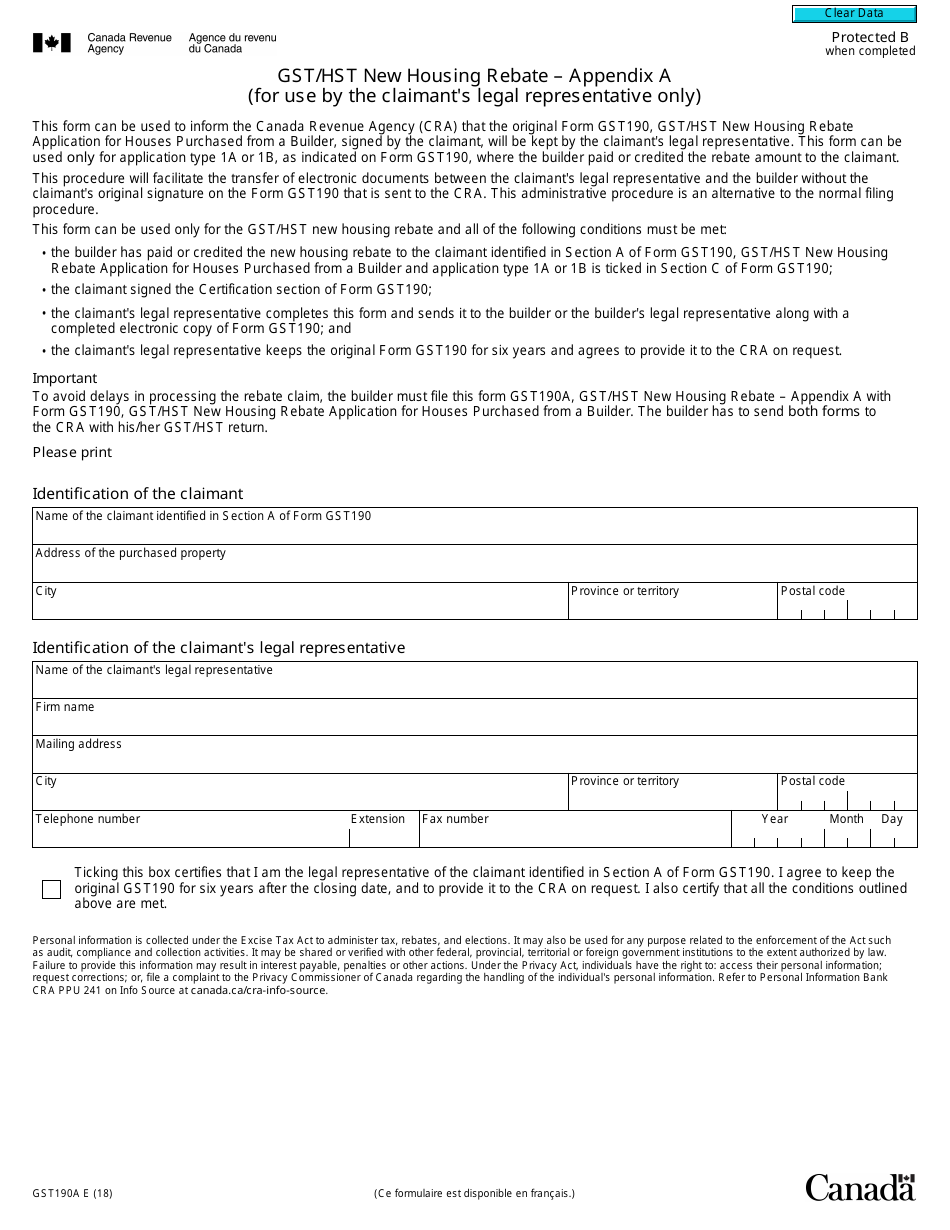

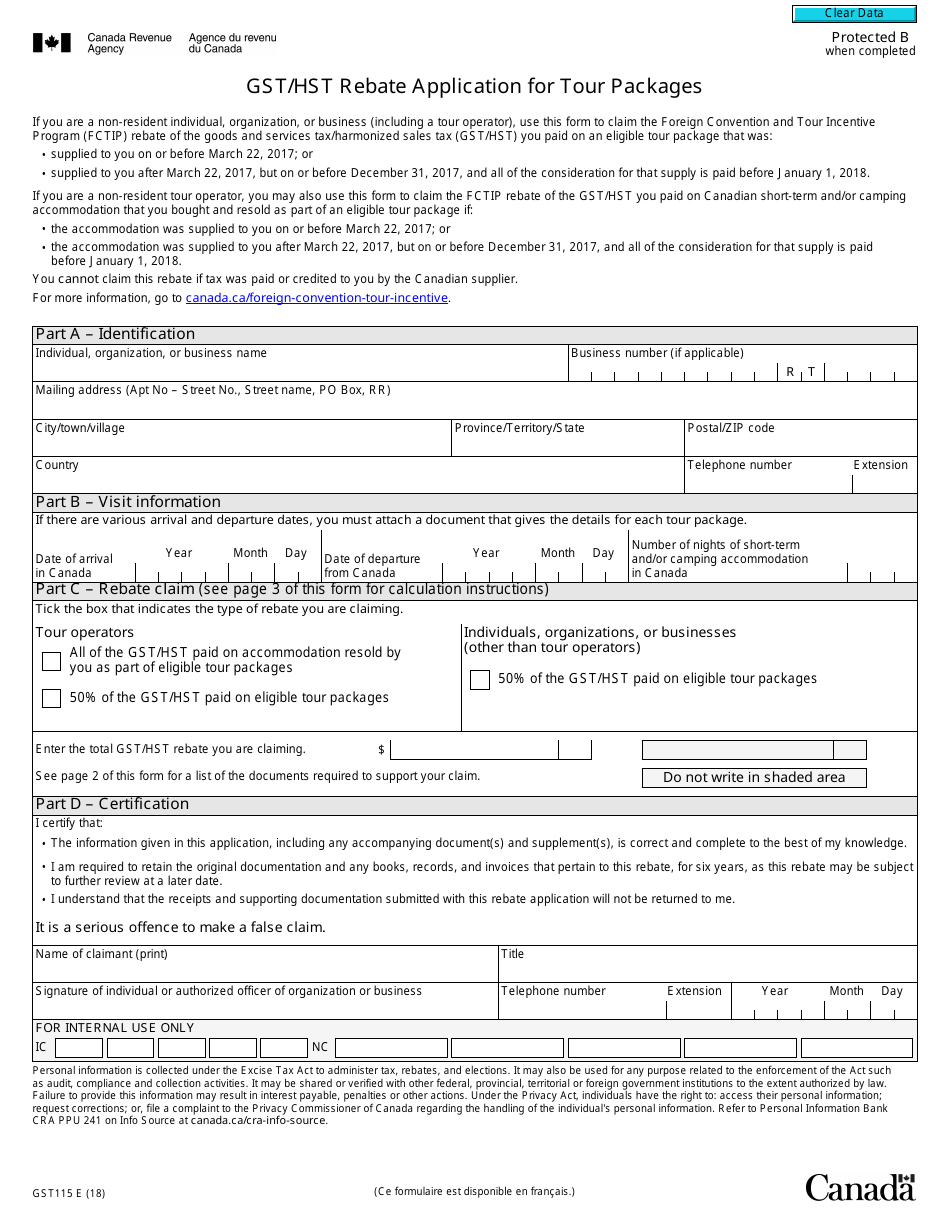

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Check more sample of Substantial Renovation Hst Rebate Form below

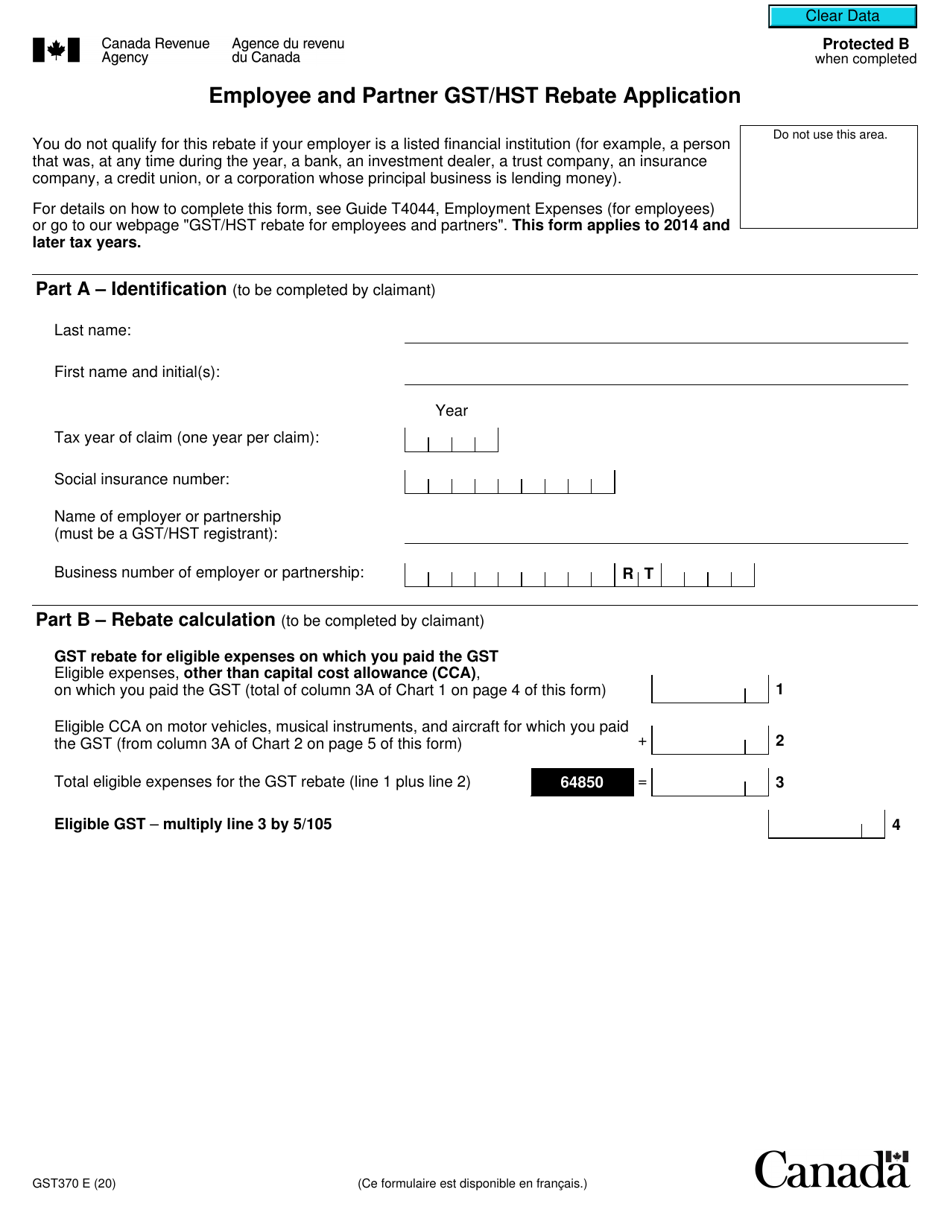

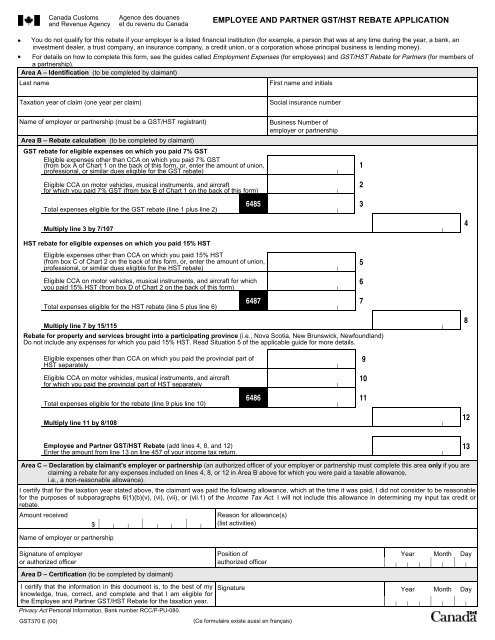

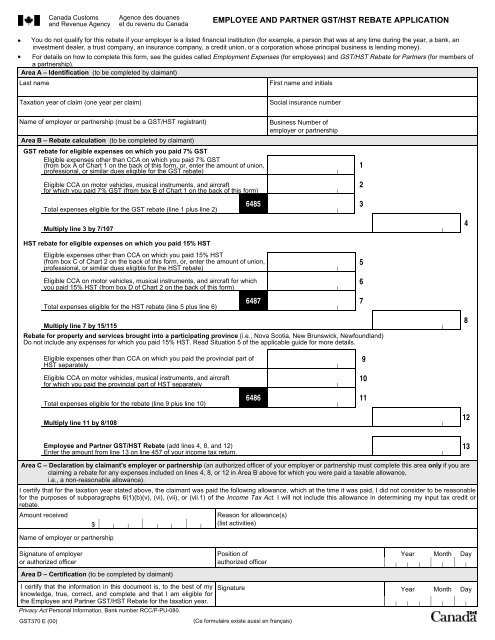

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

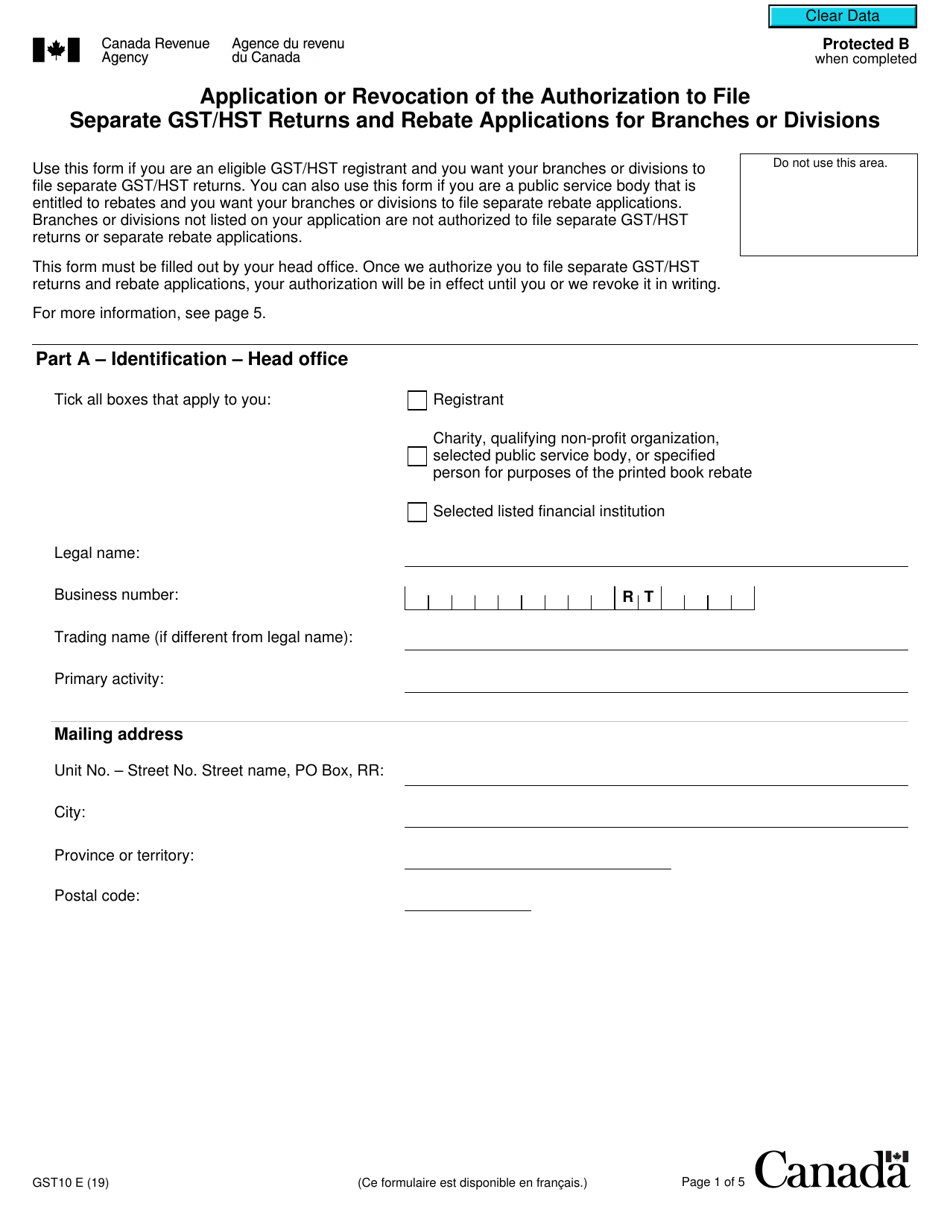

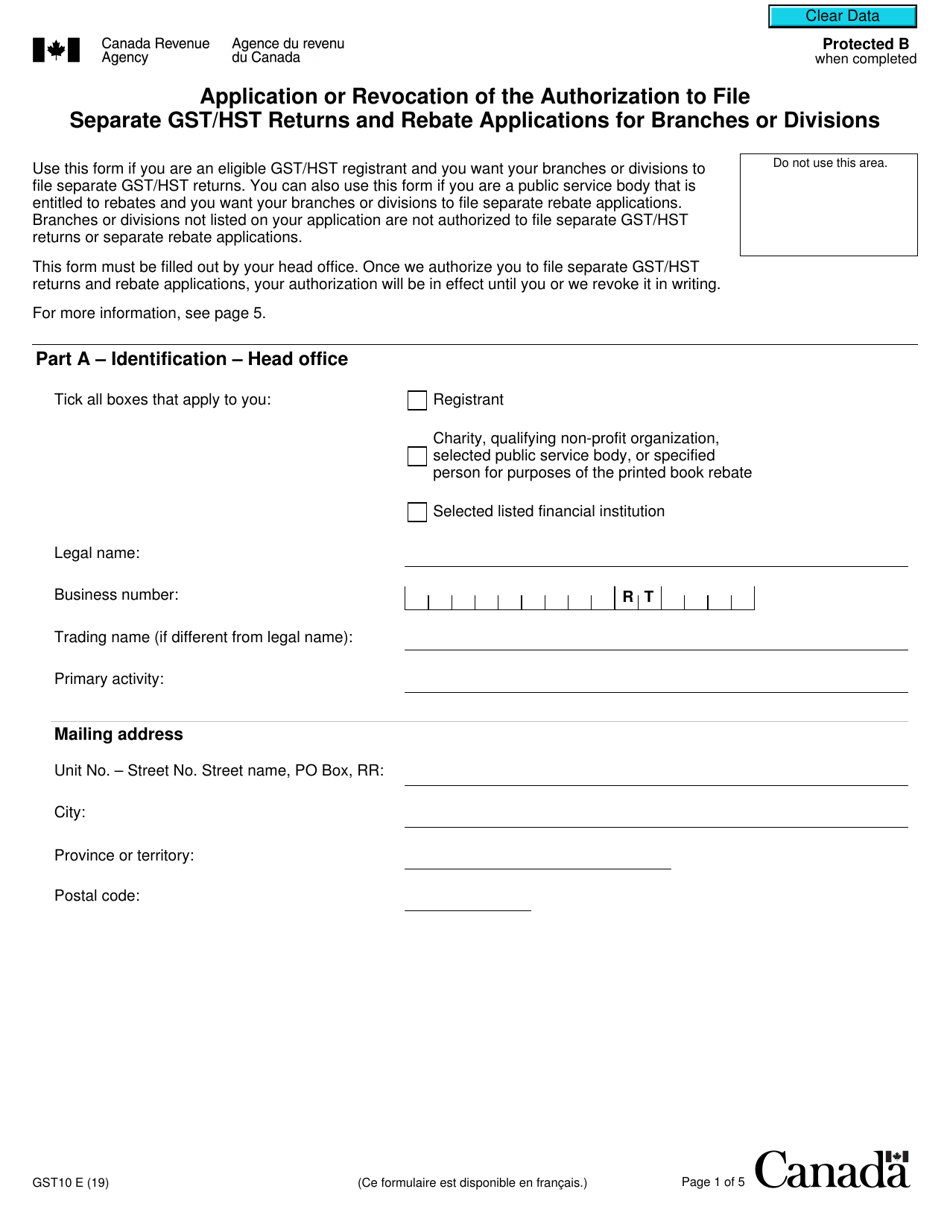

Form GST10 Download Fillable PDF Or Fill Online Application Or

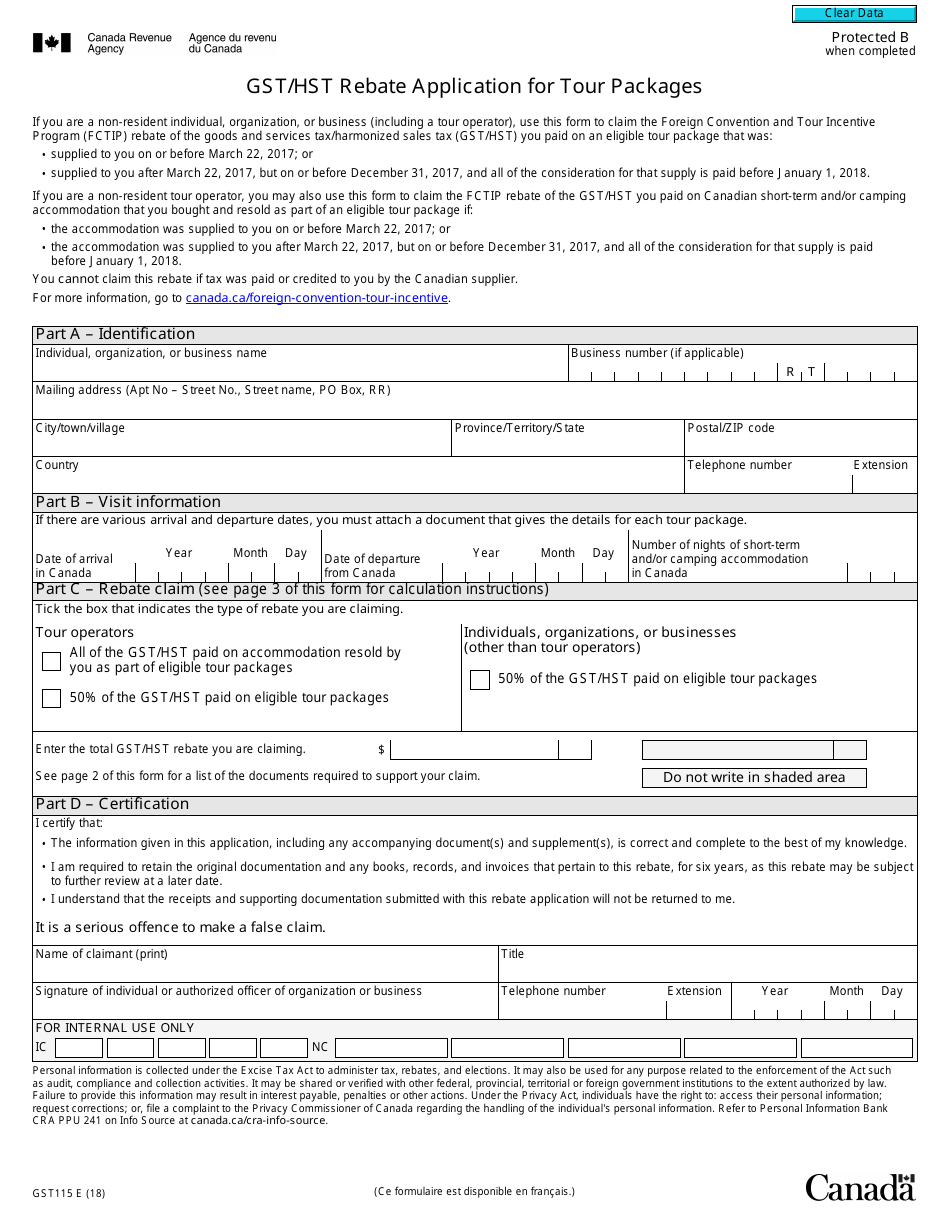

GST HST Rebate Form Asset Services Inc

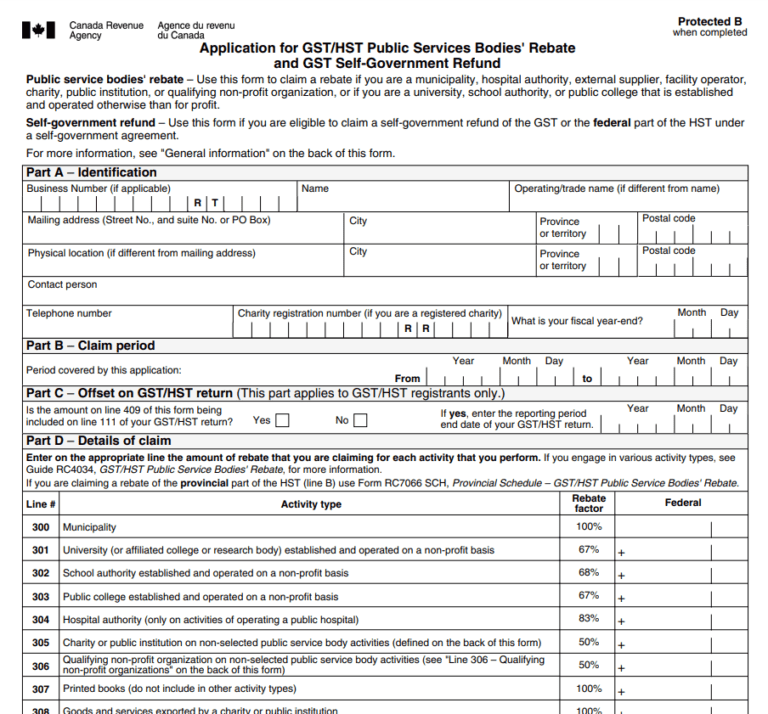

HST Charity Rebate Form Ontario Auction Printable Rebate Form

GST370 Employee And Partner GST HST Rebate Application

Gst Fillable Form Printable Forms Free Online

https://www.canada.ca/.../gst-hst-rebates/application.html

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web 6 janv 2005 nbsp 0183 32 This bulletin sets out the Canada Revenue Agency s CRA interpretation of the term substantial renovation as it relates to the GST HST new housing rebate

Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate

Web 6 janv 2005 nbsp 0183 32 This bulletin sets out the Canada Revenue Agency s CRA interpretation of the term substantial renovation as it relates to the GST HST new housing rebate

HST Charity Rebate Form Ontario Auction Printable Rebate Form

Form GST10 Download Fillable PDF Or Fill Online Application Or

GST370 Employee And Partner GST HST Rebate Application

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses