In this day and age of consuming everybody loves a good deal. One way to earn substantial savings when you shop is with Credit Rebate Tax Forms. The use of Credit Rebate Tax Forms is a method used by manufacturers and retailers for offering customers a percentage cash back on their purchases once they have completed them. In this article, we'll examine the subject of Credit Rebate Tax Forms. We'll explore what they are, how they work, and how you can maximise the savings you can make by using these cost-effective incentives.

Get Latest Credit Rebate Tax Form Below

Credit Rebate Tax Form

Credit Rebate Tax Form -

Web 10 d 233 c 2021 nbsp 0183 32 A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

A Credit Rebate Tax Form, in its simplest form, is a cash refund provided to customers after having purchased a item or service. This is a potent tool used by companies to attract customers, increase sales, or promote a specific product.

Types of Credit Rebate Tax Form

Original Rebate Receipt Template Pretty Receipt Templates

Original Rebate Receipt Template Pretty Receipt Templates

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Cash Credit Rebate Tax Form

Cash Credit Rebate Tax Form are the most straightforward kind of Credit Rebate Tax Form. Customers receive a certain amount of money after purchasing a particular item. These are often used for large-ticket items such as electronics and appliances.

Mail-In Credit Rebate Tax Form

Mail-in Credit Rebate Tax Form demand that customers provide documents of purchase to claim the refund. They are a bit more complicated but could provide huge savings.

Instant Credit Rebate Tax Form

Instant Credit Rebate Tax Form are credited at the point of sale, which reduces the purchase cost immediately. Customers don't have to wait for savings by using this method.

How Credit Rebate Tax Form Work

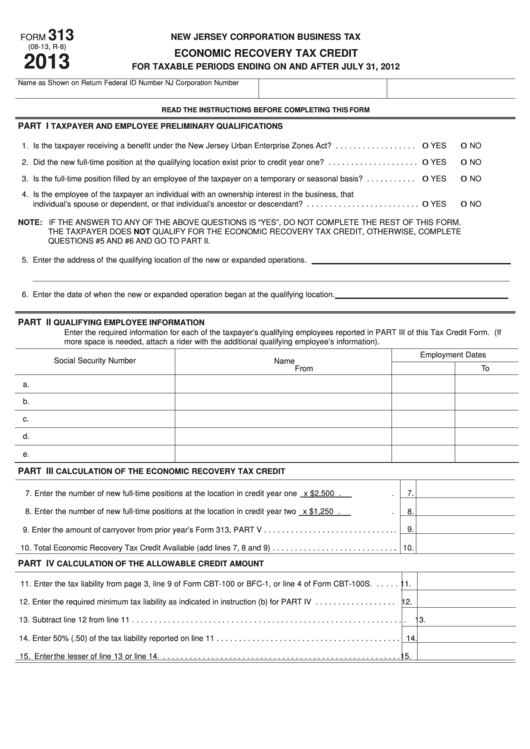

Form 313 Economic Recovery Tax Credit 2013 Printable Pdf Download

Form 313 Economic Recovery Tax Credit 2013 Printable Pdf Download

Web Non refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not refunded See FYI 106 Claiming Business

The Credit Rebate Tax Form Process

The process usually involves a handful of simple steps:

-

Then, you purchase the product, you purchase the item like you normally do.

-

Fill out your Credit Rebate Tax Form forms: The Credit Rebate Tax Form form will need submit some information like your name, address, and purchase information, in order to receive your Credit Rebate Tax Form.

-

Complete the Credit Rebate Tax Form Based on the kind of Credit Rebate Tax Form the recipient may be required to either mail in a request form or send it via the internet.

-

Wait for the company's approval: They will evaluate your claim to verify that it is compliant with the refund's conditions and terms.

-

Get your Credit Rebate Tax Form If it is approved, you'll receive your cash back via check, prepaid card, or a different option that's specified in the offer.

Pros and Cons of Credit Rebate Tax Form

Advantages

-

Cost savings The use of Credit Rebate Tax Form can greatly reduce the price you pay for a product.

-

Promotional Deals Incentivize customers to try out new products or brands.

-

Improve Sales Credit Rebate Tax Form can help boost companies' sales and market share.

Disadvantages

-

Complexity mail-in Credit Rebate Tax Form in particular the case of HTML0, can be a hassle and lengthy.

-

Day of Expiration A majority of Credit Rebate Tax Form have certain deadlines for submitting.

-

Risk of not receiving payment Some customers might not be able to receive their Credit Rebate Tax Form if they do not adhere to the guidelines exactly.

Download Credit Rebate Tax Form

Download Credit Rebate Tax Form

FAQs

1. Are Credit Rebate Tax Form similar to discounts? No, Credit Rebate Tax Form offer one-third of the amount refunded following purchase, while discounts reduce the purchase price at the moment of sale.

2. Are multiple Credit Rebate Tax Form available for the same product The answer is dependent on the terms of the Credit Rebate Tax Form offer and also the item's quality and eligibility. Certain companies may permit it, and some don't.

3. How long does it take to get the Credit Rebate Tax Form? The time frame will differ, but can be anywhere from a few weeks up to a few months to get your Credit Rebate Tax Form.

4. Do I need to pay tax when I receive Credit Rebate Tax Form amounts? In the majority of situations, Credit Rebate Tax Form amounts are not considered to be taxable income.

5. Can I trust Credit Rebate Tax Form offers from brands that aren't well-known It's crucial to research and verify that the brand giving the Credit Rebate Tax Form is credible prior to making any purchase.

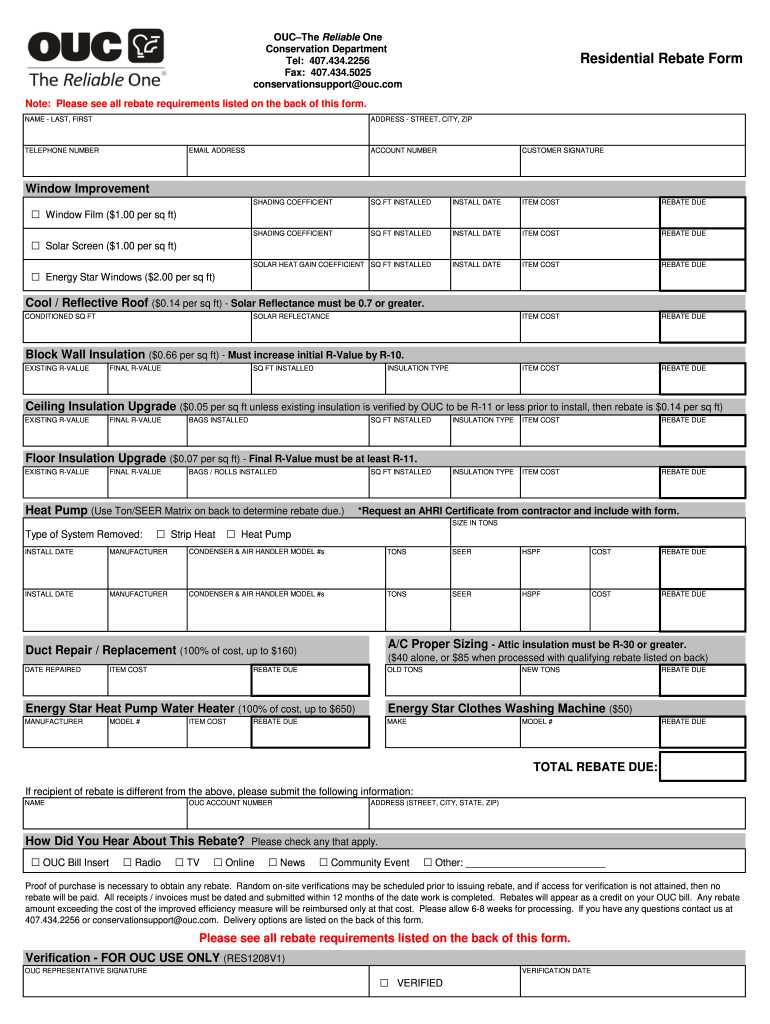

Printable Old Style Rebate Form Printable Forms Free Online

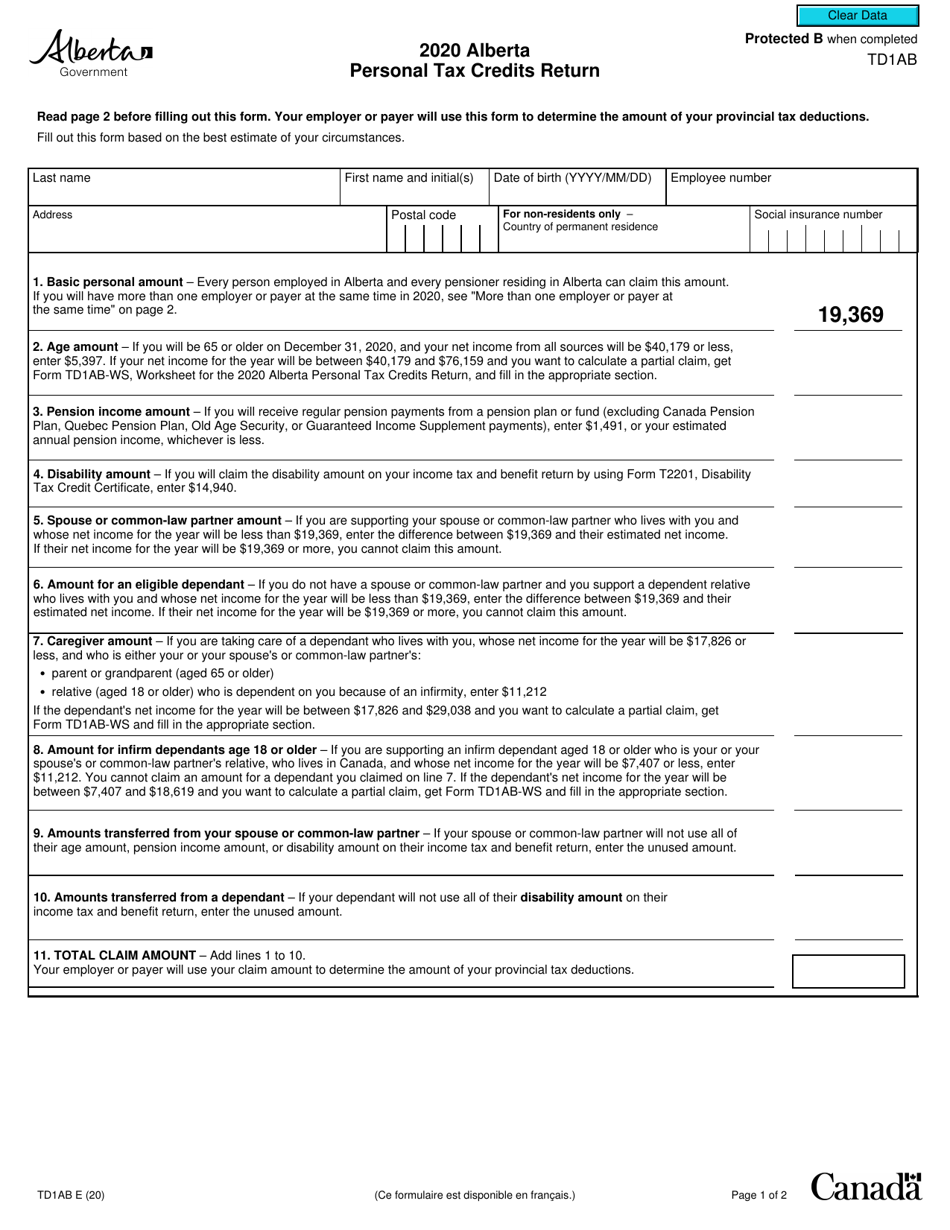

Form TD1AB 2020 Fill Out Sign Online And Download Fillable PDF

Check more sample of Credit Rebate Tax Form below

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

P G Printable Rebate Form

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

The Recovery Rebate Credit Calculator ShauntelRaya

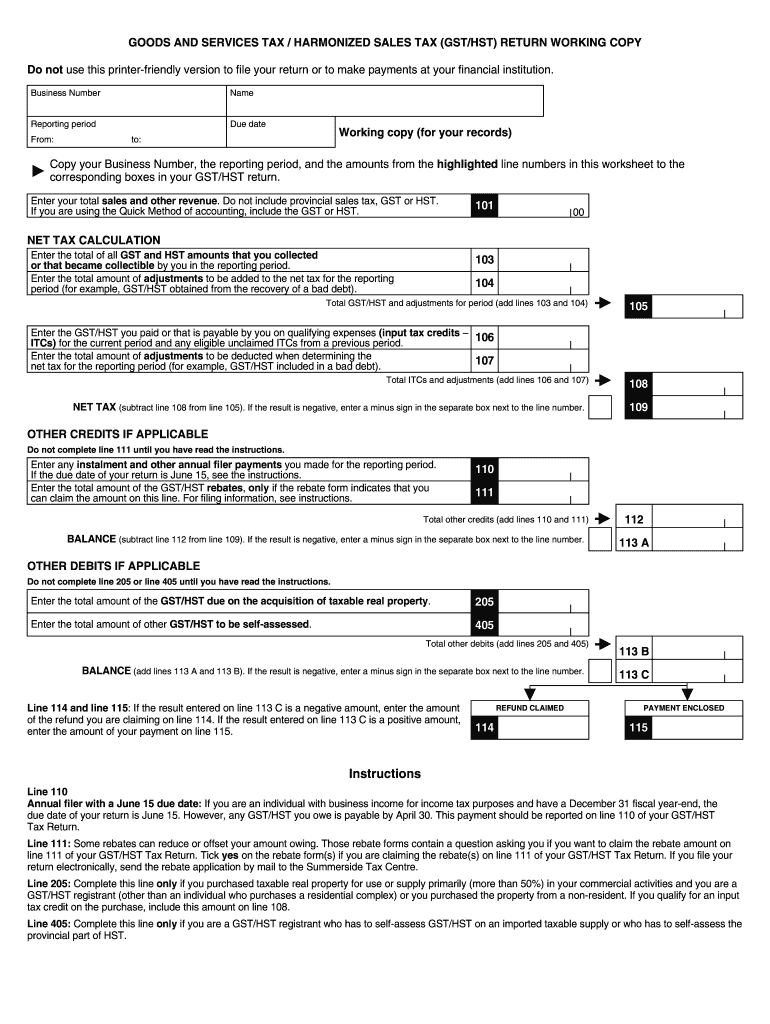

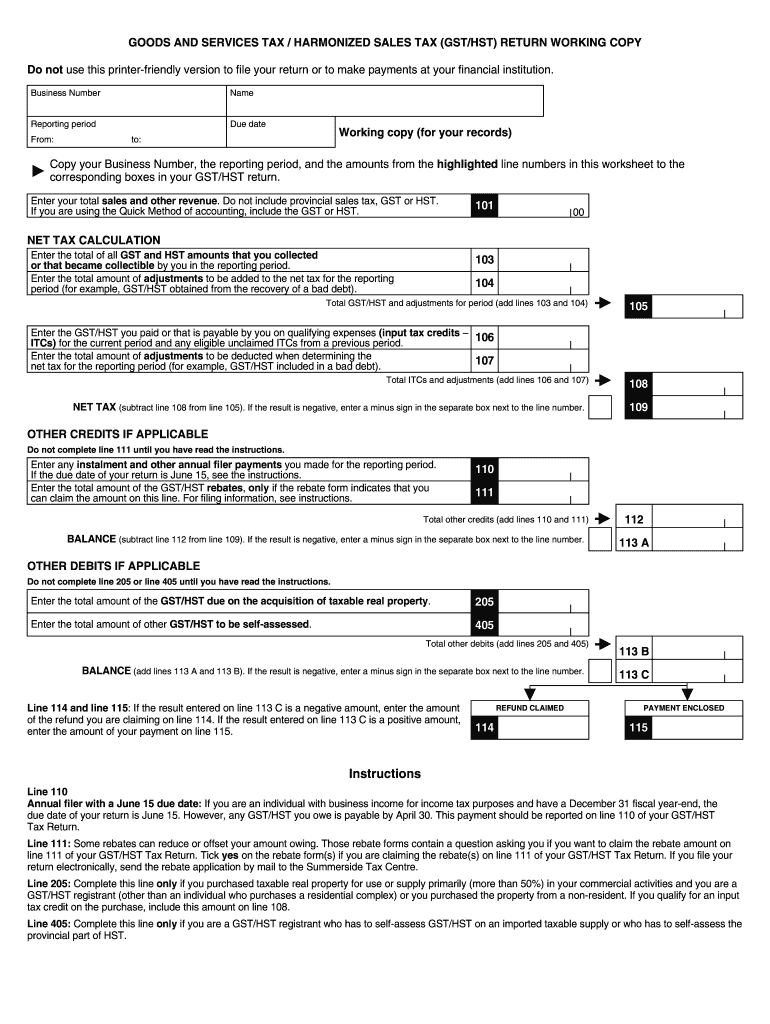

Business Gst Remittance Form Santos Czerwinski s Template

Massachusetts Agi Worksheet Speed Test Site

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

The Recovery Rebate Credit Calculator ShauntelRaya

P G Printable Rebate Form

Business Gst Remittance Form Santos Czerwinski s Template

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Massachusetts Agi Worksheet Speed Test Site

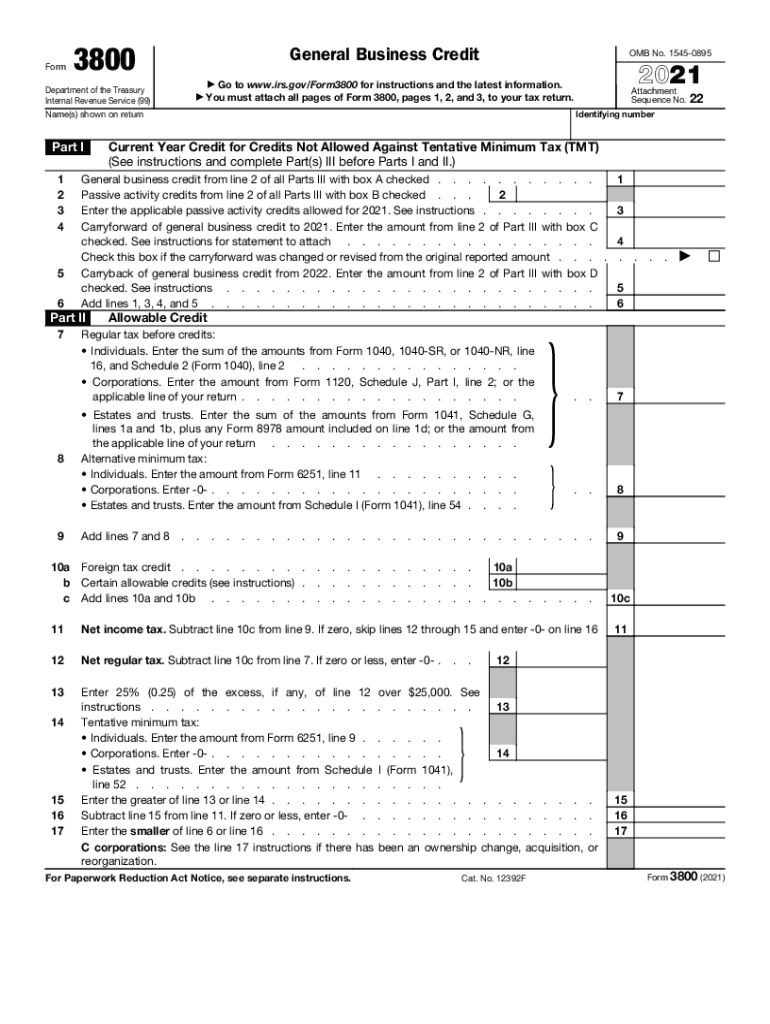

Form 3800 Fill Out And Sign Printable PDF Template SignNow

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf