Today, in a world that is driven by the consumer everyone is looking for a great deal. One option to obtain significant savings on your purchases is by using Minnesota Sales Tax Rebate Forms. Minnesota Sales Tax Rebate Forms are an effective marketing tactic employed by retailers and manufacturers to provide customers with a portion of a refund on purchases made after they've completed them. In this post, we'll look into the world of Minnesota Sales Tax Rebate Forms. We'll look at what they are and how they operate, and how you can maximise your savings through these cost-effective incentives.

Get Latest Minnesota Sales Tax Rebate Form Below

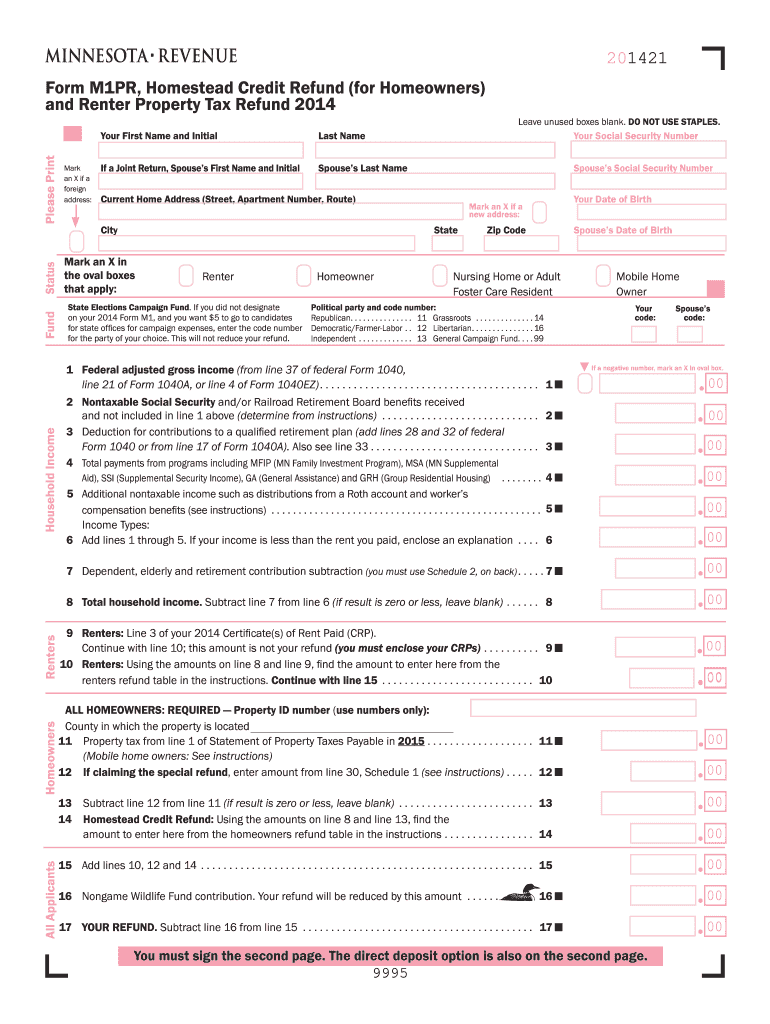

Minnesota Sales Tax Rebate Form

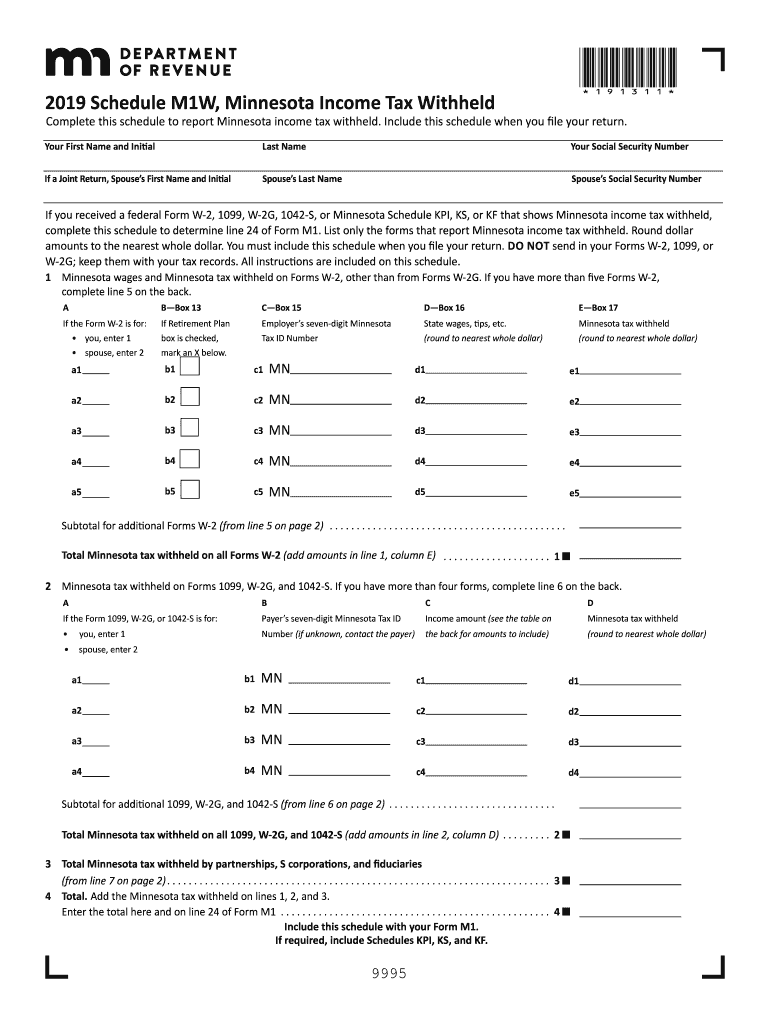

Minnesota Sales Tax Rebate Form - Minnesota Sales Tax Return Form, Minnesota Sales Tax Refund Form, Minnesota Sales Tax Return Form Pdf, Minnesota Sales Tax Return Form Number, Minnesota State Tax Return Form, Minnesota State Tax Return Form 2022, Minnesota State Property Tax Refund Form, What Is A Sales Tax Rebate, How To Register For Sales Tax In Minnesota, State Of Mn Tax Refund

Web 16 ao 251 t 2023 nbsp 0183 32 There is no application or form to fill out rebates will be sent automatically based on income tax returns for tax year 2021 including the adjusted gross income

Web 10 juil 2023 nbsp 0183 32 Who is eligible for the one time tax rebate You are eligible if you meet all of the following requirements You were a Minnesota resident for part or all of 2021 You

A Minnesota Sales Tax Rebate Form is, in its most basic form, is a cash refund provided to customers after having purchased a item or service. It's a highly effective tool used by companies to attract customers, increase sales, and advertise specific products.

Types of Minnesota Sales Tax Rebate Form

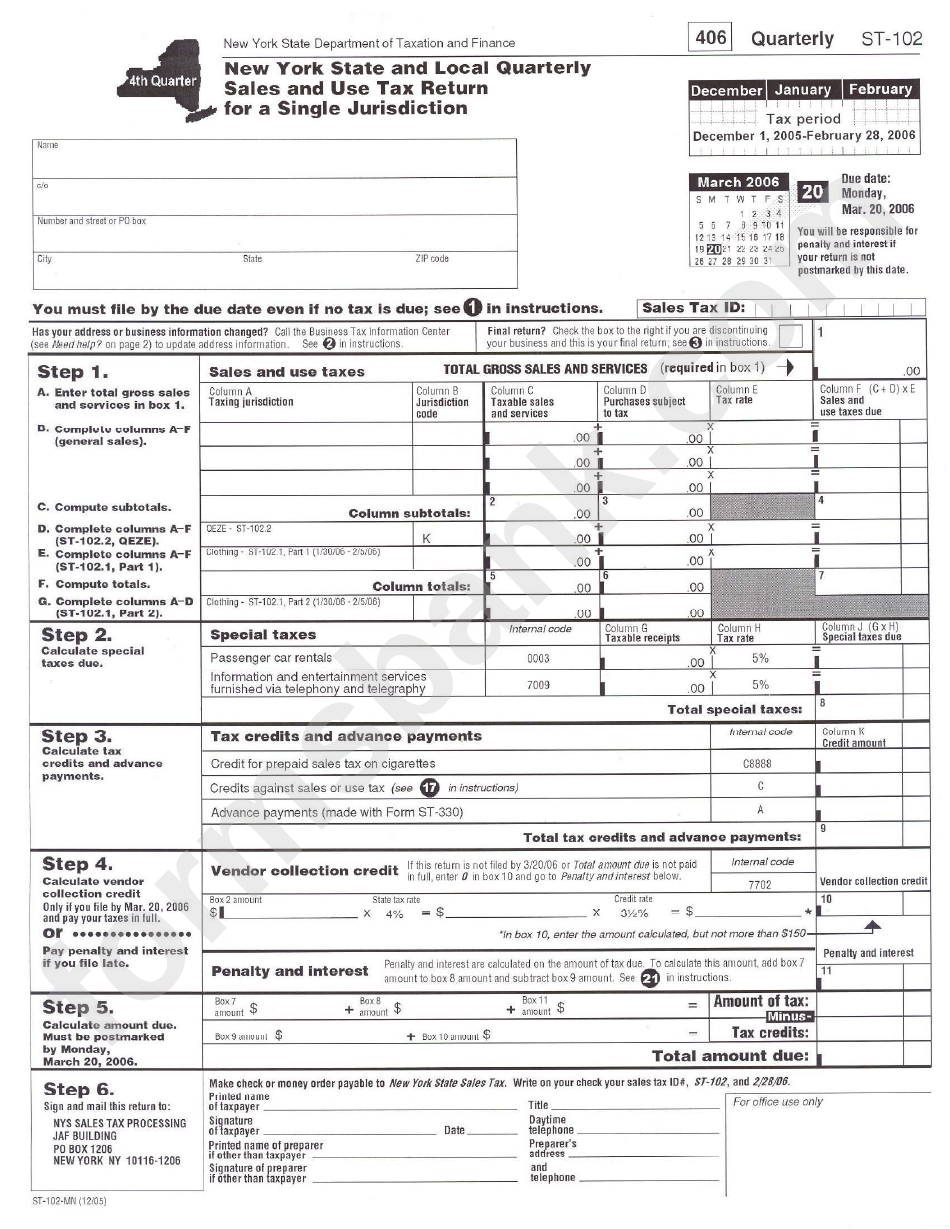

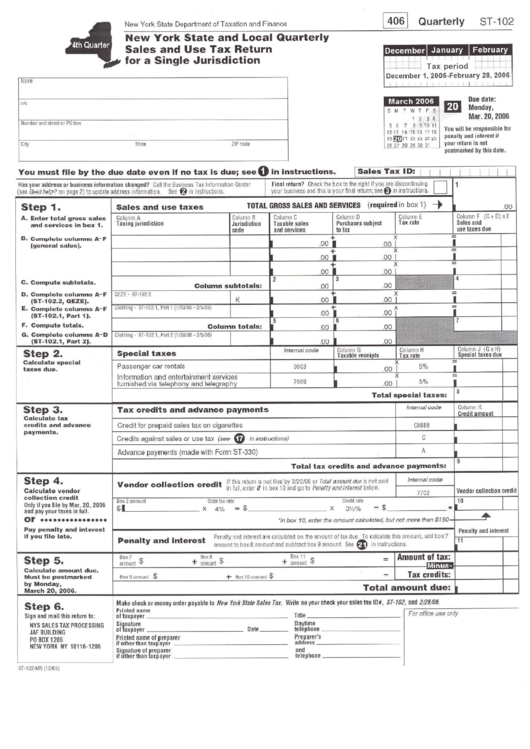

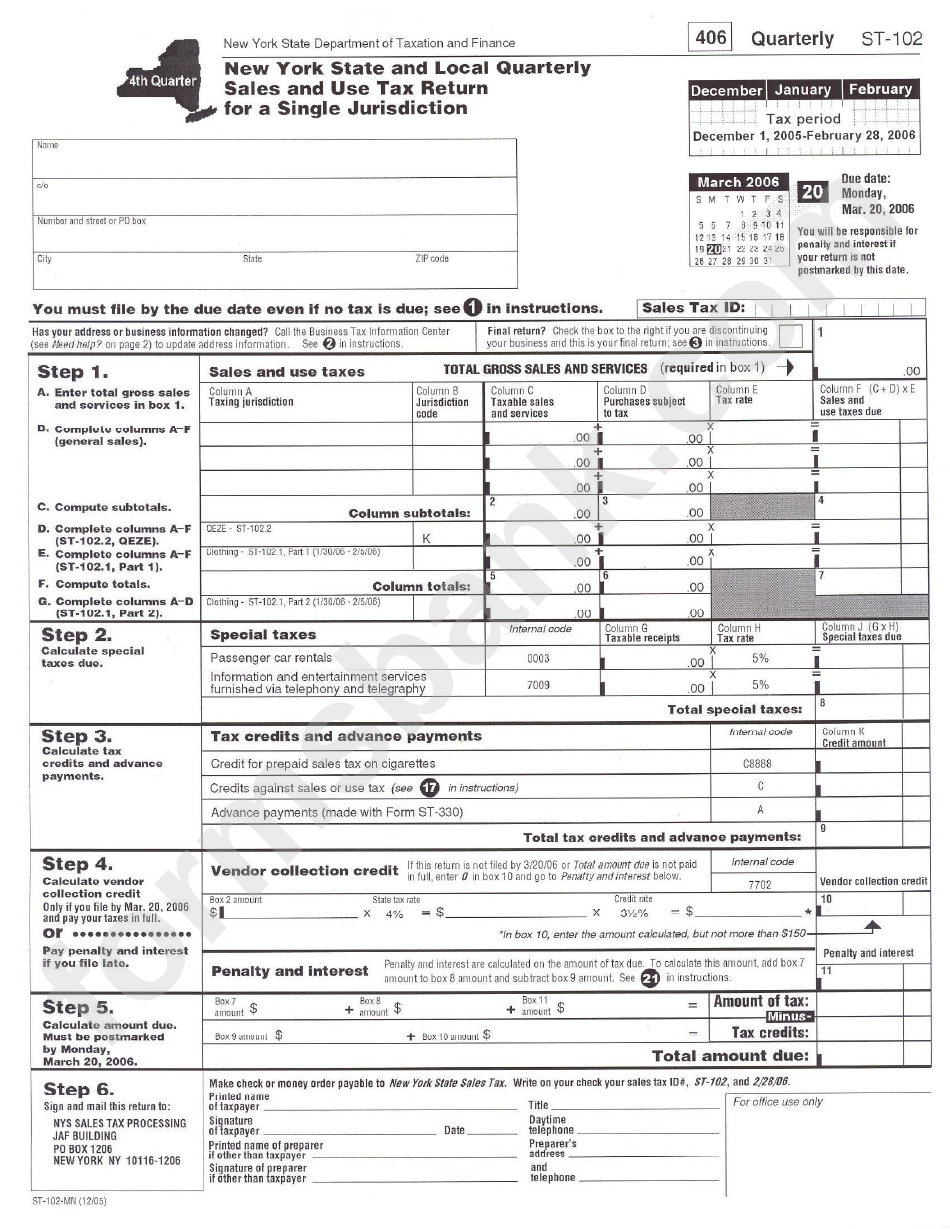

Sales And Use Tax Return Form St John The Baptist Parish Printable

Sales And Use Tax Return Form St John The Baptist Parish Printable

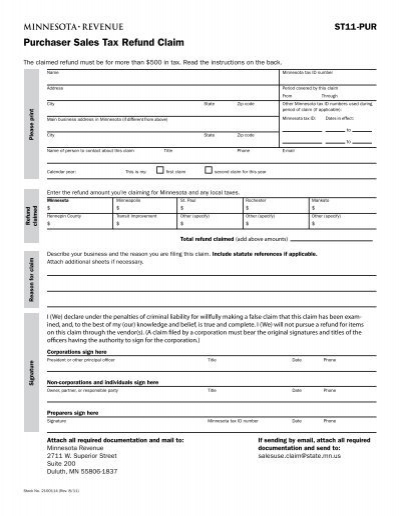

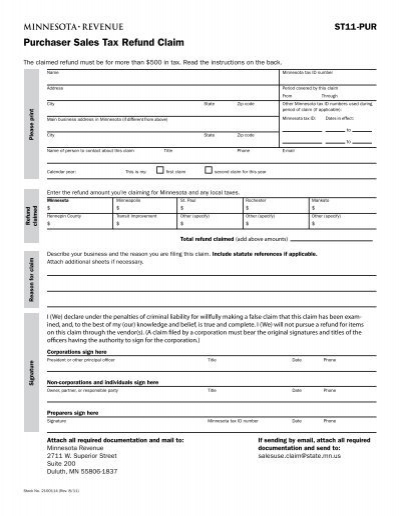

Web Rev 3 21 for Form ST11 When should I use this form To request a refund of sales tax you paid in error such as Tax paid on exempt capital equipment Tax paid on items

Web 11 juil 2023 nbsp 0183 32 Dana Ferguson St Paul July 11 2023 8 52 AM Minnesotans who have moved or changed banking information since filing their 2021 taxes will have to update

Cash Minnesota Sales Tax Rebate Form

Cash Minnesota Sales Tax Rebate Form are the most basic type of Minnesota Sales Tax Rebate Form. Customers receive a certain amount back in cash after purchasing a item. This is often for the most expensive products like electronics or appliances.

Mail-In Minnesota Sales Tax Rebate Form

Mail-in Minnesota Sales Tax Rebate Form demand that customers provide the proof of purchase to be eligible for the money. They're more involved, but can result in substantial savings.

Instant Minnesota Sales Tax Rebate Form

Instant Minnesota Sales Tax Rebate Form are credited at the point of sale, reducing the price of your purchase instantly. Customers do not have to wait for their savings when they purchase this type of Minnesota Sales Tax Rebate Form.

How Minnesota Sales Tax Rebate Form Work

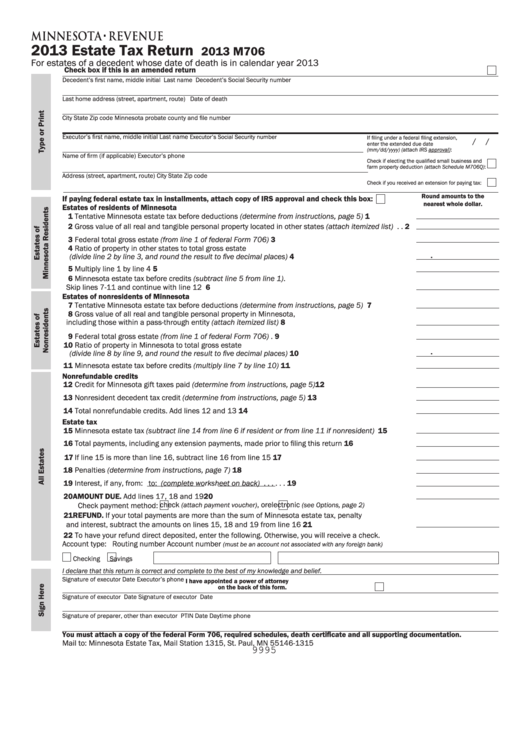

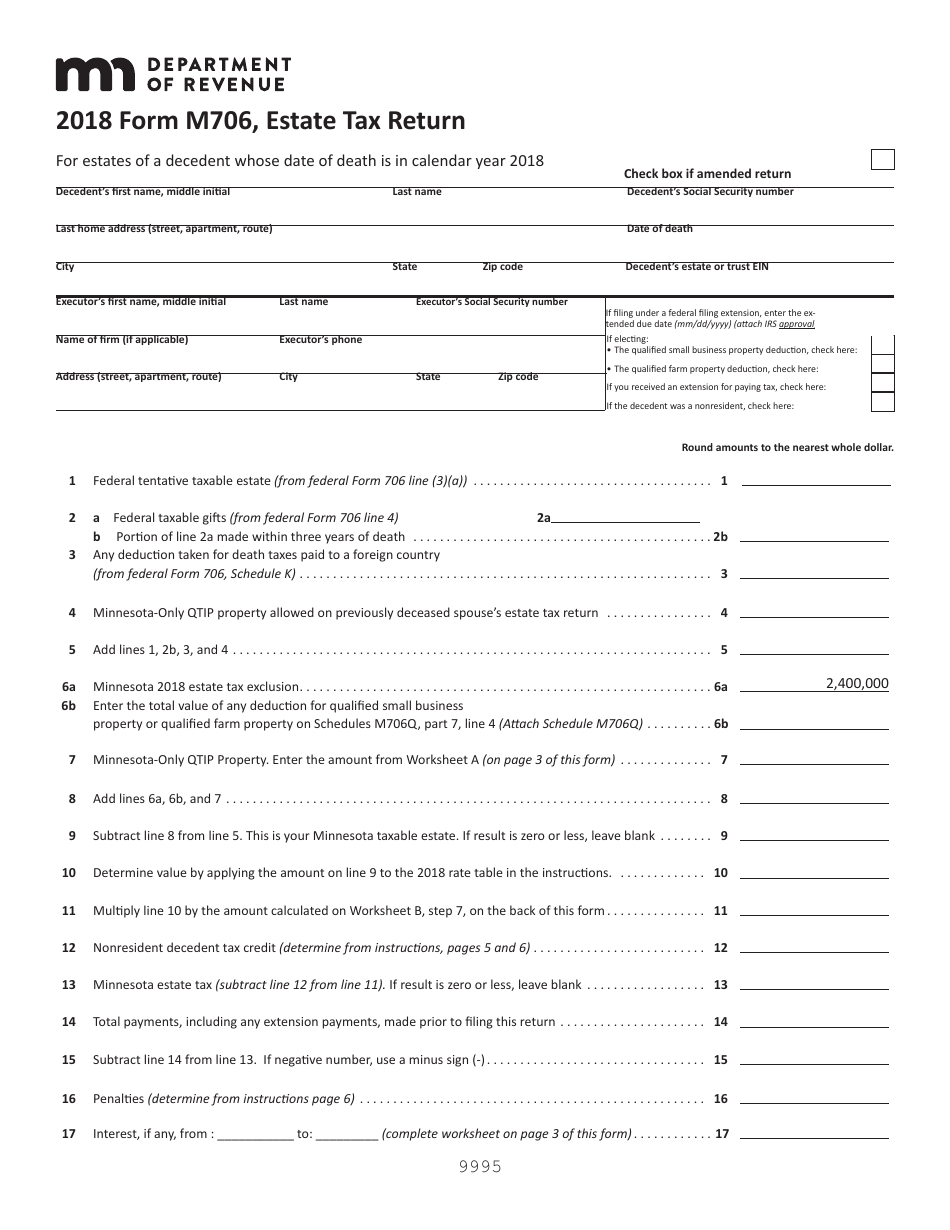

Fillable Form M706 Estate Tax Return Minnesota Department Of

Fillable Form M706 Estate Tax Return Minnesota Department Of

Web 10 juil 2023 nbsp 0183 32 The Department of Revenue uses taxpayers 2021 adjusted gross income line 1 on most state income tax forms to determine eligibility Residents can visit taxrebate mn gov to submit new or

The Minnesota Sales Tax Rebate Form Process

The procedure typically consists of a few steps

-

When you buy the product then, you buy the item just as you would ordinarily.

-

Fill in the Minnesota Sales Tax Rebate Form Form: To claim the Minnesota Sales Tax Rebate Form you'll need be able to provide a few details including your name, address along with the purchase details, to apply for your Minnesota Sales Tax Rebate Form.

-

Submit the Minnesota Sales Tax Rebate Form The Minnesota Sales Tax Rebate Form must be submitted in accordance with the nature of Minnesota Sales Tax Rebate Form it is possible that you need to submit a form by mail or send it via the internet.

-

Wait for approval: The business will examine your application and ensure that it's compliant with Minnesota Sales Tax Rebate Form's terms and conditions.

-

Enjoy your Minnesota Sales Tax Rebate Form Once you've received your approval, you'll receive your cash back whether via check, credit card, or any other option that's specified in the offer.

Pros and Cons of Minnesota Sales Tax Rebate Form

Advantages

-

Cost savings A Minnesota Sales Tax Rebate Form can significantly cut the price you pay for products.

-

Promotional Offers: They encourage customers to experiment with new products, or brands.

-

Help to Increase Sales Reward programs can boost sales for a company and also increase market share.

Disadvantages

-

Complexity: Mail-in Minnesota Sales Tax Rebate Form, in particular difficult and slow-going.

-

Extension Dates Most Minnesota Sales Tax Rebate Form come with specific deadlines for submission.

-

The risk of non-payment Some customers might not be able to receive their Minnesota Sales Tax Rebate Form if they don't follow the regulations exactly.

Download Minnesota Sales Tax Rebate Form

Download Minnesota Sales Tax Rebate Form

FAQs

1. Are Minnesota Sales Tax Rebate Form similar to discounts? No, Minnesota Sales Tax Rebate Form involve one-third of the amount refunded following purchase, and discounts are a reduction of their price at moment of sale.

2. Are there any Minnesota Sales Tax Rebate Form that I can use on the same product This is dependent on terms on the Minnesota Sales Tax Rebate Form offered and product's suitability. Certain companies may permit it, while others won't.

3. How long will it take to receive an Minnesota Sales Tax Rebate Form What is the timeframe? can vary, but typically it will last from a few weeks until a few months for you to receive your Minnesota Sales Tax Rebate Form.

4. Do I need to pay taxes regarding Minnesota Sales Tax Rebate Form quantities? the majority of situations, Minnesota Sales Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Minnesota Sales Tax Rebate Form offers from brands that aren't well-known it is crucial to conduct research and confirm that the brand that is offering the Minnesota Sales Tax Rebate Form is reputable prior to making any purchase.

Sales And Use Tax Return Form St John The Baptist Parish Printable

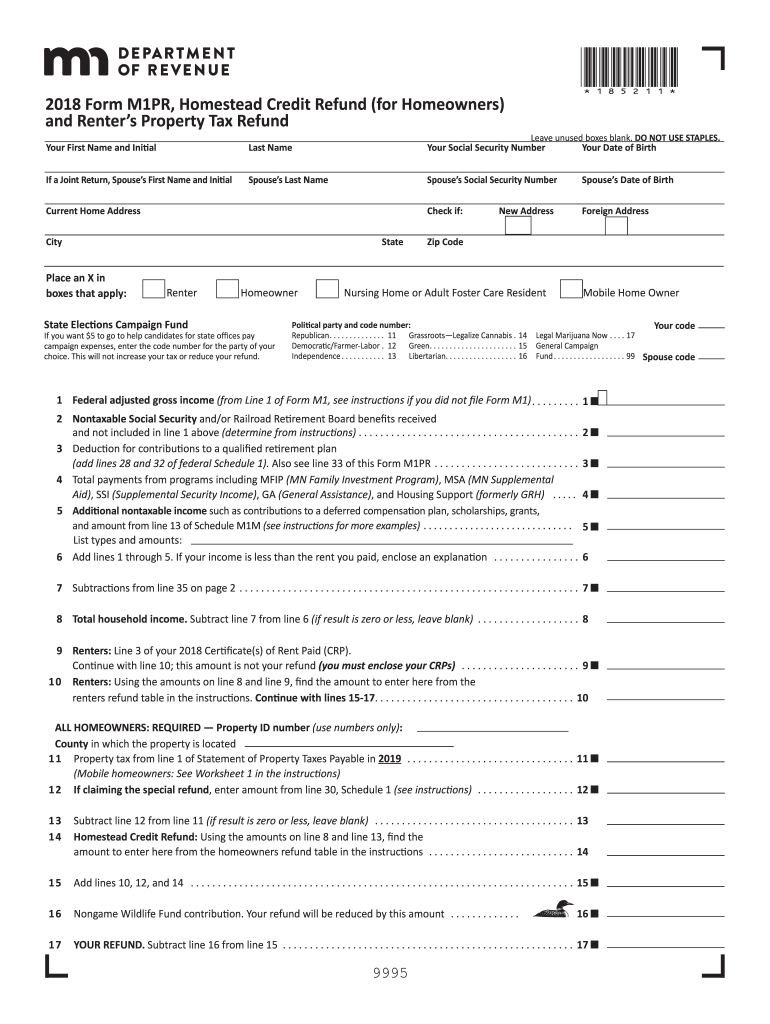

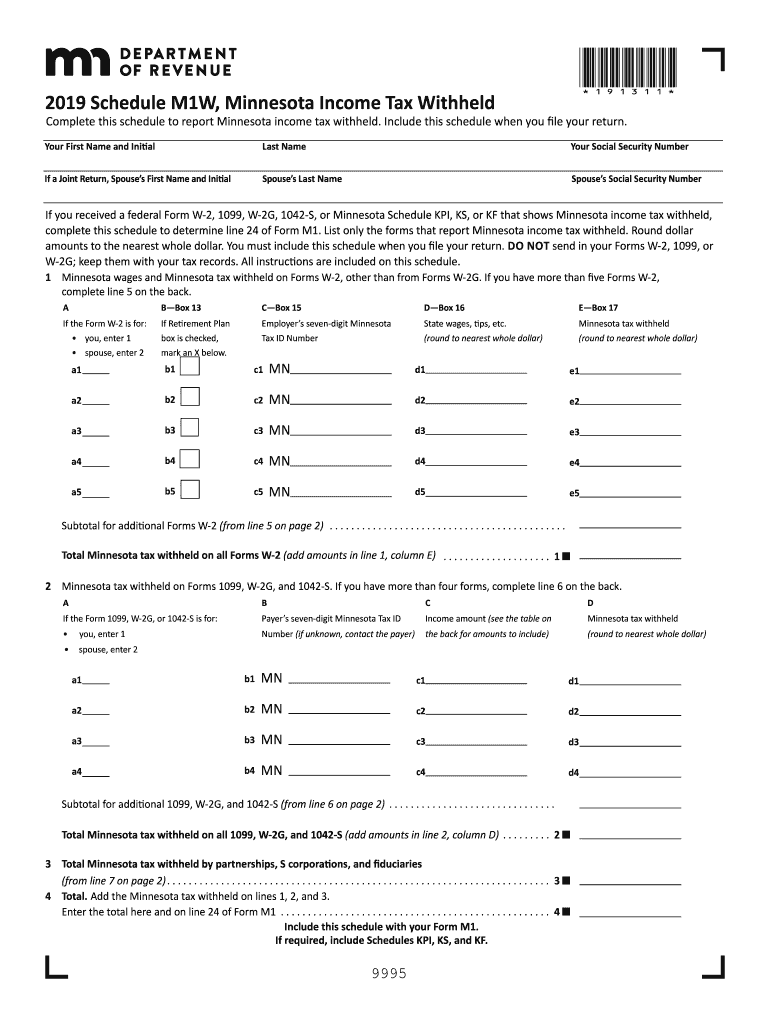

M1pr Form Fill Out Sign Online DocHub

Check more sample of Minnesota Sales Tax Rebate Form below

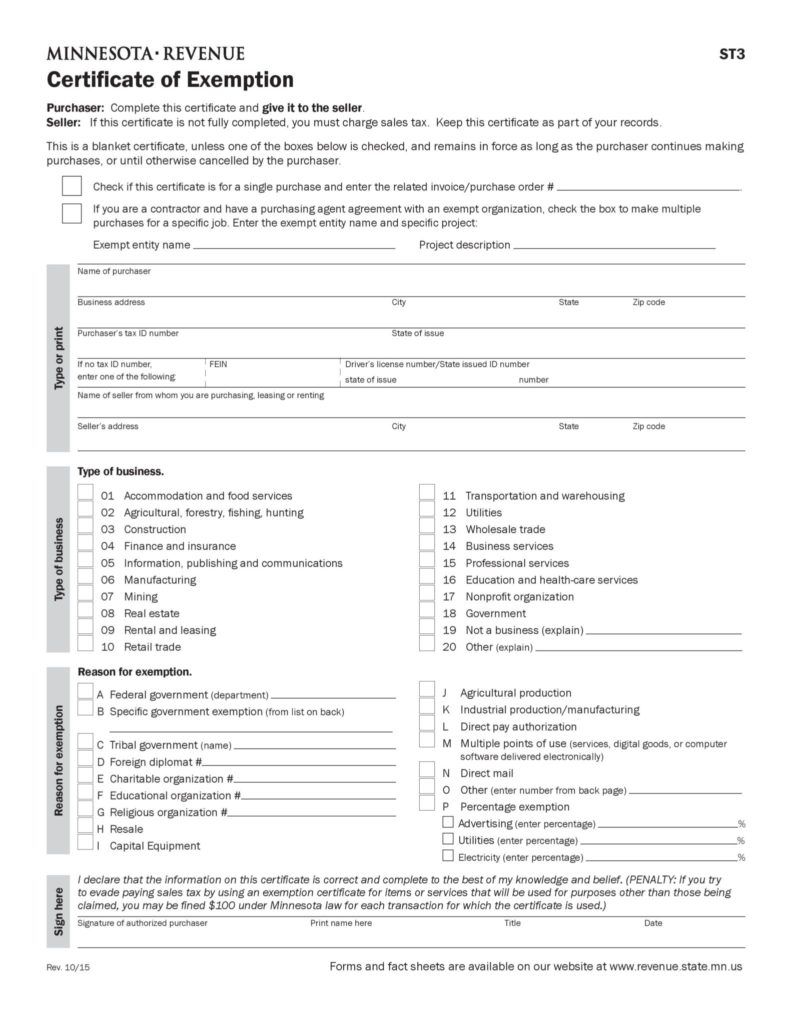

2019 2023 Form MN DoR ST3 Fill Online Printable Fillable Blank

Minneaots Income Tax Form M1prx Fill Out Sign Online DocHub

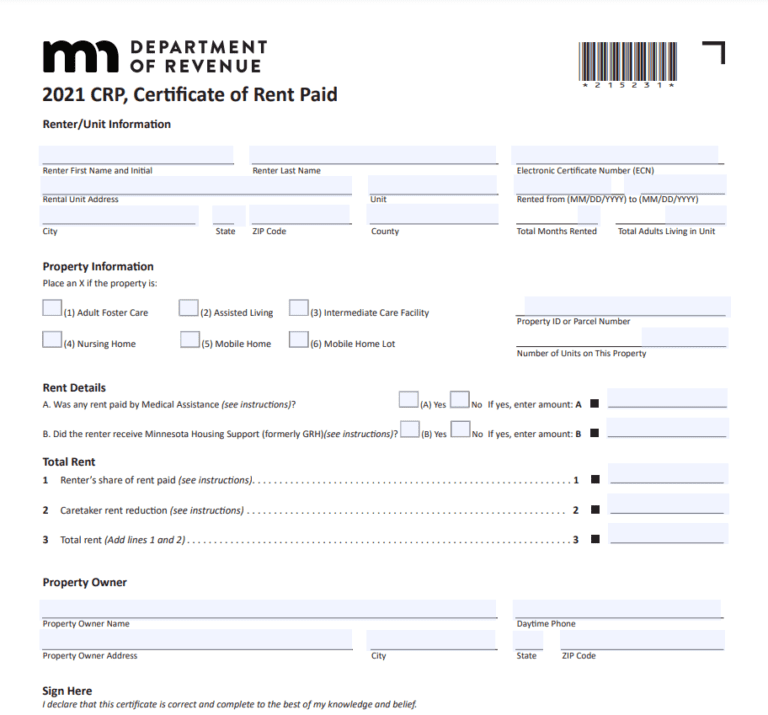

MN Renters Printable Rebate Form

2020 Minnesota Tax Fill Out And Sign Printable PDF Template SignNow

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

Form ST11 PUR Purchaser Sales Tax Refund Claim Minnesota

https://www.revenue.state.mn.us/press-release/2023-07-10/department...

Web 10 juil 2023 nbsp 0183 32 Who is eligible for the one time tax rebate You are eligible if you meet all of the following requirements You were a Minnesota resident for part or all of 2021 You

https://www.revenue.state.mn.us/sales-and-use-tax

Web Calculate Sales Tax Rate Log into e Services Fact Sheets and Industry Guides Sales Tax Business Guide Make a Payment Find a Form

Web 10 juil 2023 nbsp 0183 32 Who is eligible for the one time tax rebate You are eligible if you meet all of the following requirements You were a Minnesota resident for part or all of 2021 You

Web Calculate Sales Tax Rate Log into e Services Fact Sheets and Industry Guides Sales Tax Business Guide Make a Payment Find a Form

2020 Minnesota Tax Fill Out And Sign Printable PDF Template SignNow

Minneaots Income Tax Form M1prx Fill Out Sign Online DocHub

Minnesota Property Tax Refund Fill Out And Sign Printable PDF

Form ST11 PUR Purchaser Sales Tax Refund Claim Minnesota

C mo Usar Un Certificado De Reventa De MinnesotaTaxJar Blog Home

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Form M706 Download Fillable PDF Or Fill Online Estate Tax Return 2018