In our current world of high-end consumer goods, everyone loves a good bargain. One of the ways to enjoy significant savings when you shop is with Employee And Partner Gst Hst Rebate Forms. Employee And Partner Gst Hst Rebate Forms are a marketing strategy employed by retailers and manufacturers to provide customers with a partial return on their purchases once they've made them. In this post, we'll examine the subject of Employee And Partner Gst Hst Rebate Forms and explore what they are as well as how they work and the best way to increase your savings via these cost-effective incentives.

Get Latest Employee And Partner Gst Hst Rebate Form Below

Employee And Partner Gst Hst Rebate Form

Employee And Partner Gst Hst Rebate Form -

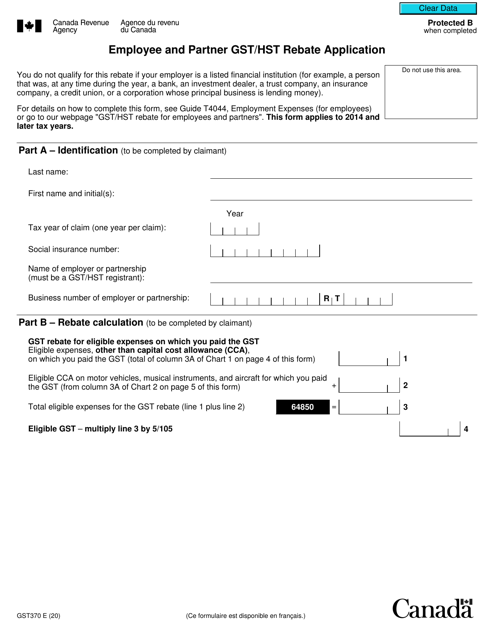

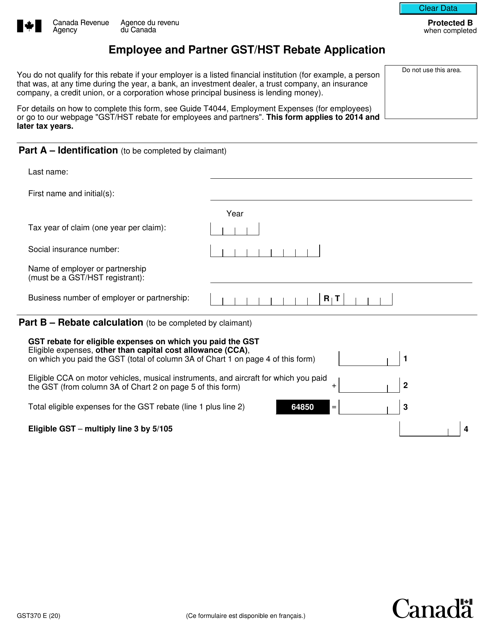

Web Application GST370 Employee and Partner GST HST Rebate Application How to complete Form GST370 You have to complete Parts A B and D of Form GST370

Web Rebate Application You must complete parts A B and D of Form GST370 If applicable your employer has to complete Part C Use a separate form for each tax year Part A

A Employee And Partner Gst Hst Rebate Form the simplest form, is a return to the customer who has purchased a particular product or service. It's a powerful method used by companies to attract buyers, increase sales and promote specific products.

Types of Employee And Partner Gst Hst Rebate Form

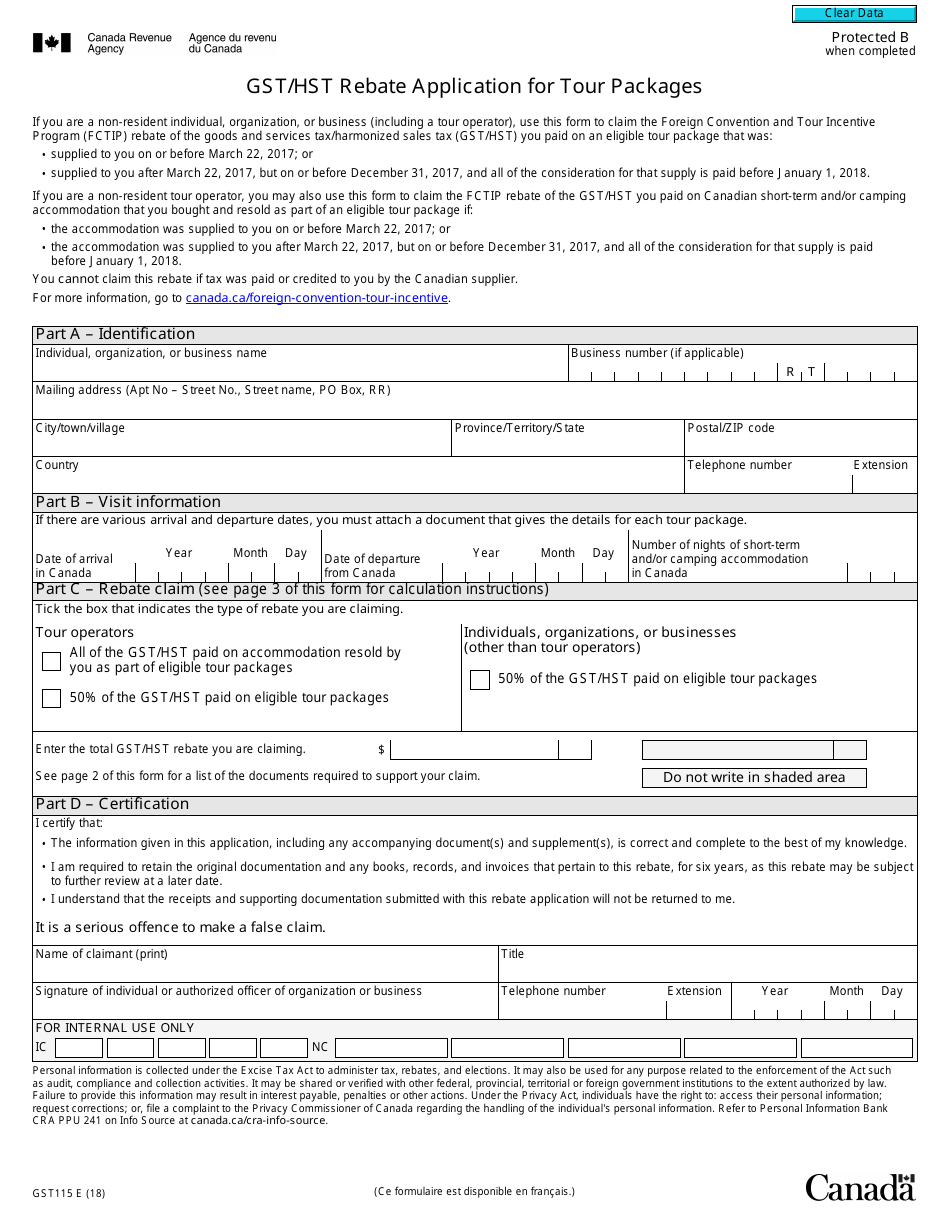

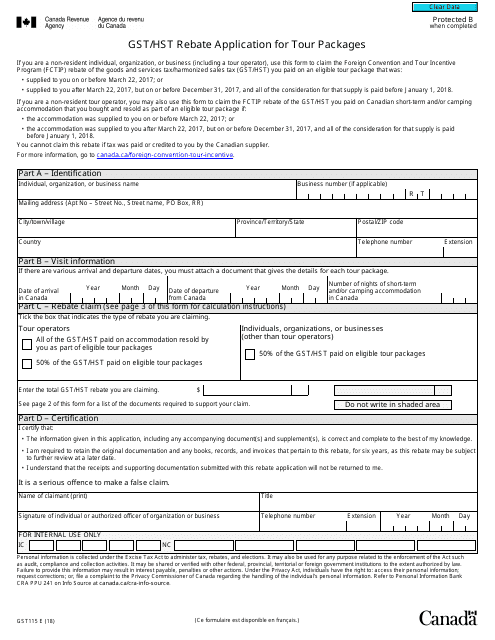

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

Web If you were employed by a company or you re a member of a partnership that is a GST HST registrant you might be able to claim a rebate for the GST HST you paid on any

Web EMPLOYEE AND PARTNER GST HST REBATE APPLICATION GST370 E 11 For details on how to complete this form see Guide T4044 Employment Expenses for

Cash Employee And Partner Gst Hst Rebate Form

Cash Employee And Partner Gst Hst Rebate Form are the most straightforward type of Employee And Partner Gst Hst Rebate Form. Customers are offered a certain amount of money when purchasing a product. These are typically for high-ticket items like electronics or appliances.

Mail-In Employee And Partner Gst Hst Rebate Form

Mail-in Employee And Partner Gst Hst Rebate Form require consumers to provide the proof of purchase in order to receive their reimbursement. They're somewhat more complicated, but they can provide significant savings.

Instant Employee And Partner Gst Hst Rebate Form

Instant Employee And Partner Gst Hst Rebate Form are applied right at the moment of sale, cutting the price of your purchase instantly. Customers don't have to wait long for savings through this kind of offer.

How Employee And Partner Gst Hst Rebate Form Work

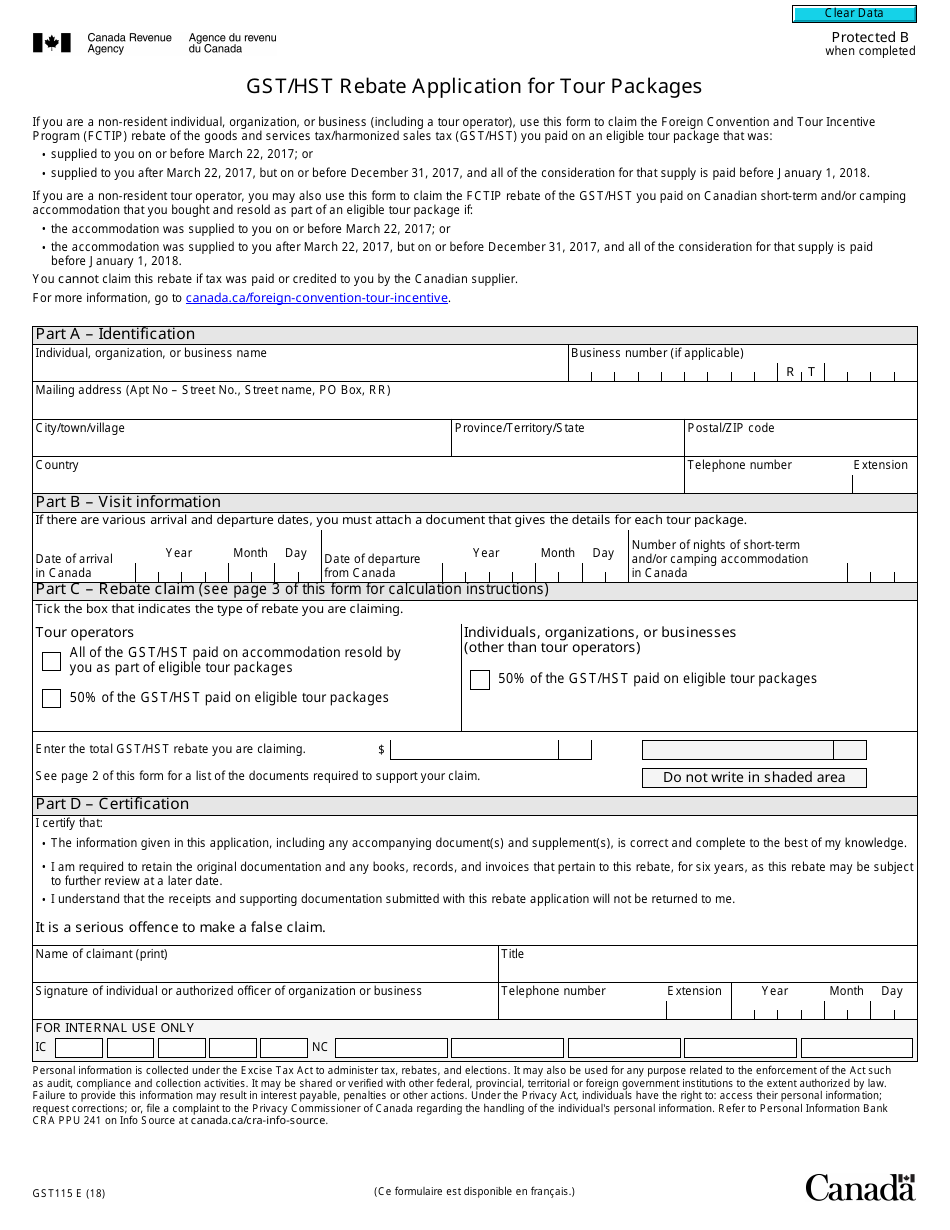

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Web partners who are eligible to deduct expenses regarding their partnership duties if the partnership is a GST HST registrant This rebate is claimed on the personal income tax

The Employee And Partner Gst Hst Rebate Form Process

The process usually involves a few steps:

-

Then, you purchase the product, you purchase the item just like you normally would.

-

Complete the Employee And Partner Gst Hst Rebate Form form: You'll need to provide some data like your name, address and purchase details, in order to get your Employee And Partner Gst Hst Rebate Form.

-

Send in the Employee And Partner Gst Hst Rebate Form According to the nature of Employee And Partner Gst Hst Rebate Form there may be a requirement to submit a claim form to the bank or make it available online.

-

Wait for approval: The business will look over your submission to ensure it meets the refund's conditions and terms.

-

Redeem your Employee And Partner Gst Hst Rebate Form After approval, you'll receive your refund via check, prepaid card, or any other option specified by the offer.

Pros and Cons of Employee And Partner Gst Hst Rebate Form

Advantages

-

Cost Savings Employee And Partner Gst Hst Rebate Form can dramatically reduce the cost for the product.

-

Promotional Offers they encourage their customers to try out new products or brands.

-

boost sales: Employee And Partner Gst Hst Rebate Form can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Employee And Partner Gst Hst Rebate Form that are mail-in, in particular the case of HTML0, can be a hassle and take a long time to complete.

-

Deadlines for Expiration Some Employee And Partner Gst Hst Rebate Form have certain deadlines for submitting.

-

Risk of Non-Payment Certain customers could miss out on Employee And Partner Gst Hst Rebate Form because they don't adhere to the rules precisely.

Download Employee And Partner Gst Hst Rebate Form

Download Employee And Partner Gst Hst Rebate Form

FAQs

1. Are Employee And Partner Gst Hst Rebate Form similar to discounts? No, Employee And Partner Gst Hst Rebate Form require one-third of the amount refunded following purchase, whereas discounts cut the purchase price at the moment of sale.

2. Do I have to use multiple Employee And Partner Gst Hst Rebate Form on the same item What is the best way to do it? It's contingent on terms for the Employee And Partner Gst Hst Rebate Form offer and also the item's quality and eligibility. Certain companies might permit it, while others won't.

3. How long does it take to get the Employee And Partner Gst Hst Rebate Form? The length of time will vary, but it may take several weeks to a few months to get your Employee And Partner Gst Hst Rebate Form.

4. Do I have to pay tax of Employee And Partner Gst Hst Rebate Form montants? the majority of instances, Employee And Partner Gst Hst Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Employee And Partner Gst Hst Rebate Form offers from lesser-known brands Consider doing some research and confirm that the company which is providing the Employee And Partner Gst Hst Rebate Form is legitimate prior to making an acquisition.

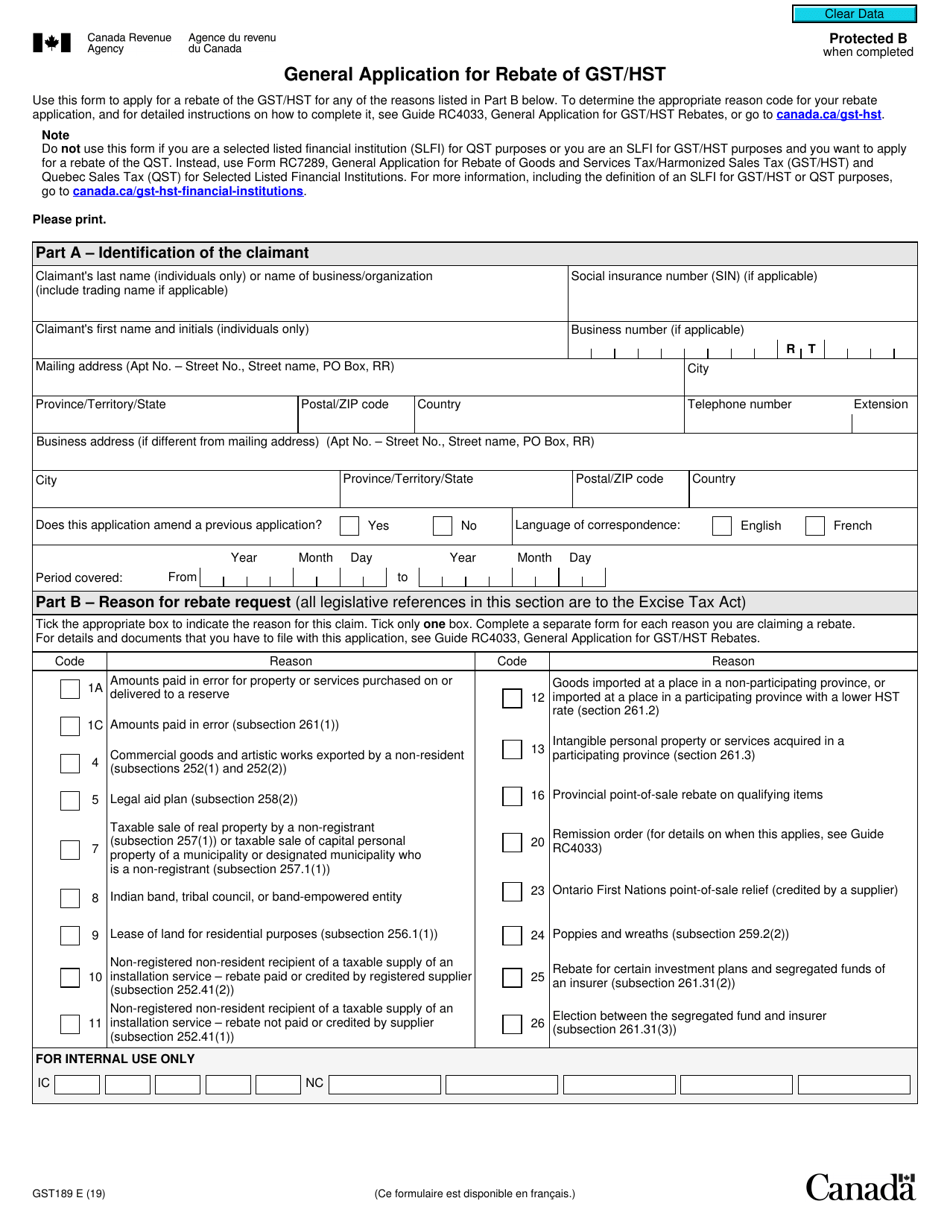

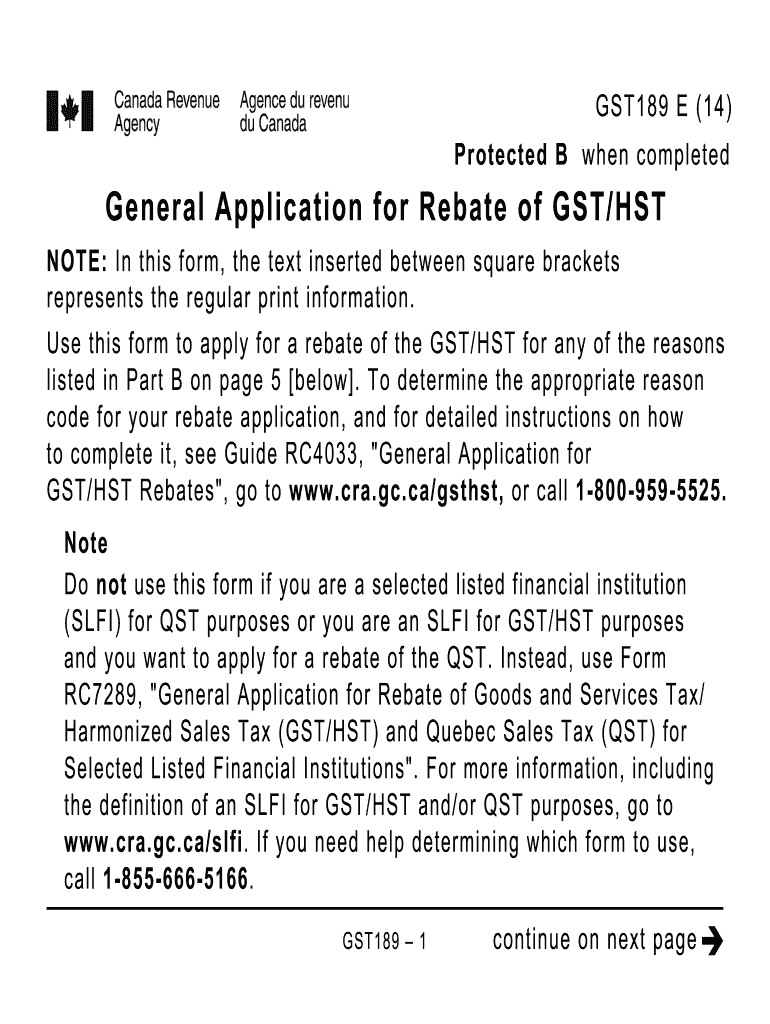

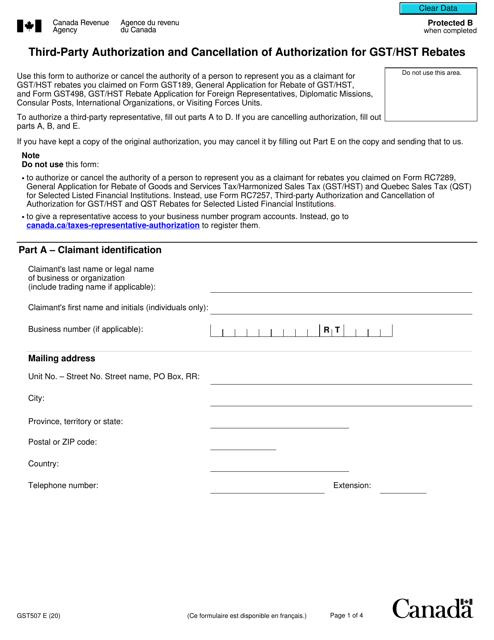

Form GST189 Download Fillable PDF Or Fill Online General Application

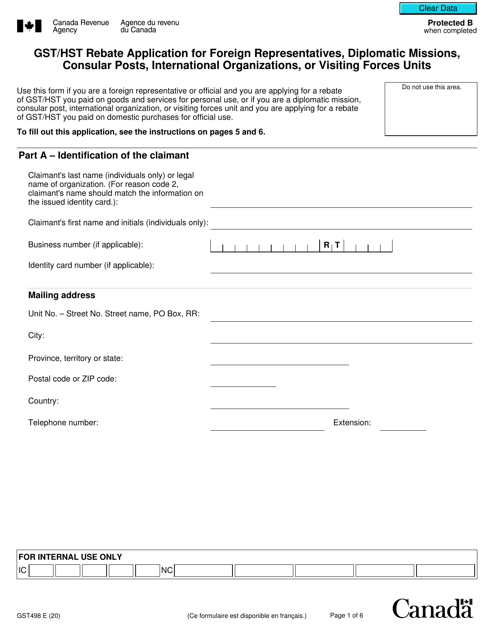

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Check more sample of Employee And Partner Gst Hst Rebate Form below

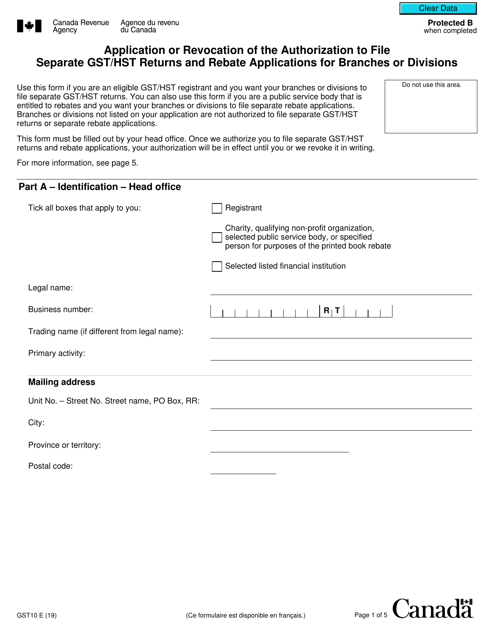

Form GST10 Download Fillable PDF Or Fill Online Application Or

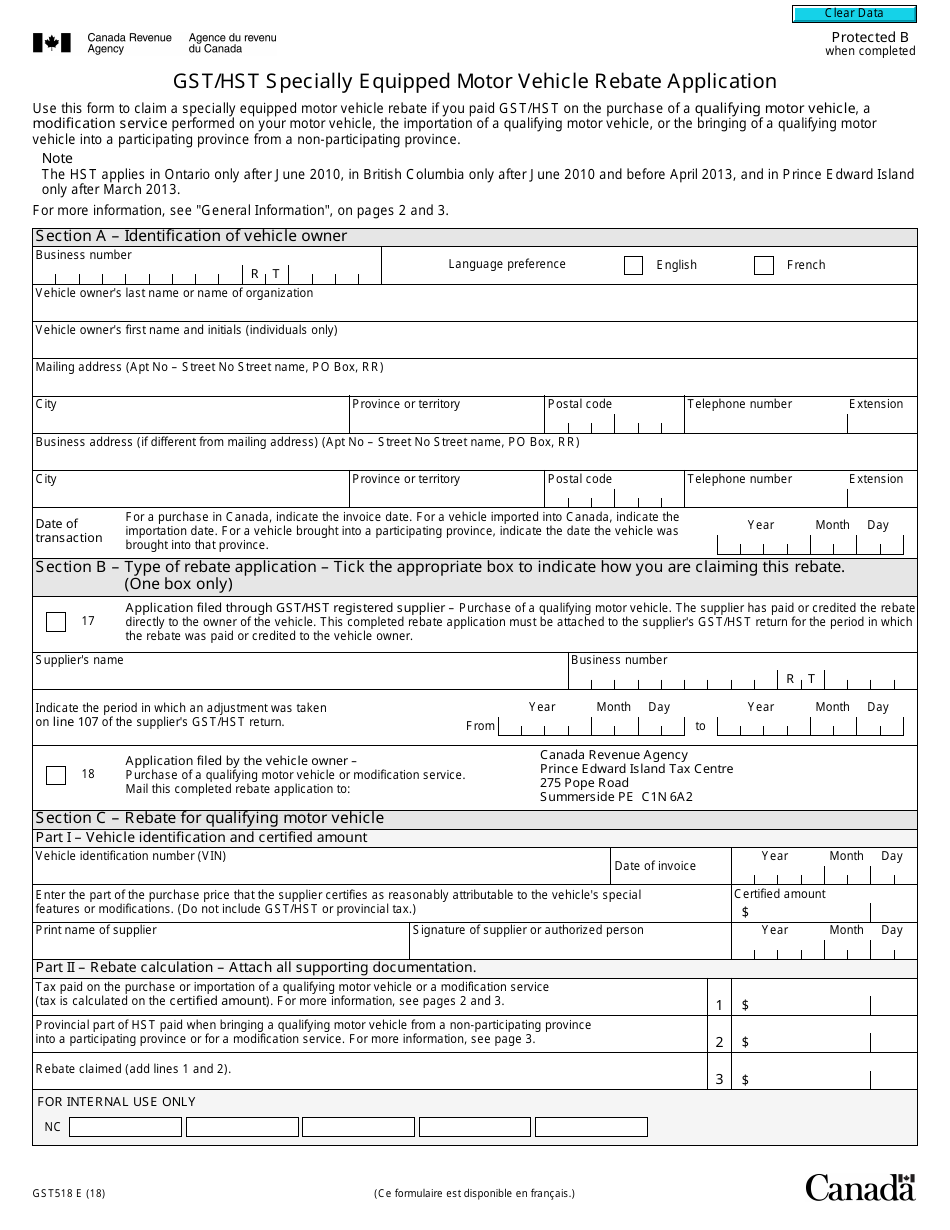

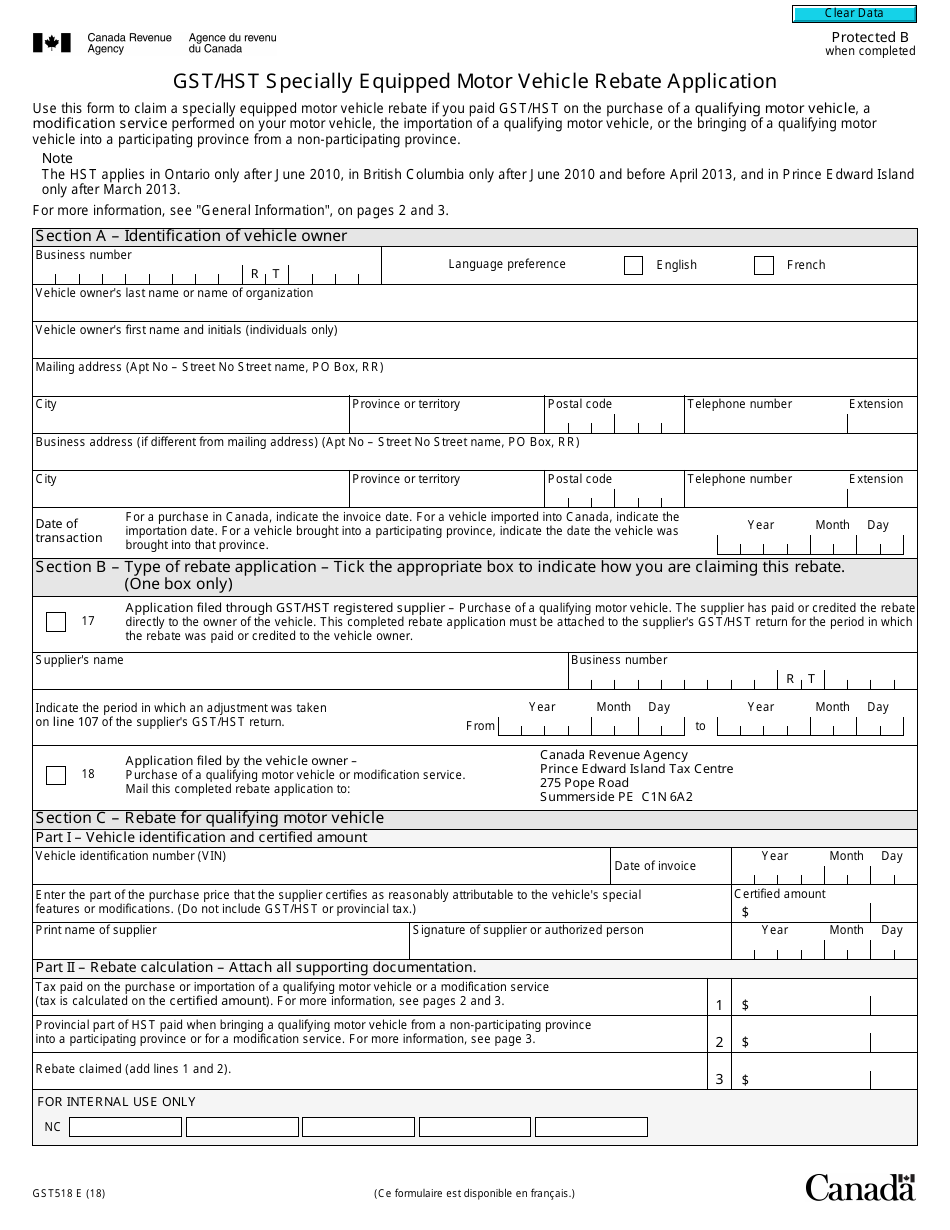

Form GST518 Download Fillable PDF Or Fill Online Gst Hst Specially

Gst Rebate Canada Fill Out And Sign Printable PDF Template SignNow

Gst hst New Residential Rental Property Rebate PropertyRebate

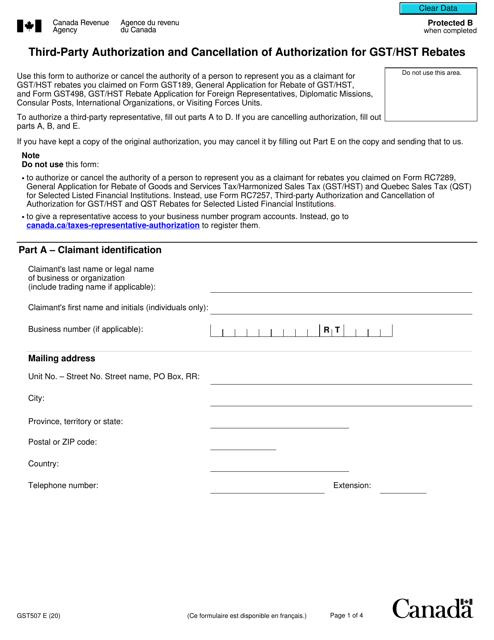

Form GST507 Download Fillable PDF Or Fill Online Third Party

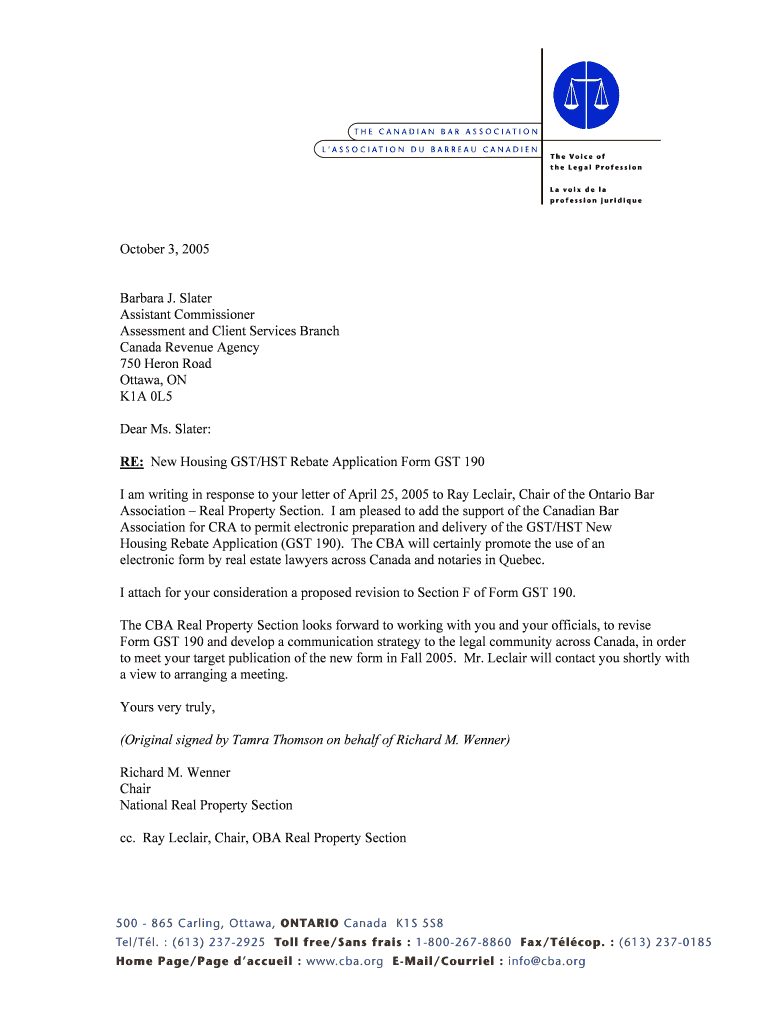

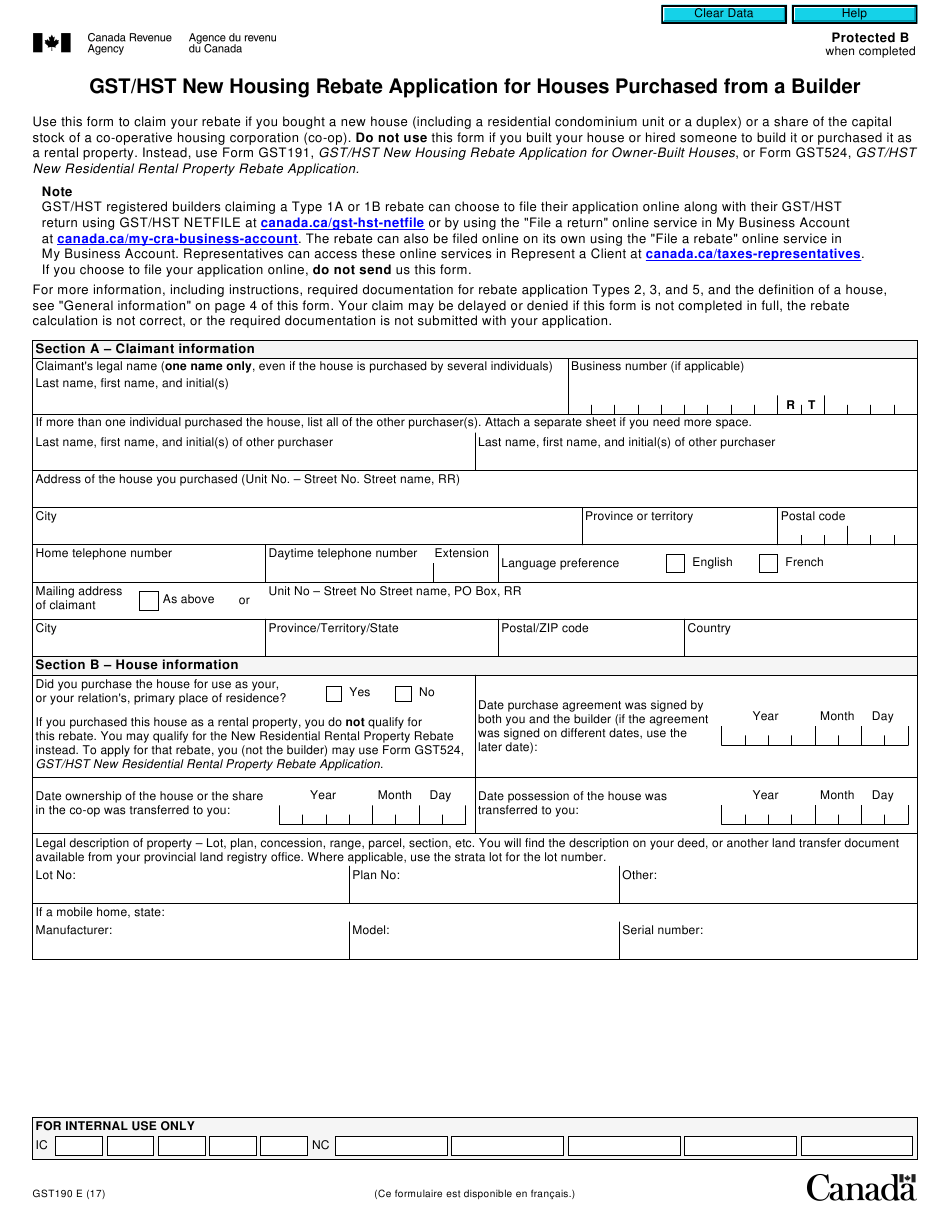

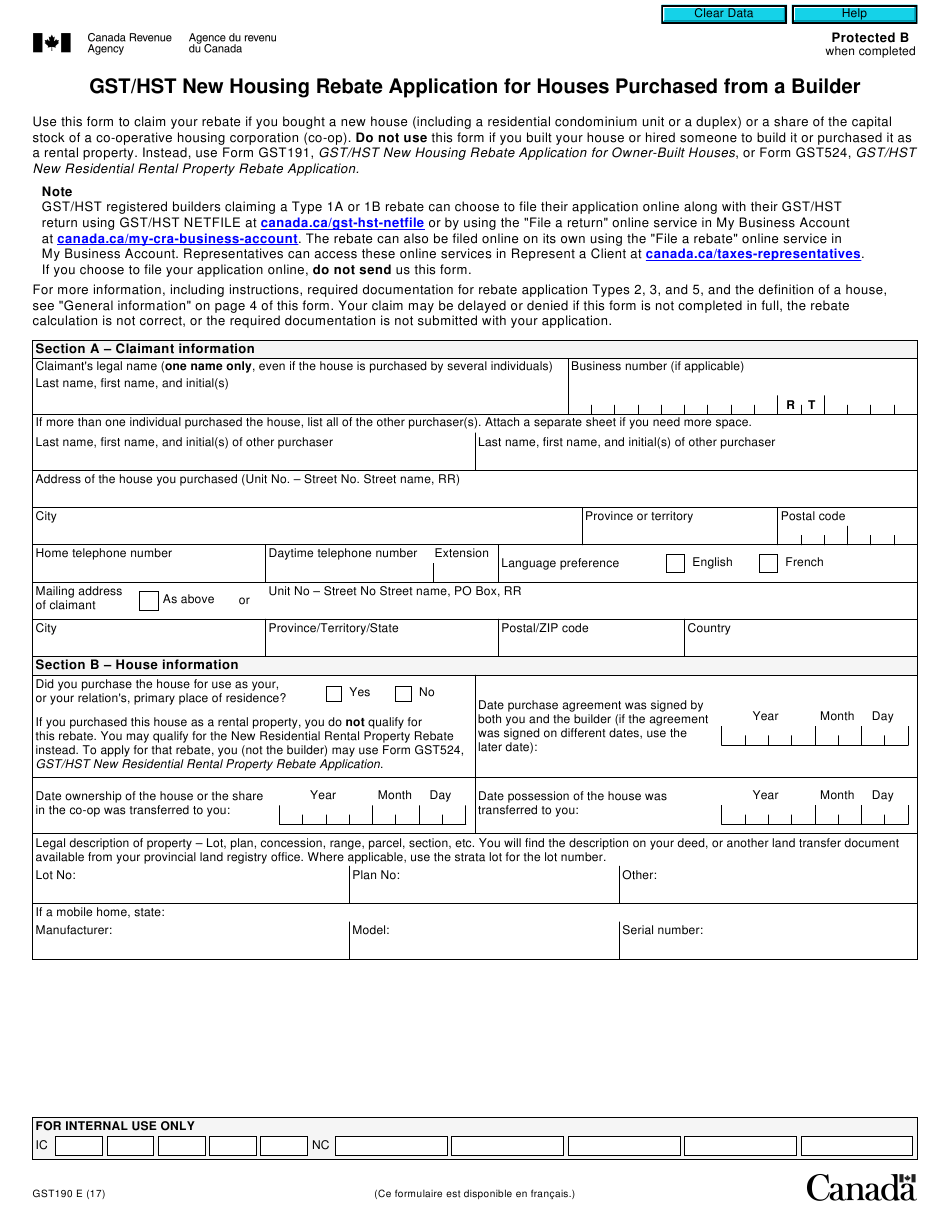

Fillable Online New Housing GST HST Rebate Application Form GST 190 Fax

https://www.canada.ca/.../complete-form-gst370.html

Web Rebate Application You must complete parts A B and D of Form GST370 If applicable your employer has to complete Part C Use a separate form for each tax year Part A

https://www.canada.ca/.../line-45700-employee-partner-gst-hst-rebate.html

Web You are a member of a GST HST registered partnership and you have reported on your return your share of the income from that partnership For information see Guide T4044

Web Rebate Application You must complete parts A B and D of Form GST370 If applicable your employer has to complete Part C Use a separate form for each tax year Part A

Web You are a member of a GST HST registered partnership and you have reported on your return your share of the income from that partnership For information see Guide T4044

Gst hst New Residential Rental Property Rebate PropertyRebate

Form GST518 Download Fillable PDF Or Fill Online Gst Hst Specially

Form GST507 Download Fillable PDF Or Fill Online Third Party

Fillable Online New Housing GST HST Rebate Application Form GST 190 Fax

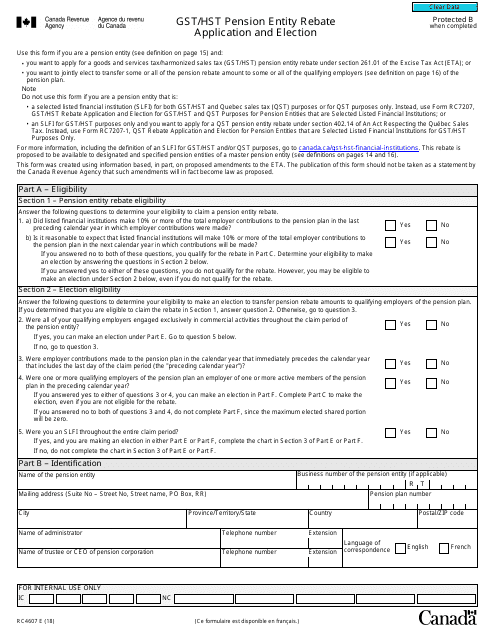

Form RC4607 Download Fillable PDF Or Fill Online Gst Hst Pension Entity

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Gst191 Fillable Form Printable Forms Free Online