In our current world of high-end consumer goods everyone enjoys a good bargain. One way to earn significant savings from your purchases is via Irs Recovery Rebate Credit Forms. Irs Recovery Rebate Credit Forms can be a way of marketing that retailers and manufacturers use for offering customers a percentage payment on their purchases, after they have taken them. In this post, we'll look into the world of Irs Recovery Rebate Credit Forms. We'll explore what they are about, how they work, and how you can make the most of your savings by taking advantage of these cost-effective incentives.

Get Latest Irs Recovery Rebate Credit Form Below

Irs Recovery Rebate Credit Form

Irs Recovery Rebate Credit Form - Irs Recovery Rebate Credit Form, Irs Forms 2021 Recovery Rebate Credit Worksheet, What Is Irs Recovery Rebate Credit

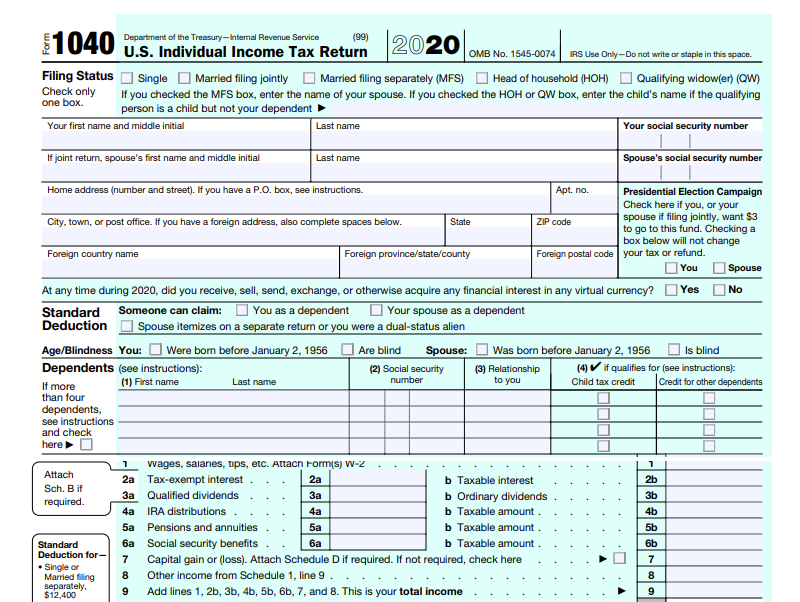

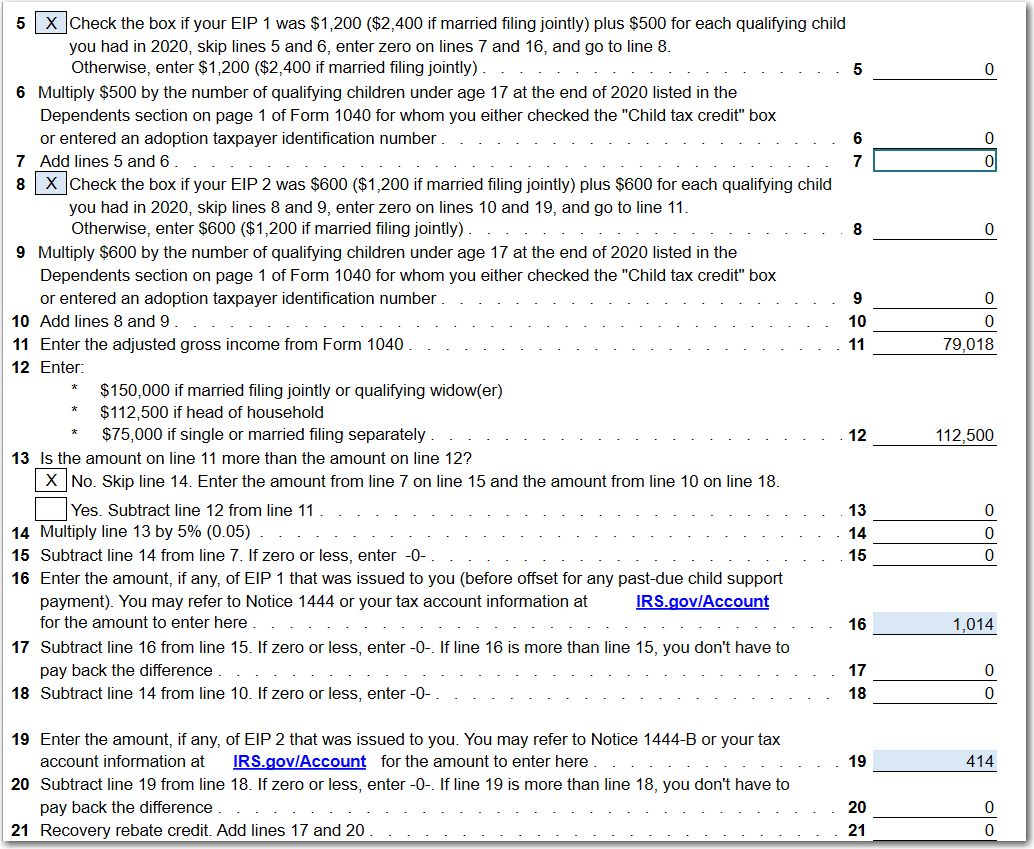

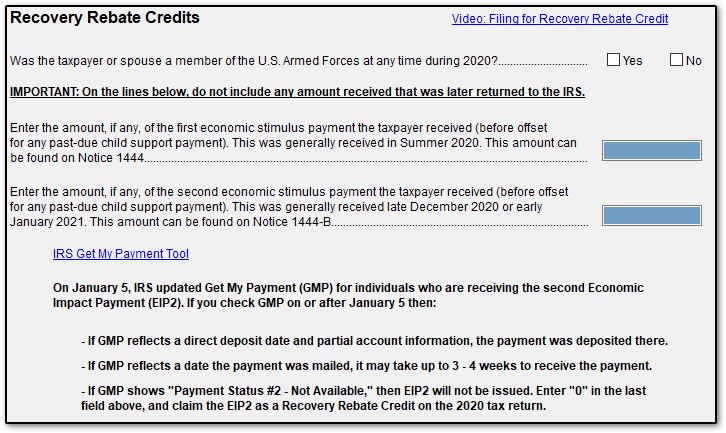

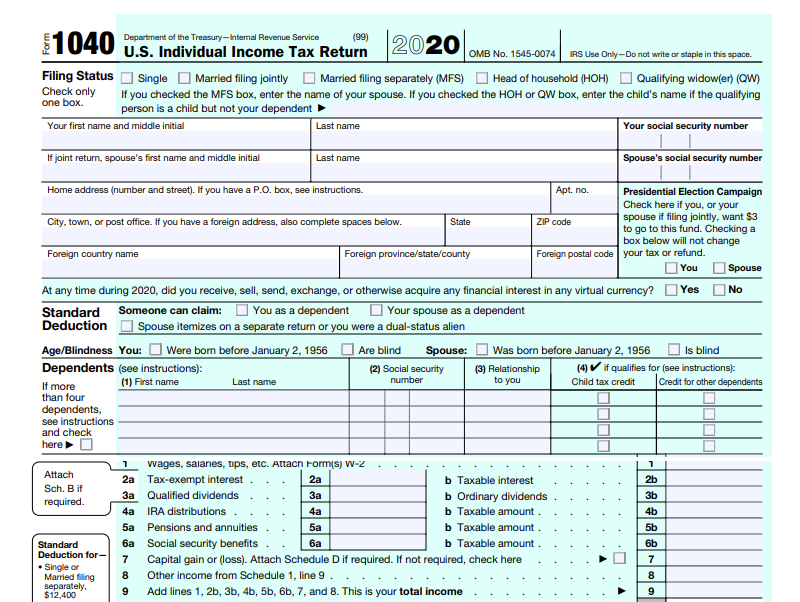

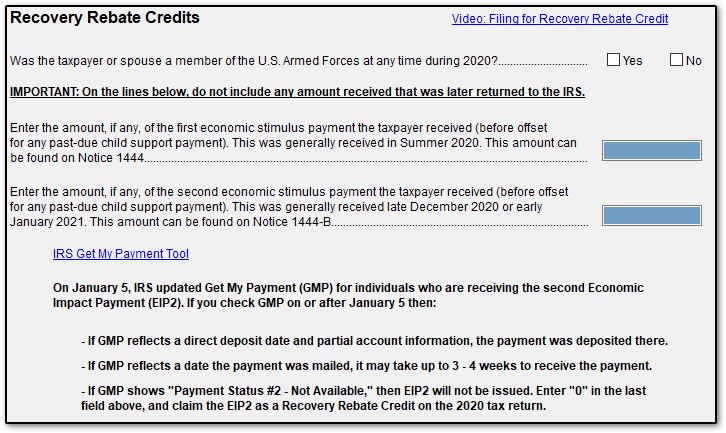

2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time

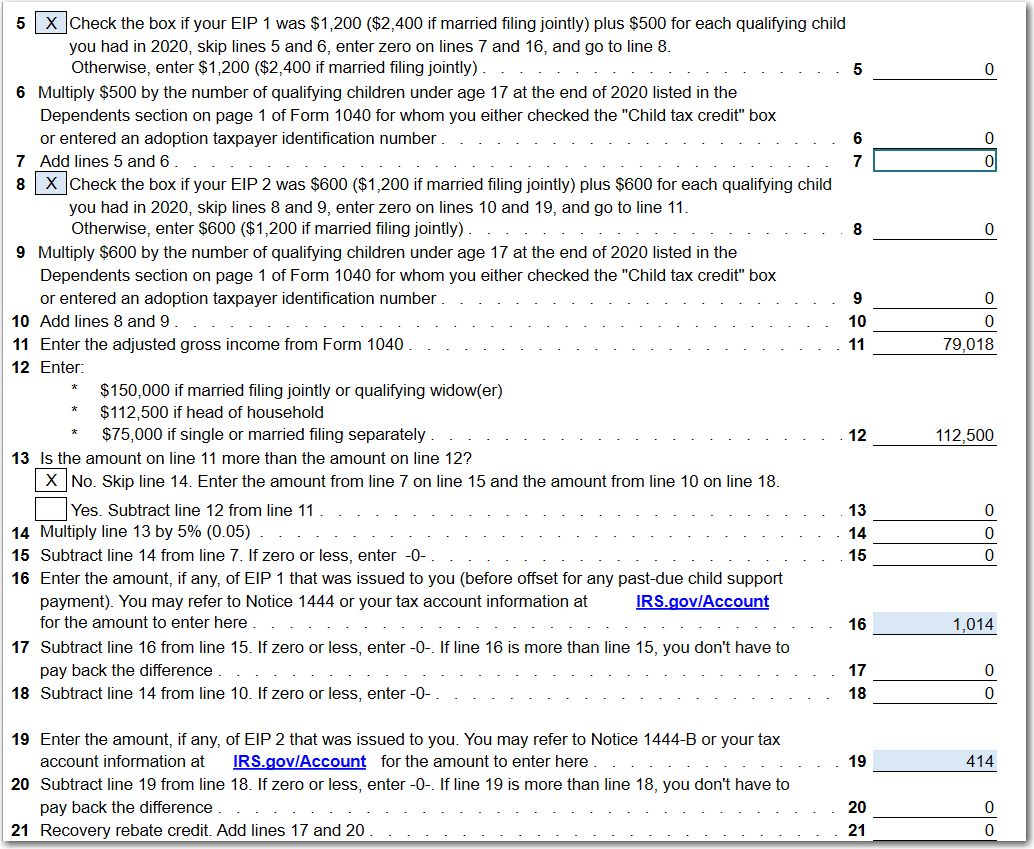

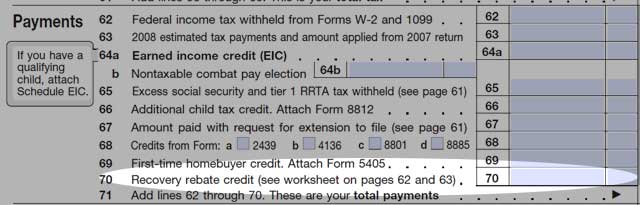

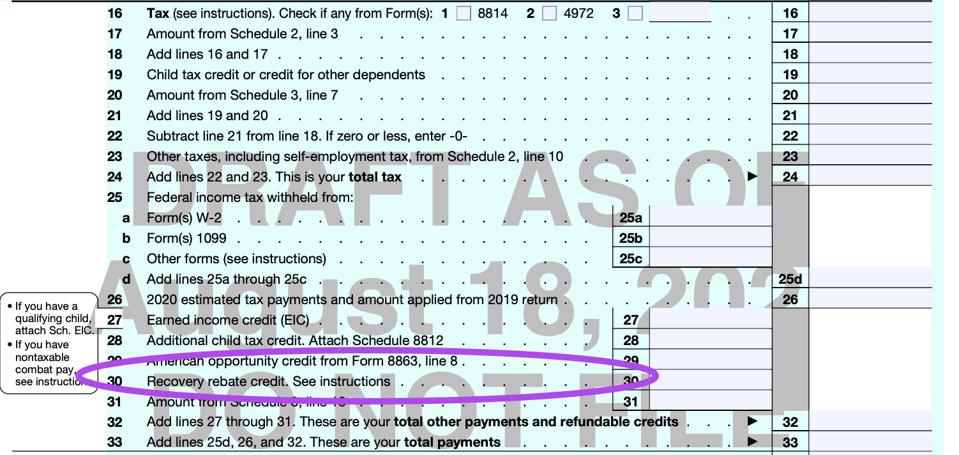

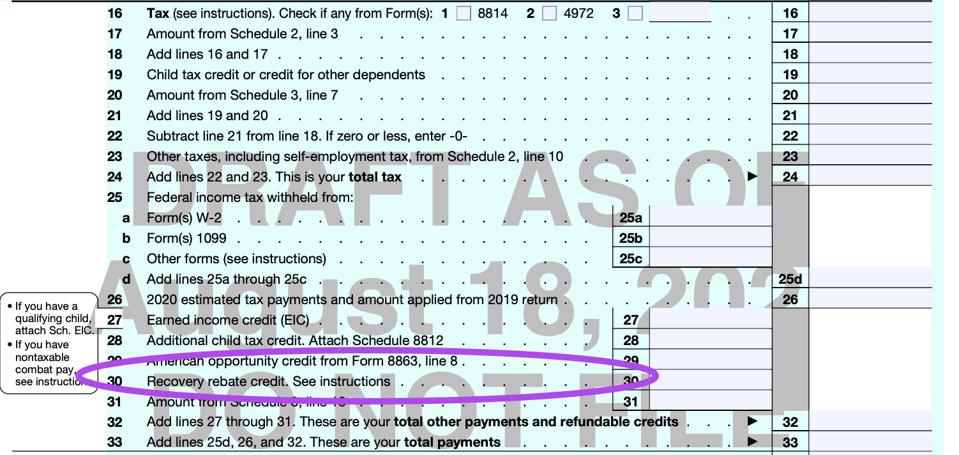

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and the amount to enter on line 30 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

A Irs Recovery Rebate Credit Form at its most basic format, is a refund given to a client after they've bought a product or service. It's a powerful method used by companies to attract customers, increase sales, and even promote certain products.

Types of Irs Recovery Rebate Credit Form

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The fastest way to get your tax refund is to have it direct deposited contactless and free

IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity to claim credits like the Recovery Rebate Credit and other deductions the Internal Revenue Service announced

Cash Irs Recovery Rebate Credit Form

Cash Irs Recovery Rebate Credit Form are the most straightforward kind of Irs Recovery Rebate Credit Form. Customers receive a specific amount of money in return for purchasing a product. These are typically applied to products that are expensive, such as electronics or appliances.

Mail-In Irs Recovery Rebate Credit Form

Mail-in Irs Recovery Rebate Credit Form require customers to submit proof of purchase in order to receive their refund. They're somewhat more involved, but offer substantial savings.

Instant Irs Recovery Rebate Credit Form

Instant Irs Recovery Rebate Credit Form are credited at the point of sale. They reduce your purchase cost instantly. Customers do not have to wait long for savings with this type.

How Irs Recovery Rebate Credit Form Work

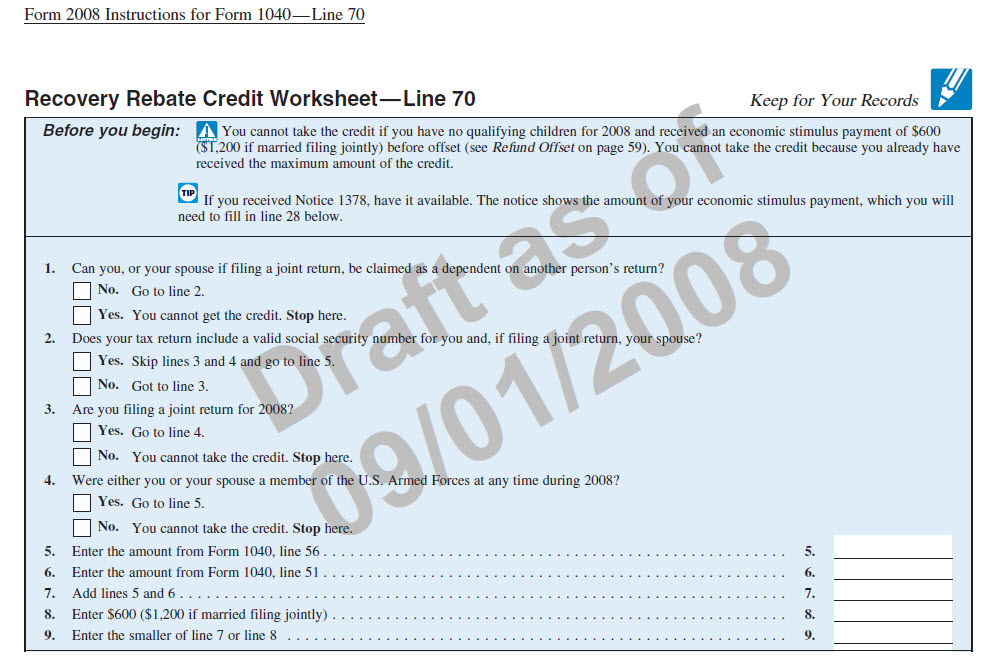

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

2008 Form 1040 1040A or 1040EZ and following the Credit Figured by the IRS instructions People however may choose to calculate the Recovery Rebate Credit themselves Commercial tax preparation software will automatically calculate the Recovery Rebate Credit The credit can also be calculated by following the instructions on the

The Irs Recovery Rebate Credit Form Process

The procedure usually involves a number of easy steps:

-

Buy the product: Firstly make sure you purchase the product just as you would ordinarily.

-

Fill in the Irs Recovery Rebate Credit Form application: In order to claim your Irs Recovery Rebate Credit Form, you'll have to provide some information like your name, address, and information about the purchase to get your Irs Recovery Rebate Credit Form.

-

You must submit the Irs Recovery Rebate Credit Form It is dependent on the nature of Irs Recovery Rebate Credit Form there may be a requirement to fill out a paper form or submit it online.

-

Wait for approval: The company is going to review your entry to determine if it's in compliance with the Irs Recovery Rebate Credit Form's terms and conditions.

-

Take advantage of your Irs Recovery Rebate Credit Form After approval, you'll receive a refund whether via check, credit card, or other method that is specified in the offer.

Pros and Cons of Irs Recovery Rebate Credit Form

Advantages

-

Cost savings: Irs Recovery Rebate Credit Form can significantly lower the cost you pay for products.

-

Promotional Offers Incentivize customers to test new products or brands.

-

Help to Increase Sales Irs Recovery Rebate Credit Form can enhance the sales of a company as well as its market share.

Disadvantages

-

Complexity mail-in Irs Recovery Rebate Credit Form in particular, can be cumbersome and long-winded.

-

Expiration Dates Some Irs Recovery Rebate Credit Form have extremely strict deadlines to submit.

-

Risk of not receiving payment: Some customers may not be able to receive their Irs Recovery Rebate Credit Form if they don't adhere to the rules exactly.

Download Irs Recovery Rebate Credit Form

Download Irs Recovery Rebate Credit Form

FAQs

1. Are Irs Recovery Rebate Credit Form the same as discounts? No, Irs Recovery Rebate Credit Form offer an amount of money that is refunded after the purchase, whereas discounts cut the purchase price at the moment of sale.

2. Can I get multiple Irs Recovery Rebate Credit Form for the same product It's contingent upon the terms that apply to the Irs Recovery Rebate Credit Form incentives and the specific product's admissibility. Some companies will allow it, but others won't.

3. How long does it take to get an Irs Recovery Rebate Credit Form? The period varies, but it can be from several weeks to several months to receive a Irs Recovery Rebate Credit Form.

4. Do I have to pay tax of Irs Recovery Rebate Credit Form the amount? the majority of situations, Irs Recovery Rebate Credit Form amounts are not considered to be taxable income.

5. Can I trust Irs Recovery Rebate Credit Form offers from lesser-known brands It's crucial to research to ensure that the name offering the Irs Recovery Rebate Credit Form is reputable prior to making purchases.

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Check more sample of Irs Recovery Rebate Credit Form below

What Is The Recovery Rebate Credit CD Tax Financial

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit Irs Form Recovery Rebate

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and the amount to enter on line 30 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

https://www.irs.gov/newsroom/2020-recovery-rebate...

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020 Form 1040 SR

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and the amount to enter on line 30 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020 Form 1040 SR

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit Irs Form Recovery Rebate

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Free File 1040 Form 2021 Recovery Rebate