In today's consumer-driven world everyone enjoys a good deal. One option to obtain substantial savings on your purchases is through Chicago Tax Rebate Forms. Chicago Tax Rebate Forms are a strategy for marketing used by manufacturers and retailers to give customers a part cash back on their purchases once they've purchased them. In this article, we'll take a look at the world that is Chicago Tax Rebate Forms, exploring the nature of them what they are, how they function, and the best way to increase your savings through these cost-effective incentives.

Get Latest Chicago Tax Rebate Form Below

Chicago Tax Rebate Form

Chicago Tax Rebate Form -

Web What is the Property Tax Rebate The property tax rebate was created by Public Act 102 0700 and is equal to the lesser of the property tax credit you could qualify for 2020

Web All refund claims must be substantiated with the following documentation 1 Proof of payment of the tax 2 Copies of the original tax returns and amended tax returns for all

A Chicago Tax Rebate Form, in its simplest format, is a return to the customer after having purchased a item or service. It's a highly effective tool employed by companies to draw customers, increase sales and advertise specific products.

Types of Chicago Tax Rebate Form

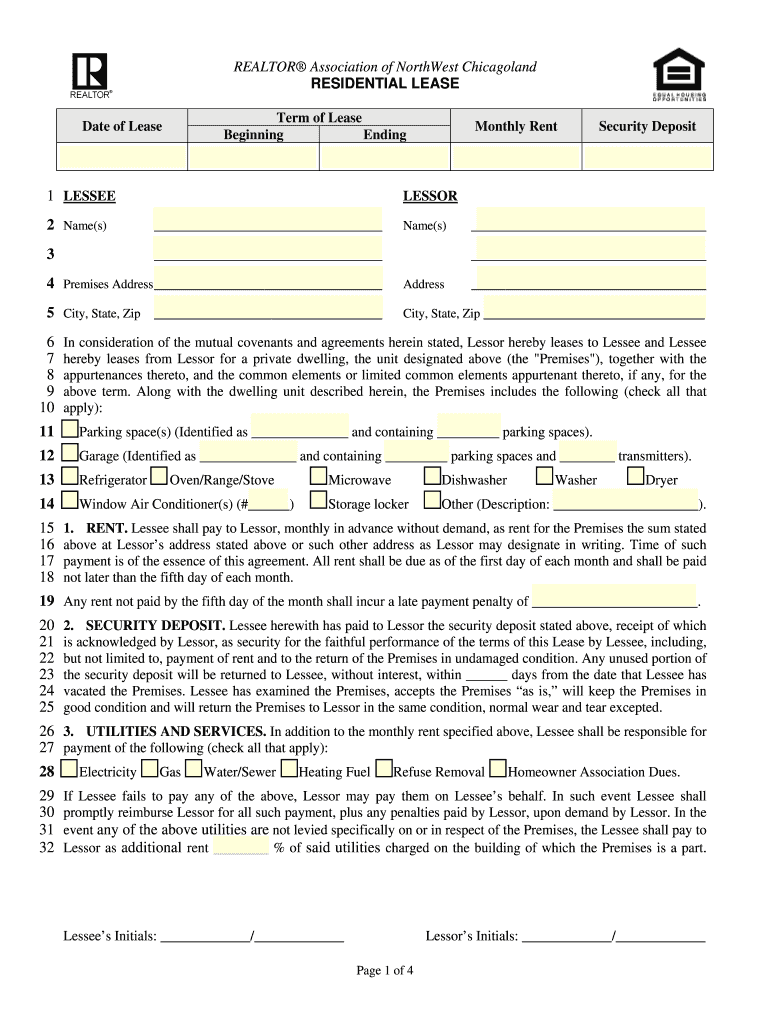

Realtor Association Of Northwest Chicagoland Residential Lease Fill

Realtor Association Of Northwest Chicagoland Residential Lease Fill

Web The City of Chicago Property Tax Relief Program is aimed toward helping homeowners with increases in their 2008 property tax bills for their primary residences Homeowners may

Web 5 mai 2023 nbsp 0183 32 Last Updated on 5 5 2023 The HBPP Rebate Application closed on Sunday April 2 at 11 00 pm CST All pending applications submitted on or prior to April 2 will be processed and eligible applicants

Cash Chicago Tax Rebate Form

Cash Chicago Tax Rebate Form are by far the easiest kind of Chicago Tax Rebate Form. The customer receives a particular sum of money back when buying a product. This is often for the most expensive products like electronics or appliances.

Mail-In Chicago Tax Rebate Form

Mail-in Chicago Tax Rebate Form need customers to send in proof of purchase to receive their money back. They're a bit more complicated but could provide huge savings.

Instant Chicago Tax Rebate Form

Instant Chicago Tax Rebate Form are made at the points of sale. This reduces the price of purchases immediately. Customers don't need to wait until they can save with this type.

How Chicago Tax Rebate Form Work

The Trick To Getting The Cook County Homeowner Property Tax Exemption

The Trick To Getting The Cook County Homeowner Property Tax Exemption

Web 27 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To

The Chicago Tax Rebate Form Process

The procedure typically consists of a number of easy steps:

-

Buy the product: Firstly make sure you purchase the product like you normally do.

-

Fill in your Chicago Tax Rebate Form questionnaire: you'll have provide certain information like your name, address, and purchase details to receive your Chicago Tax Rebate Form.

-

In order to submit the Chicago Tax Rebate Form: Depending on the type of Chicago Tax Rebate Form the recipient may be required to submit a claim form to the bank or submit it online.

-

Wait for approval: The company will go through your application to determine if it's in compliance with the guidelines and conditions of the Chicago Tax Rebate Form.

-

Receive your Chicago Tax Rebate Form: Once approved, you'll receive your cash back whether by check, prepaid card, or by another method as specified by the offer.

Pros and Cons of Chicago Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically reduce the cost for the item.

-

Promotional Offers: They encourage customers to try out new products or brands.

-

Improve Sales Reward programs can boost companies' sales and market share.

Disadvantages

-

Complexity Mail-in Chicago Tax Rebate Form in particular the case of HTML0, can be a hassle and slow-going.

-

Days of expiration Some Chicago Tax Rebate Form have specific deadlines for submission.

-

Risk of Not Being Paid Customers may have their Chicago Tax Rebate Form delayed if they don't comply with the rules precisely.

Download Chicago Tax Rebate Form

Download Chicago Tax Rebate Form

FAQs

1. Are Chicago Tax Rebate Form equivalent to discounts? No, the Chicago Tax Rebate Form will be a partial refund after purchase whereas discounts will reduce costs at moment of sale.

2. Are there multiple Chicago Tax Rebate Form I can get for the same product It's contingent upon the conditions of Chicago Tax Rebate Form deals and product's admissibility. Certain companies might permit it, while other companies won't.

3. How long does it take to get a Chicago Tax Rebate Form? The timing can vary, but typically it will take a couple of weeks or a few months to receive your Chicago Tax Rebate Form.

4. Do I need to pay tax regarding Chicago Tax Rebate Form amount? most situations, Chicago Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Chicago Tax Rebate Form deals from lesser-known brands It's crucial to research and ensure that the brand that is offering the Chicago Tax Rebate Form is reliable prior to making an purchase.

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

Illinois Unemployment 941x Fill Out Sign Online DocHub

Check more sample of Chicago Tax Rebate Form below

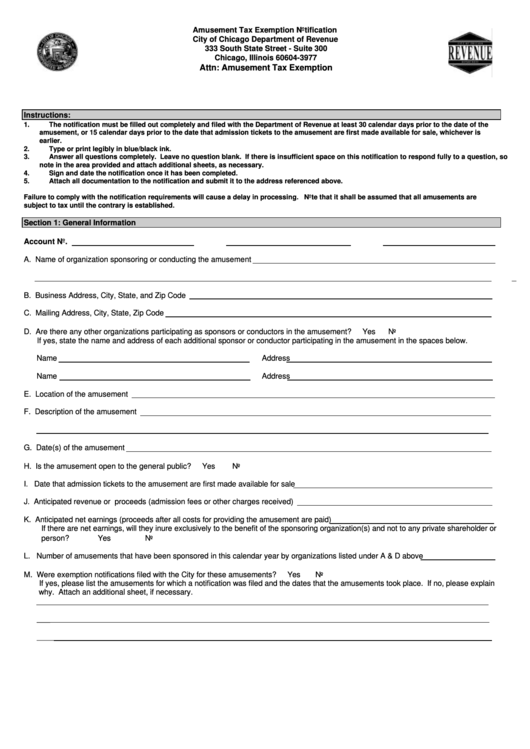

Amusement Tax Exemption Notification Form City Of Chicago Department

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

P G And E Ev Rebate Printable Rebate Form

Fillable Pa 40 Fill Out Sign Online DocHub

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

https://www.chicago.gov/city/en/depts/fin/provdrs/tax_division/svcs/...

Web All refund claims must be substantiated with the following documentation 1 Proof of payment of the tax 2 Copies of the original tax returns and amended tax returns for all

https://www.nbcchicago.com/news/local/did-you-get-your-2022-illinois...

Web 23 sept 2022 nbsp 0183 32 Those who filled out the 2021 IL 1040 tax form will receive their rebates automatically Those who haven t filed individual income tax returns and completed the

Web All refund claims must be substantiated with the following documentation 1 Proof of payment of the tax 2 Copies of the original tax returns and amended tax returns for all

Web 23 sept 2022 nbsp 0183 32 Those who filled out the 2021 IL 1040 tax form will receive their rebates automatically Those who haven t filed individual income tax returns and completed the

Fillable Pa 40 Fill Out Sign Online DocHub

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Did You Get Your 2022 Illinois Tax Rebates Less Than A Month Left To

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Menards 11 Rebate 4468 Purchases 8 19 18 8 25 18

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Government Rebate Program Fill Out Sign Online DocHub