In our current world of high-end consumer goods everyone enjoys a good deal. One option to obtain substantial savings on your purchases can be achieved through Medicare Tax Rebate Forms. They are a form of marketing that retailers and manufacturers use for offering customers a percentage payment on their purchases, after they have placed them. In this post, we'll look into the world of Medicare Tax Rebate Forms. We'll look at the nature of them about, how they work, and how you can make the most of your savings with these cost-effective incentives.

Get Latest Medicare Tax Rebate Form Below

Medicare Tax Rebate Form

Medicare Tax Rebate Form -

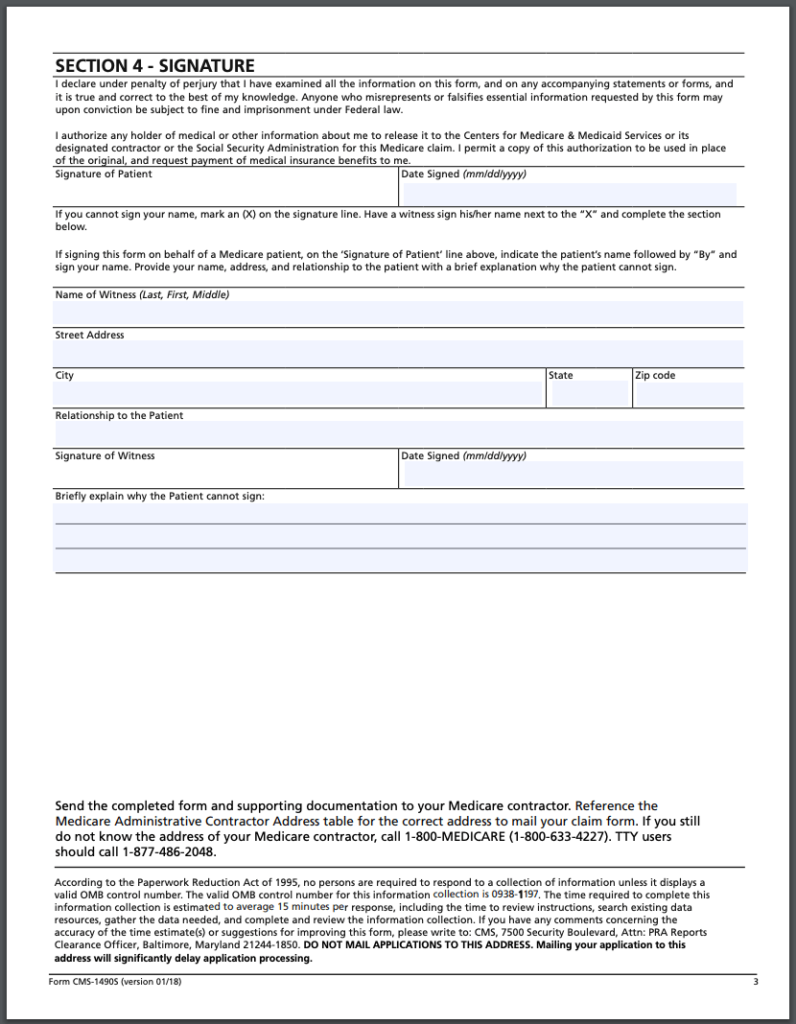

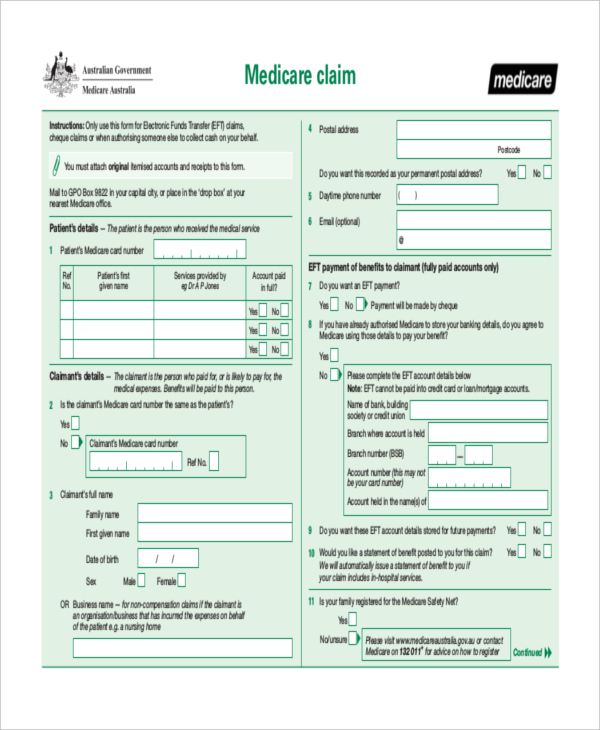

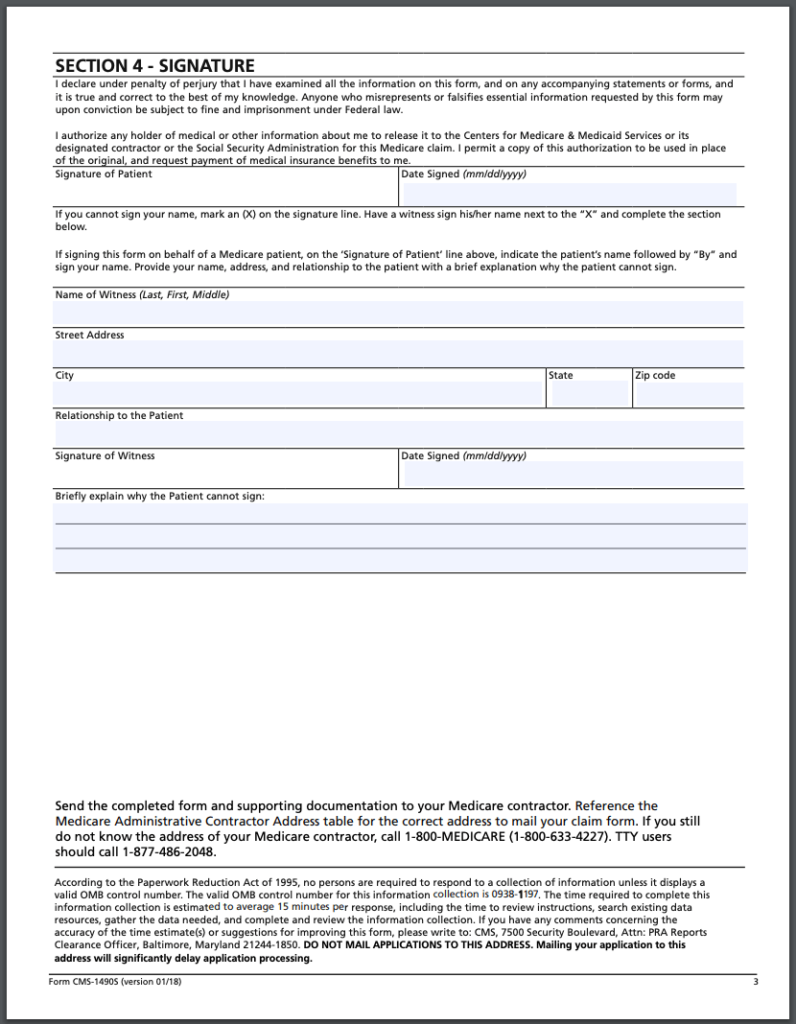

Web Returning your form Send the completed form and original accounts and receipts to Services Australia Medicare GPO Box 9822 in your capital city Patient s details The

Web 14 oct 2022 nbsp 0183 32 File Form 843 with the IRS to claim a refund along with a copy of your Form W 2 You may have to submit additional forms as well There s a three year statute of

A Medicare Tax Rebate Form at its most basic form, is a refund that a client receives after purchasing a certain product or service. It's an effective way employed by companies to draw clients, increase sales and even promote certain products.

Types of Medicare Tax Rebate Form

Form 8959 Additional Medicare Tax 2014 Free Download

Form 8959 Additional Medicare Tax 2014 Free Download

Web 25 ao 251 t 2022 nbsp 0183 32 In 2022 the Medicare tax rate is 2 9 which is split evenly between employers and employees W 2 employees pay 1 45 and

Web A Medicare levy surcharge may apply if you your spouse and all your dependants didn t maintain an appropriate level of private patient hospital cover for the full income year

Cash Medicare Tax Rebate Form

Cash Medicare Tax Rebate Form are the simplest type of Medicare Tax Rebate Form. The customer receives a particular amount of money in return for purchasing a item. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Medicare Tax Rebate Form

Mail-in Medicare Tax Rebate Form are based on the requirement that customers provide an evidence of purchase for their reimbursement. They are a bit more complicated, but they can provide huge savings.

Instant Medicare Tax Rebate Form

Instant Medicare Tax Rebate Form are applied right at the point of sale, reducing the cost of purchase immediately. Customers don't have to wait long for savings when they purchase this type of Medicare Tax Rebate Form.

How Medicare Tax Rebate Form Work

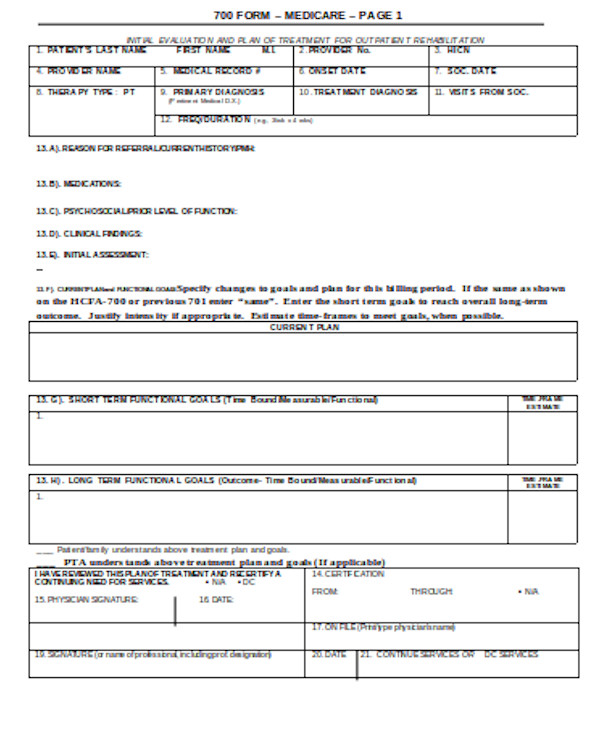

FREE 10 Sample Medicare Forms In PDF MS Word

FREE 10 Sample Medicare Forms In PDF MS Word

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

The Medicare Tax Rebate Form Process

The process typically involves few steps:

-

Purchase the product: First you purchase the item just as you would ordinarily.

-

Fill in this Medicare Tax Rebate Form request form. You'll have to supply some details including your address, name, and information about the purchase to make a claim for your Medicare Tax Rebate Form.

-

You must submit the Medicare Tax Rebate Form If you want to submit the Medicare Tax Rebate Form, based on the kind of Medicare Tax Rebate Form there may be a requirement to fill out a form and mail it in or submit it online.

-

Wait for approval: The business will go through your application to verify that it is compliant with the Medicare Tax Rebate Form's terms and conditions.

-

Redeem your Medicare Tax Rebate Form If it is approved, you'll receive a refund via check, prepaid card, or through another option as per the terms of the offer.

Pros and Cons of Medicare Tax Rebate Form

Advantages

-

Cost Savings The use of Medicare Tax Rebate Form can greatly reduce the price you pay for products.

-

Promotional Offers: They encourage customers to try new products and brands.

-

Accelerate Sales Medicare Tax Rebate Form are a great way to boost companies' sales and market share.

Disadvantages

-

Complexity Pay-in Medicare Tax Rebate Form via mail, in particular may be lengthy and slow-going.

-

Time Limits for Medicare Tax Rebate Form: Many Medicare Tax Rebate Form have strict time limits for submission.

-

A risk of not being paid Certain customers could not receive their refunds if they don't comply with the rules precisely.

Download Medicare Tax Rebate Form

Download Medicare Tax Rebate Form

FAQs

1. Are Medicare Tax Rebate Form the same as discounts? Not at all, Medicare Tax Rebate Form provide an amount of money that is refunded after the purchase whereas discounts will reduce the purchase price at point of sale.

2. Are multiple Medicare Tax Rebate Form available for the same product The answer is dependent on the terms on the Medicare Tax Rebate Form promotions and on the products qualification. Certain companies may permit it, but others won't.

3. What is the time frame to receive a Medicare Tax Rebate Form What is the timeframe? varies, but it can take anywhere from a couple of weeks to a few months to receive your Medicare Tax Rebate Form.

4. Do I need to pay taxes of Medicare Tax Rebate Form montants? most instances, Medicare Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Medicare Tax Rebate Form offers from lesser-known brands You must research and confirm that the company that is offering the Medicare Tax Rebate Form has a good reputation prior to making any purchase.

Medicare Part D Form Fill Online Printable Fillable Blank PdfFiller

Federal Register Medicaid Program Announcement Of Medicaid Drug

Check more sample of Medicare Tax Rebate Form below

Where To Claim Medicare Part B On Tax Form

Supplier Rebate Agreement Template

How To Correct A Rejected Medicare Claim

2007 Form AU Medicare 3169 Fill Online Printable Fillable Blank

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Has The Below Example On 1099 SSA This Year When Would The Medicare Be

https://www.thebalancemoney.com/social-security-and-medicare-taxes...

Web 14 oct 2022 nbsp 0183 32 File Form 843 with the IRS to claim a refund along with a copy of your Form W 2 You may have to submit additional forms as well There s a three year statute of

https://www.irs.gov/forms-pubs/about-form-8959

Web 2 juin 2023 nbsp 0183 32 All Form 8959 Revisions About Publication 15 Circular E Employer s Tax Guide About Publication 505 Tax Withholding and Estimated Tax About Publication

Web 14 oct 2022 nbsp 0183 32 File Form 843 with the IRS to claim a refund along with a copy of your Form W 2 You may have to submit additional forms as well There s a three year statute of

Web 2 juin 2023 nbsp 0183 32 All Form 8959 Revisions About Publication 15 Circular E Employer s Tax Guide About Publication 505 Tax Withholding and Estimated Tax About Publication

2007 Form AU Medicare 3169 Fill Online Printable Fillable Blank

Supplier Rebate Agreement Template

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Has The Below Example On 1099 SSA This Year When Would The Medicare Be

Medicare Levy Surcharge And Your Tax Return ISelect

What Is Medicare Surtax Medicare Part B Forms For Providers

What Is Medicare Surtax Medicare Part B Forms For Providers

Top Mass Save Rebate Form Templates Free To Download In PDF Format