In this modern-day world of consumers everyone appreciates a great deal. One way to gain significant savings in your purchase is through Recovery Rebate Instructions On 1040 Forms. They are a form of marketing that retailers and manufacturers use to offer consumers a partial return on their purchases once they've created them. In this article, we'll examine the subject of Recovery Rebate Instructions On 1040 Forms. We'll explore what they are their purpose, how they function as well as ways to maximize your savings with these cost-effective incentives.

Get Latest Recovery Rebate Instructions On 1040 Form Below

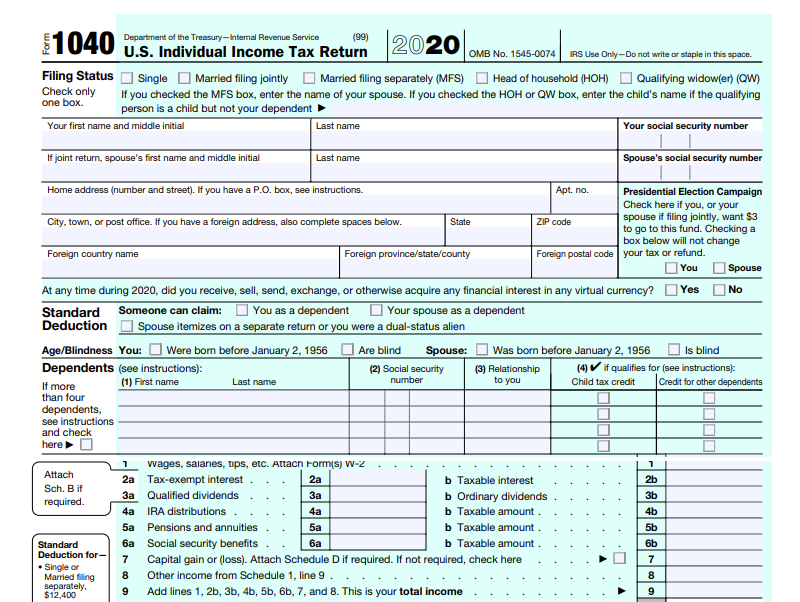

Recovery Rebate Instructions On 1040 Form

Recovery Rebate Instructions On 1040 Form -

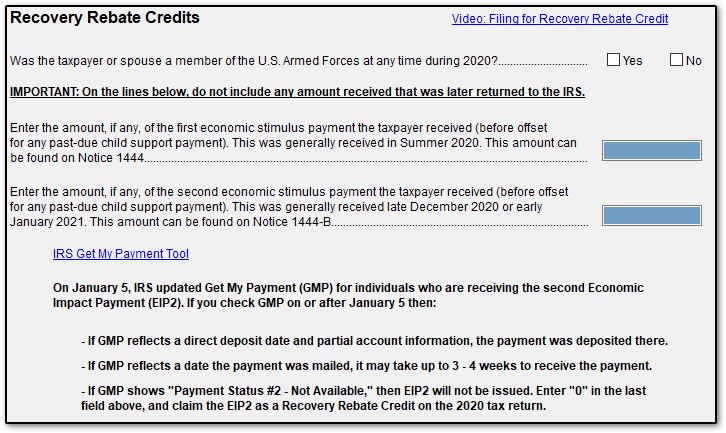

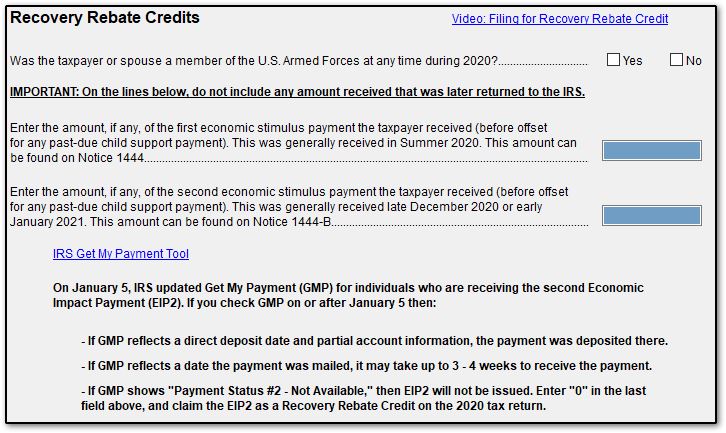

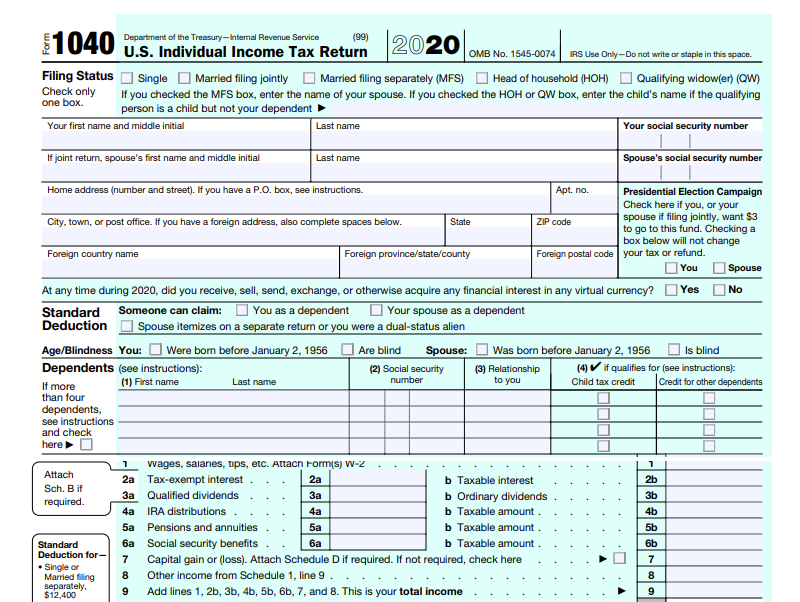

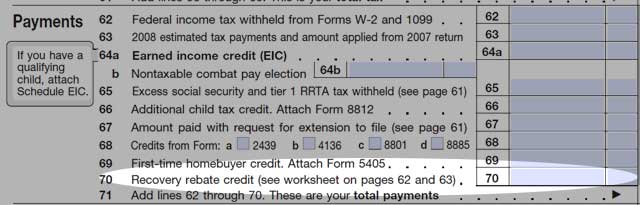

Web 10 Dez 2021 nbsp 0183 32 A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

A Recovery Rebate Instructions On 1040 Form in its simplest description, is a refund that a client receives after they've purchased a good or service. It's an effective way for businesses to entice customers, boost sales, and to promote certain products.

Types of Recovery Rebate Instructions On 1040 Form

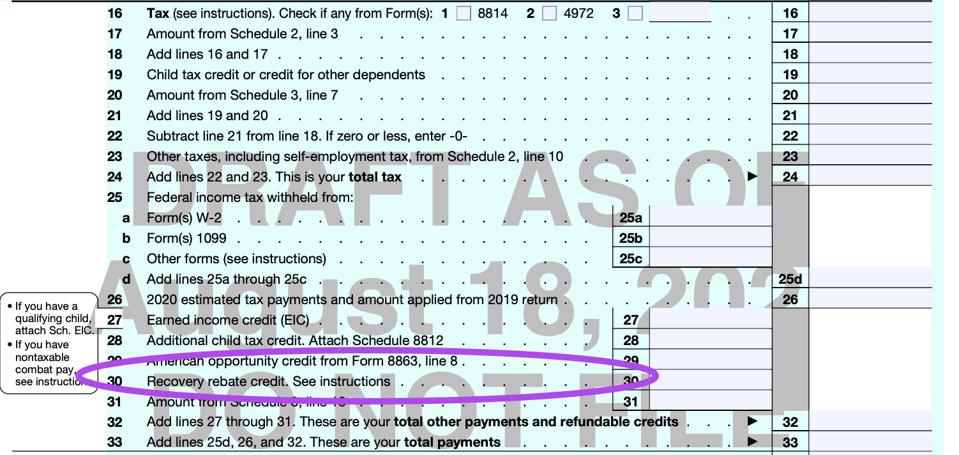

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

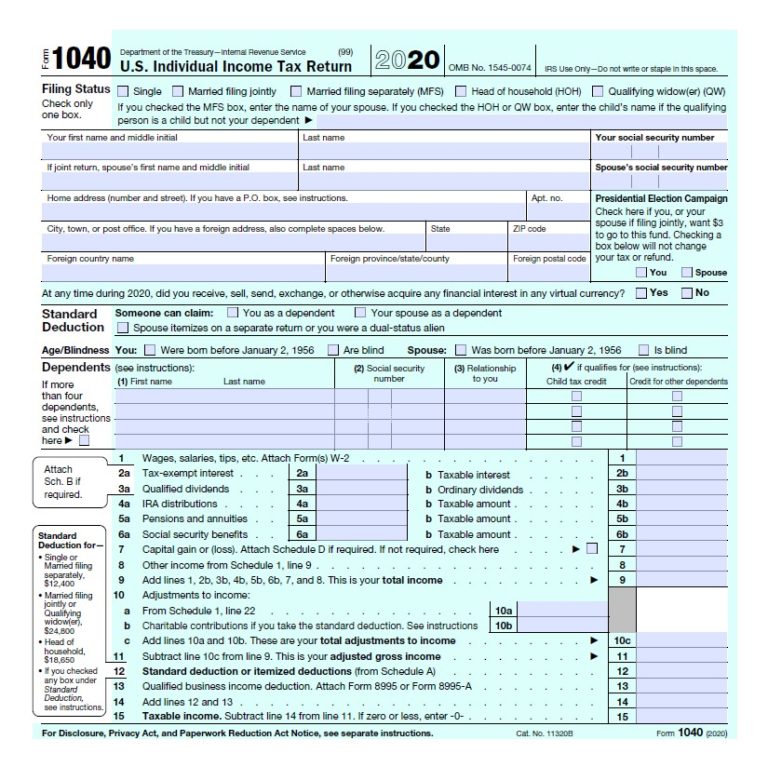

Web Line Instructions for Forms 1040 and 1040 SR Filing Status Name and Address Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and

Web The Recovery Rebate Credit is figured like the EIPs except that the credit eligibility and the credit amount are based on the IRS s most recent information for you on file Generally

Cash Recovery Rebate Instructions On 1040 Form

Cash Recovery Rebate Instructions On 1040 Form are a simple kind of Recovery Rebate Instructions On 1040 Form. Customers are offered a certain amount of money back upon purchasing a particular item. These are typically for the most expensive products like electronics or appliances.

Mail-In Recovery Rebate Instructions On 1040 Form

Mail-in Recovery Rebate Instructions On 1040 Form are based on the requirement that customers submit their proof of purchase before receiving their refund. They're somewhat more complicated, but they can provide significant savings.

Instant Recovery Rebate Instructions On 1040 Form

Instant Recovery Rebate Instructions On 1040 Form are applied at the point of sale, reducing the purchase cost immediately. Customers do not have to wait for their savings by using this method.

How Recovery Rebate Instructions On 1040 Form Work

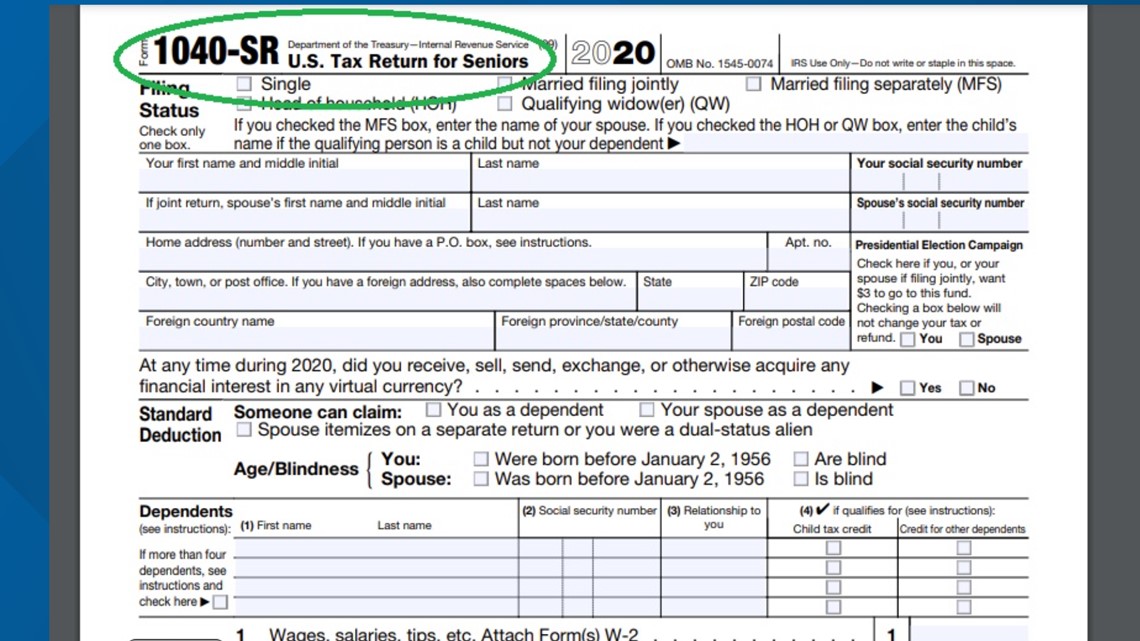

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Web 26 M 228 rz 2021 nbsp 0183 32 Can you claim the Recovery Rebate Credit on an 1040X TurboTax Self Employed Online posted March 26 2021 9 32 AM last updated March 26 2021 9 32 AM

The Recovery Rebate Instructions On 1040 Form Process

The process generally involves a few steps

-

Purchase the product: First purchase the product in the same way you would normally.

-

Complete this Recovery Rebate Instructions On 1040 Form template: You'll need be able to provide a few details including your name, address and details about your purchase, in order to take advantage of your Recovery Rebate Instructions On 1040 Form.

-

Complete the Recovery Rebate Instructions On 1040 Form According to the type of Recovery Rebate Instructions On 1040 Form you will need to submit a claim form to the bank or make it available online.

-

Wait until the company approves: The company will look over your submission to ensure it meets the rules and regulations of the Recovery Rebate Instructions On 1040 Form.

-

Take advantage of your Recovery Rebate Instructions On 1040 Form When it's approved the amount you receive will be in the form of a check, prepaid card, or other method specified by the offer.

Pros and Cons of Recovery Rebate Instructions On 1040 Form

Advantages

-

Cost Savings A Recovery Rebate Instructions On 1040 Form can significantly reduce the cost for products.

-

Promotional Offers These promotions encourage consumers to try new products and brands.

-

Help to Increase Sales Recovery Rebate Instructions On 1040 Form can increase the sales of a company as well as its market share.

Disadvantages

-

Complexity Reward mail-ins in particular could be cumbersome and slow-going.

-

Deadlines for Expiration Most Recovery Rebate Instructions On 1040 Form come with deadlines for submission.

-

Risk of Non-Payment Some customers might not receive their Recovery Rebate Instructions On 1040 Form if they don't adhere to the rules exactly.

Download Recovery Rebate Instructions On 1040 Form

Download Recovery Rebate Instructions On 1040 Form

FAQs

1. Are Recovery Rebate Instructions On 1040 Form equivalent to discounts? No, Recovery Rebate Instructions On 1040 Form involve a partial refund after the purchase whereas discounts will reduce costs at moment of sale.

2. Are there Recovery Rebate Instructions On 1040 Form that can be used on the same product? It depends on the conditions that apply to the Recovery Rebate Instructions On 1040 Form provides and the particular product's admissibility. Some companies may allow it, while some won't.

3. What is the time frame to receive an Recovery Rebate Instructions On 1040 Form? The duration can vary, but typically it will take a couple of weeks or a few months for you to receive your Recovery Rebate Instructions On 1040 Form.

4. Do I have to pay taxes with respect to Recovery Rebate Instructions On 1040 Form amount? the majority of instances, Recovery Rebate Instructions On 1040 Form amounts are not considered to be taxable income.

5. Should I be able to trust Recovery Rebate Instructions On 1040 Form deals from lesser-known brands You must research to ensure that the name which is providing the Recovery Rebate Instructions On 1040 Form is reliable prior to making an purchase.

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

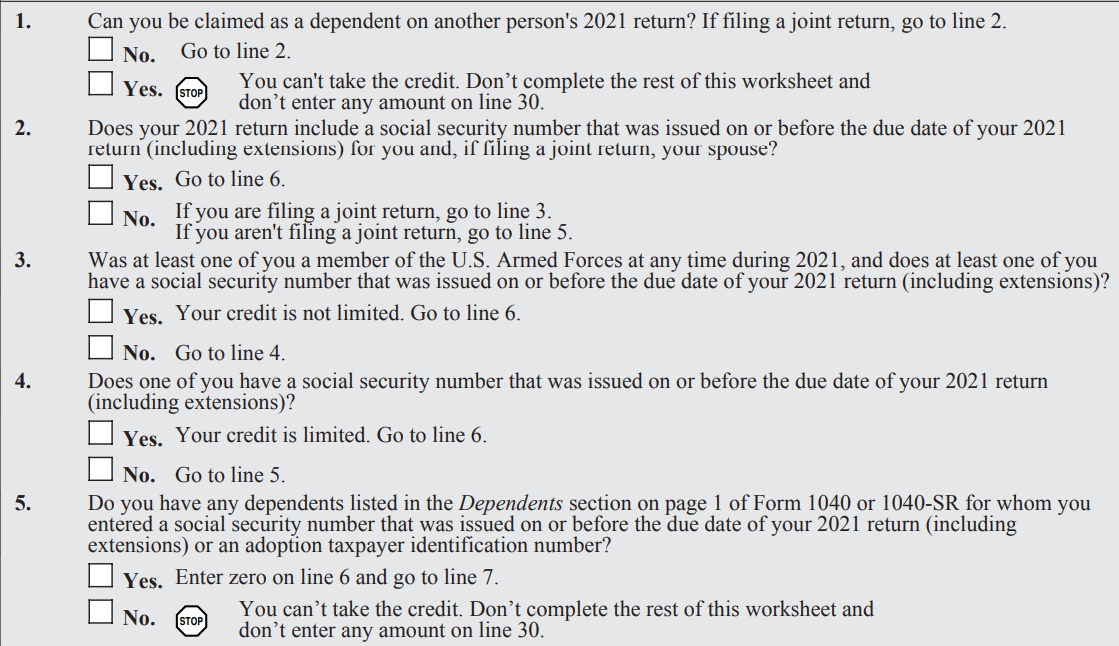

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Check more sample of Recovery Rebate Instructions On 1040 Form below

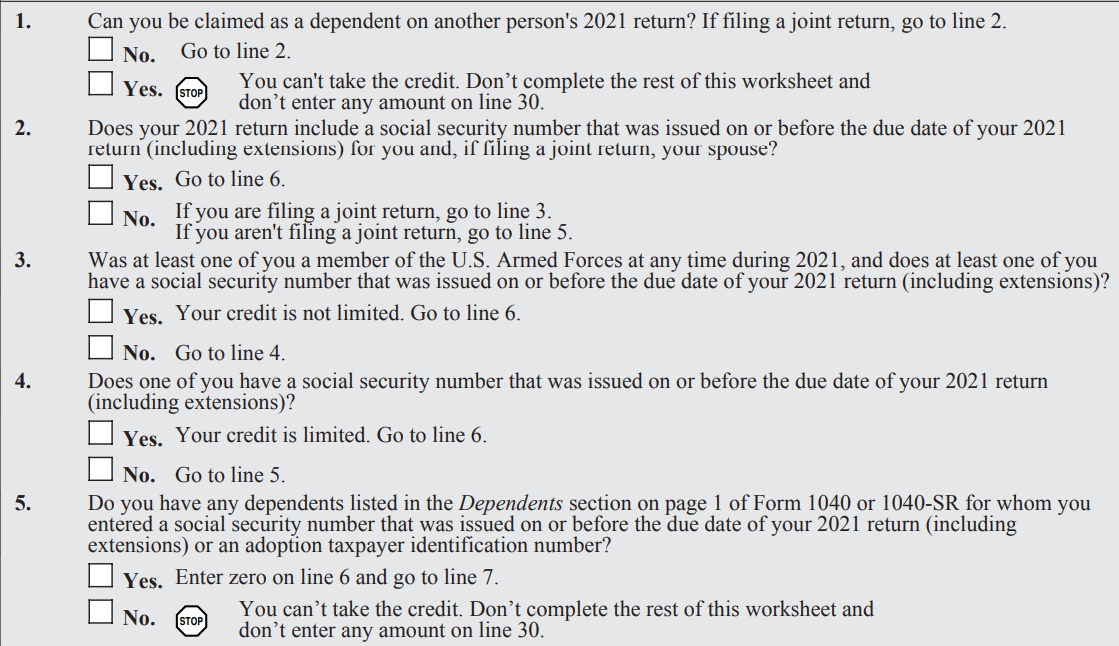

How Do I Claim The Recovery Rebate Credit On My Ta

Solved Recovery Rebate Credit Error On 1040 Instructions

1040 Recovery Rebate Credit Drake20

1040 Recovery Rebate Credit Worksheet

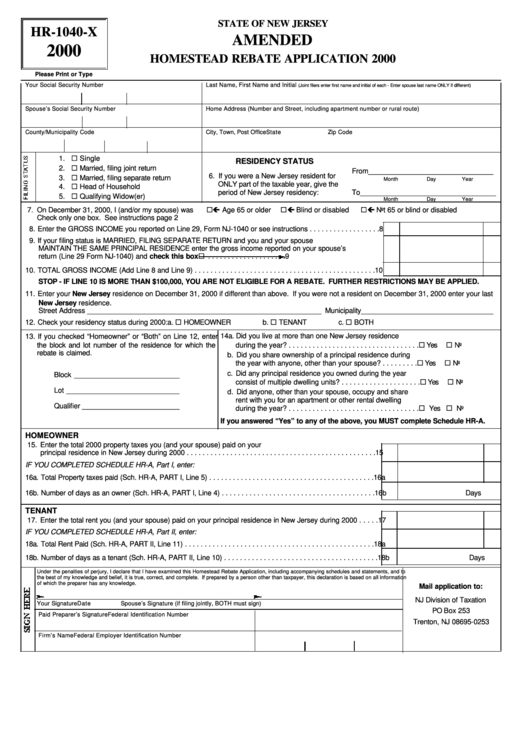

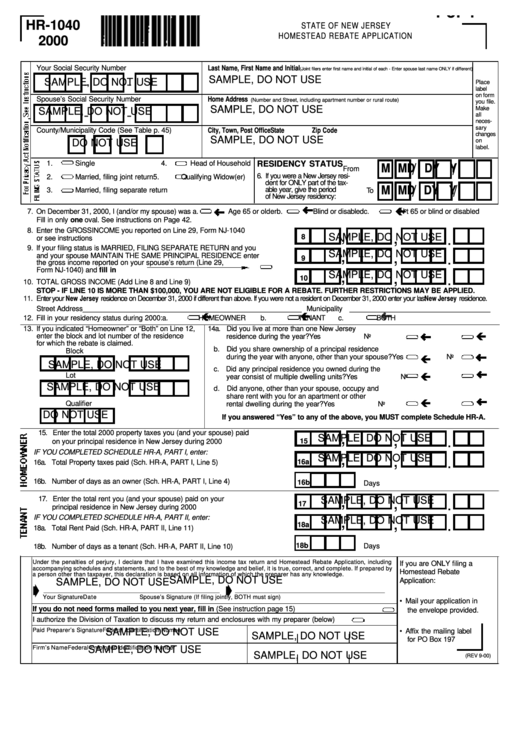

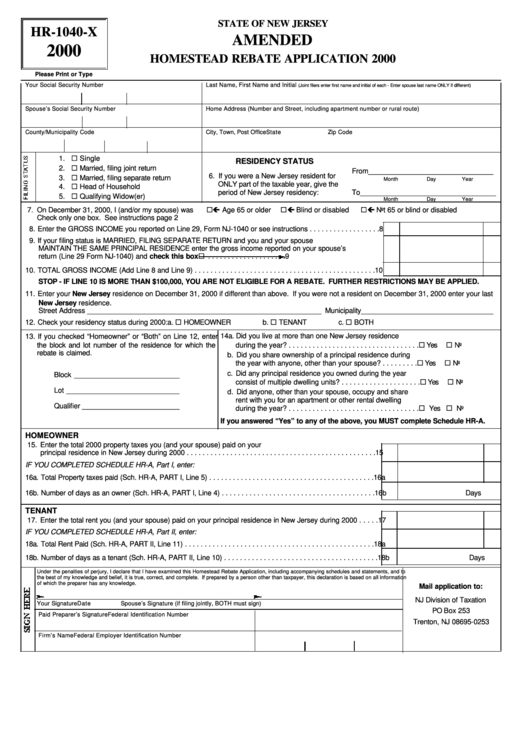

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

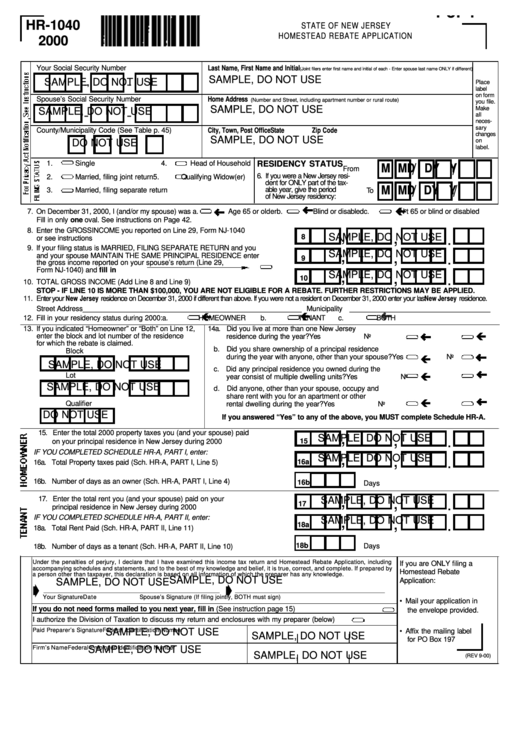

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 Dez 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Web 20 Dez 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

Web 10 Dez 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

1040 Recovery Rebate Credit Worksheet

Solved Recovery Rebate Credit Error On 1040 Instructions

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

How To Claim The Stimulus Money On Your Tax Return Wltx

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit