In this day and age of consuming, everyone loves a good deal. One way to earn substantial savings when you shop is with Which Irs Form Do You Use For Electric Car Rebates. Which Irs Form Do You Use For Electric Car Rebates can be a way of marketing that retailers and manufacturers use to provide customers with a partial reimbursement on their purchases following the time they have done so. In this article, we will delve into the world of Which Irs Form Do You Use For Electric Car Rebates. We will explore what they are what they are, how they function, and how you can maximise your savings through these efficient incentives.

Get Latest Which Irs Form Do You Use For Electric Car Rebate Below

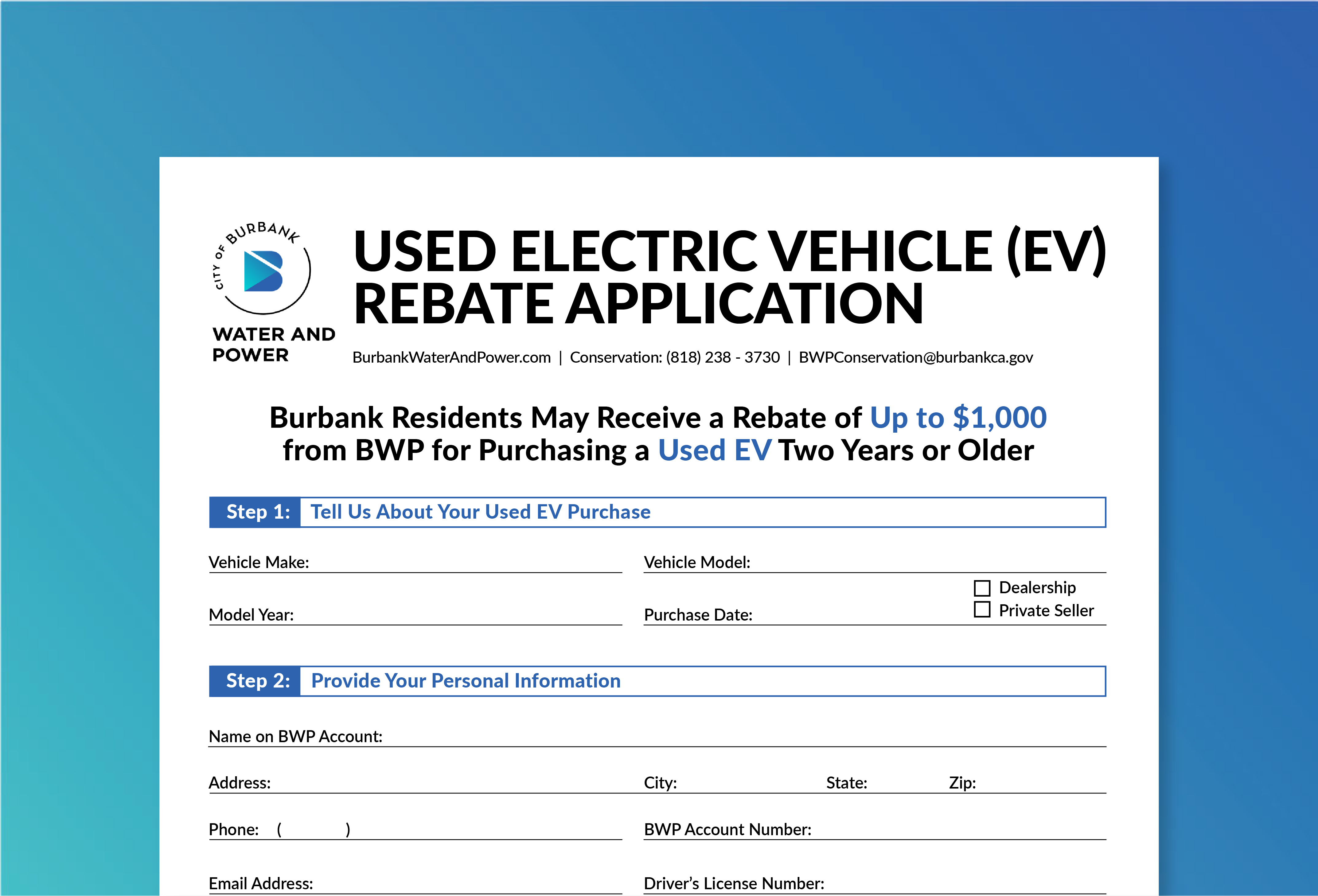

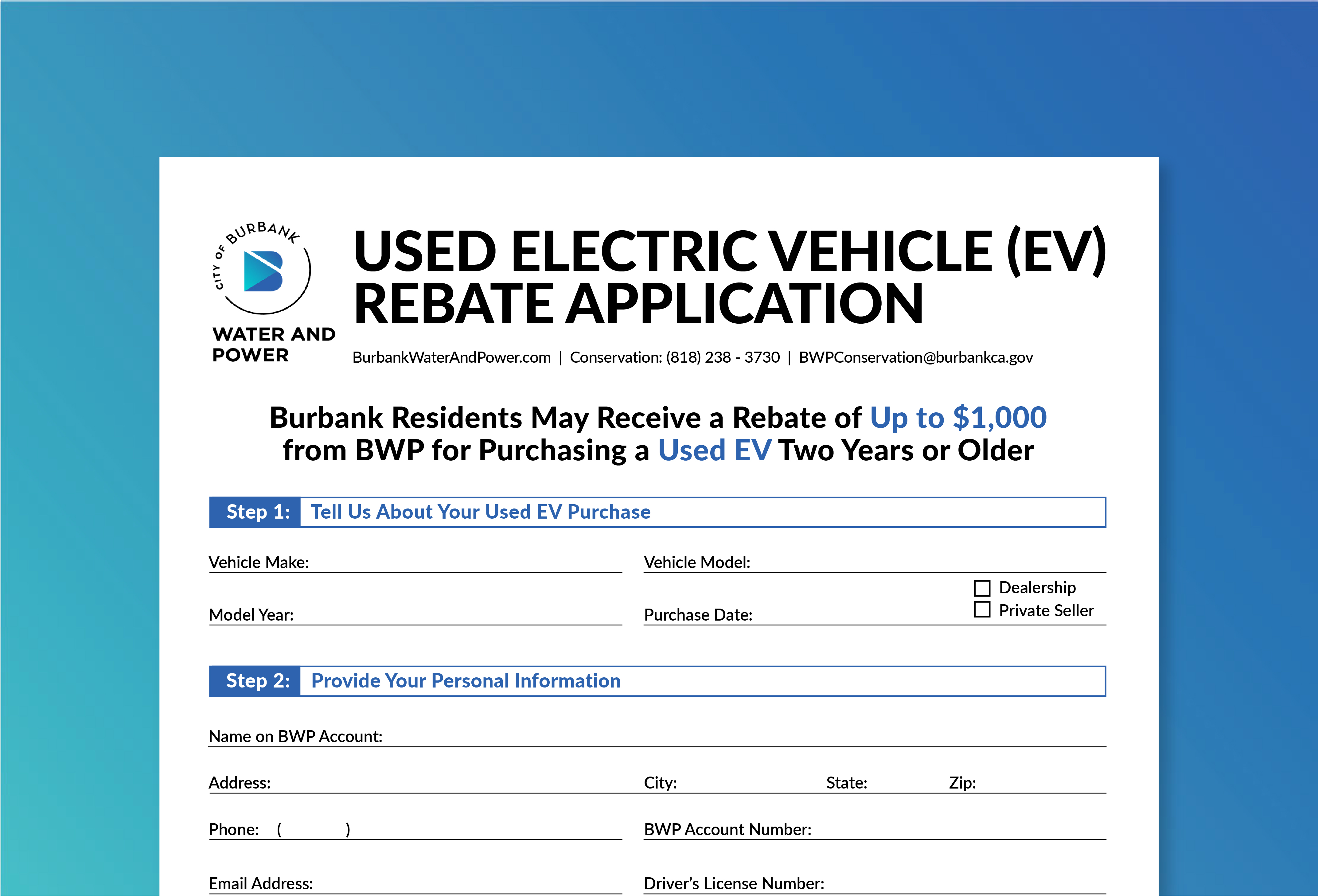

Which Irs Form Do You Use For Electric Car Rebate

Which Irs Form Do You Use For Electric Car Rebate -

Depending on when you took delivery of the vehicle you can claim the credit on your original superseding or amended 2022 tax return What is Form 8936 Form 8936 is the official IRS form used to

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

A Which Irs Form Do You Use For Electric Car Rebate or Which Irs Form Do You Use For Electric Car Rebate, in its most basic description, is a refund offered to a customer after having purchased a item or service. It is a powerful tool utilized by businesses to attract customers, increase sales, as well as promote particular products.

Types of Which Irs Form Do You Use For Electric Car Rebate

Ca Electric Car Rebate Income ElectricRebate

Ca Electric Car Rebate Income ElectricRebate

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

You can use Form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year Form 8936 is used for qualifying plug in electric drive motor

Cash Which Irs Form Do You Use For Electric Car Rebate

Cash Which Irs Form Do You Use For Electric Car Rebate are by far the easiest type of Which Irs Form Do You Use For Electric Car Rebate. Customers are given a certain amount of money back after buying a product. These are usually used for expensive items such as electronics or appliances.

Mail-In Which Irs Form Do You Use For Electric Car Rebate

Mail-in Which Irs Form Do You Use For Electric Car Rebate need customers to submit evidence of purchase to get their refund. They're somewhat more complicated but could provide substantial savings.

Instant Which Irs Form Do You Use For Electric Car Rebate

Instant Which Irs Form Do You Use For Electric Car Rebate are applied right at the point of sale, and can reduce the cost of purchase immediately. Customers don't have to wait long for savings through this kind of offer.

How Which Irs Form Do You Use For Electric Car Rebate Work

Electric Vehicle Rebate Available Until 3 31 McLeod Cooperative Power

Electric Vehicle Rebate Available Until 3 31 McLeod Cooperative Power

Do the prices for new electric vehicles make you feel faint If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit

The Which Irs Form Do You Use For Electric Car Rebate Process

The procedure typically consists of a few simple steps:

-

Purchase the product: Then make sure you purchase the product just like you normally would.

-

Fill in this Which Irs Form Do You Use For Electric Car Rebate application: In order to claim your Which Irs Form Do You Use For Electric Car Rebate, you'll need to provide some information including your name, address, and purchase information, in order to be eligible for a Which Irs Form Do You Use For Electric Car Rebate.

-

Submit the Which Irs Form Do You Use For Electric Car Rebate In accordance with the nature of Which Irs Form Do You Use For Electric Car Rebate you could be required to fill out a form and mail it in or upload it online.

-

Wait until the company approves: The company will scrutinize your submission and ensure that it's compliant with requirements of the Which Irs Form Do You Use For Electric Car Rebate.

-

Redeem your Which Irs Form Do You Use For Electric Car Rebate After you've been approved, you'll receive your refund in the form of a check, prepaid card or through a different option that's specified in the offer.

Pros and Cons of Which Irs Form Do You Use For Electric Car Rebate

Advantages

-

Cost savings Which Irs Form Do You Use For Electric Car Rebate can dramatically reduce the price you pay for the item.

-

Promotional Offers The aim is to encourage customers to try out new products or brands.

-

Boost Sales Which Irs Form Do You Use For Electric Car Rebate can increase sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Which Irs Form Do You Use For Electric Car Rebate particularly could be cumbersome and tedious.

-

Time Limits for Which Irs Form Do You Use For Electric Car Rebate: Many Which Irs Form Do You Use For Electric Car Rebate have the strictest deadlines for submission.

-

Risk of Not Being Paid Customers may miss out on Which Irs Form Do You Use For Electric Car Rebate because they do not follow the rules exactly.

Download Which Irs Form Do You Use For Electric Car Rebate

Download Which Irs Form Do You Use For Electric Car Rebate

FAQs

1. Are Which Irs Form Do You Use For Electric Car Rebate similar to discounts? No, Which Irs Form Do You Use For Electric Car Rebate involve a partial refund upon purchase, whereas discounts decrease their price at moment of sale.

2. Can I use multiple Which Irs Form Do You Use For Electric Car Rebate on the same item It's dependent on the terms in the Which Irs Form Do You Use For Electric Car Rebate is offered as well as the merchandise's ability to qualify. Some companies will allow it, but others won't.

3. How long will it take to get a Which Irs Form Do You Use For Electric Car Rebate? The period will vary, but it may take anywhere from a couple of weeks to a several months to receive a Which Irs Form Do You Use For Electric Car Rebate.

4. Do I need to pay taxes with respect to Which Irs Form Do You Use For Electric Car Rebate amount? the majority of instances, Which Irs Form Do You Use For Electric Car Rebate amounts are not considered taxable income.

5. Can I trust Which Irs Form Do You Use For Electric Car Rebate offers from lesser-known brands? It's essential to research and confirm that the brand which is providing the Which Irs Form Do You Use For Electric Car Rebate is legitimate prior to making a purchase.

Electric Vehicle Rebates Dakota Electric Association

How Do Federal Tax Credits Work FederalProTalk

Check more sample of Which Irs Form Do You Use For Electric Car Rebate below

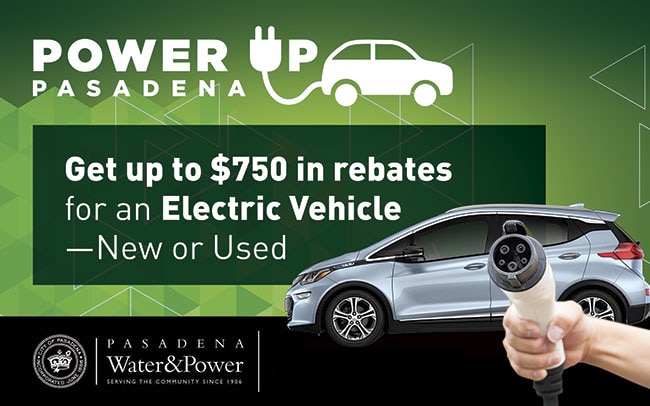

Residential Electric Vehicle Incentive Program Volkswagen Pasadena

How To Claim The Electric Car Tax Credit OsVehicle

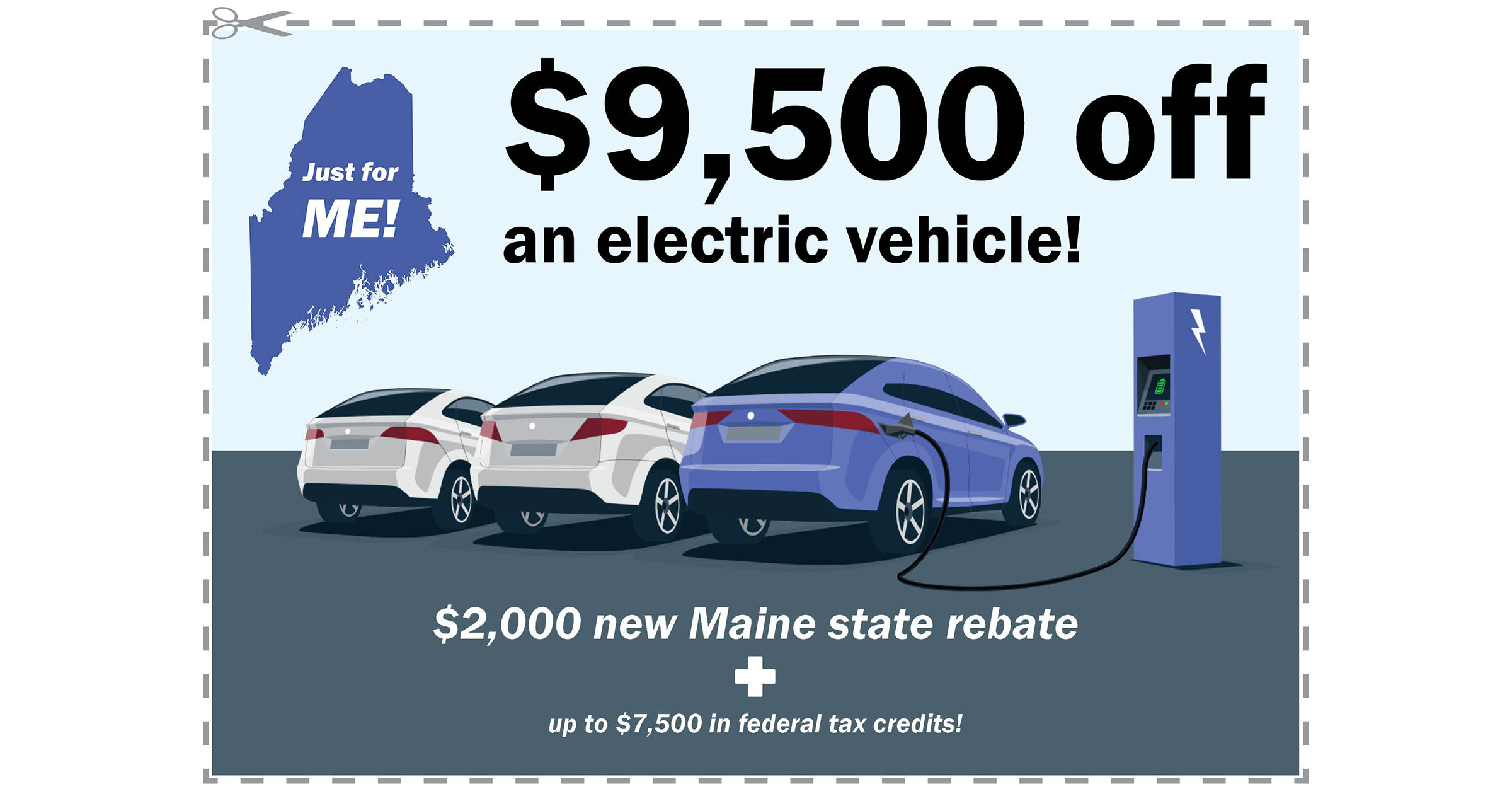

Electric Vehicle Rebates Now Available In Maine NRCM

Federal Tax Rebates Electric Vehicles ElectricRebate

Tax Rebate On Electric Vehicle ElectricRebate

Electric Vehicle Rebate 2019 VPPSA

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/forms-pubs/about-form-8936

Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Federal Tax Rebates Electric Vehicles ElectricRebate

How To Claim The Electric Car Tax Credit OsVehicle

Tax Rebate On Electric Vehicle ElectricRebate

Electric Vehicle Rebate 2019 VPPSA

The Electric Vehicle Rebate In California And Other Incentives

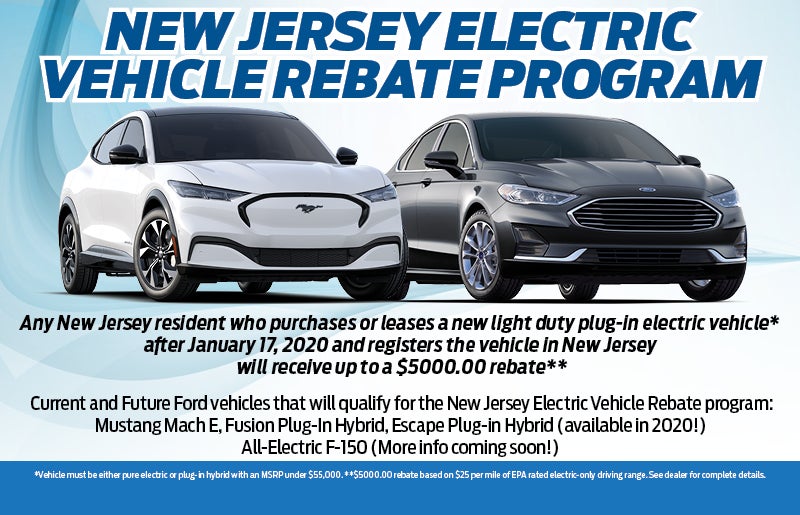

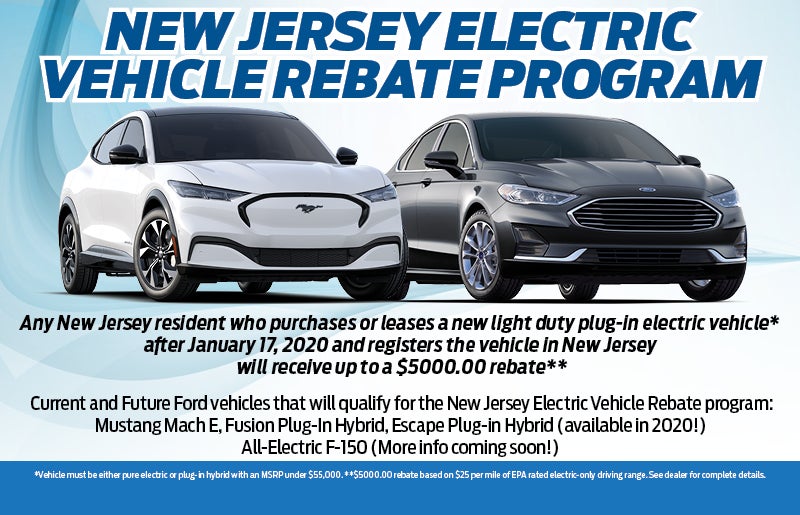

NJ Electric Vehicle Rebate Program

NJ Electric Vehicle Rebate Program

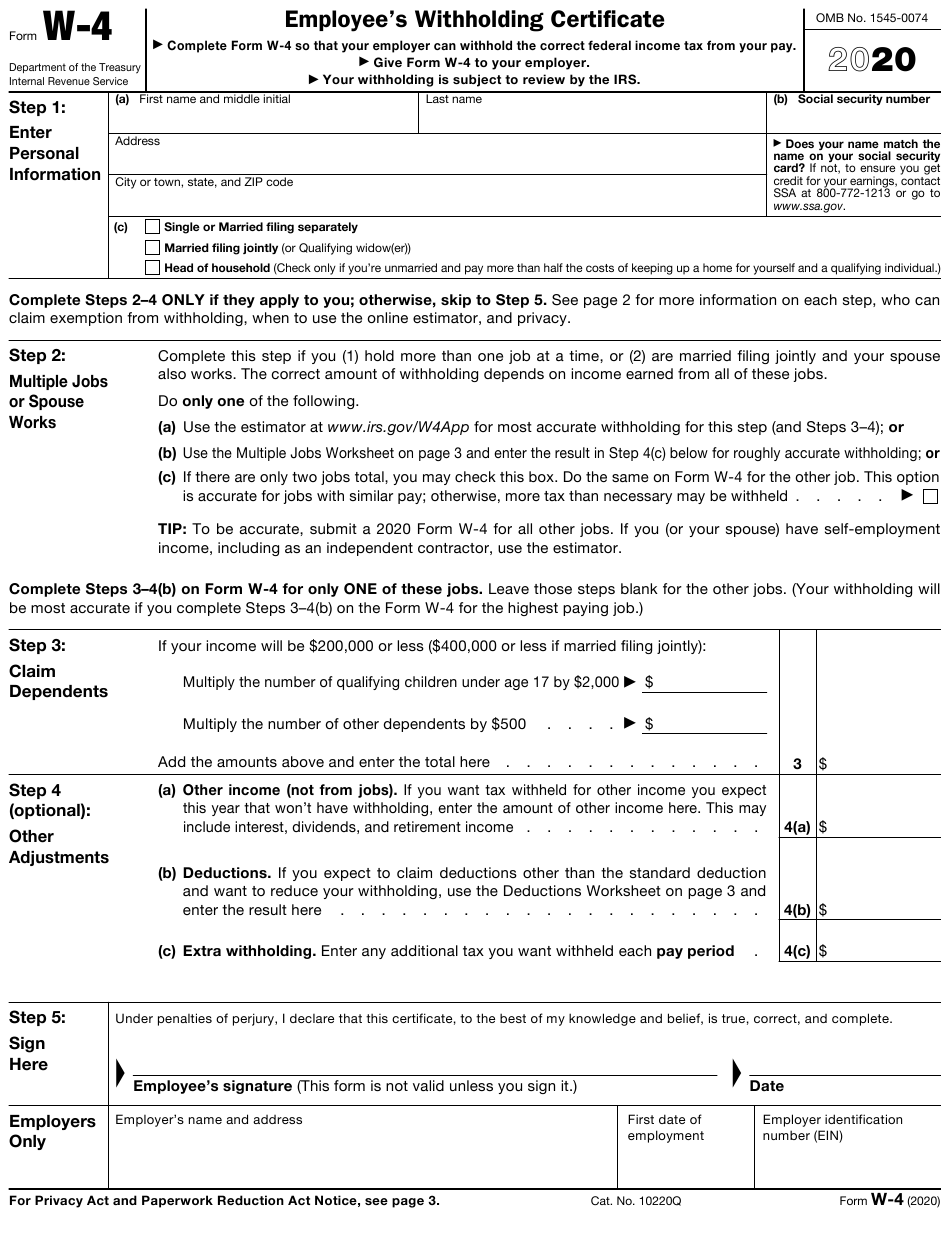

IRS W 4 Form Printable 2022 W4 Form