In today's consumer-driven world, everyone loves a good deal. One method of gaining significant savings on your purchases is through Turbotax Recovery Rebate Credit Forms. Turbotax Recovery Rebate Credit Forms are a method of marketing used by manufacturers and retailers for offering customers a percentage discount on purchases they made after they've purchased them. In this article, we'll examine the subject of Turbotax Recovery Rebate Credit Forms, looking at what they are, how they work, and how you can maximise your savings through these cost-effective incentives.

Get Latest Turbotax Recovery Rebate Credit Form Below

Turbotax Recovery Rebate Credit Form

Turbotax Recovery Rebate Credit Form -

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

A Turbotax Recovery Rebate Credit Form at its most basic definition, is a cash refund provided to customers after they've purchased a good or service. It's a powerful method for businesses to entice buyers, increase sales and advertise specific products.

Types of Turbotax Recovery Rebate Credit Form

Track Your Recovery Rebate With This Worksheet Style Worksheets

Track Your Recovery Rebate With This Worksheet Style Worksheets

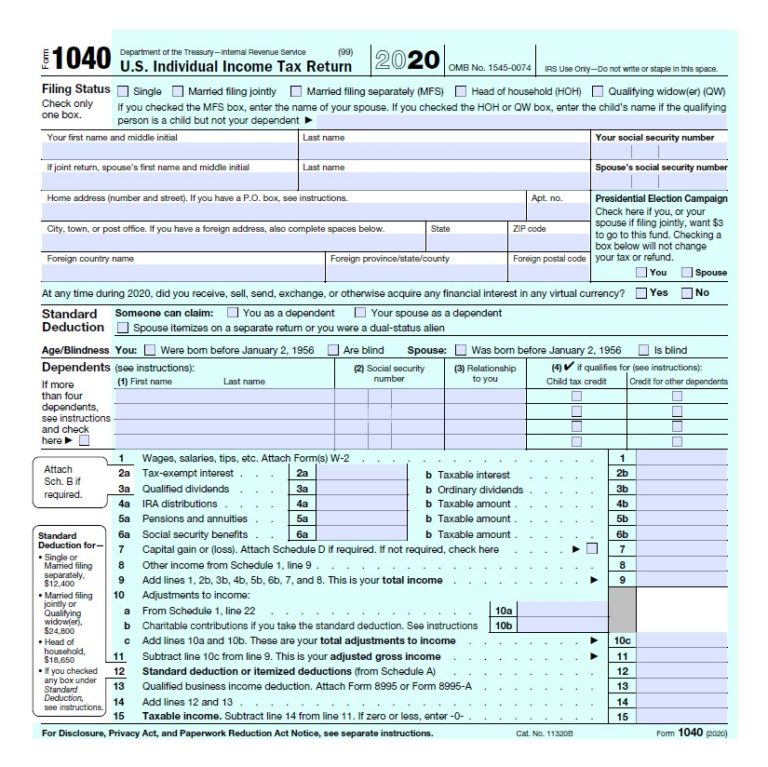

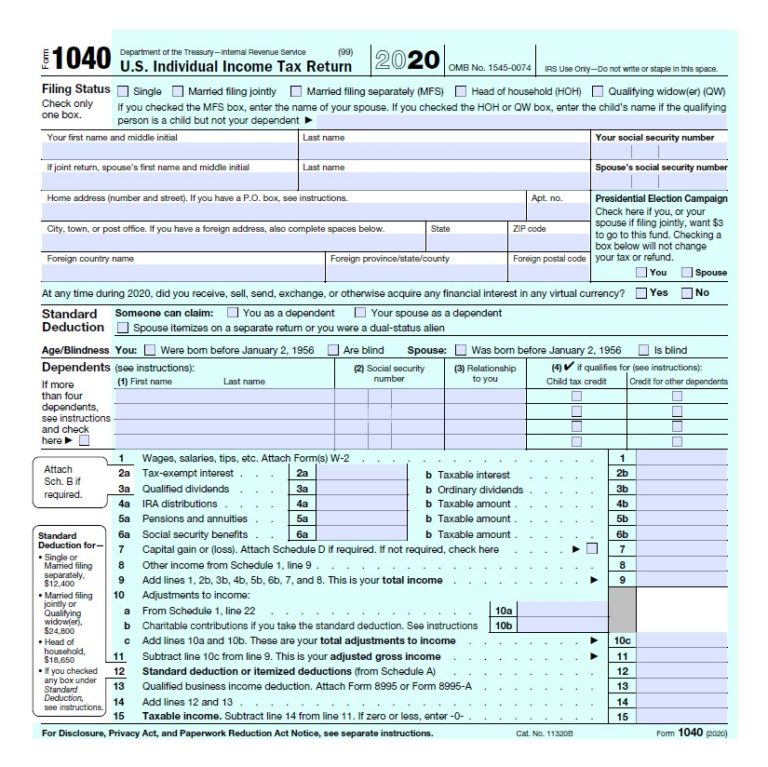

Web Follow these steps to claim the Recovery Rebate Credit on your 2020 Form 1040 Step 1 Get a copy of your Notice 1444 and 1444 b These notices will indicate the amounts of

Web 2 f 233 vr 2023 nbsp 0183 32 For answers to frequently asked questions about the Recovery Rebate Credit and economic impact payments also referred to as EIP or stimulus click here To

Cash Turbotax Recovery Rebate Credit Form

Cash Turbotax Recovery Rebate Credit Form are the most straightforward type of Turbotax Recovery Rebate Credit Form. Customers receive a specific amount of money back upon purchasing a item. These are usually used for expensive items such as electronics or appliances.

Mail-In Turbotax Recovery Rebate Credit Form

Mail-in Turbotax Recovery Rebate Credit Form require the customer to submit proof of purchase to receive their reimbursement. They're more involved, however they can yield substantial savings.

Instant Turbotax Recovery Rebate Credit Form

Instant Turbotax Recovery Rebate Credit Form are applied right at the point of sale and reduce the cost of purchase immediately. Customers don't need to wait long for savings in this manner.

How Turbotax Recovery Rebate Credit Form Work

Taxes Recovery Rebate Credit Recovery Rebate

Taxes Recovery Rebate Credit Recovery Rebate

Web 4 oct 2022 nbsp 0183 32 Turbotax Recovery Rebate Credit Form Taxpayers can get tax credits through the Recovery Rebate program This allows them to receive a tax refund for their

The Turbotax Recovery Rebate Credit Form Process

The process typically comprises a number of easy steps:

-

Buy the product: Firstly purchase the product in the same way you would normally.

-

Fill out the Turbotax Recovery Rebate Credit Form application: In order to claim your Turbotax Recovery Rebate Credit Form, you'll have to fill in some information like your name, address and details about your purchase, in order in order to claim your Turbotax Recovery Rebate Credit Form.

-

To submit the Turbotax Recovery Rebate Credit Form If you want to submit the Turbotax Recovery Rebate Credit Form, based on the type of Turbotax Recovery Rebate Credit Form you will need to submit a form by mail or submit it online.

-

Wait for the company's approval: They will look over your submission to ensure it meets the terms and conditions of the Turbotax Recovery Rebate Credit Form.

-

Pay your Turbotax Recovery Rebate Credit Form After approval, the amount you receive will be through a check, or a prepaid card, or other option that's specified in the offer.

Pros and Cons of Turbotax Recovery Rebate Credit Form

Advantages

-

Cost Savings Turbotax Recovery Rebate Credit Form can dramatically decrease the price for a product.

-

Promotional Deals they encourage their customers to try new products or brands.

-

boost sales The benefits of a Turbotax Recovery Rebate Credit Form can improve an organization's sales and market share.

Disadvantages

-

Complexity mail-in Turbotax Recovery Rebate Credit Form in particular the case of HTML0, can be a hassle and tedious.

-

Deadlines for Expiration A majority of Turbotax Recovery Rebate Credit Form have deadlines for submission.

-

The risk of non-payment Some customers might not receive their refunds if they don't follow the rules precisely.

Download Turbotax Recovery Rebate Credit Form

Download Turbotax Recovery Rebate Credit Form

FAQs

1. Are Turbotax Recovery Rebate Credit Form the same as discounts? No, Turbotax Recovery Rebate Credit Form offer a partial refund after purchase, whereas discounts reduce the purchase price at point of sale.

2. Are there multiple Turbotax Recovery Rebate Credit Form I can get for the same product It's dependent on the terms for the Turbotax Recovery Rebate Credit Form promotions and on the products eligibility. Certain companies might permit it, while others won't.

3. How long will it take to receive an Turbotax Recovery Rebate Credit Form? The length of time differs, but it can range from several weeks to few months to receive your Turbotax Recovery Rebate Credit Form.

4. Do I need to pay tax for Turbotax Recovery Rebate Credit Form amount? most circumstances, Turbotax Recovery Rebate Credit Form amounts are not considered taxable income.

5. Can I trust Turbotax Recovery Rebate Credit Form offers from lesser-known brands You must research and verify that the organization offering the Turbotax Recovery Rebate Credit Form is reputable prior to making an investment.

Recovery Credit Printable Rebate Form

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Check more sample of Turbotax Recovery Rebate Credit Form below

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

Taxes Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Taxes Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

1040 Line 30 Recovery Rebate Credit Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate