In today's world of consumerism every person loves a great bargain. One option to obtain significant savings on your purchases is through Where On Form 1040 Recovery Rebate Credits. They are a form of marketing that retailers and manufacturers use to provide customers with a partial cash back on their purchases once they've taken them. In this article, we'll explore the world of Where On Form 1040 Recovery Rebate Credits. We'll explore the nature of them, how they work, and ways to maximize your savings through these cost-effective incentives.

Get Latest Where On Form 1040 Recovery Rebate Credit Below

Where On Form 1040 Recovery Rebate Credit

Where On Form 1040 Recovery Rebate Credit - Form 1040 Recovery Rebate Credit Worksheet, Form 1040 Recovery Rebate Credit, Form 1040 Recovery Rebate Credit Worksheet 2021, Form 1040 Recovery Rebate Credit Worksheet 2020

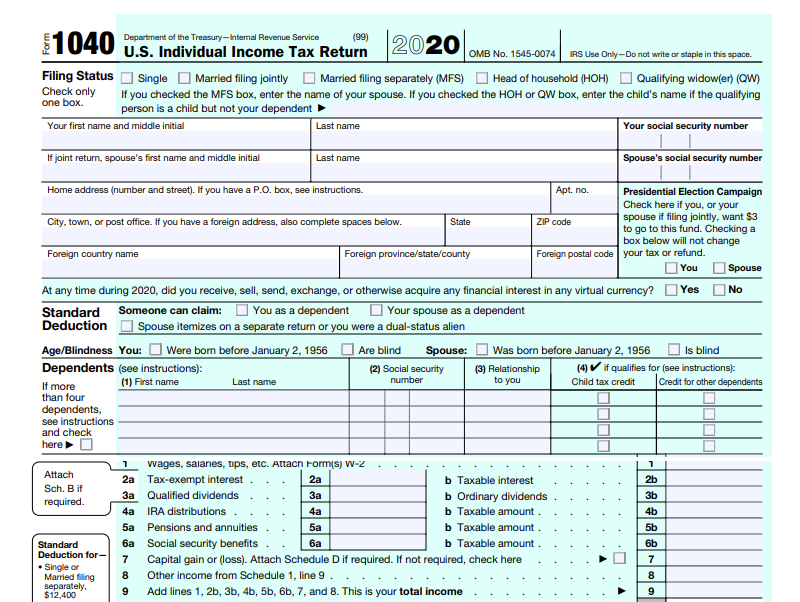

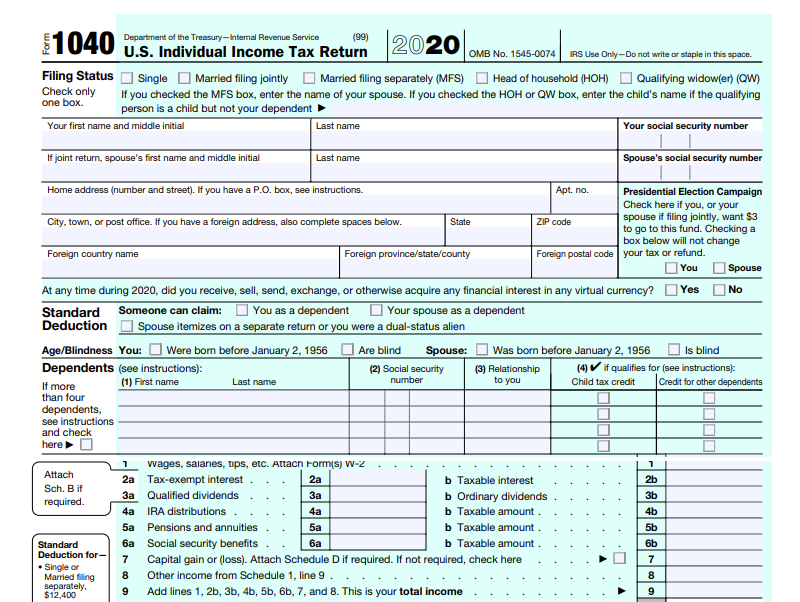

Enter the amount on the Refundable Credits section of the 1040 X and include Recovery Rebate Credit in the Explanation of Changes section If you filed

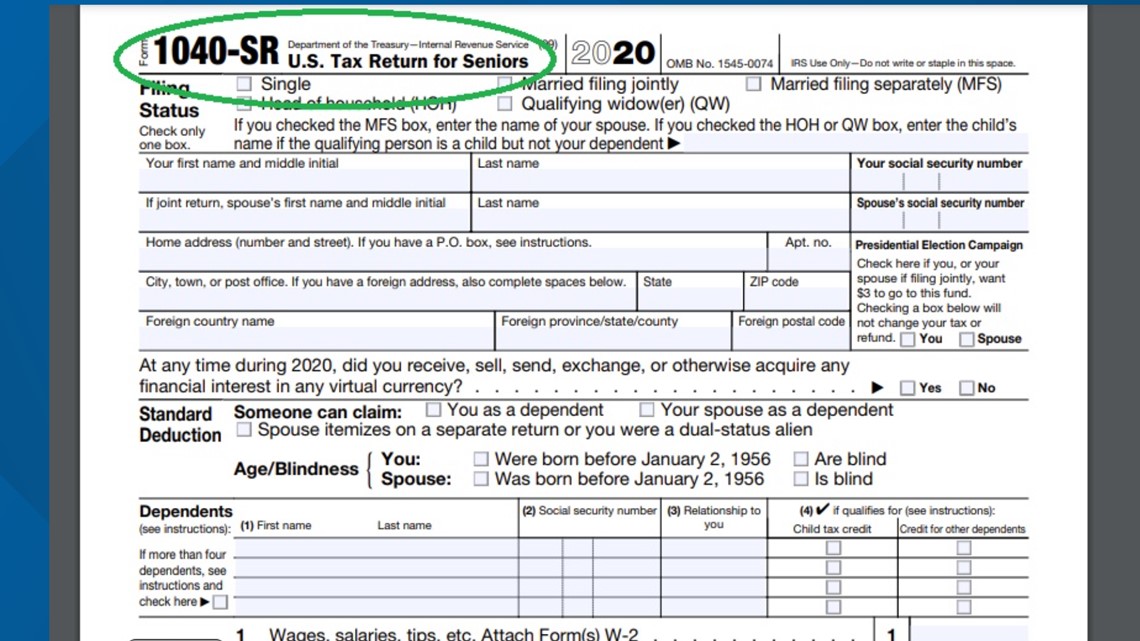

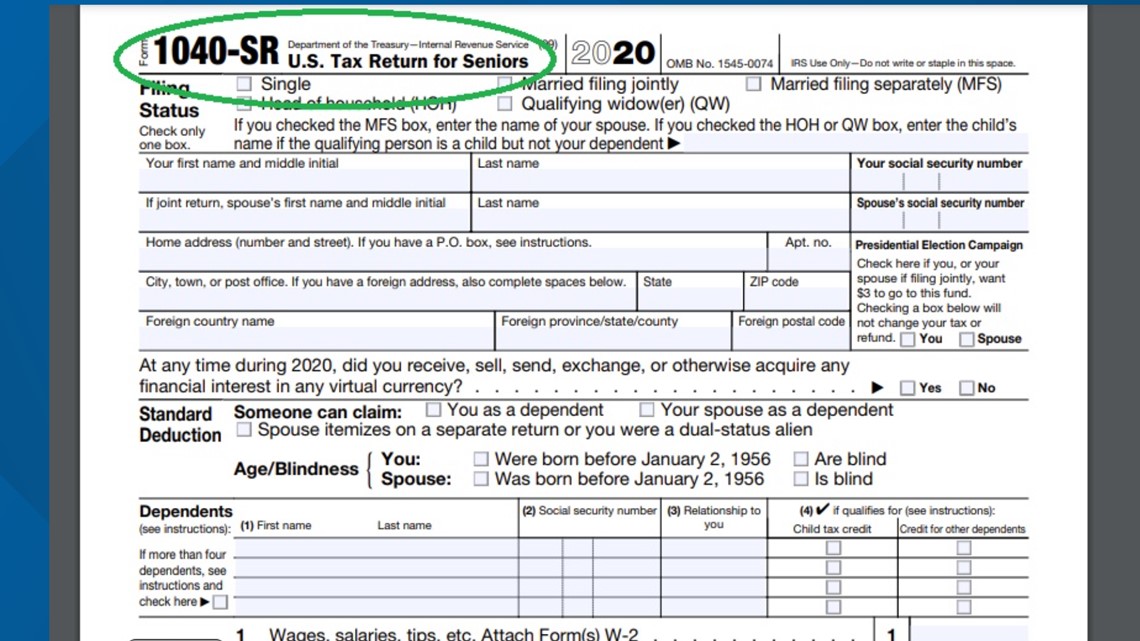

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

A Where On Form 1040 Recovery Rebate Credit in its simplest definition, is a refund to a purchaser when they purchase a product or service. It's a highly effective tool utilized by businesses to attract clients, increase sales and market specific products.

Types of Where On Form 1040 Recovery Rebate Credit

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Cash Where On Form 1040 Recovery Rebate Credit

Cash Where On Form 1040 Recovery Rebate Credit are the most straightforward type of Where On Form 1040 Recovery Rebate Credit. Customers receive a specific amount of money back after purchasing a particular item. These are often used for expensive items such as electronics or appliances.

Mail-In Where On Form 1040 Recovery Rebate Credit

Mail-in Where On Form 1040 Recovery Rebate Credit require customers to provide the proof of purchase in order to receive their refund. They're somewhat more involved, however they can yield substantial savings.

Instant Where On Form 1040 Recovery Rebate Credit

Instant Where On Form 1040 Recovery Rebate Credit can be applied at the point of sale, which reduces the purchase price immediately. Customers don't need to wait around for savings in this manner.

How Where On Form 1040 Recovery Rebate Credit Work

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are

The Where On Form 1040 Recovery Rebate Credit Process

The process usually involves a few steps:

-

Purchase the item: First you purchase the product in the same way you would normally.

-

Fill in this Where On Form 1040 Recovery Rebate Credit application: In order to claim your Where On Form 1040 Recovery Rebate Credit, you'll need to provide some information, such as your name, address, as well as the details of your purchase in order to apply for your Where On Form 1040 Recovery Rebate Credit.

-

To submit the Where On Form 1040 Recovery Rebate Credit The Where On Form 1040 Recovery Rebate Credit must be submitted in accordance with the nature of Where On Form 1040 Recovery Rebate Credit there may be a requirement to mail in a form or make it available online.

-

Wait for the company's approval: They will scrutinize your submission and ensure that it's compliant with Where On Form 1040 Recovery Rebate Credit's terms and conditions.

-

Accept your Where On Form 1040 Recovery Rebate Credit Once you've received your approval, you'll be able to receive your reimbursement, whether by check, prepaid card or another method as specified by the offer.

Pros and Cons of Where On Form 1040 Recovery Rebate Credit

Advantages

-

Cost Savings Where On Form 1040 Recovery Rebate Credit are a great way to reduce the price you pay for the product.

-

Promotional Deals Customers are enticed to try new products and brands.

-

boost sales Where On Form 1040 Recovery Rebate Credit can increase sales for a company and also increase market share.

Disadvantages

-

Complexity Reward mail-ins in particular they can be time-consuming and slow-going.

-

Days of expiration: Many Where On Form 1040 Recovery Rebate Credit have deadlines for submission.

-

Risk of not receiving payment Some customers might not receive Where On Form 1040 Recovery Rebate Credit if they don't follow the rules exactly.

Download Where On Form 1040 Recovery Rebate Credit

Download Where On Form 1040 Recovery Rebate Credit

FAQs

1. Are Where On Form 1040 Recovery Rebate Credit similar to discounts? No, Where On Form 1040 Recovery Rebate Credit involve a partial refund upon purchase, whereas discounts decrease your purchase cost at moment of sale.

2. Can I get multiple Where On Form 1040 Recovery Rebate Credit on the same item It is contingent on the conditions applicable to Where On Form 1040 Recovery Rebate Credit is offered as well as the merchandise's potential eligibility. Certain companies may allow this, whereas others will not.

3. How long does it take to get an Where On Form 1040 Recovery Rebate Credit? The time frame varies, but it can take several weeks to a few months for you to receive your Where On Form 1040 Recovery Rebate Credit.

4. Do I need to pay tax in relation to Where On Form 1040 Recovery Rebate Credit amount? the majority of situations, Where On Form 1040 Recovery Rebate Credit amounts are not considered taxable income.

5. Should I be able to trust Where On Form 1040 Recovery Rebate Credit offers from brands that aren't well-known You must research and ensure that the business offering the Where On Form 1040 Recovery Rebate Credit is reputable prior making an purchase.

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

1040 EF Message 0006 Recovery Rebate Credit Drake20

Check more sample of Where On Form 1040 Recovery Rebate Credit below

What Is The Recovery Rebate Credit CD Tax Financial

How To Claim The Stimulus Money On Your Tax Return Wltx

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

1040 Recovery Rebate Credit Drake20

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/newsroom/2021-recovery-rebate...

If you need to file an amended return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit use the worksheet in the 2021 instructions for

The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

If you need to file an amended return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit use the worksheet in the 2021 instructions for

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Claim The Stimulus Money On Your Tax Return Wltx

1040 Recovery Rebate Credit Drake20

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

1040 Recovery Rebate Credit Worksheet

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Solved Recovery Rebate Credit Error On 1040 Instructions