In this modern-day world of consumers, everyone loves a good bargain. One way to make substantial savings when you shop is with Vermont Property Tax Rebate Forms. Vermont Property Tax Rebate Forms are a method of marketing employed by retailers and manufacturers to give customers a part payment on their purchases, after they've created them. In this post, we'll take a look at the world that is Vermont Property Tax Rebate Forms. We'll discuss what they are what they are, how they function, and how you can make the most of the value of these incentives.

Get Latest Vermont Property Tax Rebate Form Below

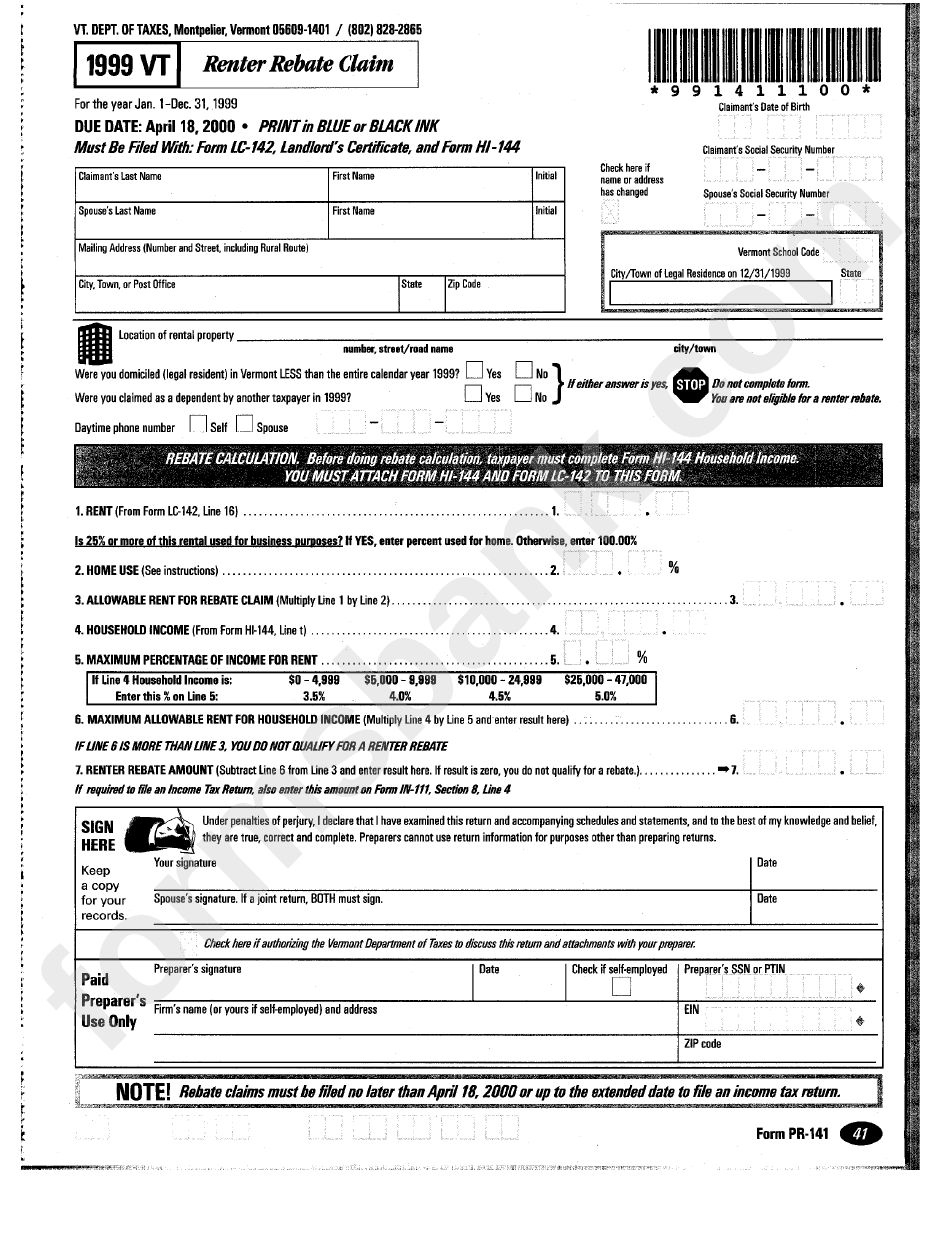

Vermont Property Tax Rebate Form

Vermont Property Tax Rebate Form -

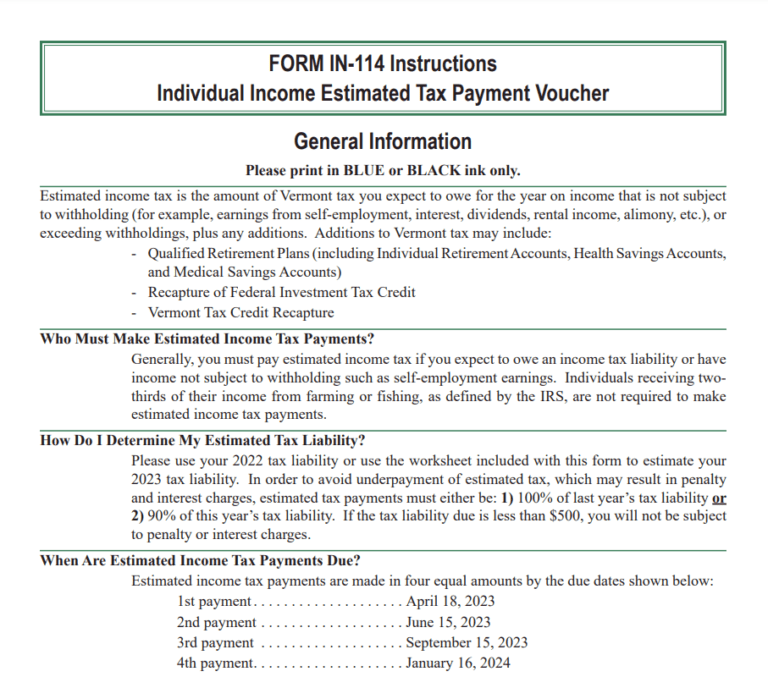

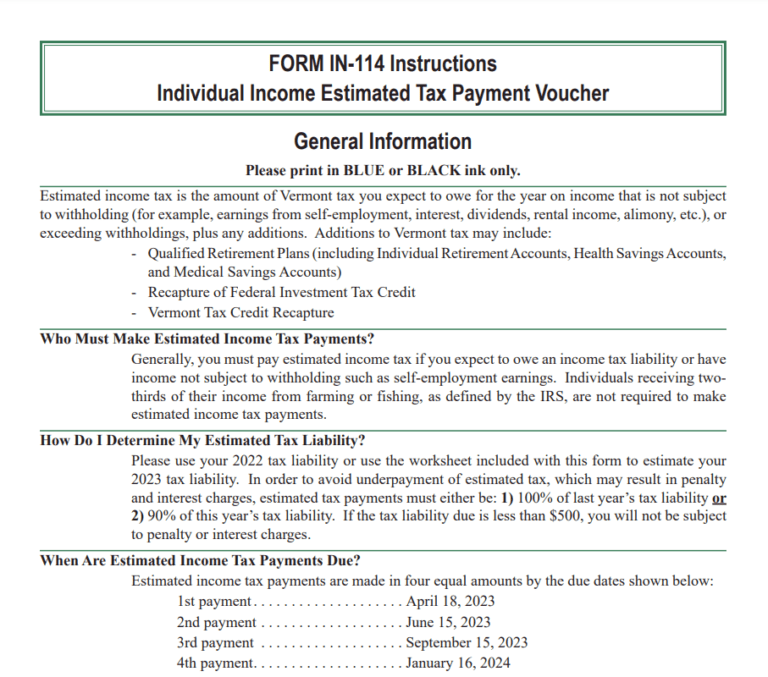

Web 14 f 233 vr 2023 nbsp 0183 32 FS 1038 The Vermont Property Tax Credit Fact Sheet Fri 03 18 2022 12 00 2021 Form HS 122W Form Mon 01 24 2022 12 00

Web The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your 2022 and 2023

A Vermont Property Tax Rebate Form, in its simplest model, refers to a partial return to the customer after they've bought a product or service. This is a potent tool used by businesses to attract clients, increase sales as well as promote particular products.

Types of Vermont Property Tax Rebate Form

Vermont Tax Rebate 2023 Printable Rebate Form

Vermont Tax Rebate 2023 Printable Rebate Form

Web 20 janv 2022 nbsp 0183 32 Pay Use Tax Tax Bill Overview Property Tax Bill Overview Interest and Penalties Payment Plans Voluntary Disclosure Program Refunds Where s My Refund

Web 18 avr 2023 nbsp 0183 32 Be sure to verify your SPAN as your property tax credit is credited to the property tax bill for the SPAN entered on this form Line A2 Business Use of Dwelling If

Cash Vermont Property Tax Rebate Form

Cash Vermont Property Tax Rebate Form are the most basic type of Vermont Property Tax Rebate Form. Customers are offered a certain amount of cash back after buying a product. These are often used for costly items like electronics or appliances.

Mail-In Vermont Property Tax Rebate Form

Mail-in Vermont Property Tax Rebate Form demand that customers present their proof of purchase before receiving their reimbursement. They're a bit more complicated, but they can provide substantial savings.

Instant Vermont Property Tax Rebate Form

Instant Vermont Property Tax Rebate Form are applied at moment of sale, cutting the price of purchases immediately. Customers don't need to wait around for savings with this type.

How Vermont Property Tax Rebate Form Work

Form Rew 1 Vermont Withholding Tax Return For Transfer Of Real

Form Rew 1 Vermont Withholding Tax Return For Transfer Of Real

Web Form HS 122 HI 144 requires you to list multiple forms of income such as wages interest or alimony We last updated the Homestead Declaration AND Property Tax Adjustment

The Vermont Property Tax Rebate Form Process

The process typically involves few steps

-

Buy the product: At first, you buy the product in the same way you would normally.

-

Fill in the Vermont Property Tax Rebate Form questionnaire: you'll have be able to provide a few details, such as your address, name, along with the purchase details, to take advantage of your Vermont Property Tax Rebate Form.

-

In order to submit the Vermont Property Tax Rebate Form: Depending on the kind of Vermont Property Tax Rebate Form you may have to mail in a form or make it available online.

-

Wait for approval: The business will scrutinize your submission to make sure that it's in accordance with the Vermont Property Tax Rebate Form's terms and conditions.

-

Enjoy your Vermont Property Tax Rebate Form Once it's approved, you'll receive a refund through a check, or a prepaid card, or by another procedure specified by the deal.

Pros and Cons of Vermont Property Tax Rebate Form

Advantages

-

Cost savings: Vermont Property Tax Rebate Form can significantly reduce the cost for a product.

-

Promotional Deals The aim is to encourage customers to try out new products or brands.

-

Increase Sales Vermont Property Tax Rebate Form can help boost a company's sales and market share.

Disadvantages

-

Complexity The mail-in Vermont Property Tax Rebate Form particularly are often time-consuming and time-consuming.

-

End Dates: Many Vermont Property Tax Rebate Form have strict time limits for submission.

-

Risk of Non-Payment Customers may lose their Vermont Property Tax Rebate Form in the event that they don't follow the regulations exactly.

Download Vermont Property Tax Rebate Form

Download Vermont Property Tax Rebate Form

FAQs

1. Are Vermont Property Tax Rebate Form equivalent to discounts? Not necessarily, as Vermont Property Tax Rebate Form are a partial refund after the purchase whereas discounts will reduce the price of the purchase at the moment of sale.

2. Are there any Vermont Property Tax Rebate Form that I can use for the same product This is dependent on terms that apply to the Vermont Property Tax Rebate Form offers and the product's quality and eligibility. Certain companies might allow it, and some don't.

3. How long will it take to receive a Vermont Property Tax Rebate Form? The length of time will vary, but it may take several weeks to a few months for you to receive your Vermont Property Tax Rebate Form.

4. Do I have to pay taxes in relation to Vermont Property Tax Rebate Form values? the majority of situations, Vermont Property Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Vermont Property Tax Rebate Form offers from lesser-known brands Do I need to conduct a thorough research and confirm that the brand that is offering the Vermont Property Tax Rebate Form is reputable prior to making an acquisition.

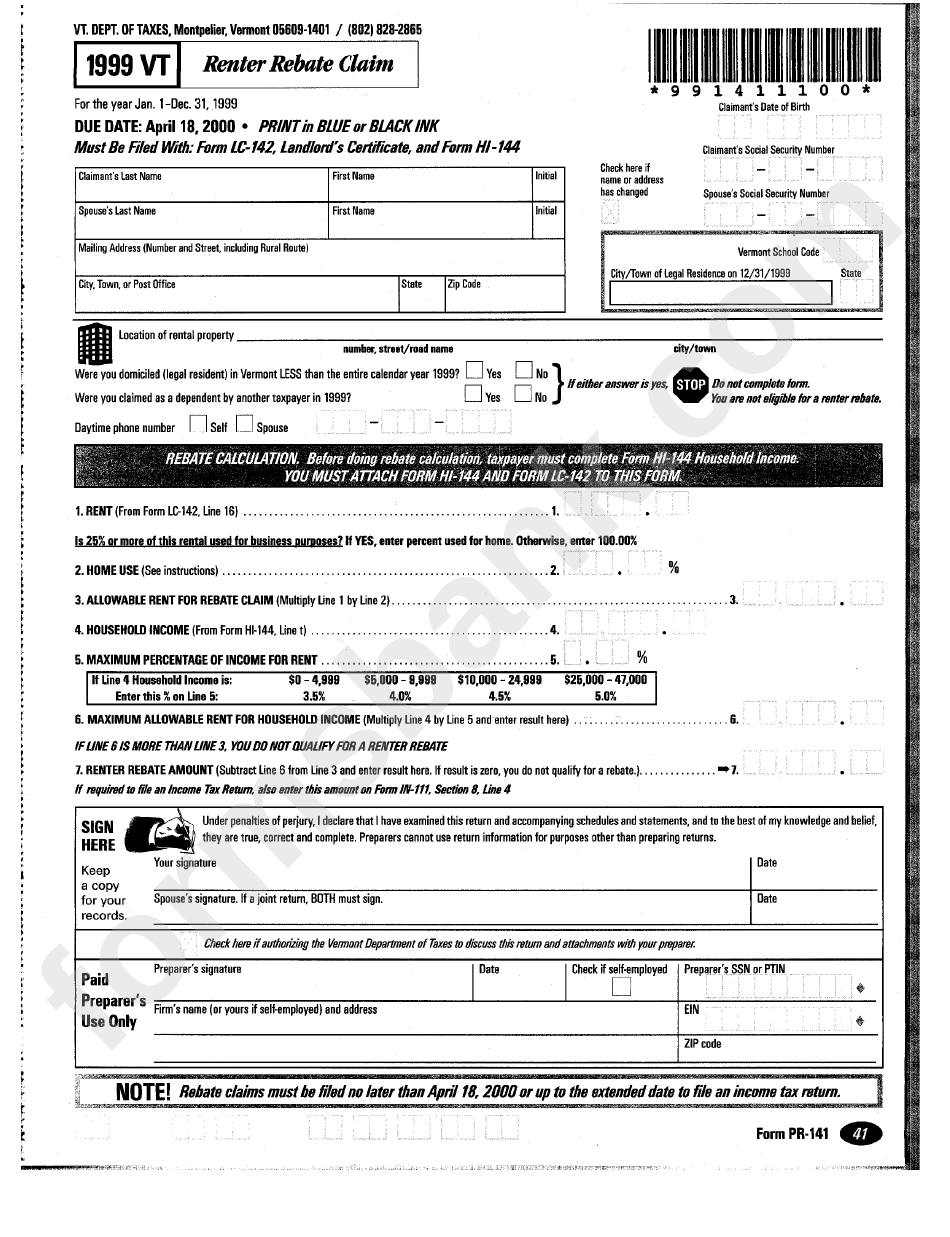

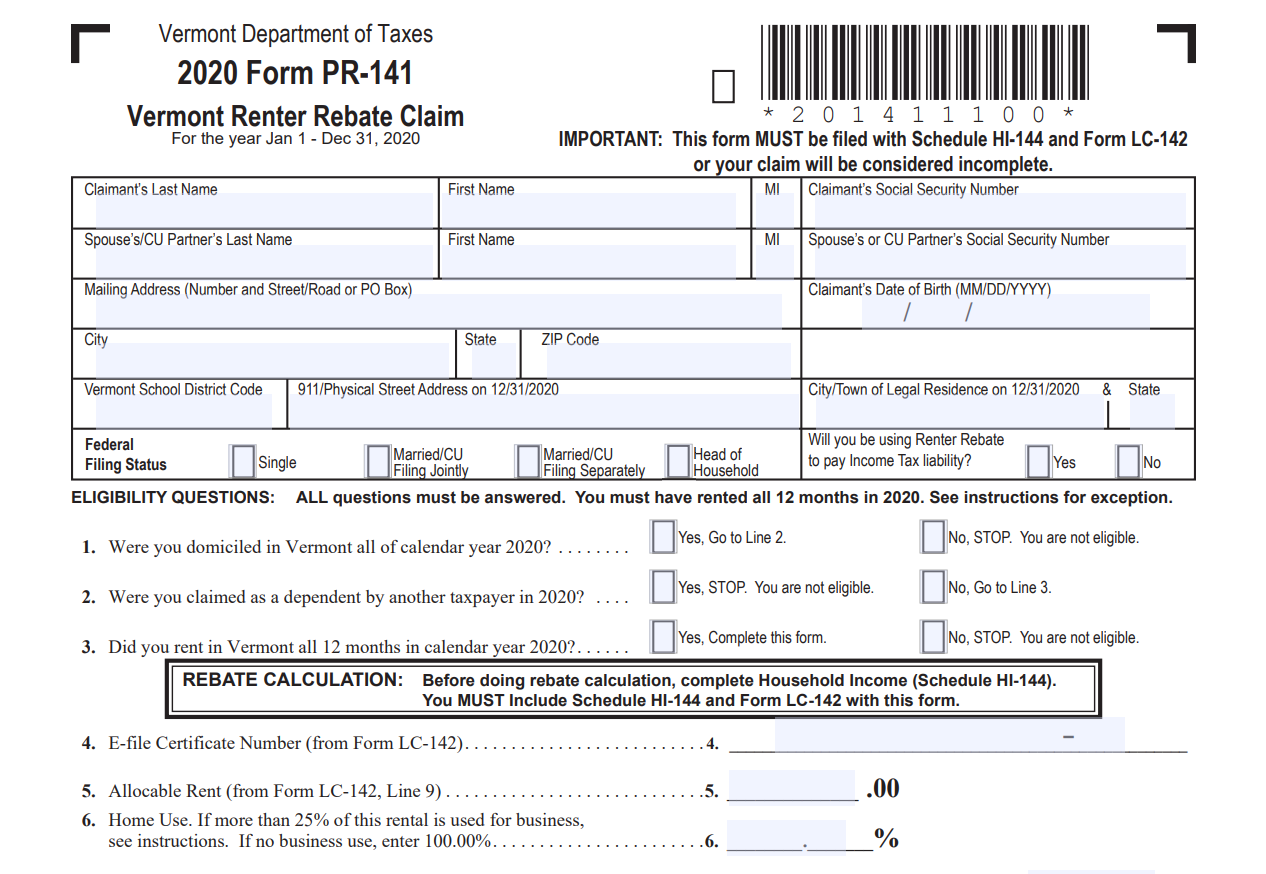

Vermont Renters Rebate Form Fill Online Printable Fillable Blank

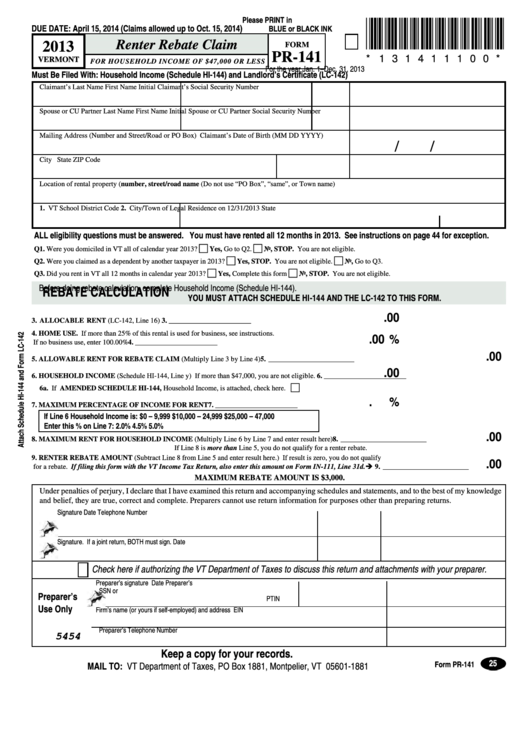

Fillable Form Pr 141 Vermont Renter Rebate Claim 2013 Printable Pdf

Check more sample of Vermont Property Tax Rebate Form below

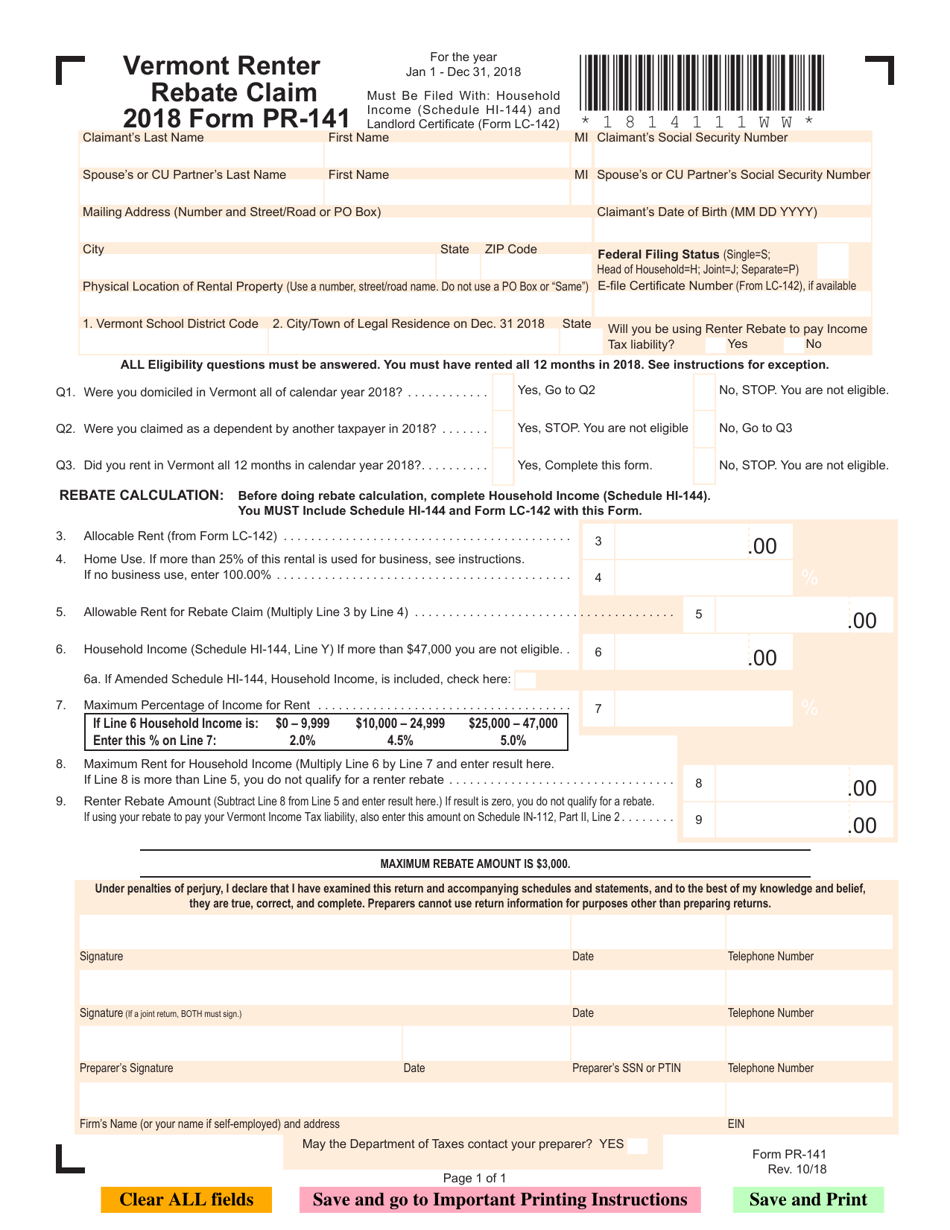

Form PR 141 2018 Fill Out Sign Online And Download Fillable PDF

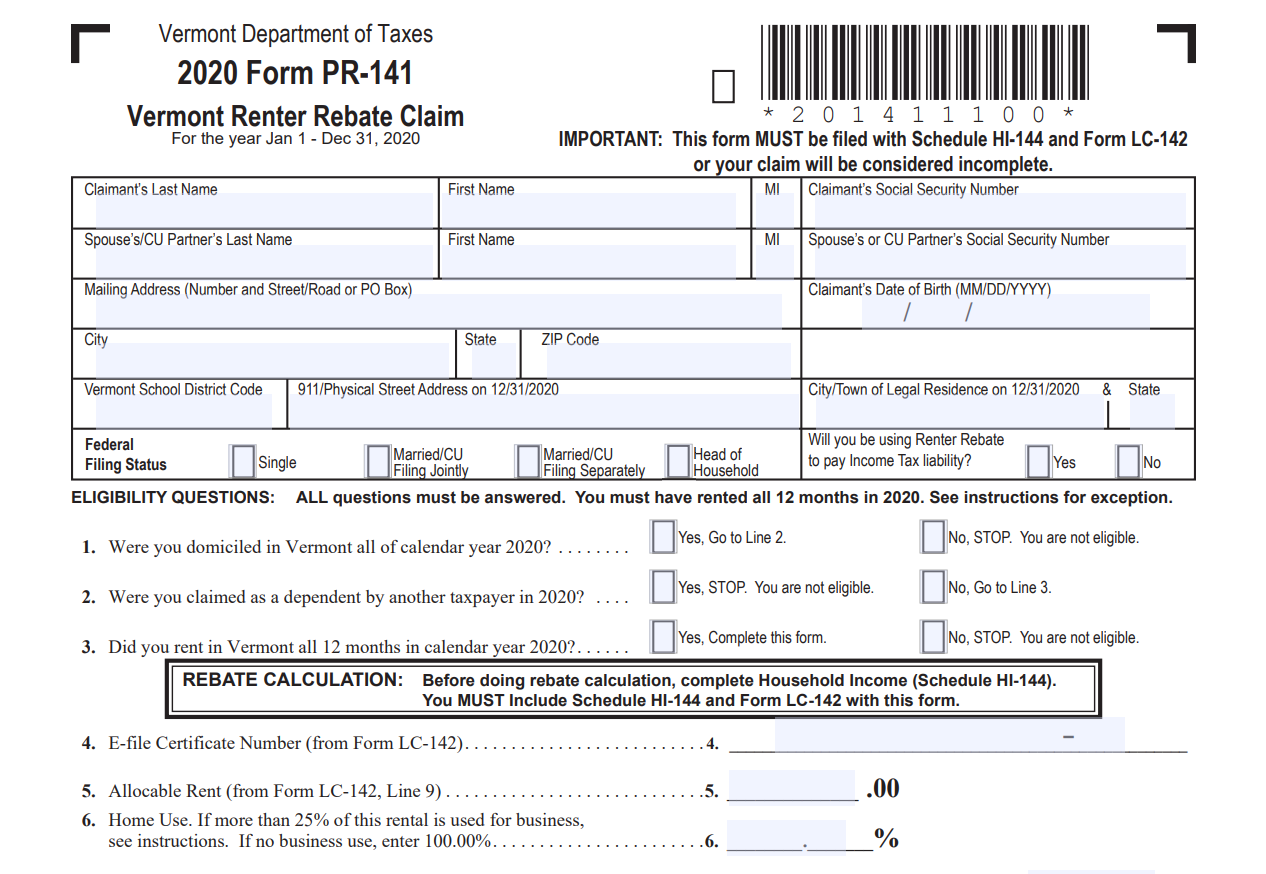

Renters Printable Rebate Form

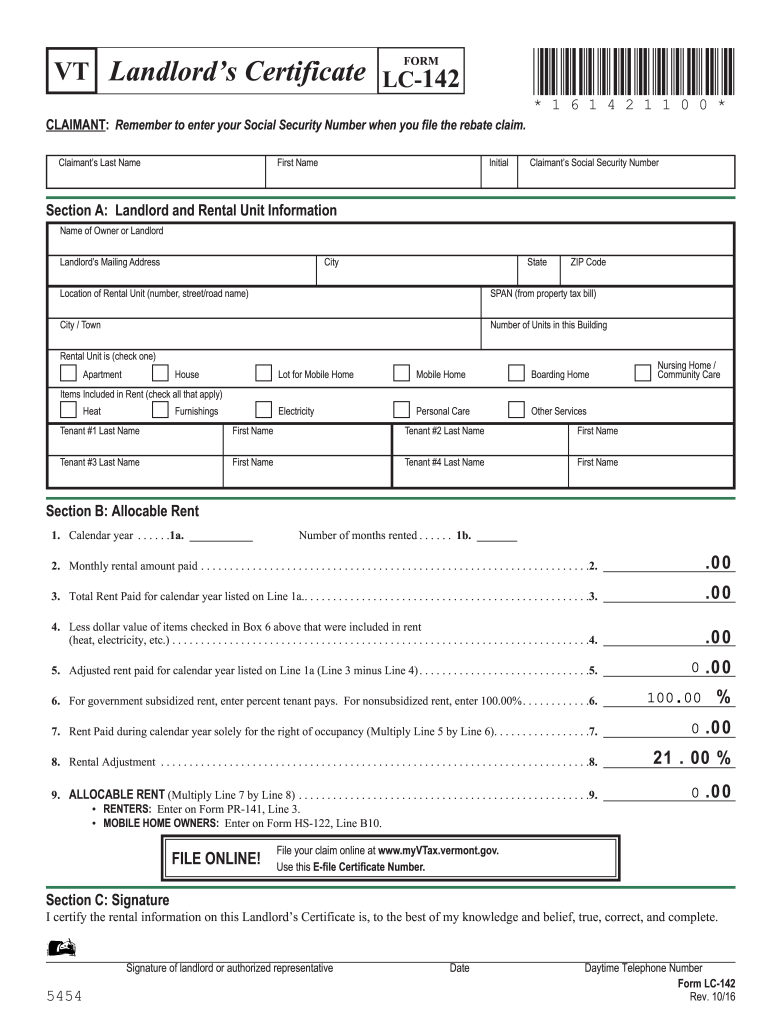

2019 2023 Form VT LC 142 Fill Online Printable Fillable Blank

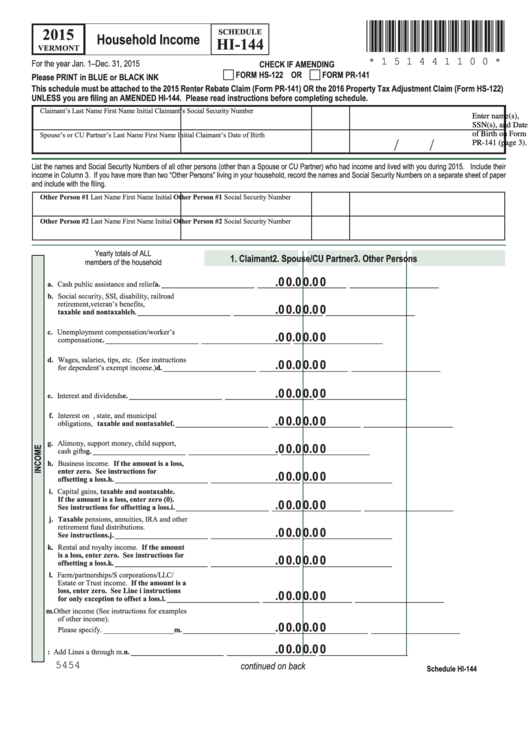

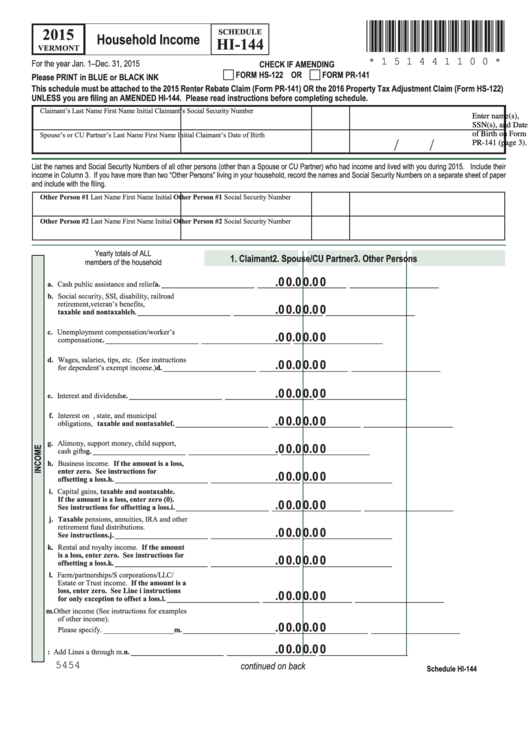

Fillable Schedule Hi 144 Vermont Household Income 2015 Form Pr 141

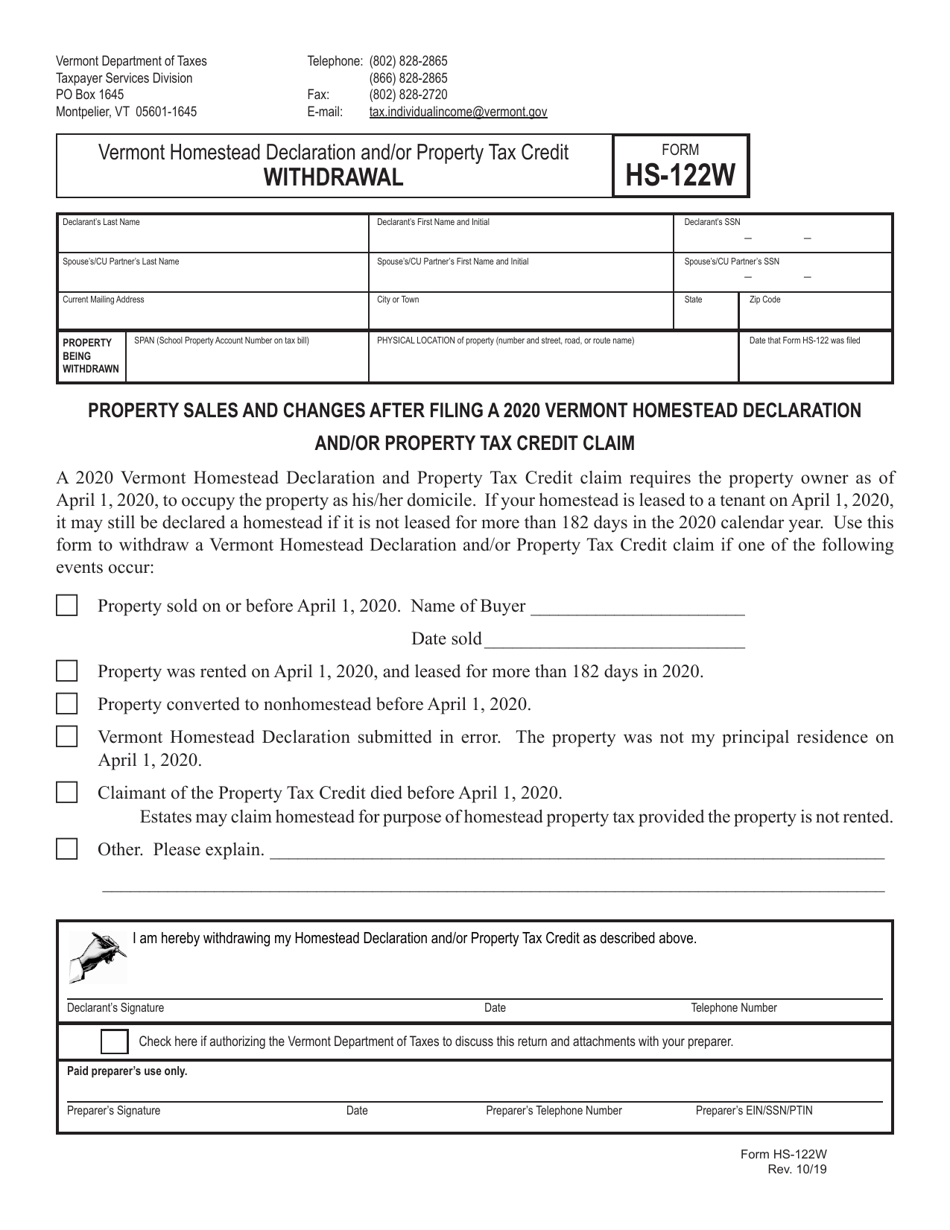

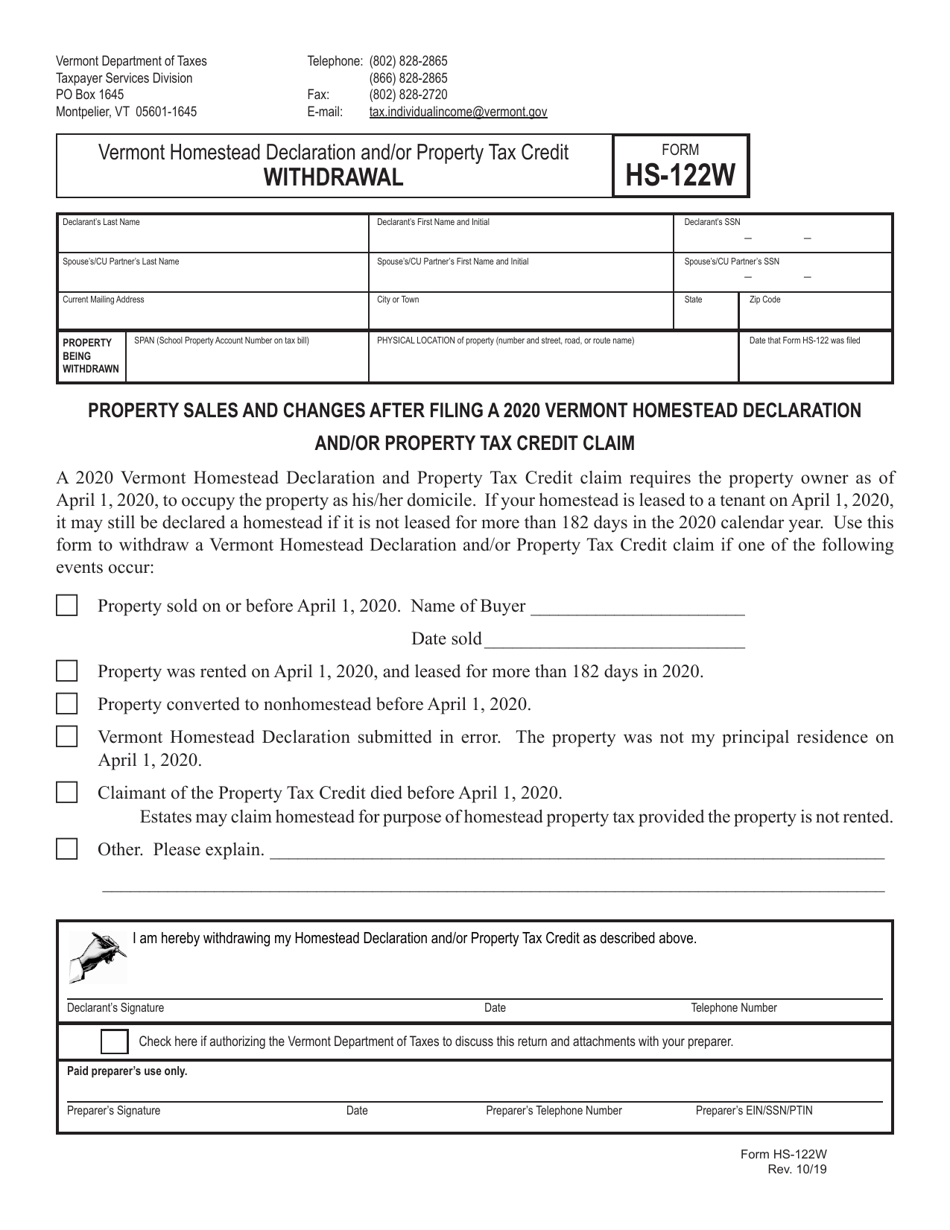

Form HS 122W Download Printable PDF Or Fill Online Vermont Homestead

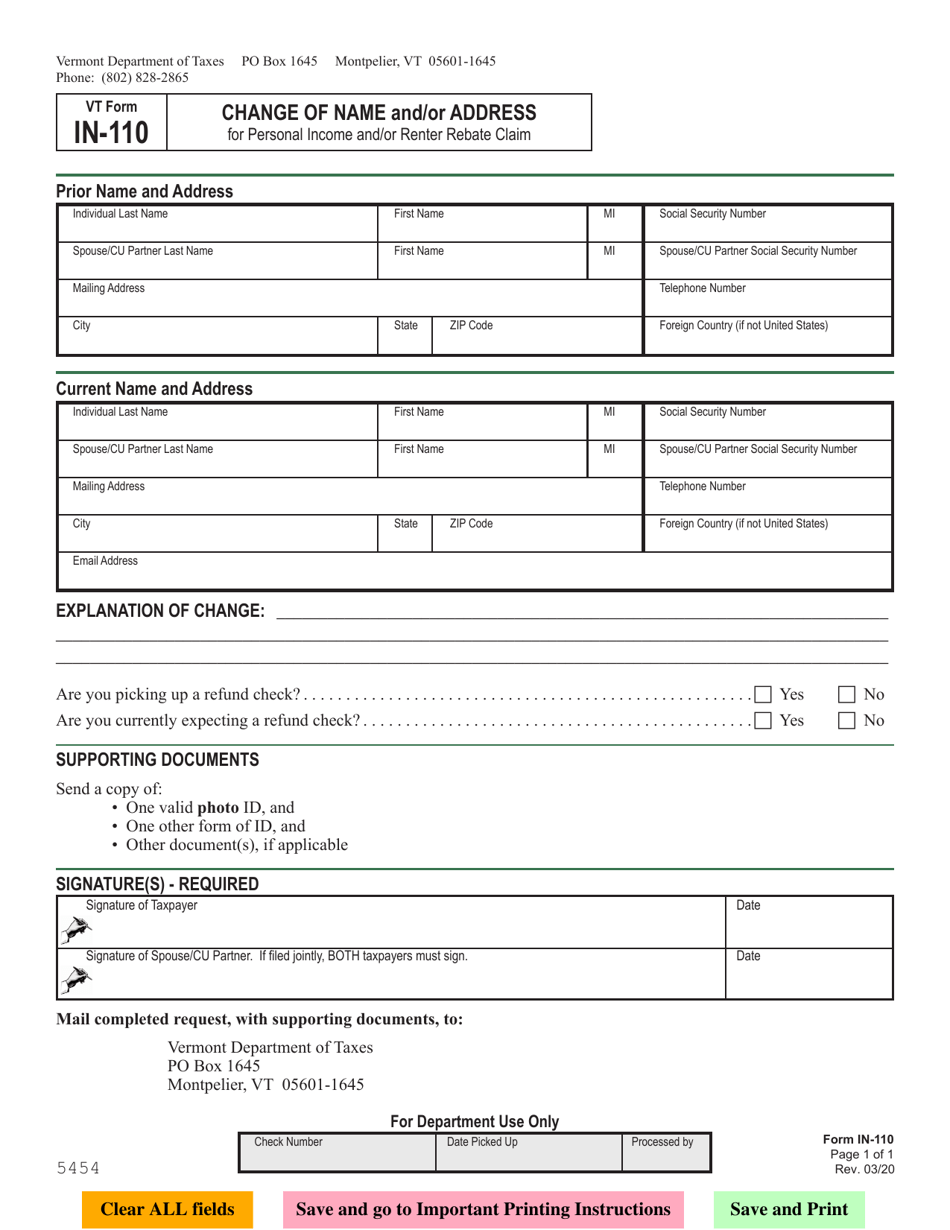

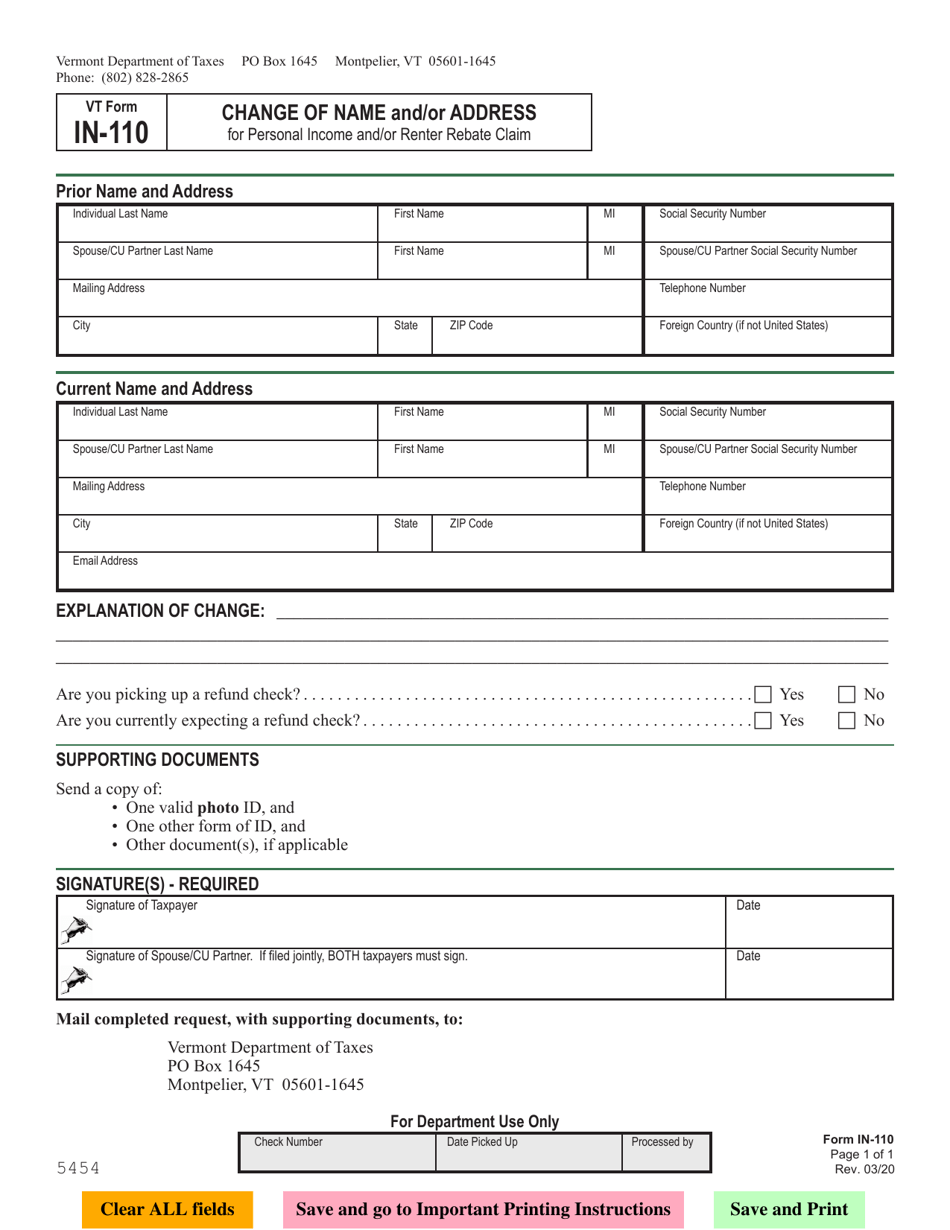

VT Form IN 110 Download Fillable PDF Or Fill Online Change Of Name And

https://tax.vermont.gov/sites/tax/files/documents/FS-1038.pdf

Web The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your 2022 and 2023

https://tax.vermont.gov/sites/tax/files/documents/HS-122-20…

Web How to file a Property Tax Credit Claim To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit

Web The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit on your 2022 and 2023

Web How to file a Property Tax Credit Claim To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit

Fillable Schedule Hi 144 Vermont Household Income 2015 Form Pr 141

Renters Printable Rebate Form

Form HS 122W Download Printable PDF Or Fill Online Vermont Homestead

VT Form IN 110 Download Fillable PDF Or Fill Online Change Of Name And

Vermont Landlord Certificate LC 142 EZ Landlord Forms Being A

2021 Form VT HS 122 HI 144 Fill Online Printable Fillable Blank

2021 Form VT HS 122 HI 144 Fill Online Printable Fillable Blank

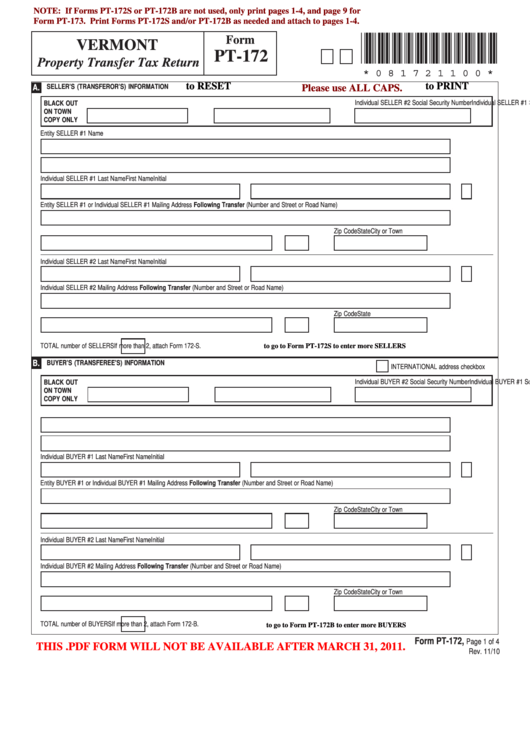

Fillable Form Pt 172 Property Transfer Tax Return Vermont Printable