In today's world of consumerism everyone appreciates a great bargain. One method of gaining significant savings for your purchases is through Tax Rebate Forms Irelands. Tax Rebate Forms Irelands are a method of marketing employed by retailers and manufacturers to offer customers a refund on their purchases after they have created them. In this article, we'll investigate the world of Tax Rebate Forms Irelands and explore what they are what they are, how they function, and how you can make the most of your savings via these cost-effective incentives.

Get Latest Tax Rebate Forms Ireland Below

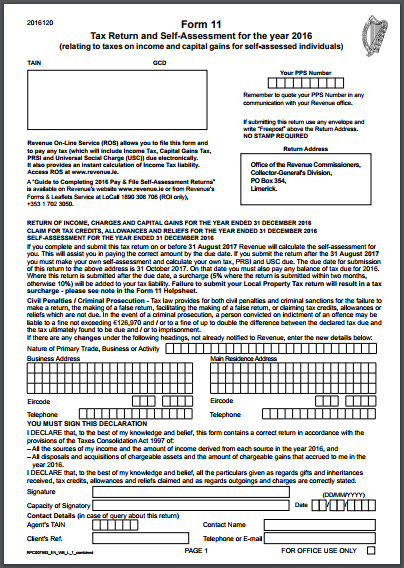

Tax Rebate Forms Ireland

Tax Rebate Forms Ireland -

Web How to apply Introduction Working from home also known as remote working or e working is where you work from home for substantial periods on a full time or part time basis

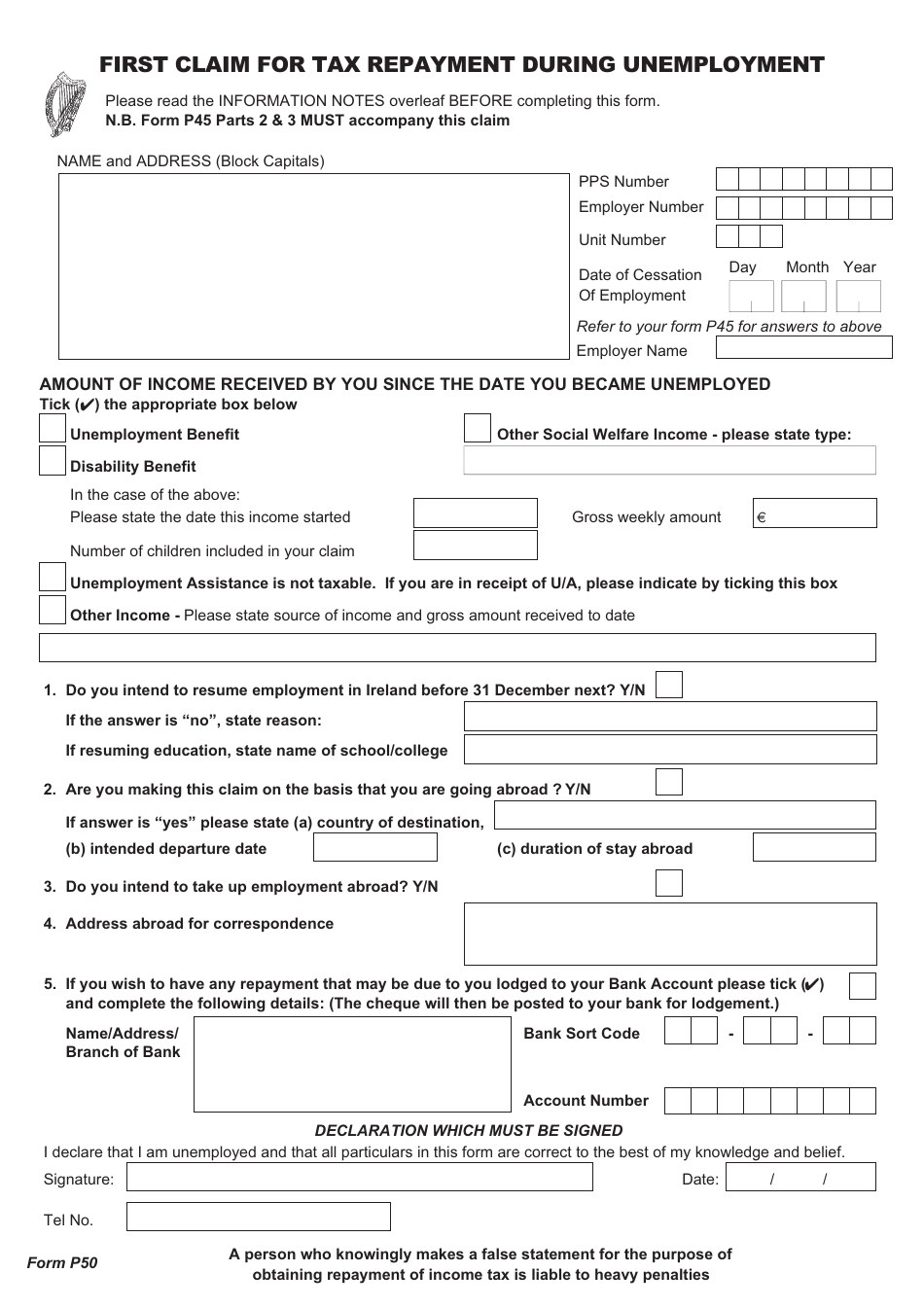

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

A Tax Rebate Forms Ireland in its simplest format, is a reimbursement to a buyer after they've bought a product or service. It is a powerful tool that businesses use to draw clients, increase sales and also to advertise certain products.

Types of Tax Rebate Forms Ireland

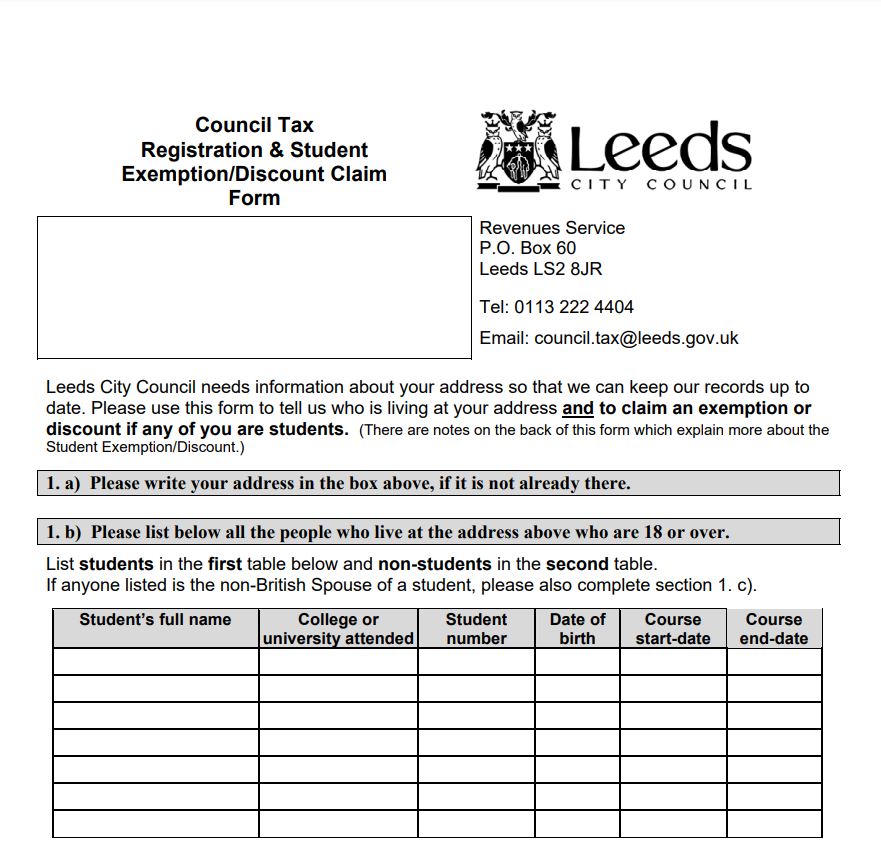

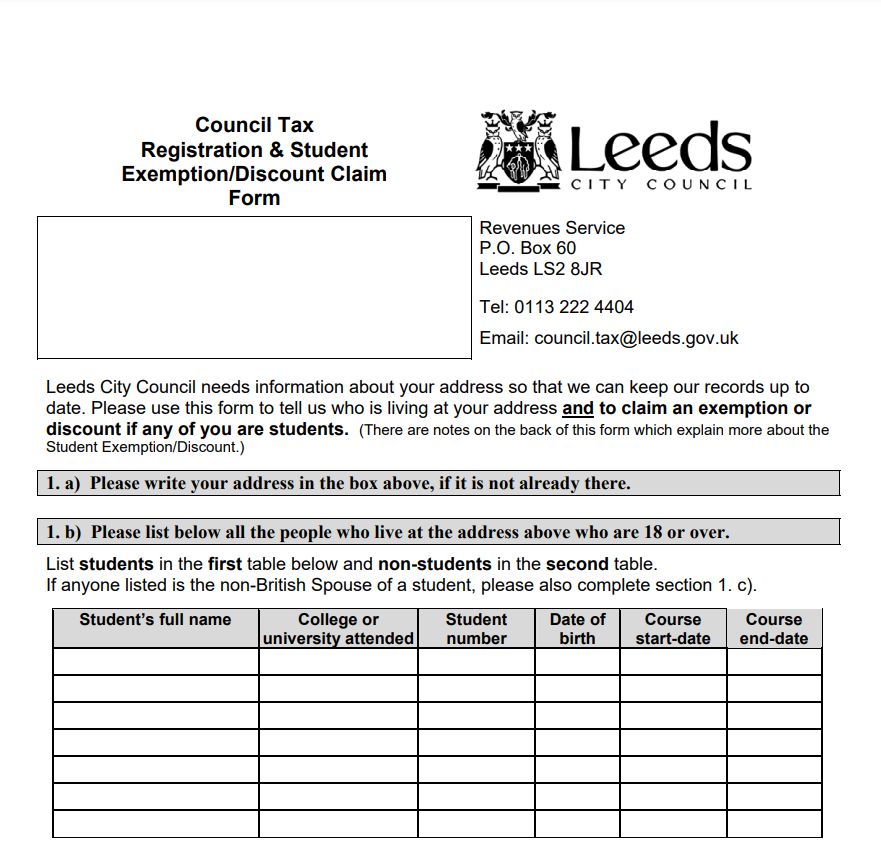

Leeds Council Tax Helpline Printable Rebate Form

Leeds Council Tax Helpline Printable Rebate Form

Web 1 janv 2023 nbsp 0183 32 How you will receive a refund if due What to do in an underpayment position Income Tax Return Note For self assessed and self employed customers please see

Web Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your

Cash Tax Rebate Forms Ireland

Cash Tax Rebate Forms Ireland are a simple type of Tax Rebate Forms Ireland. Customers receive a specified amount back in cash after buying a product. These are usually used for costly items like electronics or appliances.

Mail-In Tax Rebate Forms Ireland

Mail-in Tax Rebate Forms Ireland are based on the requirement that customers submit proof of purchase to receive their reimbursement. They're more involved but can offer significant savings.

Instant Tax Rebate Forms Ireland

Instant Tax Rebate Forms Ireland are applied at point of sale and reduce your purchase cost instantly. Customers don't need to wait until they can save with this type.

How Tax Rebate Forms Ireland Work

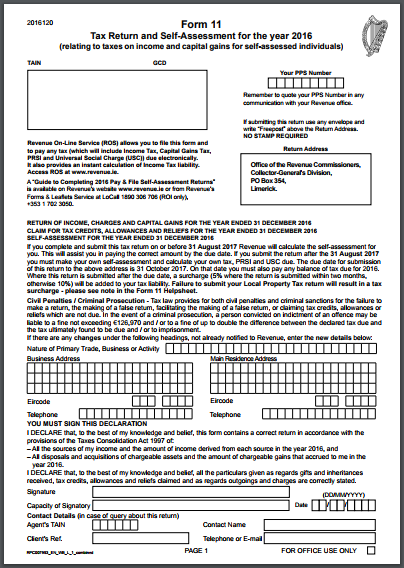

2018 2022 Form IE RF100A Fill Online Printable Fillable Blank

2018 2022 Form IE RF100A Fill Online Printable Fillable Blank

Web 9 nov 2022 nbsp 0183 32 your full postal address including Eircode Alternatively you can also use these details to request forms by emailing custform revenue ie Please note that you

The Tax Rebate Forms Ireland Process

It usually consists of a few steps:

-

You purchase the item: First purchase the product as you normally would.

-

Fill in your Tax Rebate Forms Ireland request form. You'll have to provide some information like your name, address and purchase details, to take advantage of your Tax Rebate Forms Ireland.

-

Make sure you submit the Tax Rebate Forms Ireland depending on the kind of Tax Rebate Forms Ireland it is possible that you need to submit a claim form to the bank or make it available online.

-

Wait for the company's approval: They will look over your submission for compliance with reimbursement's terms and condition.

-

You will receive your Tax Rebate Forms Ireland After being approved, you'll get your refund, through a check, or a prepaid card, or any other method that is specified in the offer.

Pros and Cons of Tax Rebate Forms Ireland

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for the product.

-

Promotional Deals They encourage customers in trying new products or brands.

-

Accelerate Sales Tax Rebate Forms Ireland can enhance sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Tax Rebate Forms Ireland in particular is a time-consuming process and lengthy.

-

Extension Dates Many Tax Rebate Forms Ireland impose very strict deadlines for filing.

-

The risk of non-payment Customers may not receive Tax Rebate Forms Ireland if they don't adhere to the requirements precisely.

Download Tax Rebate Forms Ireland

Download Tax Rebate Forms Ireland

FAQs

1. Are Tax Rebate Forms Ireland similar to discounts? No, the Tax Rebate Forms Ireland will be only a partial reimbursement following the purchase, whereas discounts reduce prices at time of sale.

2. Can I make use of multiple Tax Rebate Forms Ireland for the same product It's dependent on the conditions of the Tax Rebate Forms Ireland offer and also the item's eligibility. Some companies may allow it, while some won't.

3. What is the time frame to get the Tax Rebate Forms Ireland? The length of time differs, but could take several weeks to a few months before you receive your Tax Rebate Forms Ireland.

4. Do I need to pay tax regarding Tax Rebate Forms Ireland montants? the majority of situations, Tax Rebate Forms Ireland amounts are not considered to be taxable income.

5. Can I trust Tax Rebate Forms Ireland deals from lesser-known brands Do I need to conduct a thorough research and verify that the brand offering the Tax Rebate Forms Ireland has a good reputation prior to making purchases.

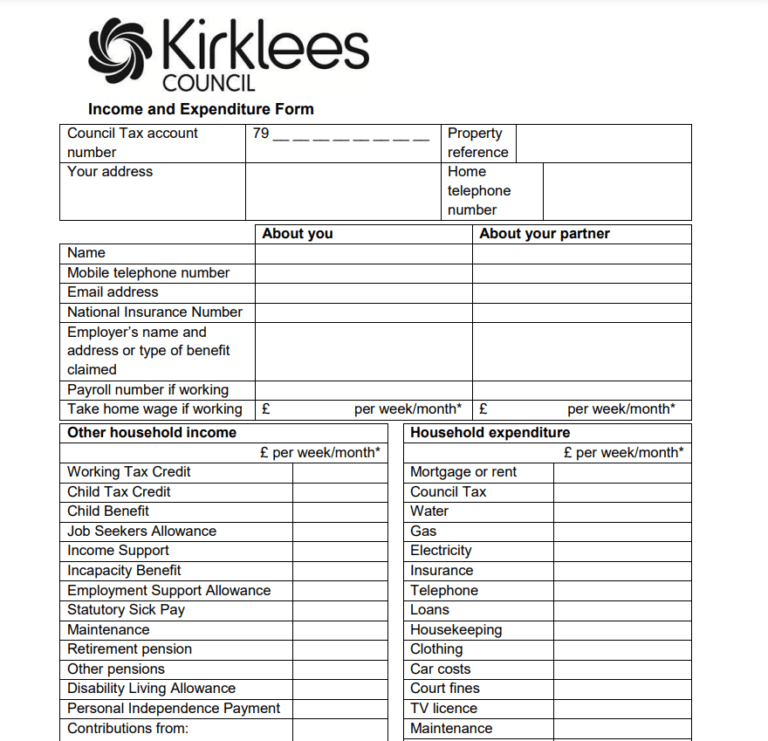

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

Form P50 Download Fillable PDF Or Fill Online First Claim For Tax

Check more sample of Tax Rebate Forms Ireland below

Council Tax Rebate Single Person

5 Reasons To Use Irish Tax Rebates Irish Tax Rebates

Bolton Council Tax Rebate Form Printable Rebate Form

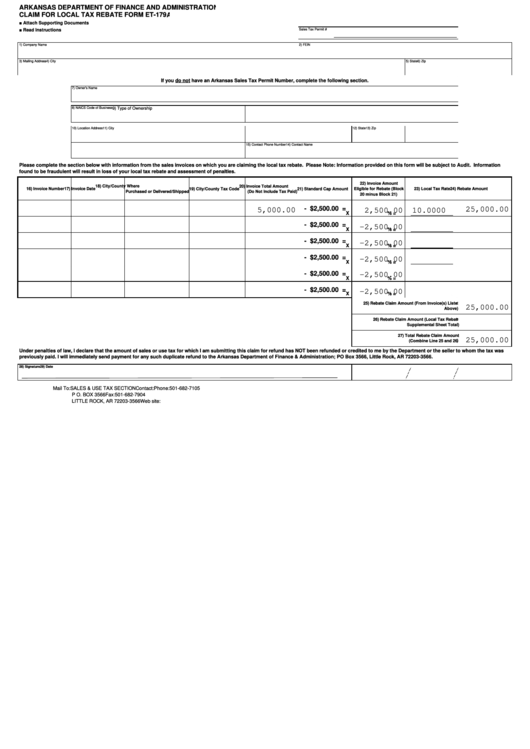

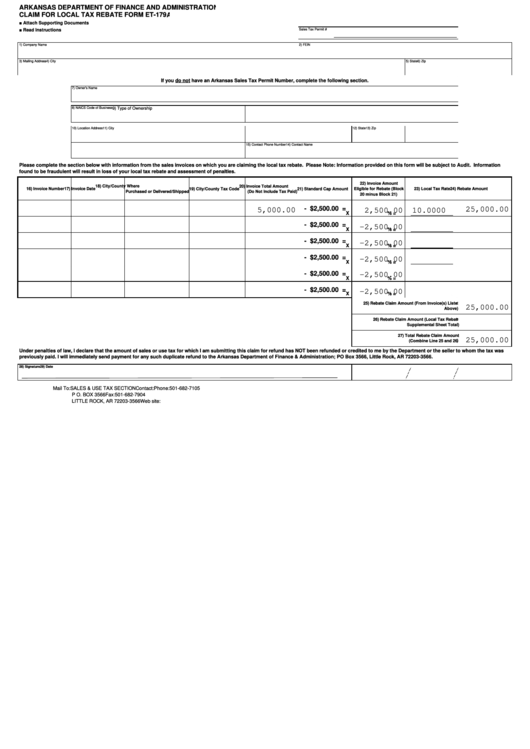

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

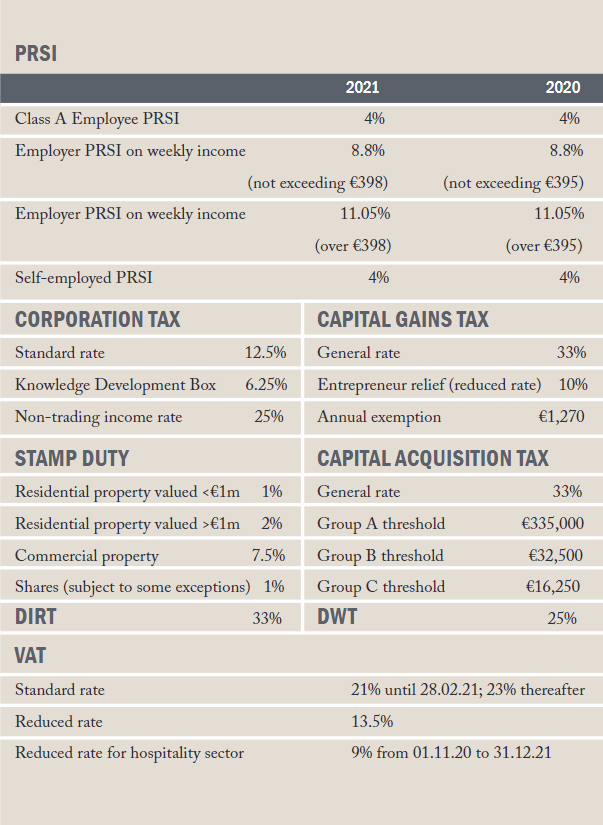

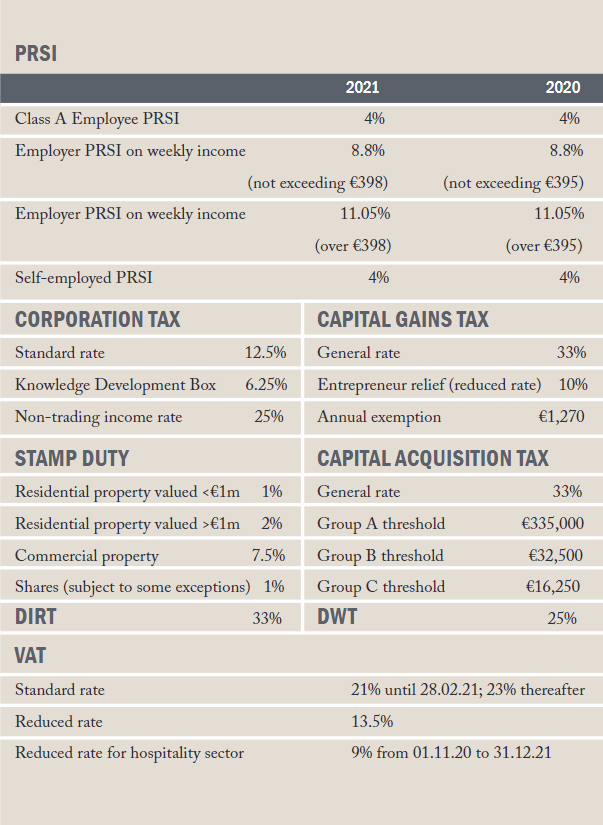

Budget 2021 IRISH TAX GUIDE FOR 2021 Rebates

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

https://www.revenue.ie/.../are-you-entitled-to-a-refund-of-tax.aspx

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

https://www.revenue.ie/.../documents/form12.pdf

Web Income Tax Return for the year 2022 Form 12 Employees Pension Recipients amp Non Proprietary Directors Remember to quote this number in all correspondence or

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the

Web Income Tax Return for the year 2022 Form 12 Employees Pension Recipients amp Non Proprietary Directors Remember to quote this number in all correspondence or

Fillable Form Et 179a Claim For Local Tax Rebate Printable Pdf Download

5 Reasons To Use Irish Tax Rebates Irish Tax Rebates

Budget 2021 IRISH TAX GUIDE FOR 2021 Rebates

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

P G Printable Rebate Form

Tax Rebate For Individual It Is The Refund Which An Individual Can

Tax Rebate For Individual It Is The Refund Which An Individual Can

Menards 11 Rebate Form 4468 MenardsRebateForms