Today, in a world that is driven by the consumer people love a good deal. One of the ways to enjoy substantial savings on your purchases is by using Us Tax Rebate Forms. Us Tax Rebate Forms can be a way of marketing used by manufacturers and retailers to give customers a part return on their purchases once they've made them. In this article, we will look into the world of Us Tax Rebate Forms, examining what they are and how they work and ways to maximize your savings via these cost-effective incentives.

Get Latest Us Tax Rebate Form Below

Us Tax Rebate Form

Us Tax Rebate Form - Us Tax Return Form, Us Tax Return Form For Non Residents, Us Tax Return Form 1040-sr, Us Tax Return Form 2555, Us Tax Return Form 1042-s, Us Tax Return Form 2022, Us Tax Return Form 1116, Us Tax Return Form 3520, Us Tax Return Form 1099, Us Tax Return Form 1065

Web 6 d 233 c 2022 nbsp 0183 32 POPULAR FORMS amp INSTRUCTIONS Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

A Us Tax Rebate Form or Us Tax Rebate Form, in its most basic type, is a refund to a purchaser after they've bought a product or service. It's a very effective technique employed by companies to draw clients, increase sales and to promote certain products.

Types of Us Tax Rebate Form

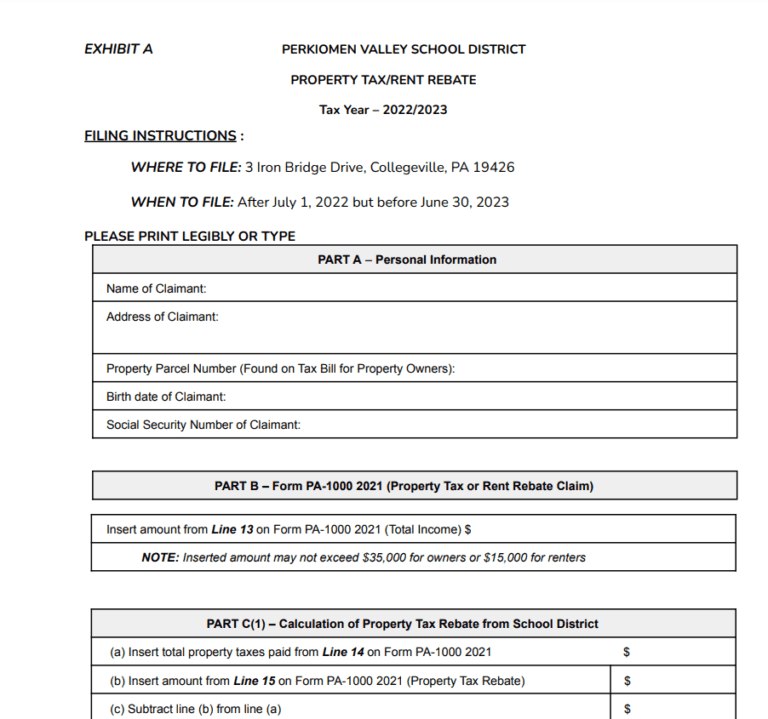

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040

Cash Us Tax Rebate Form

Cash Us Tax Rebate Form are the most straightforward type of Us Tax Rebate Form. Clients receive a predetermined amount of money when purchasing a particular item. These are usually used for the most expensive products like electronics or appliances.

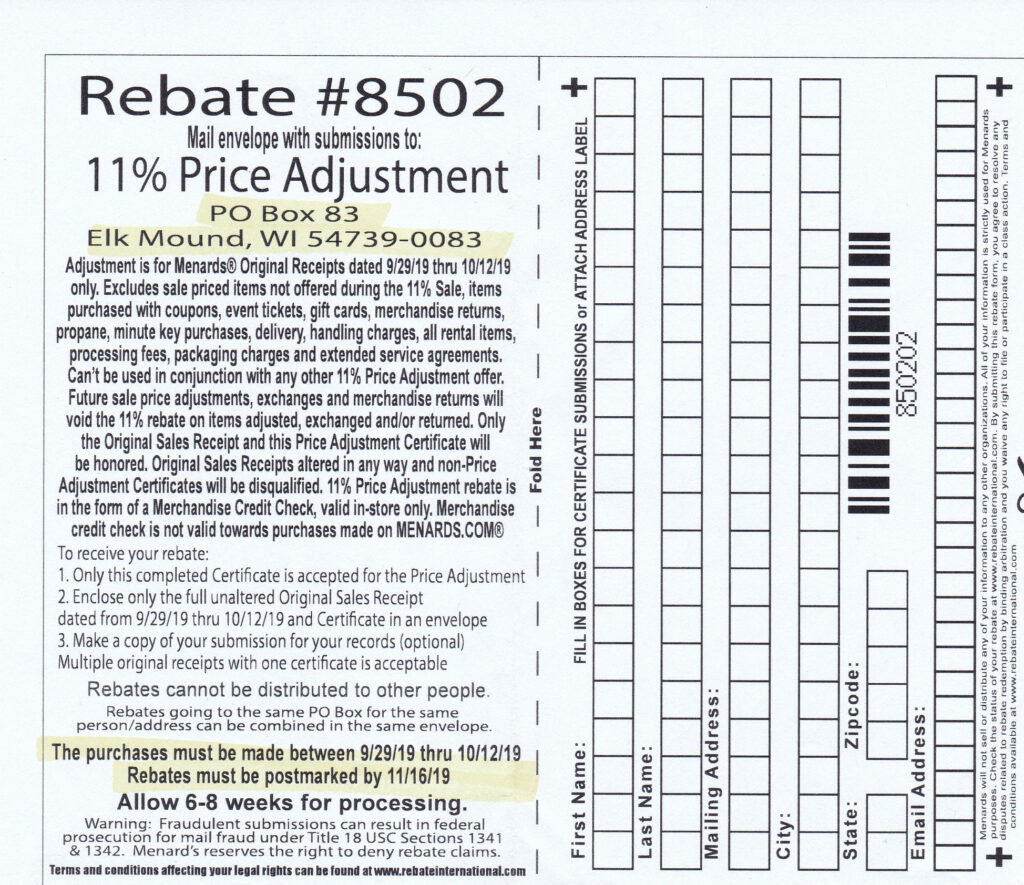

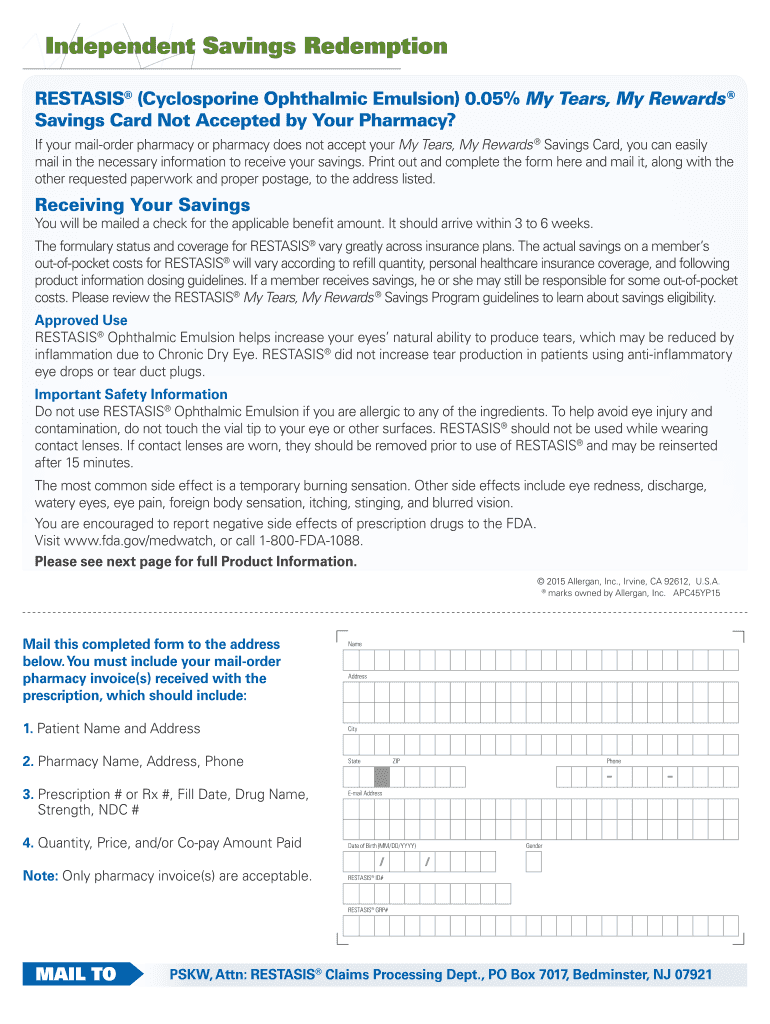

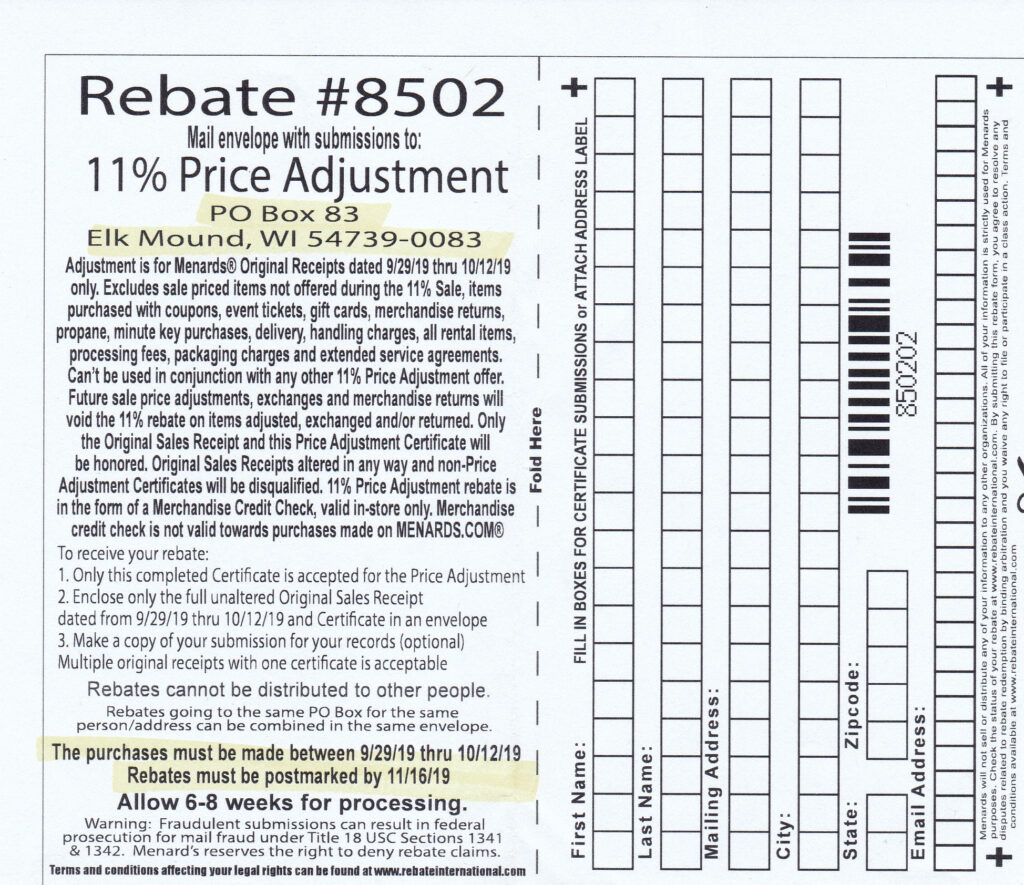

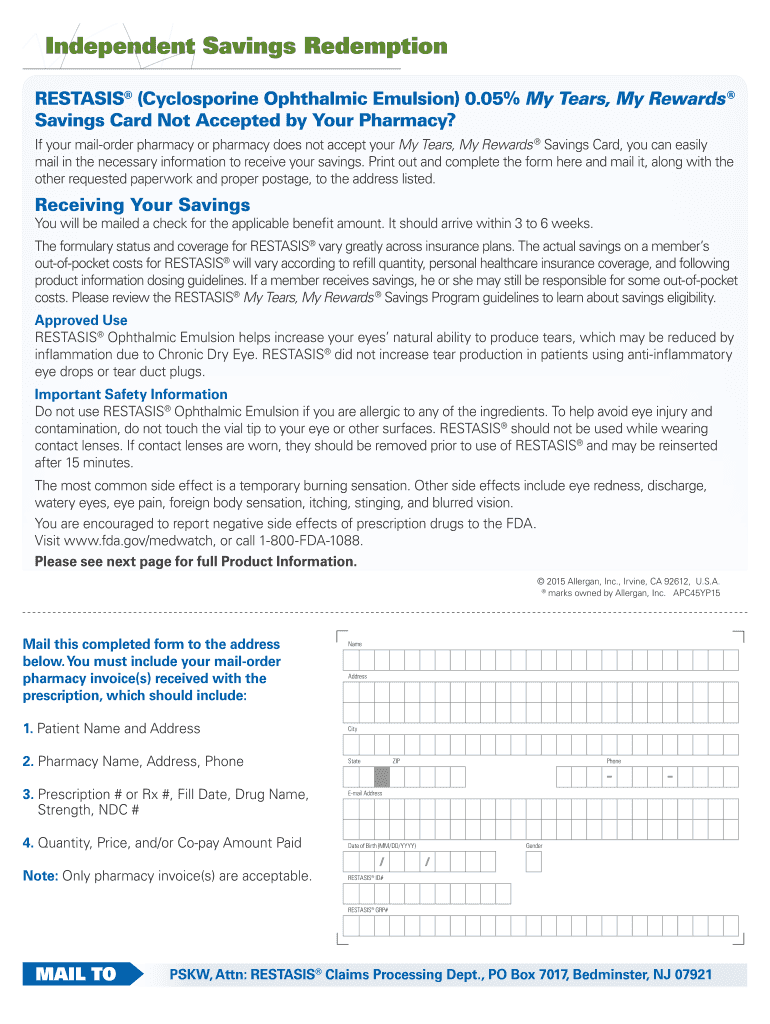

Mail-In Us Tax Rebate Form

Mail-in Us Tax Rebate Form require that customers provide evidence of purchase to get their reimbursement. They're more complicated, but they can provide significant savings.

Instant Us Tax Rebate Form

Instant Us Tax Rebate Form are applied at point of sale and reduce prices immediately. Customers don't need to wait for their savings with this type.

How Us Tax Rebate Form Work

Ppi Tax Rebate Form Amount Printable Rebate Form

Ppi Tax Rebate Form Amount Printable Rebate Form

Web 15 janv 2021 nbsp 0183 32 IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Income Tax Credit EITC In 2020 the IRS issued

The Us Tax Rebate Form Process

The procedure typically consists of a couple of steps that are easy to follow:

-

Buy the product: Firstly, you purchase the item like you normally do.

-

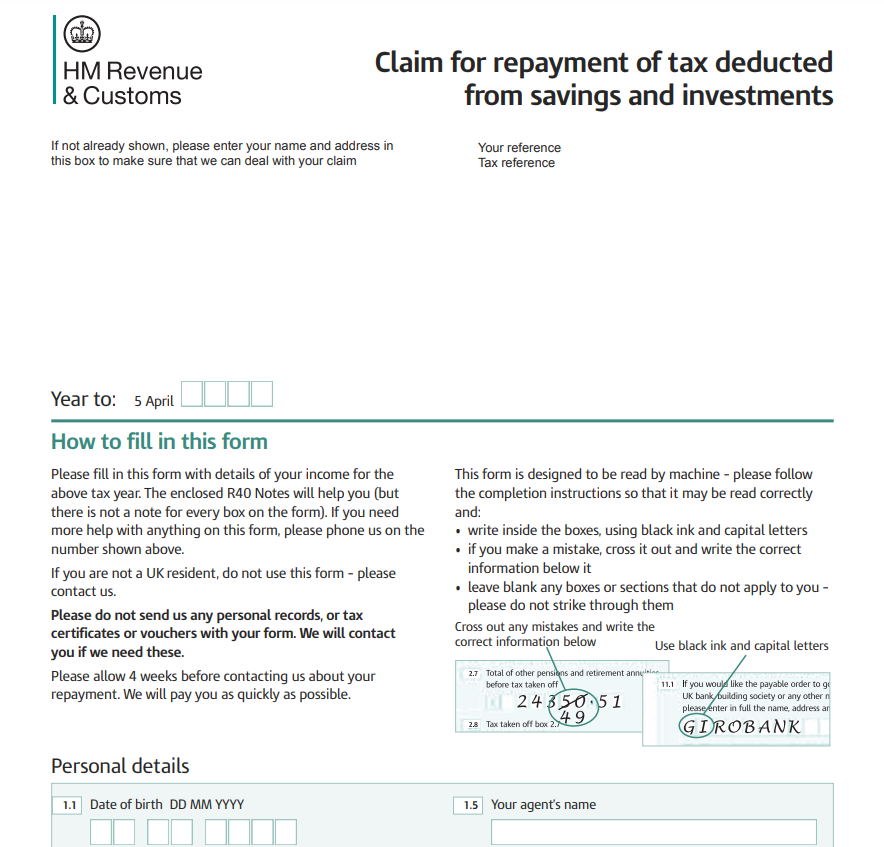

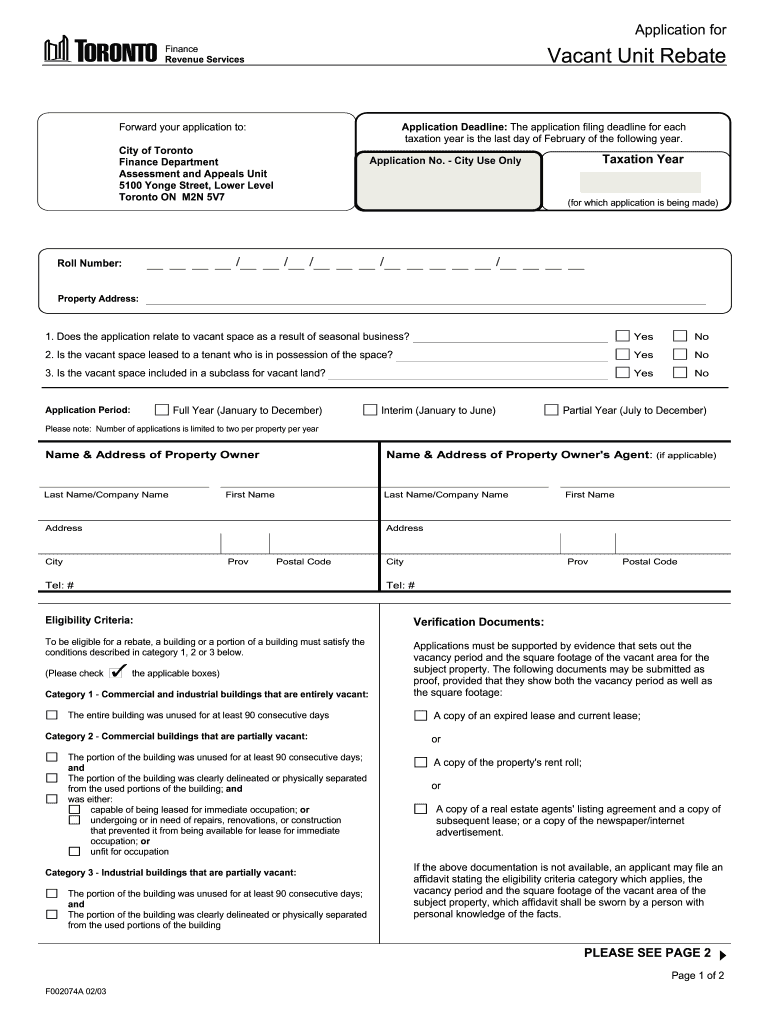

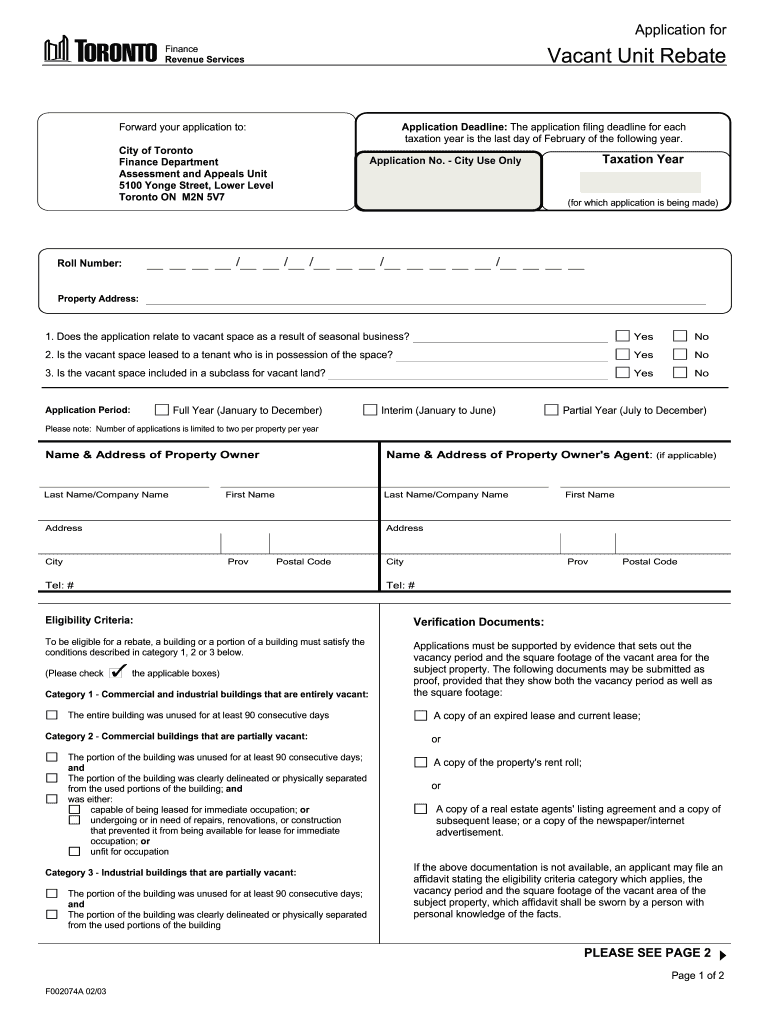

Fill out your Us Tax Rebate Form application: In order to claim your Us Tax Rebate Form, you'll need provide certain information, such as your address, name, and purchase details, to make a claim for your Us Tax Rebate Form.

-

Complete the Us Tax Rebate Form depending on the type of Us Tax Rebate Form there may be a requirement to mail a Us Tax Rebate Form form in or make it available online.

-

Wait for approval: The company will review your submission for compliance with reimbursement's terms and condition.

-

Receive your Us Tax Rebate Form When it's approved you'll receive your money back, using a check or prepaid card, or any other option as per the terms of the offer.

Pros and Cons of Us Tax Rebate Form

Advantages

-

Cost Savings A Us Tax Rebate Form can significantly reduce the cost for the product.

-

Promotional Deals Incentivize customers to experiment with new products, or brands.

-

increase sales Us Tax Rebate Form can help boost companies' sales and market share.

Disadvantages

-

Complexity Us Tax Rebate Form that are mail-in, particularly they can be time-consuming and tedious.

-

Expiration Dates: Many Us Tax Rebate Form have deadlines for submission.

-

Risk of Not Being Paid: Some customers may not receive their Us Tax Rebate Form if they do not adhere to the guidelines precisely.

Download Us Tax Rebate Form

FAQs

1. Are Us Tax Rebate Form equivalent to discounts? Not necessarily, as Us Tax Rebate Form are an amount of money that is refunded after the purchase, whereas discounts reduce costs at time of sale.

2. Can I make use of multiple Us Tax Rebate Form on the same product The answer is dependent on the conditions on the Us Tax Rebate Form offer and also the item's admissibility. Certain businesses may allow it, while others won't.

3. How long will it take to receive a Us Tax Rebate Form? The timing will vary, but it may take anywhere from a couple of weeks to a couple of months before you get your Us Tax Rebate Form.

4. Do I have to pay taxes on Us Tax Rebate Form sums? the majority of circumstances, Us Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Us Tax Rebate Form deals from lesser-known brands You must research and confirm that the brand which is providing the Us Tax Rebate Form is reputable prior making any purchase.

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Renters Rebate Form Printable Rebate Form

Check more sample of Us Tax Rebate Form below

Rent Rebate Tax Form Missouri Printable Rebate Form

Working From Home Tax Rebate Form 2022 Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

P G Printable Rebate Form

Rebate Form Fill And Sign Printable Template Online US Legal Forms

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

Working From Home Tax Rebate Form 2022 Printable Rebate Form

P G Printable Rebate Form

Rebate Form Fill And Sign Printable Template Online US Legal Forms

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word