Today, in a world that is driven by the consumer every person loves a great bargain. One method of gaining significant savings for your purchases is through 2023 Form 1040 Recovery Rebate Credits. 2023 Form 1040 Recovery Rebate Credits are a marketing strategy used by manufacturers and retailers to offer consumers a partial refund on their purchases after they've placed them. In this article, we will dive into the world 2023 Form 1040 Recovery Rebate Credits. We'll explore what they are about, how they work, and how you can maximize your savings by taking advantage of these cost-effective incentives.

Get Latest 2023 Form 1040 Recovery Rebate Credit Below

2023 Form 1040 Recovery Rebate Credit

2023 Form 1040 Recovery Rebate Credit -

Verkko 15 maalisk 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can

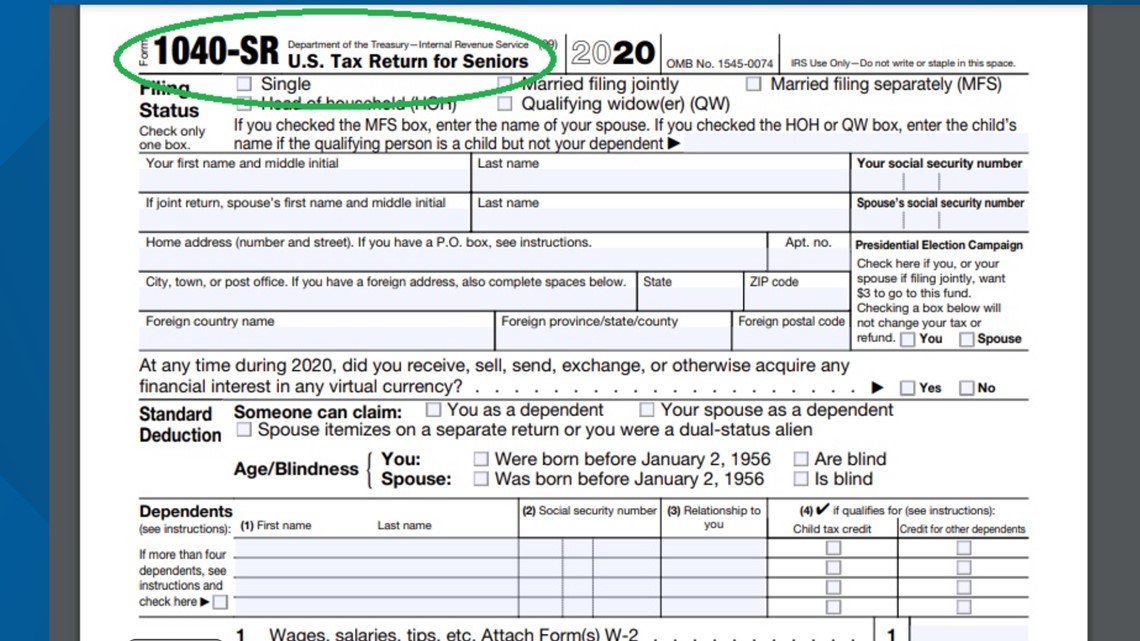

Verkko 17 helmik 2021 nbsp 0183 32 You report the final amount on Line 30 of your 2021 federal income tax return Form 1040 or Form 1040 SR The

A 2023 Form 1040 Recovery Rebate Credit in its most basic definition, is a reimbursement to a buyer after they've bought a product or service. It's a very effective technique used by companies to attract clients, increase sales and even promote certain products.

Types of 2023 Form 1040 Recovery Rebate Credit

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Verkko 13 tammik 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file

Verkko 8 helmik 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in

Cash 2023 Form 1040 Recovery Rebate Credit

Cash 2023 Form 1040 Recovery Rebate Credit are the most straightforward type of 2023 Form 1040 Recovery Rebate Credit. Customers receive a specific amount of money in return for purchasing a product. They are typically used to purchase more expensive items such electronics or appliances.

Mail-In 2023 Form 1040 Recovery Rebate Credit

Mail-in 2023 Form 1040 Recovery Rebate Credit require the customer to submit proof of purchase in order to receive the money. They're more involved but offer huge savings.

Instant 2023 Form 1040 Recovery Rebate Credit

Instant 2023 Form 1040 Recovery Rebate Credit are credited at the point of sale and reduce the purchase cost immediately. Customers don't have to wait until they can save through this kind of offer.

How 2023 Form 1040 Recovery Rebate Credit Work

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Verkko 1 helmik 2023 nbsp 0183 32 Your income could affect how much you receive an amount of recovery credit Your credit rating could drop to zero when you earn more than 75 000 Joint

The 2023 Form 1040 Recovery Rebate Credit Process

The process generally involves a few simple steps:

-

Buy the product: Firstly make sure you purchase the product exactly as you would normally.

-

Complete this 2023 Form 1040 Recovery Rebate Credit paper: You'll have submit some information, such as your address, name, and purchase details to be eligible for a 2023 Form 1040 Recovery Rebate Credit.

-

To submit the 2023 Form 1040 Recovery Rebate Credit: Depending on the nature of 2023 Form 1040 Recovery Rebate Credit you will need to send in a form, or make it available online.

-

Wait until the company approves: The company will review your request for compliance with terms and conditions of the 2023 Form 1040 Recovery Rebate Credit.

-

Get your 2023 Form 1040 Recovery Rebate Credit When it's approved you'll receive a refund via check, prepaid card, or by another method as specified by the offer.

Pros and Cons of 2023 Form 1040 Recovery Rebate Credit

Advantages

-

Cost Savings A 2023 Form 1040 Recovery Rebate Credit can significantly cut the price you pay for a product.

-

Promotional Deals Incentivize customers to try out new products or brands.

-

Help to Increase Sales The benefits of a 2023 Form 1040 Recovery Rebate Credit can improve the company's sales as well as market share.

Disadvantages

-

Complexity 2023 Form 1040 Recovery Rebate Credit that are mail-in, in particular is a time-consuming process and lengthy.

-

End Dates Many 2023 Form 1040 Recovery Rebate Credit have extremely strict deadlines to submit.

-

Risk of not receiving payment: Some customers may have their 2023 Form 1040 Recovery Rebate Credit delayed if they don't observe the rules precisely.

Download 2023 Form 1040 Recovery Rebate Credit

Download 2023 Form 1040 Recovery Rebate Credit

FAQs

1. Are 2023 Form 1040 Recovery Rebate Credit equivalent to discounts? No, they are some form of refund following the purchase whereas discounts will reduce the purchase price at point of sale.

2. Do I have to use multiple 2023 Form 1040 Recovery Rebate Credit for the same product It's contingent upon the conditions and conditions of 2023 Form 1040 Recovery Rebate Credit promotions and on the products qualification. Some companies may allow it, while other companies won't.

3. What is the time frame to receive a 2023 Form 1040 Recovery Rebate Credit? The timing differs, but it can be anywhere from a few weeks up to a few months to receive your 2023 Form 1040 Recovery Rebate Credit.

4. Do I need to pay tax in relation to 2023 Form 1040 Recovery Rebate Credit sums? most cases, 2023 Form 1040 Recovery Rebate Credit amounts are not considered taxable income.

5. Should I be able to trust 2023 Form 1040 Recovery Rebate Credit deals from lesser-known brands It is essential to investigate and confirm that the company that is offering the 2023 Form 1040 Recovery Rebate Credit has a good reputation prior to making any purchase.

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

Check more sample of 2023 Form 1040 Recovery Rebate Credit below

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

IRS Form 1040 Individual Income Tax Return 2022 NerdWallet Recovery

2023 Recovery Rebate Credit Turbotax Recovery Rebate

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Form 1040 Recovery Rebate

https://www.kiplinger.com/taxes/602269/wha…

Verkko 17 helmik 2021 nbsp 0183 32 You report the final amount on Line 30 of your 2021 federal income tax return Form 1040 or Form 1040 SR The

https://www.taxuni.com/recovery-rebate-cred…

Verkko To claim the Recovery Rebate Credit on your 2023 tax return complete the Recovery Rebate Credit Worksheet and enter the amount from Line 5 of the worksheet on Line 30 of Form 1040 or 1040 SR Will the

Verkko 17 helmik 2021 nbsp 0183 32 You report the final amount on Line 30 of your 2021 federal income tax return Form 1040 or Form 1040 SR The

Verkko To claim the Recovery Rebate Credit on your 2023 tax return complete the Recovery Rebate Credit Worksheet and enter the amount from Line 5 of the worksheet on Line 30 of Form 1040 or 1040 SR Will the

2023 Recovery Rebate Credit Turbotax Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Form 1040 Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

2022 Form 1040 Schedule A Instructions

2022 Form 1040 Schedule A Instructions

How To Claim The Stimulus Money On Your Tax Return 13newsnow