In the modern world of consumerization everyone appreciates a great bargain. One option to obtain substantial savings for your purchases is through Tax Rebate Form P50zs. The use of Tax Rebate Form P50zs is a method used by manufacturers and retailers to give customers a part refund on purchases made after they have bought them. In this article, we'll examine the subject of Tax Rebate Form P50zs, looking at the nature of them as well as how they work and the best way to increase your savings through these cost-effective incentives.

Get Latest Tax Rebate Form P50z Below

Tax Rebate Form P50z

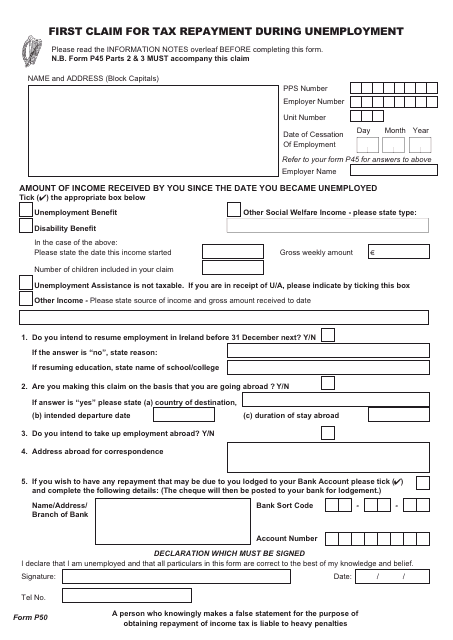

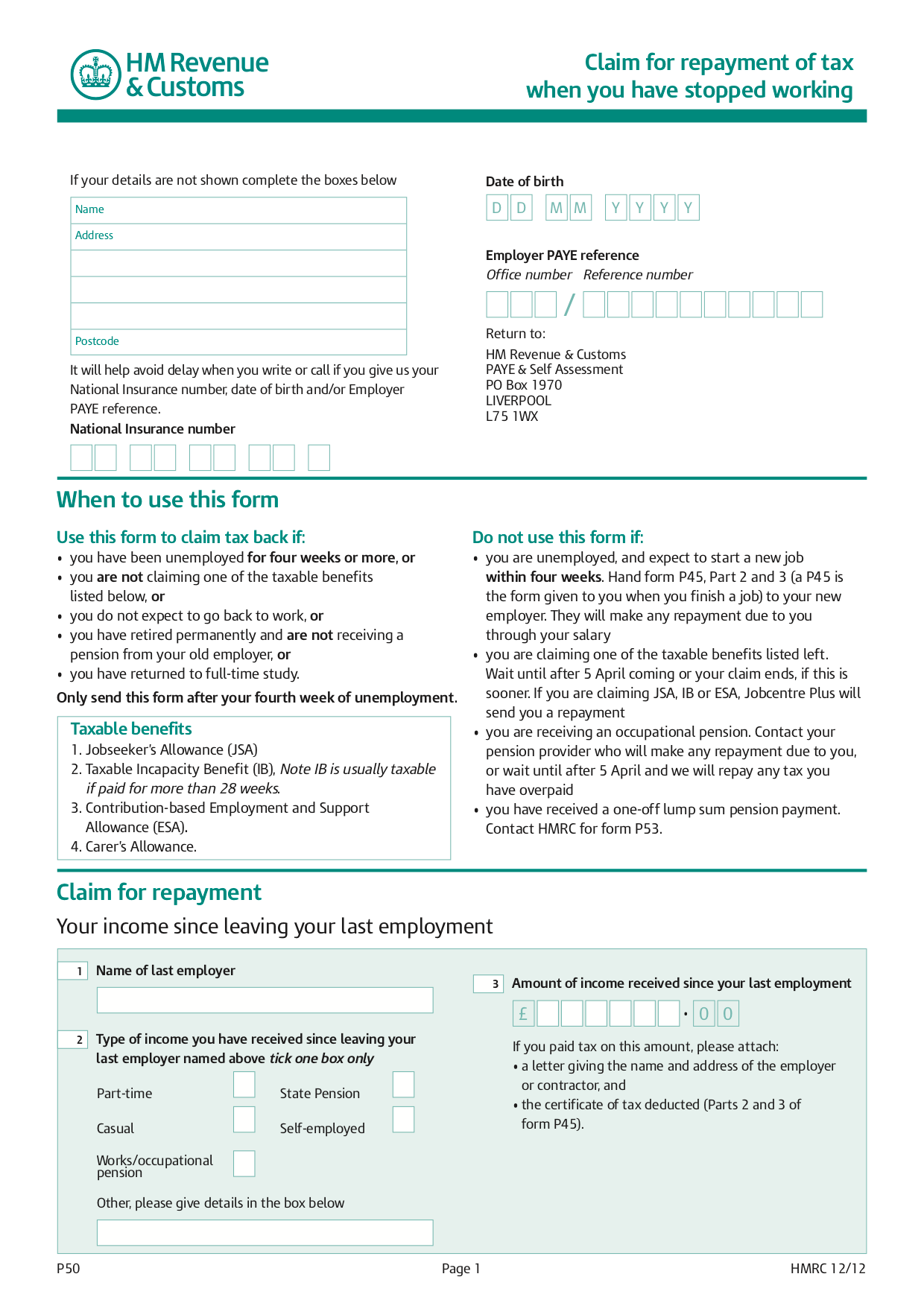

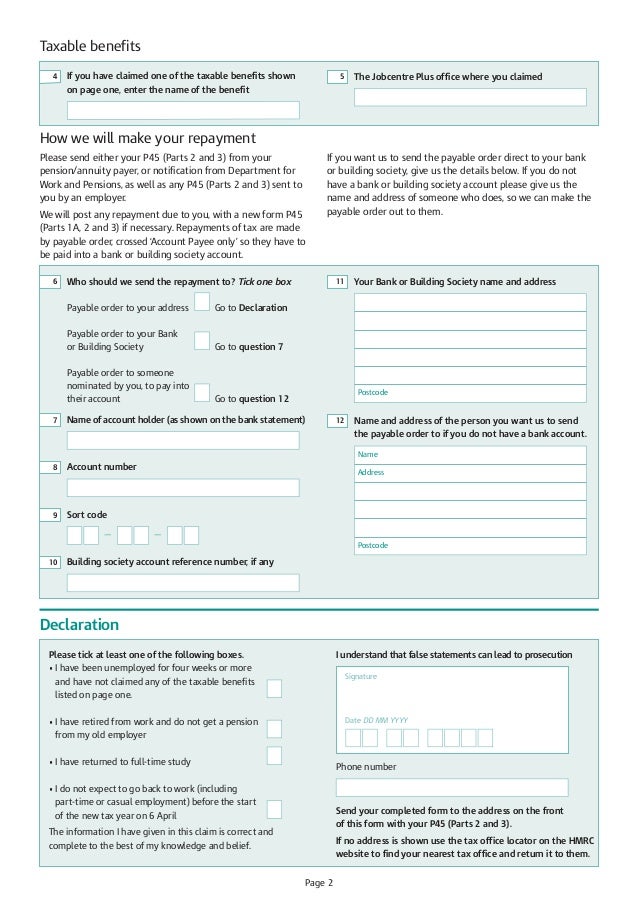

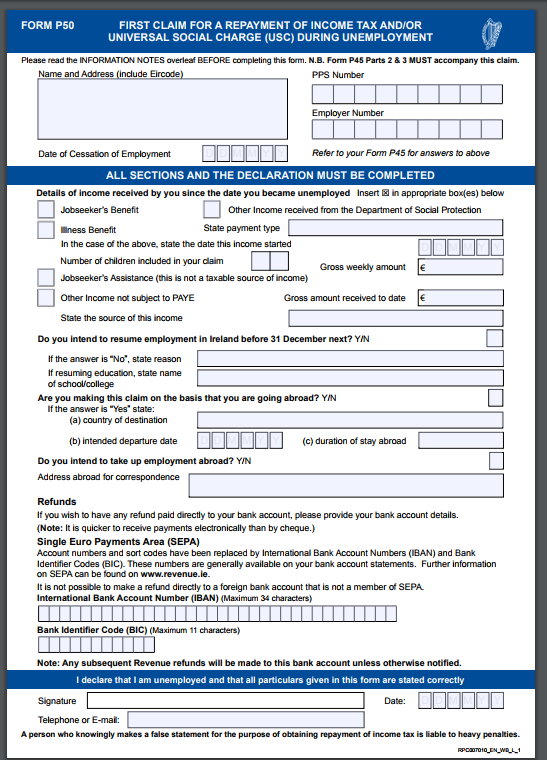

Tax Rebate Form P50z - Tax Refund Form P50z, Hmrc Tax Refund Form P50z, What Tax Rebates Can I Claim, How To Get Rebate On Tax

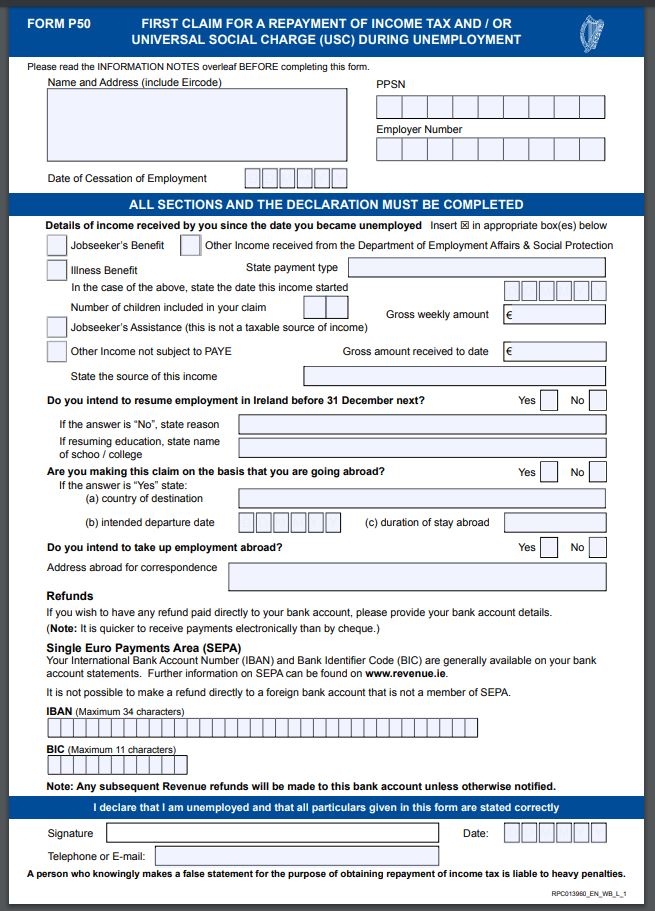

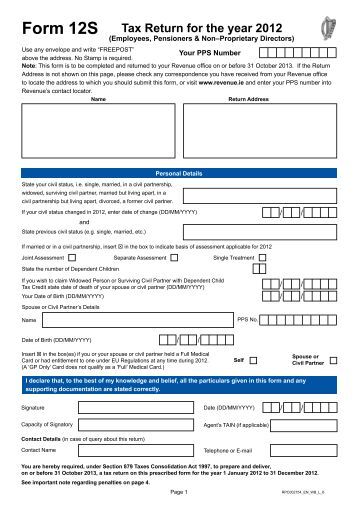

Web What is a P50Z Form P50Z is for reclaiming tax paid on a drawdown pension payment under certain circumstances Previously an initial pension withdrawal was taxed at an

Web About this form Use this form to claim back tax we owe you on a pension flexibility payment you recently had if any of the following apply you ve taken a pension

A Tax Rebate Form P50z is, in its most basic type, is a reimbursement to a buyer when they purchase a product or service. It's a powerful method employed by companies to draw customers, increase sales, or promote a specific product.

Types of Tax Rebate Form P50z

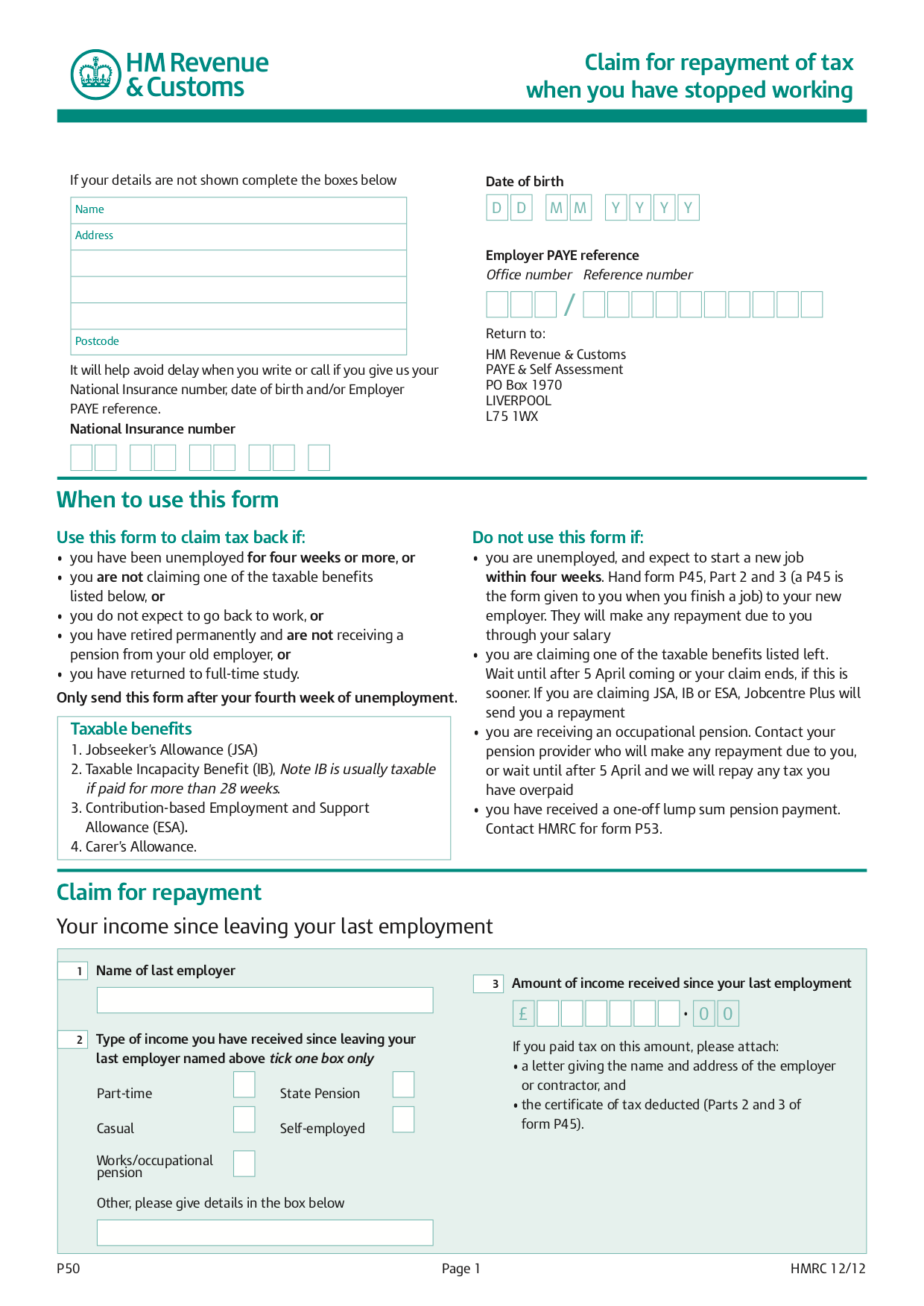

How To Claim Personal Tax Back With P50 If You Overpaid HMRC

How To Claim Personal Tax Back With P50 If You Overpaid HMRC

Web 13 juil 2023 nbsp 0183 32 How to claim a refund in the current tax year if you are not getting taxable benefits or a pension from your employer and you ve not started a new job P50 From

Web 12 ao 251 t 2023 nbsp 0183 32 HMRC Form P50Z also known as the Claim for Income Tax Repayment on the Cessation of a Taxable State Benefit is a document used by individuals to claim a

Cash Tax Rebate Form P50z

Cash Tax Rebate Form P50z are the most straightforward kind of Tax Rebate Form P50z. Customers receive a specific amount of money when buying a product. This is often for expensive items such as electronics or appliances.

Mail-In Tax Rebate Form P50z

Customers who want to receive mail-in Tax Rebate Form P50z must provide an evidence of purchase for their refund. They're a little more complicated, but they can provide huge savings.

Instant Tax Rebate Form P50z

Instant Tax Rebate Form P50z apply at the point of sale. They reduce your purchase cost instantly. Customers don't need to wait until they can save through this kind of offer.

How Tax Rebate Form P50z Work

HMRC P50 FORM TO FREE DOWNLOAD

HMRC P50 FORM TO FREE DOWNLOAD

Web 23 ao 251 t 2023 nbsp 0183 32 HM Revenue amp Customs Published 23 August 2023 Get emails about this page Contents Before you start Claim online What happens next Information you ll

The Tax Rebate Form P50z Process

The procedure typically consists of a few easy steps:

-

Then, you purchase the product you buy the product as you normally would.

-

Complete this Tax Rebate Form P50z Form: To claim the Tax Rebate Form P50z you'll have to supply some details like your address, name, and purchase details, in order to receive your Tax Rebate Form P50z.

-

Complete the Tax Rebate Form P50z It is dependent on the kind of Tax Rebate Form P50z, you may need to either mail in a request form or upload it online.

-

Wait until the company approves: The company will evaluate your claim to ensure it meets the rules and regulations of the Tax Rebate Form P50z.

-

Receive your Tax Rebate Form P50z: Once approved, you'll receive a refund whether via check, credit card, or by another method that is specified in the offer.

Pros and Cons of Tax Rebate Form P50z

Advantages

-

Cost savings Tax Rebate Form P50z are a great way to cut the price you pay for the item.

-

Promotional Offers These deals encourage customers to try new products and brands.

-

Accelerate Sales Tax Rebate Form P50z can help boost a company's sales and market share.

Disadvantages

-

Complexity The mail-in Tax Rebate Form P50z in particular may be lengthy and time-consuming.

-

Day of Expiration Some Tax Rebate Form P50z have deadlines for submission.

-

A risk of not being paid Certain customers could lose their Tax Rebate Form P50z in the event that they do not follow the rules precisely.

Download Tax Rebate Form P50z

FAQs

1. Are Tax Rebate Form P50z equivalent to discounts? No, Tax Rebate Form P50z are a partial refund after purchase whereas discounts will reduce costs at moment of sale.

2. Are there multiple Tax Rebate Form P50z I can get for the same product It's contingent upon the conditions of Tax Rebate Form P50z provides and the particular product's admissibility. Certain companies may allow it, while others won't.

3. How long does it take to get the Tax Rebate Form P50z? The timing is different, but it could take several weeks to a couple of months for you to receive your Tax Rebate Form P50z.

4. Do I need to pay taxes on Tax Rebate Form P50z sums? the majority of circumstances, Tax Rebate Form P50z amounts are not considered to be taxable income.

5. Should I be able to trust Tax Rebate Form P50z offers from brands that aren't well-known? It's essential to research to ensure that the name that is offering the Tax Rebate Form P50z is credible prior to making an acquisition.

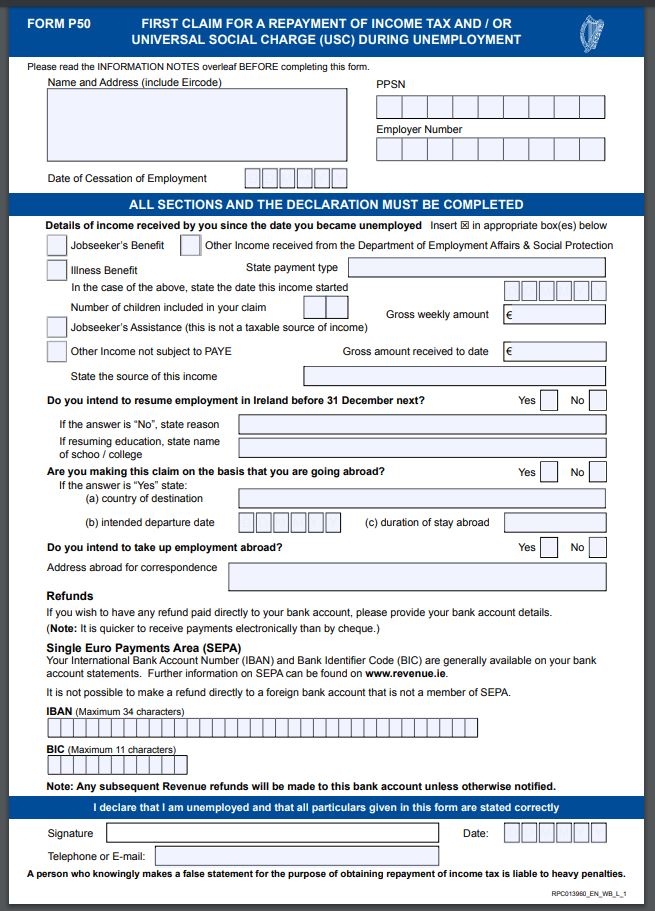

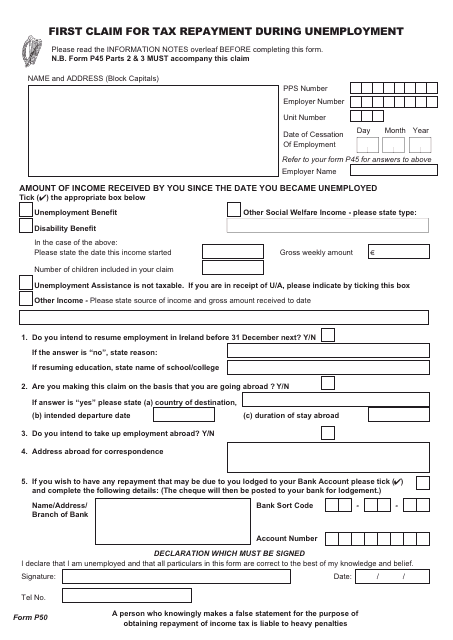

P50 Tax Form Printable Printable Forms Free Online

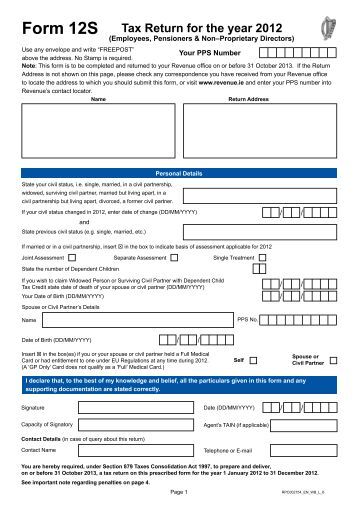

Your Bullsh t Free Guide To PAYE Taxes In Ireland

Check more sample of Tax Rebate Form P50z below

Form P50 Income Tax pdf Tax Refund Taxes

P50 Tax Form Printable Printable Forms Free Online

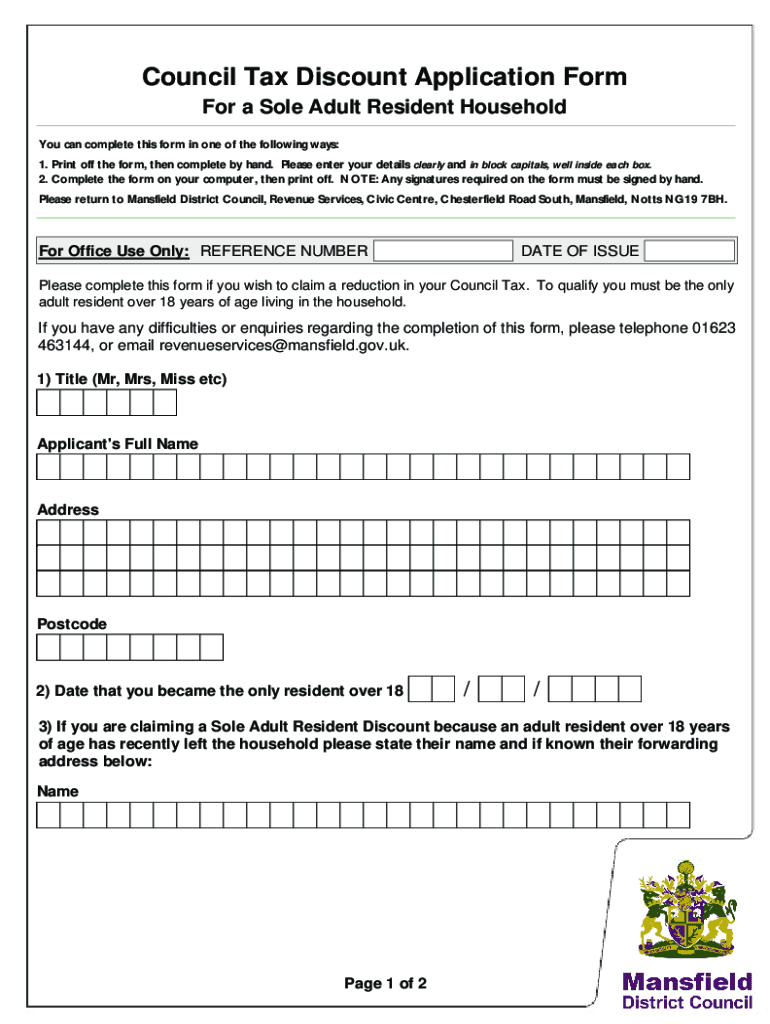

PA Property Tax Rebate Forms Printable Rebate Form

Supplier Rebate Agreement Template

Simple PAYE Taxes Guide Tax Refund Ireland

Form P50 First Claim For Tax Repayment During Unemployment

https://assets.publishing.service.gov.uk/.../file/1085949/P50Z…

Web About this form Use this form to claim back tax we owe you on a pension flexibility payment you recently had if any of the following apply you ve taken a pension

https://www.gov.uk/government/publications/income-tax-claim-for-a...

Web Use form P53Z DB to claim back tax HMRC owes you on a pension death benefit lump sum payment you recently received which used up all your fund but are working or

Web About this form Use this form to claim back tax we owe you on a pension flexibility payment you recently had if any of the following apply you ve taken a pension

Web Use form P53Z DB to claim back tax HMRC owes you on a pension death benefit lump sum payment you recently received which used up all your fund but are working or

Supplier Rebate Agreement Template

P50 Tax Form Printable Printable Forms Free Online

Simple PAYE Taxes Guide Tax Refund Ireland

Form P50 First Claim For Tax Repayment During Unemployment

Government Rebate Program Fill Out Sign Online DocHub

Scottish Council Tax Rebates Fill Online Printable Fillable Blank

Scottish Council Tax Rebates Fill Online Printable Fillable Blank

Property Tax Rebate Application Printable Pdf Download