In our modern, consumer-driven society everyone is looking for a great deal. One way to earn substantial savings in your purchase is through Rebate Under Section 87as. Rebate Under Section 87as are marketing strategies that retailers and manufacturers use for offering customers a percentage payment on their purchases, after they have purchased them. In this article, we'll take a look at the world that is Rebate Under Section 87as and explore the nature of them their purpose, how they function and ways to maximize your savings with these cost-effective incentives.

Get Latest Rebate Under Section 87a Below

Rebate Under Section 87a

Rebate Under Section 87a - Rebate Under Section 87a, Rebate Under Section 87a For Ay 2024-25, Rebate Under Section 87a For Fy 2023-24, Rebate Under Section 87a In New Tax Regime, Rebate Under Section 87a If Applicable, Rebate Under Section 87a For Ay 2023-24 In Hindi, Rebate Under Section 87a In Hindi, Rebate Under Section 87a For Fy 2022-23, Rebate Under Section 87a Is Available To, Rebate Under Section 87a Of Income Tax Act

Web 9 d 233 c 2022 nbsp 0183 32 The income tax rebate u s 87A is the same for both FY 2020 21 AY 2021 22 and FY 2021 22 AY 2022 23 The maximum rebate that can be claimed u s 87A of the income tax act for FY

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

A Rebate Under Section 87a in its simplest type, is a return to the customer following the purchase of a product or service. It's an effective way employed by companies to attract customers, increase sales, and even promote certain products.

Types of Rebate Under Section 87a

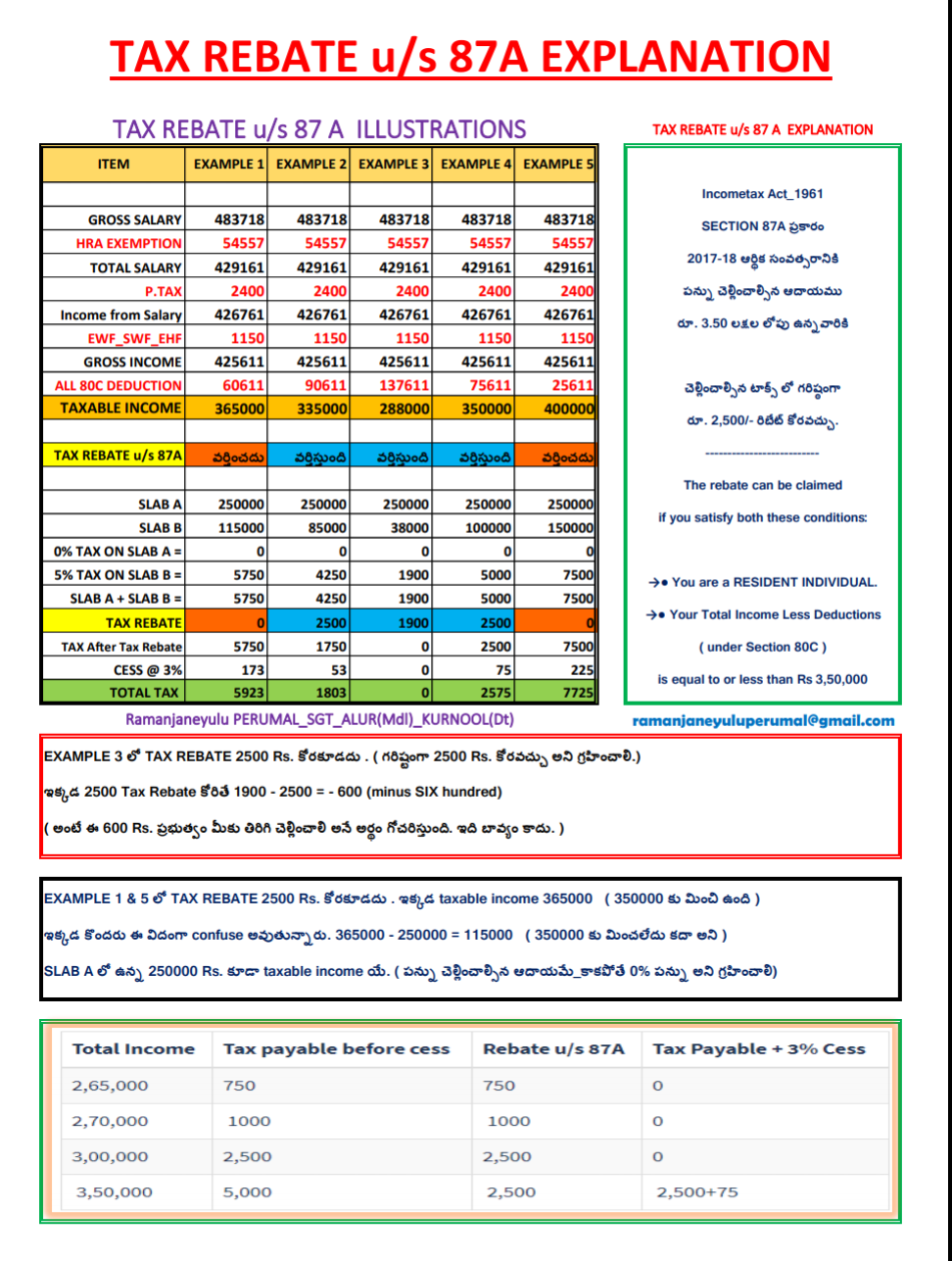

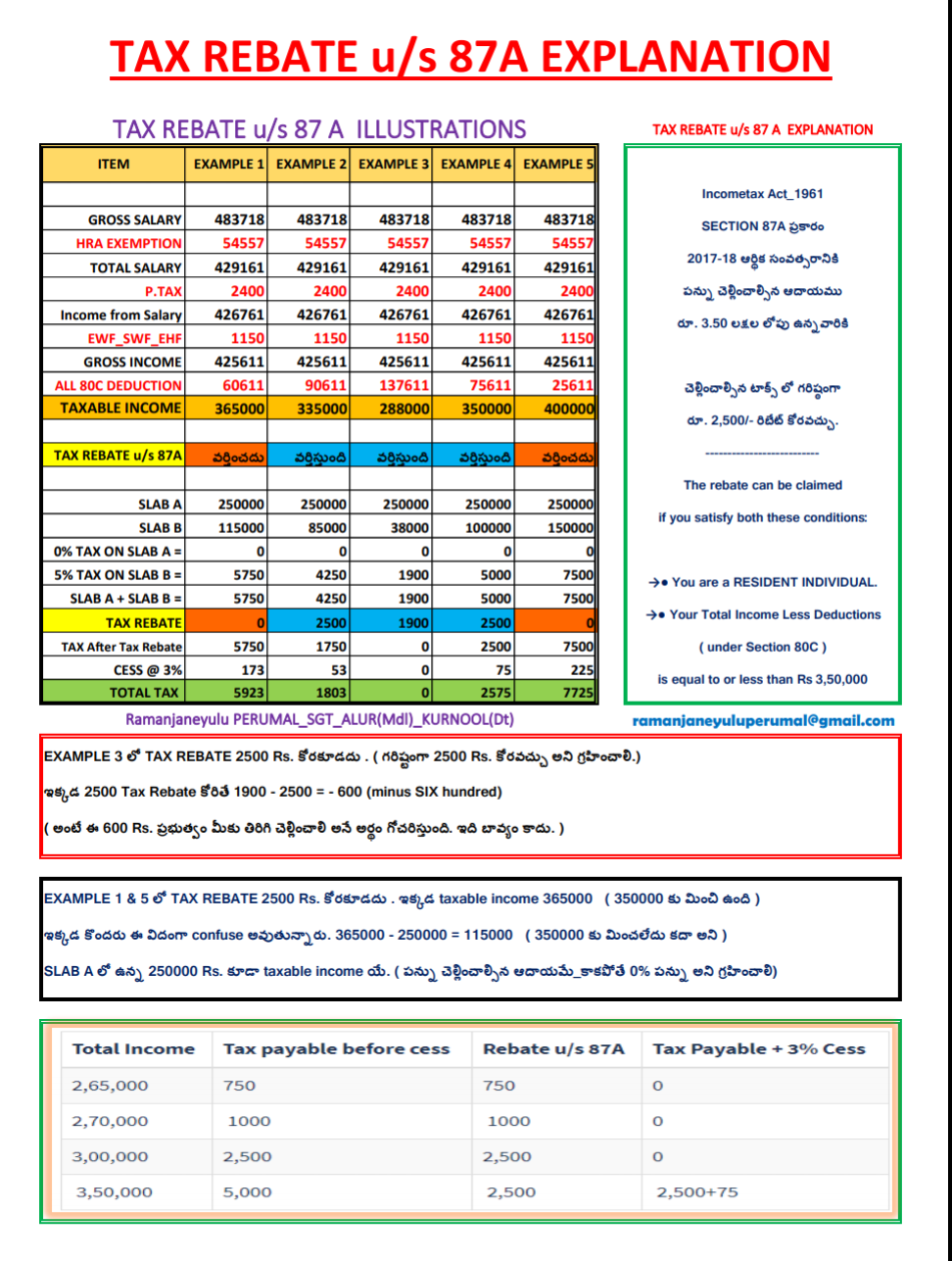

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Web 10 avr 2023 nbsp 0183 32 Who can claim a rebate under section 87A Individual taxpayers are eligible for a rebate under Section 87A provided their total taxable income does not exceed Rs

Web The maximum rebate under Section 87A will be 100 up to Rs 12 500 in a financial year So if your tax liability is Rs 2 500 the rebate amount will be Rs 2 500 only While if

Cash Rebate Under Section 87a

Cash Rebate Under Section 87a is the most basic type of Rebate Under Section 87a. Customers receive a specified amount of money back after purchasing a product. This is often for more expensive items such electronics or appliances.

Mail-In Rebate Under Section 87a

Mail-in Rebate Under Section 87a require the customer to provide documents of purchase to claim the money. They are a bit longer-lasting, however they offer huge savings.

Instant Rebate Under Section 87a

Instant Rebate Under Section 87a are applied at the place of purchase, reducing the price of your purchase instantly. Customers don't have to wait long for savings when they purchase this type of Rebate Under Section 87a.

How Rebate Under Section 87a Work

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

Web To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is

The Rebate Under Section 87a Process

The process generally involves a number of easy steps:

-

Purchase the product: First you purchase the product the way you normally do.

-

Complete your Rebate Under Section 87a paper: You'll need be able to provide a few details including your address, name, and purchase information, in order to apply for your Rebate Under Section 87a.

-

Complete the Rebate Under Section 87a: Depending on the kind of Rebate Under Section 87a, you may need to submit a claim form to the bank or make it available online.

-

Wait for the company's approval: They will look over your submission to make sure that it's in accordance with the refund's conditions and terms.

-

Receive your Rebate Under Section 87a Once you've received your approval, you'll receive a refund whether by check, prepaid card, or through another method as specified by the offer.

Pros and Cons of Rebate Under Section 87a

Advantages

-

Cost Savings Rebate Under Section 87a can dramatically decrease the price for the product.

-

Promotional Deals They encourage customers to explore new products or brands.

-

increase sales Rebate Under Section 87a are a great way to boost the sales of a company as well as its market share.

Disadvantages

-

Complexity: Mail-in Rebate Under Section 87a, particularly the case of HTML0, can be a hassle and time-consuming.

-

Expiration Dates Many Rebate Under Section 87a are subject to rigid deadlines to submit.

-

The risk of non-payment Certain customers could have their Rebate Under Section 87a delayed if they don't adhere to the requirements exactly.

Download Rebate Under Section 87a

Download Rebate Under Section 87a

FAQs

1. Are Rebate Under Section 87a equivalent to discounts? No, Rebate Under Section 87a are partial reimbursement after purchase, whereas discounts decrease the price of the purchase at the point of sale.

2. Can I use multiple Rebate Under Section 87a for the same product The answer is dependent on the conditions on the Rebate Under Section 87a offers and the product's ability to qualify. Certain businesses may allow the use of multiple Rebate Under Section 87a, whereas other won't.

3. How long does it take to get an Rebate Under Section 87a? The amount of time is variable, however it can last from a few weeks until a several months to receive a Rebate Under Section 87a.

4. Do I have to pay taxes upon Rebate Under Section 87a sums? most instances, Rebate Under Section 87a amounts are not considered taxable income.

5. Can I trust Rebate Under Section 87a offers from lesser-known brands? It's essential to research and verify that the organization giving the Rebate Under Section 87a has a good reputation prior to making purchases.

Rebate Of Income Tax Under Section 87A YouTube

Rebate Of Income Tax Under Section 87A YouTube

Check more sample of Rebate Under Section 87a below

Income Tax Rebate Under Section 87A

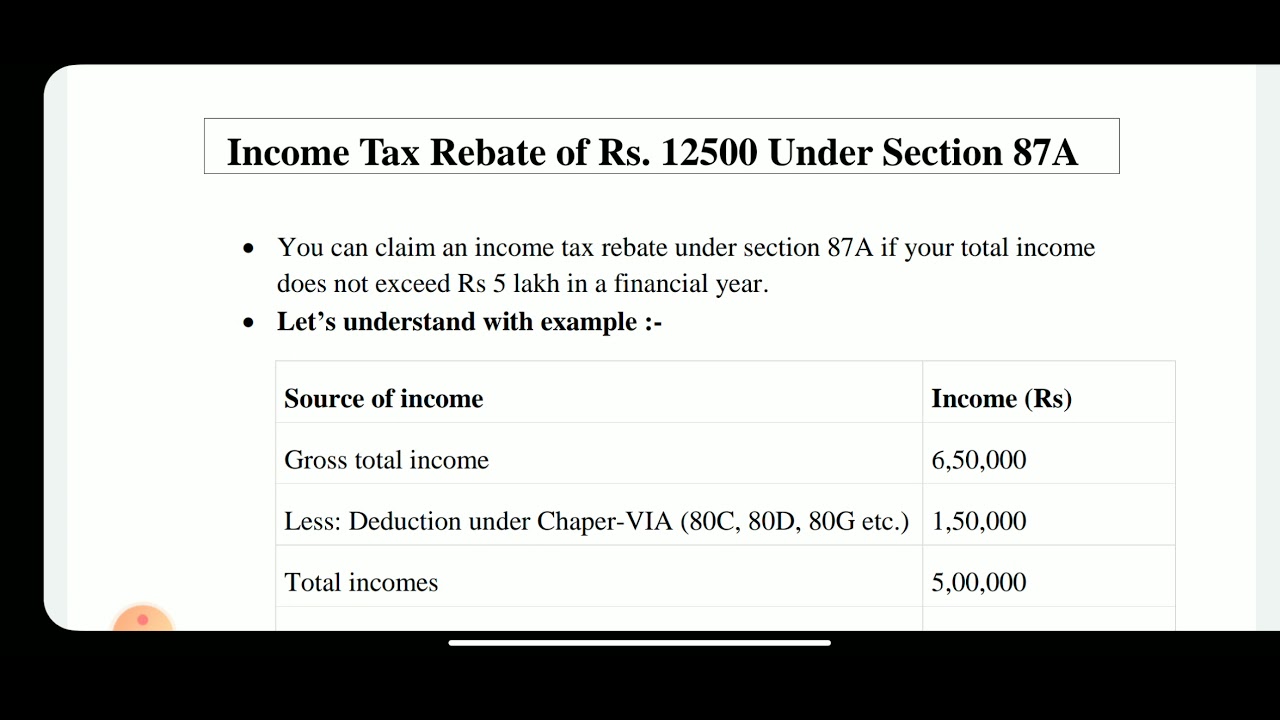

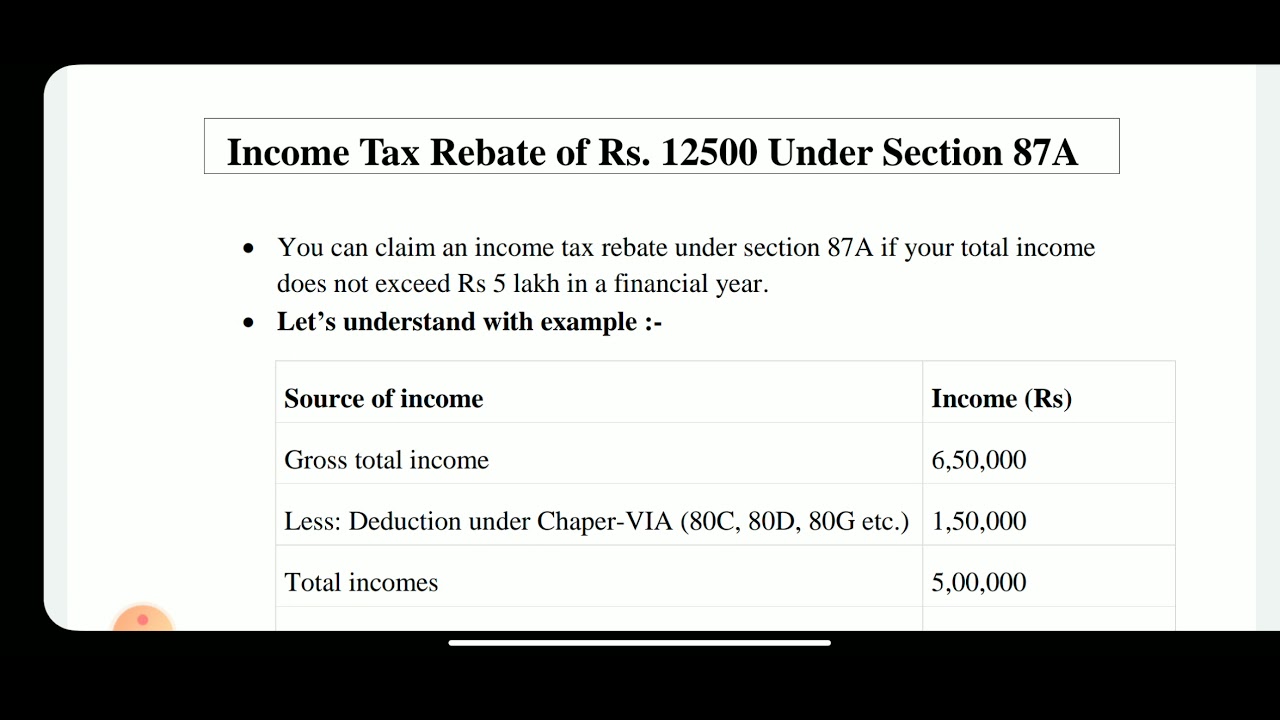

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

Section 87A Tax Rebate Under Section 87A Rebates Financial

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Tax Rebate 2017 18 Clarification Under Section 87 A Teachers9 Com

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Tax Rebate 2017 18 Clarification Under Section 87 A Teachers9 Com

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

New Income Tax Slab And Tax Rebate Credit Under Section 87A With