In our current world of high-end consumer goods everyone appreciates a great bargain. One way to earn substantial savings on your purchases can be achieved through Tax Form For Solar Rebates. Tax Form For Solar Rebates are a marketing strategy used by manufacturers and retailers to give customers a part discount on purchases they made after they have purchased them. In this article, we'll go deeper into the realm of Tax Form For Solar Rebates and explore what they are about, how they work, and how to maximize the value of these incentives.

Get Latest Tax Form For Solar Rebate Below

Tax Form For Solar Rebate

Tax Form For Solar Rebate - Tax Form For Solar Rebate, Irs Form For Solar Credit, Federal Tax Rebates For Solar, Federal Tax Credit For Solar Form, What Tax Form Do I Use For Solar Credit

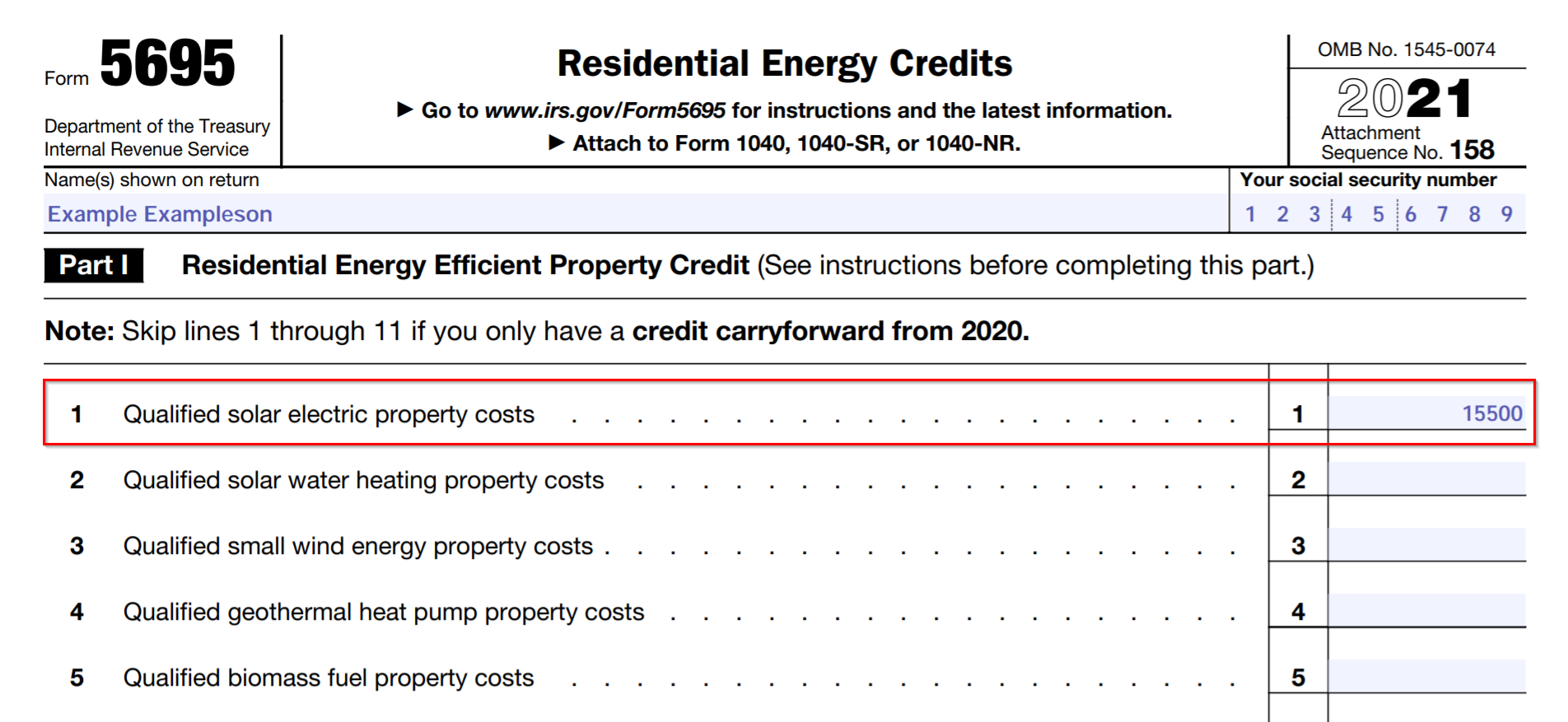

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

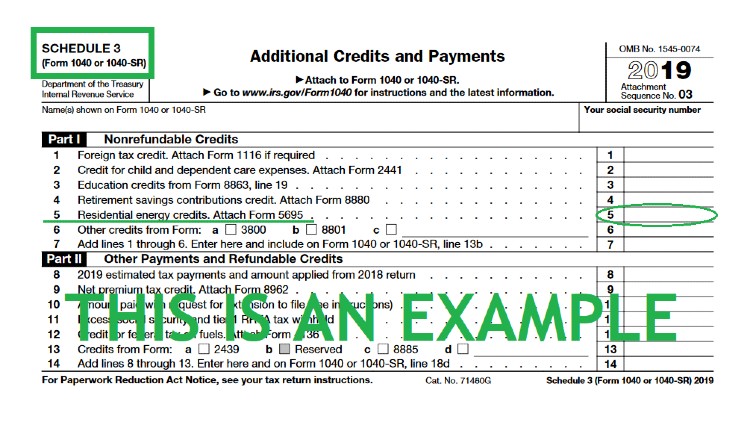

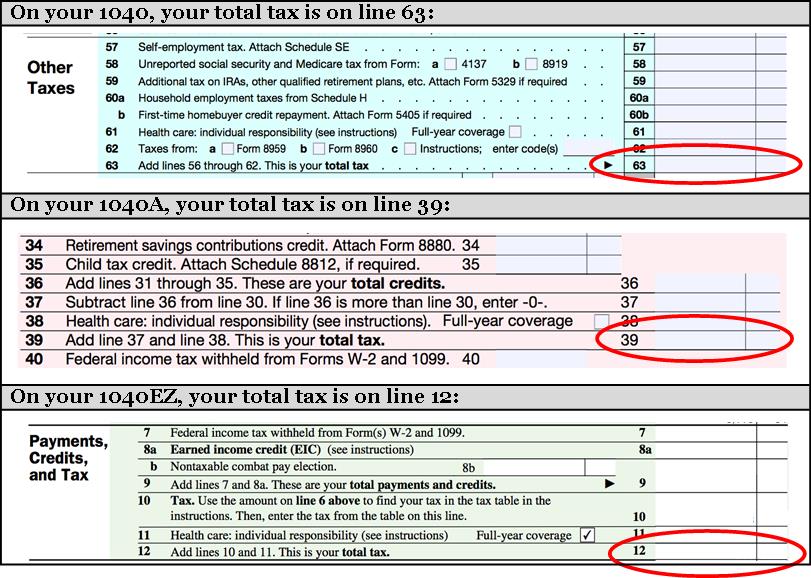

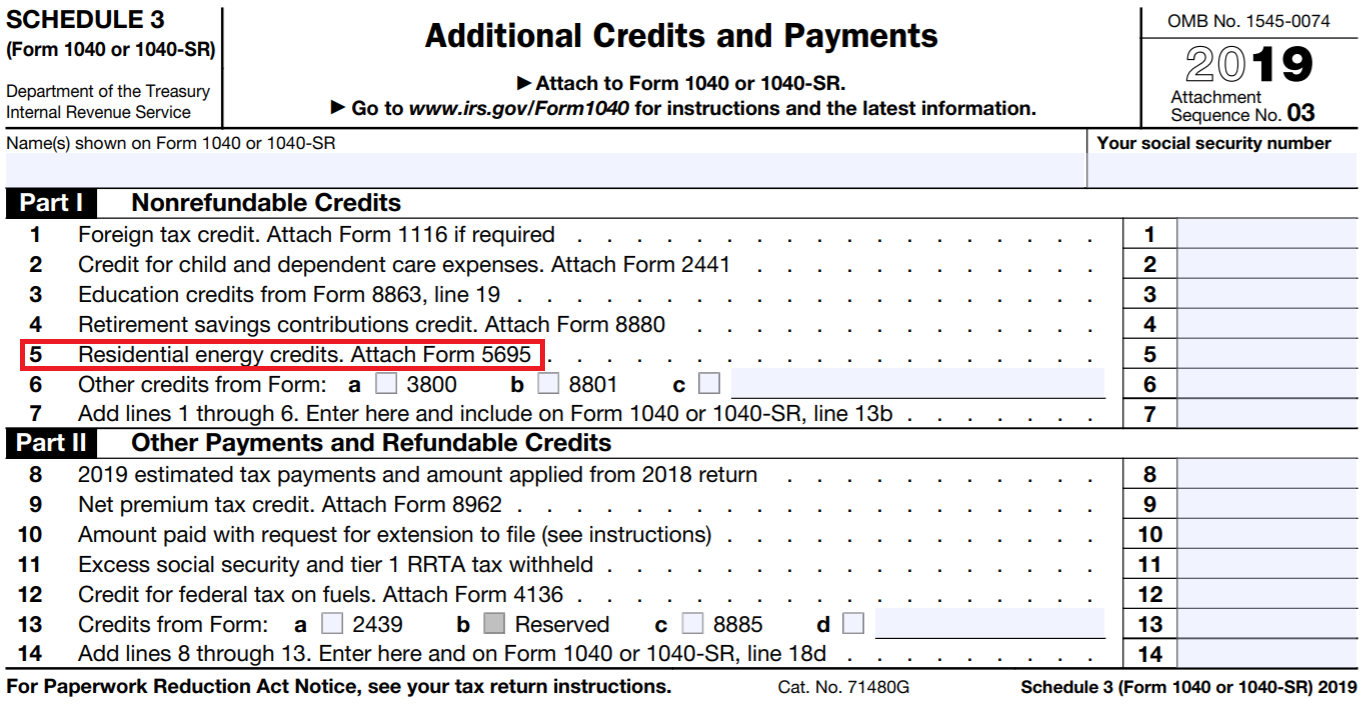

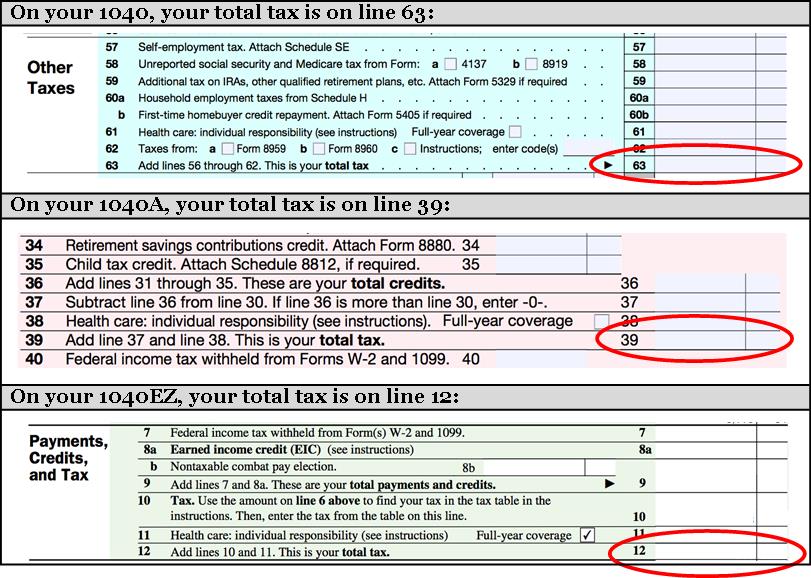

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

A Tax Form For Solar Rebate at its most basic type, is a cash refund provided to customers after they've bought a product or service. It's a very effective technique employed by companies to attract customers, boost sales, or promote a specific product.

Types of Tax Form For Solar Rebate

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Web 1 ao 251 t 2023 nbsp 0183 32 To claim the solar tax credit you ll have to fill out IRS Form 5695 You can claim the tax credit if you receive other clean energy incentives for the same project although this might result

Web Sept 11 2023 3 22 a m PT 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable

Cash Tax Form For Solar Rebate

Cash Tax Form For Solar Rebate are a simple type of Tax Form For Solar Rebate. Customers get a set amount of money after purchasing a item. They are typically used to purchase costly items like electronics or appliances.

Mail-In Tax Form For Solar Rebate

Mail-in Tax Form For Solar Rebate demand that customers provide proof of purchase to receive their reimbursement. They're a little more involved, but offer substantial savings.

Instant Tax Form For Solar Rebate

Instant Tax Form For Solar Rebate can be applied at the point of sale. They reduce the purchase cost immediately. Customers don't have to wait until they can save in this manner.

How Tax Form For Solar Rebate Work

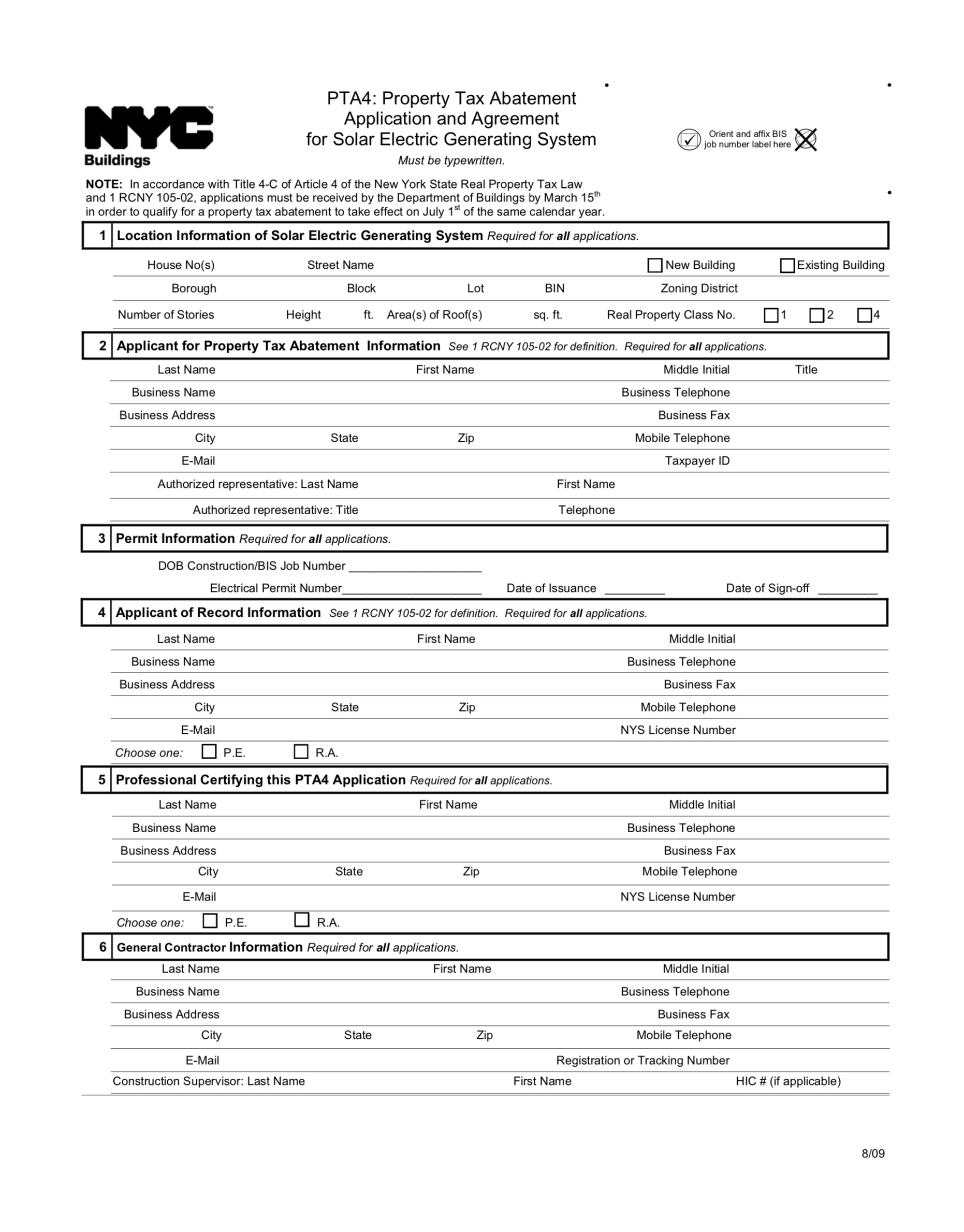

NYC Solar Property Tax Abatement Form PTA4 Explained Sologistics

NYC Solar Property Tax Abatement Form PTA4 Explained Sologistics

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

The Tax Form For Solar Rebate Process

The process typically involves handful of simple steps:

-

Purchase the product: First you purchase the product like you would normally.

-

Fill out your Tax Form For Solar Rebate paper: You'll have to supply some details like your name, address, and purchase details in order to take advantage of your Tax Form For Solar Rebate.

-

To submit the Tax Form For Solar Rebate: Depending on the type of Tax Form For Solar Rebate you may have to send in a form, or make it available online.

-

Wait for the company's approval: They will review your request to verify that it is compliant with the Tax Form For Solar Rebate's terms and conditions.

-

Redeem your Tax Form For Solar Rebate If it is approved, you'll receive your cash back via check, prepaid card, or through another option as per the terms of the offer.

Pros and Cons of Tax Form For Solar Rebate

Advantages

-

Cost savings Tax Form For Solar Rebate can substantially reduce the cost for a product.

-

Promotional Offers they encourage their customers to try new products or brands.

-

Increase Sales A Tax Form For Solar Rebate program can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity The mail-in Tax Form For Solar Rebate particularly difficult and take a long time to complete.

-

The Expiration Dates Some Tax Form For Solar Rebate have specific deadlines for submission.

-

Risk of Non-Payment Some customers might lose their Tax Form For Solar Rebate in the event that they don't adhere to the requirements precisely.

Download Tax Form For Solar Rebate

Download Tax Form For Solar Rebate

FAQs

1. Are Tax Form For Solar Rebate the same as discounts? No, the Tax Form For Solar Rebate will be some form of refund following the purchase, but discounts can reduce the cost of purchase at point of sale.

2. Can I get multiple Tax Form For Solar Rebate for the same product What is the best way to do it? It's contingent on terms that apply to the Tax Form For Solar Rebate offer and also the item's ability to qualify. Some companies may allow it, but some will not.

3. How long does it take to get an Tax Form For Solar Rebate? The timing is variable, however it can range from several weeks to few months to get your Tax Form For Solar Rebate.

4. Do I have to pay taxes for Tax Form For Solar Rebate montants? the majority of circumstances, Tax Form For Solar Rebate amounts are not considered taxable income.

5. Can I trust Tax Form For Solar Rebate offers from brands that aren't well-known Do I need to conduct a thorough research and verify that the brand providing the Tax Form For Solar Rebate is reputable prior making any purchase.

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Check more sample of Tax Form For Solar Rebate below

Filing For The Solar Tax Credit Wells Solar

Solar Tax Credit And Your Boat

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

ITC Solar Tax Credit NATiVE

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

https://www.irs.gov/forms-pubs/about-form-5695

Web 17 f 233 vr 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

Web 17 f 233 vr 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

Solar Tax Credit And Your Boat

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

ITC Solar Tax Credit NATiVE

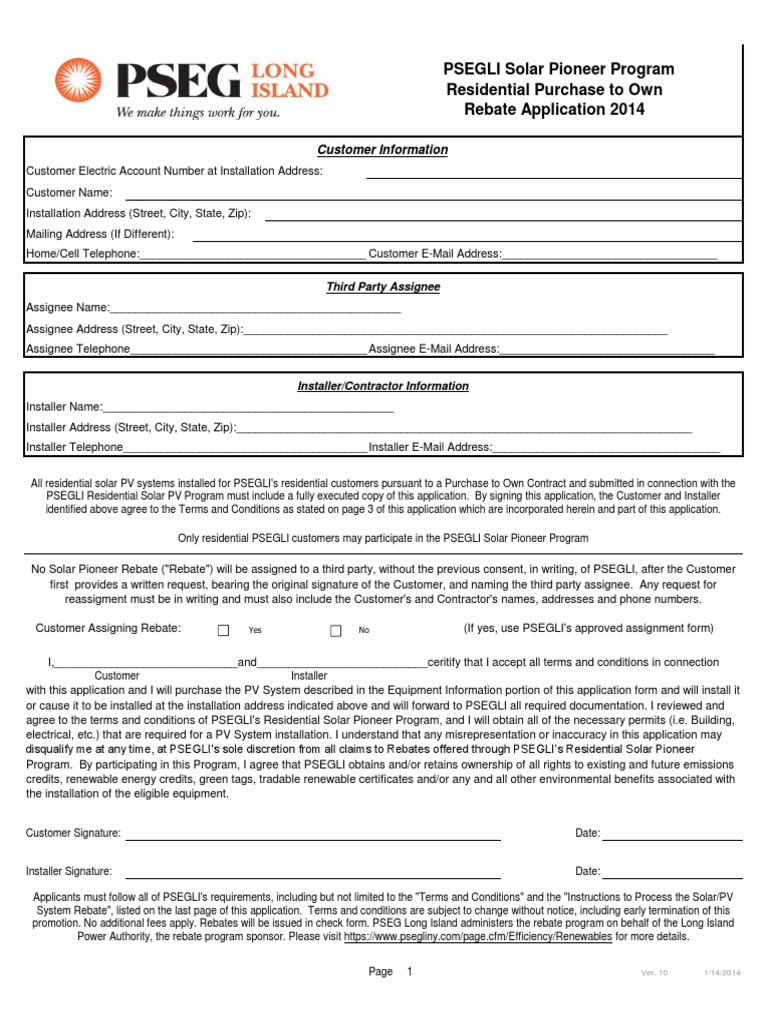

Application Form Residential Solar Electric Rebate United Power

Solar Rebates And Tax Incentives Realsolar PowerRebate

Solar Rebates And Tax Incentives Realsolar PowerRebate

PSEG Long Island PSEGLI Solar Pioneer Program Residential