In the modern world of consumerization everyone is looking for a great bargain. One way to make significant savings in your purchase is through Medical Loss Ratio Rebate Former Employees. The use of Medical Loss Ratio Rebate Former Employees is a method used by manufacturers and retailers to offer consumers a partial refund on their purchases after they've completed them. In this post, we'll explore the world of Medical Loss Ratio Rebate Former Employees. We will explore the nature of them their purpose, how they function and how to maximize your savings with these cost-effective incentives.

Get Latest Medical Loss Ratio Rebate Former Employee Below

Medical Loss Ratio Rebate Former Employee

Medical Loss Ratio Rebate Former Employee - Medical Loss Ratio Rebate Former Employees, Medical Loss Ratio Rebate Terminated Employees, What Is A Medical Loss Ratio Rebate, Are Medical Loss Ratio Rebates Taxable

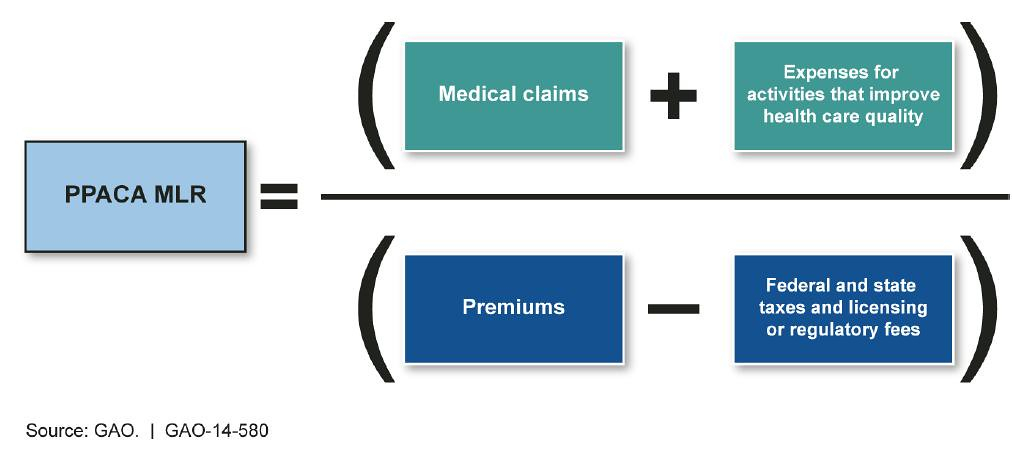

Web Industry Insights Medical Loss Ratio Rebates FAQs Answers to the most common questions around Medical Loss Ratio MLR rebates What is Medical Loss Ratio

Web 1 sept 2020 nbsp 0183 32 The minimum required percentage called the medical loss ratio MLR is If the employer is the policyholder as is most often the case the portion of the rebate

A Medical Loss Ratio Rebate Former Employee in its most basic version, is an ad-hoc refund given to a client after having purchased a item or service. It's a powerful instrument utilized by businesses to attract customers, increase sales and promote specific products.

Types of Medical Loss Ratio Rebate Former Employee

Medical Loss Ratio MLR Questionnaire Rebate2022

Medical Loss Ratio MLR Questionnaire Rebate2022

Web how former health plan participants should receive their share of the MLR rebate However under DOL guidance if the plan fiduciary finds that the cost of distributing shares of the

Web 26 juil 2019 nbsp 0183 32 If a carrier maintains a lower MLR it must issue a premium rebate to policyholders by no later than September 30 each year If HHS notifies a carrier that its MLR is too low the carrier must issue an MLR

Cash Medical Loss Ratio Rebate Former Employee

Cash Medical Loss Ratio Rebate Former Employee are a simple kind of Medical Loss Ratio Rebate Former Employee. The customer receives a particular amount of money when purchasing a product. These are usually used for more expensive items such electronics or appliances.

Mail-In Medical Loss Ratio Rebate Former Employee

Mail-in Medical Loss Ratio Rebate Former Employee require customers to provide evidence of purchase to get their reimbursement. They're a little longer-lasting, however they offer substantial savings.

Instant Medical Loss Ratio Rebate Former Employee

Instant Medical Loss Ratio Rebate Former Employee apply at the point of sale, and can reduce the cost of purchase immediately. Customers don't have to wait until they can save with this type.

How Medical Loss Ratio Rebate Former Employee Work

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

Web 1 nov 2021 nbsp 0183 32 Returning the rebate to current participants in the plan during the year in which the rebate is received and to former participants from the year used to calculate

The Medical Loss Ratio Rebate Former Employee Process

The process generally involves a few steps:

-

Buy the product: At first you purchase the item just as you would ordinarily.

-

Fill out your Medical Loss Ratio Rebate Former Employee questionnaire: you'll need submit some information including your address, name, and information about the purchase in order to take advantage of your Medical Loss Ratio Rebate Former Employee.

-

Send in the Medical Loss Ratio Rebate Former Employee: Depending on the nature of Medical Loss Ratio Rebate Former Employee you might need to send in a form, or submit it online.

-

Wait for the company's approval: They will review your request and ensure that it's compliant with requirements of the Medical Loss Ratio Rebate Former Employee.

-

Pay your Medical Loss Ratio Rebate Former Employee After approval, you'll be able to receive your reimbursement, either through check, prepaid card, or other method as specified by the offer.

Pros and Cons of Medical Loss Ratio Rebate Former Employee

Advantages

-

Cost Savings Medical Loss Ratio Rebate Former Employee could significantly reduce the price you pay for an item.

-

Promotional Offers Incentivize customers to try new products and brands.

-

Accelerate Sales A Medical Loss Ratio Rebate Former Employee program can boost an organization's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly, can be cumbersome and demanding.

-

Expiration Dates Many Medical Loss Ratio Rebate Former Employee are subject to specific deadlines for submission.

-

A risk of not being paid Customers may not receive their Medical Loss Ratio Rebate Former Employee if they don't adhere to the requirements precisely.

Download Medical Loss Ratio Rebate Former Employee

Download Medical Loss Ratio Rebate Former Employee

FAQs

1. Are Medical Loss Ratio Rebate Former Employee the same as discounts? Not at all, Medical Loss Ratio Rebate Former Employee provide partial reimbursement after purchase, whereas discounts decrease the cost of purchase at moment of sale.

2. Are multiple Medical Loss Ratio Rebate Former Employee available for the same product? It depends on the conditions of the Medical Loss Ratio Rebate Former Employee offer and also the item's qualification. Certain companies might allow it, and some don't.

3. How long will it take to receive a Medical Loss Ratio Rebate Former Employee? The time frame differs, but it can be from several weeks to couple of months for you to receive your Medical Loss Ratio Rebate Former Employee.

4. Do I need to pay taxes regarding Medical Loss Ratio Rebate Former Employee values? most circumstances, Medical Loss Ratio Rebate Former Employee amounts are not considered taxable income.

5. Should I be able to trust Medical Loss Ratio Rebate Former Employee offers from brands that aren't well-known Consider doing some research and ensure that the brand which is providing the Medical Loss Ratio Rebate Former Employee is legitimate prior to making an investment.

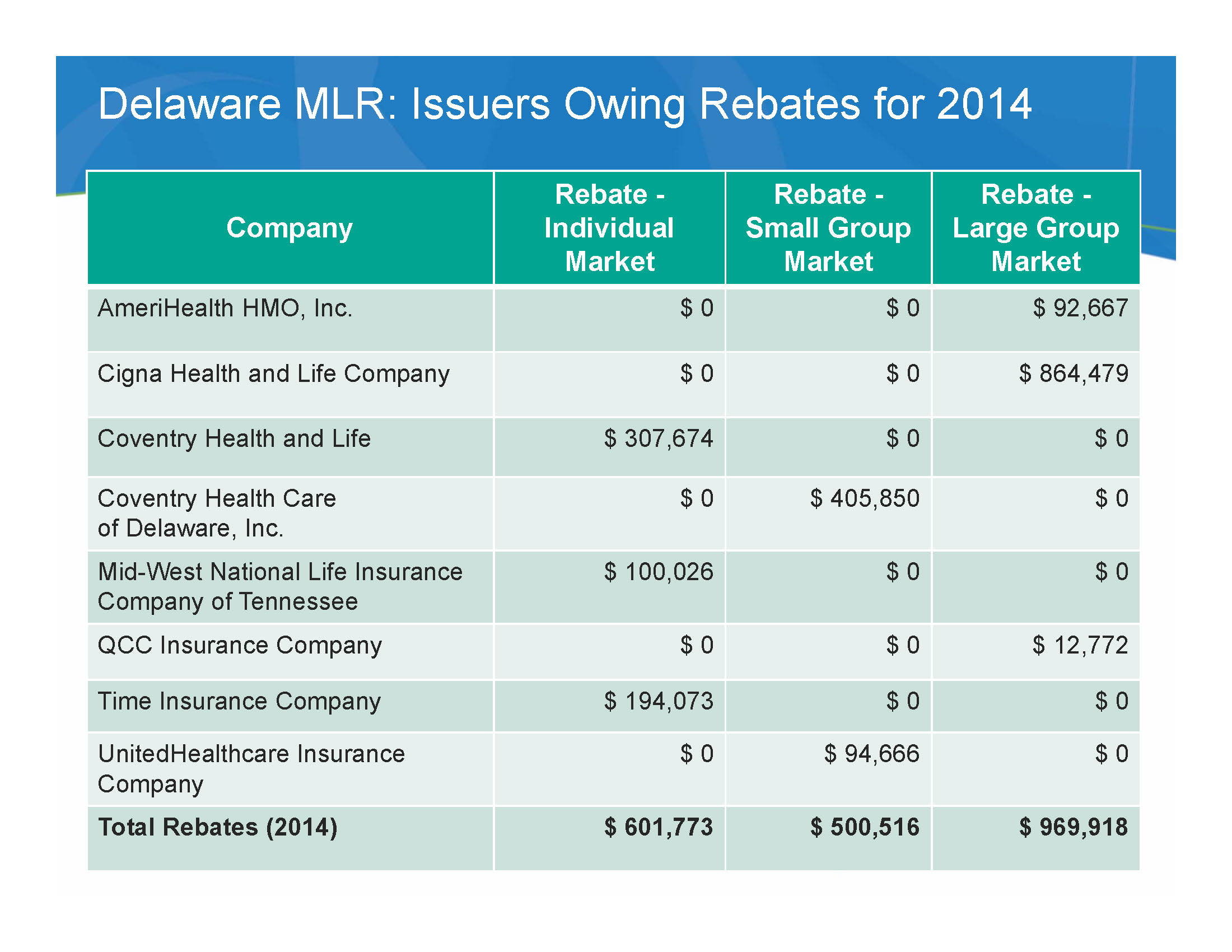

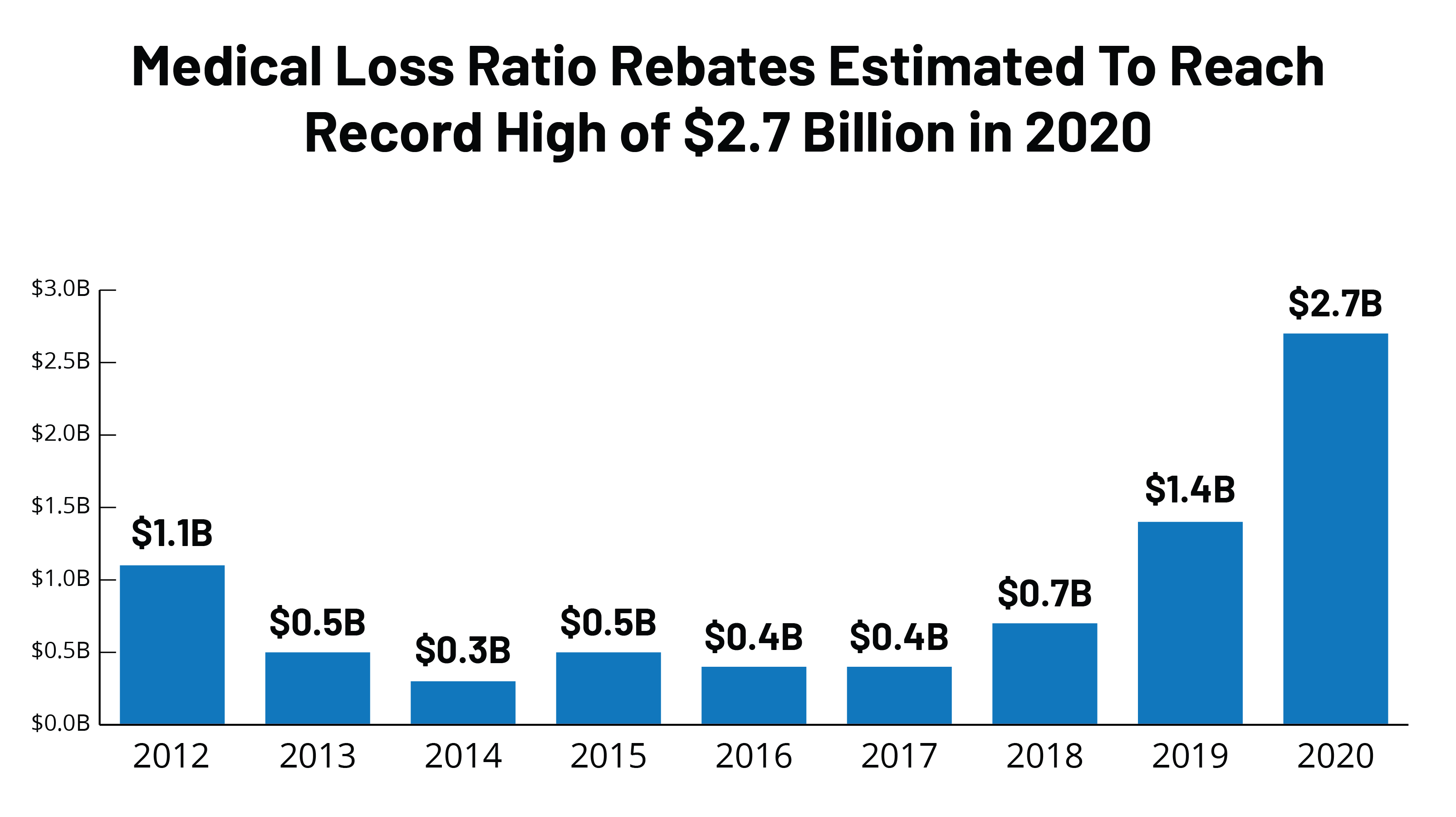

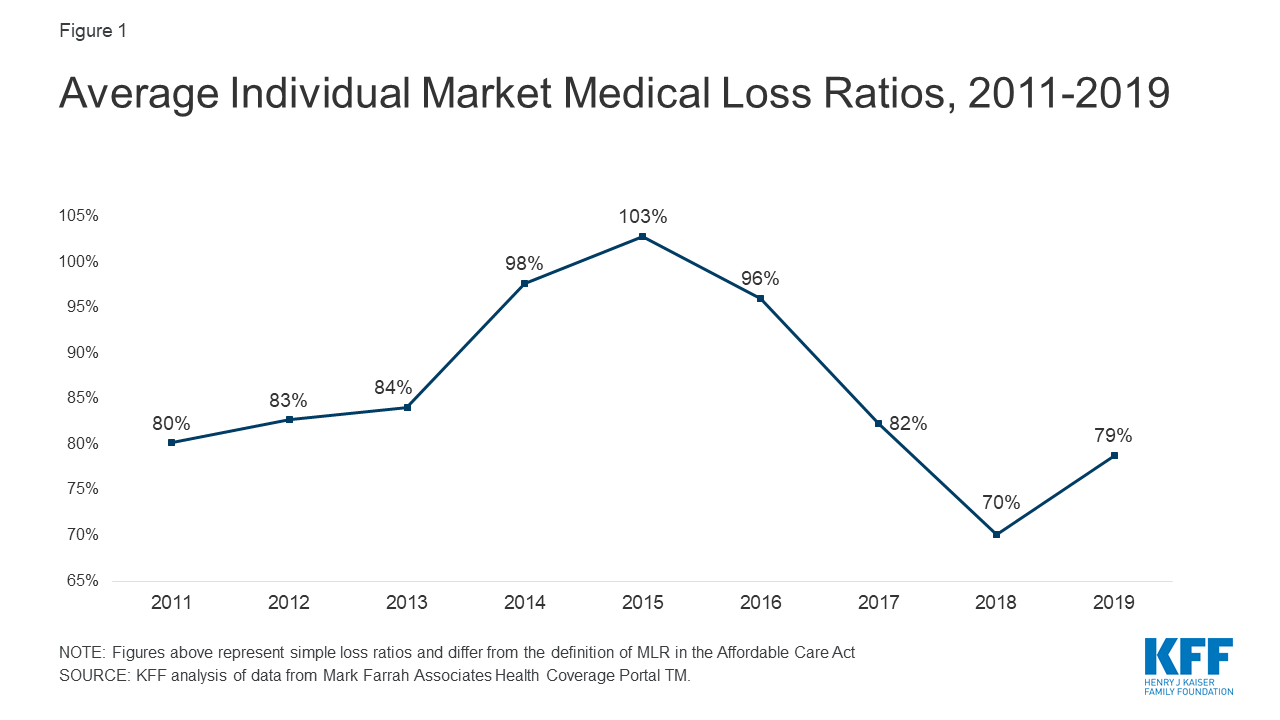

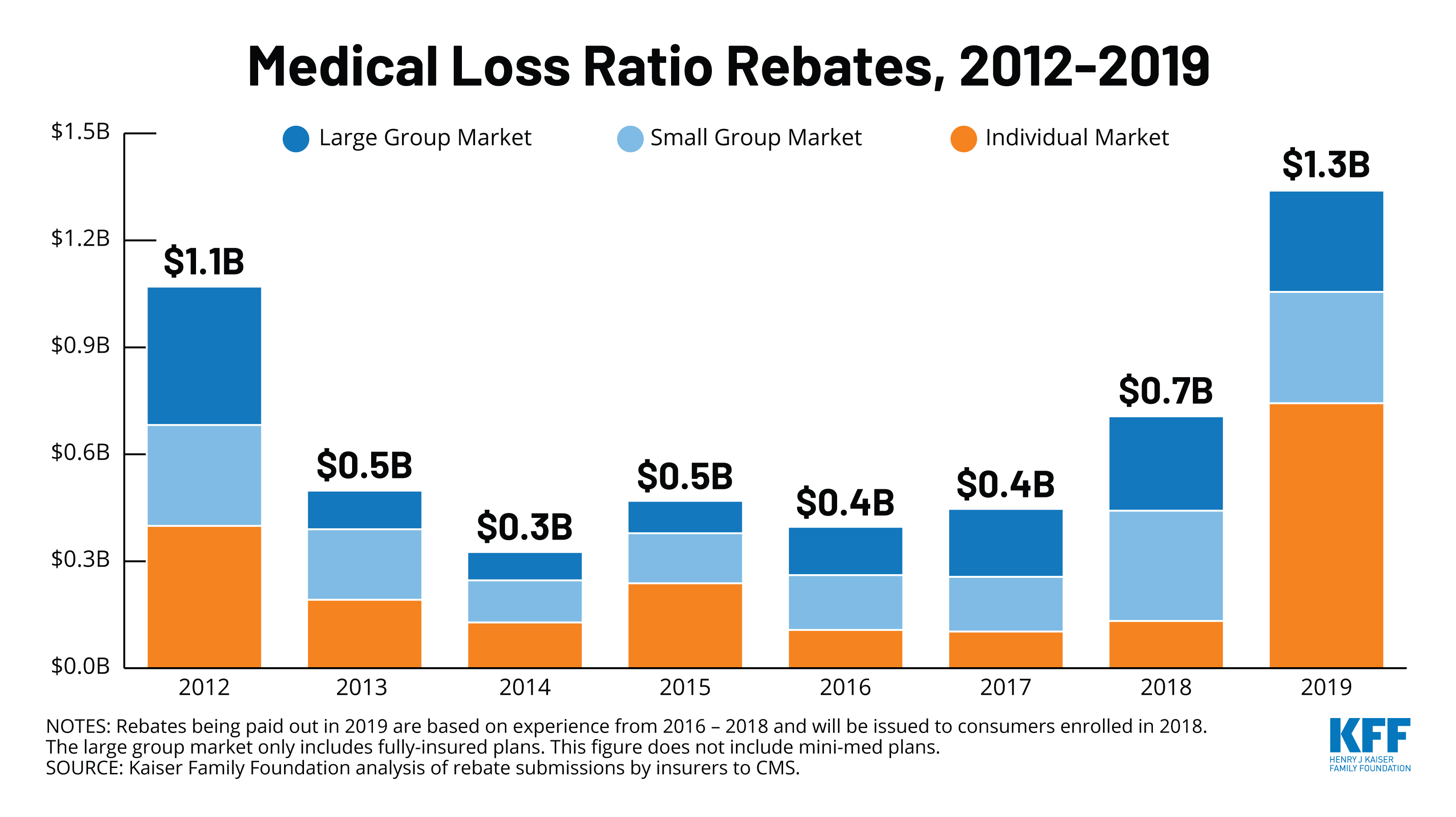

Data Note 2020 Medical Loss Ratio Rebates KFF

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Check more sample of Medical Loss Ratio Rebate Former Employee below

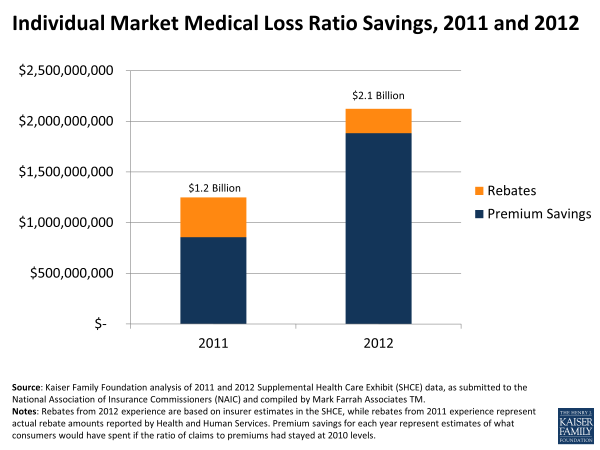

Beyond Rebates How Much Are Consumers Saving From The ACA s Medical

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

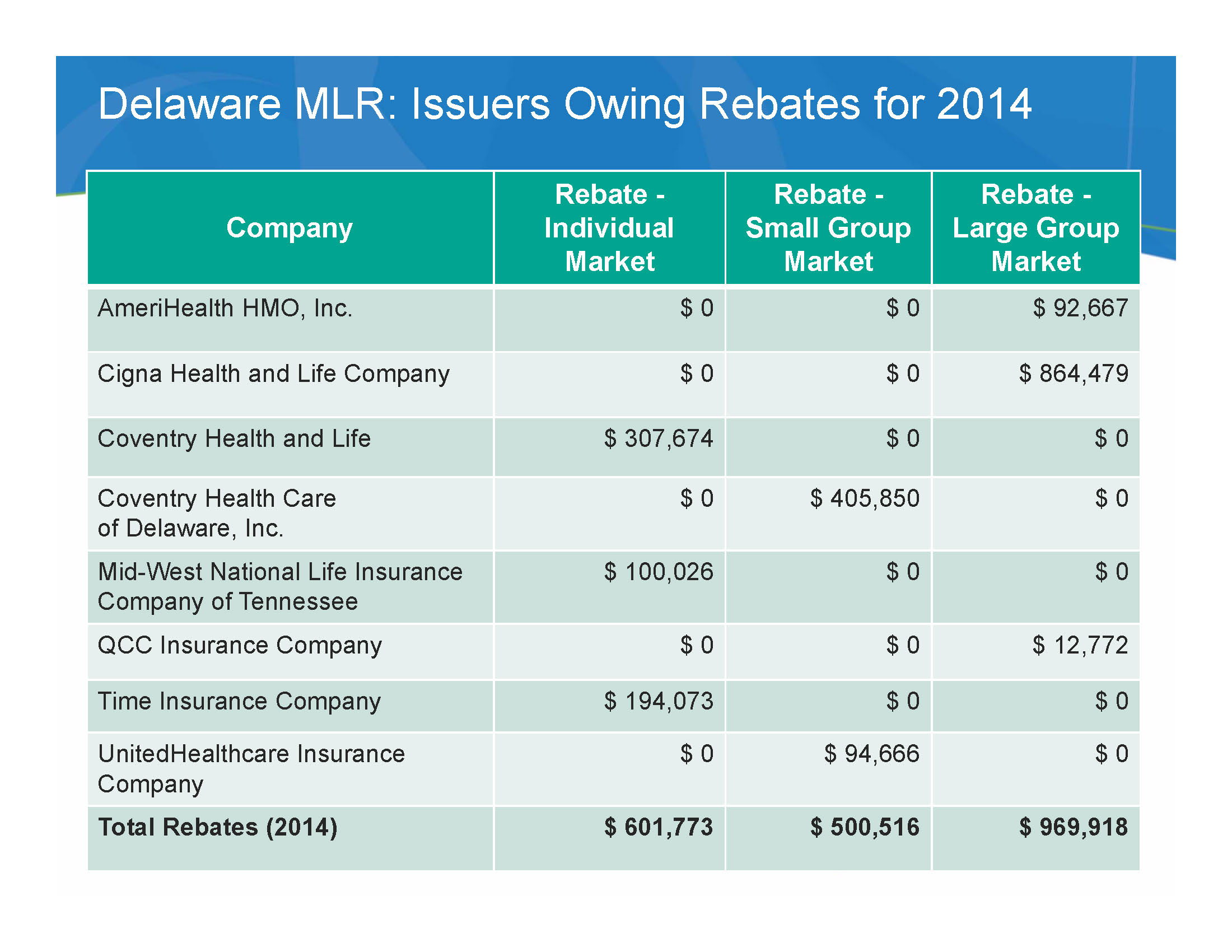

Medical Loss Ratio Rebates

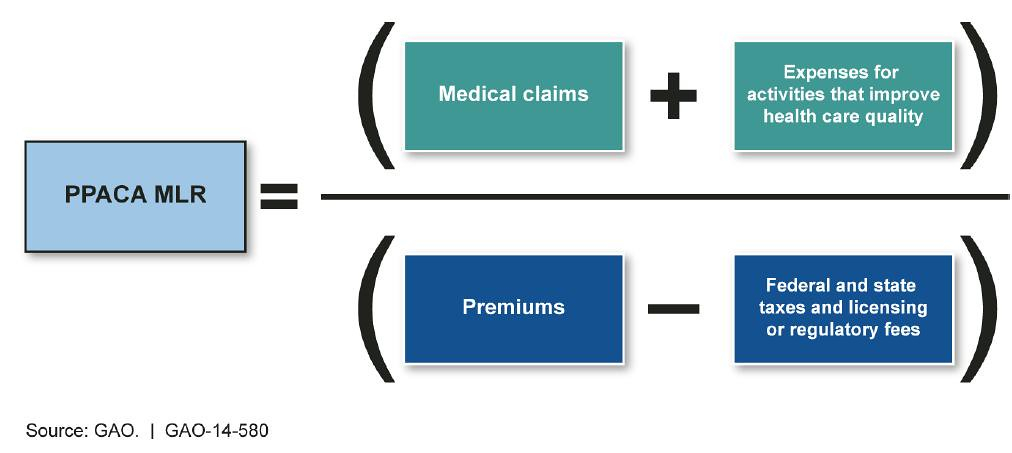

Medical Loss Ratio Definition DEFINITION KLW

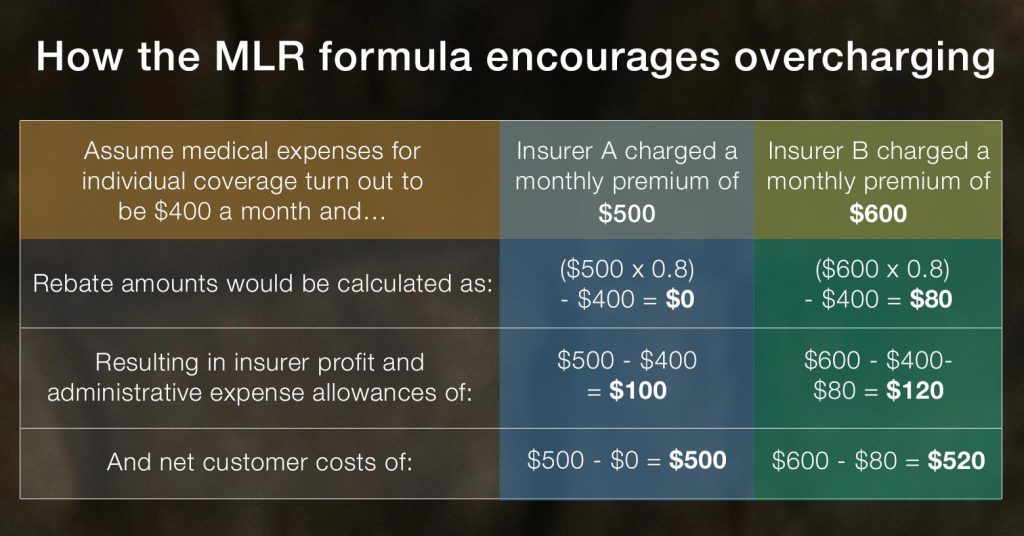

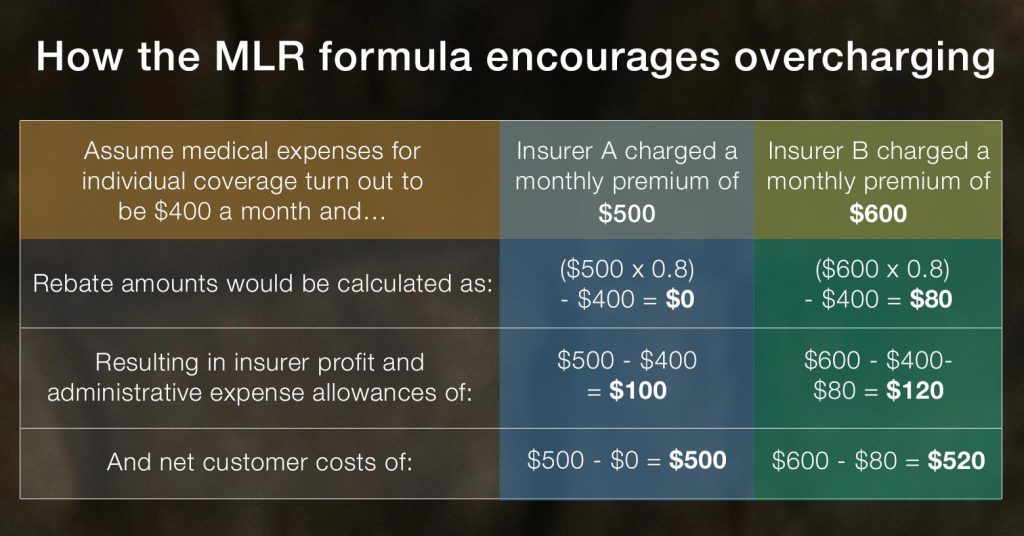

One Way To Ease ACA Rate Hikes Fix The Rebate Formula

Ask The Experts Medical Loss Ratio MLR Rebates ThinkHR

https://www.epicbrokers.com/insights/properly-handling-medical-loss...

Web 1 sept 2020 nbsp 0183 32 The minimum required percentage called the medical loss ratio MLR is If the employer is the policyholder as is most often the case the portion of the rebate

https://www.dol.gov/.../resource-center/faqs/mlr-insurance-re…

Web MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked

Web 1 sept 2020 nbsp 0183 32 The minimum required percentage called the medical loss ratio MLR is If the employer is the policyholder as is most often the case the portion of the rebate

Web MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked

Medical Loss Ratio Definition DEFINITION KLW

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

One Way To Ease ACA Rate Hikes Fix The Rebate Formula

Ask The Experts Medical Loss Ratio MLR Rebates ThinkHR

Medical Loss Ratio Commonly Asked Questions Employee Benefit

2023 Medical Loss Ratio Rebates KFF

2023 Medical Loss Ratio Rebates KFF

TWITTER Medical Loss Ratio Rebates 1 KFF