In this day and age of consuming every person loves a great bargain. One way to earn significant savings on your purchases is through Solar Rebate Tax Form Californias. Solar Rebate Tax Form Californias can be a way of marketing that retailers and manufacturers use to provide customers with a partial discount on purchases they made after they've done so. In this article, we will investigate the world of Solar Rebate Tax Form Californias. We'll look at what they are about, how they work, as well as ways to maximize the value of these incentives.

Get Latest Solar Rebate Tax Form California Below

Solar Rebate Tax Form California

Solar Rebate Tax Form California -

Web Under the Inflation Reduction Act passed in August 2022 the federal solar tax credit is worth 30 of your total system cost What is the California solar tax credit for 2023

Web 8 sept 2023 nbsp 0183 32 The total cost of solar panels in California generally ranges between 15 000 and 25 000

A Solar Rebate Tax Form California is, in its most basic format, is a refund to a purchaser who has purchased a particular product or service. It's a very effective technique utilized by businesses to attract customers, increase sales, and to promote certain products.

Types of Solar Rebate Tax Form California

California Home Solar Power Rebates Tax Credits Savings

California Home Solar Power Rebates Tax Credits Savings

Web 25 ao 251 t 2023 nbsp 0183 32 We break down every CA solar rebate incentive and tax credit so you can max out your savings Qualify for NEM 2 0 today

Web 20 mai 2022 nbsp 0183 32 Of course all American homeowners can take advantage of the federal solar investment tax credit ITC which deducts 26 of the solar system installation cost from their 2022 taxes This effectively

Cash Solar Rebate Tax Form California

Cash Solar Rebate Tax Form California are probably the most simple type of Solar Rebate Tax Form California. Customers get a set amount of money in return for buying a product. These are typically applied to more expensive items such electronics or appliances.

Mail-In Solar Rebate Tax Form California

Mail-in Solar Rebate Tax Form California need customers to submit the proof of purchase in order to receive their refund. They're more involved, but can result in substantial savings.

Instant Solar Rebate Tax Form California

Instant Solar Rebate Tax Form California will be applied at point of sale, and can reduce the price instantly. Customers don't have to wait long for savings in this manner.

How Solar Rebate Tax Form California Work

How To Claim The Solar Tax Credit Using IRS Form 5695

How To Claim The Solar Tax Credit Using IRS Form 5695

Web The property tax incentive for the installation of an active solar energy system is in the form of a new construction exclusion It is not an exemption Therefore the installation of a

The Solar Rebate Tax Form California Process

The procedure typically consists of a few simple steps:

-

Buy the product: Firstly purchase the product the way you normally do.

-

Fill in this Solar Rebate Tax Form California forms: The Solar Rebate Tax Form California form will have to supply some details including your name, address, and information about the purchase to claim your Solar Rebate Tax Form California.

-

Make sure you submit the Solar Rebate Tax Form California It is dependent on the type of Solar Rebate Tax Form California you might need to mail a Solar Rebate Tax Form California form in or make it available online.

-

Wait for approval: The business will review your submission to determine if it's in compliance with the requirements of the Solar Rebate Tax Form California.

-

Get your Solar Rebate Tax Form California Once it's approved, you'll get your refund, using a check or prepaid card, or by another method that is specified in the offer.

Pros and Cons of Solar Rebate Tax Form California

Advantages

-

Cost Savings The use of Solar Rebate Tax Form California can greatly cut the price you pay for the product.

-

Promotional Offers They encourage customers in trying new products or brands.

-

Enhance Sales The benefits of a Solar Rebate Tax Form California can improve a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Solar Rebate Tax Form California, particularly difficult and time-consuming.

-

Time Limits for Solar Rebate Tax Form California A majority of Solar Rebate Tax Form California have very strict deadlines for filing.

-

The risk of non-payment: Some customers may not receive Solar Rebate Tax Form California if they don't observe the rules exactly.

Download Solar Rebate Tax Form California

Download Solar Rebate Tax Form California

FAQs

1. Are Solar Rebate Tax Form California equivalent to discounts? No, they are only a partial reimbursement following the purchase, whereas discounts cut prices at moment of sale.

2. Are there Solar Rebate Tax Form California that can be used for the same product What is the best way to do it? It's contingent on terms in the Solar Rebate Tax Form California offered and product's acceptance. Some companies will allow it, but others won't.

3. What is the time frame to receive a Solar Rebate Tax Form California? The time frame is different, but it could take anywhere from a couple of weeks to a couple of months for you to receive your Solar Rebate Tax Form California.

4. Do I need to pay taxes of Solar Rebate Tax Form California values? the majority of situations, Solar Rebate Tax Form California amounts are not considered to be taxable income.

5. Do I have confidence in Solar Rebate Tax Form California deals from lesser-known brands? It's essential to research and ensure that the brand providing the Solar Rebate Tax Form California has a good reputation prior to making any purchase.

Free Download Rebate Tax Incentive Solar Power California Others

Rebate Tax Incentive Solar Power California Others Template Angle

Check more sample of Solar Rebate Tax Form California below

2021 Form CA FTB 592 F Fill Online Printable Fillable Blank PdfFiller

California Home Solar Power Rebates Tax Credits Savings

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

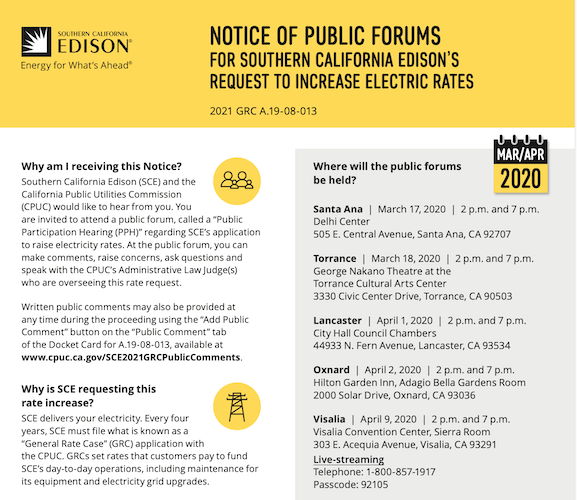

Edison Electric Solar Rebates ElectricRebate

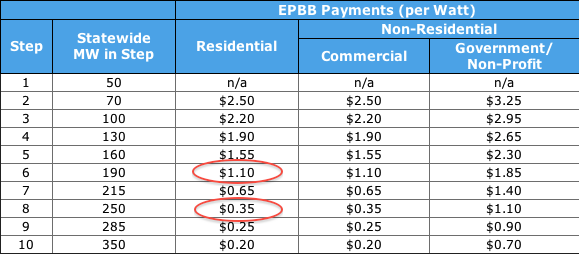

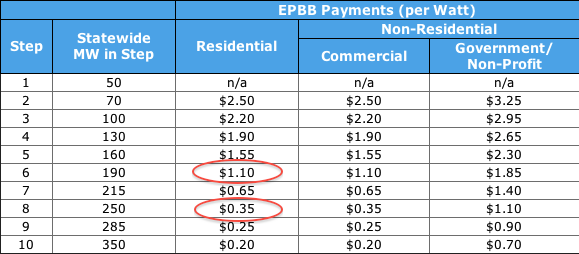

Solar Initiative Rebates And Credits

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

https://www.forbes.com/home-improvement/solar/california-solar-incenti…

Web 8 sept 2023 nbsp 0183 32 The total cost of solar panels in California generally ranges between 15 000 and 25 000

https://www.energysage.com/local-data/solar-rebates-incentives/ca

Web What are the main California solar tax credits and rebates Check out our top list of incentives to go solar in California Local solar rebates Homeowners have access to

Web 8 sept 2023 nbsp 0183 32 The total cost of solar panels in California generally ranges between 15 000 and 25 000

Web What are the main California solar tax credits and rebates Check out our top list of incentives to go solar in California Local solar rebates Homeowners have access to

Edison Electric Solar Rebates ElectricRebate

California Home Solar Power Rebates Tax Credits Savings

Solar Initiative Rebates And Credits

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

2018 California Solar Rebates And Incentives EnergySage Solar

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar