In our current world of high-end consumer goods everybody loves a good deal. One way to make significant savings on your purchases is by using Form 40 Kicker Rebate Oregon Surplus Credits. Form 40 Kicker Rebate Oregon Surplus Credits are an effective marketing tactic used by manufacturers and retailers to offer consumers a partial refund on purchases made after they have completed them. In this post, we'll look into the world of Form 40 Kicker Rebate Oregon Surplus Credits. We'll discuss what they are and how they operate, and ways you can increase your savings via these cost-effective incentives.

Get Latest Form 40 Kicker Rebate Oregon Surplus Credit Below

Form 40 Kicker Rebate Oregon Surplus Credit

Form 40 Kicker Rebate Oregon Surplus Credit -

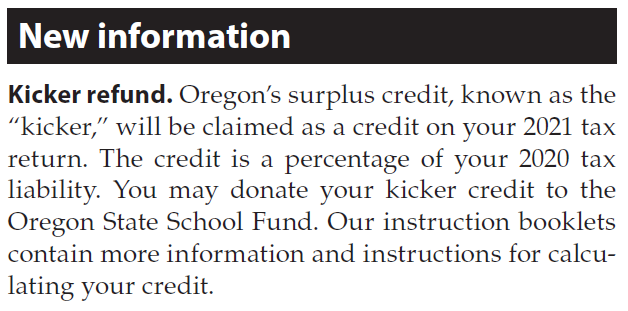

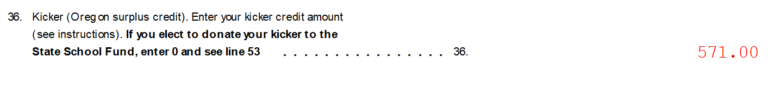

Web Oregon s surplus credit known as the kicker is claimed as a refundable credit on your 2021 tax return The credit is 17 341 percent of your 2020 tax liability from Form OR 41

Web based on your AGI See instructions for line 40 Kicker credit Oregon s surplus credit known as the kicker will be claimed as a credit on your 2021 tax return See the

A Form 40 Kicker Rebate Oregon Surplus Credit in its simplest format, is a refund given to a client after purchasing a certain product or service. It's a powerful method that businesses use to draw customers, increase sales or promote a specific product.

Types of Form 40 Kicker Rebate Oregon Surplus Credit

What Is Oregon s kicker Tax Rebate Kgw

What Is Oregon s kicker Tax Rebate Kgw

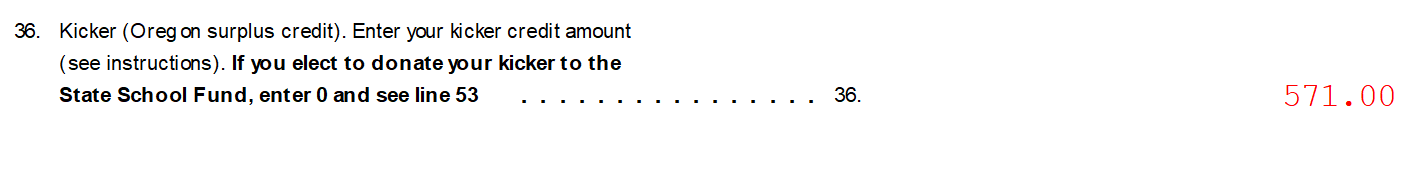

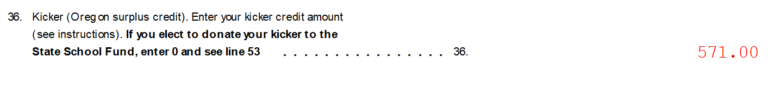

Web 36 Earned income credit see instructions 36 37 Kicker Oregon surplus credit Enter your kicker credit amount see instructions If you elect to donate your kicker to

Web 12 oct 2021 nbsp 0183 32 To calculate the amount of your credit you can multiply your 2020 tax liability before any credits which appears on line 22 of form OR 40 by 17 341 Taxpayers who claimed a credit for tax paid to another

Cash Form 40 Kicker Rebate Oregon Surplus Credit

Cash Form 40 Kicker Rebate Oregon Surplus Credit are probably the most simple type of Form 40 Kicker Rebate Oregon Surplus Credit. Clients receive a predetermined amount back in cash after buying a product. These are usually used for big-ticket items, like electronics and appliances.

Mail-In Form 40 Kicker Rebate Oregon Surplus Credit

Mail-in Form 40 Kicker Rebate Oregon Surplus Credit require the customer to submit the proof of purchase to be eligible for the money. They're a bit more involved but offer huge savings.

Instant Form 40 Kicker Rebate Oregon Surplus Credit

Instant Form 40 Kicker Rebate Oregon Surplus Credit apply at the point of sale, which reduces the price of your purchase instantly. Customers don't have to wait long for savings through this kind of offer.

How Form 40 Kicker Rebate Oregon Surplus Credit Work

Oregon s Surplus Kicker Credit Solid State Tax

Oregon s Surplus Kicker Credit Solid State Tax

Web 12 oct 2021 nbsp 0183 32 SALEM Ore KTVZ The Oregon Office of Economic Analysis confirmed this month a nearly 1 9 billion tax surplus triggering a tax surplus credit or kicker

The Form 40 Kicker Rebate Oregon Surplus Credit Process

The process typically involves a couple of steps that are easy to follow:

-

Purchase the product: First, you buy the product the way you normally do.

-

Complete the Form 40 Kicker Rebate Oregon Surplus Credit Form: To claim the Form 40 Kicker Rebate Oregon Surplus Credit you'll have to provide some information including your address, name, and purchase details to claim your Form 40 Kicker Rebate Oregon Surplus Credit.

-

Submit the Form 40 Kicker Rebate Oregon Surplus Credit It is dependent on the kind of Form 40 Kicker Rebate Oregon Surplus Credit, you may need to fill out a paper form or upload it online.

-

Wait for approval: The business will review your request for compliance with Form 40 Kicker Rebate Oregon Surplus Credit's terms and conditions.

-

Get your Form 40 Kicker Rebate Oregon Surplus Credit If it is approved, the amount you receive will be whether by check, prepaid card or through a different option that's specified in the offer.

Pros and Cons of Form 40 Kicker Rebate Oregon Surplus Credit

Advantages

-

Cost Savings Form 40 Kicker Rebate Oregon Surplus Credit are a great way to reduce the price you pay for the item.

-

Promotional Offers: They encourage customers to try out new products or brands.

-

Accelerate Sales: Form 40 Kicker Rebate Oregon Surplus Credit can boost companies' sales and market share.

Disadvantages

-

Complexity mail-in Form 40 Kicker Rebate Oregon Surplus Credit particularly they can be time-consuming and lengthy.

-

Day of Expiration Many Form 40 Kicker Rebate Oregon Surplus Credit are subject to certain deadlines for submitting.

-

Risk of Non-Payment Certain customers could not receive Form 40 Kicker Rebate Oregon Surplus Credit if they don't comply with the rules precisely.

Download Form 40 Kicker Rebate Oregon Surplus Credit

Download Form 40 Kicker Rebate Oregon Surplus Credit

FAQs

1. Are Form 40 Kicker Rebate Oregon Surplus Credit the same as discounts? No, Form 40 Kicker Rebate Oregon Surplus Credit require a partial refund after the purchase whereas discounts will reduce your purchase cost at time of sale.

2. Can I get multiple Form 40 Kicker Rebate Oregon Surplus Credit on the same product This is dependent on conditions that apply to the Form 40 Kicker Rebate Oregon Surplus Credit incentives and the specific product's acceptance. Certain companies allow it, while some won't.

3. How long will it take to get the Form 40 Kicker Rebate Oregon Surplus Credit? The length of time differs, but could take anywhere from a few weeks to a couple of months for you to receive your Form 40 Kicker Rebate Oregon Surplus Credit.

4. Do I need to pay tax regarding Form 40 Kicker Rebate Oregon Surplus Credit sums? most circumstances, Form 40 Kicker Rebate Oregon Surplus Credit amounts are not considered taxable income.

5. Can I trust Form 40 Kicker Rebate Oregon Surplus Credit offers from lesser-known brands It is essential to investigate and confirm that the brand offering the Form 40 Kicker Rebate Oregon Surplus Credit is legitimate prior to making a purchase.

What Is Oregon s kicker Tax Rebate Kgw

OP ED Why It s Time For Oregon To Kick It s Kicker Habit

Check more sample of Form 40 Kicker Rebate Oregon Surplus Credit below

Oregon s Surplus Kicker Credit Solid State Tax

What s My Kicker Oregon Releases Plan For Tax Surplus Money Local

Most Of Oregon kicker Tax Rebate Will Be Saved Not Spent State

Oregon s Surplus Kicker Credit Solid State Tax

Most Of Oregon kicker Tax Rebate Will Be Saved Not Spent State

Oregon s kicker Tax Rebate Could Grow To Record 1 4 Billion

https://www.oregon.gov/dor/forms/FormsPubs/form-or-40-…

Web based on your AGI See instructions for line 40 Kicker credit Oregon s surplus credit known as the kicker will be claimed as a credit on your 2021 tax return See the

https://www.oregon.gov/dor/forms/FormsPubs/form-or-40-i…

Web Form OR 40 Instructions Check out our online services Revenue Online is a secure online portal that provides access to your tax account at any time You can Check the status

Web based on your AGI See instructions for line 40 Kicker credit Oregon s surplus credit known as the kicker will be claimed as a credit on your 2021 tax return See the

Web Form OR 40 Instructions Check out our online services Revenue Online is a secure online portal that provides access to your tax account at any time You can Check the status

Oregon s Surplus Kicker Credit Solid State Tax

What s My Kicker Oregon Releases Plan For Tax Surplus Money Local

Most Of Oregon kicker Tax Rebate Will Be Saved Not Spent State

Oregon s kicker Tax Rebate Could Grow To Record 1 4 Billion

Oregon Kicker Taxpayers Set To Get A 1 6 Billion Rebate Next Year

Oregon s Kicker Tax Rebate Would Be Suspended Under Bill From Beaverton

Oregon s Kicker Tax Rebate Would Be Suspended Under Bill From Beaverton

Oregon kicker Rebate To Taxpayers 1 6 Billion 100 Million Bigger