In this day and age of consuming everyone is looking for a great bargain. One way to score significant savings on your purchases can be achieved through Solar Rebate Irs Form For 2023s. Solar Rebate Irs Form For 2023s are a method of marketing used by manufacturers and retailers to provide customers with a partial refund on their purchases after they have completed them. In this article, we'll investigate the world of Solar Rebate Irs Form For 2023s, exploring what they are and how they operate, and ways you can increase your savings through these efficient incentives.

Get Latest Solar Rebate Irs Form For 2023 Below

Solar Rebate Irs Form For 2023

Solar Rebate Irs Form For 2023 -

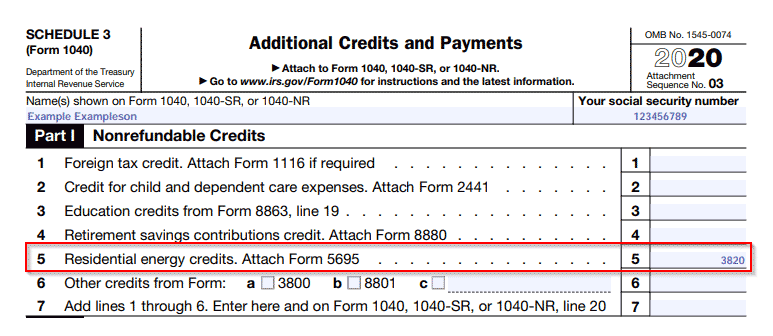

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

A Solar Rebate Irs Form For 2023 at its most basic form, is a partial reimbursement to a buyer when they purchase a product or service. It is a powerful tool for businesses to entice clients, increase sales and to promote certain products.

Types of Solar Rebate Irs Form For 2023

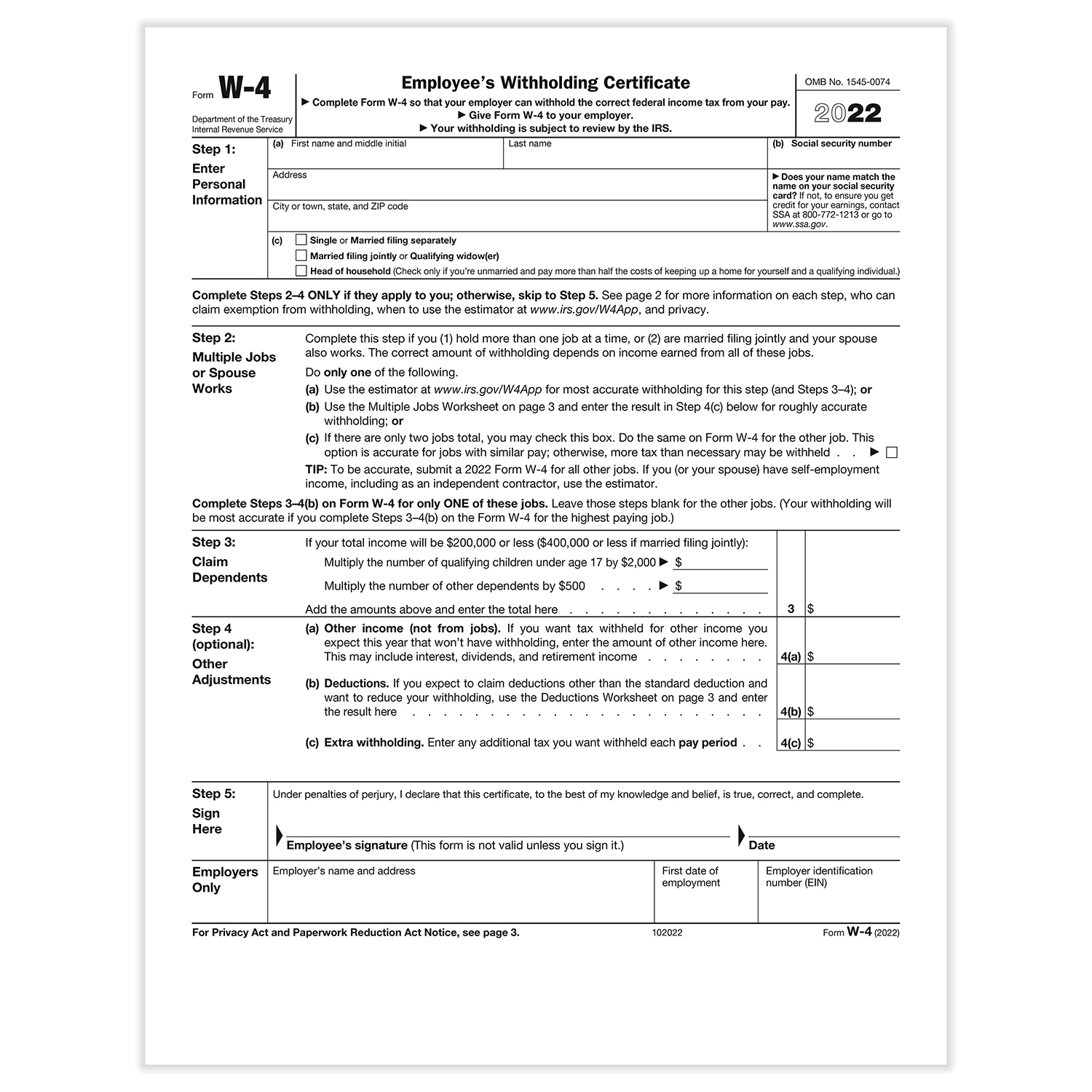

W 9 Form 2023 Printable W9 Form 2023

W 9 Form 2023 Printable W9 Form 2023

Page Last Reviewed or Updated 17 Feb 2023 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

Part I Residential Clean Energy Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2021 1 Qualified solar

Cash Solar Rebate Irs Form For 2023

Cash Solar Rebate Irs Form For 2023 are a simple kind of Solar Rebate Irs Form For 2023. Customers are offered a certain amount of cash back after purchasing a item. These are typically applied to high-ticket items like electronics or appliances.

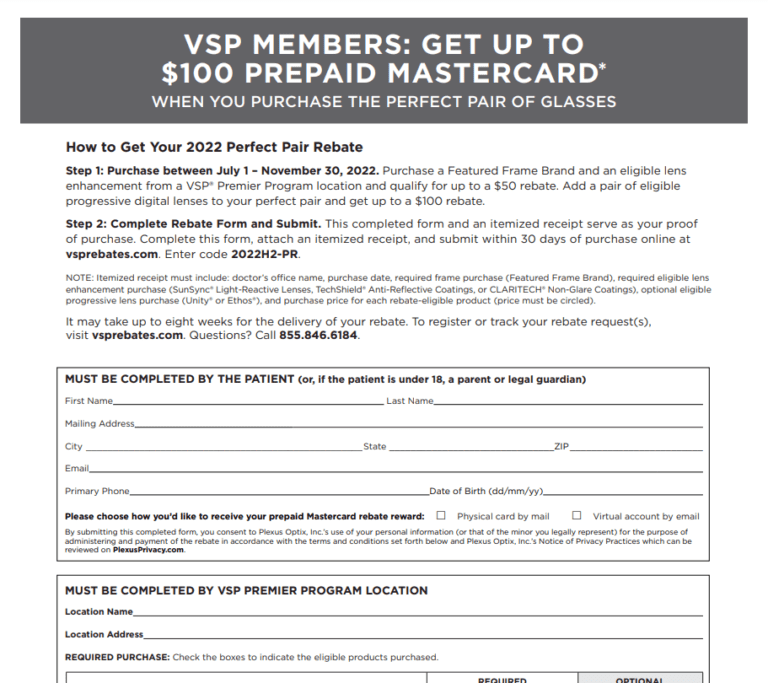

Mail-In Solar Rebate Irs Form For 2023

Mail-in Solar Rebate Irs Form For 2023 require consumers to send in documents of purchase to claim their money back. They are a bit more complicated, but they can provide substantial savings.

Instant Solar Rebate Irs Form For 2023

Instant Solar Rebate Irs Form For 2023 can be applied at the point of sale. They reduce the price of your purchase instantly. Customers don't have to wait around for savings by using this method.

How Solar Rebate Irs Form For 2023 Work

Missouri Rent Rebate 2023 Printable Rebate Form

Missouri Rent Rebate 2023 Printable Rebate Form

IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The Solar Rebate Irs Form For 2023 Process

The process usually involves a few steps:

-

Purchase the product: Then purchase the product just like you normally would.

-

Fill out the Solar Rebate Irs Form For 2023 paper: You'll have to give some specific information, such as your name, address, and purchase details, to get your Solar Rebate Irs Form For 2023.

-

Make sure you submit the Solar Rebate Irs Form For 2023 In accordance with the nature of Solar Rebate Irs Form For 2023 you will need to mail in a form or make it available online.

-

Wait until the company approves: The company is going to review your entry to confirm that it complies with the terms and conditions of the Solar Rebate Irs Form For 2023.

-

Enjoy your Solar Rebate Irs Form For 2023 After approval, you'll get your refund, in the form of a check, prepaid card or through a different method that is specified in the offer.

Pros and Cons of Solar Rebate Irs Form For 2023

Advantages

-

Cost savings Solar Rebate Irs Form For 2023 can dramatically lower the cost you pay for a product.

-

Promotional Offers They encourage customers to explore new products or brands.

-

increase sales A Solar Rebate Irs Form For 2023 program can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Pay-in Solar Rebate Irs Form For 2023 via mail, particularly, can be cumbersome and lengthy.

-

Days of expiration Many Solar Rebate Irs Form For 2023 have extremely strict deadlines to submit.

-

Risk of Not Being Paid Some customers might have their Solar Rebate Irs Form For 2023 delayed if they don't observe the rules exactly.

Download Solar Rebate Irs Form For 2023

Download Solar Rebate Irs Form For 2023

FAQs

1. Are Solar Rebate Irs Form For 2023 similar to discounts? No, they are a partial refund after the purchase whereas discounts will reduce costs at time of sale.

2. Can I get multiple Solar Rebate Irs Form For 2023 on the same item It is contingent on the terms on the Solar Rebate Irs Form For 2023 provides and the particular product's suitability. Certain companies allow it, but others won't.

3. How long does it take to receive an Solar Rebate Irs Form For 2023? The period will vary, but it may last from a few weeks until a couple of months to receive your Solar Rebate Irs Form For 2023.

4. Do I need to pay tax in relation to Solar Rebate Irs Form For 2023 amount? most instances, Solar Rebate Irs Form For 2023 amounts are not considered taxable income.

5. Do I have confidence in Solar Rebate Irs Form For 2023 offers from brands that aren't well-known It is essential to investigate to ensure that the name offering the Solar Rebate Irs Form For 2023 is trustworthy prior to making any purchase.

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

How To Claim The Solar Tax Credit Using IRS Form 5695

Check more sample of Solar Rebate Irs Form For 2023 below

2021 Pa Fill Out Sign Online DocHub

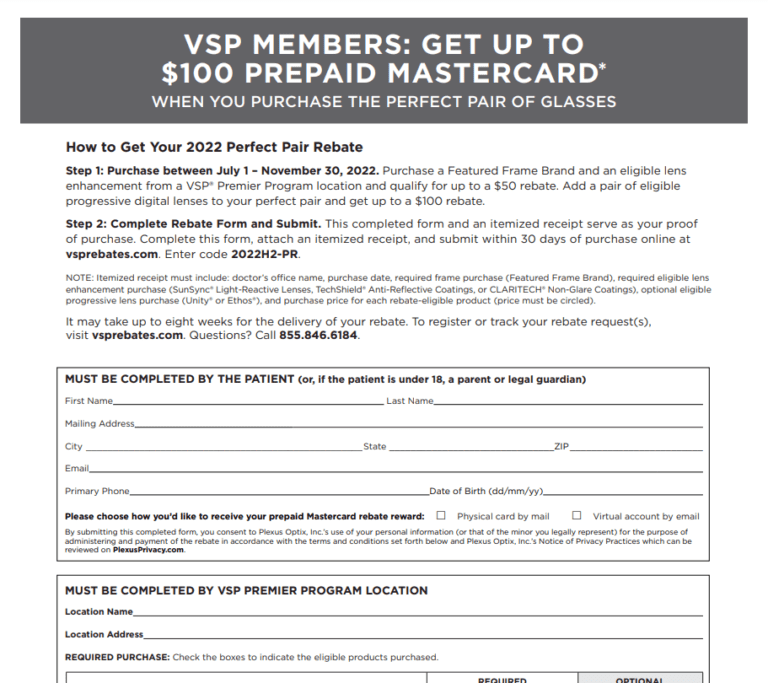

Vsp Rebate 2023 Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

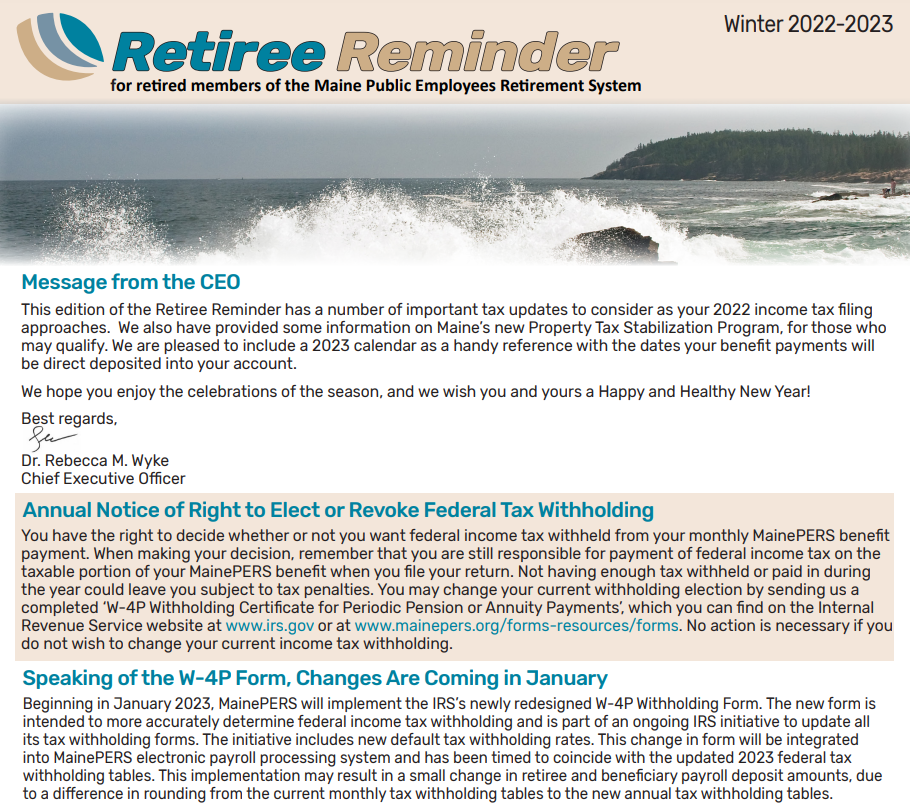

Maine Renters Rebate 2023 Printable Rebate Form

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

https://www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel property and fuel cell property

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel property and fuel cell property

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Vsp Rebate 2023 Printable Rebate Form

Maine Renters Rebate 2023 Printable Rebate Form

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Maryland Energy Rebates 2023 Printable Rebate Form

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

How To Claim The Federal Solar Tax Credit Form 5695 Instructions