In this modern-day world of consumers we all love a good deal. One way to make significant savings in your purchase is through Rental Real Estate Rebate Form Irss. Rental Real Estate Rebate Form Irss are a marketing strategy used by manufacturers and retailers to offer consumers a partial payment on their purchases, after they have placed them. In this article, we'll look into the world of Rental Real Estate Rebate Form Irss and explore the nature of them about, how they work, and ways you can increase the value of these incentives.

Get Latest Rental Real Estate Rebate Form Irs Below

Rental Real Estate Rebate Form Irs

Rental Real Estate Rebate Form Irs -

Financial Resources Real Estate This section provides you with direct links to many commonly used financial resources for small businesses Tips on Rental Real Estate Income Deductions and Recordkeeping Questions and answers pertaining to rental real estate tax issues Reporting and Paying Tax on U S Real Property Interests

In general you can deduct expenses of renting property from your rental income Real Estate Rentals You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and

A Rental Real Estate Rebate Form Irs as it is understood in its simplest model, refers to a partial refund offered to a customer who has purchased a particular product or service. It's a powerful instrument for businesses to entice customers, increase sales, and also to advertise certain products.

Types of Rental Real Estate Rebate Form Irs

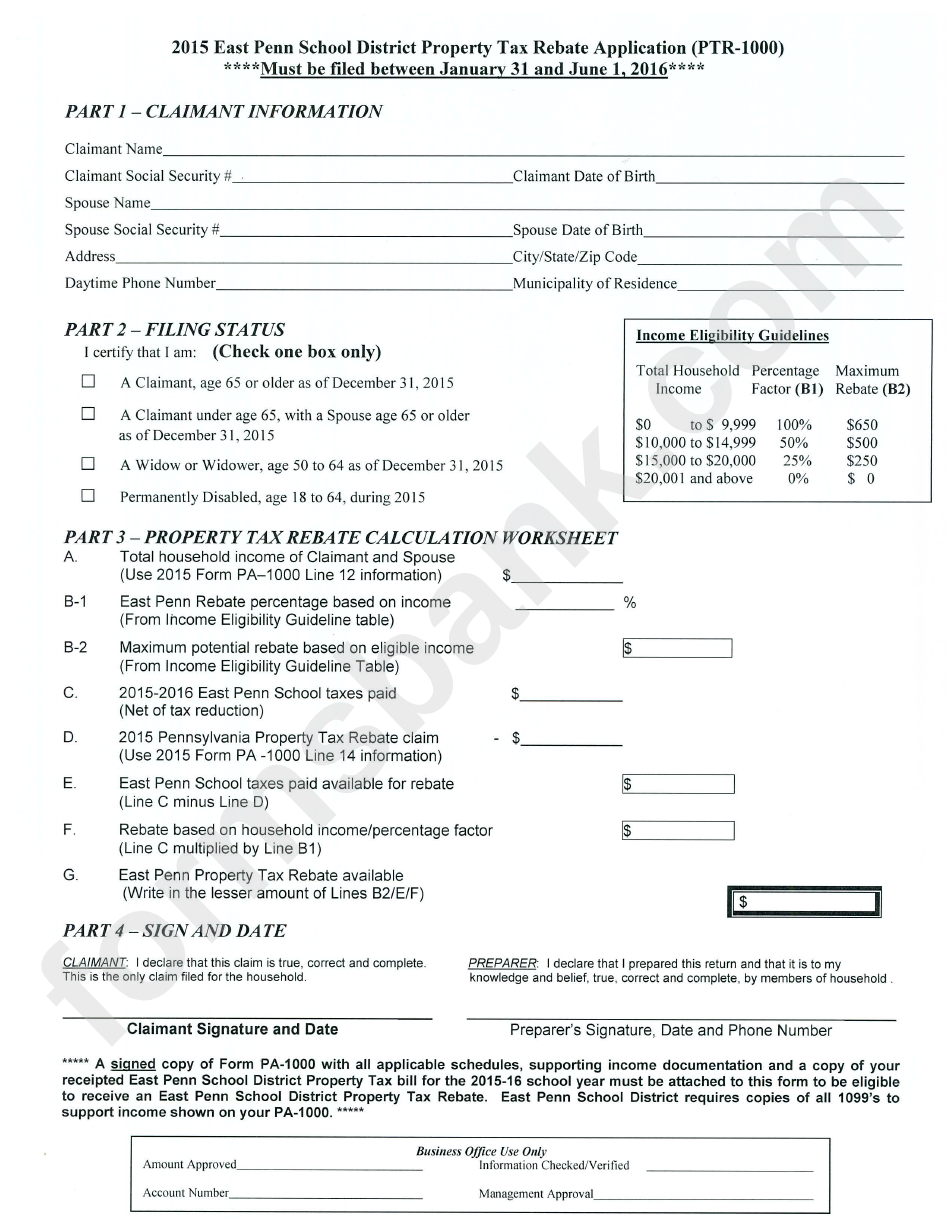

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Supplemental Income and Loss From rental real estate royalties partnerships S corporations estates trusts REMICs etc Attach to Form 1040 1040 SR 1040 NR or 1041 Go to www irs gov ScheduleE for instructions and the latest information

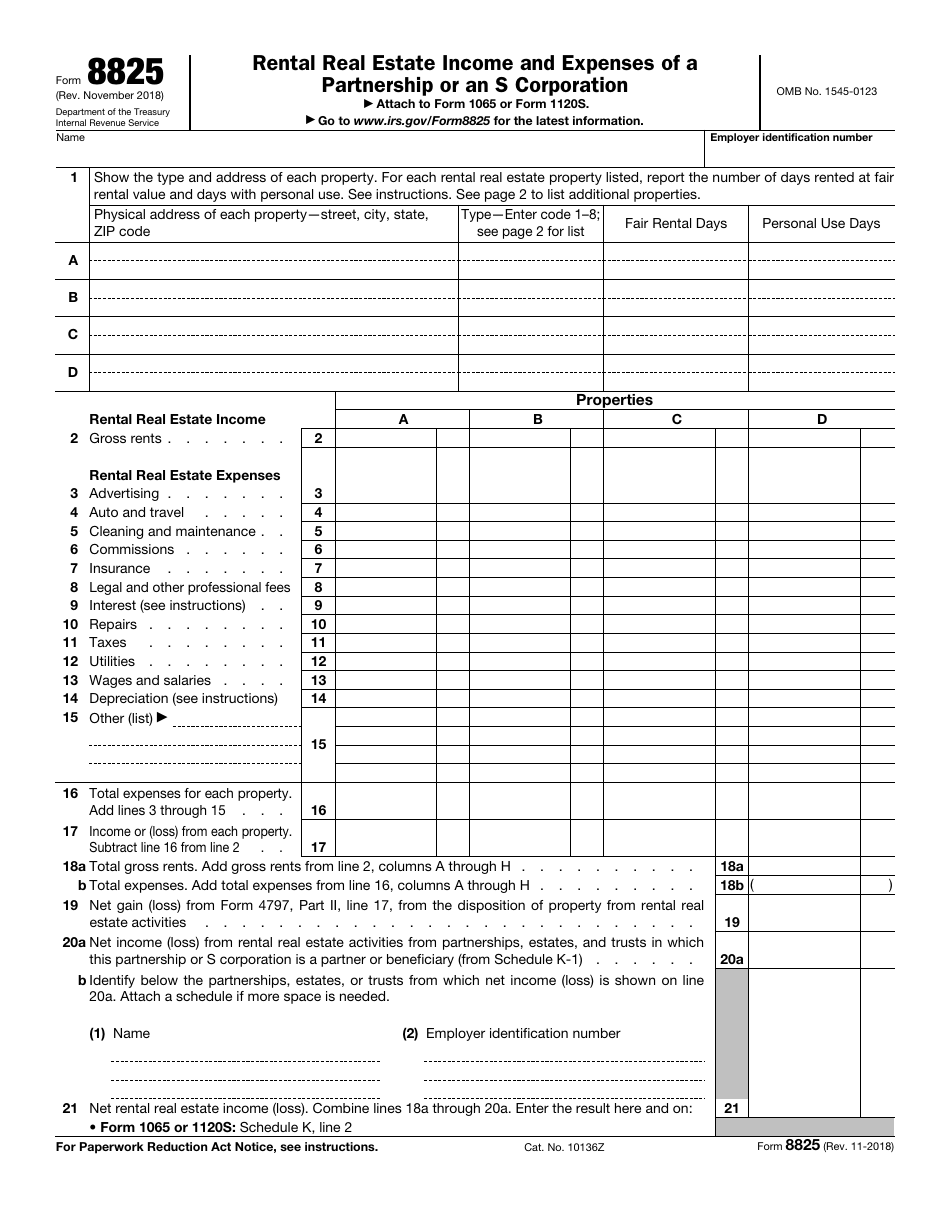

Form 8825 Rental Real Estate Income and Expenses of a Partnership or an S Corporation Publication 527 Residential Rental Property Including Rental of Vacation Homes Publication 534 Depreciating Property Placed in Service Before 1987 PDF Publication 925 Passive Activity At Risk Rules

Cash Rental Real Estate Rebate Form Irs

Cash Rental Real Estate Rebate Form Irs are the most straightforward kind of Rental Real Estate Rebate Form Irs. The customer receives a particular sum of money back when purchasing a item. These are typically for high-ticket items like electronics or appliances.

Mail-In Rental Real Estate Rebate Form Irs

Mail-in Rental Real Estate Rebate Form Irs need customers to send in the proof of purchase in order to receive their reimbursement. They are a bit more complicated, but they can provide substantial savings.

Instant Rental Real Estate Rebate Form Irs

Instant Rental Real Estate Rebate Form Irs can be applied at the point of sale. They reduce the purchase cost immediately. Customers do not have to wait for their savings with this type.

How Rental Real Estate Rebate Form Irs Work

IRS Form 8825 Download Fillable PDF Or Fill Online Rental Real Estate

IRS Form 8825 Download Fillable PDF Or Fill Online Rental Real Estate

1099 for rental income There are three types of 1099 rental income related forms We ll outline them by situation Reporting rental income on your tax return Typically the rental income tax forms you ll use to report your rental income include Form 1040 or 1040 SR Schedule E Here are the steps you ll take for claiming rental

The Rental Real Estate Rebate Form Irs Process

The process usually involves a couple of steps that are easy to follow:

-

Buy the product: At first you purchase the product just like you normally would.

-

Fill in the Rental Real Estate Rebate Form Irs template: You'll have be able to provide a few details, such as your name, address and the purchase details, in order to receive your Rental Real Estate Rebate Form Irs.

-

Send in the Rental Real Estate Rebate Form Irs It is dependent on the kind of Rental Real Estate Rebate Form Irs there may be a requirement to mail a Rental Real Estate Rebate Form Irs form in or upload it online.

-

Wait until the company approves: The company will examine your application to verify that it is compliant with the Rental Real Estate Rebate Form Irs's terms and conditions.

-

Receive your Rental Real Estate Rebate Form Irs After being approved, the amount you receive will be whether by check, prepaid card, or any other procedure specified by the deal.

Pros and Cons of Rental Real Estate Rebate Form Irs

Advantages

-

Cost Savings Rental Real Estate Rebate Form Irs are a great way to cut the price you pay for products.

-

Promotional Offers Incentivize customers to try new products and brands.

-

Improve Sales Reward programs can boost the company's sales as well as market share.

Disadvantages

-

Complexity Reward mail-ins particularly are often time-consuming and slow-going.

-

Time Limits for Rental Real Estate Rebate Form Irs Some Rental Real Estate Rebate Form Irs have extremely strict deadlines to submit.

-

A risk of not being paid Customers may not receive Rental Real Estate Rebate Form Irs if they don't follow the regulations precisely.

Download Rental Real Estate Rebate Form Irs

Download Rental Real Estate Rebate Form Irs

FAQs

1. Are Rental Real Estate Rebate Form Irs the same as discounts? No, Rental Real Estate Rebate Form Irs require a partial refund upon purchase, and discounts are a reduction of costs at time of sale.

2. Are there any Rental Real Estate Rebate Form Irs that I can use on the same item It is contingent on the conditions applicable to Rental Real Estate Rebate Form Irs offer and also the item's quality and eligibility. Certain companies allow it, and some don't.

3. What is the time frame to receive a Rental Real Estate Rebate Form Irs What is the timeframe? can vary, but typically it will take anywhere from a couple of weeks to a few months for you to receive your Rental Real Estate Rebate Form Irs.

4. Do I have to pay tax when I receive Rental Real Estate Rebate Form Irs funds? most circumstances, Rental Real Estate Rebate Form Irs amounts are not considered taxable income.

5. Do I have confidence in Rental Real Estate Rebate Form Irs deals from lesser-known brands? It's essential to research and confirm that the brand which is providing the Rental Real Estate Rebate Form Irs has a good reputation prior to making an acquisition.

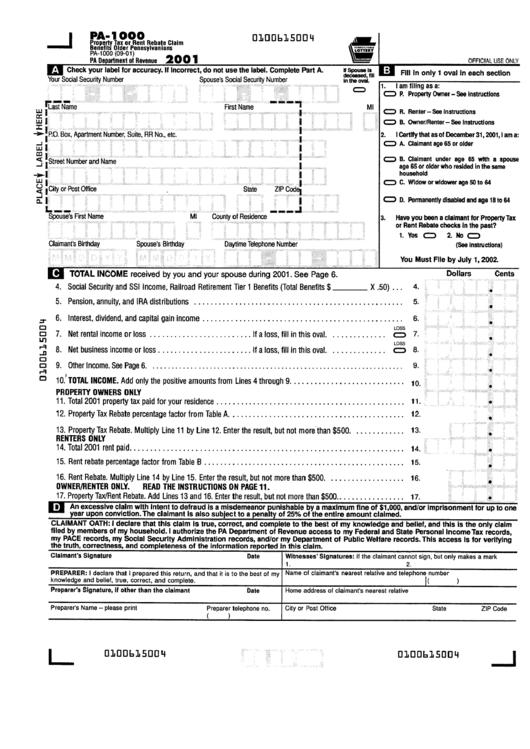

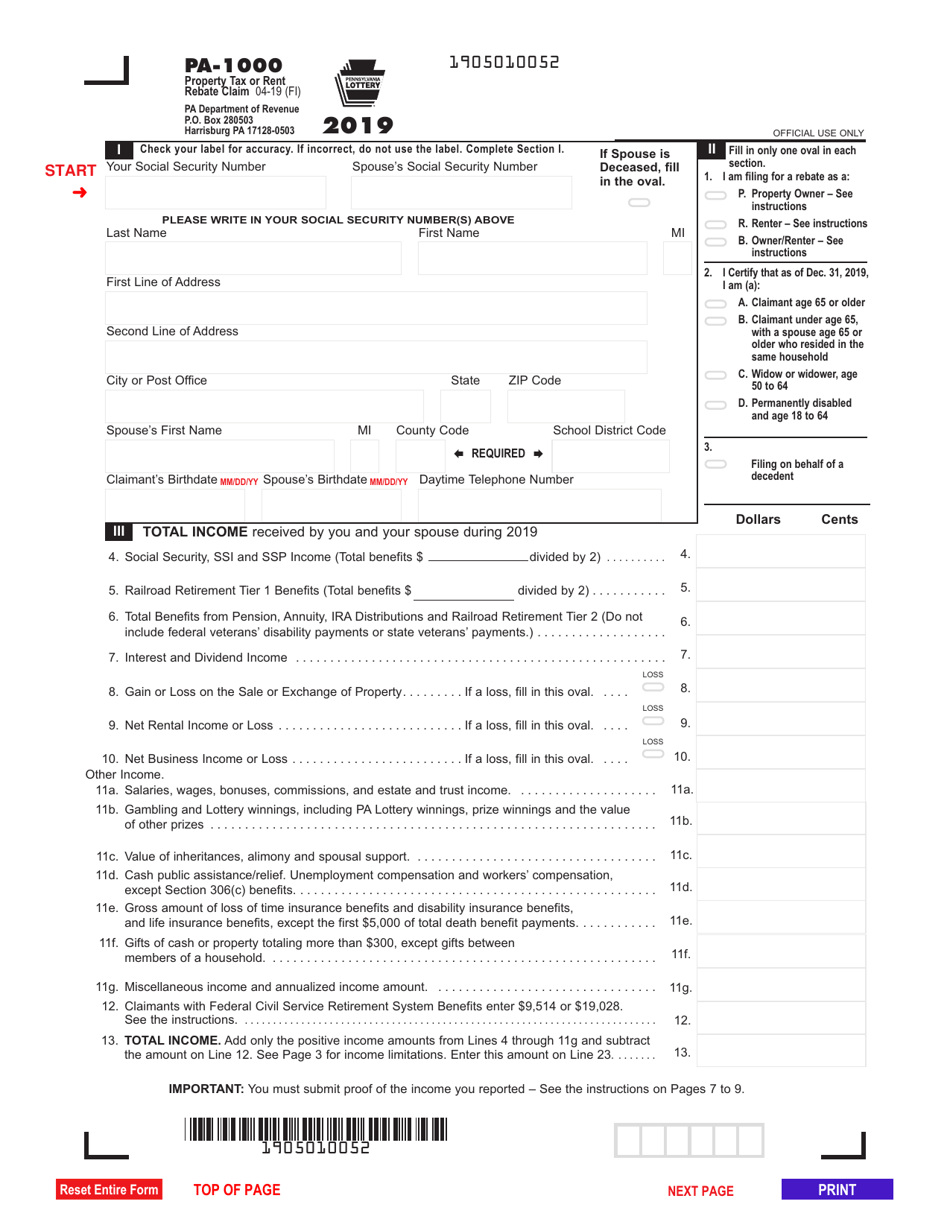

PA 1000 2014 Property Tax Or Rent Rebate Claim Free Download

Renters Rebate Sample Form Free Download

Check more sample of Rental Real Estate Rebate Form Irs below

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

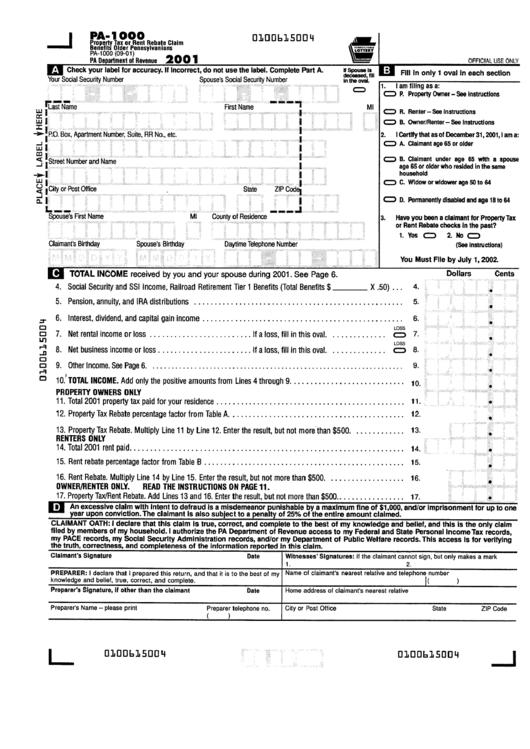

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Top Mass Save Rebate Form Templates Free To Download In PDF Format

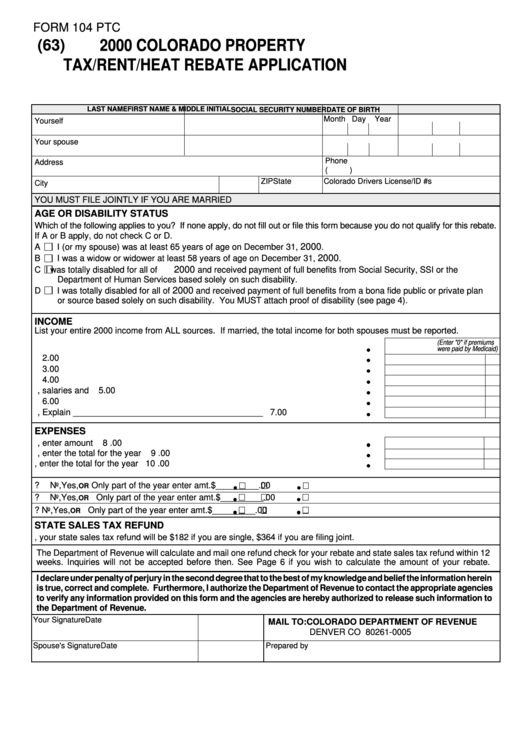

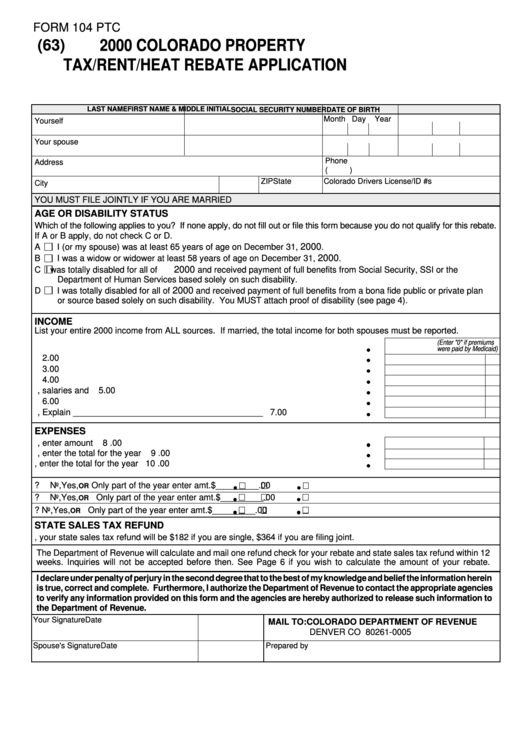

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

Supplier Rebate Agreement Template

https://www.irs.gov/taxtopics/tc414

In general you can deduct expenses of renting property from your rental income Real Estate Rentals You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and

https://www.irs.gov/pub/irs-pdf/f8825.pdf

Form Rev November 2018 Department of the Treasury Internal Revenue Service Name Rental Real Estate Income and Expenses of a Partnership or an S Corporation Attach to Form 1065 or Form 1120S Go to www irs gov Form8825 for the latest information OMB No 1545 0123 Employer identification number

In general you can deduct expenses of renting property from your rental income Real Estate Rentals You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and

Form Rev November 2018 Department of the Treasury Internal Revenue Service Name Rental Real Estate Income and Expenses of a Partnership or an S Corporation Attach to Form 1065 or Form 1120S Go to www irs gov Form8825 for the latest information OMB No 1545 0123 Employer identification number

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

Supplier Rebate Agreement Template

Form 8825 Rental Real Estate Income And Expenses Of A Partnership Or

Mo Crp Form 2018 Fill Out Sign Online DocHub

Mo Crp Form 2018 Fill Out Sign Online DocHub

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent