In our modern, consumer-driven society everyone appreciates a great bargain. One method of gaining substantial savings in your purchase is through Rebate Under 80ds. Rebate Under 80ds are a method of marketing that retailers and manufacturers use to offer consumers a partial return on their purchases once they've created them. In this post, we'll look into the world of Rebate Under 80ds. We'll discuss the nature of them their purpose, how they function and how to maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Rebate Under 80d Below

Rebate Under 80d

Rebate Under 80d - Rebate Under 80d, Rebate Under 80ddb, Rebate Under 80d For Senior Citizens, Rebate Under 80dd, Deduction Under 80d, Deduction Under 80d Of Income Tax Act, Deduction Under 80d To 80u, Deduction Under 80d For Ay 2023-24, Rebate U/s 80ddb, Rebate U/s 80dd

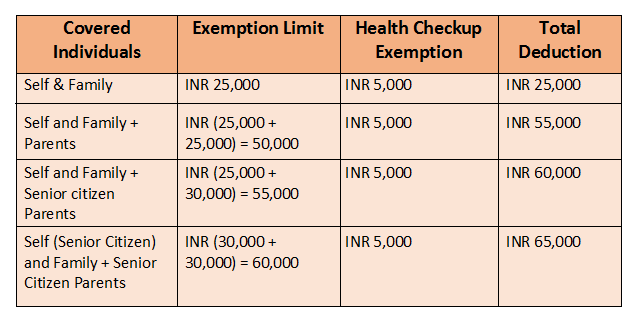

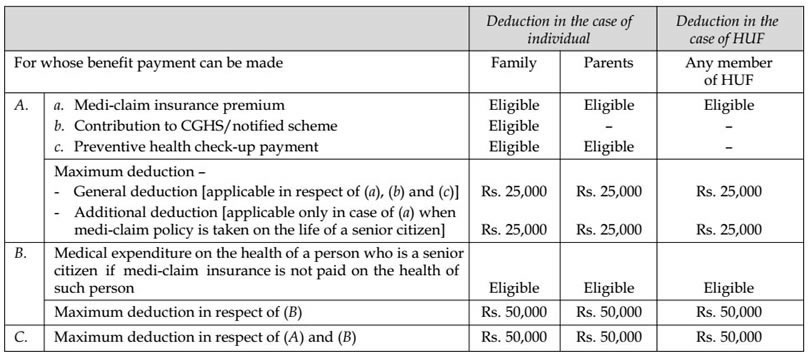

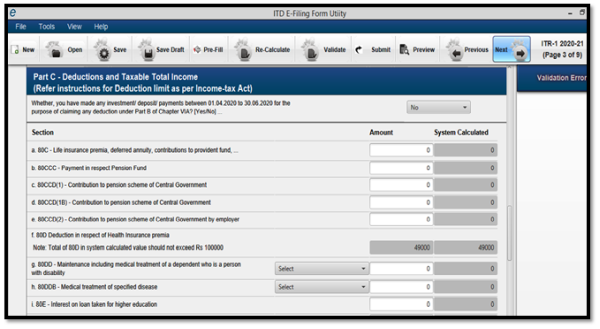

Verkko 30 marrask 2023 nbsp 0183 32 If you purchase health insurance you can avail deductions up to Rs 25 000 under Section 80D for yourself and your family Rs 50 000 if the insured is

Verkko 15 helmik 2023 nbsp 0183 32 The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable income falls in If an individual s

A Rebate Under 80d, in its simplest definition, is a cash refund provided to customers following the purchase of a product or service. It's an effective method utilized by businesses to attract buyers, increase sales and to promote certain products.

Types of Rebate Under 80d

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Verkko Ty 246 tt 246 myysetuuden ehtoja alle 25 vuotiaille hakijoille Kela hoitaa Suomessa asuvien perusturvaa eri el 228 m 228 ntilanteissa Kela fi verkkopalvelun k 228 ytt 246 edellytt 228 228

Verkko August 4 2020 20 18 IST Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing

Cash Rebate Under 80d

Cash Rebate Under 80d are probably the most simple kind of Rebate Under 80d. Clients receive a predetermined amount back in cash after purchasing a item. They are typically used to purchase costly items like electronics or appliances.

Mail-In Rebate Under 80d

Mail-in Rebate Under 80d require consumers to provide documents of purchase to claim the money. They're somewhat more involved but offer huge savings.

Instant Rebate Under 80d

Instant Rebate Under 80d apply at the place of purchase, reducing the price instantly. Customers don't need to wait long for savings with this type.

How Rebate Under 80d Work

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Verkko 26 marrask 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self

The Rebate Under 80d Process

It usually consists of a few easy steps:

-

Purchase the product: Then, you buy the product in the same way you would normally.

-

Fill in the Rebate Under 80d forms: The Rebate Under 80d form will need to fill in some information including your name, address, along with the purchase details, in order to get your Rebate Under 80d.

-

Complete the Rebate Under 80d: Depending on the kind of Rebate Under 80d you may have to submit a form by mail or send it via the internet.

-

Wait for approval: The business will review your submission and ensure that it's compliant with Rebate Under 80d's terms and conditions.

-

Get your Rebate Under 80d Once you've received your approval, you'll receive your refund whether via check, credit card or another procedure specified by the deal.

Pros and Cons of Rebate Under 80d

Advantages

-

Cost Savings The use of Rebate Under 80d can greatly cut the price you pay for the item.

-

Promotional Deals they encourage their customers to try new products and brands.

-

Help to Increase Sales Rebate Under 80d can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Mail-in Rebate Under 80d in particular may be lengthy and take a long time to complete.

-

End Dates Many Rebate Under 80d have strict time limits for submission.

-

Risk of Non-Payment Customers may lose their Rebate Under 80d in the event that they do not adhere to the guidelines precisely.

Download Rebate Under 80d

FAQs

1. Are Rebate Under 80d equivalent to discounts? No, Rebate Under 80d offer partial reimbursement after purchase, but discounts can reduce the purchase price at moment of sale.

2. Are there any Rebate Under 80d that I can use for the same product? It depends on the terms in the Rebate Under 80d incentives and the specific product's admissibility. Certain companies may permit it, while other companies won't.

3. How long will it take to get an Rebate Under 80d? The duration differs, but could take anywhere from a couple of weeks to a couple of months for you to receive your Rebate Under 80d.

4. Do I need to pay tax of Rebate Under 80d the amount? the majority of cases, Rebate Under 80d amounts are not considered taxable income.

5. Can I trust Rebate Under 80d offers from lesser-known brands Do I need to conduct a thorough research and verify that the brand offering the Rebate Under 80d is legitimate prior to making the purchase.

Deduction Available Under Section 80D

Section 80D Guide Tax Deductions For Health Insurance Medical

Check more sample of Rebate Under 80d below

Section 80D Deduction In Respect Of Health Or Medical Insurance

Conclusion Of Life Insurance Policy Keijupolypuoti

Deduction Under 80D Tips Before Investing In A Health Insurance Plan

Deduction Under Section 80D Tutorial In Tamil YouTube

All About Section 80D Deduction On Medical Insurance

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Verkko 15 helmik 2023 nbsp 0183 32 The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable income falls in If an individual s

https://www.forbes.com/advisor/in/tax/section …

Verkko Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and

Verkko 15 helmik 2023 nbsp 0183 32 The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable income falls in If an individual s

Verkko Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and

Deduction Under Section 80D Tutorial In Tamil YouTube

Conclusion Of Life Insurance Policy Keijupolypuoti

All About Section 80D Deduction On Medical Insurance

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

Deduction Under Section 80C 80CCC 80CCD 80D YouTube

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Tax Planning Hirannya