In today's consumer-driven world every person loves a great deal. One way to gain substantial savings when you shop is with Ev Federal Tax Rebate Forms. Ev Federal Tax Rebate Forms are a marketing strategy employed by retailers and manufacturers in order to offer customers a small refund on their purchases after they've bought them. In this article, we will look into the world of Ev Federal Tax Rebate Forms, examining the nature of them about, how they work, and the best way to increase your savings using these low-cost incentives.

Get Latest Ev Federal Tax Rebate Form Below

Ev Federal Tax Rebate Form

Ev Federal Tax Rebate Form -

Web 16 ao 251 t 2022 nbsp 0183 32 To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

A Ev Federal Tax Rebate Form or Ev Federal Tax Rebate Form, in its most basic version, is an ad-hoc refund to a purchaser when they purchase a product or service. It's a very effective technique for businesses to entice customers, boost sales, or promote a specific product.

Types of Ev Federal Tax Rebate Form

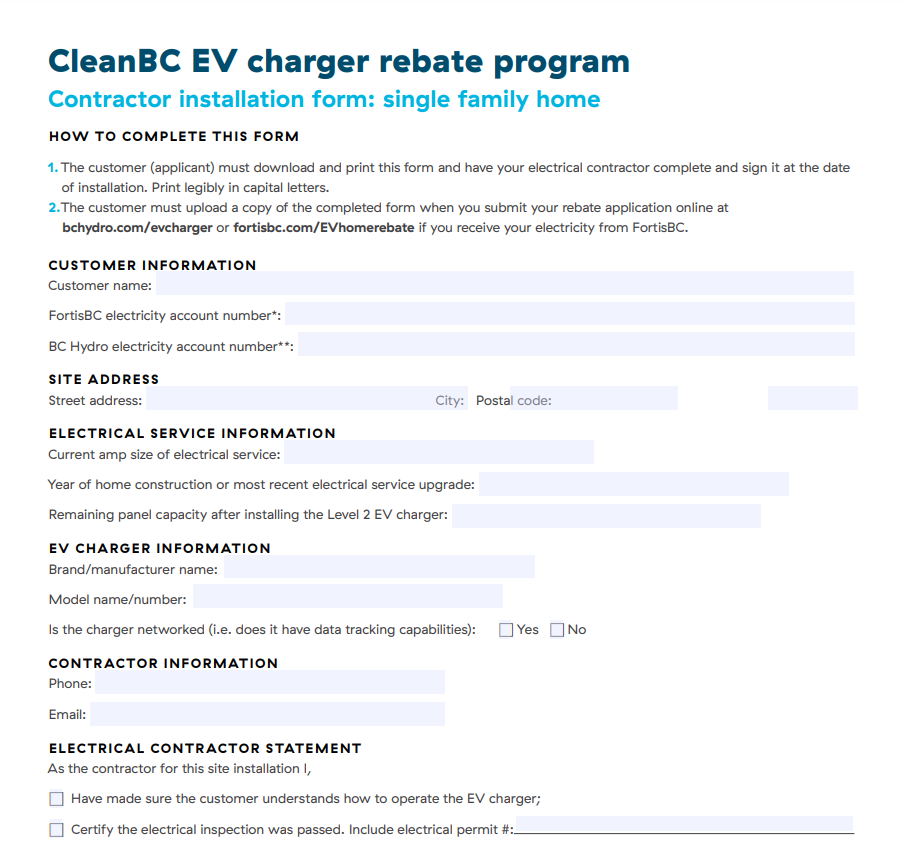

P G And E Ev Rebate Printable Rebate Form

P G And E Ev Rebate Printable Rebate Form

Web We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new

Web 18 avr 2023 nbsp 0183 32 For a list of incentives by vehicle see Federal Tax Credits on FuelEconomy gov Vehicles Placed in Service on or After April 18 2023 For vehicles

Cash Ev Federal Tax Rebate Form

Cash Ev Federal Tax Rebate Form is the most basic type of Ev Federal Tax Rebate Form. Customers receive a specific amount back in cash after buying a product. This is often for high-ticket items like electronics or appliances.

Mail-In Ev Federal Tax Rebate Form

Mail-in Ev Federal Tax Rebate Form demand that customers provide an evidence of purchase for the refund. They are a bit more involved, but can result in huge savings.

Instant Ev Federal Tax Rebate Form

Instant Ev Federal Tax Rebate Form apply at the point of sale. They reduce the purchase cost immediately. Customers don't have to wait long for savings through this kind of offer.

How Ev Federal Tax Rebate Form Work

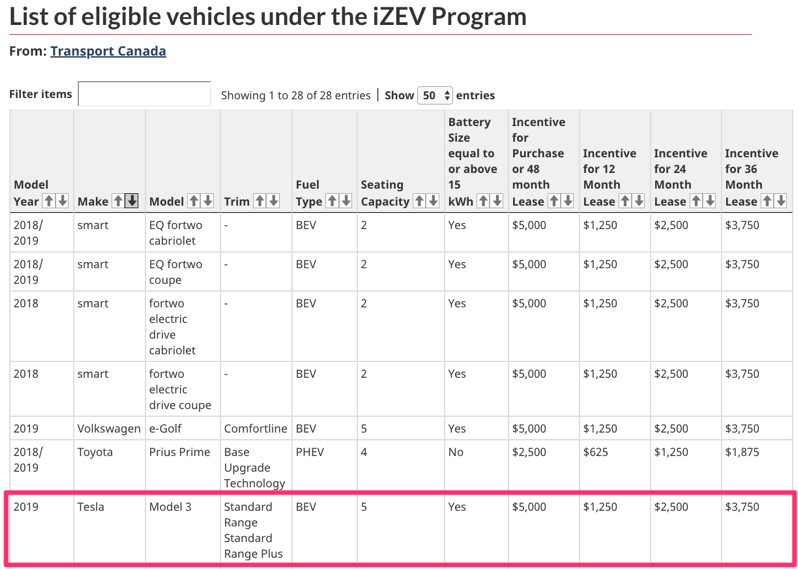

Tesla Model 3 US Federal EV Tax Credit Update CleanTechnica

Tesla Model 3 US Federal EV Tax Credit Update CleanTechnica

Web 5 sept 2023 nbsp 0183 32 To claim the EV tax credit you file IRS Form 8936 with your federal income tax return You ll need the VIN vehicle identification number for your electric vehicle to

The Ev Federal Tax Rebate Form Process

The process usually involves a few easy steps:

-

Buy the product: At first you buy the product just like you normally would.

-

Fill in the Ev Federal Tax Rebate Form request form. You'll have to provide some data, such as your name, address, as well as the details of your purchase to submit your Ev Federal Tax Rebate Form.

-

To submit the Ev Federal Tax Rebate Form According to the nature of Ev Federal Tax Rebate Form you may have to send in a form, or upload it online.

-

Wait for the company's approval: They will review your request to ensure it meets the rules and regulations of the Ev Federal Tax Rebate Form.

-

Get your Ev Federal Tax Rebate Form Once it's approved, the amount you receive will be either through check, prepaid card, or a different option that's specified in the offer.

Pros and Cons of Ev Federal Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically reduce the price you pay for an item.

-

Promotional Offers they encourage their customers to experiment with new products, or brands.

-

Enhance Sales Reward programs can boost an organization's sales and market share.

Disadvantages

-

Complexity mail-in Ev Federal Tax Rebate Form in particular may be lengthy and demanding.

-

Deadlines for Expiration Many Ev Federal Tax Rebate Form are subject to deadlines for submission.

-

Risk of Non-Payment Certain customers could lose their Ev Federal Tax Rebate Form in the event that they do not adhere to the guidelines exactly.

Download Ev Federal Tax Rebate Form

Download Ev Federal Tax Rebate Form

FAQs

1. Are Ev Federal Tax Rebate Form equivalent to discounts? No, the Ev Federal Tax Rebate Form will be a partial refund after purchase, whereas discounts cut your purchase cost at point of sale.

2. Are there multiple Ev Federal Tax Rebate Form I can get for the same product? It depends on the conditions for the Ev Federal Tax Rebate Form is offered as well as the merchandise's eligibility. Certain companies may allow it, but some will not.

3. What is the time frame to receive a Ev Federal Tax Rebate Form? The duration differs, but it can last from a few weeks until a few months before you receive your Ev Federal Tax Rebate Form.

4. Do I need to pay taxes of Ev Federal Tax Rebate Form values? most instances, Ev Federal Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Ev Federal Tax Rebate Form deals from lesser-known brands it is crucial to conduct research and make sure that the company offering the Ev Federal Tax Rebate Form is reputable before making an purchase.

Ev Federal Tax Credit Form FederalProTalk

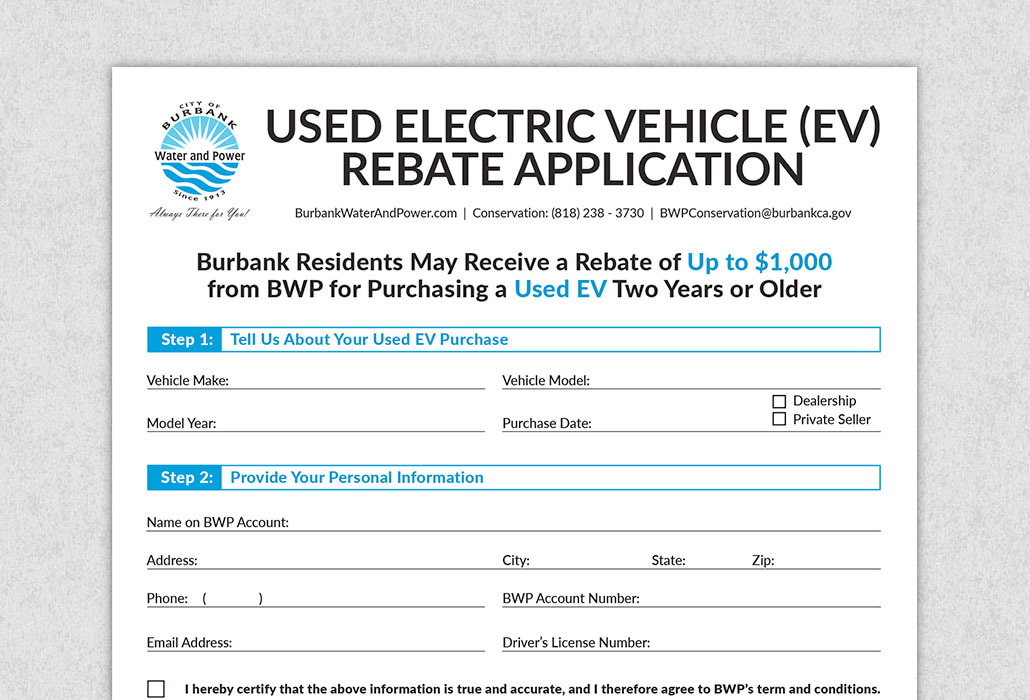

Ontario Ev Charger Rebate Form By State Printable Rebate Form

Check more sample of Ev Federal Tax Rebate Form below

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

Electric Car Tax Rebate California ElectricCarTalk

Surprise Tesla Model 3 Now Qualifies For 5 000 Federal Rebate In

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

T1159 Fill Out Sign Online DocHub

Ev Car Tax Rebate Calculator 2022 Carrebate

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

Electric Car Tax Rebate California ElectricCarTalk

T1159 Fill Out Sign Online DocHub

Ev Car Tax Rebate Calculator 2022 Carrebate

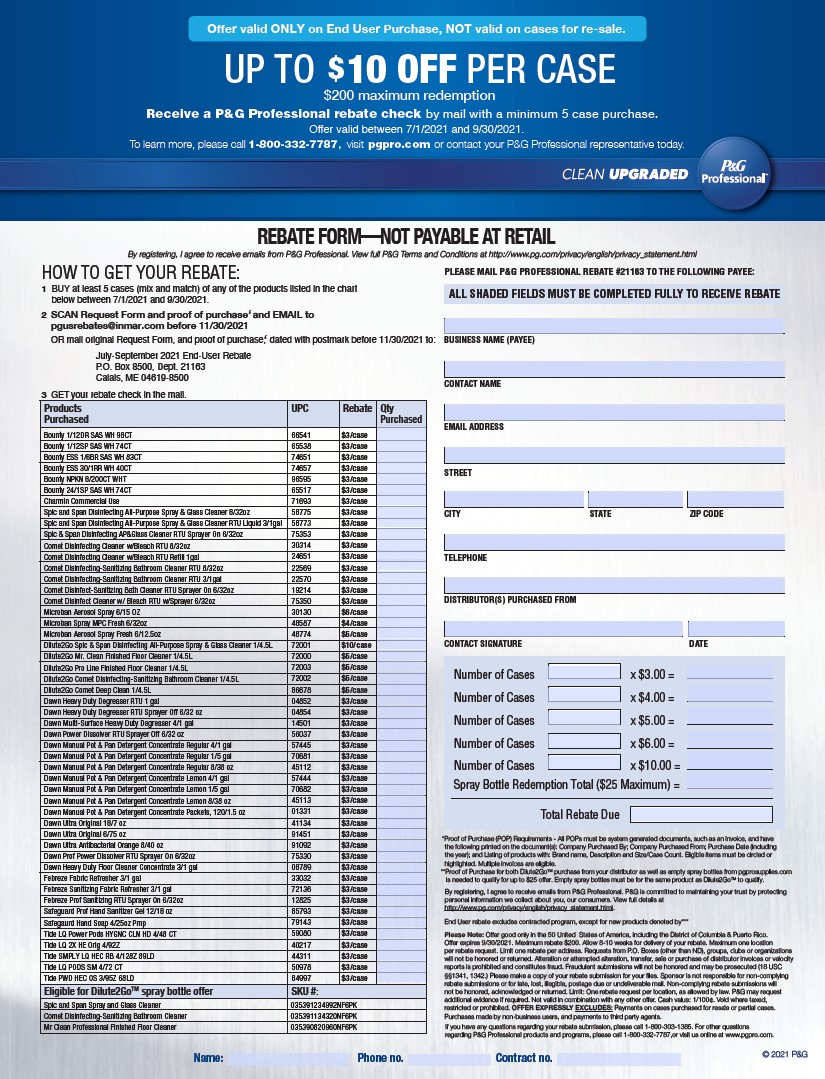

Rebate Form Download Printable PDF Templateroller

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form