In our current world of high-end consumer goods we all love a good bargain. One way to earn substantial savings on your purchases is through Recovery Rebate Credit Form Turbotaxs. Recovery Rebate Credit Form Turbotaxs are an effective marketing tactic employed by retailers and manufacturers for offering customers a percentage return on their purchases once they have placed them. In this article, we will explore the world of Recovery Rebate Credit Form Turbotaxs, exploring what they are and how they operate, and how you can maximize your savings via these cost-effective incentives.

Get Latest Recovery Rebate Credit Form Turbotax Below

Recovery Rebate Credit Form Turbotax

Recovery Rebate Credit Form Turbotax -

Web 24 f 233 vr 2023 nbsp 0183 32 SOLVED by TurboTax 690 Updated February 24 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the 2022 Recovery Rebate Credit make the correction

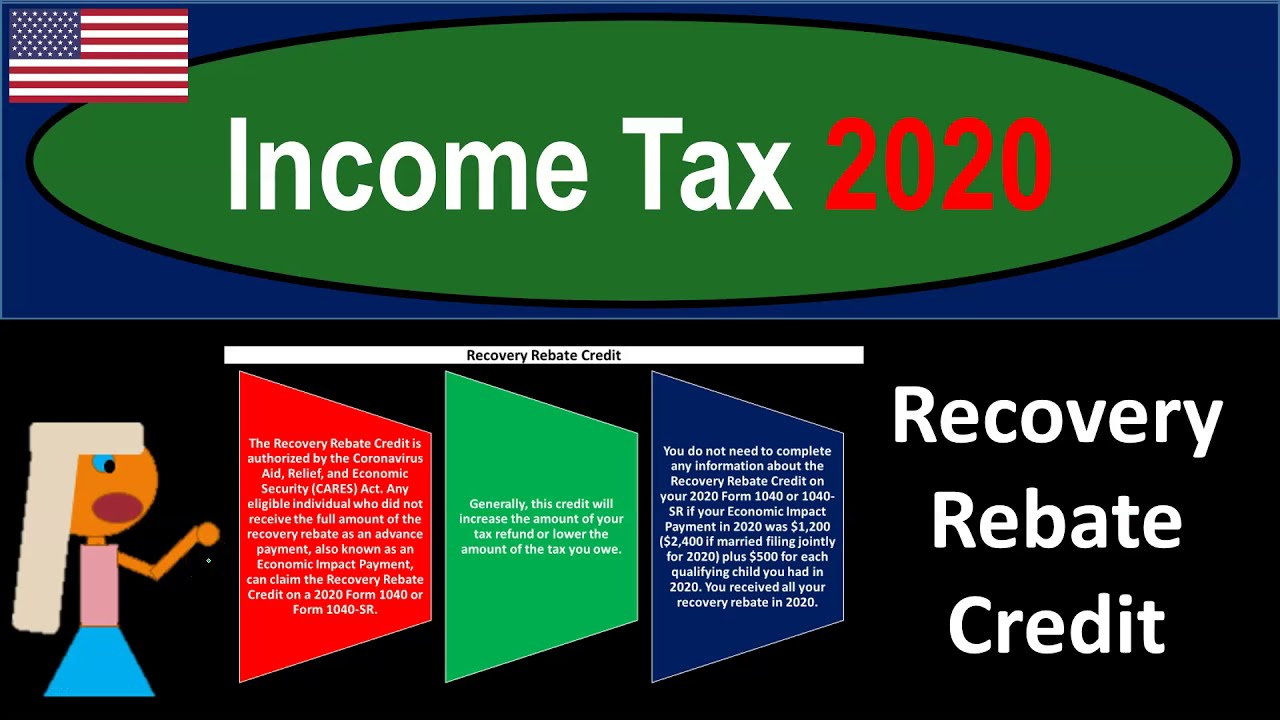

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

A Recovery Rebate Credit Form Turbotax as it is understood in its simplest format, is a reimbursement to a buyer after they have purchased a product or service. This is a potent tool that companies use to attract customers, increase sales, and market specific products.

Types of Recovery Rebate Credit Form Turbotax

Track Your Recovery Rebate With This Worksheet Style Worksheets

Track Your Recovery Rebate With This Worksheet Style Worksheets

Web 13 janv 2022 nbsp 0183 32 If you need to file an amended return even if you don t usually file taxes to claim the 2021 Recovery Rebate Credit use the worksheet in the 2021 instructions for Form 1040 and 1040 SR to determine the amount of your credit Enter the amount on the Refundable Credits section of the Form 1040 X and include quot Recovery Rebate

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Cash Recovery Rebate Credit Form Turbotax

Cash Recovery Rebate Credit Form Turbotax is the most basic kind of Recovery Rebate Credit Form Turbotax. Customers receive a certain amount back in cash after buying a product. These are often used for products that are expensive, such as electronics or appliances.

Mail-In Recovery Rebate Credit Form Turbotax

Mail-in Recovery Rebate Credit Form Turbotax need customers to provide the proof of purchase in order to receive their reimbursement. They're a little more involved, but offer huge savings.

Instant Recovery Rebate Credit Form Turbotax

Instant Recovery Rebate Credit Form Turbotax are applied at point of sale, reducing the purchase cost immediately. Customers do not have to wait long for savings with this type.

How Recovery Rebate Credit Form Turbotax Work

Does TurboTax Allow Me To File A Recovery Rebate Credit Form With My

Does TurboTax Allow Me To File A Recovery Rebate Credit Form With My

Web 29 janv 2021 nbsp 0183 32 1 Best answer Yes you can claim the Recovery Rebate when you file your 2020 tax return When you are inside your tax return click on Federal on the left menu then click Federal Review at the top to be taken to the stimulus questions needed for the Recovery Rebate You can also type stimulus in the search bar to get a link to that section

The Recovery Rebate Credit Form Turbotax Process

The process generally involves a couple of steps that are easy to follow:

-

You purchase the item: First you purchase the product just as you would ordinarily.

-

Fill out your Recovery Rebate Credit Form Turbotax application: In order to claim your Recovery Rebate Credit Form Turbotax, you'll need submit some information like your name, address, as well as the details of your purchase in order to be eligible for a Recovery Rebate Credit Form Turbotax.

-

Send in the Recovery Rebate Credit Form Turbotax depending on the nature of Recovery Rebate Credit Form Turbotax you could be required to fill out a form and mail it in or submit it online.

-

Wait for the company's approval: They will review your submission to determine if it's in compliance with the Recovery Rebate Credit Form Turbotax's terms and conditions.

-

Pay your Recovery Rebate Credit Form Turbotax Once it's approved, you'll receive your refund via check, prepaid card, or through another procedure specified by the deal.

Pros and Cons of Recovery Rebate Credit Form Turbotax

Advantages

-

Cost savings Recovery Rebate Credit Form Turbotax can substantially decrease the price for products.

-

Promotional Deals: They encourage customers to explore new products or brands.

-

increase sales The benefits of a Recovery Rebate Credit Form Turbotax can improve sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Recovery Rebate Credit Form Turbotax particularly difficult and lengthy.

-

End Dates: Many Recovery Rebate Credit Form Turbotax have extremely strict deadlines to submit.

-

A risk of not being paid Some customers might have their Recovery Rebate Credit Form Turbotax delayed if they do not adhere to the guidelines precisely.

Download Recovery Rebate Credit Form Turbotax

Download Recovery Rebate Credit Form Turbotax

FAQs

1. Are Recovery Rebate Credit Form Turbotax the same as discounts? No, they are one-third of the amount refunded following purchase whereas discounts will reduce the cost of purchase at point of sale.

2. Are multiple Recovery Rebate Credit Form Turbotax available on the same product It's contingent upon the conditions of the Recovery Rebate Credit Form Turbotax offered and product's quality and eligibility. Certain companies may permit it, and some don't.

3. How long will it take to get the Recovery Rebate Credit Form Turbotax? The duration is different, but it could be from several weeks to couple of months before you get your Recovery Rebate Credit Form Turbotax.

4. Do I need to pay taxes on Recovery Rebate Credit Form Turbotax the amount? the majority of circumstances, Recovery Rebate Credit Form Turbotax amounts are not considered taxable income.

5. Do I have confidence in Recovery Rebate Credit Form Turbotax deals from lesser-known brands It's crucial to research and ensure that the business which is providing the Recovery Rebate Credit Form Turbotax is reliable prior to making the purchase.

1040 Line 30 Recovery Rebate Credit Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Check more sample of Recovery Rebate Credit Form Turbotax below

Taxes Recovery Rebate Credit Recovery Rebate

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

Track Your Recovery Rebate With This Worksheet Style Worksheets

Recovery Credit Printable Rebate Form

Recovery Credit Printable Rebate Form

Recovery Rebate Credit For Non Filers Form Recovery Rebate