In today's consumer-driven world everyone appreciates a great deal. One way to gain substantial savings on your purchases can be achieved through Irc Tax Rebate Forms. Irc Tax Rebate Forms are a strategy for marketing used by manufacturers and retailers to offer customers a partial refund for their purchases after they've bought them. In this article, we'll look into the world of Irc Tax Rebate Forms, exploring what they are about, how they work, as well as ways to maximize your savings via these cost-effective incentives.

Get Latest Irc Tax Rebate Form Below

Irc Tax Rebate Form

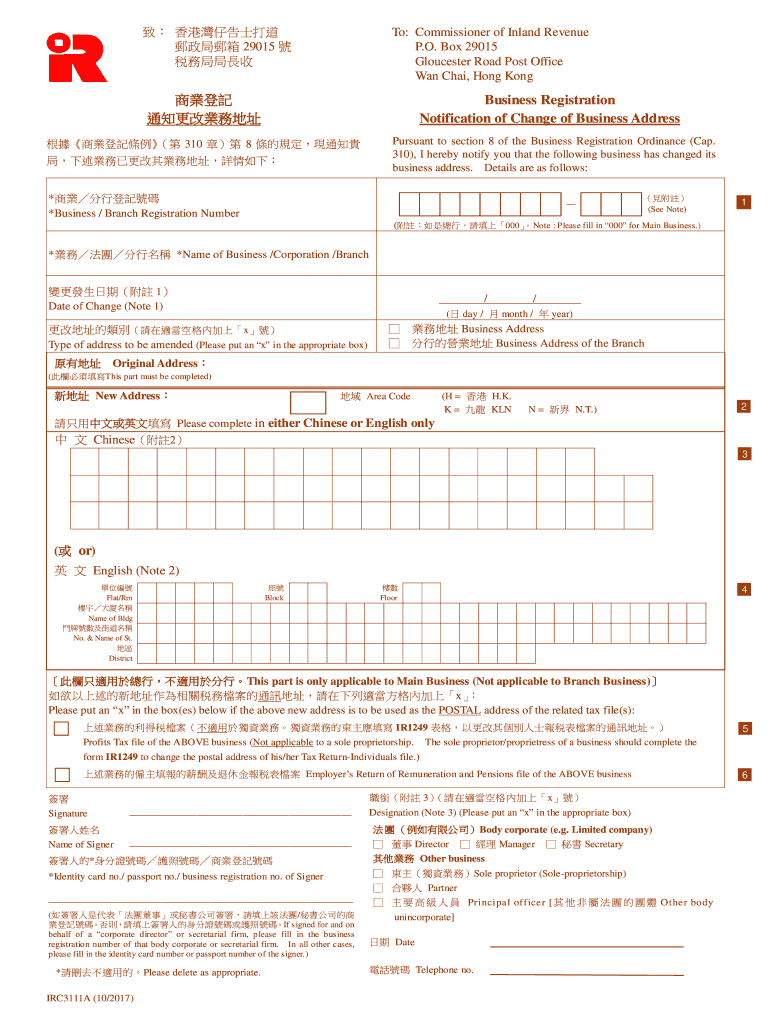

Irc Tax Rebate Form -

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

A Irc Tax Rebate Form or Irc Tax Rebate Form, in its most basic type, is a cash refund provided to customers following the purchase of a product or service. It's a very effective technique for businesses to entice customers, boost sales, and advertise specific products.

Types of Irc Tax Rebate Form

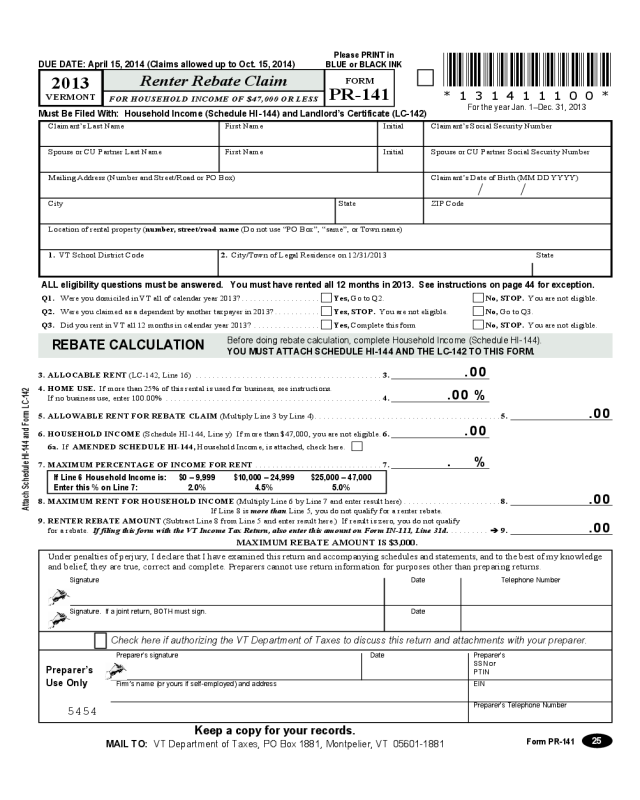

Renters Rebate Sample Form Edit Fill Sign Online Handypdf

Renters Rebate Sample Form Edit Fill Sign Online Handypdf

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Cash Irc Tax Rebate Form

Cash Irc Tax Rebate Form are the simplest type of Irc Tax Rebate Form. Customers receive a specific amount of money after purchasing a particular item. These are often used for high-ticket items like electronics or appliances.

Mail-In Irc Tax Rebate Form

Customers who want to receive mail-in Irc Tax Rebate Form must provide the proof of purchase to be eligible for their reimbursement. They're somewhat more involved but offer huge savings.

Instant Irc Tax Rebate Form

Instant Irc Tax Rebate Form are made at the point of sale. They reduce prices immediately. Customers do not have to wait long for savings through this kind of offer.

How Irc Tax Rebate Form Work

IRS Releases Form 1040 For 2020 Tax Year

IRS Releases Form 1040 For 2020 Tax Year

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

The Irc Tax Rebate Form Process

The process generally involves a few steps:

-

Purchase the product: Then make sure you purchase the product just like you normally would.

-

Complete the Irc Tax Rebate Form template: You'll have to provide some data like your name, address and purchase information, to claim your Irc Tax Rebate Form.

-

To submit the Irc Tax Rebate Form In accordance with the type of Irc Tax Rebate Form the recipient may be required to submit a form by mail or make it available online.

-

Wait until the company approves: The company is going to review your entry to make sure it is in line with the refund's conditions and terms.

-

Accept your Irc Tax Rebate Form If it is approved, you'll receive a refund via check, prepaid card, or other way specified in the offer.

Pros and Cons of Irc Tax Rebate Form

Advantages

-

Cost Savings Irc Tax Rebate Form can substantially cut the price you pay for the item.

-

Promotional Deals Customers are enticed to try new items or brands.

-

Help to Increase Sales A Irc Tax Rebate Form program can boost a company's sales and market share.

Disadvantages

-

Complexity Mail-in Irc Tax Rebate Form in particular they can be time-consuming and slow-going.

-

End Dates A majority of Irc Tax Rebate Form have very strict deadlines for filing.

-

Risk of Not Being Paid Certain customers could not receive Irc Tax Rebate Form if they don't follow the rules exactly.

Download Irc Tax Rebate Form

FAQs

1. Are Irc Tax Rebate Form equivalent to discounts? No, the Irc Tax Rebate Form will be one-third of the amount refunded following purchase, whereas discounts cut your purchase cost at point of sale.

2. Can I get multiple Irc Tax Rebate Form for the same product This depends on the terms and conditions of Irc Tax Rebate Form offer and also the item's admissibility. Certain businesses may allow it, while other companies won't.

3. What is the time frame to get the Irc Tax Rebate Form? The amount of time is different, but it could be from several weeks to couple of months before you get your Irc Tax Rebate Form.

4. Do I have to pay taxes in relation to Irc Tax Rebate Form the amount? most circumstances, Irc Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Irc Tax Rebate Form offers from brands that aren't well-known You must research and ensure that the business that is offering the Irc Tax Rebate Form is legitimate prior to making an acquisition.

Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of

Irc Application Form Fill Online Printable Fillable Blank PdfFiller

Check more sample of Irc Tax Rebate Form below

Irc3111A Form Fill Out And Sign Printable PDF Template SignNow

How To Calculate Form 8962 Printable Form Templates And Letter

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

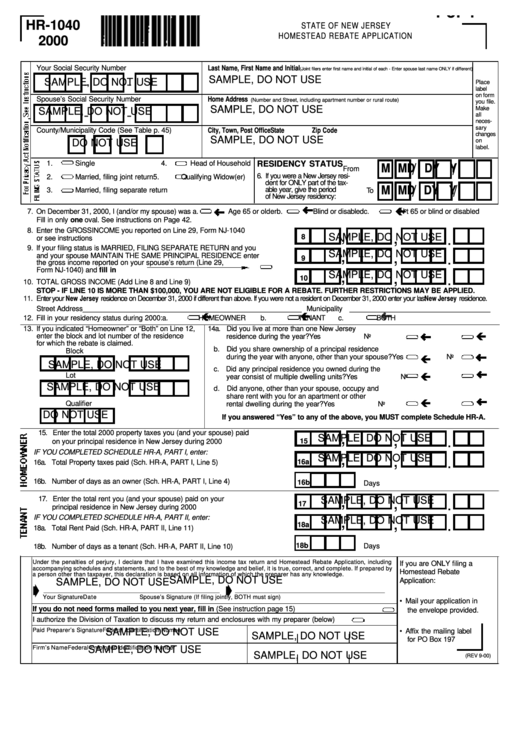

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of

Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of

The New IRS Tax Forms Are Out Here s What You Should Know

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

How To Calculate Form 8962 Printable Form Templates And Letter

Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of

The New IRS Tax Forms Are Out Here s What You Should Know

2019 Con Los Campos En Blanco IRS 1040 PREl Formulario Se Puede

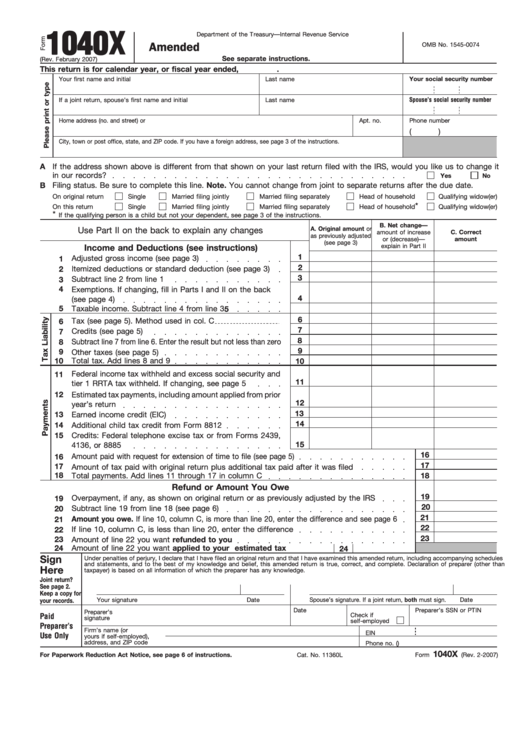

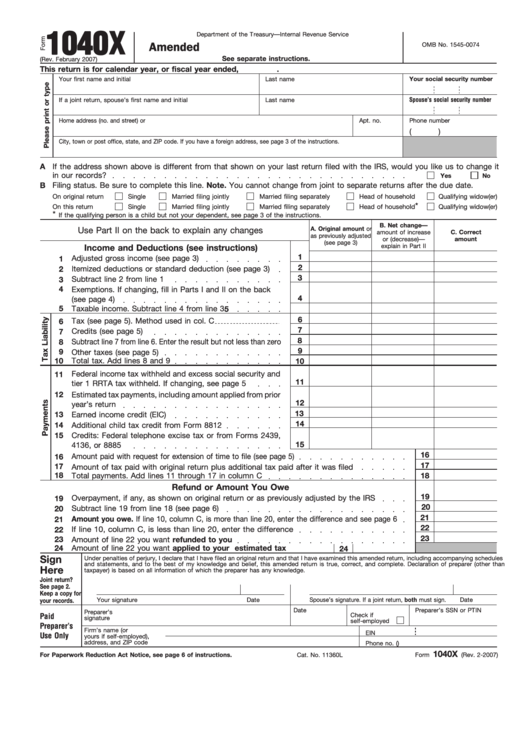

Printable Irs Form 1040x Printable Forms Free Online

Printable Irs Form 1040x Printable Forms Free Online

Irs Form W 4V Printable How To Fill Out A Form W 4 2019 Edition