In our current world of high-end consumer goods everyone appreciates a great bargain. One way to gain significant savings on your purchases is through Recovery Rebate Credit 2023 Form 1040s. Recovery Rebate Credit 2023 Form 1040s can be a way of marketing that retailers and manufacturers use to offer customers a refund on their purchases after they've completed them. In this post, we'll look into the world of Recovery Rebate Credit 2023 Form 1040s. We'll look at the nature of them and how they work and how you can maximize your savings with these cost-effective incentives.

Get Latest Recovery Rebate Credit 2023 Form 1040 Below

Recovery Rebate Credit 2023 Form 1040

Recovery Rebate Credit 2023 Form 1040 -

Web 23 Jan 2023 nbsp 0183 32 Due to tax law changes such as the elimination of the Advance Child Tax

Web 13 Okt 2023 nbsp 0183 32 Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or

A Recovery Rebate Credit 2023 Form 1040 at its most basic form, is a refund offered to a customer after they've bought a product or service. It's an effective way used by businesses to attract clients, increase sales and promote specific products.

Types of Recovery Rebate Credit 2023 Form 1040

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Web Recovery Rebate Credit Worksheet Explained As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your return If you do not know the amounts of your

Web 8 Feb 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most

Cash Recovery Rebate Credit 2023 Form 1040

Cash Recovery Rebate Credit 2023 Form 1040 are by far the easiest kind of Recovery Rebate Credit 2023 Form 1040. Customers receive a certain amount of money after buying a product. These are typically applied to costly items like electronics or appliances.

Mail-In Recovery Rebate Credit 2023 Form 1040

Mail-in Recovery Rebate Credit 2023 Form 1040 require the customer to send in the proof of purchase in order to receive the money. They're a bit more involved but can offer significant savings.

Instant Recovery Rebate Credit 2023 Form 1040

Instant Recovery Rebate Credit 2023 Form 1040 are credited at the point of sale, reducing the price instantly. Customers don't need to wait long for savings by using this method.

How Recovery Rebate Credit 2023 Form 1040 Work

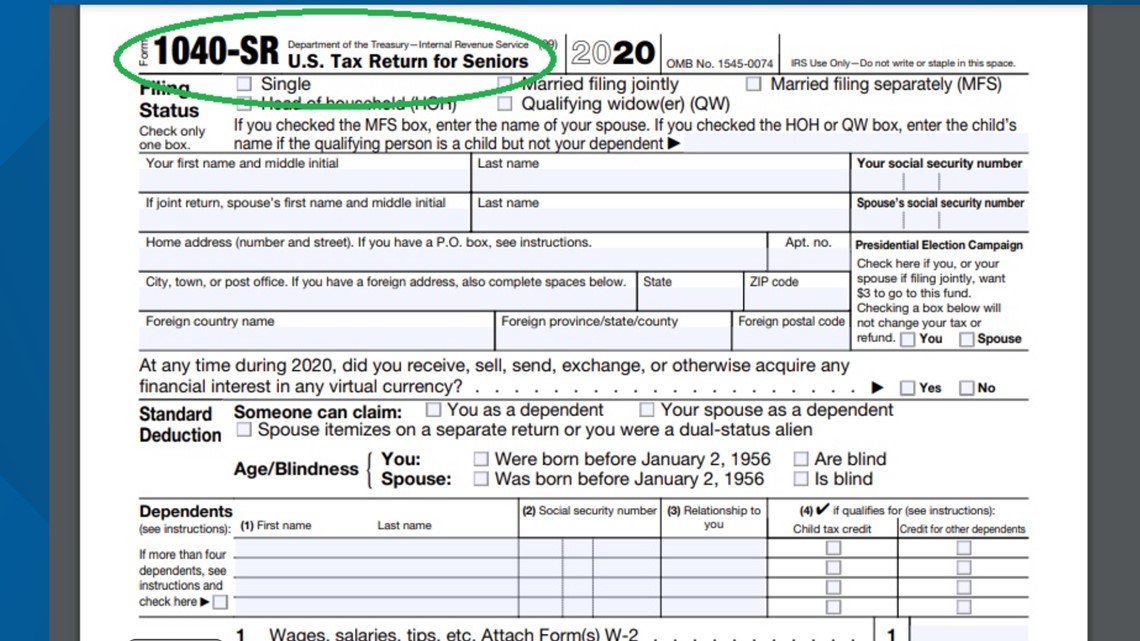

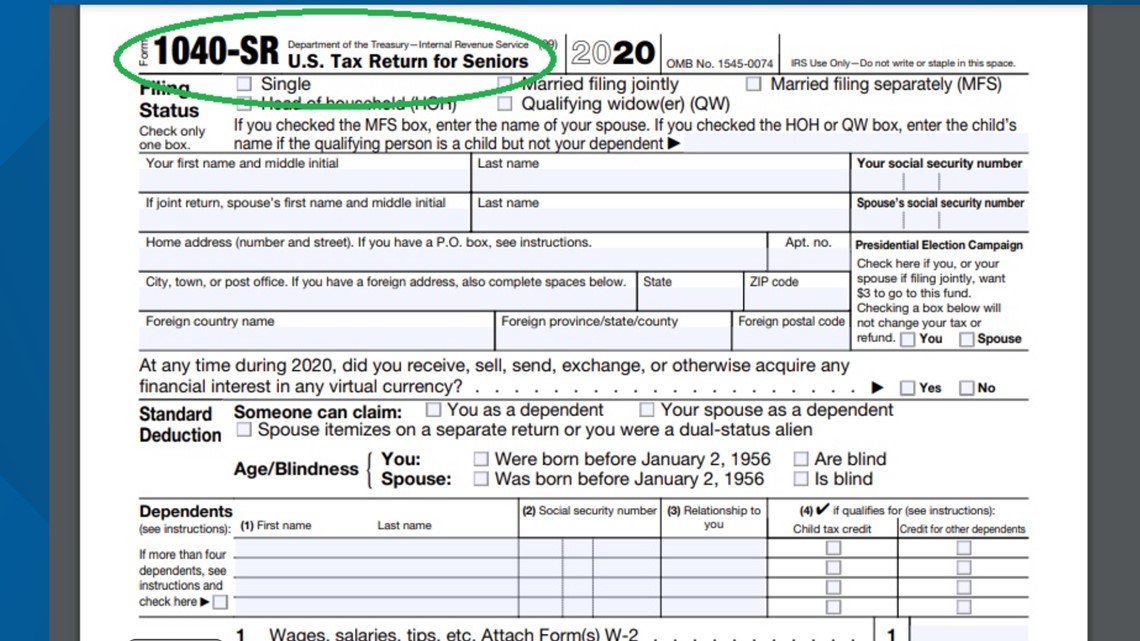

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Web 13 Jan 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021

The Recovery Rebate Credit 2023 Form 1040 Process

The procedure usually involves a few easy steps:

-

Purchase the product: Then make sure you purchase the product the way you normally do.

-

Fill in this Recovery Rebate Credit 2023 Form 1040 paper: You'll have to supply some details including your name, address, and details about your purchase, in order to receive your Recovery Rebate Credit 2023 Form 1040.

-

To submit the Recovery Rebate Credit 2023 Form 1040 In accordance with the type of Recovery Rebate Credit 2023 Form 1040, you may need to submit a form by mail or send it via the internet.

-

Wait until the company approves: The company will review your request to determine if it's in compliance with the guidelines and conditions of the Recovery Rebate Credit 2023 Form 1040.

-

Pay your Recovery Rebate Credit 2023 Form 1040 If it is approved, you'll receive your refund whether by check, prepaid card, or other option as per the terms of the offer.

Pros and Cons of Recovery Rebate Credit 2023 Form 1040

Advantages

-

Cost Savings The use of Recovery Rebate Credit 2023 Form 1040 can greatly reduce the cost for products.

-

Promotional Offers The aim is to encourage customers in trying new products or brands.

-

increase sales A Recovery Rebate Credit 2023 Form 1040 program can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Reward mail-ins particularly are often time-consuming and slow-going.

-

Days of expiration Many Recovery Rebate Credit 2023 Form 1040 are subject to the strictest deadlines for submission.

-

A risk of not being paid Customers may not be able to receive their Recovery Rebate Credit 2023 Form 1040 if they do not follow the rules precisely.

Download Recovery Rebate Credit 2023 Form 1040

Download Recovery Rebate Credit 2023 Form 1040

FAQs

1. Are Recovery Rebate Credit 2023 Form 1040 equivalent to discounts? No, the Recovery Rebate Credit 2023 Form 1040 will be partial reimbursement after purchase, whereas discounts decrease prices at point of sale.

2. Can I use multiple Recovery Rebate Credit 2023 Form 1040 on the same item It's contingent upon the terms that apply to the Recovery Rebate Credit 2023 Form 1040 offered and product's eligibility. Certain companies may allow it, but some will not.

3. How long will it take to get the Recovery Rebate Credit 2023 Form 1040? The period will differ, but can last from a few weeks until a couple of months for you to receive your Recovery Rebate Credit 2023 Form 1040.

4. Do I have to pay tax upon Recovery Rebate Credit 2023 Form 1040 quantities? the majority of instances, Recovery Rebate Credit 2023 Form 1040 amounts are not considered to be taxable income.

5. Can I trust Recovery Rebate Credit 2023 Form 1040 deals from lesser-known brands It's crucial to research and ensure that the brand that is offering the Recovery Rebate Credit 2023 Form 1040 is reputable prior to making an investment.

2022 Form 1040 Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Form 1040 Recovery Rebate

Check more sample of Recovery Rebate Credit 2023 Form 1040 below

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

2023 Recovery Rebate Credit Turbotax Recovery Rebate

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

How To Claim The Stimulus Money On Your Tax Return 13newsnow

Recovery Rebate Credit Your Last Chance To Get A 1 400 Stimulus

https://www.irs.gov/newsroom/tax-tips-for-september-2023

Web 13 Okt 2023 nbsp 0183 32 Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or

https://www.greenbacktaxservices.com/blog/recovery-rebate-credit

Web 8 M 228 rz 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering

Web 13 Okt 2023 nbsp 0183 32 Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or

Web 8 M 228 rz 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

2023 Recovery Rebate Credit Turbotax Recovery Rebate

How To Claim The Stimulus Money On Your Tax Return 13newsnow

Recovery Rebate Credit Your Last Chance To Get A 1 400 Stimulus

1040 Form Pdf Fillable Printable Forms Free Online

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

2022 Form 1040 Schedule A Instructions