In our current world of high-end consumer goods every person loves a great deal. One way to gain substantial savings on your purchases is to use Gst Rebate Form New House Constructions. The use of Gst Rebate Form New House Constructions is a method used by manufacturers and retailers to offer consumers a partial reimbursement on their purchases following the time they've purchased them. In this article, we'll explore the world of Gst Rebate Form New House Constructions and explore what they are their purpose, how they function and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Gst Rebate Form New House Construction Below

Gst Rebate Form New House Construction

Gst Rebate Form New House Construction -

Web Effective April 19 2021 adenine GST QST rebate can be claimed in all single who co own adenine fresh home that is used than the primary placed of residency of first of this

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

A Gst Rebate Form New House Construction at its most basic form, is a partial refund to a purchaser after they have purchased a product or service. It's a powerful method employed by companies to draw customers, boost sales, as well as promote particular products.

Types of Gst Rebate Form New House Construction

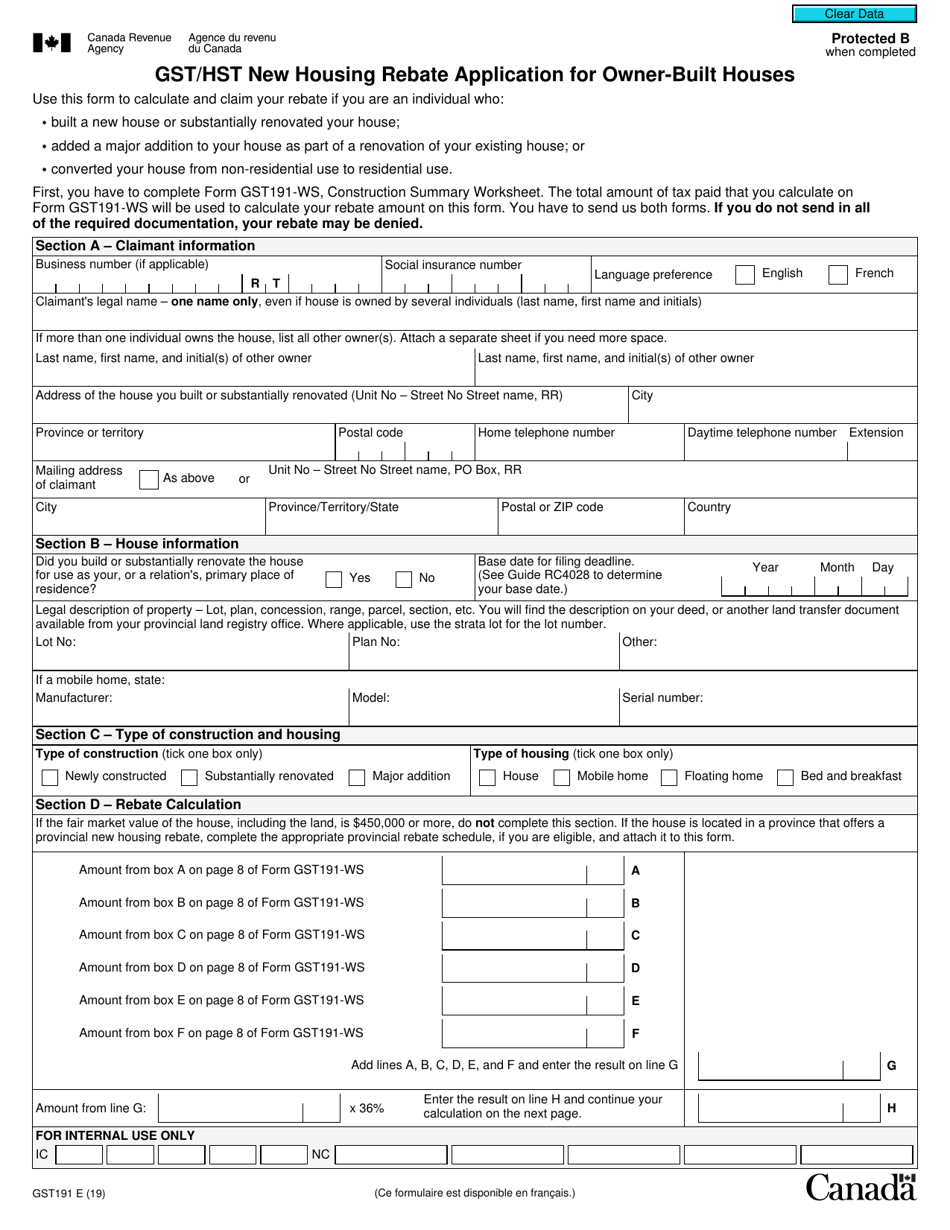

Gst Hst New House Rebate Application Owner Built

Gst Hst New House Rebate Application Owner Built

Web 19 avr 2021 nbsp 0183 32 GST QST New Housing Rebate Application Owner of a Home on Leased Land or a Share in a Housing Co Op FP 2190 L V QST and GST Rebates New or

Web Use this form to claim your rebate if you bought a new house including a residential condominium unit or a share of the capital stock of a co operative housing corporation

Cash Gst Rebate Form New House Construction

Cash Gst Rebate Form New House Construction are the most basic kind of Gst Rebate Form New House Construction. Customers are offered a certain amount of money back upon purchasing a particular item. These are often used for high-ticket items like electronics or appliances.

Mail-In Gst Rebate Form New House Construction

Mail-in Gst Rebate Form New House Construction require customers to provide documents of purchase to claim the refund. They're longer-lasting, however they offer substantial savings.

Instant Gst Rebate Form New House Construction

Instant Gst Rebate Form New House Construction will be applied at moment of sale, cutting prices immediately. Customers don't have to wait for savings when they purchase this type of Gst Rebate Form New House Construction.

How Gst Rebate Form New House Construction Work

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

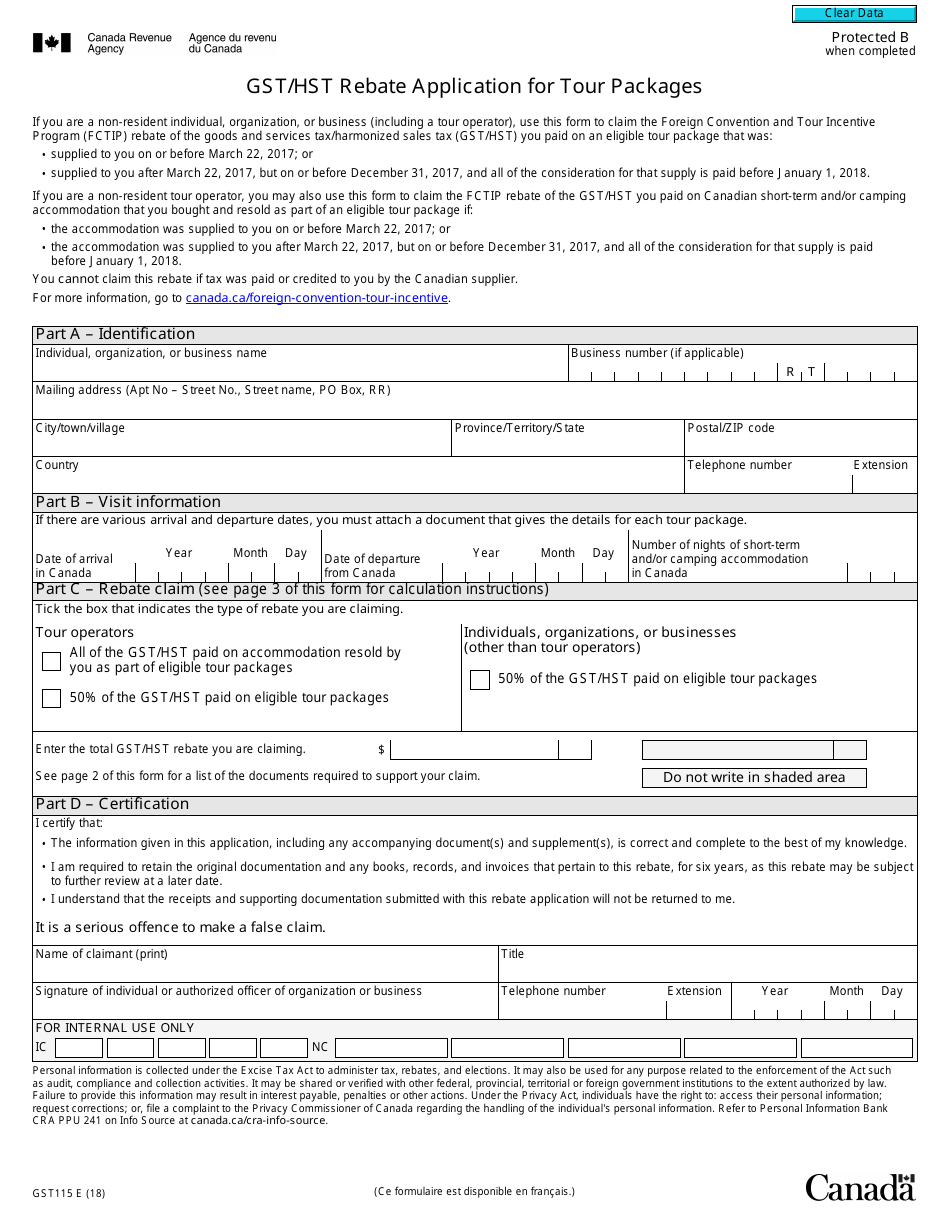

Web GST HST New Housing Rebate Application for Houses Purchased from a Builder Use this form to claim your rebate if you bought a new house including a residential

The Gst Rebate Form New House Construction Process

The process typically involves few easy steps:

-

Purchase the item: First you purchase the item the way you normally do.

-

Fill in this Gst Rebate Form New House Construction Form: To claim the Gst Rebate Form New House Construction you'll need be able to provide a few details including your name, address, along with the purchase details, in order to make a claim for your Gst Rebate Form New House Construction.

-

To submit the Gst Rebate Form New House Construction It is dependent on the nature of Gst Rebate Form New House Construction the recipient may be required to mail a Gst Rebate Form New House Construction form in or send it via the internet.

-

Wait for the company's approval: They will review your submission to make sure that it's in accordance with the requirements of the Gst Rebate Form New House Construction.

-

You will receive your Gst Rebate Form New House Construction After you've been approved, you'll receive your money back, using a check or prepaid card, or another method as specified by the offer.

Pros and Cons of Gst Rebate Form New House Construction

Advantages

-

Cost Savings Gst Rebate Form New House Construction are a great way to lower the cost you pay for the item.

-

Promotional Offers These deals encourage customers to try new products or brands.

-

Help to Increase Sales Gst Rebate Form New House Construction can help boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Gst Rebate Form New House Construction that are mail-in, particularly, can be cumbersome and tedious.

-

Day of Expiration: Many Gst Rebate Form New House Construction have very strict deadlines for filing.

-

The risk of non-payment Customers may not get their Gst Rebate Form New House Construction if they don't observe the rules precisely.

Download Gst Rebate Form New House Construction

Download Gst Rebate Form New House Construction

FAQs

1. Are Gst Rebate Form New House Construction similar to discounts? No, Gst Rebate Form New House Construction are partial reimbursement after purchase, but discounts can reduce your purchase cost at moment of sale.

2. Are multiple Gst Rebate Form New House Construction available for the same product This is dependent on terms on the Gst Rebate Form New House Construction promotions and on the products suitability. Certain companies allow this, whereas others will not.

3. How long does it take to get a Gst Rebate Form New House Construction? The amount of time varies, but it can take a couple of weeks or a few months to receive your Gst Rebate Form New House Construction.

4. Do I have to pay taxes with respect to Gst Rebate Form New House Construction amounts? In most instances, Gst Rebate Form New House Construction amounts are not considered taxable income.

5. Do I have confidence in Gst Rebate Form New House Construction offers from lesser-known brands It's crucial to research and ensure that the brand which is providing the Gst Rebate Form New House Construction has a good reputation prior to making a purchase.

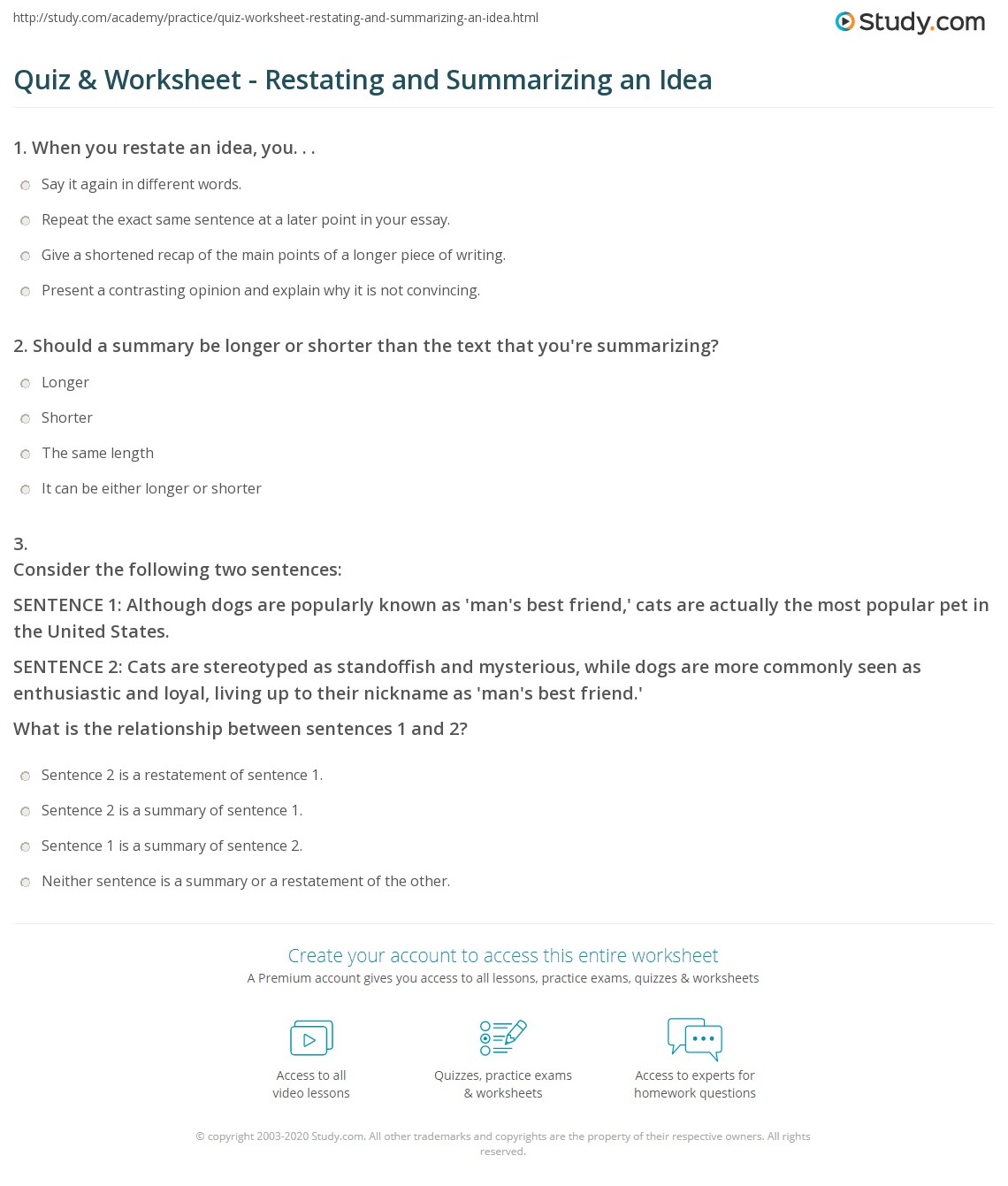

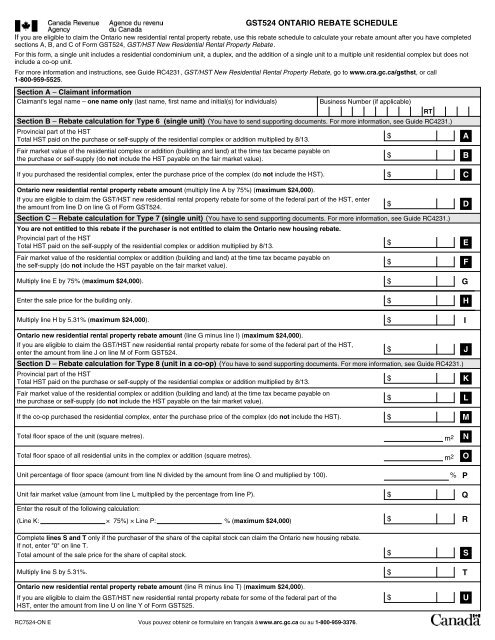

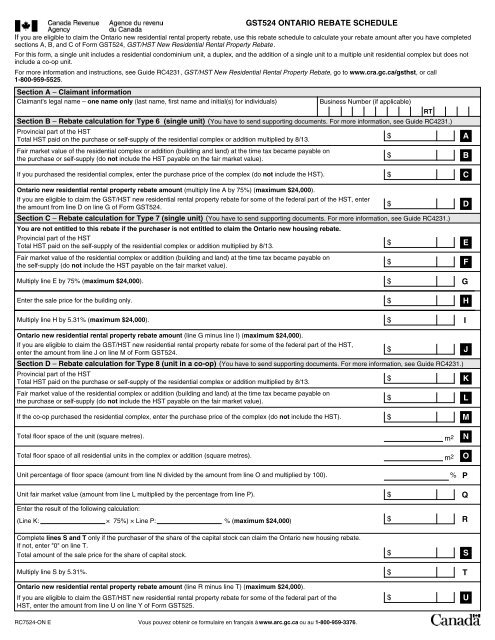

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

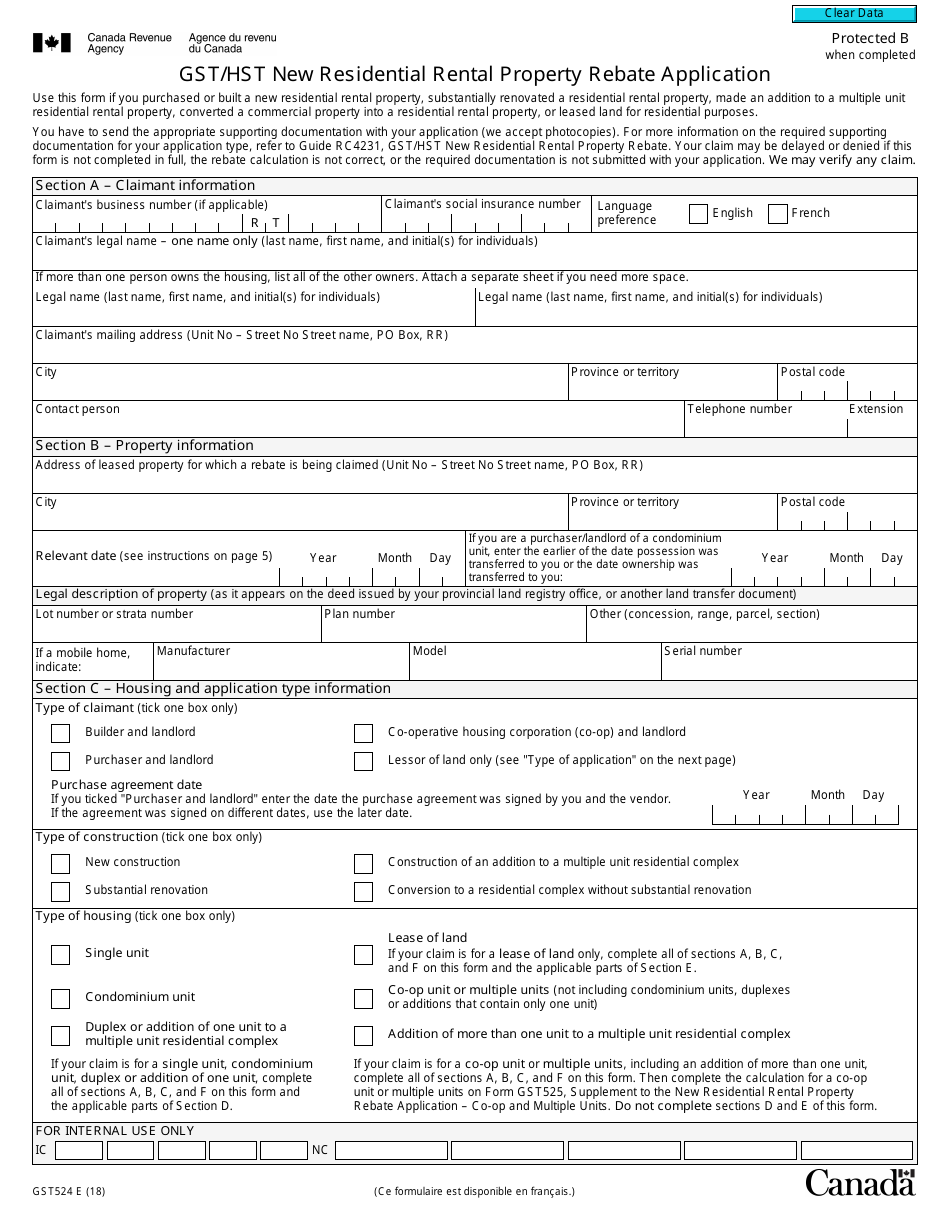

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Check more sample of Gst Rebate Form New House Construction below

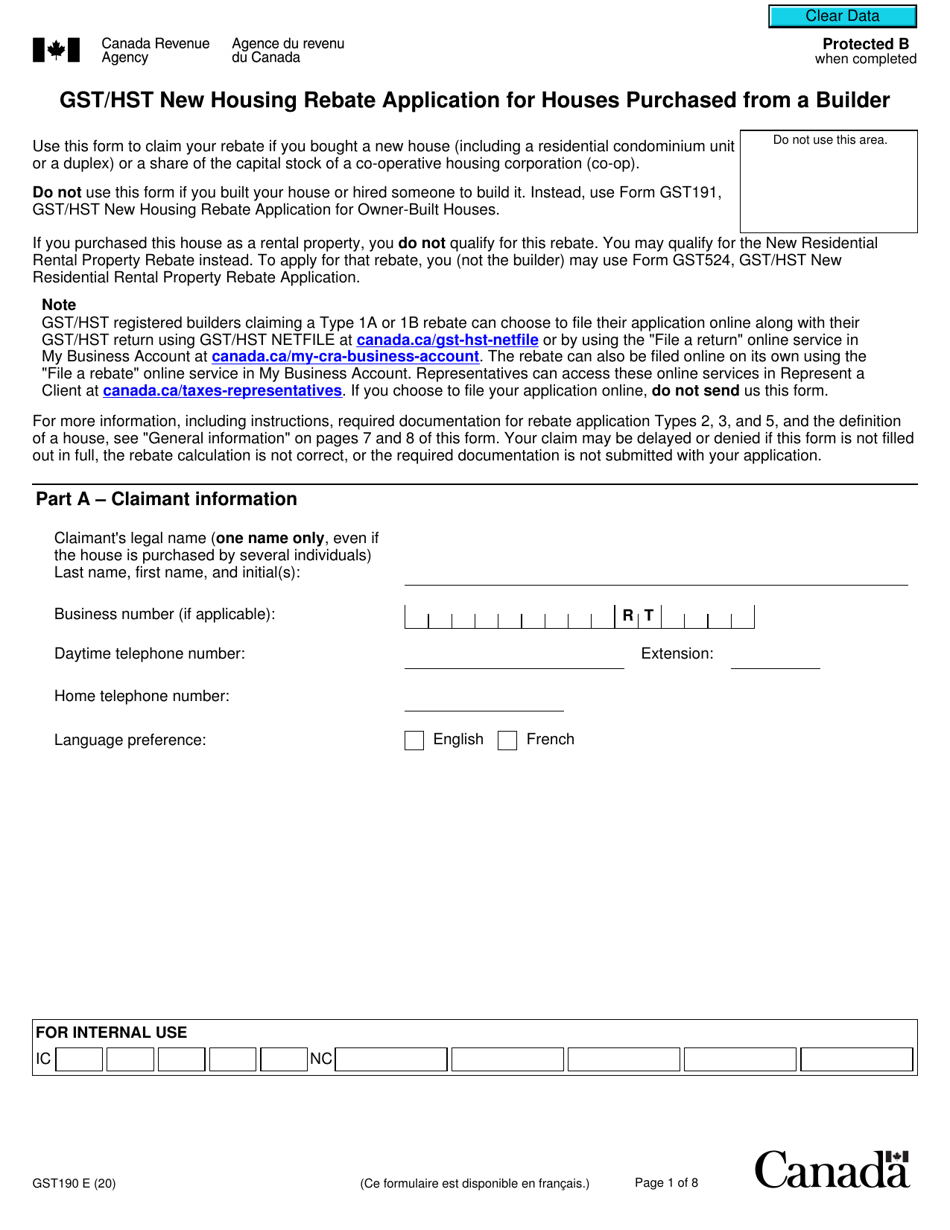

Form GST190 Download Printable PDF Or Fill Online Gst Hst New Housing

Pin On Moving Buying Selling Home

Gst Return Working Copy Form Fill Out And Sign Printable PDF Template

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

Gst Hst New Housing Rebate Application For Owner Built Houses

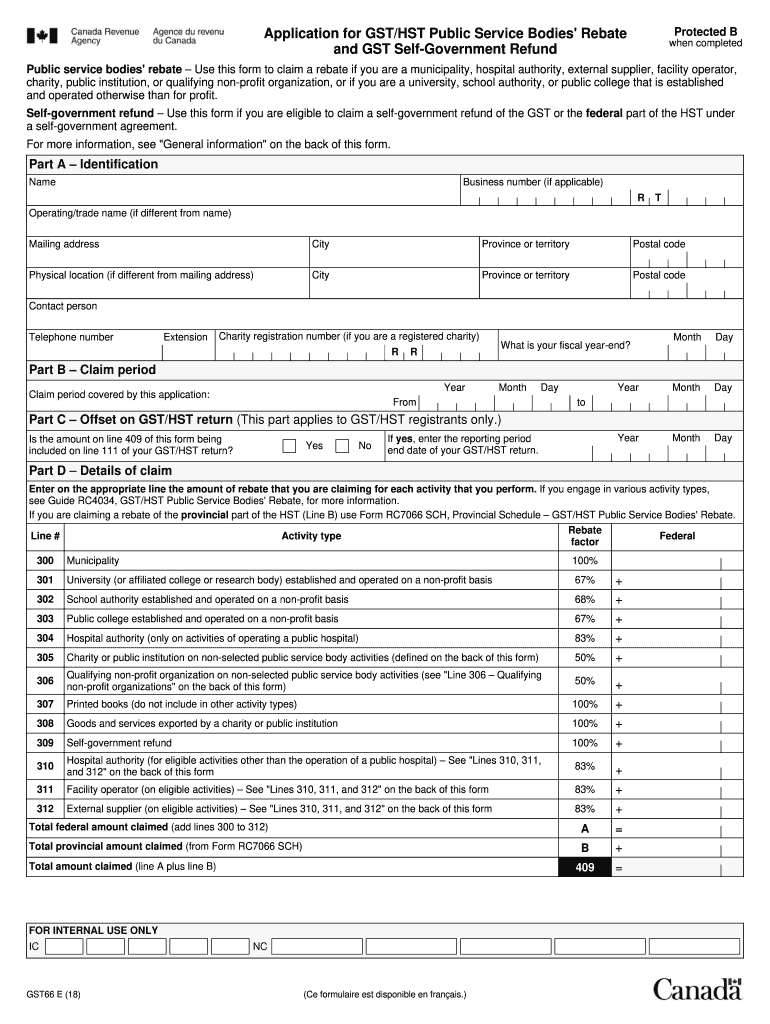

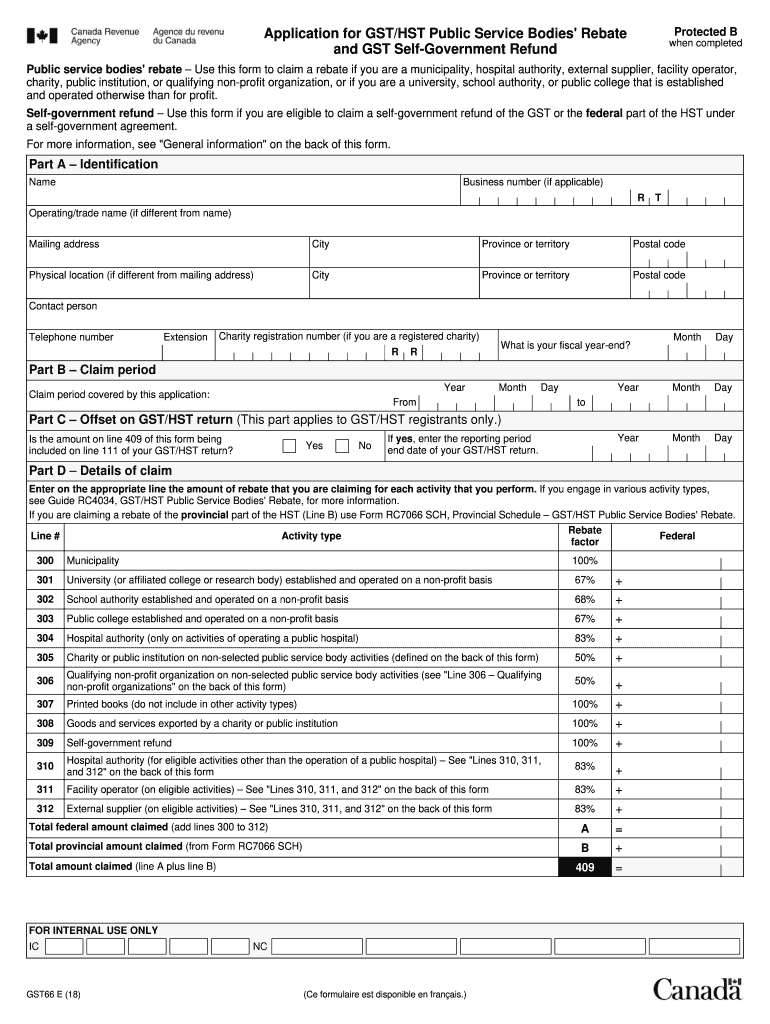

Gst66 E Fill Out Sign Online DocHub

https://www.canada.ca/.../services/forms-publications/forms/gst191-ws.html

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Web Form GST190 GST HST New Housing Rebate Application for Houses Purchased from a Builder You have to fill out this form to claim your new housing rebate You must fill out

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

Web Form GST190 GST HST New Housing Rebate Application for Houses Purchased from a Builder You have to fill out this form to claim your new housing rebate You must fill out

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

Pin On Moving Buying Selling Home

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst66 E Fill Out Sign Online DocHub

Gst Hst New Housing Rebate Application For Owner Built Houses

GST HST New Housing Rebate Rebates House With Land Home Construction

GST HST New Housing Rebate Rebates House With Land Home Construction

Gst Fillable Form Printable Forms Free Online