In this day and age of consuming everyone is looking for a great deal. One option to obtain significant savings on your purchases is through Rebates Accountings. Rebates Accountings are marketing strategies that retailers and manufacturers use to provide customers with a partial refund on their purchases after they have completed them. In this article, we will take a look at the world that is Rebates Accountings, examining the nature of them as well as how they work and how you can maximize the value of these incentives.

Get Latest Rebates Accounting Below

Rebates Accounting

Rebates Accounting - Rebates Accounting, Rebates Accounting Treatment Ifrs, Rebates Accounting Definition, Rebate Accounting Journal Entry, Rebate Accounting Us Gaap, Rebate Accounting Meaning, Rebate Accounting Jobs, Rebate Accounting Entries In Sap, Rebate Accounting Guidance, Rebate Accounting Record

Web 1 sept 2023 nbsp 0183 32 While you re likely familiar with the concept of a rebate we are going to

Web 12 nov 2015 nbsp 0183 32 12 Nov 2015 Discounts and rebates can be offered to purchasers in a

A Rebates Accounting in its most basic version, is an ad-hoc return to the customer when they purchase a product or service. It's a powerful instrument used by businesses to attract clients, increase sales as well as promote particular products.

Types of Rebates Accounting

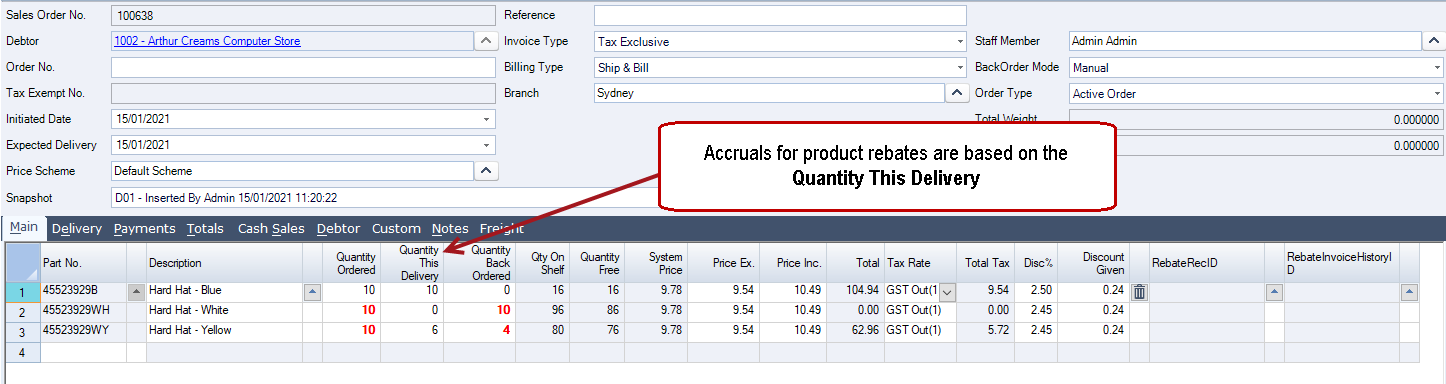

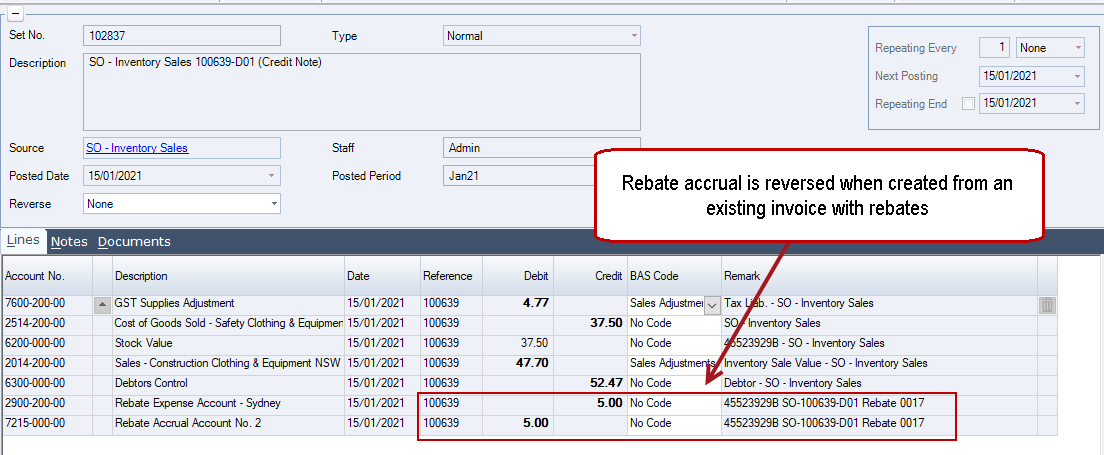

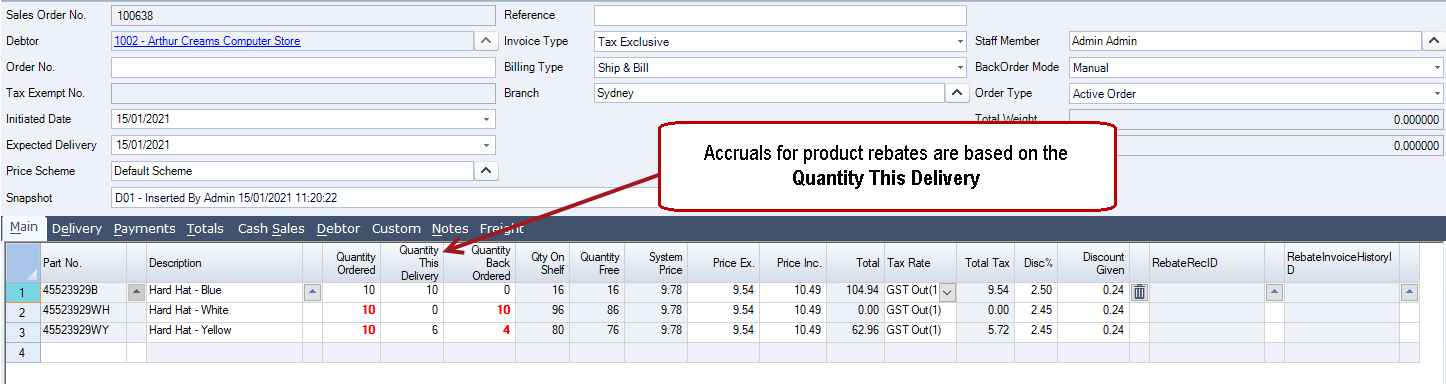

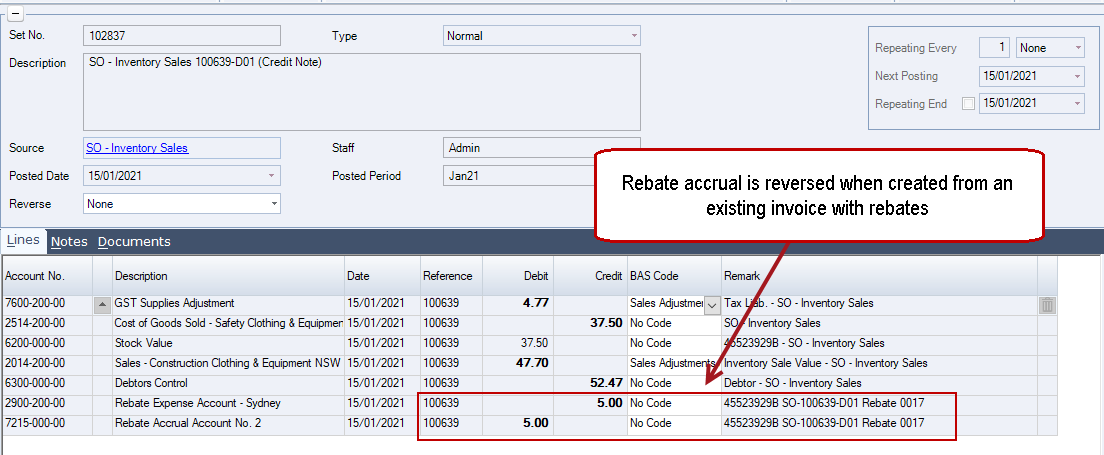

Rebates Rebate Accruals JIWA Training

Rebates Rebate Accruals JIWA Training

Web 2 sept 2023 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase

Web Rebate It is provided by a seller to the buyer for reasons such as inferior quality of

Cash Rebates Accounting

Cash Rebates Accounting are by far the easiest type of Rebates Accounting. Customers are given a certain amount of money in return for purchasing a product. These are typically applied to expensive items such as electronics or appliances.

Mail-In Rebates Accounting

Customers who want to receive mail-in Rebates Accounting must submit proof of purchase in order to receive their money back. They're more involved, but can result in significant savings.

Instant Rebates Accounting

Instant Rebates Accounting are credited at the point of sale. They reduce the purchase cost immediately. Customers do not have to wait around for savings with this type.

How Rebates Accounting Work

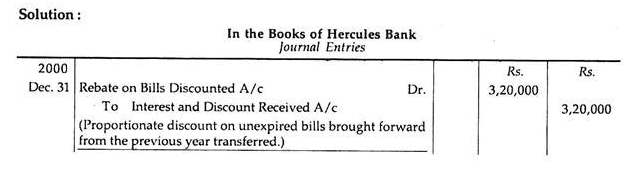

Rebate On Bills Discounted Banking Company Accounts Advanced

Rebate On Bills Discounted Banking Company Accounts Advanced

Web Accounting for vendor rebates can either be complex or easy To make it easy many organisations leverage the aid of financial automation tools Whether you choose to handle rebates accounting manually or

The Rebates Accounting Process

The process generally involves a few steps

-

Then, you purchase the product, you buy the product like you normally do.

-

Complete your Rebates Accounting questionnaire: you'll have to provide some data like your address, name, and information about the purchase in order to be eligible for a Rebates Accounting.

-

To submit the Rebates Accounting If you want to submit the Rebates Accounting, based on the kind of Rebates Accounting it is possible that you need to mail a Rebates Accounting form in or make it available online.

-

Wait for the company's approval: They will examine your application to make sure that it's in accordance with the reimbursement's terms and condition.

-

You will receive your Rebates Accounting Once it's approved, you'll receive your refund either by check, prepaid card, or a different option specified by the offer.

Pros and Cons of Rebates Accounting

Advantages

-

Cost Savings Rebates Accounting could significantly decrease the price for a product.

-

Promotional Deals They encourage customers to experiment with new products, or brands.

-

Improve Sales Rebates Accounting are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity The mail-in Rebates Accounting in particular the case of HTML0, can be a hassle and demanding.

-

The Expiration Dates Many Rebates Accounting have the strictest deadlines for submission.

-

Risk of not receiving payment Certain customers could not get their Rebates Accounting if they don't follow the regulations precisely.

Download Rebates Accounting

FAQs

1. Are Rebates Accounting similar to discounts? No, the Rebates Accounting will be an amount of money that is refunded after the purchase, whereas discounts reduce their price at point of sale.

2. Are there Rebates Accounting that can be used for the same product What is the best way to do it? It's contingent on conditions applicable to Rebates Accounting offers and the product's acceptance. Certain companies may permit it, but some will not.

3. How long does it take to get a Rebates Accounting? The timing differs, but could take several weeks to a few months for you to receive your Rebates Accounting.

4. Do I need to pay tax when I receive Rebates Accounting sums? the majority of situations, Rebates Accounting amounts are not considered to be taxable income.

5. Can I trust Rebates Accounting deals from lesser-known brands Consider doing some research and verify that the organization offering the Rebates Accounting is reputable prior to making the purchase.

Rebate Accounting Product

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

Check more sample of Rebates Accounting below

Rebate Accounting Product

Rebate In MM SAP Blogs

Rebate Accounting Entries pdf Rebate Marketing Debits And Credits

Rebate Adjustment Sample Clauses AccountingCoaching

Enhancing Your Inventory Rebate Accounting Process Enable

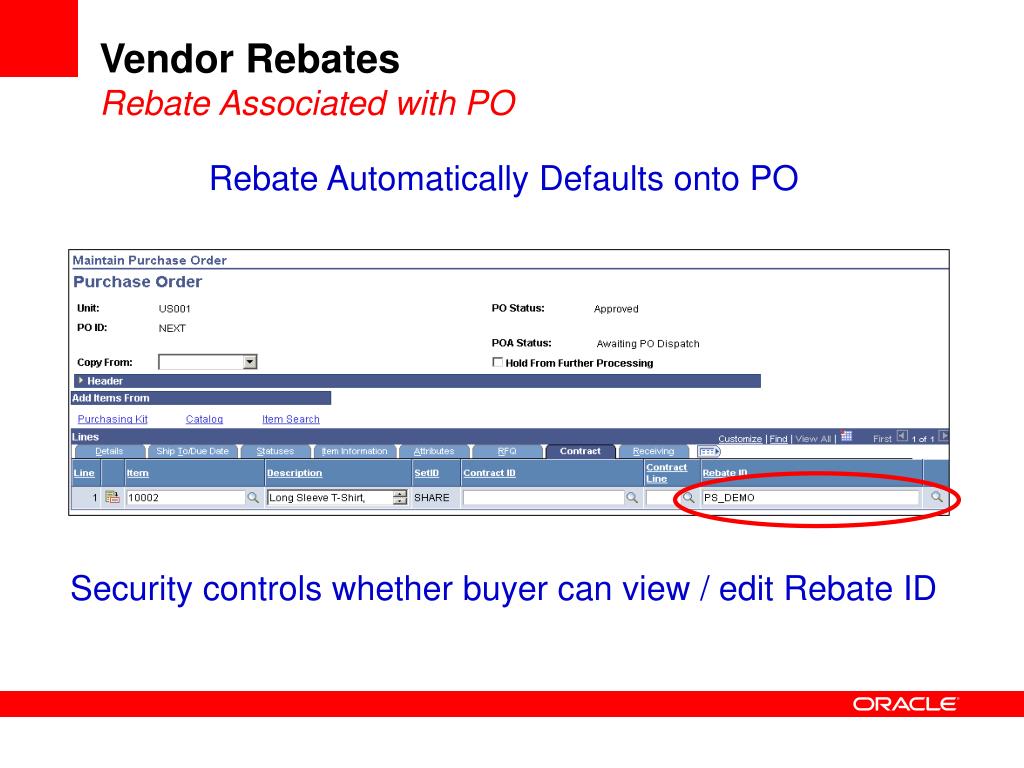

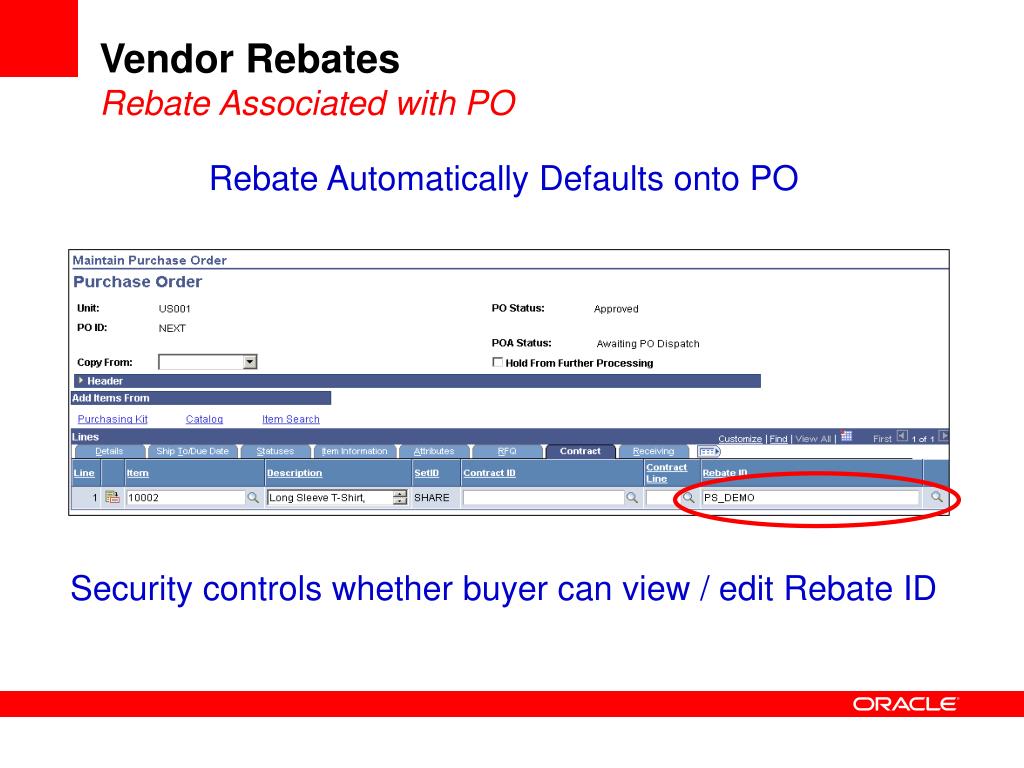

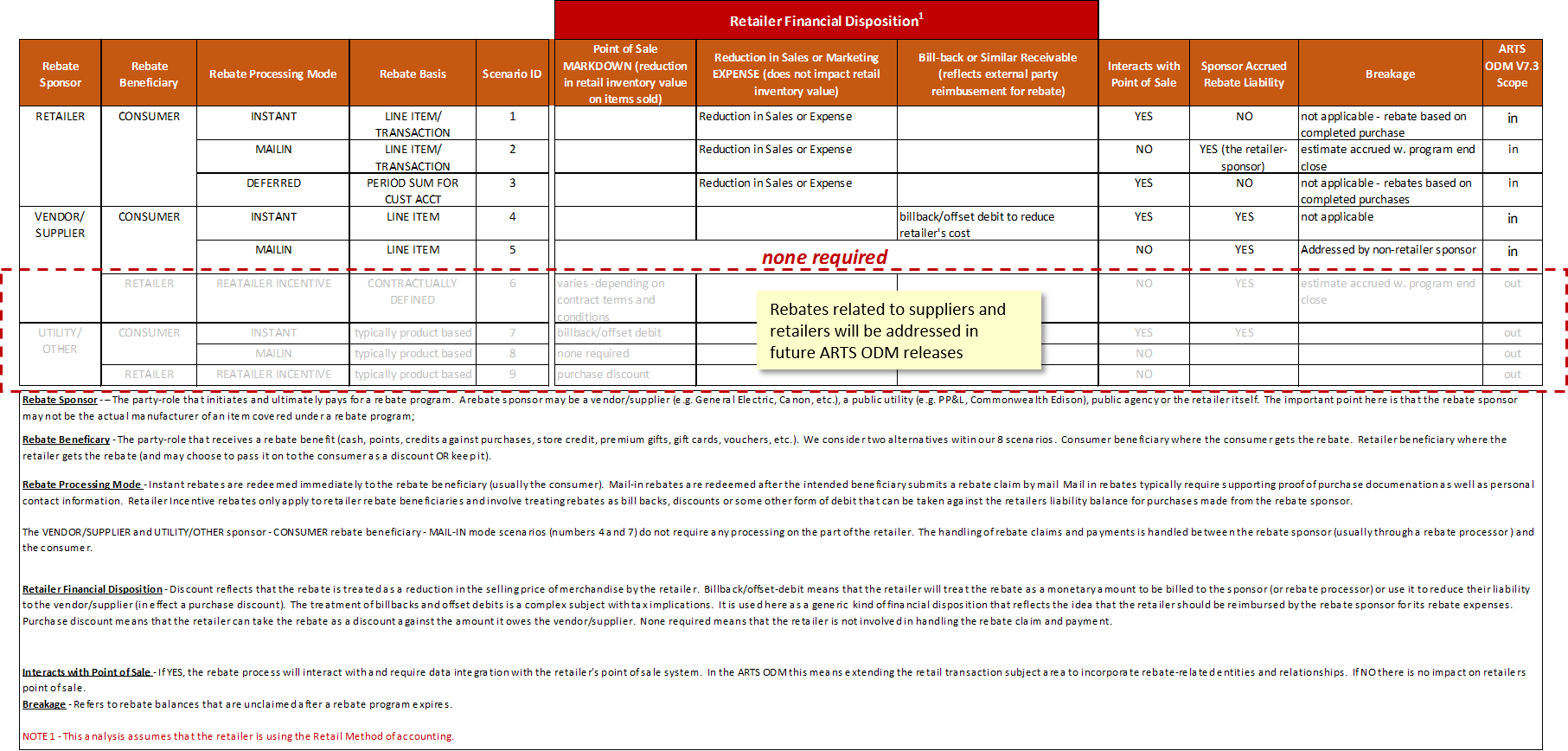

PPT Vendor Rebates PowerPoint Presentation Free Download ID 2924033

https://www.grantthornton.ie/insights/factsheets/ifrs-viewpoint-3

Web 12 nov 2015 nbsp 0183 32 12 Nov 2015 Discounts and rebates can be offered to purchasers in a

https://www.solvexia.com/blog/rebate-accoun…

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

Web 12 nov 2015 nbsp 0183 32 12 Nov 2015 Discounts and rebates can be offered to purchasers in a

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

Rebate Adjustment Sample Clauses AccountingCoaching

Rebate In MM SAP Blogs

Enhancing Your Inventory Rebate Accounting Process Enable

PPT Vendor Rebates PowerPoint Presentation Free Download ID 2924033

Volume Rebate Agreement Template

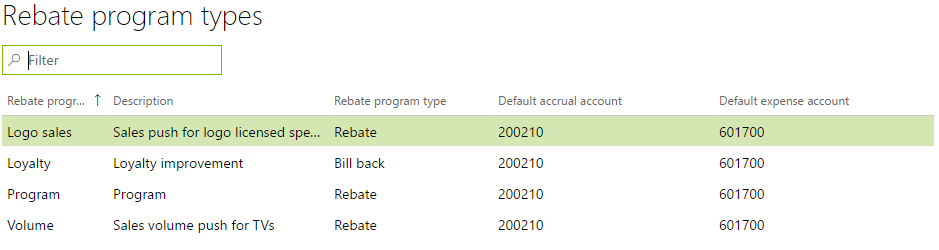

Managing Rebates In Dynamics 365 For Operations AXSource

Managing Rebates In Dynamics 365 For Operations AXSource

Rebate Accounting Product