Today, in a world that is driven by the consumer everyone is looking for a great deal. One method of gaining significant savings when you shop is with Ga Fuel Tax Rebate Forms. Ga Fuel Tax Rebate Forms are a strategy for marketing employed by retailers and manufacturers to offer consumers a partial payment on their purchases, after they have done so. In this article, we'll investigate the world of Ga Fuel Tax Rebate Forms, looking at what they are as well as how they work and how you can maximize your savings through these cost-effective incentives.

Get Latest Ga Fuel Tax Rebate Form Below

Ga Fuel Tax Rebate Form

Ga Fuel Tax Rebate Form -

Web Natural gas Hydrogen Check the online guide for AFVs eligible for a GA Alternative Fuel Tag Please note that Georgia does not consider hybrid vehicles to be AFVs so the

Web Motor Fuel Tax is an excise tax imposed on the sale of motor fuel The Georgia Motor Fuel Tax Unit collects Motor Fuel Tax and administers and enforces the Georgia Motor Fuel

A Ga Fuel Tax Rebate Form in its simplest description, is a refund that a client receives after they've bought a product or service. It's an effective method employed by companies to attract customers, boost sales, and advertise specific products.

Types of Ga Fuel Tax Rebate Form

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

Web 11 mai 2022 nbsp 0183 32 This legislation allows for an additional refund of income taxes from 2020 due to the state experiencing a revenue surplus Single filers and married individuals

Web 11 mai 2022 nbsp 0183 32 Atlanta GA Governor Brian P Kemp and the Department of Revenue DOR announced today that DOR will begin issuing special one time tax refunds this

Cash Ga Fuel Tax Rebate Form

Cash Ga Fuel Tax Rebate Form are the most straightforward type of Ga Fuel Tax Rebate Form. Customers get a set amount of money after purchasing a item. These are typically applied to costly items like electronics or appliances.

Mail-In Ga Fuel Tax Rebate Form

Mail-in Ga Fuel Tax Rebate Form need customers to present an evidence of purchase for their cash back. They're more involved but offer substantial savings.

Instant Ga Fuel Tax Rebate Form

Instant Ga Fuel Tax Rebate Form will be applied at points of sale. This reduces the cost of purchase immediately. Customers do not have to wait for their savings when they purchase this type of Ga Fuel Tax Rebate Form.

How Ga Fuel Tax Rebate Form Work

Military Journal Nm Gas Rebate 2022 When You Submit Your

Military Journal Nm Gas Rebate 2022 When You Submit Your

Web 24 mars 2022 nbsp 0183 32 Gov Brian Kemp signed HB 1302 on Wednesday The tax relief bill provides a one time refund of 250 to 500 depending on filing status for those who filed returns

The Ga Fuel Tax Rebate Form Process

The procedure typically consists of a couple of steps that are easy to follow:

-

You purchase the item: First you purchase the item the way you normally do.

-

Fill in your Ga Fuel Tax Rebate Form template: You'll have to give some specific information, such as your name, address and information about the purchase in order to get your Ga Fuel Tax Rebate Form.

-

You must submit the Ga Fuel Tax Rebate Form According to the nature of Ga Fuel Tax Rebate Form, you may need to submit a claim form to the bank or submit it online.

-

Wait until the company approves: The company will look over your submission to verify that it is compliant with the guidelines and conditions of the Ga Fuel Tax Rebate Form.

-

Receive your Ga Fuel Tax Rebate Form Once it's approved, you'll receive your cash back whether by check, prepaid card or another procedure specified by the deal.

Pros and Cons of Ga Fuel Tax Rebate Form

Advantages

-

Cost Savings Ga Fuel Tax Rebate Form could significantly lower the cost you pay for products.

-

Promotional Deals These promotions encourage consumers to try out new products or brands.

-

Help to Increase Sales Ga Fuel Tax Rebate Form can help boost the company's sales as well as market share.

Disadvantages

-

Complexity mail-in Ga Fuel Tax Rebate Form in particular is a time-consuming process and take a long time to complete.

-

End Dates A lot of Ga Fuel Tax Rebate Form have certain deadlines for submitting.

-

Risk of not receiving payment Certain customers could not receive their refunds if they don't adhere to the requirements exactly.

Download Ga Fuel Tax Rebate Form

Download Ga Fuel Tax Rebate Form

FAQs

1. Are Ga Fuel Tax Rebate Form equivalent to discounts? No, Ga Fuel Tax Rebate Form involve a partial refund after purchase, while discounts lower the cost of purchase at moment of sale.

2. Do I have to use multiple Ga Fuel Tax Rebate Form on the same item This is dependent on conditions of the Ga Fuel Tax Rebate Form promotions and on the products potential eligibility. Certain companies allow it, while other companies won't.

3. How long does it take to get a Ga Fuel Tax Rebate Form? The amount of time differs, but could range from several weeks to few months before you receive your Ga Fuel Tax Rebate Form.

4. Do I need to pay taxes upon Ga Fuel Tax Rebate Form the amount? the majority of circumstances, Ga Fuel Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Ga Fuel Tax Rebate Form offers from brands that aren't well-known It's important to do your research and ensure that the business providing the Ga Fuel Tax Rebate Form is reputable prior to making an acquisition.

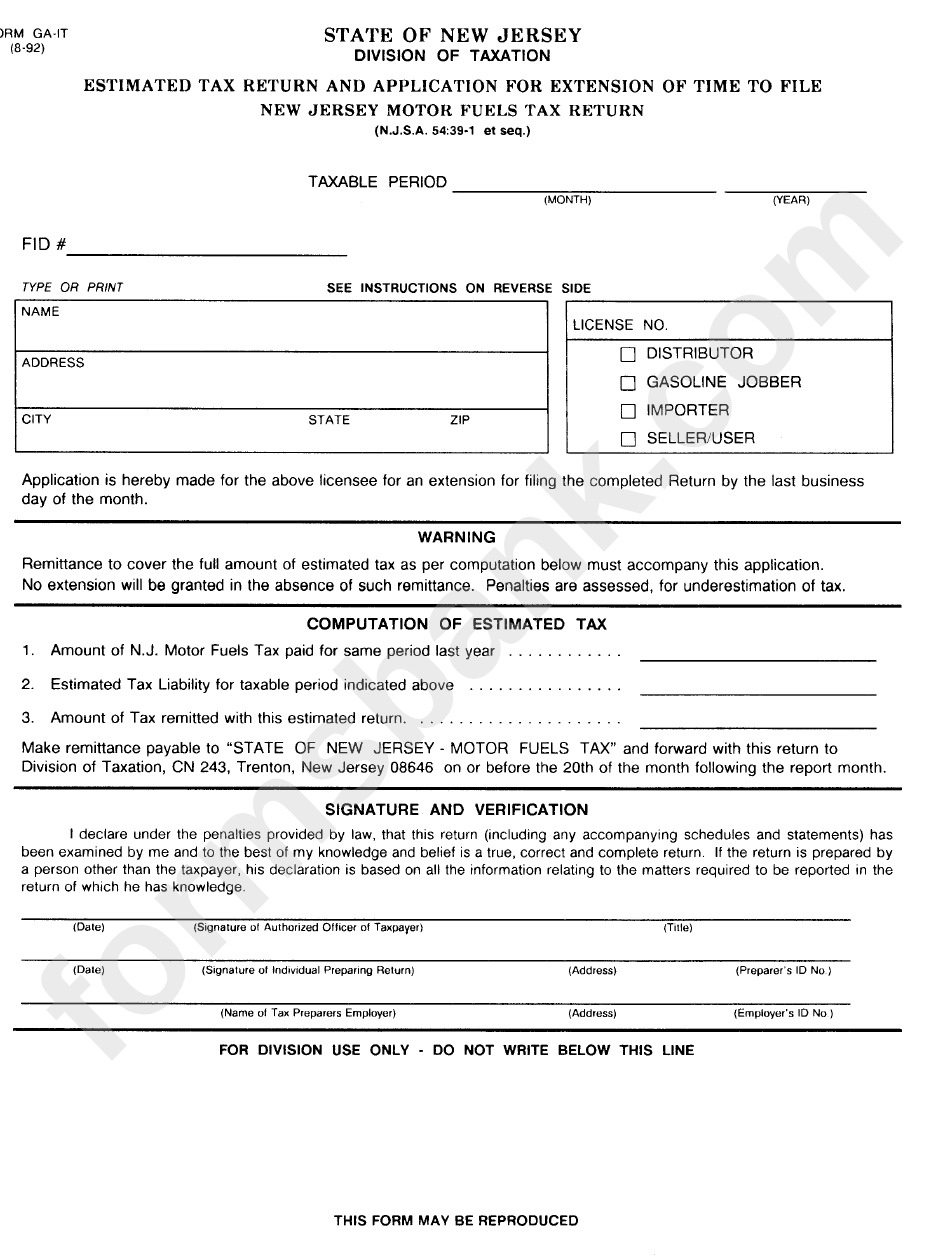

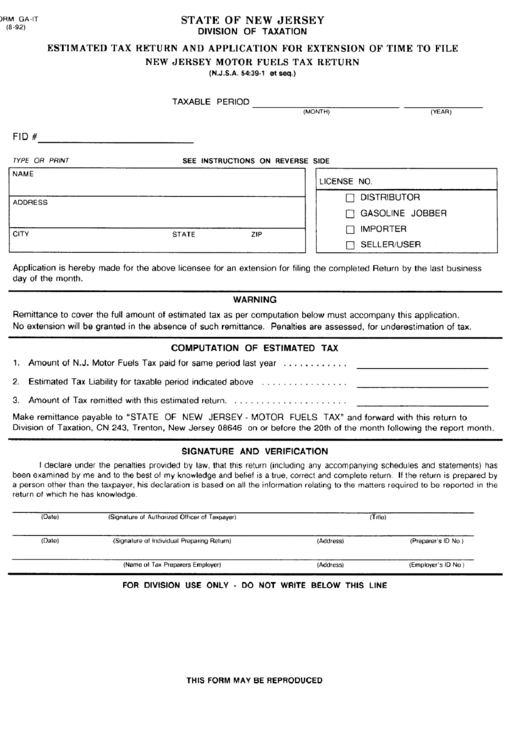

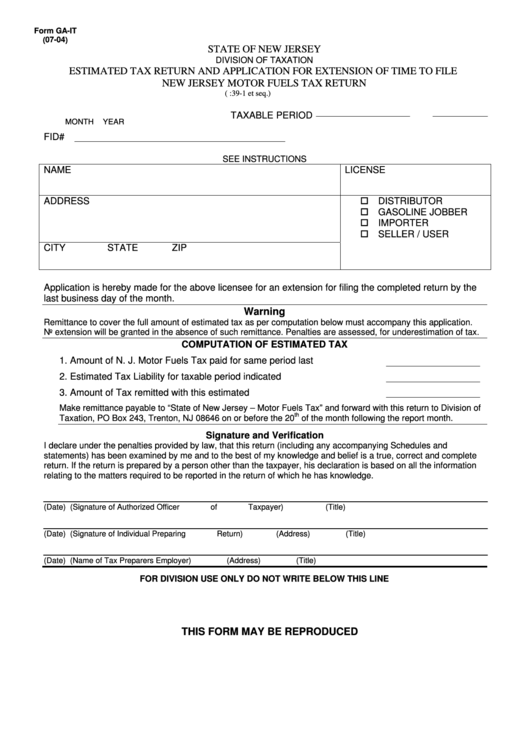

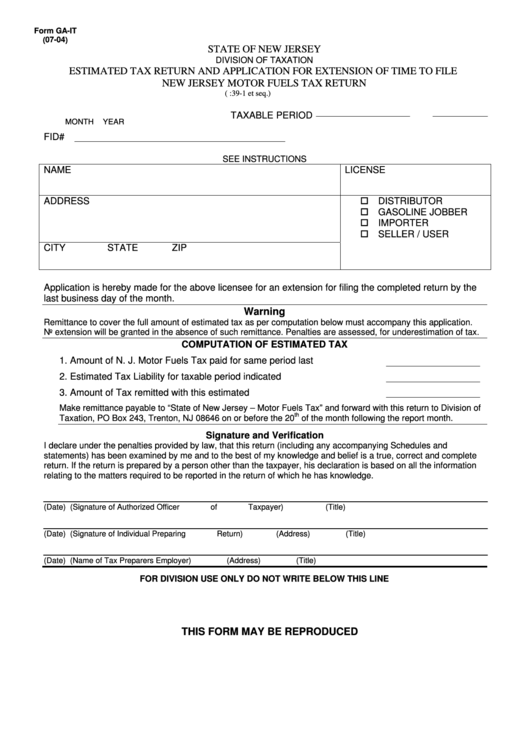

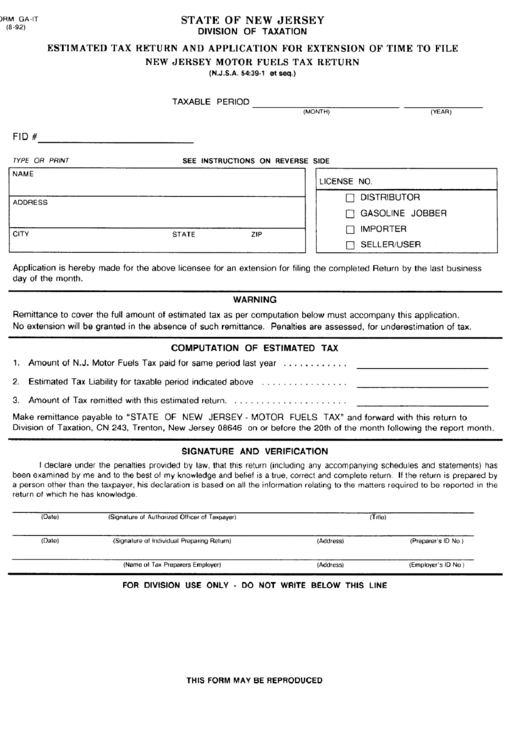

Form Ga It Estimated Tax Return And Application For Extension Of Time

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

Check more sample of Ga Fuel Tax Rebate Form below

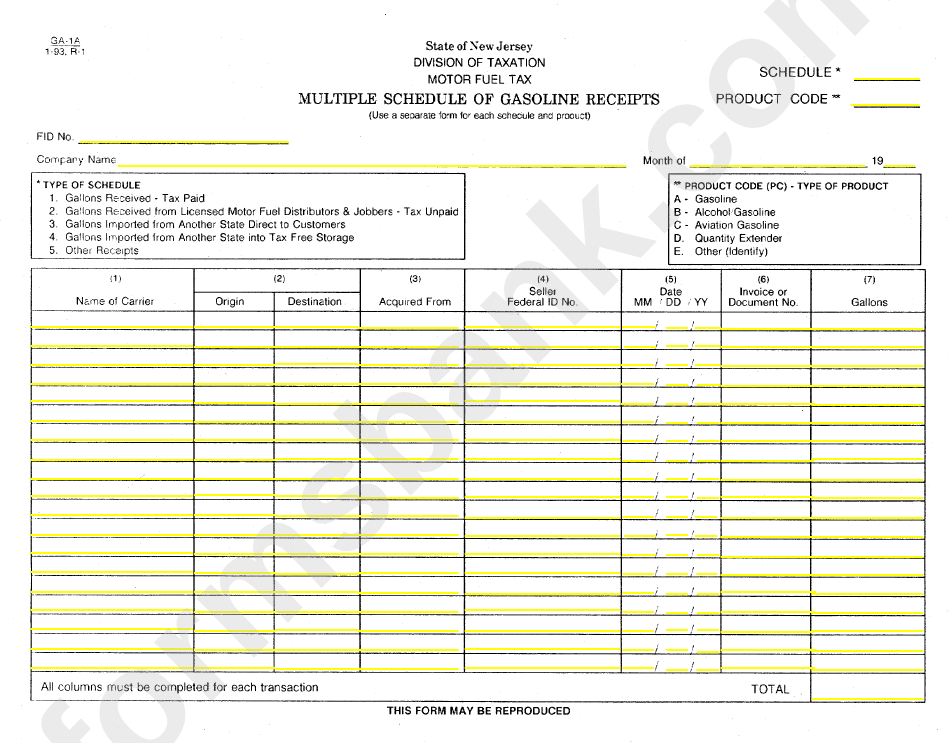

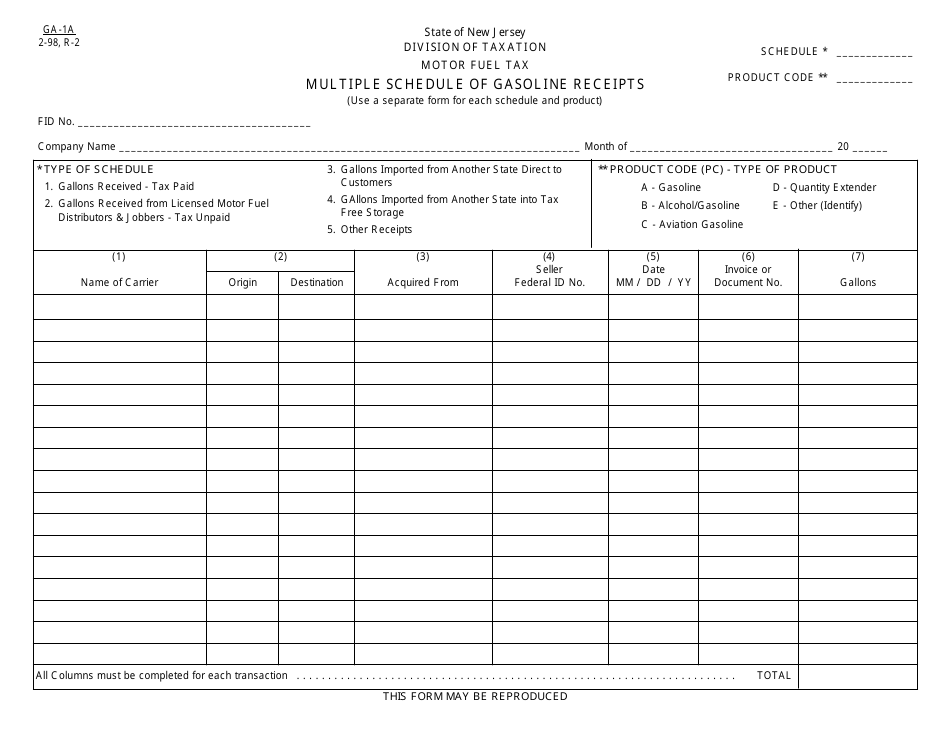

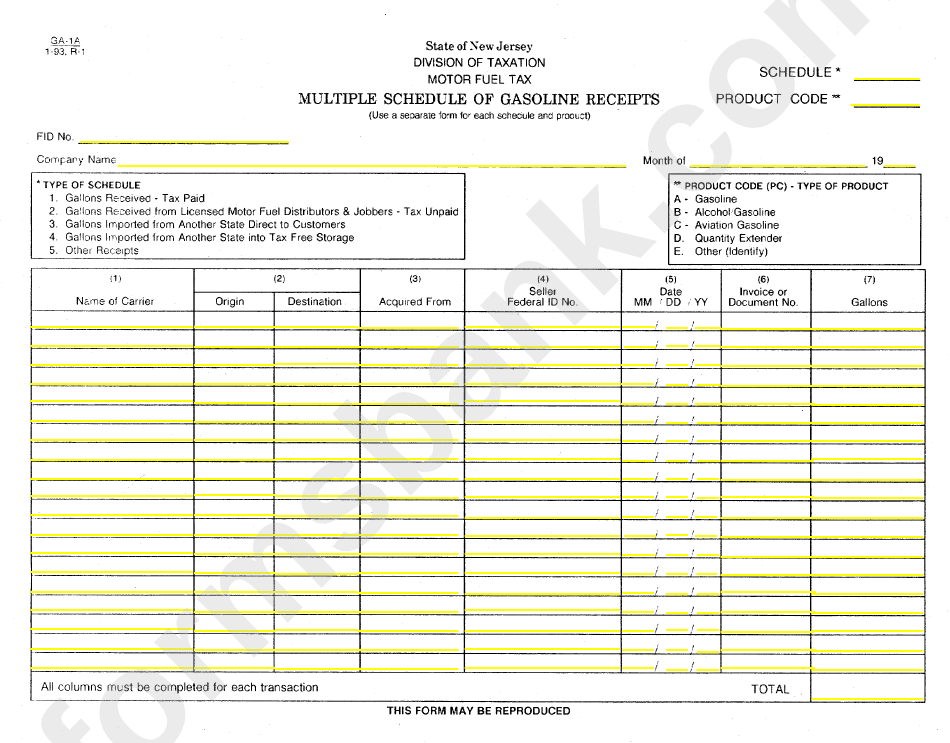

Form GA 1A Download Fillable PDF Or Fill Online Motor Fuel Tax Multiple

Form Ga It Estimated Tax Return And Application For Extension Of Time

Missouri Gas Tax Refund Form Veche info 28

Fillable Form Ga It Estimated Tax Return And Application For

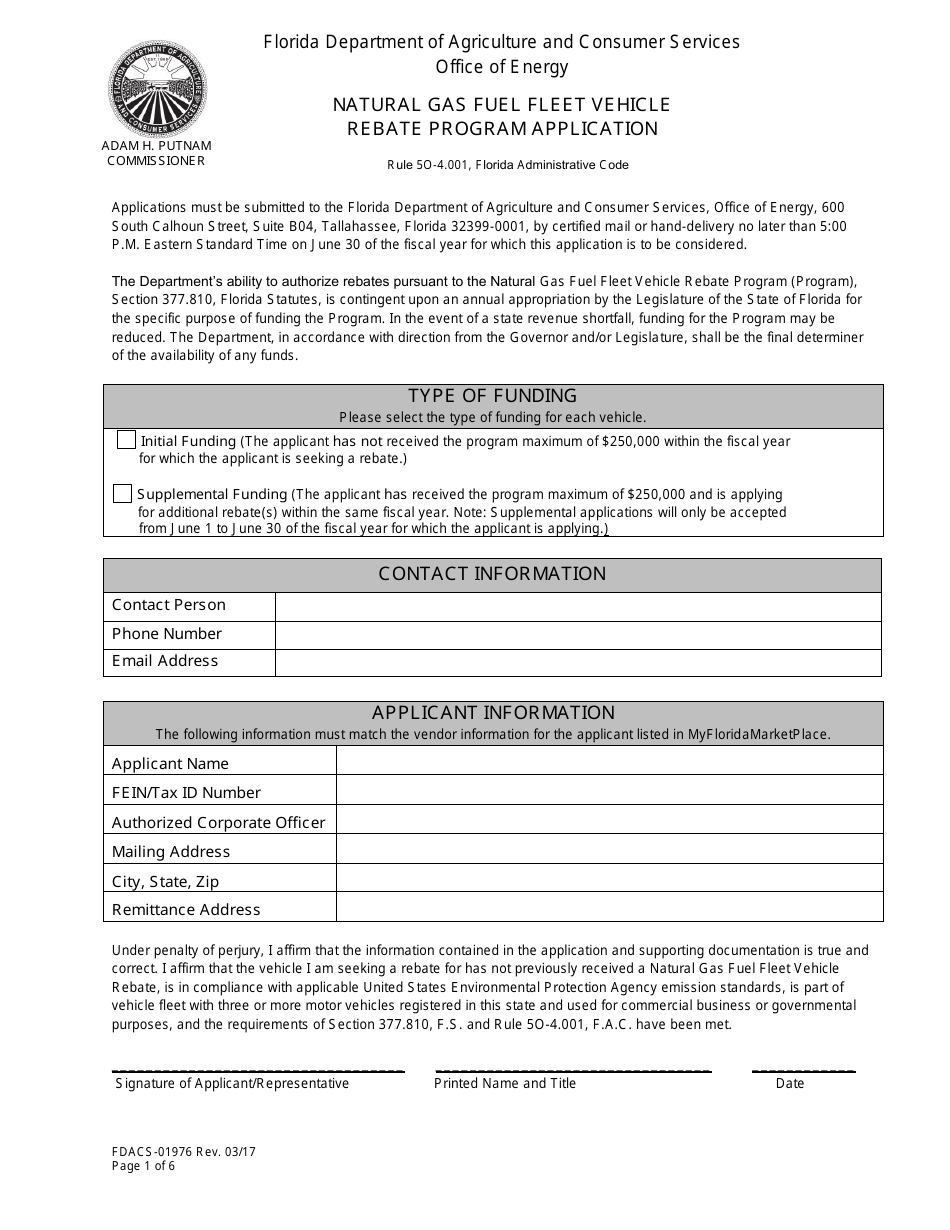

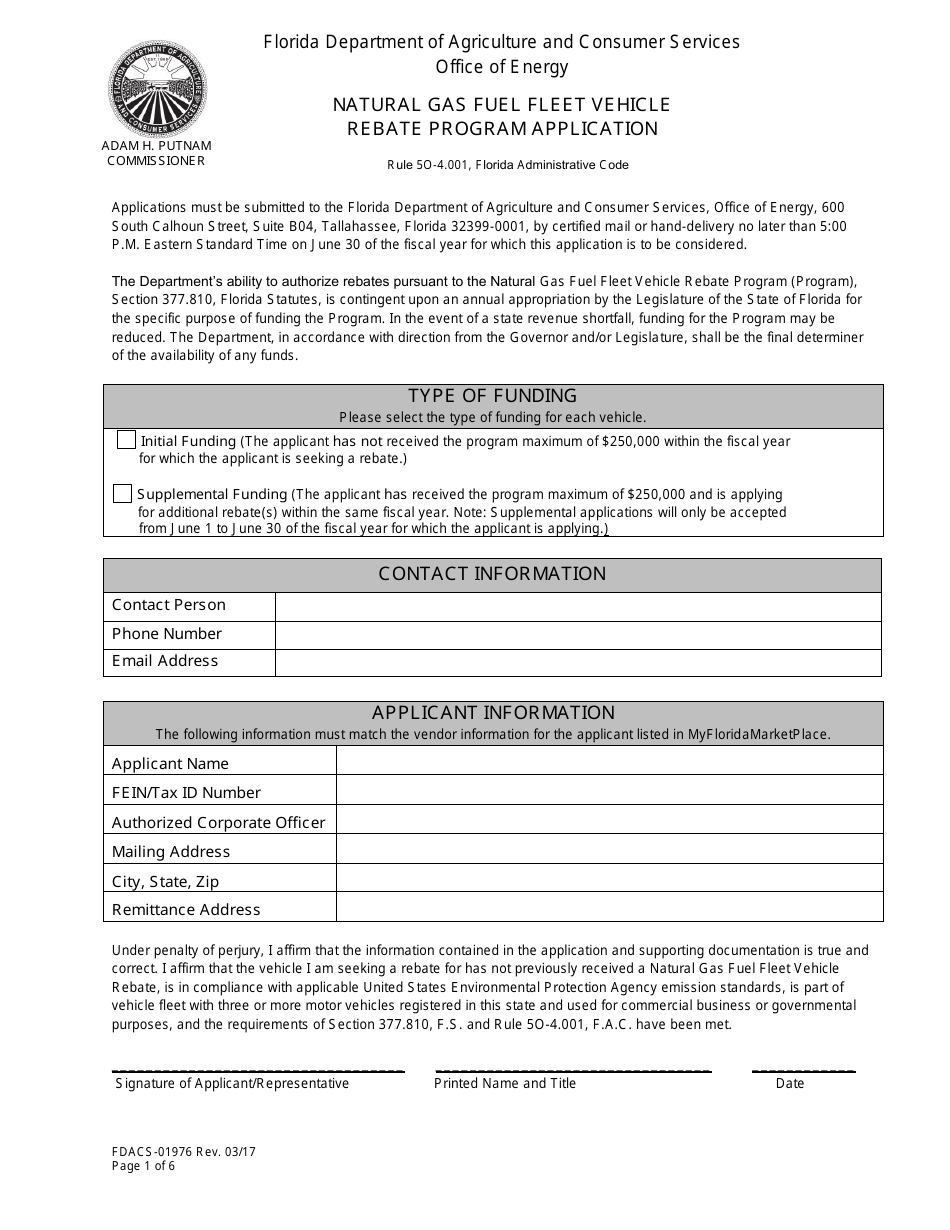

Form FDACS 01976 Download Fillable PDF Or Fill Online Natural Gas Fuel

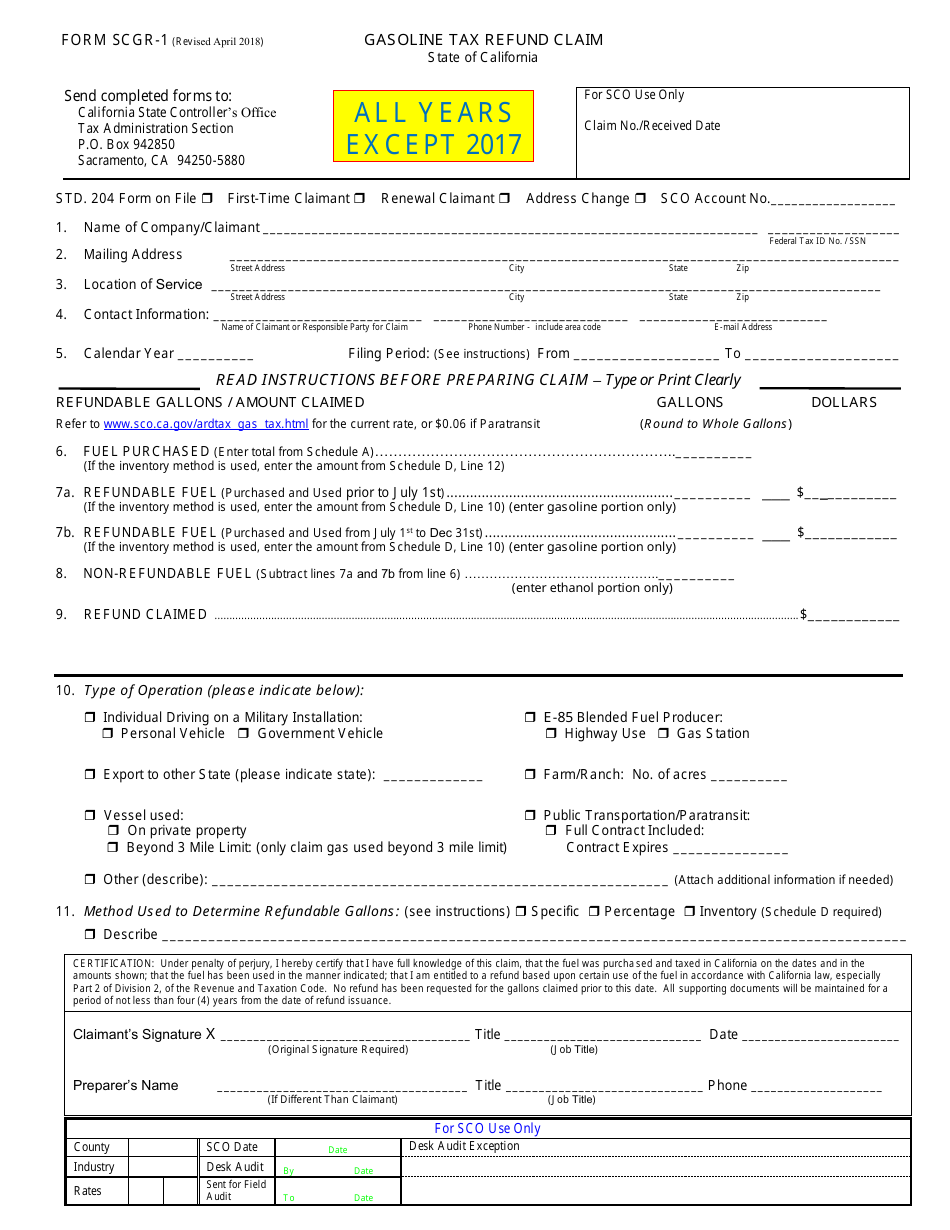

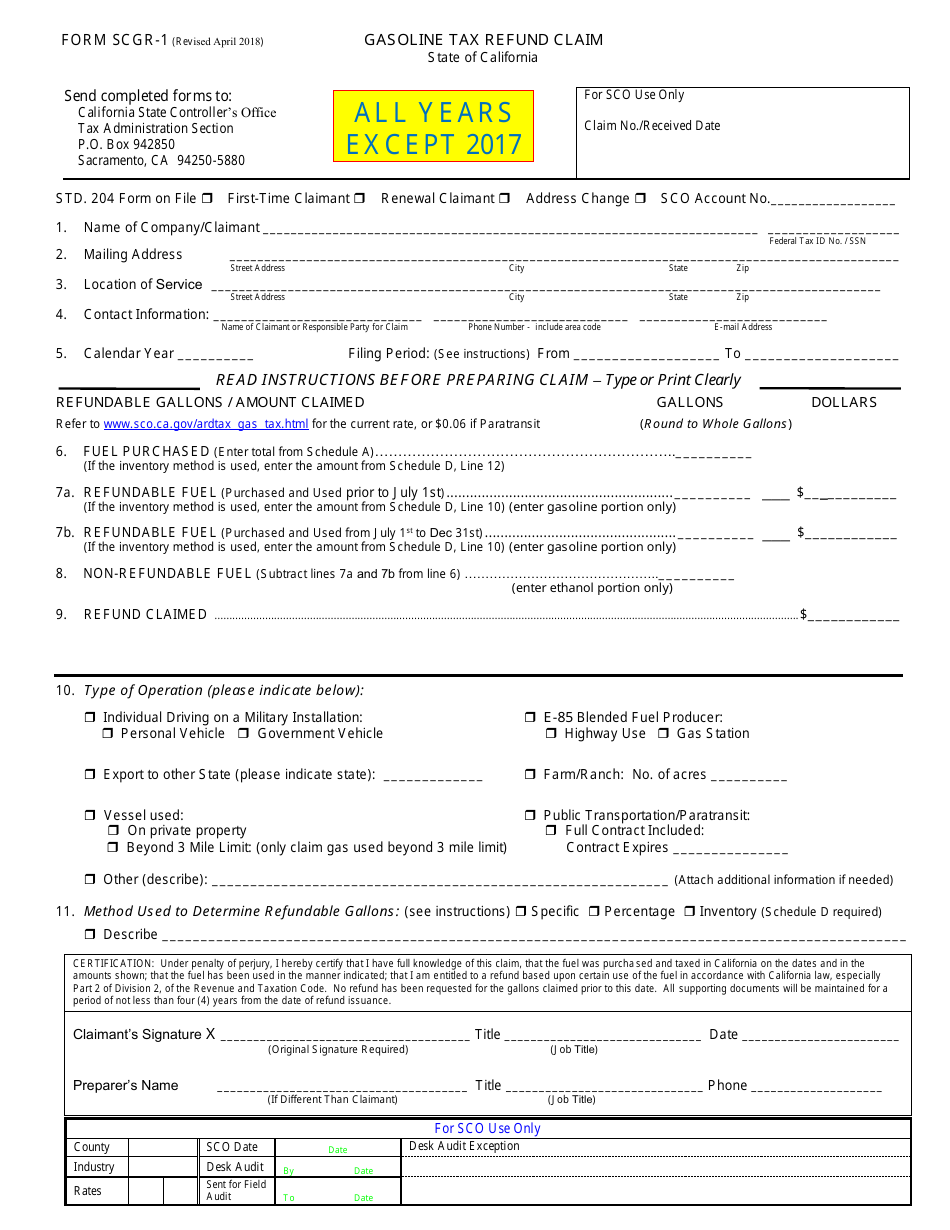

Form SCGR 1 Fill Out Sign Online And Download Fillable PDF

https://dor.georgia.gov/taxes/motor-fuel-tax

Web Motor Fuel Tax is an excise tax imposed on the sale of motor fuel The Georgia Motor Fuel Tax Unit collects Motor Fuel Tax and administers and enforces the Georgia Motor Fuel

https://dor.georgia.gov/2022-23-suspension-georgia-motor-fuel-taxes-faqs

Web I remitted Georgia motor fuel excise tax on motor fuels sold during the Suspension Period How can I request a refund for the tax paid How can I request a refund for the tax

Web Motor Fuel Tax is an excise tax imposed on the sale of motor fuel The Georgia Motor Fuel Tax Unit collects Motor Fuel Tax and administers and enforces the Georgia Motor Fuel

Web I remitted Georgia motor fuel excise tax on motor fuels sold during the Suspension Period How can I request a refund for the tax paid How can I request a refund for the tax

Fillable Form Ga It Estimated Tax Return And Application For

Form Ga It Estimated Tax Return And Application For Extension Of Time

Form FDACS 01976 Download Fillable PDF Or Fill Online Natural Gas Fuel

Form SCGR 1 Fill Out Sign Online And Download Fillable PDF

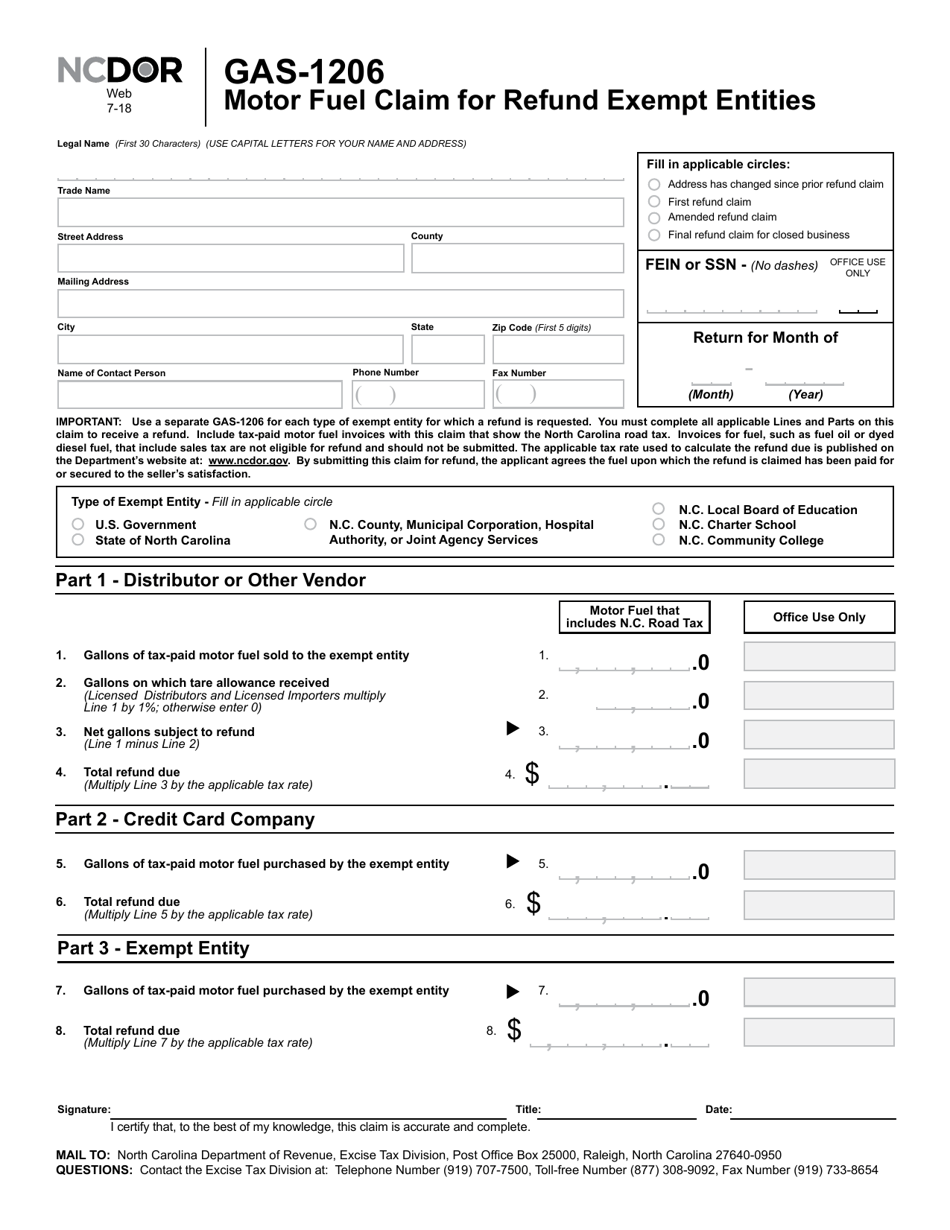

Form GAS 1206 Download Printable PDF Or Fill Online Motor Fuel Claim

National Fuel Printable Rebate Form Gas Rebates

National Fuel Printable Rebate Form Gas Rebates

P G And E Ev Rebate Printable Rebate Form