In the modern world of consumerization everyone is looking for a great deal. One way to earn significant savings on your purchases is to use Gst Housing Rebate Form 191s. Gst Housing Rebate Form 191s are marketing strategies used by manufacturers and retailers to offer customers a partial refund for their purchases after they have bought them. In this post, we'll take a look at the world that is Gst Housing Rebate Form 191s and explore the nature of them as well as how they work and how to maximize your savings with these cost-effective incentives.

Get Latest Gst Housing Rebate Form 191 Below

Gst Housing Rebate Form 191

Gst Housing Rebate Form 191 - Gst Housing Rebate Form 191, Gst New Housing Rebate Eligibility, Gst Rebate Income Limit

Web If you are eligible use the following forms to apply for an owner built housing rebate To recover the GST or federal part of the HST fill out Form GST191 GST HST New

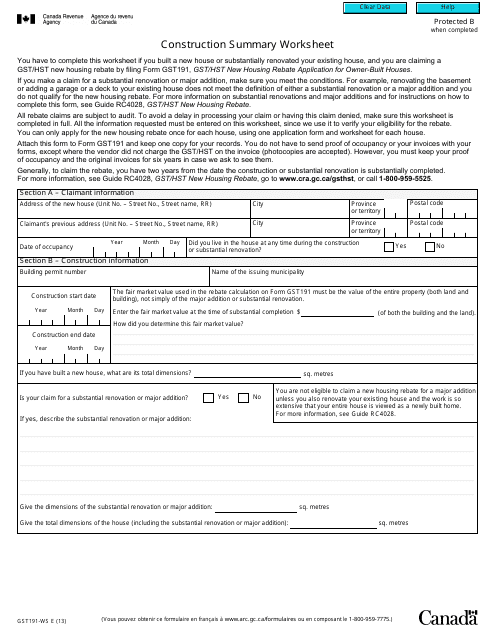

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

A Gst Housing Rebate Form 191 at its most basic description, is a payment to a consumer after they've purchased a good or service. It is a powerful tool used by businesses to attract customers, increase sales, or promote a specific product.

Types of Gst Housing Rebate Form 191

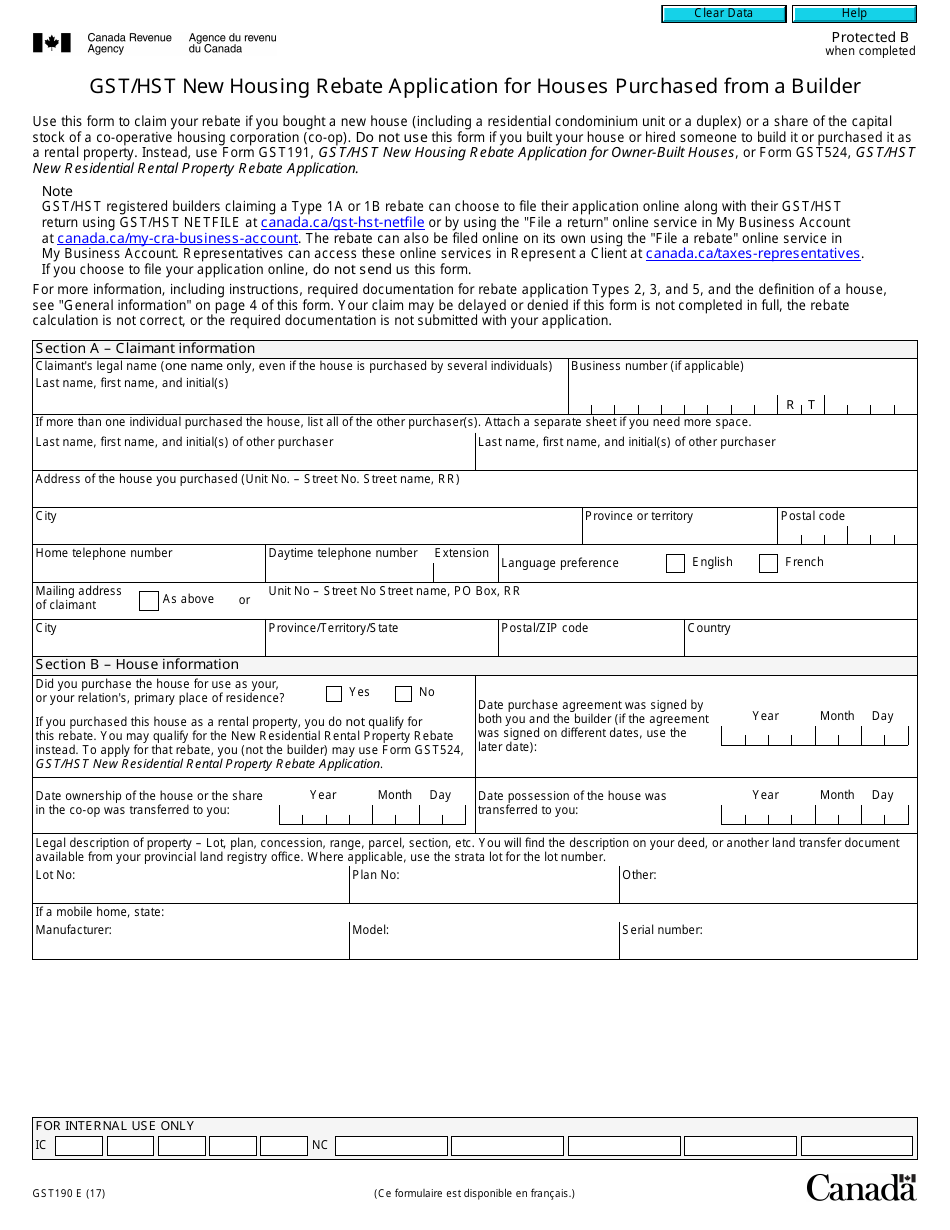

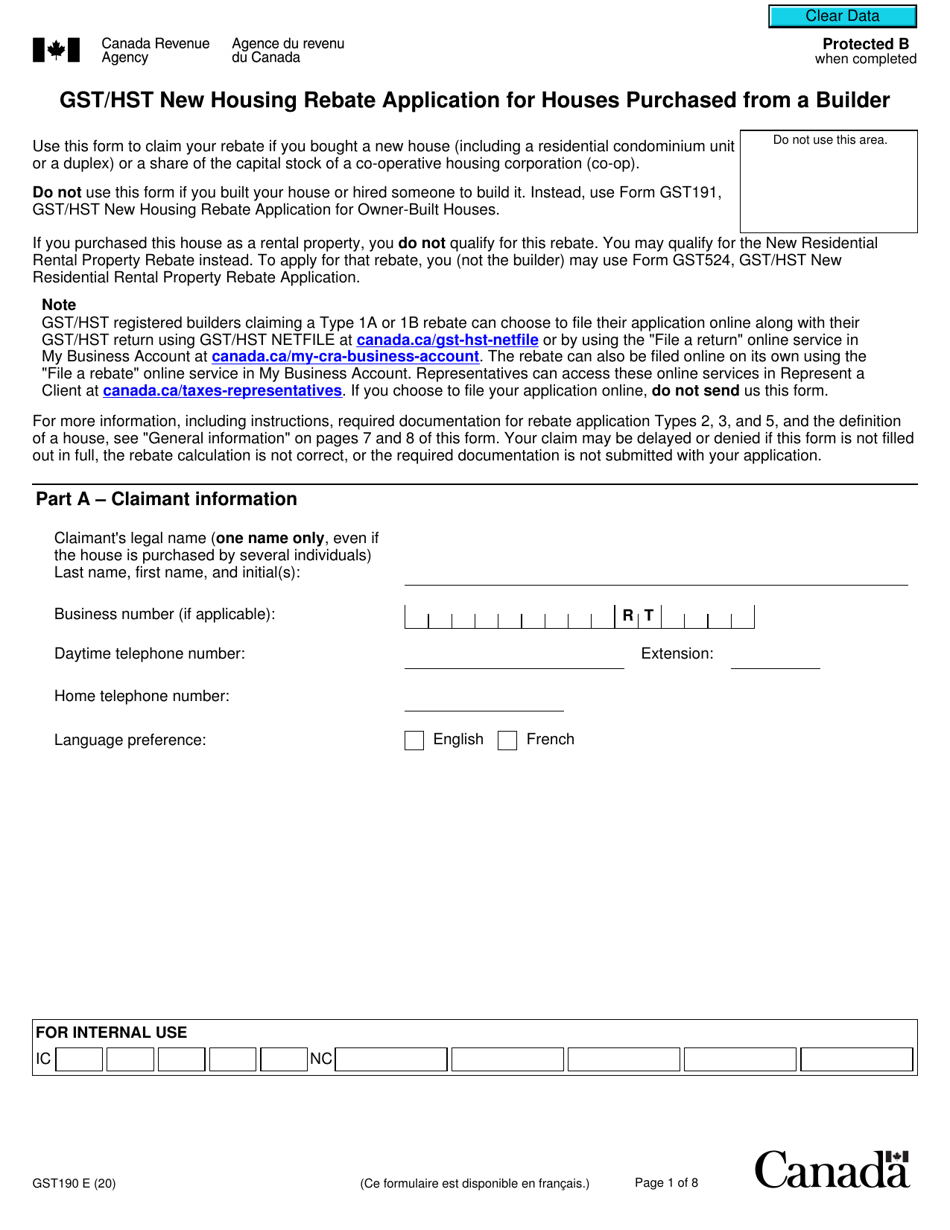

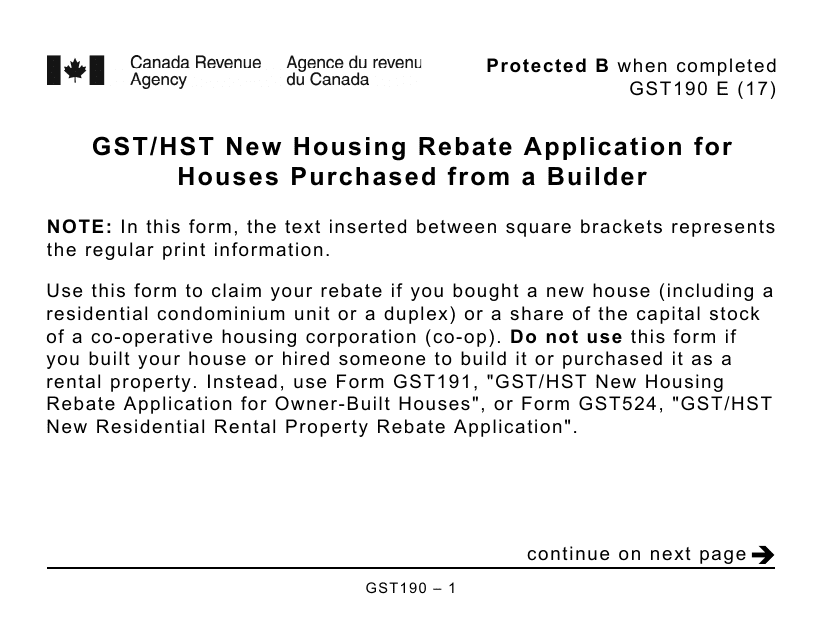

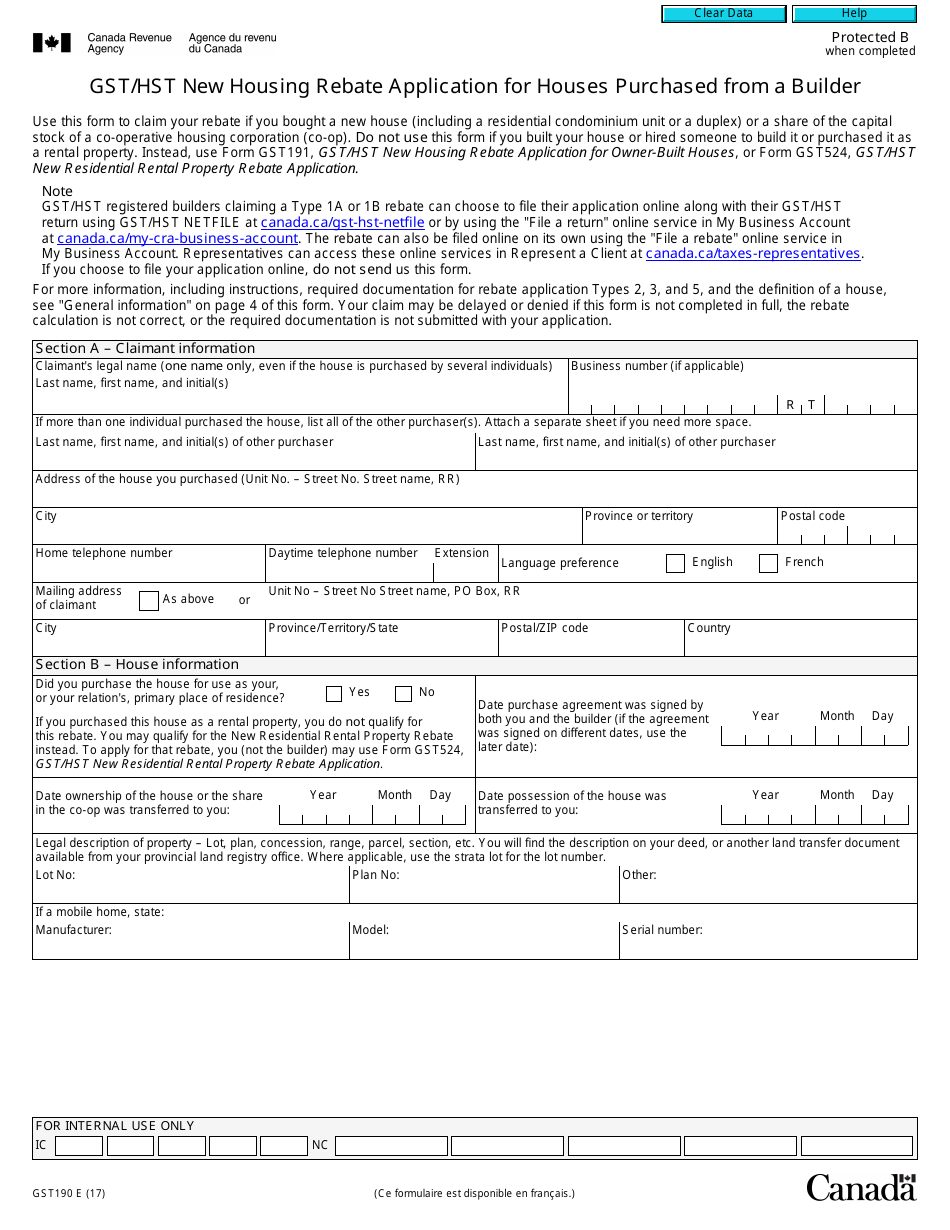

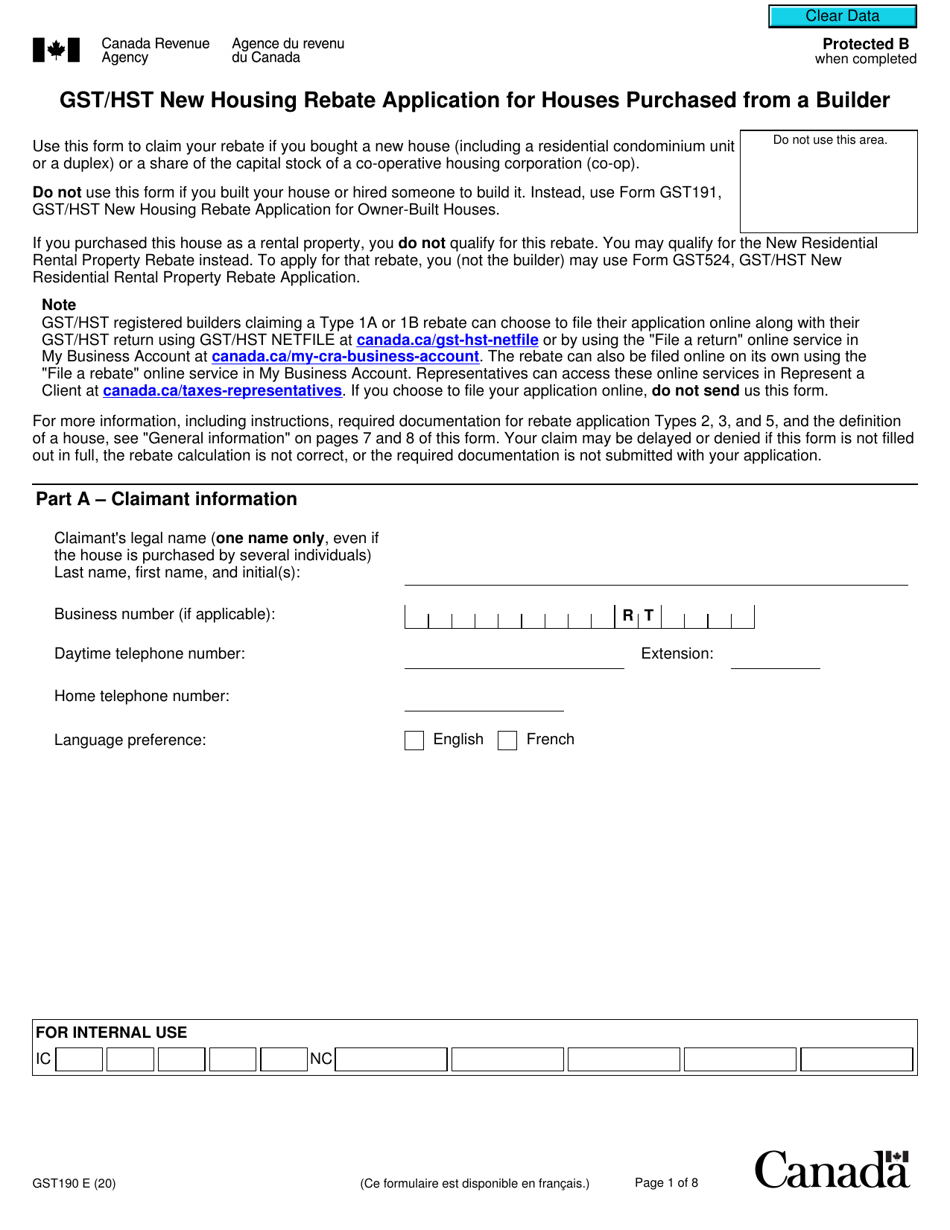

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

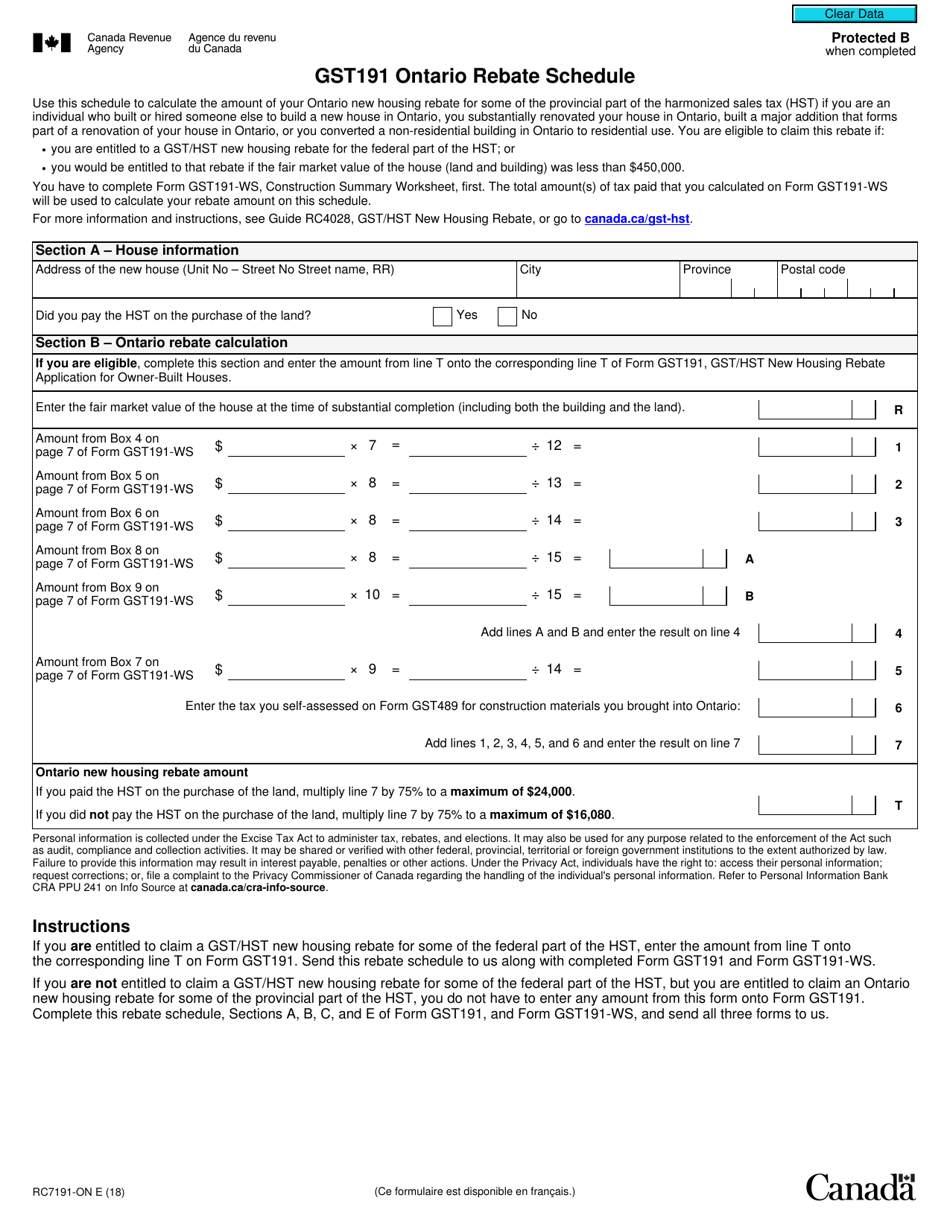

Web The total amount of tax paid that you calculate on Form GST191 WS will be used to calculate your rebate amount on this form You have to send us both forms and Form

Web Use this form to claim your rebate if you bought a new house including a residential condominium unit or a share of the capital stock of a co operative housing corporation

Cash Gst Housing Rebate Form 191

Cash Gst Housing Rebate Form 191 can be the simplest type of Gst Housing Rebate Form 191. Customers get a set amount of money back upon purchasing a item. These are typically applied to big-ticket items, like electronics and appliances.

Mail-In Gst Housing Rebate Form 191

Mail-in Gst Housing Rebate Form 191 require customers to send in the proof of purchase to be eligible for the money. They're a bit more involved but can offer huge savings.

Instant Gst Housing Rebate Form 191

Instant Gst Housing Rebate Form 191 are credited at the point of sale, reducing the cost of purchase immediately. Customers don't have to wait until they can save in this manner.

How Gst Housing Rebate Form 191 Work

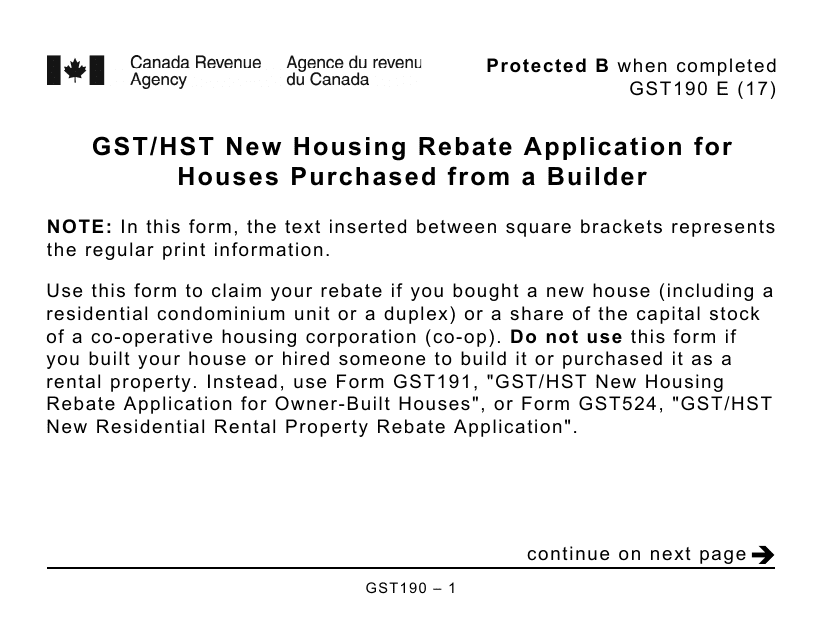

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Web 20 mai 2021 nbsp 0183 32 This will determine the amount of tax paid that you will use to calculate your rebate amount on Form GST191 GST HST New Housing Rebate Application for Owner Built Houses and if you are entitled to

The Gst Housing Rebate Form 191 Process

The process typically involves a few easy steps:

-

Buy the product: At first you purchase the item as you normally would.

-

Complete your Gst Housing Rebate Form 191 template: You'll have be able to provide a few details like your name, address, and purchase details, in order to be eligible for a Gst Housing Rebate Form 191.

-

You must submit the Gst Housing Rebate Form 191: Depending on the kind of Gst Housing Rebate Form 191, you may need to send in a form, or send it via the internet.

-

Wait until the company approves: The company will examine your application to make sure that it's in accordance with the Gst Housing Rebate Form 191's terms and conditions.

-

Redeem your Gst Housing Rebate Form 191 When it's approved you'll receive your money back, either by check, prepaid card or through a different method as specified by the offer.

Pros and Cons of Gst Housing Rebate Form 191

Advantages

-

Cost Savings Rewards can drastically cut the price you pay for the product.

-

Promotional Deals They encourage customers to test new products or brands.

-

Accelerate Sales A Gst Housing Rebate Form 191 program can boost the company's sales as well as market share.

Disadvantages

-

Complexity Mail-in Gst Housing Rebate Form 191 in particular they can be time-consuming and lengthy.

-

The Expiration Dates A lot of Gst Housing Rebate Form 191 have the strictest deadlines for submission.

-

Risk of Not Being Paid Certain customers could not receive their refunds if they don't follow the rules precisely.

Download Gst Housing Rebate Form 191

Download Gst Housing Rebate Form 191

FAQs

1. Are Gst Housing Rebate Form 191 the same as discounts? No, the Gst Housing Rebate Form 191 will be a partial refund after purchase, while discounts reduce their price at time of sale.

2. Can I get multiple Gst Housing Rebate Form 191 on the same item? It depends on the terms on the Gst Housing Rebate Form 191 offer and also the item's quality and eligibility. Certain companies might allow it, while other companies won't.

3. What is the time frame to get a Gst Housing Rebate Form 191? The length of time is variable, however it can range from several weeks to couple of months for you to receive your Gst Housing Rebate Form 191.

4. Do I need to pay tax with respect to Gst Housing Rebate Form 191 montants? the majority of cases, Gst Housing Rebate Form 191 amounts are not considered taxable income.

5. Can I trust Gst Housing Rebate Form 191 deals from lesser-known brands It is essential to investigate and ensure that the business providing the Gst Housing Rebate Form 191 is reputable prior to making an purchase.

Form RC7191 ON Download Fillable PDF Or Fill Online Gst191 Ontario

Gst191 Fillable Form Printable Forms Free Online

Check more sample of Gst Housing Rebate Form 191 below

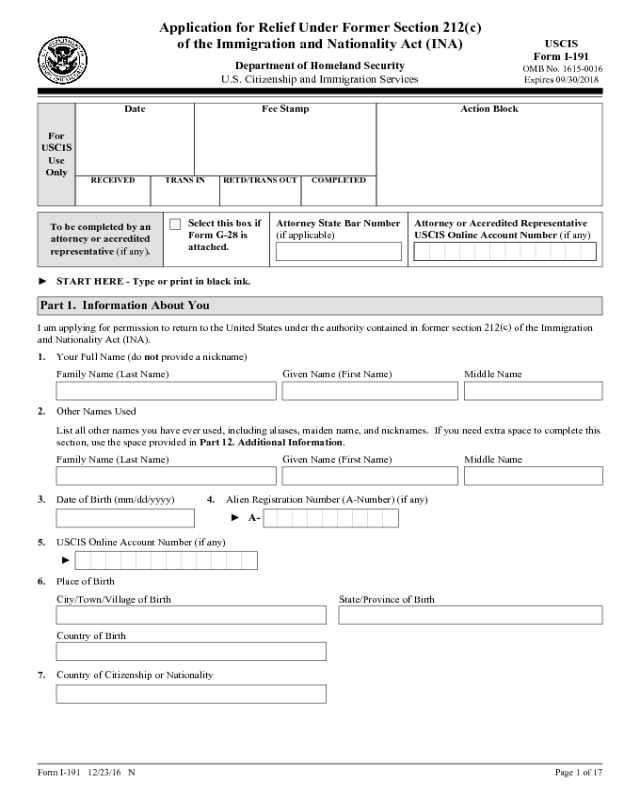

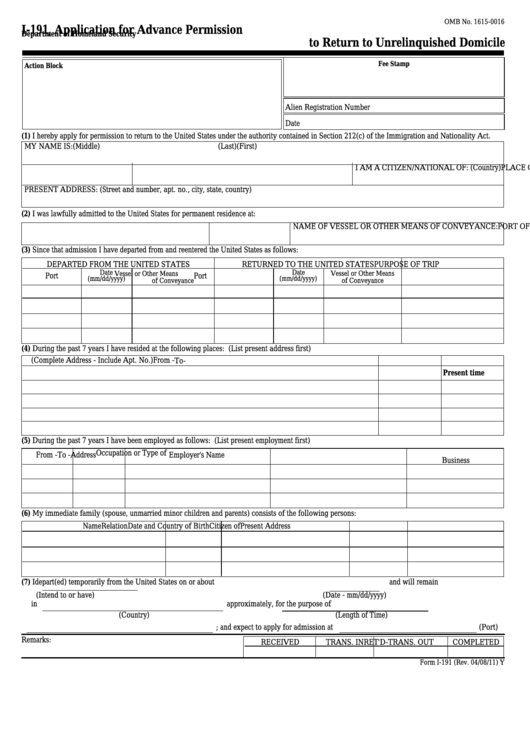

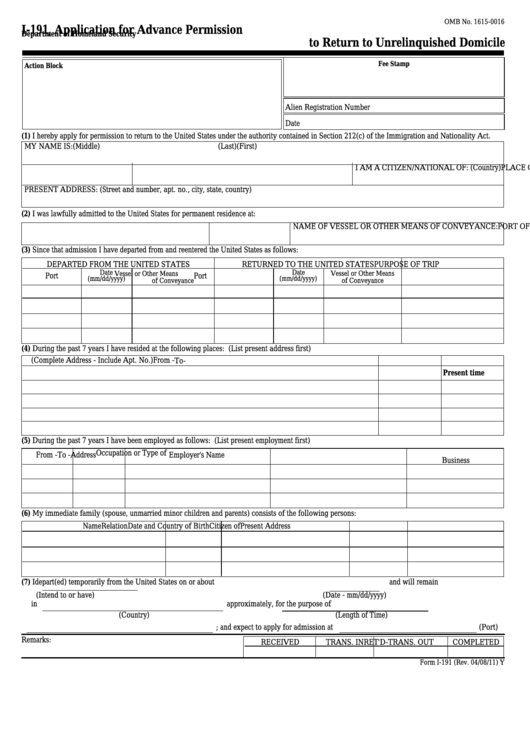

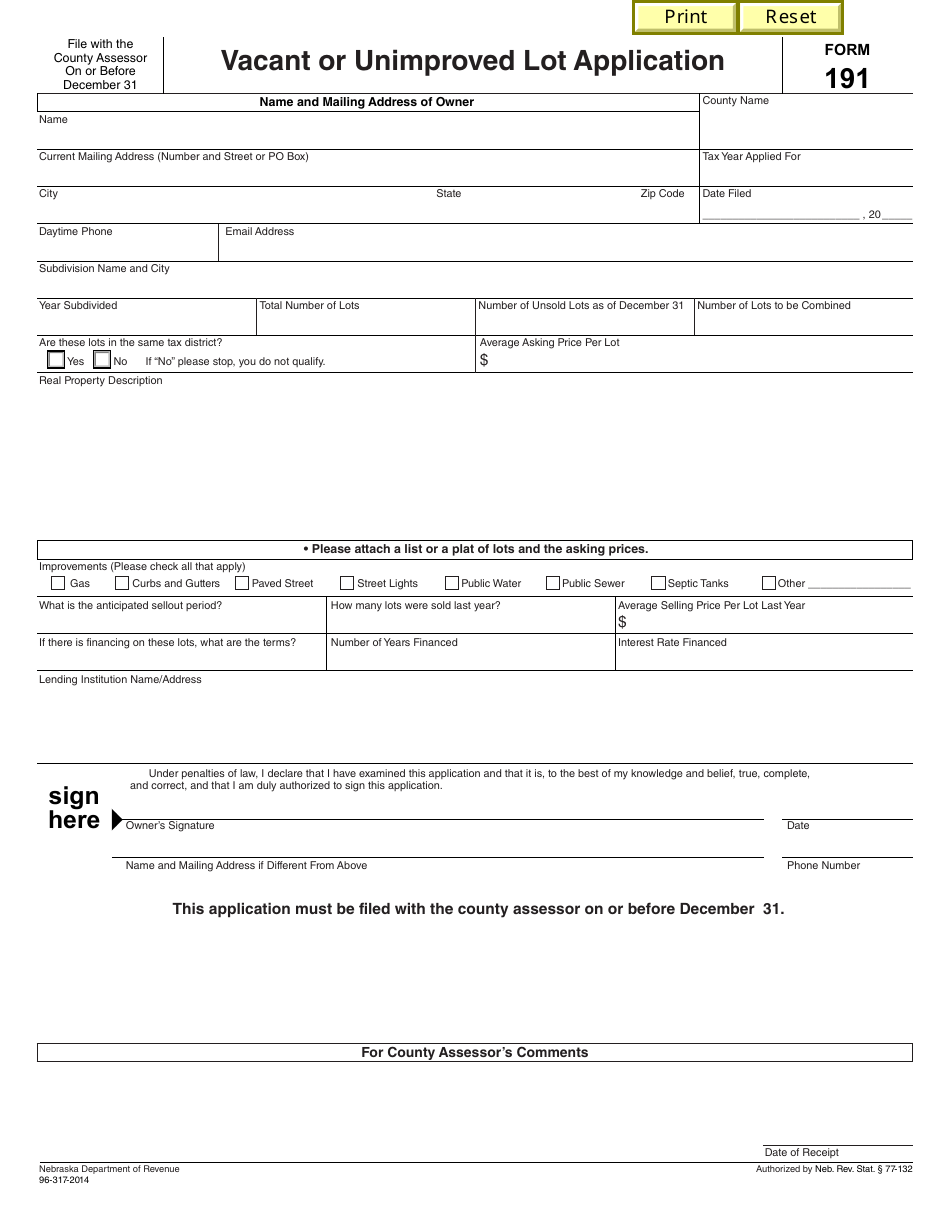

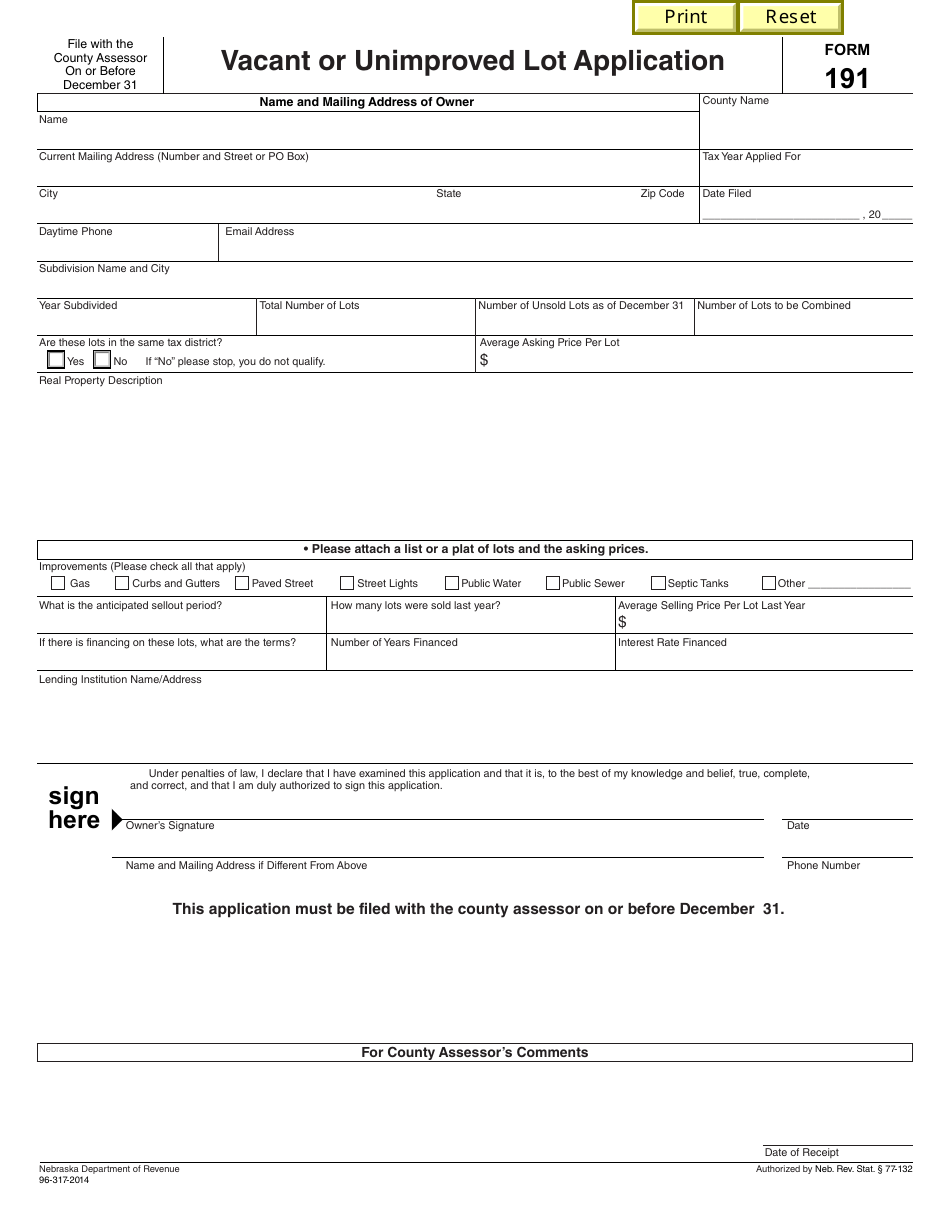

Form I 191 Edit Fill Sign Online Handypdf

Fillable Form I 191 Application For Advance Permission To Return To

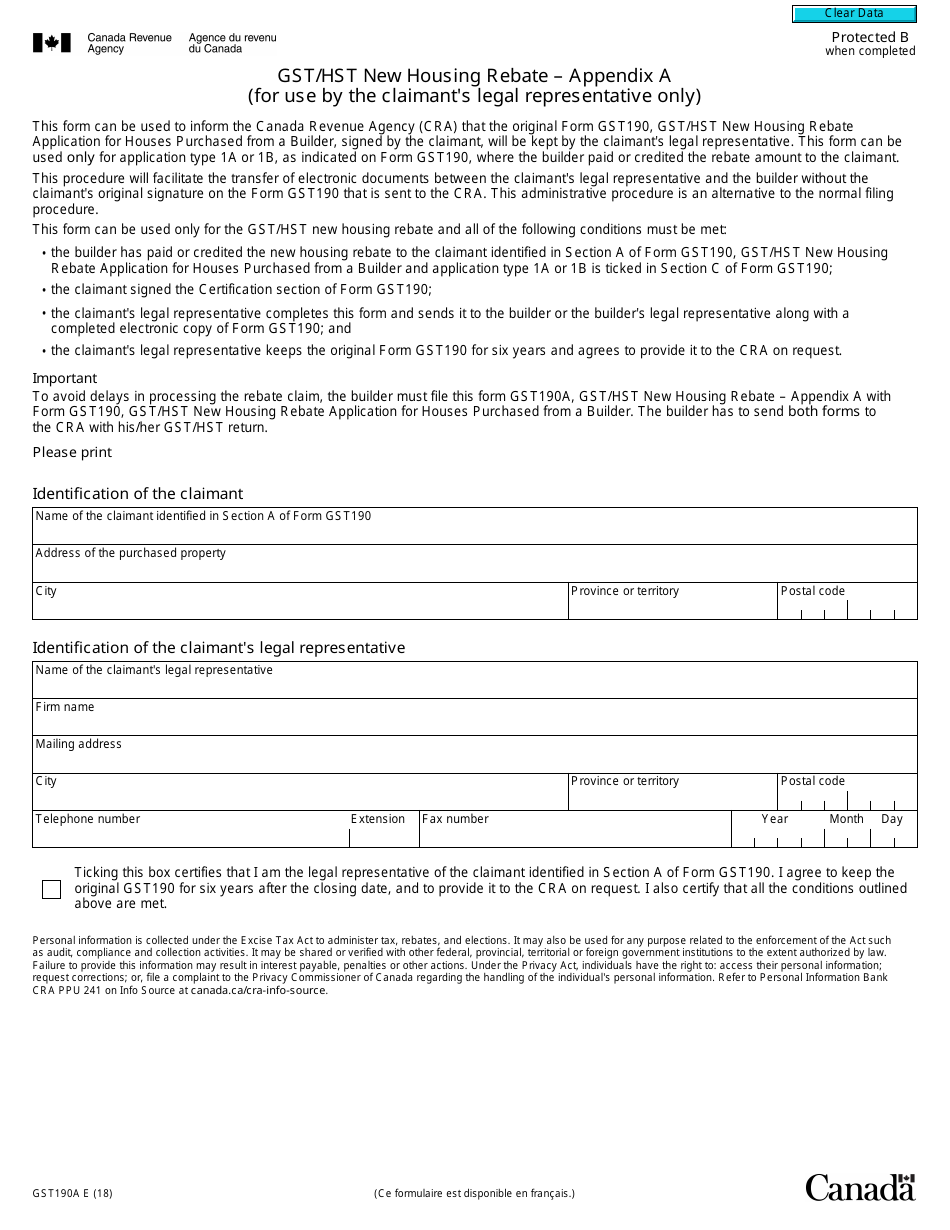

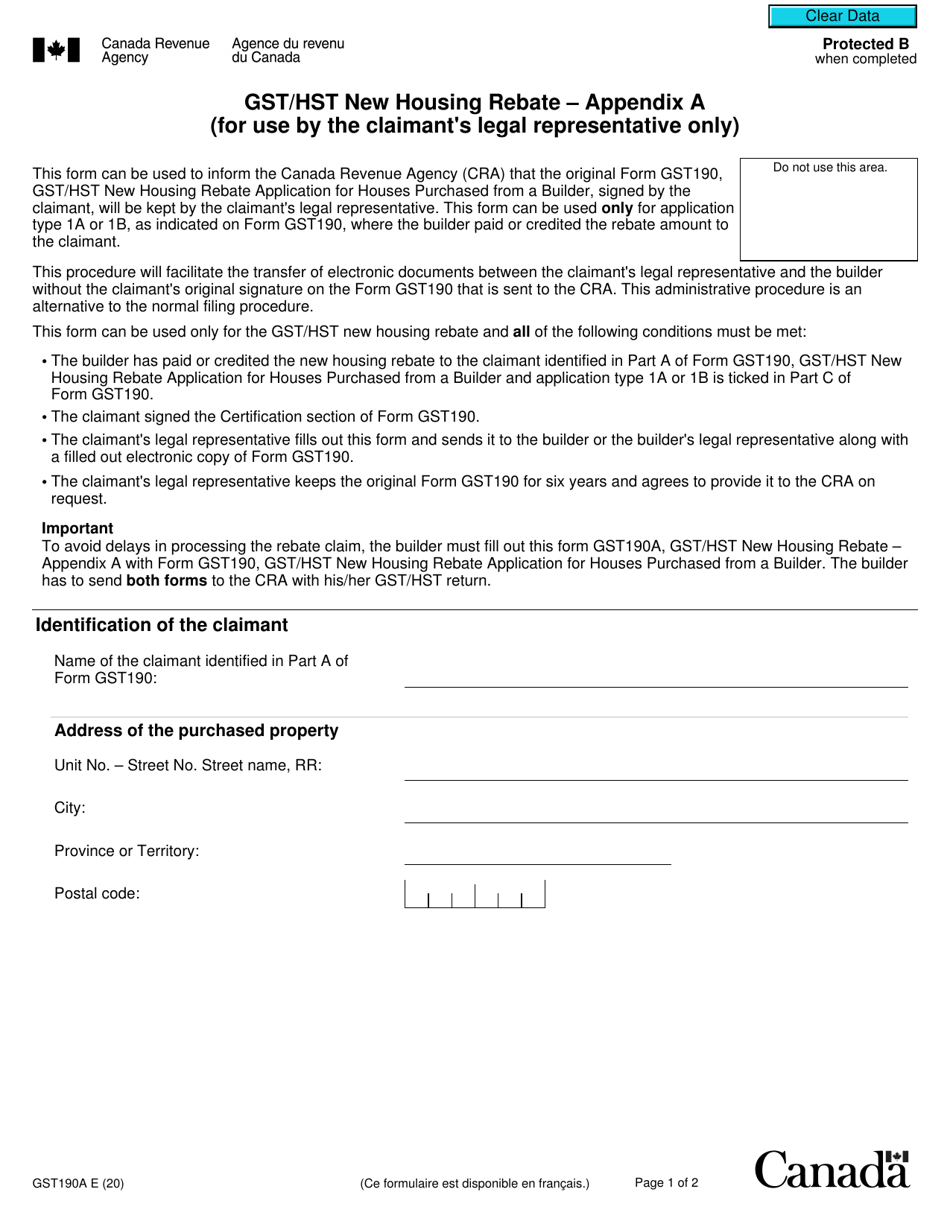

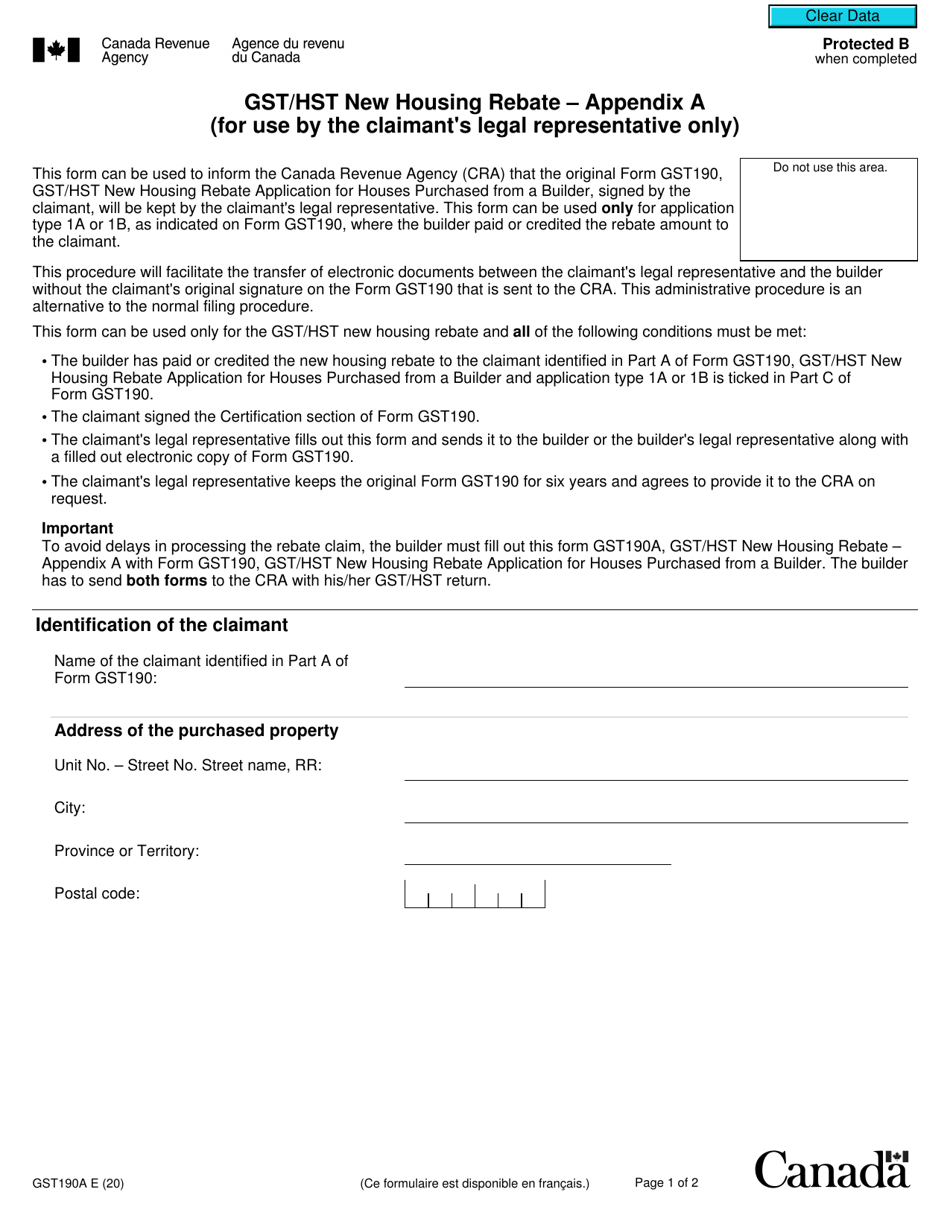

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

Form GST190A Appendix A Download Fillable PDF Or Fill Online Gst Hst

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST190 Download Printable PDF Or Fill Online Gst Hst New Housing

https://www.canada.ca/.../services/forms-publications/forms/gst191-ws.html

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Web 17 juin 2022 nbsp 0183 32 RC4028 GST HST New Housing Rebate You can view this publication in HTML rc4028 e html PDF rc4028 22e pdf Last update 2022 06 17

Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

Web 17 juin 2022 nbsp 0183 32 RC4028 GST HST New Housing Rebate You can view this publication in HTML rc4028 e html PDF rc4028 22e pdf Last update 2022 06 17

Form GST190A Appendix A Download Fillable PDF Or Fill Online Gst Hst

Fillable Form I 191 Application For Advance Permission To Return To

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Form GST190 Download Printable PDF Or Fill Online Gst Hst New Housing

Gst Hst New Housing Rebate Application For Owner Built Houses

Form 191 Download Fillable PDF Or Fill Online Vacant Or Unimproved Lot

Form 191 Download Fillable PDF Or Fill Online Vacant Or Unimproved Lot

Gst Hst New Housing Rebate Application For Owner Built Houses