In today's world of consumerism, everyone loves a good bargain. One way to earn substantial savings on your purchases is to use Energy Incentivess. Energy Incentivess are a strategy for marketing employed by retailers and manufacturers to offer customers a partial discount on purchases they made after they've placed them. In this post, we'll delve into the world of Energy Incentivess. We'll discuss the nature of them and how they function, and how to maximize your savings via these cost-effective incentives.

Get Latest Energy Incentives Below

Energy Incentives

Energy Incentives -

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC

Investments in energy transition technologies hit a record 1 3 trillion in 2022 Here are some initiatives helping households to shift to renewables

A Energy Incentives as it is understood in its simplest form, is a cash refund provided to customers after they've purchased a good or service. It's a highly effective tool employed by companies to draw customers, increase sales and to promote certain products.

Types of Energy Incentives

Renewable Energy Incentives Kaukauna Utilities

Renewable Energy Incentives Kaukauna Utilities

Energy Incentives for Individuals Residential Property Updated Questions and Answers Internal Revenue Service Q Are there incentives for making your home

The Power of Incentives in Energy Efficiency Incentives have been proven to be powerful drivers for energy efficiency initiatives By offering rewards and benefits

Cash Energy Incentives

Cash Energy Incentives are a simple type of Energy Incentives. Customers are given a certain amount of money after purchasing a product. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Energy Incentives

Mail-in Energy Incentives require consumers to send in their proof of purchase before receiving their cash back. They are a bit more involved but offer huge savings.

Instant Energy Incentives

Instant Energy Incentives are made at the point of sale, and can reduce your purchase cost instantly. Customers do not have to wait until they can save by using this method.

How Energy Incentives Work

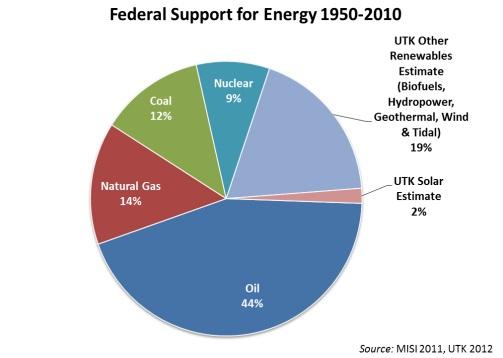

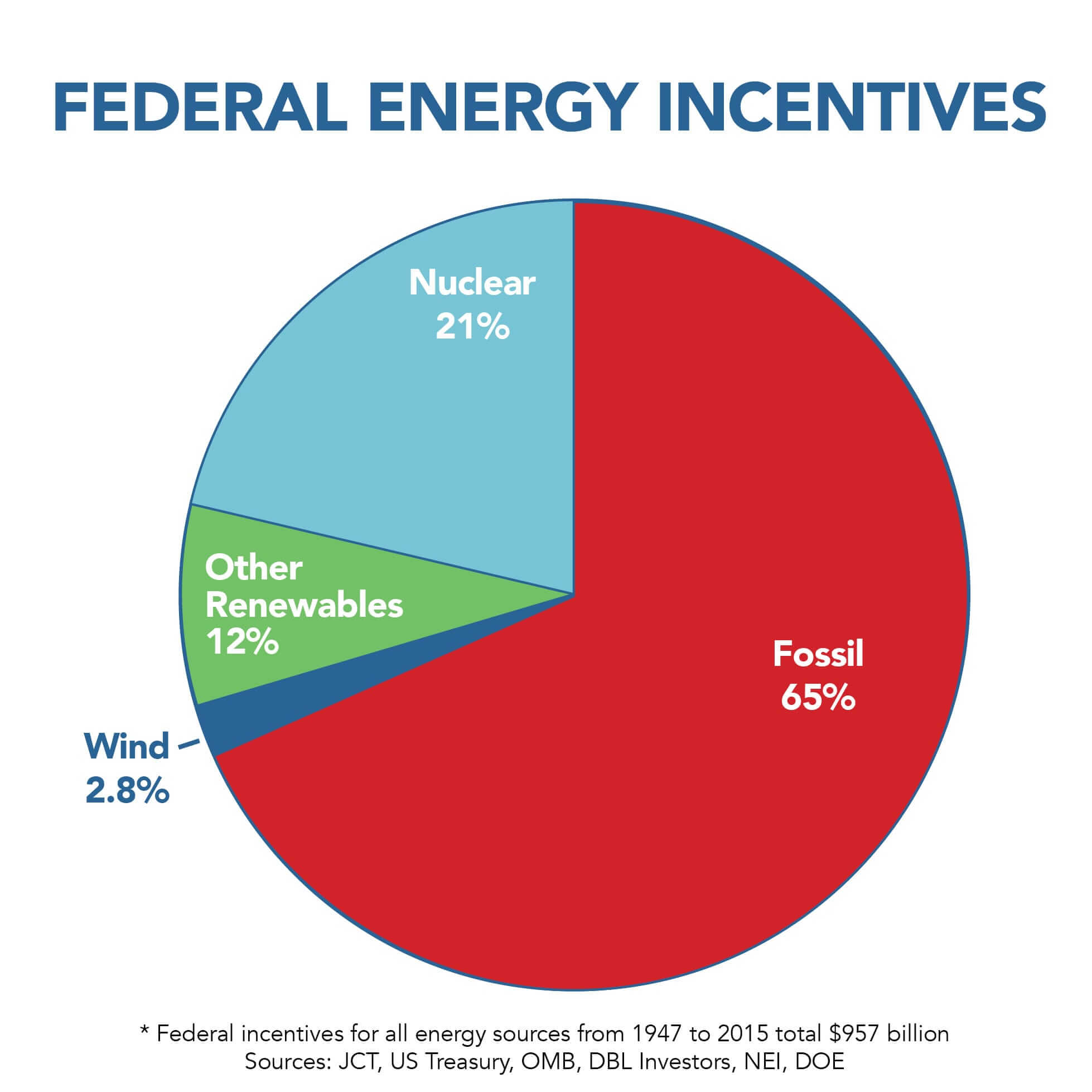

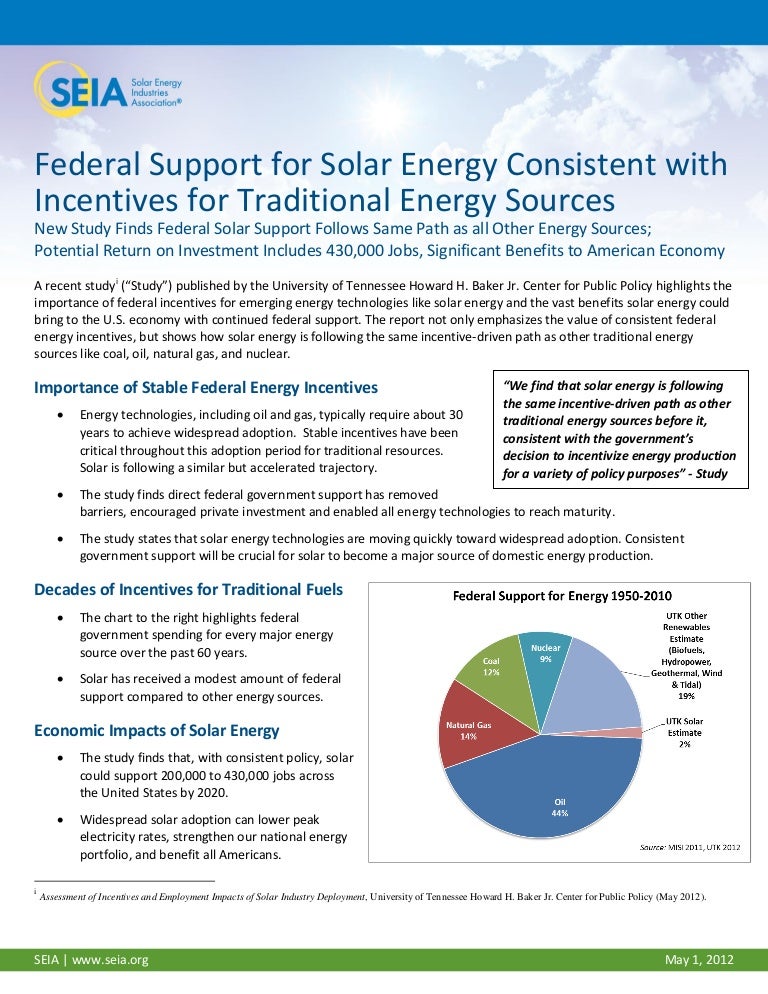

Federal Government Does Not Give Solar Industry special Support

Federal Government Does Not Give Solar Industry special Support

Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and

The Energy Incentives Process

The procedure usually involves a handful of simple steps:

-

Purchase the item: First, you buy the product like you normally do.

-

Complete this Energy Incentives request form. You'll have to provide some information, such as your name, address along with the purchase details, in order to be eligible for a Energy Incentives.

-

In order to submit the Energy Incentives It is dependent on the nature of Energy Incentives you could be required to mail in a form or send it via the internet.

-

Wait until the company approves: The company will scrutinize your submission and ensure that it's compliant with guidelines and conditions of the Energy Incentives.

-

Enjoy your Energy Incentives Once you've received your approval, you'll be able to receive your reimbursement, via check, prepaid card, or a different method specified by the offer.

Pros and Cons of Energy Incentives

Advantages

-

Cost savings Energy Incentives are a great way to reduce the cost for the item.

-

Promotional Deals These deals encourage customers to experiment with new products, or brands.

-

Increase Sales The benefits of a Energy Incentives can improve an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Energy Incentives, particularly difficult and slow-going.

-

Days of expiration A lot of Energy Incentives have extremely strict deadlines to submit.

-

Risk of Not Being Paid Certain customers could not be able to receive their Energy Incentives if they don't adhere to the requirements exactly.

Download Energy Incentives

FAQs

1. Are Energy Incentives similar to discounts? No, Energy Incentives are a partial refund upon purchase, while discounts lower their price at time of sale.

2. Can I use multiple Energy Incentives for the same product It is contingent on the terms for the Energy Incentives deals and product's potential eligibility. Certain companies may permit it, while some won't.

3. How long does it take to receive an Energy Incentives? The timing is variable, however it can be anywhere from a few weeks up to a few months to receive your Energy Incentives.

4. Do I have to pay taxes when I receive Energy Incentives funds? most instances, Energy Incentives amounts are not considered to be taxable income.

5. Can I trust Energy Incentives offers from brands that aren't well-known it is crucial to conduct research to ensure that the name which is providing the Energy Incentives is reliable prior to making the purchase.

New Analysis Wind Energy Less Than 3 Percent Of All Federal Energy

Alternative Energy Incentives Green Energy Government Derivatives

Check more sample of Energy Incentives below

Incentives And Rebates For Residential Energy Efficiency Improvements

Energy Incentive Programs Energy Discounts And Savings

California Solar Energy Incentives List 2023

Iff energy incentives 550x1850 Doeren Mayhew

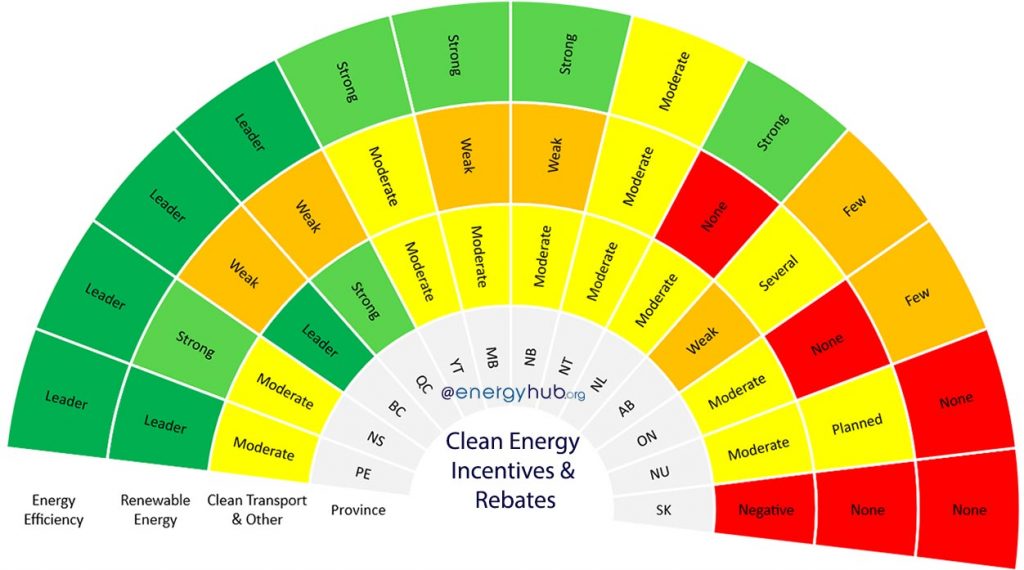

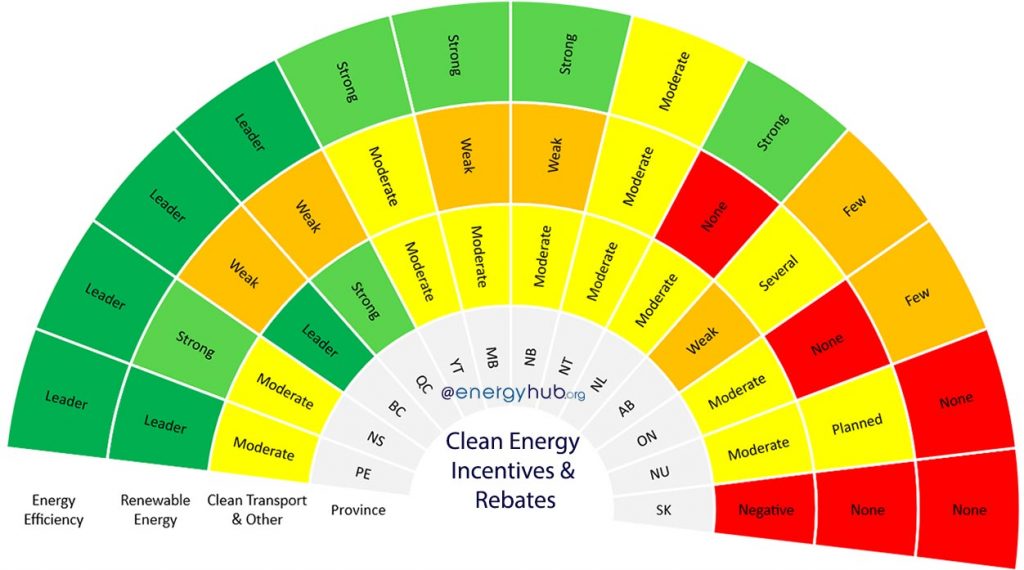

Clean Energy Incentives Rebates Canada Updated 2021

Learn More About CO State Energy Incentives Going Green E3Power

https://www.weforum.org/agenda/2023/05/ren…

Investments in energy transition technologies hit a record 1 3 trillion in 2022 Here are some initiatives helping households to shift to renewables

https://www.energy.gov/energysaver/financing-and-incentives

Energy Saver Resources Financing and Incentives Consumers can find financial incentives and assistance for energy efficient and renewable energy products and

Investments in energy transition technologies hit a record 1 3 trillion in 2022 Here are some initiatives helping households to shift to renewables

Energy Saver Resources Financing and Incentives Consumers can find financial incentives and assistance for energy efficient and renewable energy products and

Iff energy incentives 550x1850 Doeren Mayhew

Energy Incentive Programs Energy Discounts And Savings

Clean Energy Incentives Rebates Canada Updated 2021

Learn More About CO State Energy Incentives Going Green E3Power

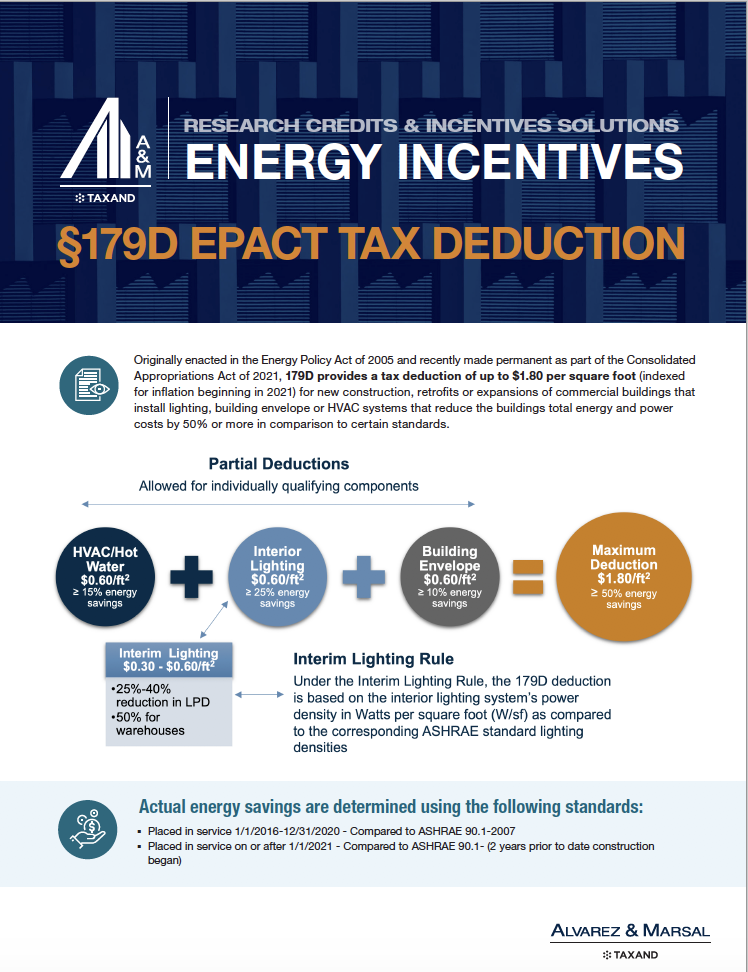

Energy Incentives 179D EPact Tax Deduction Alvarez Marsal

Renewable Energy Incentive

Renewable Energy Incentive

Federal Energy Incentives Fact Sheet