In today's world of consumerism everyone is looking for a great bargain. One way to score significant savings for your purchases is through Pennsylvania Real Estate Tax Rebate Forms. The use of Pennsylvania Real Estate Tax Rebate Forms is a method used by manufacturers and retailers to provide customers with a partial return on their purchases once they've placed them. In this article, we will delve into the world of Pennsylvania Real Estate Tax Rebate Forms, examining what they are, how they work, and how you can maximise the value of these incentives.

Get Latest Pennsylvania Real Estate Tax Rebate Form Below

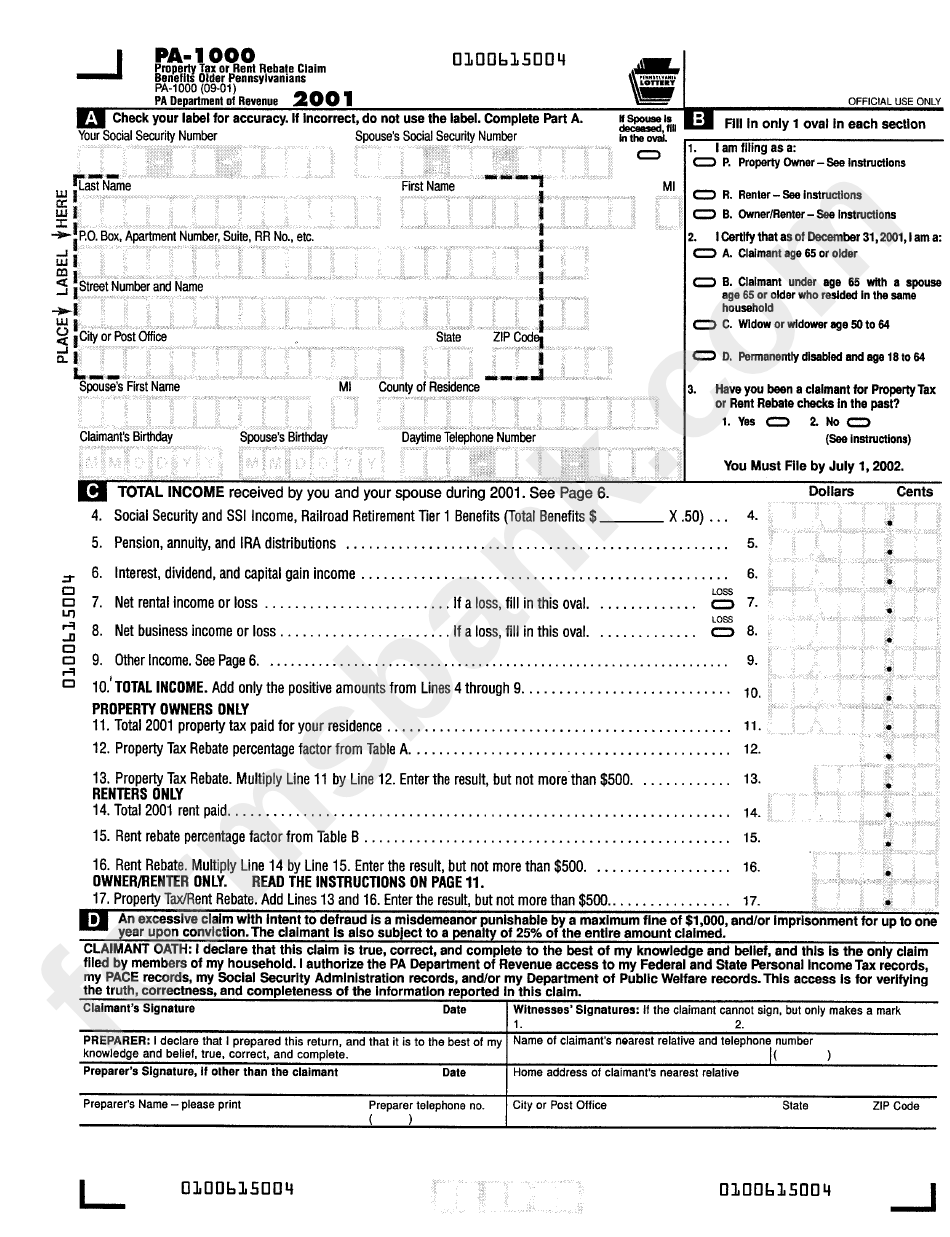

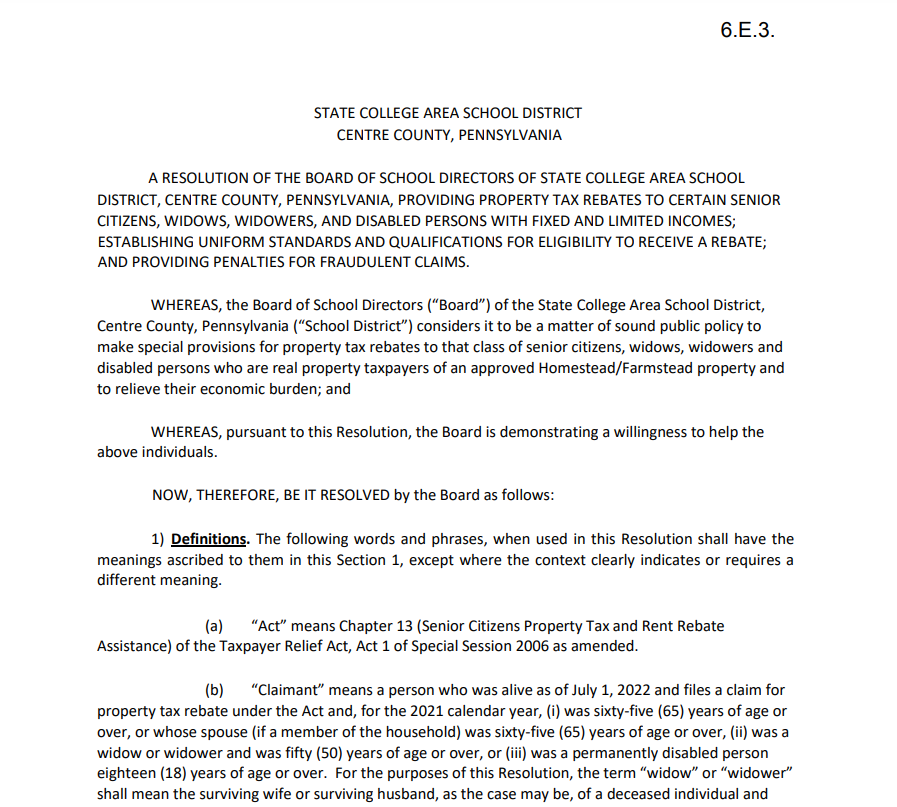

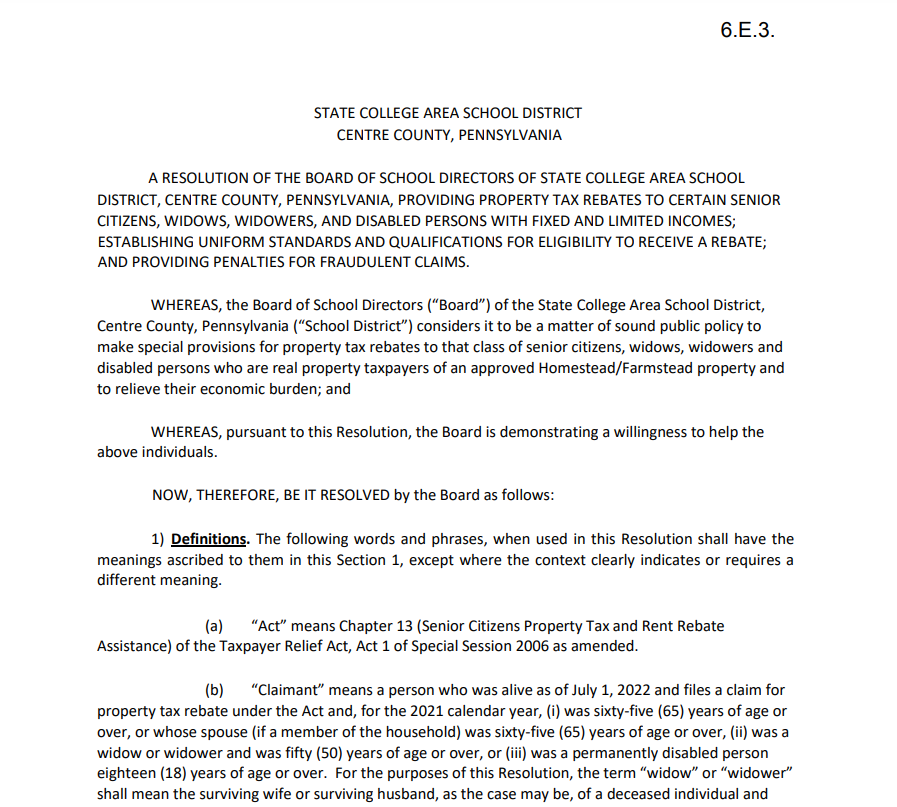

Pennsylvania Real Estate Tax Rebate Form

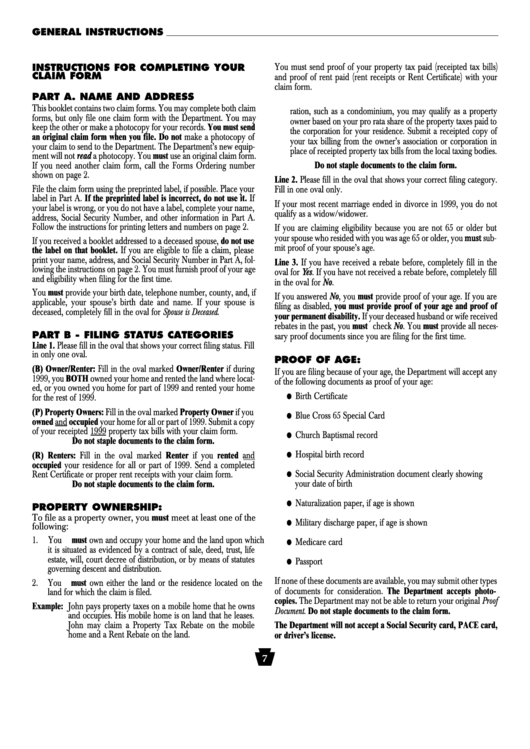

Pennsylvania Real Estate Tax Rebate Form - Pa Real Estate Tax Rebate Form, Pa Property Tax Rebate Form Instructions, Pa Property Tax Rebate Form 1000, Pa Property Tax Rebate Form Online, Where Is My Real Estate Tax Rebate, Pa Real Estate Tax Rebate Instructions, How Do I Get A Property Tax Rebate In Pa

Web PENNSYLVANIA DEPARTMENT OF REVENUE PROPERTY TAX RENT REBATE PROGRAM The Property Tax Rent Rebate program benefits eligible Pennsylvanians

Web The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one

A Pennsylvania Real Estate Tax Rebate Form the simplest form, is a partial payment to a consumer following the purchase of a product or service. It's an effective way used by businesses to attract customers, increase sales and market specific products.

Types of Pennsylvania Real Estate Tax Rebate Form

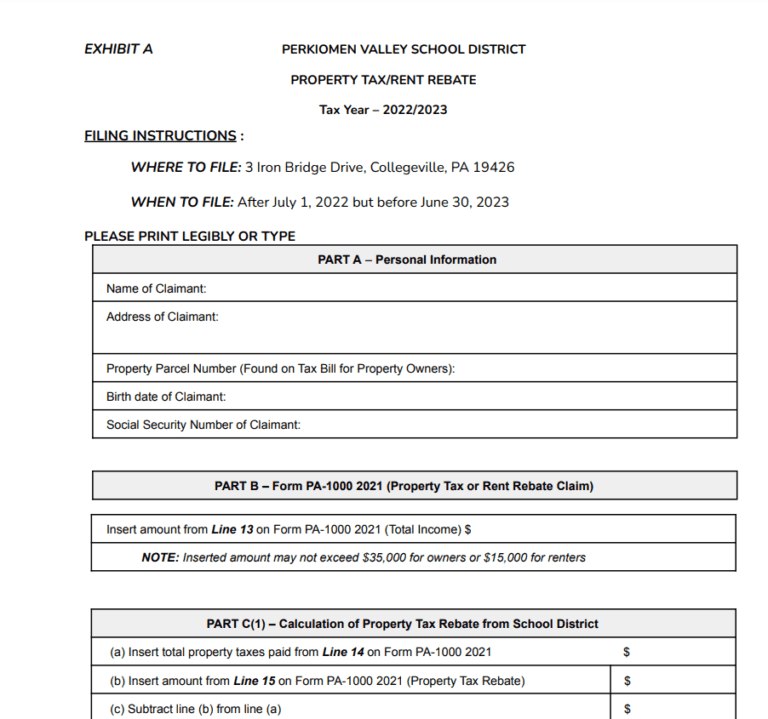

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

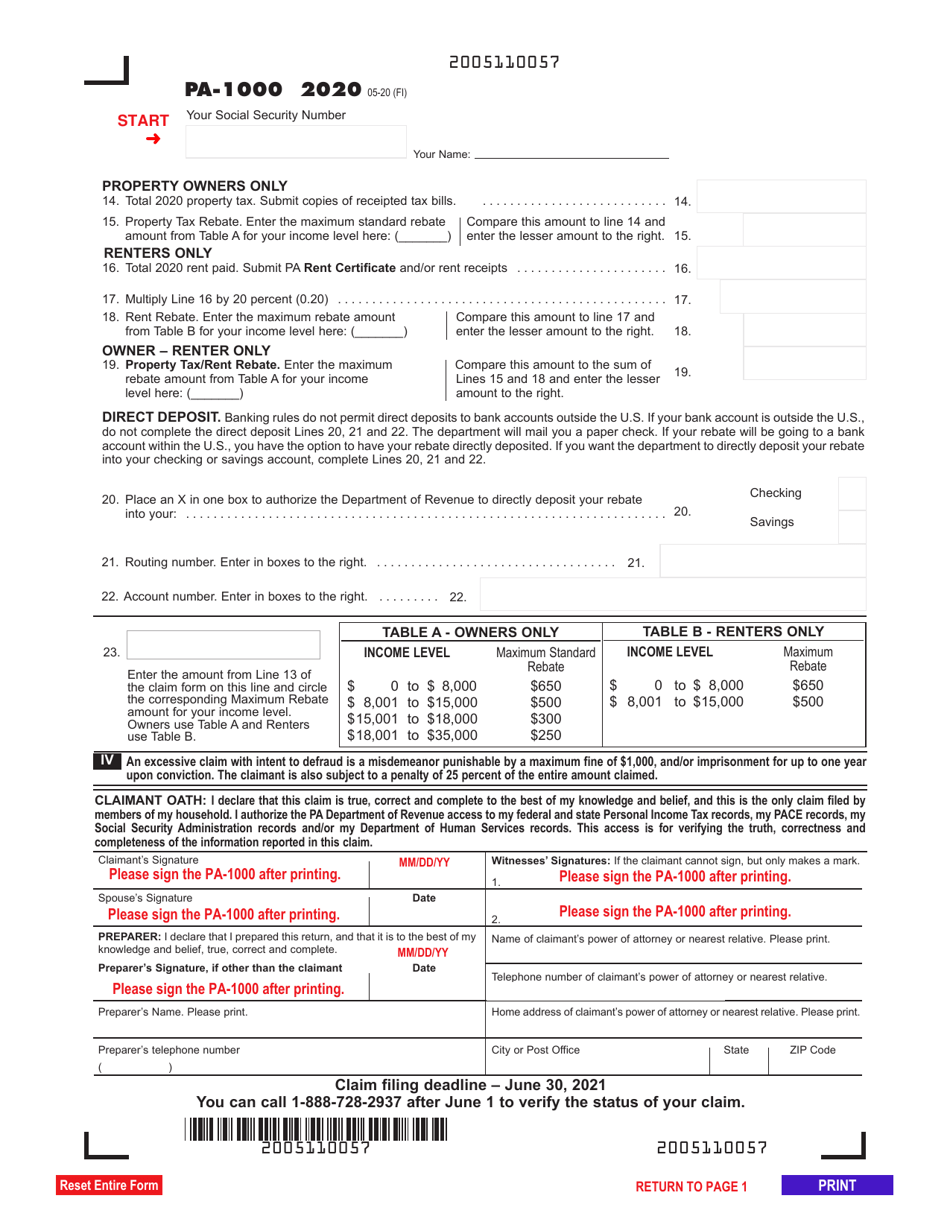

Web Rebate 0 to 8 000 650 8 001 to 15 000 500 Enter the amount from Line 13 of the claim form on this line and circle the corresponding Maximum Rebate amount for your

Web Pennsylvania Department of Revenue gt Online Services gt myPATH Information gt Individuals gt Property Tax Rent Rebate myPATH for Property Tax Rent Rebate

Cash Pennsylvania Real Estate Tax Rebate Form

Cash Pennsylvania Real Estate Tax Rebate Form is the most basic type of Pennsylvania Real Estate Tax Rebate Form. Customers are offered a certain amount of money when purchasing a particular item. These are typically for costly items like electronics or appliances.

Mail-In Pennsylvania Real Estate Tax Rebate Form

Mail-in Pennsylvania Real Estate Tax Rebate Form require that customers provide an evidence of purchase for their cash back. They're a bit more involved, but can result in substantial savings.

Instant Pennsylvania Real Estate Tax Rebate Form

Instant Pennsylvania Real Estate Tax Rebate Form apply at the point of sale, and can reduce your purchase cost instantly. Customers don't need to wait until they can save when they purchase this type of Pennsylvania Real Estate Tax Rebate Form.

How Pennsylvania Real Estate Tax Rebate Form Work

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Web claim form Rebate checks are mailed or sent via direct deposit beginning July 1 each year For more information about what documents can be used as proof of age or can be used

The Pennsylvania Real Estate Tax Rebate Form Process

It usually consists of a handful of simple steps:

-

Buy the product: Firstly you purchase the product like you would normally.

-

Fill out your Pennsylvania Real Estate Tax Rebate Form form: You'll need to give some specific information including your address, name, as well as the details of your purchase to make a claim for your Pennsylvania Real Estate Tax Rebate Form.

-

Complete the Pennsylvania Real Estate Tax Rebate Form Based on the type of Pennsylvania Real Estate Tax Rebate Form it is possible that you need to mail a Pennsylvania Real Estate Tax Rebate Form form in or submit it online.

-

Wait until the company approves: The company will examine your application to make sure that it's in accordance with the requirements of the Pennsylvania Real Estate Tax Rebate Form.

-

Receive your Pennsylvania Real Estate Tax Rebate Form After you've been approved, you'll get your refund, whether by check, prepaid card, or any other option specified by the offer.

Pros and Cons of Pennsylvania Real Estate Tax Rebate Form

Advantages

-

Cost Savings The use of Pennsylvania Real Estate Tax Rebate Form can greatly reduce the cost for the product.

-

Promotional Deals: They encourage customers to try new products or brands.

-

Increase Sales Reward programs can boost an organization's sales and market share.

Disadvantages

-

Complexity mail-in Pennsylvania Real Estate Tax Rebate Form particularly, can be cumbersome and costly.

-

Deadlines for Expiration Some Pennsylvania Real Estate Tax Rebate Form have rigid deadlines to submit.

-

Risk of Not Being Paid Some customers might not receive their Pennsylvania Real Estate Tax Rebate Form if they don't follow the rules precisely.

Download Pennsylvania Real Estate Tax Rebate Form

Download Pennsylvania Real Estate Tax Rebate Form

FAQs

1. Are Pennsylvania Real Estate Tax Rebate Form similar to discounts? Not at all, Pennsylvania Real Estate Tax Rebate Form provide only a partial reimbursement following the purchase, and discounts are a reduction of the price of the purchase at the time of sale.

2. Are there any Pennsylvania Real Estate Tax Rebate Form that I can use for the same product It is contingent on the conditions on the Pennsylvania Real Estate Tax Rebate Form offers and the product's qualification. Certain companies might allow it, but others won't.

3. How long will it take to receive the Pennsylvania Real Estate Tax Rebate Form What is the timeframe? differs, but it can take several weeks to a couple of months to receive your Pennsylvania Real Estate Tax Rebate Form.

4. Do I have to pay taxes with respect to Pennsylvania Real Estate Tax Rebate Form quantities? most instances, Pennsylvania Real Estate Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Pennsylvania Real Estate Tax Rebate Form offers from brands that aren't well-known It's important to do your research and make sure that the company giving the Pennsylvania Real Estate Tax Rebate Form is reputable before making an purchase.

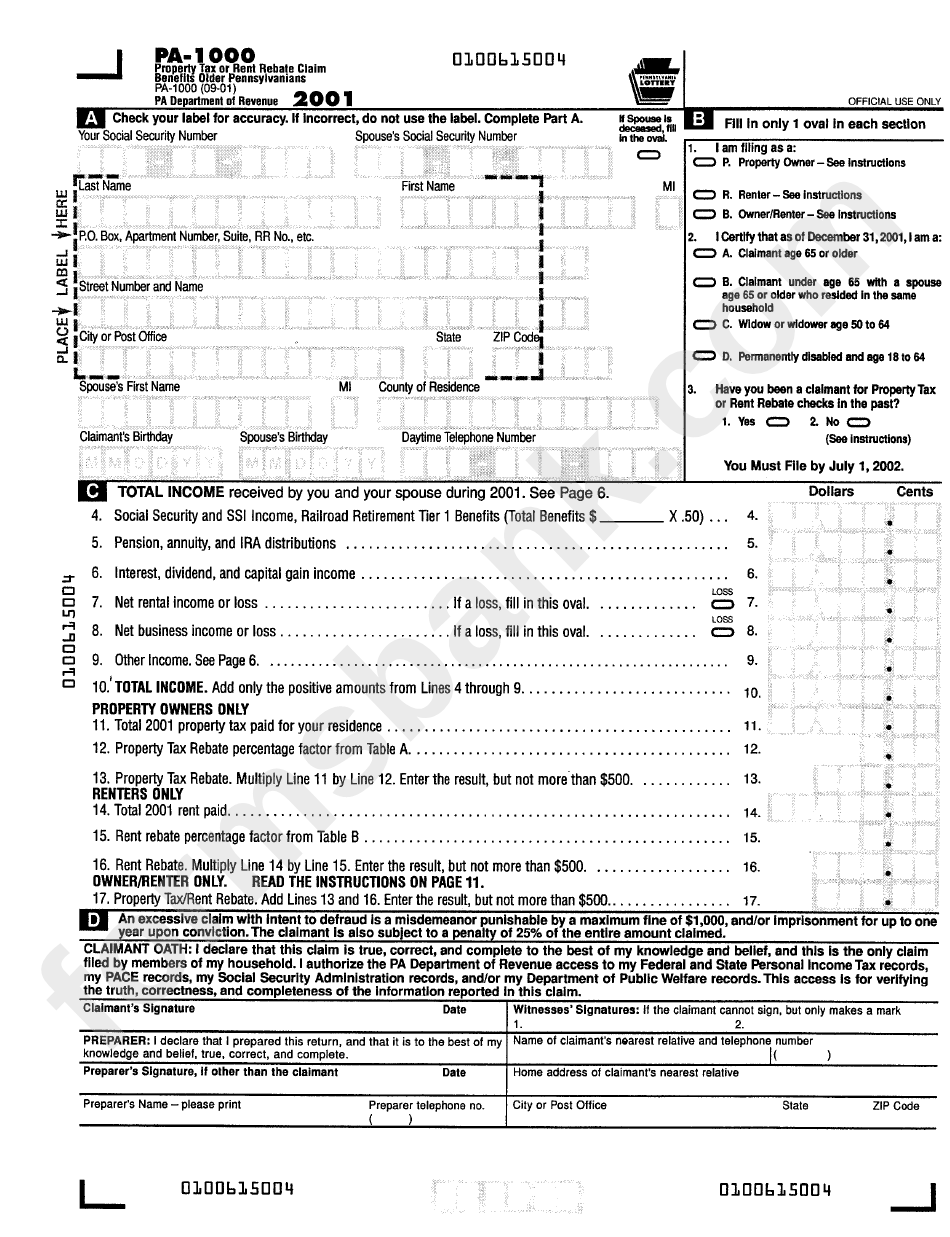

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Check more sample of Pennsylvania Real Estate Tax Rebate Form below

Fillable Pa 40 Fill Out Sign Online DocHub

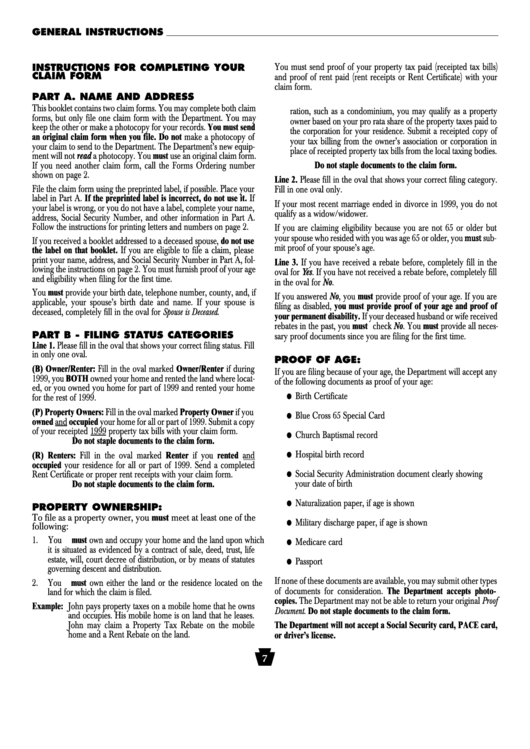

Form Pa 1000 Instructions For Completing Your Claim Form Property

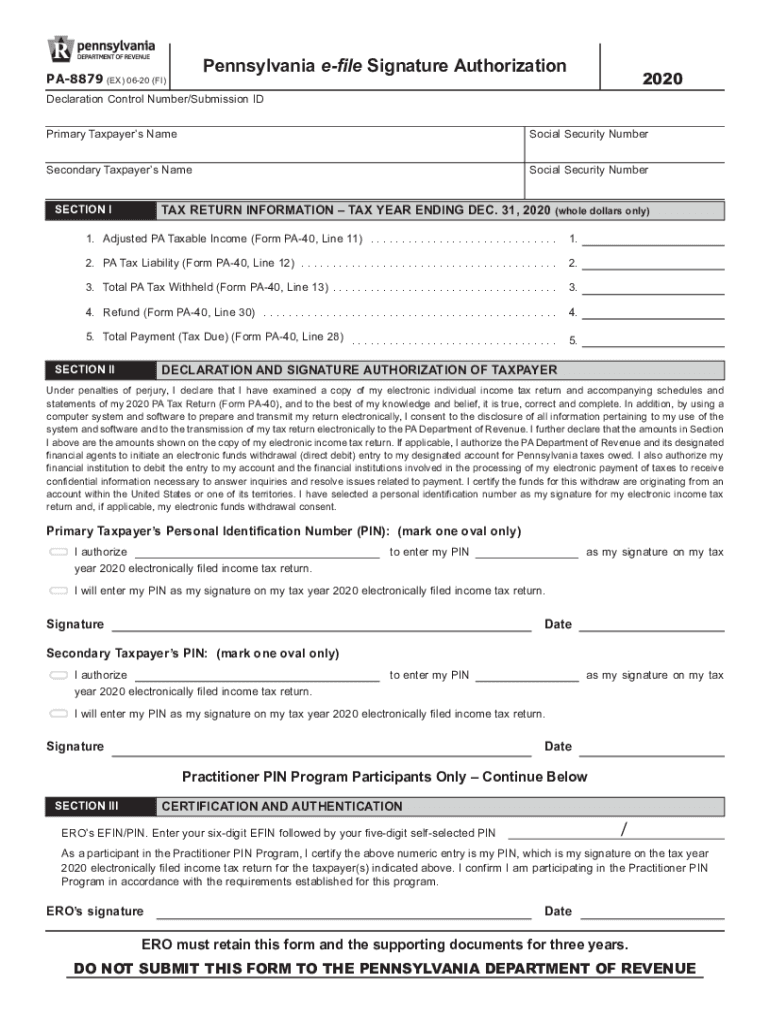

Pa Form 8879 Fill Out Sign Online DocHub

All Rebate Forms Available 2023 Printable Rebate Form

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

Web The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975 The Property Tax Rent Rebate Program is one

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

All Rebate Forms Available 2023 Printable Rebate Form

Form Pa 1000 Instructions For Completing Your Claim Form Property

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Pa Rent Rebate Form 2020 Fill Online Printable Fillable Blank

2022 Pa Property Tax Rebate Forms PropertyRebate

2022 Pa Property Tax Rebate Forms PropertyRebate

Form Et 1 Pa 2019 Fill Out Sign Online DocHub